Applied philosophy: Strategist from East of the Elbe – Q4 2024

The total returns of assets in Central and Eastern EU member countries (CEE11) have been subdued during Q3 2024 so far, especially in government bonds. Inflation has picked up in most economies, and interest rate expectations rose at the same time as global economic growth seemed to have slowed. We expect growth to reaccelerate in 2025 both within and outside the region, but remain below average, allowing inflation to fall. In our view, this outlook should support both government bonds and equities in our CEE11 universe.

Summer is over and, as the days shorten, we steel ourselves for the last push until the end of the year. Even though I left school a long time ago, September still feels like a fresh beginning. Unless the US Federal Reserve (Fed) surprises us, it will mark the beginning of their monetary easing cycle even if they seem to be “fashionably late” to the party. That tends to boost Emerging Market (EM) assets, and EM fixed income has outperformed in local currency terms in Q3 2024 so far, while equities and real estate underperformed driven by more cautious investors sentiment, in our view.

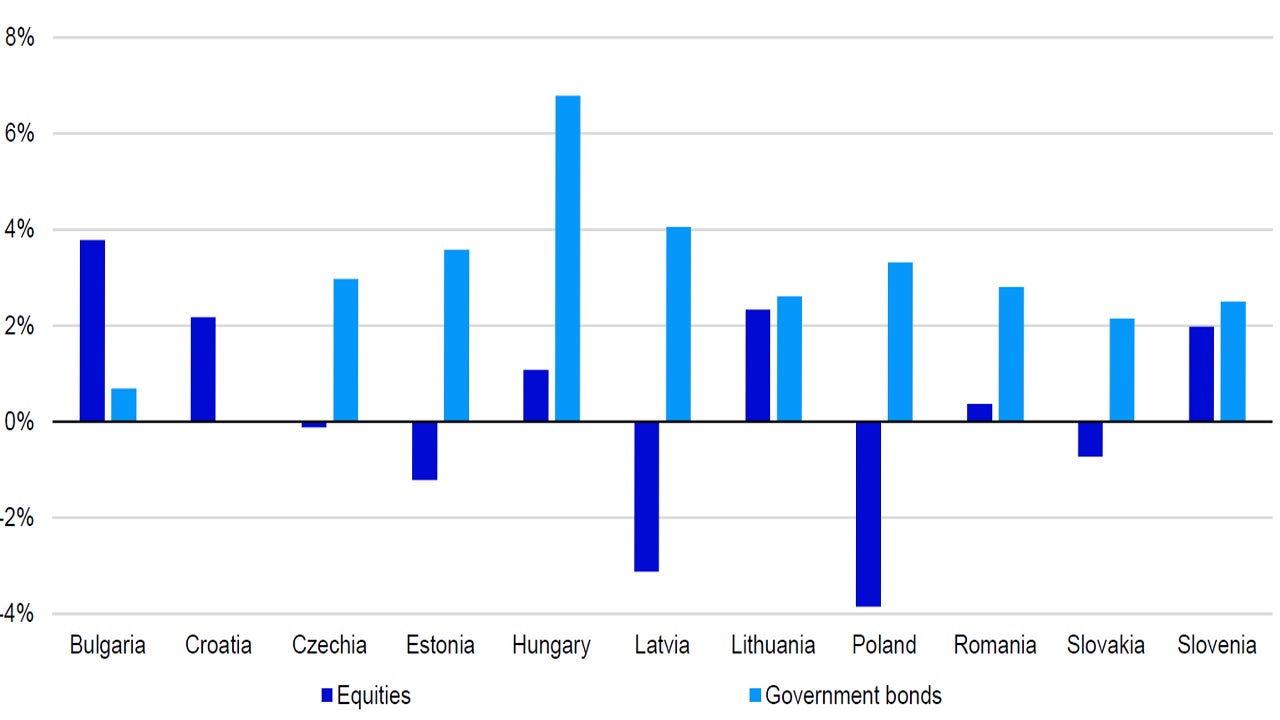

Returns in the CEE11 countries within our universe have been mostly positive, albeit limited to below 5% since the end of June 2024 (apart from Hungarian government bonds). Within equities, we highlighted Slovenia and Poland as our most preferred markets in our last edition, while we thought Hungary and Slovakia were likely to underperform (see here for the full detail). As shown in Figure 1, Slovenia was the third best performer, but Poland was the worst. At the same time, while returns for Hungary were slightly positive and close to the average, Slovakia underperformed.

