Applied philosophy: Will the sun continue to shine on technology?

The global technology sector has left nearly all other sectors in the dust so far this year. Although we expected the sector to outperform, we have been surprised by how much. A stabilisation in interest rate expectations and the excitement around generative artificial intelligence contributed to a strong re-rating in 2023. Fundamentals may take time to catch up with valuations, but we think the sector’s focus on profitability and a supportive macro environment suggest outperformance may continue over the next 12 months.

The global technology sector has been the best performer year-to-date by far (Figure 4). Even if the outperformance itself has not surprised us, its magnitude certainly has. We anticipated a moderation of the headwind from rising interest rates and that earnings would be resilient, and therefore thought the sector would be well-placed to deliver strong returns. However, we could not have predicted the excitement driven by generative artificial intelligence boosting chipmakers and developers of the most well-known models. In an attempt to look beyond the hype, we analyse the fundamentals of the sector to assess its prospects for the next 12 months.

If annualised, the total returns of the global technology sector so far in 2023 would make it the second best year ever after 1999 (as of 9 June 2023, using the Datastream World Technology index in US dollars). Even if the sector remained at current levels until the end of the year, it would still make the top five, surpassed only by the final two years of the tech bubble (1999 and 1998), the first year of the COVID-19 pandemic (2020) and a year of the US Federal Reserve’s target rate falling 350 basis points (1982).

Perhaps the main concern with this rally is that it seems quite narrow, led by a few mega-cap stocks, which may not be sustainable if sentiment turns negative. In fact, the outperformance has been almost entirely driven by the United States and almost two-thirds of the rise in market value can be attributed to the five largest stocks in the Datastream Technology index (Apple, Microsoft, Nvidia, Alphabet and Meta), compared to their 48% share of aggregate market capitalisation. Nevertheless, even an index excluding the top five would have outperformed global equities by 10.6% (as of 9 June 2023 in US dollar terms) suggesting to us that the rally is not as narrow as it seems at first glance (including those five stocks gives an outperformance of 21.5%).

