China’s Q3 GDP data: Growth stabilizing, green shoots emerging

Headline Q3 GDP came in much stronger than expected due to recent stimulus measures and it’s clear that the government’s 5.0% GDP growth target for the year is solidly back on track.1

Official GDP shows growth accelerating to 1.3% on a seasonally adjusted q/q basis1, versus the 0.5% that we had forecasted.

There may be a difference in accounting here, but what’s apparent is that growth concerns over the summer have been put to bed and the economy has turned the corner.

The September monthly data shows further m/m improvement, and we wouldn’t be surprised that growth ameliorates over the coming months, aided by bits and pieces of stimulus measures.

A deep dive into the Q3 data

China’s three main growth propellers, industrial production (manufacturing & exports), investments and consumption (retail sales) all accelerated in Q3 vs Q2.

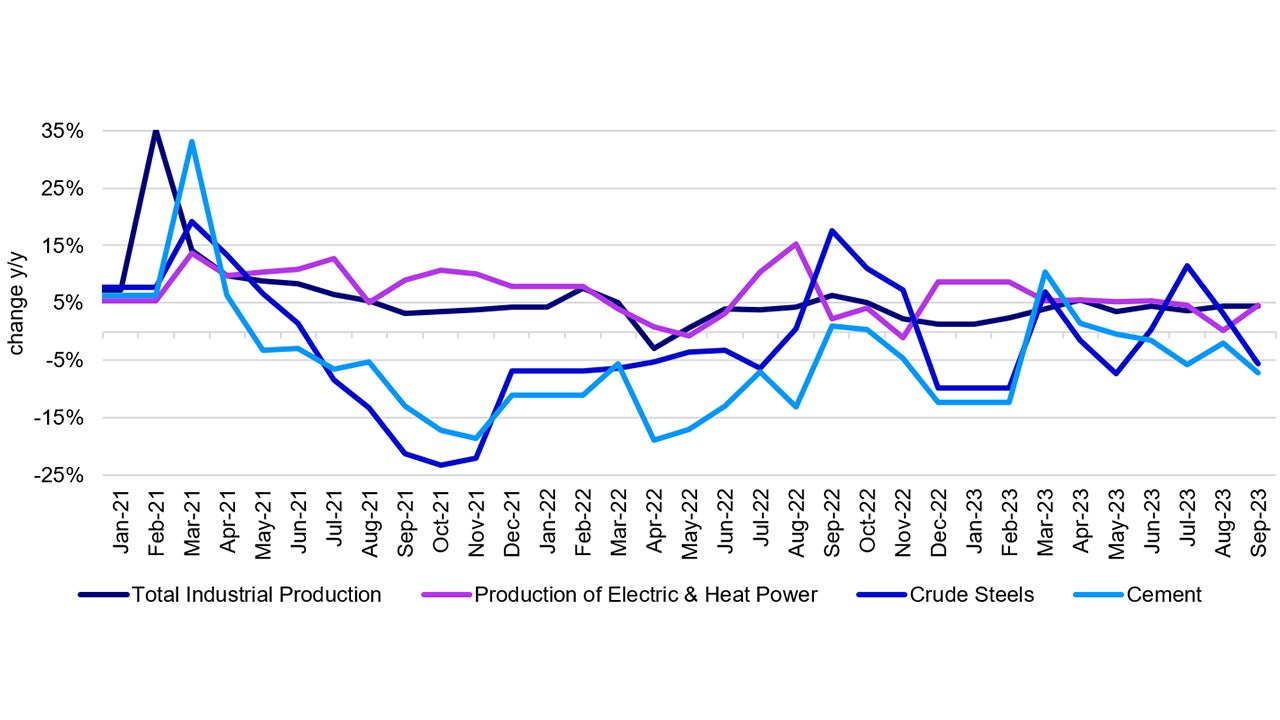

Industrial production grew +4.5% y/y1 and showed resilience last month, unsurprisingly since the exports data has been very strong. The global macro backdrop remains resilient, which has translated into a more stable industrial sector in China.

Power generation saw higher growth, reflecting the cyclical uptick in growth momentum. However, output in areas associated with the real estate sector was very weak.

Cement production fell by -7.2% y/y, crude steel down by -5.6% y/y and glass production was also lower by -6% y/y1.

Source: China National Bureau of Statistics (NBS). Monthly data as of September 2023.

Investments, and particularly property investments remain anemic. Property investments continued to face stiff headwinds in the month; housing starts have taken a dip to their lowest level in more than 15 years.

