A rise in senior secured bonds lifts high yield

Overview

The historically higher recovery rates of secured bonds and their higher position in the capital structure add extra protection for bondholders.

The growth of secured bond issuance in the high yield market has improved high yield’s overall credit quality.

We believe the rising proportion of secured bonds in the high yield market presents a unique opportunity, based on their attractive valuations and potential investment performance.

An increase in secured high yield bond issuance has improved the credit quality of the high yield asset class, in the view of the Invesco High Yield Team. We speak with Senior Portfolio Managers Philip Susser and Stuart Stanley about why secured bond issuance has grown and what it means for the US high yield market.

Q: What are senior secured bonds?

Philip: Secured bonds are backed by assets (such as real estate, physical assets, or equity in subsidiaries) that provide an extra level of protection for bondholders in the event of an issuer’s default. They typically carry an unsecured claim against the company, similar to unsecured bonds, plus a priority claim against the secured assets or collateral. While every issue is different, secured bonds typically sit higher in the capital structure than unsecured bonds, subordinated debt, or other claims. Recently, secured high yield bond issuance has grown, resulting in an all-time high percentage of secured bonds in the high yield market.

Q: Why do you think the growth in the proportion of secured bonds has improved the overall credit quality of high yield?

Stuart: The higher a bond’s position in the capital structure, the higher the recovery rate should be. Since secured bonds have priority over unsecured debt when it comes to the collateral, they should generate a higher recovery rate, assuming the collateral has value.

History shows that secured high yield bonds have provided a higher recovery rate than unsecured bonds. The long-term average recovery rate associated with secured bonds is 53 cents on the dollar versus 35 cents for senior unsecured bonds and 27 cents for senior subordinated bonds.1 On average, recovery rates of secured bonds have been comparable to recovery rates on first lien bank loans.2

Q: What has caused this growth in secured issuance, and can we assume that the historically higher secured bond recovery rates will persist?

Philip: Recovery rates fluctuate over time and can depend on the economic backdrop and prevailing number of insolvencies. But the priority position of secured bonds remains constant. As a result, we are confident that secured bond recovery rates will continue to exceed those of unsecured bonds and, therefore, that they present a significant improvement in the structure of the high yield market.

Also, due to certain technical factors and the inverted yield curve, the yield on the US high yield bond index is currently lower than the yield on the US leveraged loan index, which is unusual. This has made it cheaper for companies to borrow in the high yield bond market in many instances. Since issuers decide where they want to borrow, they have chosen to refinance or raise additional money in the high yield market to lower their overall interest costs. But to entice high yield borrowers, issuers have provided bond investors with a level of security that they might have otherwise offered to lenders. We feel that since much

of the secured issuance has been raised in a softer market, investors have been able to extract better terms than they would have received in a stronger market. This dynamic reinforces our belief that this cycle is not different and that secured recovery rates will likely be consistent with history and will likely be higher than unsecured recovery rates.

Stuart: In Europe, secured bonds have represented a large share of the high yield market for some time. The growth of secured bonds in the European high yield market came about as a way to protect bond investors in an environment with less robust insolvency codes than in the US. The breakdown of the European high yield market between senior secured and unsecured bonds is similar to the breakdown in the US, with about 33% of the market consisting of senior secured bonds and 67% consisting of unsecured bonds. The percentage of secured bonds rises to 44% when considering pure corporate high yield issuers.3

Q: What percentage of the developed market (US and Europe) high yield market is comprised of secured bonds and are they concentrated in certain industries or ratings categories?

