2025 Investment Outlook – US Senior Loans

Summary

- 2024 was a strong year-to-date for loan returns driven primarily by robust coupon, in line with our expectations.

- We expect approximately 7.5-8.0% loan returns in 2025,1 again powered by high carry and price stability, partly offset by mild erosion in spread and base rates.

- We forecast a 3.25-3.75% default rate in 2025 driven primarily by opportunistic distressed exchanges and those dictated by impending maturity/liquidity needs.

2024 Loan market recap

The US leveraged loan market returned 8.41% year-to-date (YTD) in 2024,2 exceeding the 8% total return expectation we outlined heading into the year. Total returns YTD included 8.90% of coupon income slightly offset by approximately -0.45% of price detraction.3

Source: PitchBook Data, Inc; Morningstar LSTA US Leveraged Loan Index as of November 30, 2024. The Morningstar LSTA US Leveraged Loan Index represents US leveraged loans. An investment cannot be made in an index. Past performance is not a guarantee of future results.

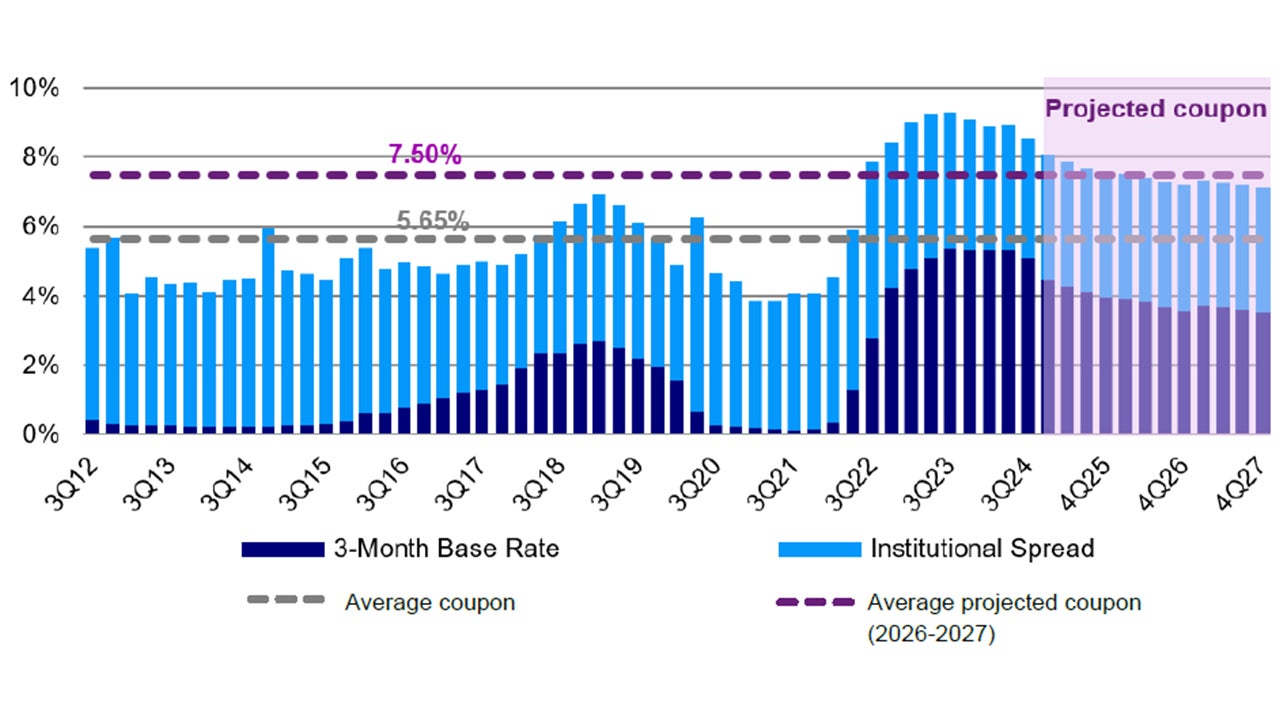

As depicted in Figure 1 above, robust coupon income endured throughout 2024 so far thanks to (1) buoyant base rates in the face of resilient economic growth and periodic concerns about the pace of disinflation, both of which slowed the US Federal Reserve’s (Fed) monetary easing, and (2) relatively stable loan spreads despite elevated repricing activity. Base rates declined from 5.33% to 4.46% during the course of the year through November, while loan spreads compressed from 3.93% to 3.66% as a result of heightened repricing activity and a debtor-friendly new issuance environment. With approximately 42% of outstanding loan principal repricing during 2024 YTD and an average spread reduction of 0.54%, we estimate repricings accounted for 22 basis points (bps) of the 27bps in spread compression.4 However, the loan market‘s coupon ended the year through November at 8.33% (versus 9.36% at the start), still near multi-year highs.5

