The case for senior loans - quarterly update

Q3 2024 market update

As the 3rd quarter comes to a close, there has been a significant focus on the uncertainty of the US macroeconomic backdrop and its potential implications for the senior secured bank loan market. Paramount among these concerns are three key questions:

1) How are underlying issuers able to handle increased debt service costs with higher interest rates?

2) Where are we in the interest rate cycle and how will this affect issuers?

3) What effect will a potential recession have on issuers?

This piece provides our view on the current market environment and attempts to answer these critical questions.

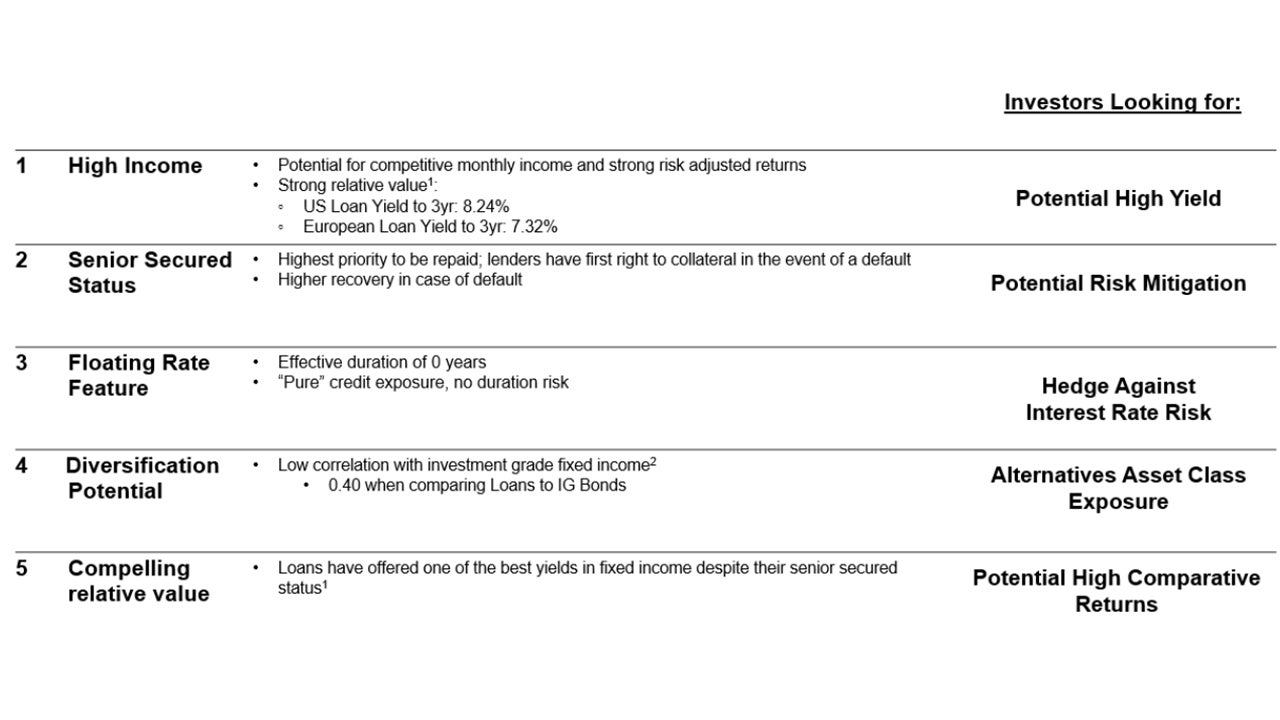

Why loans now?

In our view, there are three compelling reasons to consider investing in senior secured loans today:

