US Senior Loan Market: 2021 review and 2022 outlook

2021 review and 2022 outlook

If the year 2020 qualified as the most abnormal of our lifetimes, then surely 2021 sprouted green shoots of normalcy. The modern miracle of vaccines enabled many to return to the office, restaurants, airports, concerts, sporting events, and resume other pre-pandemic routines. Still, the year delivered its fair share of irregularity. Investors navigated a dizzying array of positive and negative market catalysts: a turbulent power transition in Washington, rapid economic recovery, intermittent waves of virus calamity, tentative resumption of pre-pandemic life, strained global supply chains, inflationary pressures not seen since last century, a shifting monetary policy outlook, and the latest emergence of a new COVID strain.

Markets initially surged on vaccine progress, reflation optimism, and earnings momentum until fears of inflation/stagflation encroached as the year progressed. More recently, discovery of the Omicron variant reignited pandemic anxiety. However, through all the crosscurrents nudging sentiment every which way, the loan market calmly carried on, delivering low volatility and solid returns as it so often has in the past.1

Looking ahead to what we anticipate will be a multi-year period of ascending interest rates, we believe that loans can continue to offer a high-income haven from duration risk. If the case for loans at the start of 2021 was built on strong coupon plus upside potential from pandemic recovery, then the case for loans in 2022 is built on strong coupon plus low duration sensitivity. In our view, exposure to loans can help investors not only generate strong yields for their portfolios, but also hedge one of the key macroeconomic risks in 2022 – that of potentially unrelenting inflation that could force the US Federal Reserve (Fed) to raise rates with unexpected haste. For this reason, we believe loans continue to merit a core role in investors’ portfolios.

2021 review

Loans delivered year-to-date (YTD) returns of 4.74% through November,2 tracking slightly below our 5.5-6.5% forecast for the year. In retrospect, many of the expectations we outlined in our 2021 loan market outlook came to fruition:

Table 1: What we got right about 2021…

| Expectation | Result |

|---|---|

| “It is impossible to forecast when economic life will return to normal, particularly for the most battered industries like cruise lines and movie theaters, but we expect visibility will improve…As the fog lifts, trading sentiment should continue to improve accordingly.” | Rising vaccination rates through 2021 paved the way for a partial return to pre-pandemic consumption behaviors. Airport traffic, restaurant & hotel bookings, box office trends and many other indicators of activity improved markedly, infusing new life into loan issuers in those damaged sectors. The starkest example is movie theaters, which saw their loan prices gain 22.88% in value YTD while the broader leisure sector gained 5.02%. |

“We anticipate performance dispersion between sectors during the upcoming year. There are some fundamentally healthy industries such as Aerospace, Consumer, Gaming/Leisure, and Transportation [which] may stand to benefit immensely from broadening vaccination...There are also sectors facing longer-term headwinds beyond the pandemic, such as Energy, which contain compelling idiosyncratic return opportunities.” |

Sector dispersion was pronounced in 2021, with the top returning sector outperforming the bottom returning sector by 1,597 basis points (bps). COVID-impacted sectors like Consumer Non-Durables, Gaming/Leisure, and Aerospace outpaced the broader loan market by 212bps, 161bps, and 121bps, respectively. We did not anticipate the exceptional strength in commodities; Energy and Metals/Mining were the two top performing sectors in 2021. |

| “We expect this dispersion dynamic will also be evident in performance by ratings quality, with lower quality broadly outperforming for similar reasons.” | Lower quality handily outperformed the market amid a buoyant price environment in which investors were increasingly willing to bid discounted issuers. CCCs returned 13.90% while Bs returned 4.44% and BBs returned 2.35%. |

“Receding macro headwinds and a more stable rates backdrop should be more conducive to M&A/LBO loan supply. Refinancing activity is also likely to accelerate…Repricing activity should remain subdued…Overall we foresee...new loan supply of...$275-300 million (mn) net of refinancing/repricing.” |

M&A/LBO financings surged to $287.8 billion (bn) (versus $142.4bn in all of 2020), while refinancings also increased to $218.5bn (versus $119.2bn). Repricings of $203.4bn (versus $109.7bn in 2020) did remain muted overall at 14% of the par loan amounts outstanding (well below the average of recent years) and resulting in just 15bps of coupon drag for the loan market. Overall, new issuance of $374.4bn net of refinancings/repricings exceeded our expectations. |