Meanwhile, a largely benign credit environment supported loans, with secondary prices only a slight headwind to returns during the year. We called for modest price declines in 2024 with more pronounced weakness among lower rated loans due to economic deceleration; however, growth held up far better than we expected and the riskiest loans in the market held firm.

The percentage of loans trading below $80 (i.e., a barometer of credit stress in the market) stood at just 3.24% at the end of November, while the loan default rate was just 0.94% on a par basis, or 1.44% on an issuer basis.6 The issuer-weighted default rate was 4.56% including distressed exchanges,7 an increasingly prevalent liability management tool deployed by over-leveraged and/or cash strapped issuers. That said, these transactions typically lower the pro forma future risk of insolvency while providing creditors with key protections in the form of more restrictive loan agreements. Distressed exchanges tend to result in higher average recoveries than true payment defaults; thus, the growing share of defaults from distressed exchanges in 2024 YTD helped improve recoveries versus the prior year.8 The low percentage of loans trading below $80 is a reasonably good proxy for the pipeline of future expected defaults, inclusive of distressed exchanges.

Away from credit fundamentals, the loan market technical remained firm throughout the year. New broadly syndicated loan (BSL) collateralized loan obligation (CLO) formation of $150.0 billion (bn)9 materially exceeded our $90-100bn expectation, providing a consistent bid for loans. Gross BSL CLO issuance inclusive of refi/reset activity ($383.9bn) was in line with 2021’s record year, a reflection of the attractive prevailing CLO origination economics.10 Additionally, loans saw demand from retail investors, who added another $18.0bn to the asset class, as well as from institutional investors.11