Still, the recent rollback in restrictive property measures has already started to have an effect, with new home sales volumes and prices firming up a bit.

The rollback in property restrictions has mostly benefitted tier 1 and tier 2 cities and we expect demand to pick up shortly.

The monthly residential housing data set to be released later this week could show further price stability.

Consumption data – the latest bright spot

The highlight to September monthly data came from consumption. Retail sales for the month beat expectations and improved to 5.5% y/y (vs cons 4.9% and 4.6% in the prior month).1

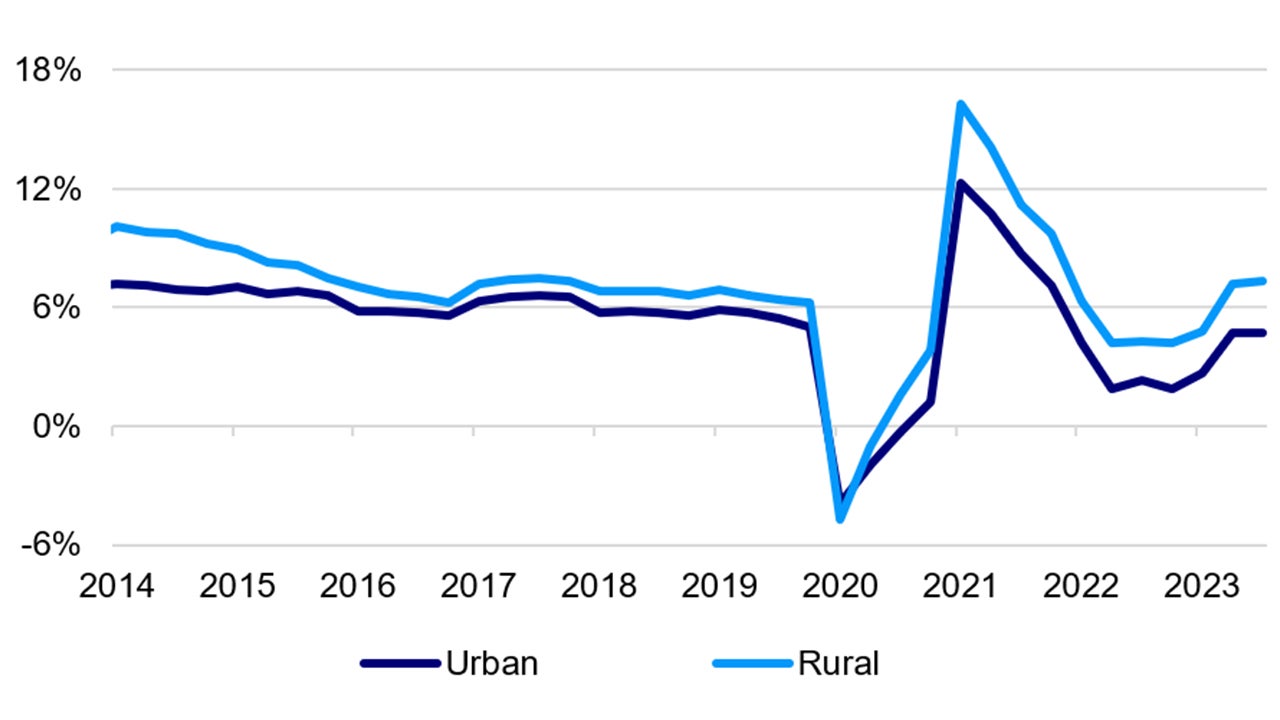

Surprisingly, the beat mostly came from goods vs services. Urban and rural per capita disposable income rose by 4.7% y/y and 7.3% y/y respectively1, and we believe that these stronger income growth figures could continue to lift Chinese household’s willingness to spend.

Source: China National Bureau of Statistics (NBS). Quarterly data as of Q3 2023.

Conclusion

The September monthly data clearly shows that growth momentum a returned and we expect the economy to gain steam over the coming months albeit slowly.

The big question for markets is whether policymakers still have any stimulus measures up their sleeves.

Investors should not expect any kind of stimulus bazookas though further measures are needed for the flailing property market.

Chinese equities jumped slightly on today’s economic print, before paring back gains. With growth on track to meet the annual target, investors may be disappointed to see lower prospects of further stimulus.

In addition, we expect further cuts to the RRR and loan prime rate (LPR) and that regulators are apt to pull forward sovereign bond issuance from 2024 to 2023.

As far as the LGFV (local government financing vehicle) debt problem, officials have instructed banks to roll over existing debts at lower interest rates.