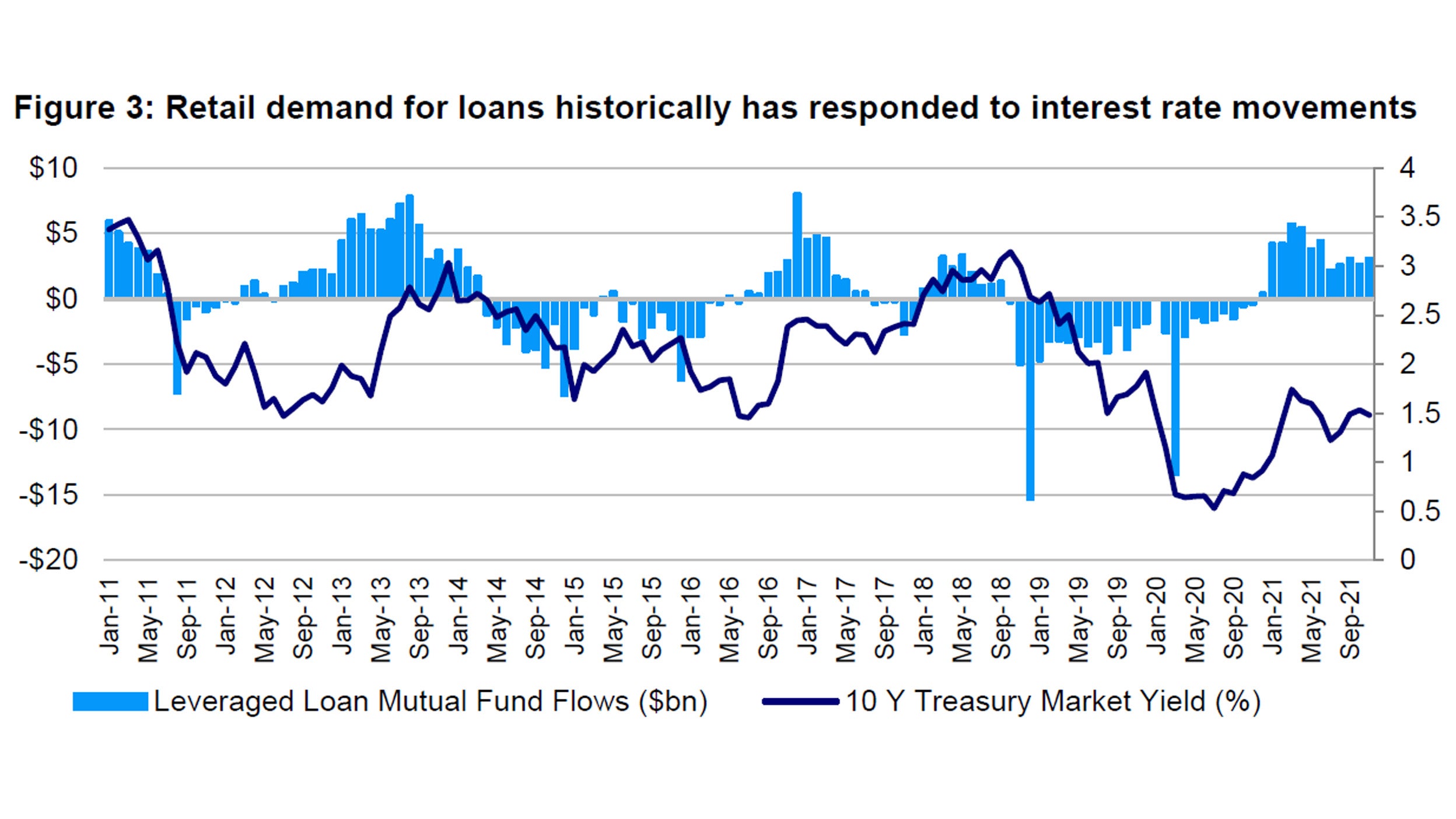

| “Should the impending recovery drive inflation above expectations, we could see a rethinking of the rates outlook and consequently renewed interest in loans among retail (and institutional) buyers.” | Inflation dominated the market narrative for much of 2021, resulting in episodes of significant rate volatility and widely shared expectations of rising interest rates over the near/medium term. Investors seeking haven from duration risk flocked to loans; retail funds recorded inflows of $42.8 billion, a significant reversal from 2020’s large outflows. |

Sources: Invesco, JP Morgan, Credit Suisse, and Barclays as of November 30, 2021. Quotations above are from Invesco’s 2021 US Loan Market Outlook. For illustrative purposes only.