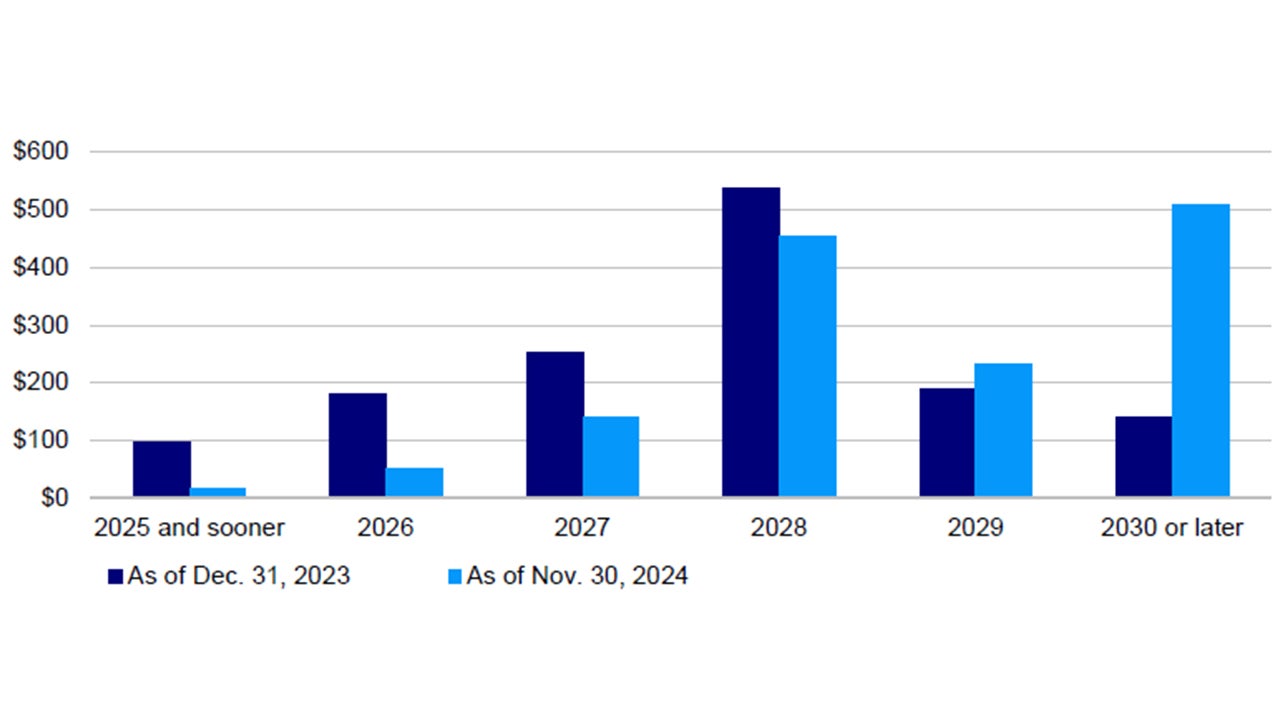

Meanwhile, net new issuance increased from 2023, but limited merger and acquisition (M&A) and leveraged buyout (LBO) activity resulted in another year of relatively muted supply. Gross issuance of $1,138.4bn was extremely robust; however, $606.7bn of this total represented repricing transactions and another $375.6bn were refinancings, leaving just $156.0bn of M&A-driven new loans.12 Against strong demand for the asset class, the market was tight on supply for the entirety of 2024 YTD. Positively, the spate of refinancings in 2024 YTD continued to push out the maturity wall as depicted in Figure 2 below, while the wave of repricings lowered issuers’ interest expense, further curtailing near-term prospective default catalysts in the market.

Source: PitchBook Data, Inc; Morningstar LSTA US Leveraged Loan Index as of November 30, 2024. Shown in $ USD billions.

2025 Loan market outlook

Looking ahead to 2025, we expect loans will deliver coupon-like total returns of approximately 7.5-8.0%.13 Loan market coupon is currently 8.33%, a function of nominal loan spreads at 3.66%, CME Term SOFR at 4.46%, and the lagged pass through of declining rates as loan coupons only reset quarterly.14 The forward SOFR curve currently implies an average 3-month SOFR rate of approximately 3.88% over the course of 2025, implying modest further erosion versus the curve-implied 2025 starting point.15 This reflects the market’s belief that the Fed will continue easing rates next year, albeit at a slower, shallower pace than was anticipated several months ago. Moderating disinflation and a policy agenda from the incoming Trump Administration widely viewed to pose inflationary risks have together prompted a recalibration of future monetary policy expectations. As shown below in Figure 3 on the following page, we expect base rates will settle at upwards of 3.5%, forming a foundation for continued well-above-average coupon income in the loan market for 2025 and beyond.

Source: PitchBook Data, Inc. as of September 30, 2024, updated quarterly. Base rate reflects the average during the quarter. Uses three-month LIBOR (prior to 2023) or SOFR (2023 or later) plus the weighted average institutional spread. (Purple) Forecasted coupon for 2/14/25, 5/14/25, 8/14/25, 11/14/25, and the same dates in 2026 and 2027 using average trailing 4 quarters spread levels and forward 3m SOFR rates as of November 14, 2024. 4Q 2025-2027 represented by the 11/14 forecasts. With dashed purple line representing average projected coupon in 2026-2027. There can be no assurance that any projected returns can be realized.