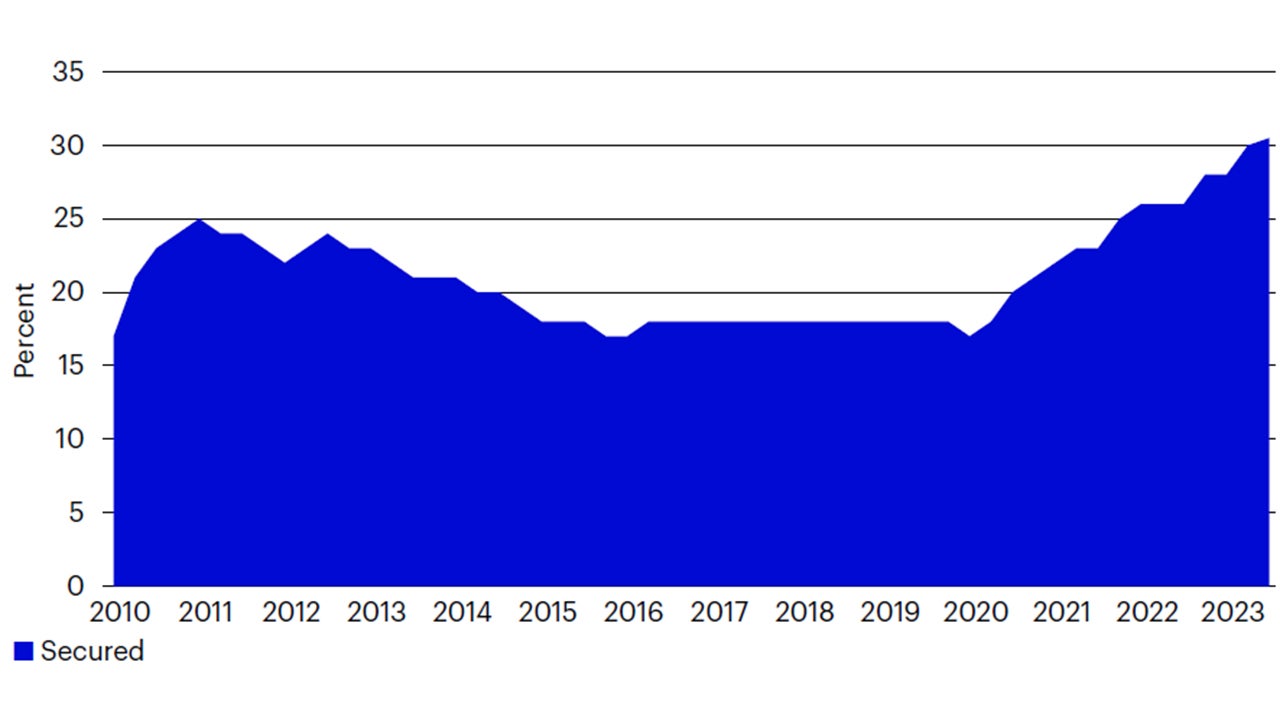

Stuart: Secured bonds have reached a record high of 30.5% percent of the developed high yield market, an increase of over 10 percentage points since October 2020 and almost 15 percentage points since 2010 (Figure 1).

Secured bonds are issued across a wide range of industries, which helps diversify their performance and reduces their vulnerability to a downturn in one or two industries. Telecommunications is the largest industry represented in the Global High Yield Secured Bond Index at 12.4%, followed by healthcare at 9.4%.4

While the ratings breakdown of the secured index is slightly weaker than the broader index, with more single-B rated issuers than the broader index, we believe the security interest and higher expected recovery rates more than offset the lower overall credit rating. In addition, there are fewer triple-C rated bonds in the secured bond segment than in the broader high yield market, which should help lower the near-term default rate of the secured segment.

Source: BofA Global Research, ICE Data Indices LLC. As of August 31, 2023.

Q: Why do you believe the growth of secured bond issuance is a unique opportunity?

Philip: For two reasons: First, secured high yield bonds have outperformed the broader high yield market by 16 basis points annually over the last 24 years, with slightly less volatility.5 Second, valuations of secured bonds look attractive compared to unsecured bonds, in our view. Secured bonds currently yield 67 basis points more than the broader index (8.56% versus 7.89%) and the duration-to-worst is almost a third of a year lower (3.37 years versus 3.75 years).6 Against this valuation backdrop, plus higher expected recovery rates and discounted prices on offer, we believe secured bonds - and the broader high yield asset class - are more attractive than would be expected based on historical spreads alone.

Stuart: In Europe, the average spread of a BB-rated secured bond is wider than the average spread of similarly rated BB unsecured bonds. This anomaly is the result of a different mix of issuers. The observation nonetheless shows that a BB bond with security can be owned at the same spread or wider than an average BB unsecured bond.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

The values of junk bonds fluctuate more than those of high quality bonds and can decline significantly over short time periods.

Footnotes

-

1

Source: JP Morgan. Data as of Aug. 31, 2023.

-

2

Source: JP Morgan. Data from Dec. 31, 1999 to Dec. 31, 2022.

-

3

Source: BofA European Currency Developed Markets HY Constrained Index. Data as of Aug. 31, 2023.

-

4

Source: ICE BofA BB-B Global High Yield Secured Bond Index. Data as of Aug. 31, 2023.

-

5

Source: ICE BofA indices, Invesco calculations. Data from Jan. 1, 1999 to Aug. 31, 2023.

-

6

Source: This compares the performance of the ICE BofA Global High Yield Secured Bond Index to the ICE BofA BB-B Global High Yield Bond Index. Data as of Sept. 14, 2023.