Table 2: and what we got wrong…

| Expectation | Result |

|---|---|

| “We anticipate that loan defaults will peak early in 2021 before declining to 3.0-3.5%.” | In fact, loan defaults peaked at 4.17% in September 2020 and then declined markedly to a near record low of 0.29% by November 2021. |

“We expect CLO origination will increase in 2021 to nearly $100 billion.” |

CLO origination shattered all-time records in 2021. Through November, 860 CLOs priced totaling $394.6bn, including $170.2bn ex-refinancing. The previous annual record was $129 billion set in 2018. |

Sources: Invesco, JP Morgan, and S&P Leveraged Commentary & Data (LCD) as of November 30, 2021. Quotations above are from Invesco’s 2021 US Loan Market Outlook. For illustrative purposes only.

In summary, YTD loan returns have been powered by both coupon income and price appreciation. Annual coupon generated by the aggregate loan market held steady at 4.07% during the year while the average loan price increased from 95.73 to 98.06.3 Prices scaled higher consistently throughout the year, with only four months in which prices pulled back slightly. Months in which prices dipped were primarily due to bursts of new issuance, except for November’s Omicron-led risk aversion. Gains were broad-based as vaccine-driven optimism enveloped the market, corporate earnings recovery healed credit metrics, and a ratings agency upgrade cycle took hold. The percentage of loans trading below $80 withered from 2.17% to 1.12%,4 reflecting the absence of financially distressed issuers, abundant liquidity, and expectations for the benign default environment to persist for the foreseeable future.

