What's driving de-dollarization in Asia?

Dollarization typically refers to economic or financial activities in an emerging market (EM) country that is conducted in a hard currency1 instead of the country’s own local currency. Given the US dollar (USD) is the most widely used currency, dollarization can also be narrowly used to refer to USD usage. In this paper, we analyze recent trends around economic and financial dollarization and de-dollarization in Asian countries relating to trade settlement and financial activities. By tying our observations back to existing theories and research literature we discuss how we expect these trends to pan out in the future.

1. Economic dollarization and USD trade settlement

So, what drives the usage of hard currency in international trades when it is not the local currency of either trading party? Till date, EM trading firms have relied mainly on hard currency and the USD in particular to settle international trades. This is largely because the USD is a relatively stable currency and is widely accepted across the globe.

At the same time, economic dollarization damages the monetary autonomy of EM markets by reducing the government or central bank’s control over the economy. Since the Global Financial Crisis we’ve seen EM governments look to combat this by promoting the settlement of international trades in their home currency.

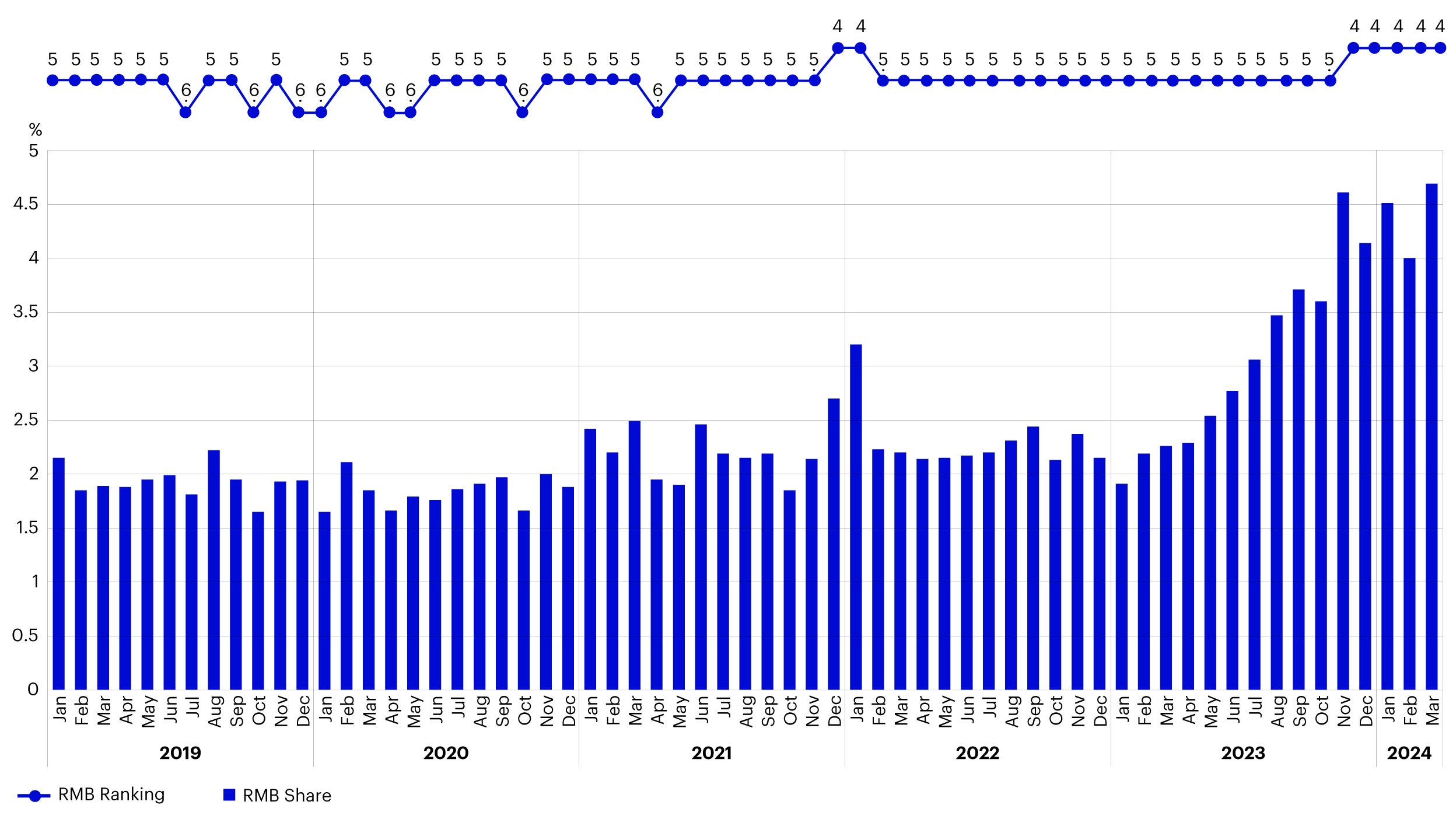

China is one example and RMB internationalization has been a policy focus for more than a decade. China’s central bank, the People’s Bank of China (PBoC), has signed currency swap agreements with more than 40 countries2 to encourage the use of the RMB for international trade settlement. As a result, the share of the RMB as a global payment currency has risen from around 2% in 2019 to above 4.6% in April 2024.3 The recent sanctions imposed on Russia have also meant that a significant proportion of Russia’s trades with China as well as with other trading partners are being settled in the RMB.

Source: SWIFT. Data as of April 2024. Note: Live and delivered, MT 103, MT 202 (Customer initiated and institutional payments), and ISO equivalent. Messages exchanged on SWIFT. Based on value.

Other Asian countries have also been promoting trade settlement in their home currencies. In 2016, Thailand and Malaysia launched the Local Currency Settlement Framework (LCSF), allowing businesses to settle bilateral transactions in Thai baht and Malaysian ringgit. Indonesia joined the LCSF in 2018. At the ASEAN Summit in May 2023, ASEAN countries also agreed to promote local currency transactions with plans to develop a Local Currency Transactions Framework (LCTF).4

2. Financial dollarization