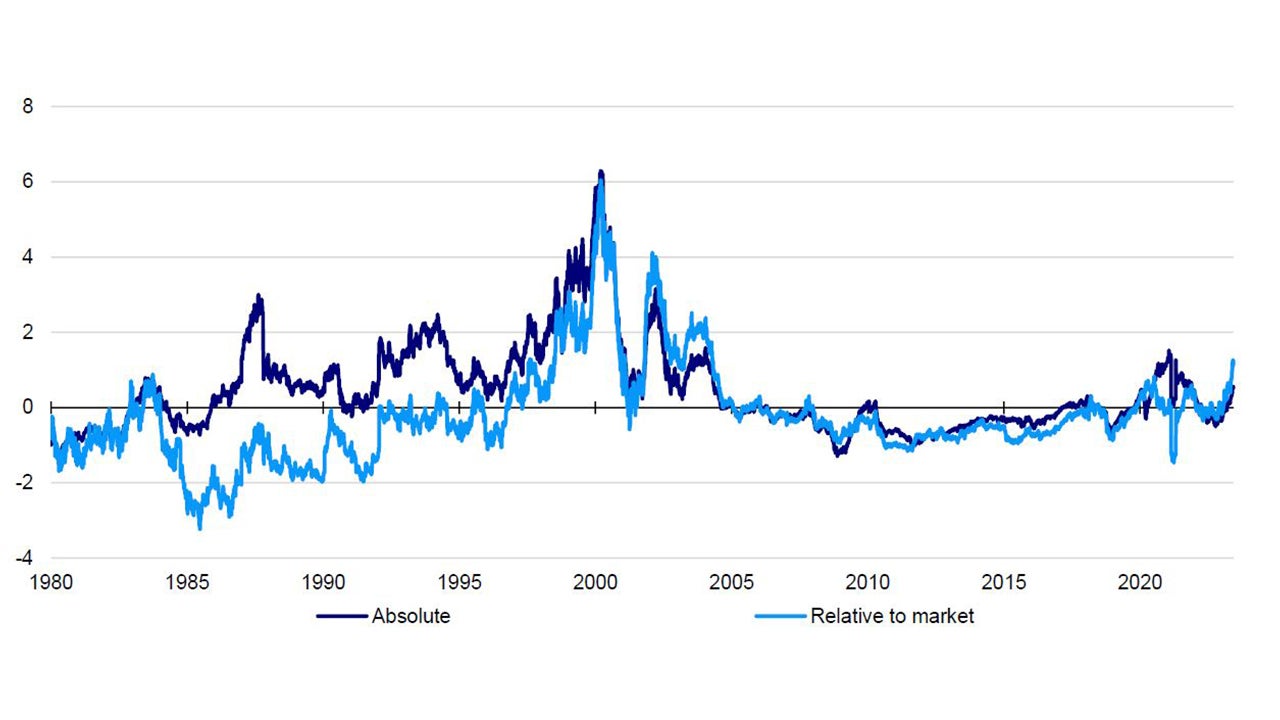

This kind of outperformance inevitably raises concerns about valuations. Short-term returns tend to be driven by changes in multiples, especially around turning points in the market cycle. This is what happened around the late-1990s tech bubble and to a smaller extent in 2020 and 2022. This seems evident in Figure 1, where we compare the global technology sector’s price-to-earnings ratios to their rolling long-term averages both in absolute terms and relative to the global equity market (using Datastream World indices).

Note: Past performance is no guarantee of future results. Data as of 9 June 2023. The chart shows price-to-earnings ratios compared to rolling averages for their whole history since 1 January 1980 for the Datastream World Technology index. The benchmark for relative valuations is the Datastream World Total Market Index. The calculations for the averages and standard deviations for z-scores (spreads versus the average divided by standard deviation) shown start on 5 January 1973. Rolling averages are calculated from 5 January 1973 until each data point including the whole history up to and including that date.

Source: Refinitiv Datastream and Invesco Global Market Strategy Office

It is also interesting that despite the talk during COVID-related lockdowns about the technology sector benefitting from the move online, relative valuations diverged from their averages less than absolute valuations, suggesting that the whole market became expensive relative to historical norms at that time. Also, valuations may look somewhat higher than average, but we do not see a significant dislocation from fundamentals at a z-score of 0.5 standard deviations in absolute terms. Relative valuations merit more concern with a z-score of 1.1, although we think that partly reflects the schizophrenic nature of the market this year. On the one hand, long duration sectors, such as technology responded to a moderation in interest rate expectations. On the other hand, sectors more sensitive to short-term cyclical forces (especially energy and banks) have underperformed on concerns about economic growth.

Nevertheless, we do not think the sector is immune to the economic cycle. The pandemic-related lockdowns may have provided the sector with a one-off boost to earnings that temporarily lifted all boats in 2020-2021. By contrast, in 2022, the share prices of many consumer-facing “stay-at-home” stocks returned to pre-pandemic levels as earnings expectations normalised and rising rates contributed to a de-rating.

Profit margins also received a boost during the pandemic. Net profit margins based on Refinitiv Datastream aggregates for the sector increased from 11.15% in August 2020 to 16.2% in January 2022 surpassing the previous all-time high of 12.9% in December 2018. However, after Western economies reopened and demand for technology products decreased, that margin reverted to 12% by May 2023 (mostly driven by the digital consumer services subsector dominated by US digital advertising platforms). The software and semiconductor subsectors also contributed to this trend, while the rest of the hardware space held up better.

Companies in the sector responded to narrower margins by reducing their cost base, which we think will help to stabilise margins near current levels. This focus on “self-help”, a conversion into a leaner business model that has been adapting to a world with scarcer capital may have contributed to an improvement in sentiment in Q4 2022.