2022 outlook

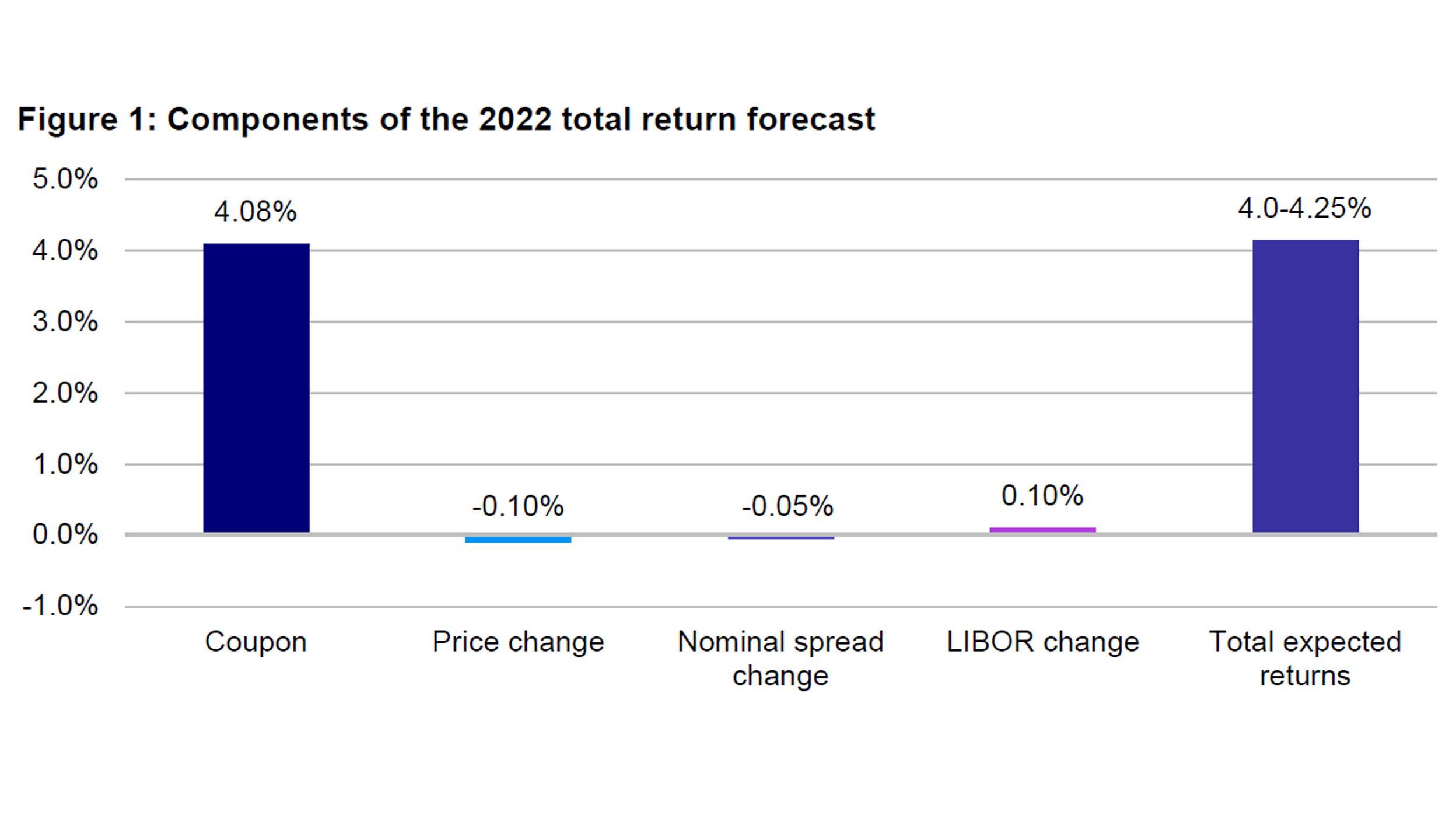

Looking forward to 2022, we expect the loan market should generate total returns of 4.0-4.25% driven primarily by coupon income. First and foremost, we acknowledge an added dimension of uncertainty stemming from the recently discovered Omicron variant (about which little is known), as well as from subsequent virus mutations which will surely arise. The prospect of a new highly transmissible COVID variant that may resist existing vaccines clearly poses risk of renewed travel/mobility restrictions which could impact consumption, growth, and earnings for many industries. As such, elevated volatility in the near-term would not come as a surprise. However, barring a worst-case outcome (i.e., low vaccine efficacy against Omicron plus a lengthy timeframe to re-engineer vaccines), we continue to expect a constructive overall economic backdrop for loan issuers based on increasingly high levels of immunity in the US and globally, broadening availability of effective anti-viral treatments, and the extent to which consumers and businesses have adapted to operate in a pandemic environment. Even through the tragic Delta wave in mid/late 2021, economic activity (though impacted) remained solid, corporate earnings surged, and loans performed well.

As economic growth remains strong but moderates from the spring-loaded rebound in 2021, we anticipate an earnings backdrop more akin to a typical mid-cycle expansion. Year-on-year earnings growth will become less eye-popping and more varied within and between sectors as ubiquitously inflating costs will impact profit margins unevenly. Dispersion in earnings performance will increase between issuers with pricing power and those without. Over the course of the year, inflation is likely to downshift due to base effects (i.e. easier year-on-year comparisons) and easing supply chain bottlenecks but should remain elevated versus the pre-pandemic baseline.

A combination of solid growth, tightening labor markets, and sustained inflation should collectively keep pressure on the Fed to withdraw monetary support. Recently passed and currently proposed infrastructure bills notwithstanding, the US economy will also see meaningful fiscal retrenchment during 2022 as the extraordinary pandemic relief measures expire.5 In short, policy is likely to become less supportive of growth as the pandemic (hopefully) recedes further from daily life and the economy is left to power itself more organically.

Source: Invesco, Credit Suisse Leveraged Loan Index (USD) as of November 30, 2021. The impact of LIBOR floors is reflected in the coupon.