Financial dollarization has been the subject of many research papers both from academia and industry. Researchers typically look to address why EM households invest in hard currency and why EM firms borrow in hard currency, rather than in their own local currency.

This concept is more nuanced as borrowers and lenders usually have opposing interests in picking a certain currency. For example, if the USD interest rate is high, while lenders or investors might prefer USD assets or investments, borrowers would shy away from it. Apart from interest rate differentials, another key factor that can have asymmetric impacts on corporate financing demand and household deposits is access to foreign currency funding via foreign financial institutions.5 Financial dollarization is also influenced by institutional factors such as the credibility of monetary policy and financial developments in the respective EM country.6

2.1. Financial dollarization in corporate financing demand

As US interest rates have been on the rise in recent years, Asian domestic interest rates have started to look more attractive to borrowers and less appealing to investors (Figure 2). This has caused significant de-dollarization from a corporate financing standpoint (i.e., a drop in USD borrowing and rise in Asian local currency financing). The trend is quite evident given the drop in dollar-denominated bond issuances by Asian issuers in latter part of 2022 till date (Figure 3).

Source: Bloomberg, Invesco. Data as of 14 Aug 2024.

Source: Bloomberg, Bank of America Global Research. Data as of July 2024.

On the other hand, financing in Asian local currency bond markets has been picking up. For example, given the low yielding environment in China, the issuance of bonds in the onshore RMB bond market has accelerated in recent years (Figure 4).

Source: Wind, Bank of America Global Research, Invesco. Data as of July 2024.

We are seeing similar trends in other Asian countries. For instance, Indian corporates have issued more INR-denominated bonds over the past two years (Figure 5). Although the all-in borrowing cost in the market has not been that low, the ratio of INR bond issuances over USD bond issuances by Indian corporate issuers has clearly increased.

Source: Bloomberg, Invesco. Data as of July 2024.

Apart from interest rate differentials, several other factors can impact how issuers decide the currency or market they wish to fundraise in. Companies often look to raise funding in bond markets that are highly liquid and therefore lend themselves to larger issuance sizes and broader global investor interest. This is a key reason why Asian corporate issuers have tapped the USD bond market in the past. However, as Asia’s local currency bond markets mature and internationalize, corporates are not as incentivized to go this route. We believe this trend has also prompted a rise in the volume of Asian local currency bond issuances in recent years.