From a macroeconomic perspective, we expect US growth will remain resilient and global growth will accelerate in response to broadly easing monetary conditions. The incoming Trump Administration does not materially alter our near-term growth expectations, but it does widen the band of plausible economic outcomes in the coming years. President Trump‘s re-election heightens the odds of disruption to the status quo on numerous fronts - global trade, international alliances, immigration, the scope and efficiency of government agencies, as well as several other domains of American society and industry. Disruption of the status quo is inherently hazardous to incumbent loan issuers, particularly those whose revenues or competitive moats depend on the current regulatory edifice. We expect winners and losers will emerge from this impending shake up, so credit selection will be critical even in a scenario of accelerating growth.

In the context of robust consumption trends, stable growth, and easing interest rates / capital market conditions, we expect the loan default rate in 2025 will be lower than in 2024. Using the 4.56% trailing twelve month default rate16 inclusive of distressed exchanges as a baseline, we expect a 3.25-3.75% default rate in 2025. Nearly every forward indicator one could look to for guidance suggests a decrease in default activity in the year ahead: a declining percentage of the loan market with worryingly thin cash flow coverage17 amid earnings growth and declining interest rates; loosening lending standards for commercial and industrial loans;18 the low percentage of loans trading at distressed levels; the limited maturity wall in 2026; and the decreasing percentage issuers with ratings which imply outsized default risk.19