After a weak period in Q2 2024, government bond returns have been positive (except for Croatia) despite an uptick of inflation in several countries. We chose Czechia and Poland as our most preferred in our last edition and they were the fourth and third best performers respectively (Hungary had the strongest returns between 30 June and 31 August 2024). On the other hand, we highlighted Croatia and Lithuania as our least preferred. While Croatia was the worst performer, Lithuania was closer to the average.

Government bond yields resumed their downward trend in Q3 2024 as concerns about the US economy increased, while declining inflation seems to have reached a level that could allow the Fed to start cutting rates. We expect Developed Market (DM) central banks to continue easing monetary policy. However, EM central banks may have reached a stage where they may pause to determine the direction of economic growth and inflation after a period of significant cuts in many countries. In our view, the global economy is going through a phase of weak growth, in which high interest rates may increasingly seem inappropriate. In CEE11, GDP growth has remained positive, but below average in every country except Croatia, and we expect that to remain the case in the next year.

Notes: Past performance is no guarantee of future results. Data as of 31 August 2024. We use Datastream Total Market indices for equity returns. Government bond returns for Czechia, Hungary and Poland are based on Datastream 10-year benchmark government bond indices. We create a monthly index of government bond returns for all other countries by calculating the net present value of coupon payments and capital repayment based on redemption yields.

Source: LSEG Datastream and Invesco Global Market Strategy Office

However, inflation ticked higher in most CEE11 countries, apart from Croatia, Latvia and Slovenia (it was unchanged in Bulgaria). This has marked a reversal of previous trends of gradually falling inflation, and there are only five countries where it is below 3%, while it is above 4% in three countries: Hungary, Poland and Romania. Nevertheless, in our view, barring a major commodity supply shock, sluggish economic growth could limit any significant uptick even as supportive base effects fade.

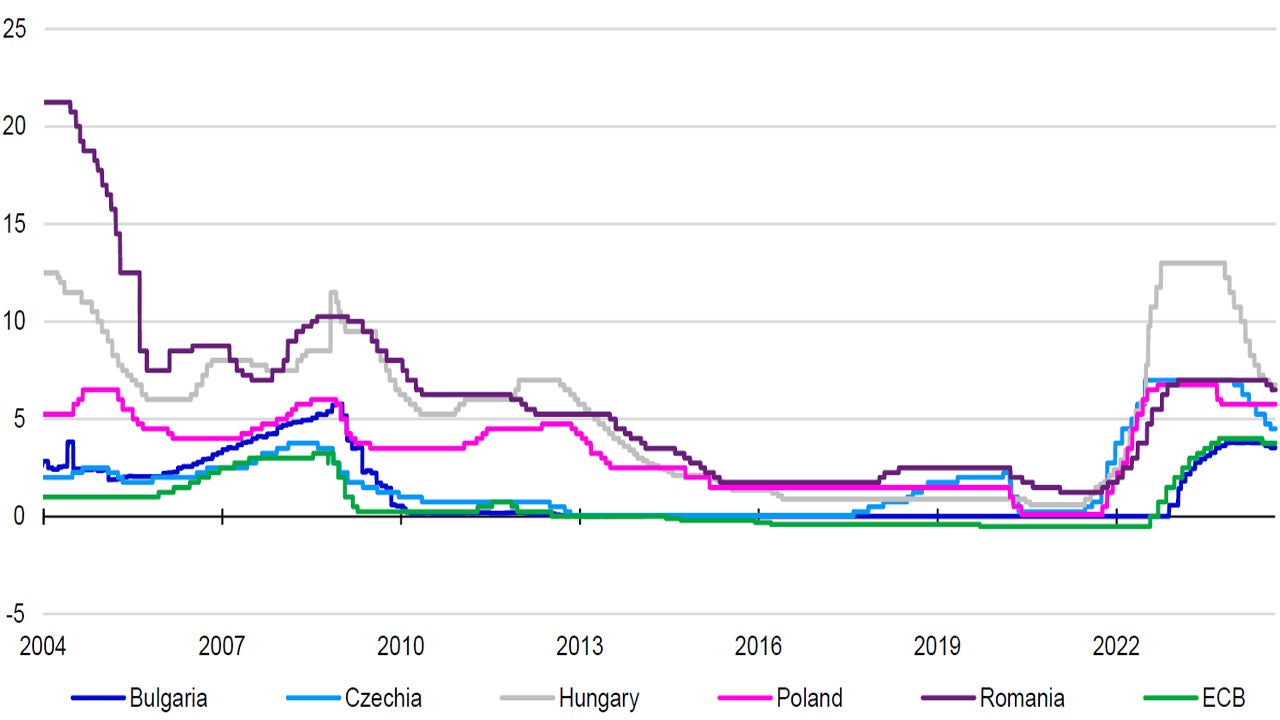

In our view, these dynamics may warrant a pause in monetary policy easing within the region in countries outside the Euro Area after a period of rapid easing especially in Hungary and Czechia (Figure 2). Nevertheless, we think that the spread between EM and DM rates will continue to narrow, especially if major DM central banks ease policy gradually. Countries outside the Euro Area must be mindful of further currency weakness potentially counteracting disinflationary forces if they continue cutting rates at their current pace (this may have contributed to the recent rise in inflation, in our view). Only Poland has maintained its target rate so far this year, although the Czech and Hungarian central banks indicated a slower pace of rate cuts for the rest of 2024.