1) Potential high level of current income

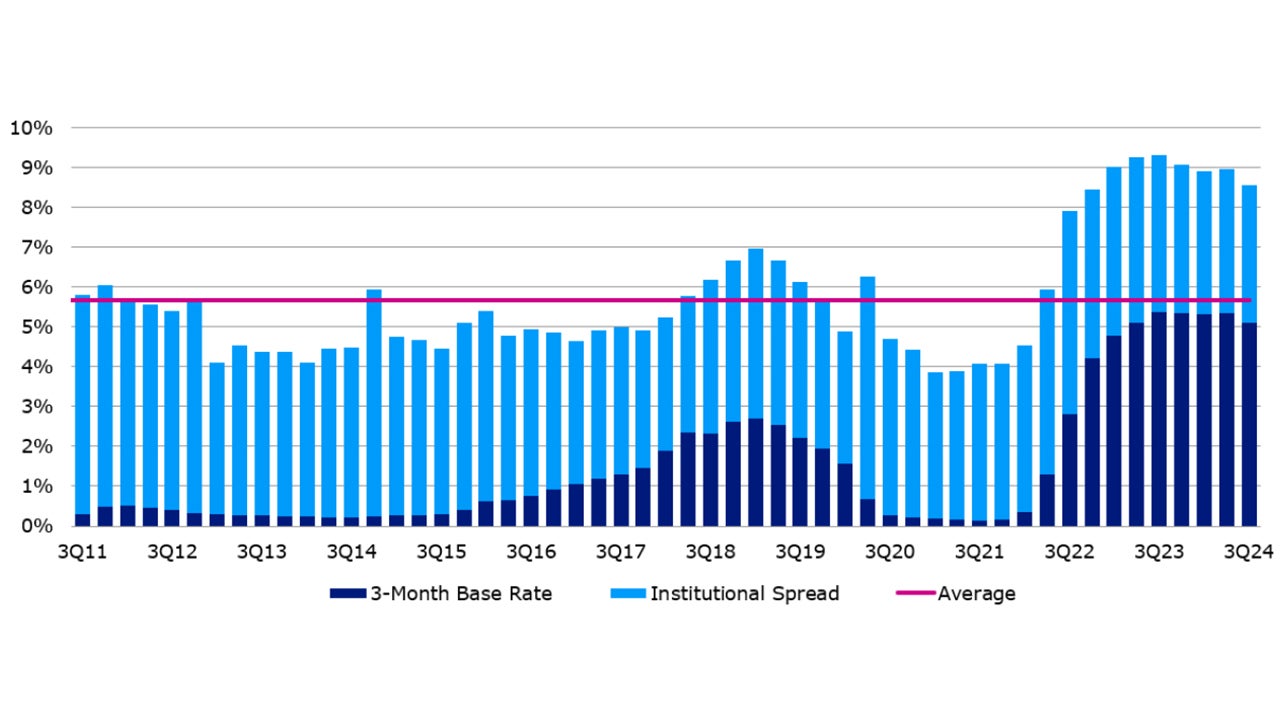

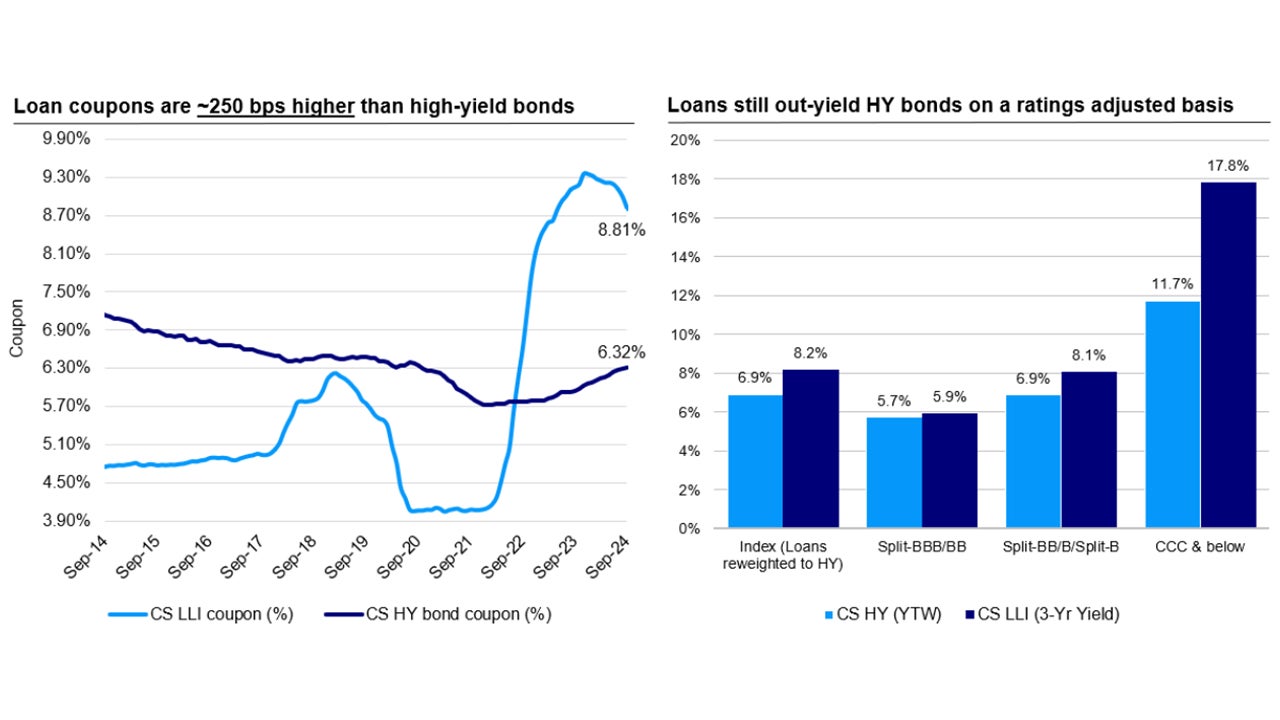

Current income is comprised of two key components—base interest rates (which are expected to stay higher for longer) and credit spreads (which continue to remain wide). Coupon income for bank loans today is 8.81%, which is near its highest since 20091. Market expectations are for rates to remain higher for longer, well above pre-2022 levels. Loans have proven to provide consistent, stable income through varying market cycles, including recessionary periods and periods of falling rates.