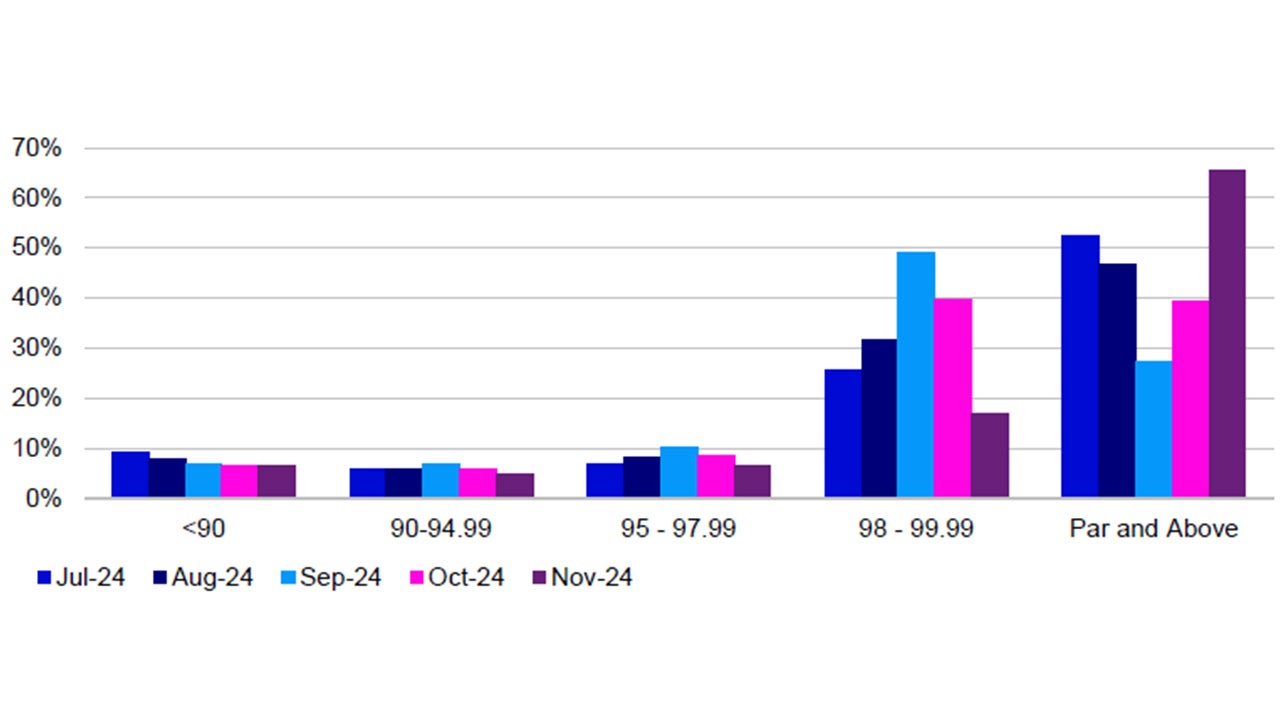

We anticipate a constructive macroeconomic backdrop will underpin general price stability in loans (away from the aforementioned credit-specific risks which may be compounded by a second Trump presidency). With 82% of loans trading at 99 or above as illustrated below in Figure 4, there is admittedly limited scope for price appreciation in the market. However, we anticipate a constructive fundamental set up for loans in 2025 that should curtail downside risk, absent a significant degradation of the growth outlook. A buoyant price environment would likely facilitate further repricing activity and tightening of new issue spreads, so we anticipate mild erosion in nominal spreads – in addition to lower base rates – will bend coupon slightly lower over the course of the year.

Source: PitchBook Data, Inc; Morningstar LSTA US Leveraged Loan Index as of November 30, 2024.

In concert with strong fundamentals, market technicals should remain generally supportive of prices in 2025. The percentage of the market hovering above par will ultimately determine the volume of repricings in 2025, but in any case, we would expect repricing activity to moderate relative to 2024. We expect new supply will increase as rallying risk asset prices, stable growth prospects, deregulation, and a relatively more stimulative policy backdrop all bode well for higher merger and acquisition / leveraged buyout activity following multiple years of subdued volume. Private equity sponsors face building pressure to deploy previously committed capital into new investments, while the constrained opportunities to exit investments in recent years suggest more lively dividend financing efforts. Away from net new issuance, we expect refinancing activity to remain active as issuers use accommodative capital markets to proactively extend their maturity runways. On the demand front, we expect retail and institutional demand for the asset class to persist given the enduring high coupon and benign credit backdrop, and for gross CLO formation to remain extremely robust as detailed below.

2025 CLO market outlook

Following a favorable 2024 for CLOs, 2025 is poised to continue many of the trends seen from this year. Strong demand for CLOs has led to US CLO gross issuance that will finish the year close to the record 2021 level of $185bn (includes BSL and private credit CLOs).20 Total gross issuance for 2025 could approach $200bn. The components of this strong demand are wide-ranging and well fueled by technicals.

Banks and insurers are likely to continue to favor CLO liabilities due to attractive regulatory capital charges (CLO AAAs in particular) and the floating-rate nature of bonds. US banks that had been on the sidelines since 2021 have re-entered the market, programmatically buying in the primary market and driving spreads tighter. International banks, particularly Japanese banks, have also continued purchases of CLOs in 2024, and appetite for CLO AAAs should remain robust into 2025 assuming hedging costs remain reasonable. On the margin, the emergence of CLO ETFs has essentially created a new buyer base this year. CLO ETF assets under management currently stand at $19bn, with over half of total flows raised in 2024 alone. Lastly, private credit CLO issuance is on pace for a record high of $35bn of gross issuance this year.21 With the capital raised by private credit participants and new private credit CLO managers bringing inaugural issuance, we expect private credit issuance to continue at an elevated pace as issuers use the securitization market to diversify funding sources and lock in relatively tight spread levels when compared to BSL issues.