The political landscape, on the other hand, is likely to be stable in the next 12 months. While the Polish presidential election of May 2025 could be impactful, especially as the current president, Andrzej Duda, is ineligible for re-election, it is still too far ahead to appear on the markets’ radar. In our view, the same is applies to the Czech parliamentary elections, which will be held in the autumn of 2025.

We think the global macroeconomic backdrop will be supportive of regional assets in general. In our latest The Big Picture, we reiterated the view that inflation is likely to continue falling in most countries, while prospects for growth may improve towards the end of 2024. Even though we shifted to a more defensive stance (given strong returns in risk assets in H1 2024), we maintained our preference for Emerging Markets as a whole.

In CEE11 countries, we think growth will stay higher than in DM as real wage growth remains strong, while interest rates continue to decline. In our view, fiscal policy is likely to be neutral, although spending may be constrained somewhat by higher debt servicing costs.

What does this imply for markets? The main question, in our view, is how far and how quickly growth reaccelerates after getting through its current soft patch, assuming the global economy avoids a significantly deeper recession. We think that markets may start anticipating stronger growth perhaps as early as Q4 2024 potentially boosting risk assets, although we may continue to see some weakness and volatility in the near term.

In general, we view this as a favourable environment for both equities and government bonds within CEE11 (we consider them risk assets within a global asset allocation context). Although this means that until we get more clarity on the outlook for growth (especially for the Euro Area) they may underperform EM and Global benchmarks. However, we think there is scope for catch-up, especially if the DM monetary easing cycle continues gradually reducing their attractiveness relative to CEE11.

Notes: Past performance is no guarantee of future results. Data as of 31 August 2024. Using daily data from 1 January 2004. Source: LSEG Datastream and Invesco Global Market Strategy Office

For those markets outside the Euro Area, currencies may also play a major part in determining returns, especially within equities, where weakness may contribute to higher profits (up to a point). However, any potential strengthening of regional currencies could be dependent on how far they cut rates compared to the ECB and the Fed.

Regional currencies oscillated within a tight range versus the euro between 31 May and 31 August 2024, while they generally strengthened against the US dollar mostly driven by falling Fed target rate expectations, in our view. We expect gradual rate cuts from both major DM and local central banks as target rates converge further. Rate futures and Reuters consensus forecasts indicate no change in interest rates for Poland, 25bps for Romania, 50bps for Hungary and 100bps of cuts for Czechia compared to 50bps for the ECB and 100bps for the Fed until the end of 2024 (as of 31 August 2024). Thus, we expect movements in exchange rates to be moderate in the short term, unless there is a sudden deterioration of economic momentum (either within the region or globally).

We believe the biggest risks to regional returns are an escalation of geopolitical conflicts pushing up commodity prices (they may boost regional inflation more than in developed markets) and a deep economic slowdown (perhaps triggered by adverse events). For the moment, we see these as tail risks and we are positive on CEE11 government bonds, given the expectation of further monetary easing in general.