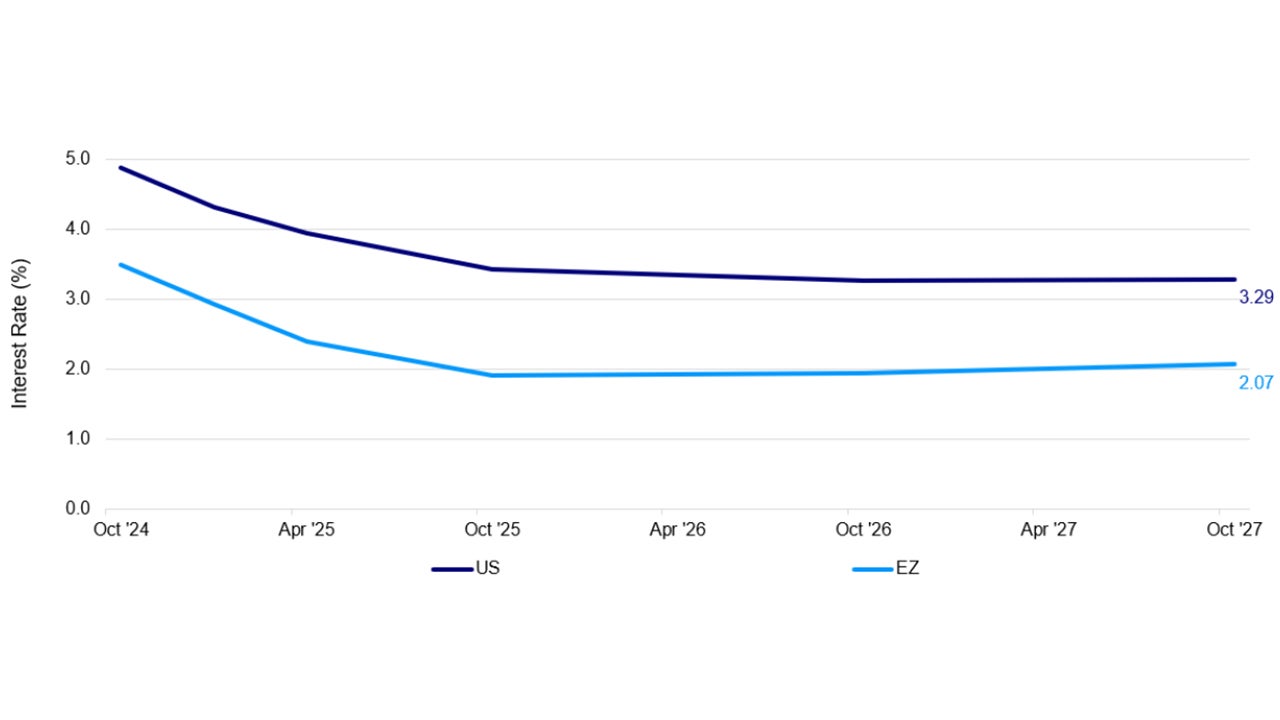

2) Rates are expected to stay higher for longer

Loans have virtually no duration risk (average ~45 days). As a floating-rate asset class, high base rates have led to higher coupons, supporting total returns for the asset class. Although coupon rates are anticipated to decrease as the Federal Reserve reduces interest rates, overall interest rates are expected to stabilize at higher levels significantly above those observed over the past decade. The coupon rate over the next 6-12 months is expected to remain above historical averages in the context of the Fed’s intended “recalibration” of interest rate policy.