As the US Federal Reserve and other major developed market central banks start to cut rates, while Asian central banks will likely follow suit, we still expect to see interest rate differentials between local currency and hard currency markets pick up in the coming years. We believe local currency financing and de-dollarization trends will continue despite the changing incentives to tap into cheaper hard currency funding. This is also the result of consistent efforts being made by Asian governments to improve the quality of domestic financial institutions and enhance financial market regulation, thereby attracting more investors, both domestic and international, to their bond markets.

2.2. Financial dollarization in investor demand

On the investor demand side, we have seen the dollarization trend gain momentum in recent years as returns on hard currency assets have become more attractive. While it is difficult to track exact figures, we are seeing increasing investor interest in USD bonds issued by Asian governments and corporates (as evidenced by recent changes in relative values).

Asia dollar-denominated bonds have traditionally traded at wider spreads relative to US issuers for various fundamental and technical reasons such home bias. However, in recent years such price discounts have disappeared given the changes in the macro environment as well as increasing technical support by Asian local investors for the asset class. Asia USD high yield (HY) bonds are trading on par with US HY bonds in spread terms while Asia investment grade (IG) bond spreads are now trading inside US IG counterparts.

Source: Bank of America, ICE Data Indices, LLC. Data as of July 2024.

Source: Bank of America, ICE Data Indices, LLC. Data as of July 2024.

We are also seeing the dollarization trend gain momentum among Asian local depositors. Taking the example of Hong Kong, the proportion of USD deposits to overall deposits in Hong Kong banks rose from 35% to more than 40% between 2018 to 2024 year-to-date (Figure 8). The amount of cash held in USD deposits has also increased by almost 50% compared to 2018. It is worth noting that as the Hong Kong dollar is pegged against the USD, foreign exchange risks would not factor into depositors’ decision-making process.

Source: Bloomberg, HK Monetary Authority, Invesco. Data as of June 2024.

Nonetheless, we believe the growth in the proportion of depositors opting for hard currencies is only a temporary phenomenon. A large body of empirical evidence has been building since World War II which shows that Asian economies are in de-dollarization mode. We can look at global central banks’ investment demand for managing their foreign currency reserves as an example. As competition from currencies such the Yen and Renminbi intensifies, we expect to see the dominance of the USD in foreign exchange reserves decline.

Source: IMF, Invesco. Data as of 16 Aug 2024.

3. Conclusion

We believe the de-dollarization trend will continue among Asian economies. Looking specifically at trade settlement, we expect the diversification away from the USD or other hard currencies toward local currencies to continue. We also expect to see financial de-dollarization progress as Asian local currency bond markets mature. Even as interest rate differentials woo local issuers to borrow in hard currencies, we believe improving local market depth and liquidity will continue to offer issuers reasons to stay home. On the investment front, as USD interest rates as well as those of other hard currencies begin to normalize, we also think the temporary dollarization trend in Asian investor demand will decline in the medium to long term.

Footnotes

-

1

Hard currencies refer to any globally traded currency which serves as a reliable and stable store of value and is not likely to suddenly depreciate.

-

2

China's central bank signs 40 currency swap agreements with foreign counterparts, February 2024, https://english.www.gov.cn/news/202402/16/content_WS65cef3efc6d0868f4e8e40d3.html

-

3

Source: SWIFT

-

4

Understanding the growing use of local currencies in cross-border payments, August 2023, https://www.atlanticcouncil.org/blogs/econographics/understanding-the-growing-use-of-local-currencies-in-cross-border-payments/

-

5

Financial Dollarization – The role of banks and interest rates, Basso, Calvo-Gonzalez and Jurgilas, May 2007, https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp748.pdf

-

6

Taming Financial Dollarization: Determinants and Effective Policies – The Case of Uruguay, Vargas and Sanchez, November 2023, https://www.imf.org/en/Publications/WP/Issues/2023/11/24/Taming-Financial-Dollarization-Determinants-and-Effective-Policies-The-Case-of-Uruguay-541781