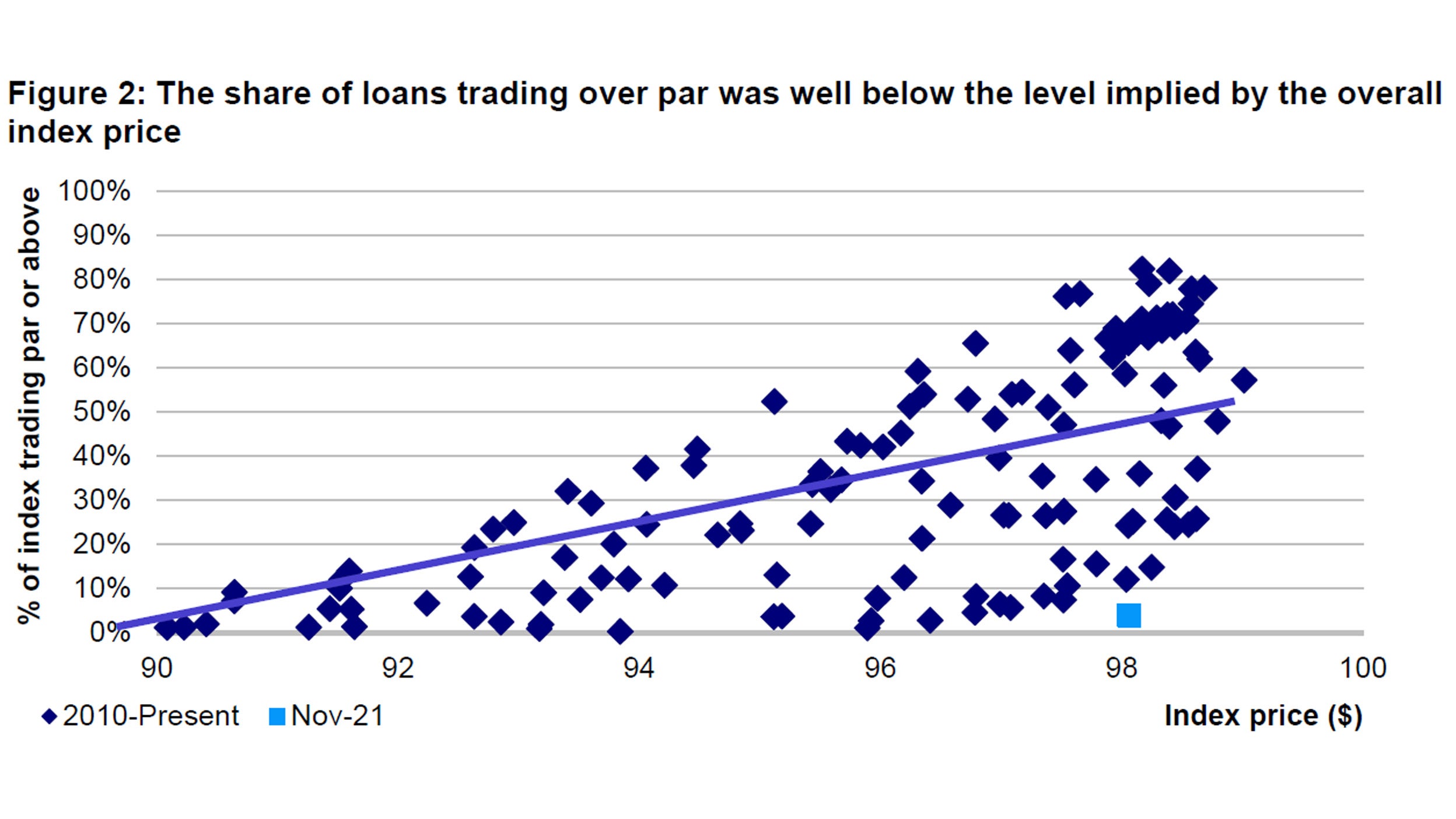

Entering the new year, loans have largely priced in economic normalization, thus we do not foresee significant overall price gains. In the loan market, price appreciation is inherently limited by loans’ callability at par; when a loan begins to trade above par, the issuer typically attempts to reprice or refinance. Between loans’ relatively high current average price of 98.06 and our expectation that a small percentage of the market should experience price erosion resulting from downward ratings migration, we forecast approximately flat price action in 2022. While low rated credit will likely outperform again, the magnitude will be smaller than in 2021 and more driven by higher spreads than by price appreciation. That said, Omicron-related concerns may induce price volatility that creates opportunity for long-term minded investors, particularly in reopening-sensitive sectors. Moreover, a historically low percentage of loans are trading above par relative to the high overall price of the market as shown in Figure 2. This implies that further loan price appreciation is certainly possible and may materialize amid strong expected demand for the asset class.

Source: Barclays as of November 30, 2021.

On the topic of demand, we expect investor appetite for loans will stay extremely robust in 2022. The macro factors outlined above set up for a sustained climb in interest rates as central banks tighten the loose monetary conditions which have been in place since the onset of COVID and are, in part, contributing to current inflationary pressures. The normalization of monetary policy began in November with the Fed starting to taper asset purchases and is expected to continue with three policy rate hikes in 2022.6 Historically, and during 2021, retail and institutional demand for floating rate assets correlates strongly to changes in interest rates as investors seek protection from duration risk (depicted in Figure 3). Duration considerations are also poised to drive demand for CLO liabilities, which in turn would prolong the healthy environment for CLO origination. Although CLO creation may not match 2021’s record setting pace, we expect it will remain elevated at $135-145bn, or 20-25% below 2021 levels. Supportive equity arbitrage (the spread between CLO assets/liabilities), demand for CLO liabilities, and a record number of open CLO warehouses7 indicate a strong start to CLO issuance in 2022.

Source: JP Morgan as of November 30, 2021.