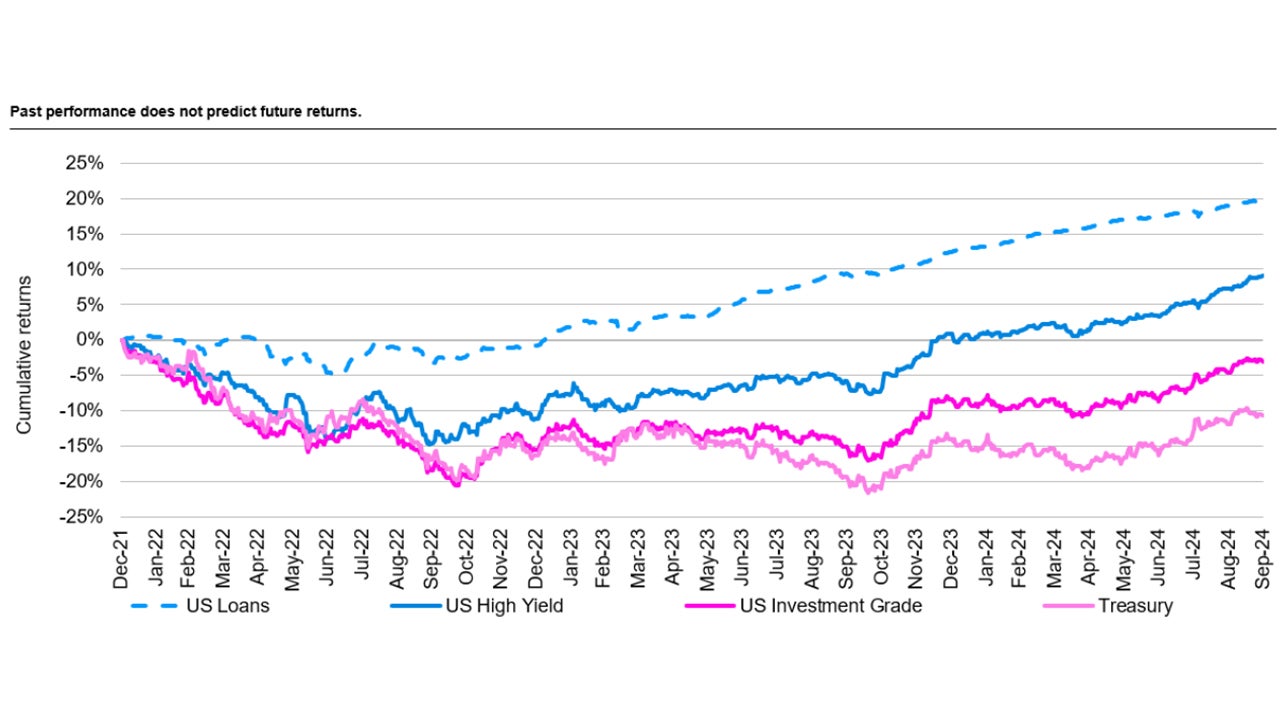

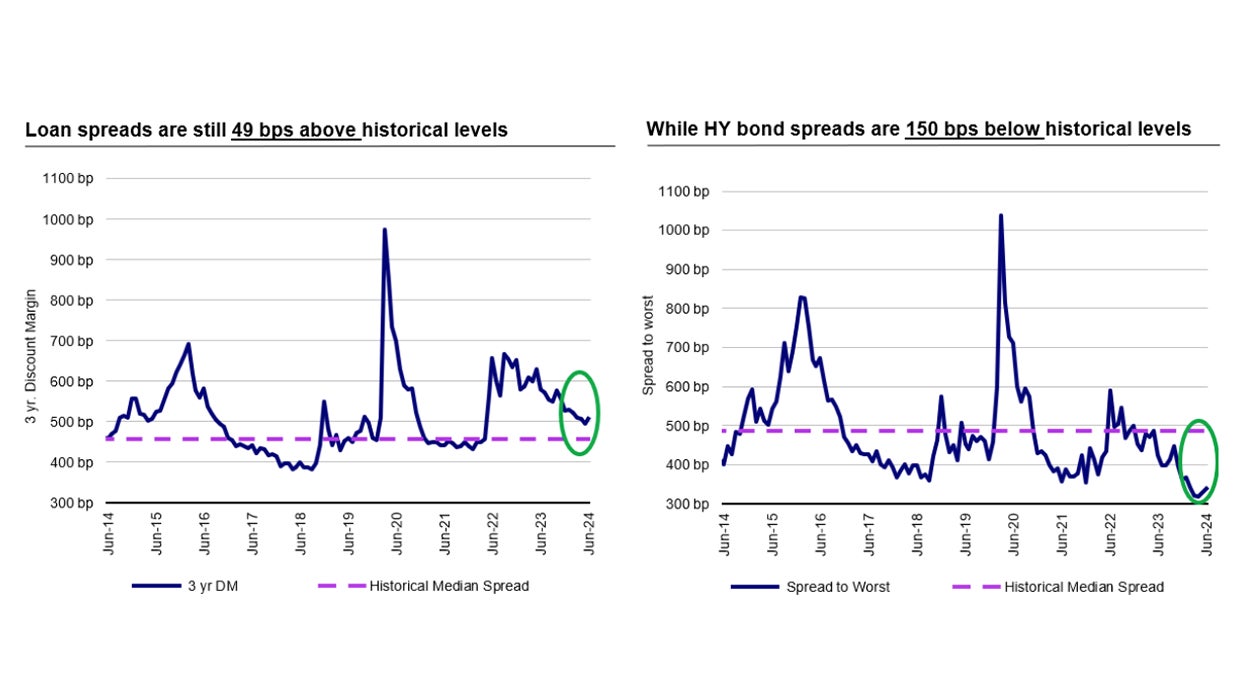

3) Compelling relative value

Loans have offered one of the best yields in fixed income, while providing downside risk mitigation by being senior in the capital structure and being secured by the assets of the company. Loans are one of the only asset classes that are still offering a historically attractive entry point, with spreads still wide of their long-term averages, compared to most fixed income spreads close to all-time tights. Loans have offered these high yields with no duration risk. In a recessionary environment, loans offer downside risk mitigation by being senior which means they are the highest priority to be repaid in the event of default. Senior secured assets may offer added risk mitigation throughout recessionary periods.

Yields

Current loan yields and spreads look very attractive both on a historical and a relative basis. A loan's yield is based on both coupon payments, which is the interest return, as well as on principal return. The average coupon for loans is 8.81%, outpacing the average high yield coupon of 6.32%1. After averaging around ~170 bps less than high yield bonds over the past fifteen years, this is the first time in history the average loan coupon has surpassed that of high yield bonds. It was only around three years ago when loans were yielding ~4.80%; loans recently have been yielding over 400 basis points more than that1.

