A narrow US stock market rally and its implications

The S&P 500 is up +9.64% YTD to the end of May.1 On surface, US stocks appear to be outperforming significantly this year – in a weaker late cycle environment where growth is slowing, and the Fed has continued to tighten.

Yet, equity market leadership has been incredibly narrow. The ten largest names in the S&P 500, for the most part tech companies, have accounted for nearly all the index’s YTD return. Large tech companies outperformed the broader market, supported by strong earnings reports and mounting investor expectations about the future potential of artificial intelligence (AI).

What has driven the narrow equity rally, is it sustainable, will it have any broader market implications?

Market concentration

It’s true that the US equity market is far more concentrated now than the equity market bubble in 1999-2000. The largest 2 stocks now account for an over 13% weighting in the S&P 500, the highest ever.2 There is some justification for large tech stocks coming to dominate the index.

Earnings have also become more concentrated, skewed towards the larger players. The gap between the market share and earnings share of the top 10 companies is currently only 1/3rd of what it was in 2000, suggesting that the fundamentals of today’s mega-caps is significantly stronger.3

Where has the “excess supply” of capital come from?

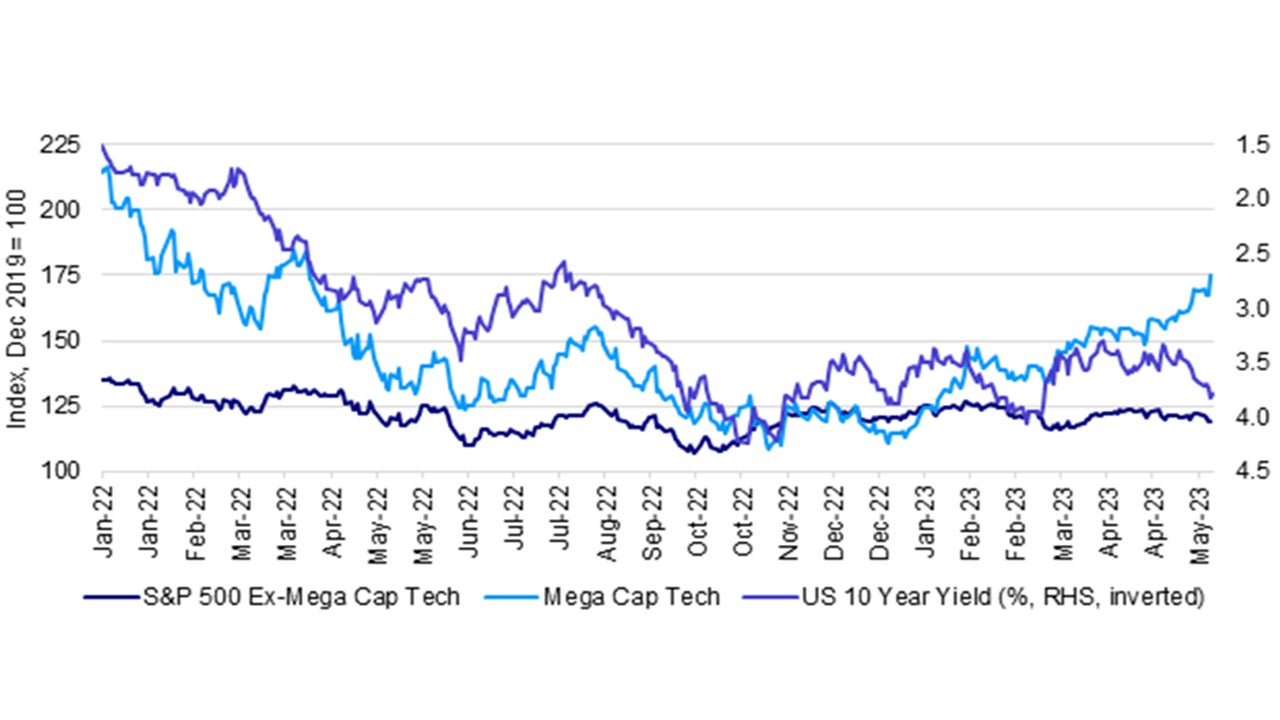

The gains in US stocks has been in spite of rising bond yields. Tech stocks tend to fall when Treasury yields rise, but during May this relationship has broken down – at least temporarily.

Sources: Bloomberg and Macrobond, as of 25 May 2023. Mega-Cap Tech is a cap-weighted combination of MSFT, AMAZN, GOOGL, GOOG, FB, V, MA, NVDA, NFLX, ADBE.

We know that the Fed has been aggressively draining liquidity through higher interest rates that has caused regional banking problems to appear and that financial conditions are tightening due to tougher lending standards which has resulted in a fall-off in new loan growth. Let us offer a few explanations.

Some possible explanations on the narrow US stock rally

On the face of it, one could make an argument that the recent rally in US mega-cap tech stocks comes at the expense of other equity benchmarks. For example in the month of May, the FTSE 100 fell -3.1%; Hang Seng -6.75%, CSI 300 -4.84% and even the DJIA fell -2.94%.4 Still, there are exceptions, Japan, Taiwan & Korean stock markets have done well for the month as the semiconductor cycle rebounds.

Another explanation to the sudden boost in AI-related stocks could very well be hinged on the notion that this is the “next big thing.” It could be that this technological development has what it takes to structurally shift “production” as we know it, and that we’re witnessing the start of a significant capex investment boom, similar to the one that we saw in the 1990s from the advent of the internet.

“AI effect” helped mega cap tech stocks to defy gravity

Already, corporations are ramping up investment spending on data centers to harness the power of new generative AI technologies. Whether this immediate AI spending boom is just a near-term cyclical trend or something that is longer-term and more structural in nature, has yet to be seen.

Still, initial indications show that AI is proving to be much more economically significant, through generating real productivity gains than other recent trends such as the metaverse and crypto.

The “AI effect” has thus helped mega cap tech stocks to defy gravity. Indeed, many of the largest tech stocks are directly involved in the development of AI. Investors have been racing to pick up these names given the excitement over potential productivity gains from the use of AI.

Historically narrow market leadership doesn’t last

While the surge in AI-linked equities may continue in the meanwhile due to the perceived shifts in the future of production, we should note that looking back historically, narrow market leadership doesn’t last.

The broad market response to recent macro developments such as the strong jobs report serves as a reminder that market leadership tends to broaden amid expectations of better economic growth.

Further, the market currently seems to only be pricing an “AI premium” in large cap tech stocks. Perhaps this is because they are the clearest and most obvious beneficiaries.

Other sectors will benefit from an eventuality where AI use is widespread, especially in high skill occupations where we could see much improved efficiencies.

As such, we could well see this narrow market start to broaden out as markets begin to price in the “AI premium” outside of large cap tech.

*with contributions from Brian Levitt and Ashley Oerth

Reference

-

1

Source: Bloomberg. Data as of 31 May 2023.

-

2

Source: Bloomberg. Data as of 31 May 2023.

-

3

Source: Bloomberg. Data as of 31 May 2023.

-

4

Source: Bloomberg. Data as of 29 May 2023.