Similar to 2021, a strong bid for loans will likely create its own supply as issuers angle to capitalize on inflows into the asset class. From 2015-2020, annual gross loan issuance averaged 36% of the size of the overall market as measured at the start of the year; 2021 issuance is on pace to be 46% of the market’s par value at the start of the year.8 Considering the constructive economic outlook and strong tailwinds to M&A and LBO activity (including significant cash on corporate balance sheets and unallocated capital held by private equity sponsors), we anticipate 2022 will be another above-average year for primary loan supply. With so many issuers having refinanced loans in 2020/2021 and a benign maturity calendar in upcoming years, refinancing activity will likely decline from this past year’s active pace.

The exceptionally good outlook for loan demand in 2022 combined with our view that supply will likely remain abundant suggests a constructive, albeit less relentlessly buoyant, technical environment. For this reason, we expect new issuance spreads in 2022 to price approximately in line with current market spreads. Additionally, loan repricings are not likely to contribute meaningful coupon drag in the upcoming year considering the low percentage of loans trading above par (4.37% at the end of November)9, which implies less repricing activity than in 2021.10 These two factors would support the stable nominal spreads reflected in our return forecast. Meanwhile, our forecast assumes limited benefit from rising base rates during 2022. Unless the Fed undertakes an even steeper path to policy normalization than current guidance implies (which we acknowledge is a distinct possibility), accretion to loan coupon from higher base rates is probably more relevant for 2023. The 43% of loans subject to 0% LIBOR floors will accrue the most benefit this coming year, while the 57% of loans subject to floors of 0.5% or higher would not be impacted until late in the year, assuming the current LIBOR forward curve materializes.11

