A historical shift, the Bank of Japan hikes rates

In a move widely anticipated by the market, the Bank of Japan (BOJ) has exited its negative interest rate policy (NIRP), yield curve control and other unconventional policy tools.

The primary policy rate will be the overnight rate, which the BOJ hiked to 0–0.1%, up from -0.1% which was set in 2016.1

The BOJ isn’t turning altogether hawkish

Despite this first rate hike since 2007, the BOJ isn’t turning altogether hawkish. It still plans to purchase Japan Government Bonds (JGB) at similar levels as before, ensuring plenty of liquidity in the market and an accommodative financial environment.

Markets were muted after the announcement, the JPY weakened past 150/ USD and the TOPIX rallied +1.0%, as investors largely anticipated this move.2

Deputy governor Uchida recently commented that “it is hard to imagine a path in which it would then keep raising the interest rate rapidly.” Dovish statements from the BOJ, coupled with the bank’s continued purchase of JGBs, could mean that the JPY remains weak vs USD or until it becomes clear when the Fed is expected to start cutting rates.

Going forward, we do not anticipate additional rate hikes from the BOJ before the end of the year.

Possible changes to the policy rate will be based on price stability projections. For now, the BOJ has maintained its core CPI projection of around 2% for the upcoming fiscal year.

Unlike the Fed’s dot plot, the BOJ doesn’t give out an overt future policy rate path. Instead, more guidance can be expected – a good read through are comments surrounding the bank’s inflation targeting.

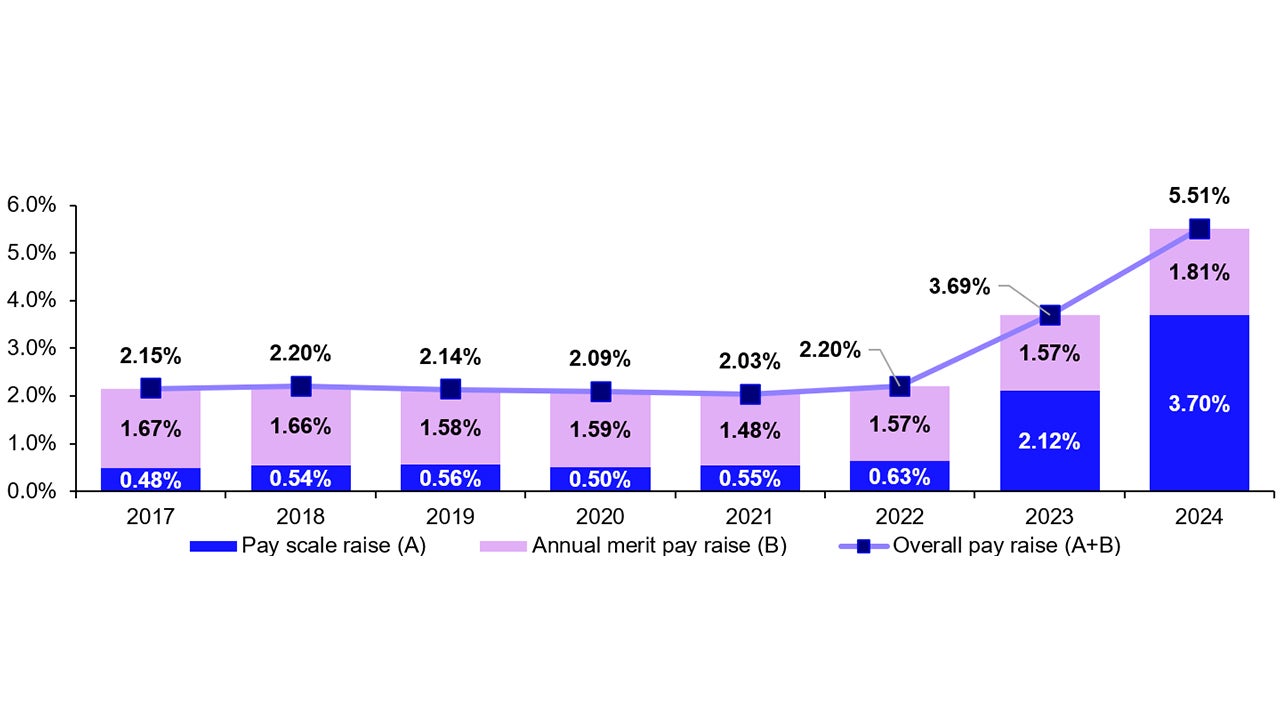

Shunto: wage growth improving in Japan

The exit from a decade of ultra-loose monetary policy is a victory for the BOJ, after a long period of low growth and deflationary headwinds. Japan’s first round Shunto – annual wage negotiations – recently concluded and the data indicate an overall pay raise of 5.3% YoY, which would be the highest pay raise since 1991.3

Source: Invesco from Rengo. Annual data as at 16 March, 2024. Note: Final data until 2023. Figures for 2024 are the first-round results. Figures for RHS chart are based on those negotiation results under which pay scale raise was clearly calculated.