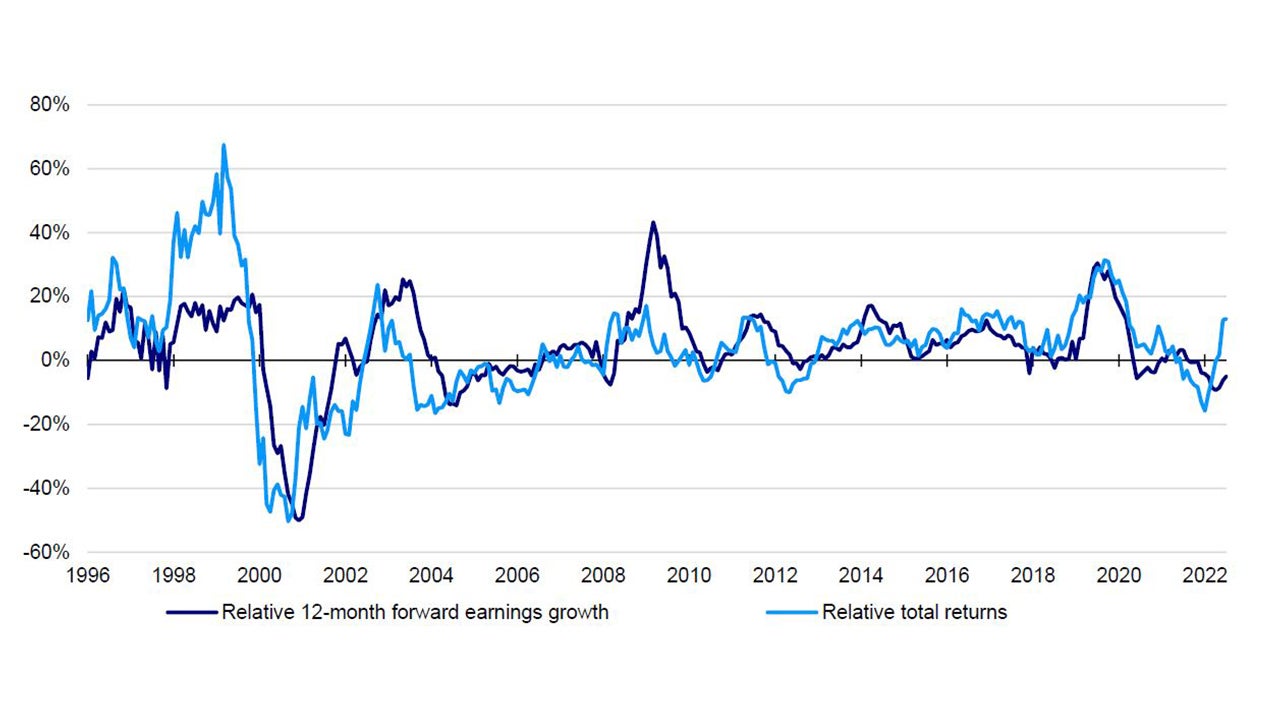

In our view, the biggest threats to technology sector outperformance come from a rise in interest rate expectations driven by sticky inflation and the sharp increase in valuations, which may contribute to a near-term increase in volatility. Economic indicators remain consistent with a slowdown in the global economy and lower long bond yields which we think will benefit the technology sector. Even better, our analysis of previous market cycles suggests that technology performs relatively well in the early stages of market recoveries. Therefore, based on previous experience, we would expect the technology sector to continue outperforming. Finally, relative 12-month forward earnings expectations seem to be turning (Figure 2), which given the strong historical correlation with relative returns, could provide support for our Overweight stance on the sector in our model sector allocation (see Figure 7).

Notes: Past performance is no guarantee of future returns. Monthly data from December 1995 to June 2023. Data as of 9 June 2023. We use the year-on-year change in IBES consensus weighted average 12-month forward earnings estimates and total returns based on the MSCI All-Country World Information Technology index relative to the MSCI All-Country World index.

Source: Refinitiv Datastream, IBES, Invesco Global Market Strategy Office