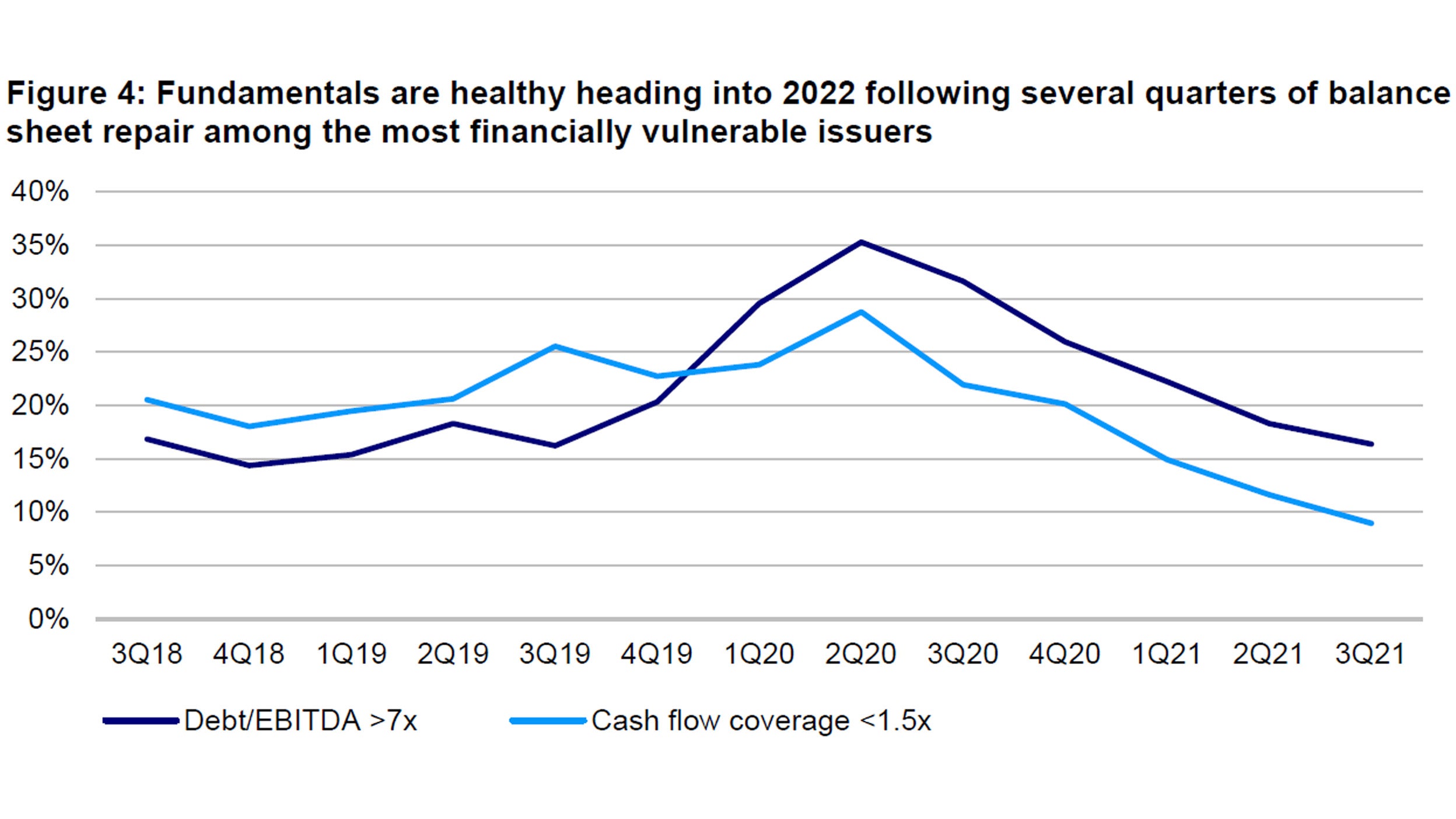

While we devote much attention to supply/demand dynamics and their impact on return considerations, we would be remiss to neglect the far more important rationale for investing in loans: strong credit fundamentals. Throughout 2021, earnings recovery restored health to the pandemic-impacted credit metrics investors rely upon to assess issuers’ financial stability. These include leverage, interest coverage ratios, cash flow, and balance sheet liquidity. Improvement was especially notable among issuers with weaker financial profiles as depicted in Figure 4.

Source: S&P Leveraged Commentary & Data (LCD). Data through September 30, 2021.

Cost inflation certainly complicates the profit outlook in 2022 given uncertainties around wage/raw material inflation, supply availability, and pricing power. Ongoing spread of the Delta variant and potential spread of Omicron may pose an additional challenge, especially for reopening-sensitive issuers. Clearly, not all companies will fare equally in this environment. However, given the alignment of macro factors (i.e., robust economic growth/aggregate demand and abundant capital market liquidity) with healthy corporate fundamentals in the loan market entering 2022 (i.e., manageable leverage and cash flow coverage, limited maturities, paucity of issuers trading at distressed levels), we expect the benign default environment will persist. We are expecting a default rate of 1.25-1.75% in 2022; this would be slightly more eventful than 2021 which was quiet partially because the pandemic pulled forward some defaults into 2020, but well below average. Despite the low default environment, our return forecast reflects the probability that some portion of issuers will experience margin compression, rating downgrades, and resulting loan price pressure.

Topics in loans

Each year, we seek to highlight a few key themes and developments in the loan market:

- Loans versus high yield bonds: With inflation surging and labor markets tightening, the hour is late on the Fed’s rock-bottom policy rate posture. As the Fed begins its hiking cycle, loan investors will stand to benefit from floating rate coupons once base rates rise above loans’ LIBOR floors (or immediately in the case of loans with 0% floors). By comparison, fixed rate credit products like high yield bonds expose investors to duration risk. With loans and high yield bonds currently offering roughly equivalent yields,12 loans present a more compelling yield/duration trade off. Additionally, nearly 20% of high yield bonds that are currently callable or callable within one year are trading above or within $1 of their call price. 13 With fewer than 5% of loans trading above par, the loan market thus appears less priced to perfection, with relatively more price appreciation potential.

- LIBOR transition update: The long-awaited transition away from LIBOR as a base rate draws near with banks scheduled to cease publishing the 1-, 3-, 6-, and 12-month benchmark lending rates after June 30, 2023. Encouragingly, loan market stakeholders have coalesced around SOFR as a replacement rate; there will also be an added credit spread adjustment (CSA) included above SOFR based on SOFR’s historical gap to LIBOR. Moreover, the vast majority of new issuance in 2021 included “hardwired” alternative base rate language in credit agreements to ensure a smooth, automatic transition for computing interest payments once LIBOR is no longer available. The next 18 months will see a significant portion of outstanding loans either refinanced with similar language built into their new credit agreements or amended in accordance with this approach.

Beyond embedding the proper triggers into loan documentation, the market also saw its first SOFR-based loan deals in the waning months of 2021, a prelude to universal SOFR-based loan issuance in the years ahead. A standardized approach to the credit spread adjustment is still evolving, but early indications point to 10, 15, and 25 bp credit spread adjustments for 1-, 3-, and 6-month SOFR tenors (i.e., a loan will price at SOFR + CSA + Credit Spread, with the CSA determined by which SOFR tenor is chosen in any given interest payment period). That issuers and arranging banks are proactively pivoting to SOFR promises a smooth upcoming transition.