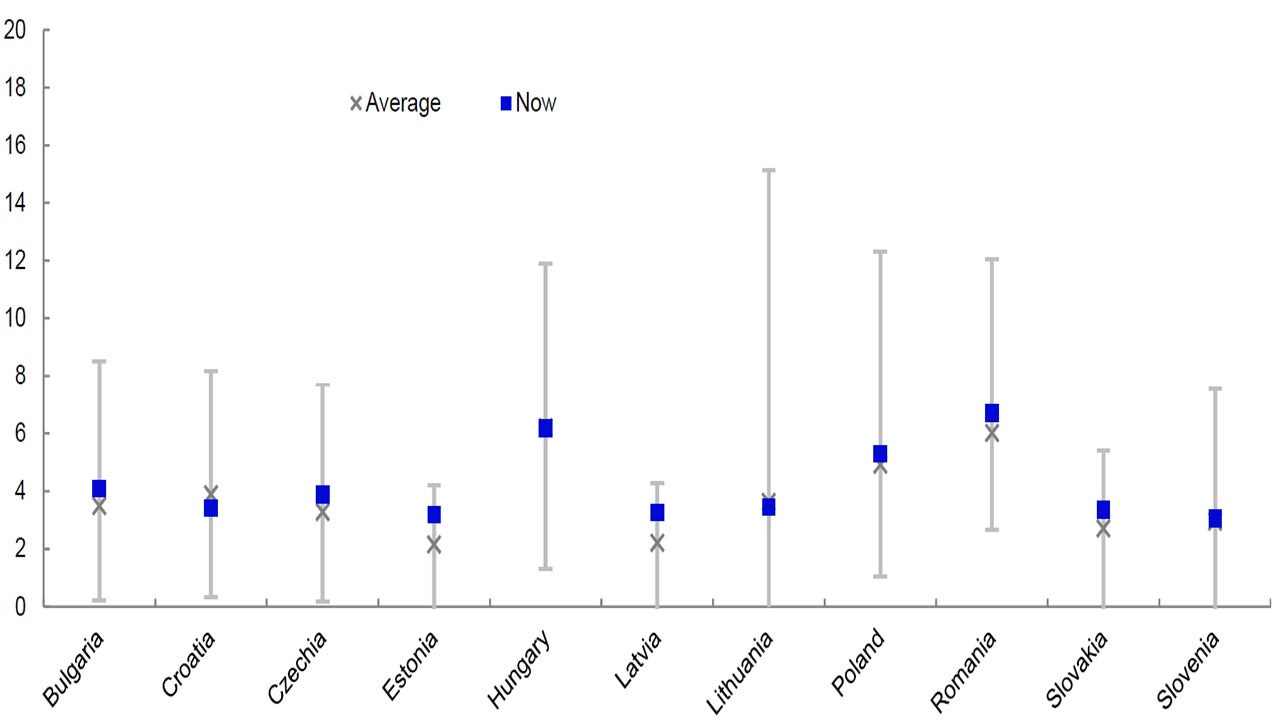

In absolute terms, the 10-year yields of Romania and Hungary at 6.7% and 6.2% respectively are the highest, which is not surprising given that they also have the highest central bank rates within the region (as of 31 August 2024 – see Figure 3). This is still lower than the 7.2% yield on the broader EM universe (based on the Bloomberg Aggregate Sovereign Bond Index in USD as of 31 August 2024) perhaps due to their structurally lower inflation and interest rate expectations.

In Hungary’s case, we are concerned that recent strong returns may have become disconnected from how interest rates are likely to change in the next 12 months. Inflation has moved above the central bank’s target range and may be fuelled further by rising energy prices, although weakening domestic economic momentum may offset some of that. In our view, returns in Romania have been a closer reflection of economic fundamentals, although may be somewhat dampened by election uncertainty.

Thus, we think there may be better opportunities elsewhere, for example in the “Visegrád Four” (V4) countries excluding Hungary (Czechia, Poland and Slovakia). Within that group, Czechia and Slovakia seem to have the most potential for outperformance with spreads versus German Bunds at 68bps and 28bps and yields over 60bps above historical averages. Polish yields, however, are significantly higher than both in absolute terms at 5.4% (see Figure 3), while there remains a possibility of a doveish turn from the central bank currently guiding for no rate cuts before 2026. At the same time, Croatian and Lithuanian bonds seem to have the least attractive valuations with yields and spreads versus Bunds below or close to historical averages.

Notes: Past performance is no guarantee of future returns. Data as of 31 August 2024. Historical ranges and averages include daily data from 14 April 2006 for Bulgaria, 30 January 2008 for Croatia, 1 May 2000 for Czechia, 1 February 1999 for Hungary, 15 April 2003 for Lithuania, 1 January 2001 for Poland, 16 August 2007 for Romania, 7 January 2004 for Slovakia, 3 April 2007 for Slovenia and 24 November 2020 for Estonia and Latvia. We use Refinitiv Government Benchmark 10-year bond indices for Bulgaria, Croatia, Lithuania, Romania, Slovakia and Slovenia. We use Datastream benchmark 10-year government bond indices for Czechia, Hungary and Poland. We use S&P Sovereign Bond Index yields for Estonia and Latvia.