The strong wage growth results raise the possibility that Japan enters a virtuous cycle between wages and prices, leading to sustained, 2% inflation. These dynamics are certainly behind why the BOJ raised rates.

The start of Japanaissance?

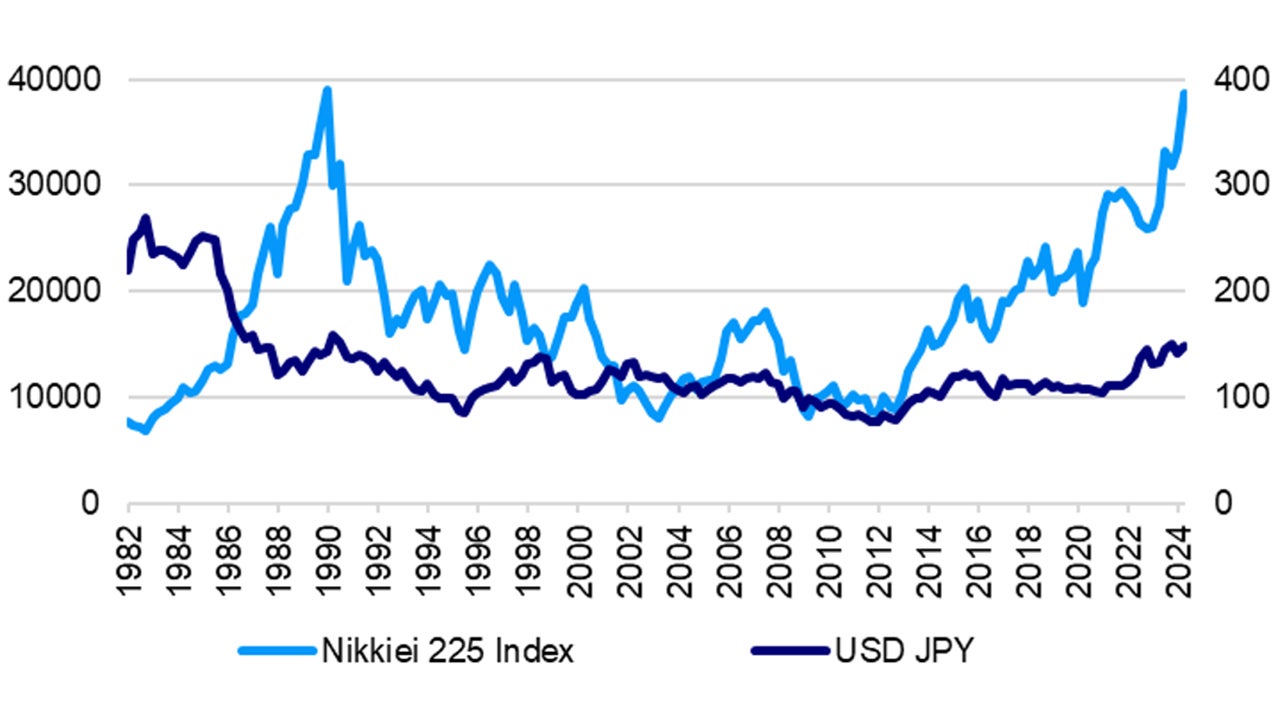

The Japanese economy was going strong in the late 1980s, with the Nikkei 225 Index peaking in December 1989. It finally surpassed that level in February and then rose above the 40,000 level earlier this month (easing modestly since then).4

Source: Bloomberg, as of 15 March 2024. Note: Past performance is not a guarantee of future results. An investment cannot be made directly in an index.

The question becomes whether the Japanese stock market can continue its strong performance. There are some compelling arguments for continued strength.

While Japanese equities have experienced a strong rally in the past year, their valuations are still attractive relative to other major indices. In addition, the dividend yield on Japanese equities is higher than that of other major indices.

A powerful catalyst for Japanese equities to climb higher could be the new NISA (Nippon Individual Savings Account), a tax-exempt investment savings plan introduced in January.

Cash deposits comprise 52.5% of households' financial assets in Japan, 12.5% in the US and 35.5% in the eurozone. The NISA could be the catalyst to move some Japanese household cash to equities.5

The Bank of Japan’s decision to gradually normalize monetary policy is a positive development. Such normalization could be a boost to confidence, with the first rate hike in 17 years sending a strong message that the Japanese economy no longer needs such a high level of support because it is in better condition and is expected to continue to improve.

With contribution from Tomo Kinoshita, Kristina Hooper & Thomas Wu

Reference:

-

1

Source: Bank of Japan, as of March 19, 2024

-

2

Source: Bloomberg, as of March 19, 2024

-

3

Source: Reuters, as of March 16, 2024

-

4

Source: Bloomberg, as of March 19, 2024

-

5

Source: Nikkei Asia, as of December 26, 2023