The transition to SOFR-based issuance will occur even more rapidly for CLO liabilities, all of which we expect will price off of SOFR beginning in 2022. October 2021 saw the first SOFR-based CLO liabilities clear the market as managers prepare for the switch over. Because CLO liabilities will pay 3M SOFR + CSA + Credit Spread while loans still have the option to pay 1M, 3M, or 6M (or even LIBOR for now), there is some basis risk to CLO equity in the near term. However, this is mitigated by two factors: the increasing prevalence of LIBOR floors (57% of the loan market has floors above 0 bps) and the loan market’s typically brisk repayment rate of 20-30% annually.14 Repayments (mostly through refinancings) will help migrate the collateral pool to SOFR-based issuance and thus lessen basis risk potential over time.

- Growth of ESG: Environmental, social, and governance considerations remain a major discussion point within the loan market and increasingly influence how investors allocate capital. Investors are demanding better ESG disclosure, and issuers have responded with better communication on these important topics (and in some cases, more thoughtful ESG strategy). While the loan market broadly lags other asset classes in terms of ESG adoption/sophistication, Invesco remains a clear market leader in this area. Invesco introduced first-of-their-kind ESG loan strategies during 2019 and 2020 and we continue to build an ESG-centric investment platform atop our best-in-class proprietary process for evaluating loan issuers’ ESG profiles.

Emphasis on ESG is beginning to show up in loan issuance itself as the broader market increasingly attributes importance to these considerations. For instance, 2021 brought the first “ESG margin ratchet” in US loan issuance whereby an issuer can secure interest cost reductions upon achieving pre-defined ESG goals (such as meeting carbon emissions targets). ESG margin ratchets are already somewhat common in Europe, and we expect will become more common in the US in coming years.

CLOs represent another frontier of ESG adoption within the loan space. Managers have begun issuing ESG-compliant CLOs that implement negative screening criteria in their indentures. Here again, Invesco is at the forefront of industry change: we manage our ESG-compliant CLO strategy leveraging the same proprietary ESG ratings database utilized by our retail and institutional products,15 extending our ESG commitments deeper into our investment enterprise.

Key risks to 2022 returns

Our 2022 return forecast is the outcome we believe to be most probable for the loan market; however, we acknowledge that key variables could cause actual performance to differ from our base case, either positively or negatively. Important swing factors include, but may not be limited to:

- COVID: The emergence of Omicron as a threat to public health took investors by surprise in November. Preliminary evidence suggests higher transmissibility and milder symptoms than prior virus strains, as well as good (albeit lower) vaccine efficacy, but we still know very little about this new variant. If this strain turns out to be more resistant to existing mRNA vaccines, it could disrupt global economic activity even more than prior mutations.

- Policy considerations: The Fed’s apparent inclination to tighten monetary policy in the face of rising inflation could impede economic growth and undermine the earnings environment for loan issuers if pursued too hastily. This is particularly relevant if tightening monetary conditions collide with disappointing growth, either due to impact from COVID, supply chain issues, or other headwinds.

- Impact of secular shifts on default rate: The pandemic has precipitated or accelerated certain societal shifts that could permanently impair the operating environment for certain companies which may never see consumer behavior fully normalize to the pre-pandemic status quo. This could contribute to lessening lender appetite to fund such challenged issuers, and lead to rising defaults / falling recoveries.

^1 The US loan market (as measured by the Credit Suisse Leveraged Loan Index total returns in USD) has experienced two years of negative returns over the past 29 years. Source: Credit Suisse Leveraged Loan Index data through December 30, 2020. Past performance is not a guarantee of future results.

^2 Credit Suisse Leverage Loan Index, November 30, 2021.

^3 Credit Suisse Leverage Loan Index, November 30, 2021.

^4 LCD Research, November 30, 2021.

^5 Goldman Sachs Research, August 31, 2021.

^6 Bloomberg; Fed Funds Futures as of December 3, 2021.

^7 Morgan Stanley Research, December 2, 2021.

^8 Barclays Credit Research, 2022 Supply Outlook: A Decline is All Relative, November 12, 2021.

^9 JP Morgan, November 30, 2021.

^10 Barclays Credit Research, 2022 Supply Outlook: A Decline is All Relative, November 12, 2021.

^11 Credit Suisse Leverage Loan Index, November 30, 2021.

^12 JP Morgan, November 30, 2021.

^13 JP Morgan, November 30, 2021.

^14 Morgan Stanley, November 30, 2021.

^15 Not all products are available in all regions. Please consult your local Invesco representative for more information.