Source: LSEG Datastream and Invesco Global Market Strategy Office

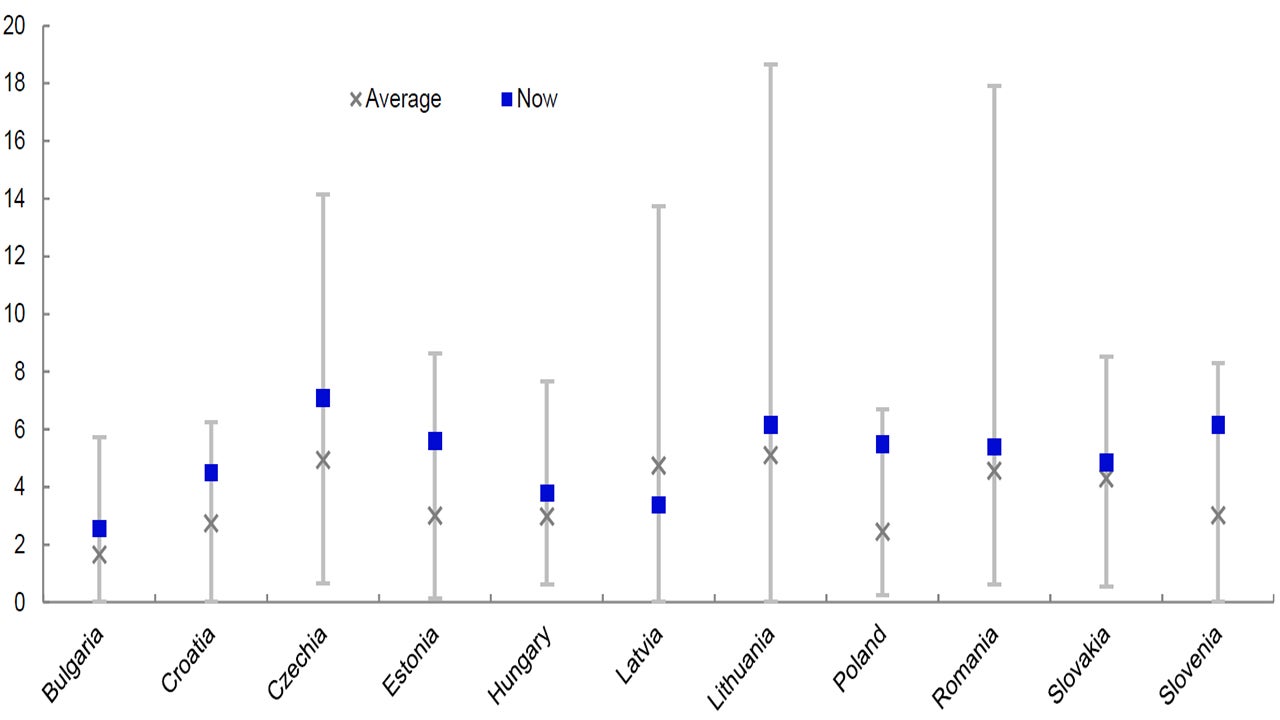

Despite the increasingly uncertain economic outlook in the short term, we expect healthy equity returns in the region based on our assumption of a global economic recovery in 2025. While there may be a few bumps on the road in the near term and around the US Presidential Election in November, valuations look favourable in most markets within the CEE11. Apart from Bulgaria, they also offer higher yields in absolute terms than the 3.2% of the broader EM universe (using Datastream Total Market indices as of 31 August 2024). In our view, Slovenia continues to be in the sweet spot of having a dividend yield well-above historical norms and relative to its peers in the region (see Figure 4) despite over 30% returns year-to-date. Polish dividend yields are also significantly higher than historical averages and the market has lower levels of concentration than other markets, while it provides exposure to cyclical sectors, which may outperform if economic growth picks up. At the same time, we still view Czechia as an attractive hedge against potential market volatility in the near term with its dominance by the country’s largest utility company.

On the other hand, after its strong performance year-to-date, the dividend yield on Slovakian equities fell close to long-term averages, while the yield premium compared to historical norms is now the second lowest within the region for Hungary, thus we view these markets as having the least potential for outperformance.

Notes: Past performance is no guarantee of future returns. Data as of 31 August 2024. Based on daily data using Datastream Total Market indices. Historical ranges and averages include daily data from 2 October 2000 for Bulgaria, 3 October 2005 for Croatia, 27 January 1994 for Czechia, 5 June 1997 for Estonia, 21 June 1991 for Hungary, 3 November 1997 for Latvia, 1 April 1998 for Lithuania, 1 March 1994 for Poland, 29 December 1997 for Romania, 1 March 2006 for Slovakia and 31 December 1998 for Slovenia.

Source: LSEG Datastream and Invesco Global Market Strategy Office

Figure 5 – Our most favoured and least favoured markets in Central and Eastern Europe

| Government bonds | Equities | |

| Most favoured | Czechia, Poland | Slovenia, Poland |

| Least favoured | Croatia, Lithuania | Hungary, Slovakia |

Source: Invesco Global Market Strategy Office