Perhaps the most influential driver of total issuance, net issuance has remained muted following elevated investor paydowns that have come from CLO amortizations and called CLOs. While the percent of post reinvestment US BSL CLOs is down from 40% to begin the year, this percentage remains elevated, at approximately 25% of the market.22 Year-to-date (YTD) CLO gross issuance in 2024 is currently approximately $173bn, but net issuance is closer to $41bn ($90bn in amortization payments and $42bn in called CLOs).23 Looking to 2025, amortizations could decrease slightly and called volume could see a modest increase. Overall, CLO investors will need to replace called and amortized notes, further feeding gross issuance demand and driving higher levels of net issuance.

With CLO spreads tightening, CLO managers and equity holders have capitalized on the opportunity to extend reinvestment and preserve assets under management with refinance and reset activity. This year has already surpassed the prior annual record of $250bn for refinance / reset activity set in 2021.24 This activity is likely to continue at a slightly lower, albeit historically elevated pace in 2025 as essentially the entire post non-call market will be “in-the-money” for some sort of refinance or reset transaction. Factors that will determine if 2025 meets or exceeds 2024’s level will include where CLO spreads migrate to for the year, loan secondary prices, and arranger capacity.

While primary CLO spreads have already declined in 2024 by 18% and 33% YTD for AAAs and BBs, respectively, the above noted demand dynamics and limited net supply could drive CLO spreads tighter still. New issue tier 1 CLO AAAs are currently at SOFR + 131 basis points (bps) but could end the year inside SOFR + 130bps. Next year could see these liabilities tighten to the SOFR + 110-120bps range, which would be the tightest level for the 2.0 CLO era (previous tightest for CLO AAAs was LIBOR + M90s in 2018 which translates to approximately SOFR + 120bps).25 The biggest risk to this forecast remains the macroeconomic outlook with spread widening occurring in a risk-off market environment.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Many senior loans are illiquid, meaning that the investors may not be able to sell them quickly at a fair price and/or that the redemptions may be delayed due to illiquidity of the senior loans. The market for illiquid securities is more volatile than the market for liquid securities. The market for senior loans could be disrupted in the event of an economic downturn or a substantial increase or decrease in interest rates. Senior loans, like most other debt obligations, are subject to the risk of default.

Footnotes

-

1

There is no guarantee that the forecast will be realized.

-

2

S&P UBS Leveraged Loan Index as of November 30, 2024.

-

3

S&P UBS Leveraged Loan Index as of November 30, 2024.

-

4

Deutsche Bank as of December 2, 2024.

-

5

S&P UBS Leveraged Loan Index as of November 30, 2024.

-

6

PitchBook Data, Inc. as of November 30, 2024.

-

7

PitchBook Data, Inc. as of November 30, 2024.

-

8

Bank of America Merrill Lynch, “Defaults and Losses in 2025” November 8, 2024.

-

9

JP Morgan as of November 30, 2024.

-

10

JP Morgan as of November 30, 2024.

-

11

JP Morgan as of November 30, 2024.

-

12

JP Morgan as of November 30, 2024.

-

13

There is no guarantee that the forecast will be realized.

-

14

Sources: Bloomberg, S&P UBS Leveraged Loan Index as of November 30, 2024.

-

15

Sources: Bloomberg, Invesco as of November 30, 2024.

-

16

PitchBook Data, Inc. as of November 30, 2024.

-

17

PitchBook | LCD, “Loan issuer credit trends hold steady as EBITDA growth persists under high rates” August 14, 2024.

-

18

Q4 2024 Senior Loan Officer Survey

-

19

PitchBook | LCD, “US leverage loan Weakest Links tally hits 2-year low as issuers turn to private credit” October 24, 2024.

-

20

Citibank as of November 26, 2024.

-

21

Citibank as of November 26, 2024.

-

22

Invesco, Valitana, Intex as of November 30, 2024. Invesco pays a subscription fee to access this data.

-

23

BofA Global Research as of November 25, 2024.

-

24

Citibank as of November 26, 2024.

-

25

Invesco as of November 30, 2024.