A Unique combination of appealing characteristics

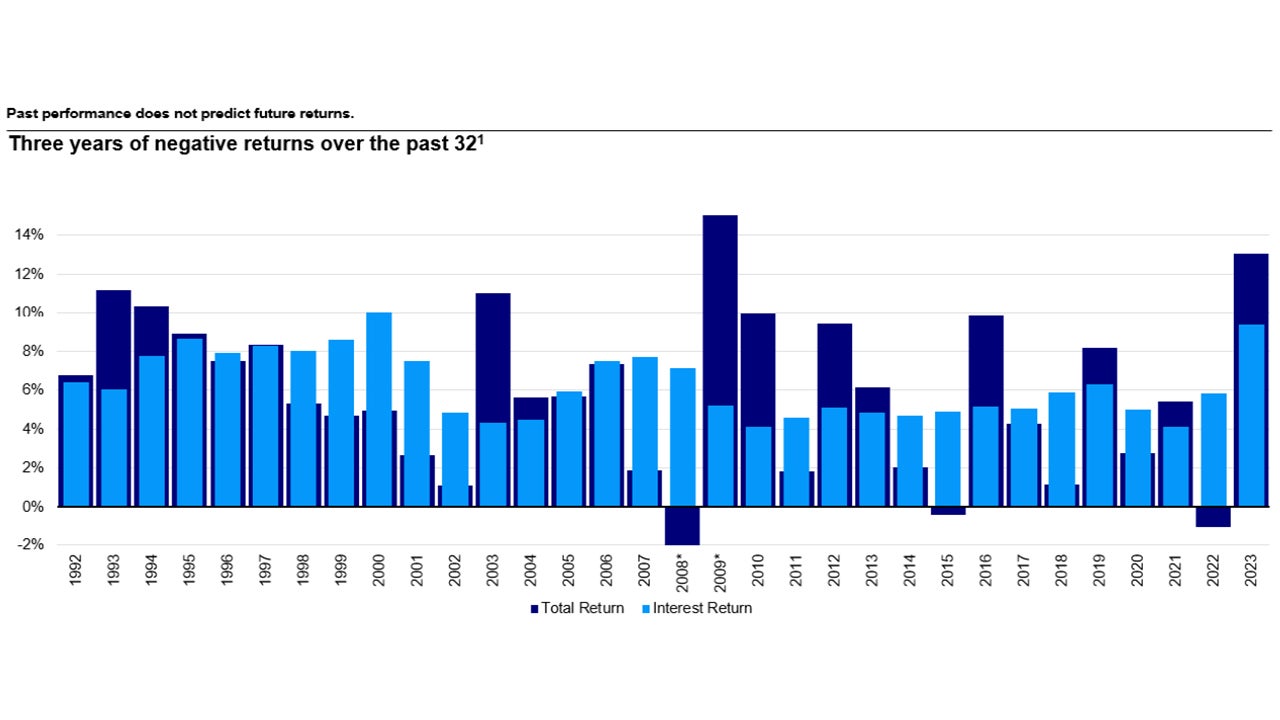

Source: 1Credit Suisse Leveraged Loan Index data through December 31, 2023, updated annually. *Denotes returns in excess of the axis. 2008 returns were –28.75%, 2009 returns were 44.87%.

Source: Pitchbook LCD as of September 30, 2024. Base rate reflects the average during the quarter. Uses three-month LIBOR (prior to 2023) or SOFR (2023 or later) plus the weighted average institutional spread.

Throughout 2023, rising rates put the floating-rate loan asset class on pace for one of the strongest years since the Global Financial Crisis2. The US leveraged loan market returned 13.04% in 20231. Loans still offer amongst the highest yields and are expected to remain high, as the market anticipates a higher for longer interest rate environment3.

Steady US loan returns stood in stark contrast to other risk assets

Sources: PitchBook Data, Inc.; Bank of America Merrill Lynch; Bloomberg as of September 30, 2024. The Morningstar LSTA US Leveraged Loan Index represents US Loans, the ICE BofA US High Yield Index represents US High Yield, the ICE BofA US Corporate Index represents US Investment Grade, the ICE BofA Current 10-Year US Treasury Index-TR represents Treasury. An investment cannot be made directly in an index.

The higher interest rate environment has put pressure on borrowers due to increased interest expense cost. However, as the Federal Reserve pauses interest rate increases (or decreases rates), it can have both direct and indirect positive effects on the leveraged loan market such as:

- Lower borrowing costs: rate cuts lower borrowing costs for companies and potentially stimulates demand for new issuance.

- Improved debt serviceability: stable or lower interest rates reduce the interest expense burden for companies, which can positively impact loan performance.

- Increased investor demand: when the Federal Reserve signals a pause in rate hikes, it may boost investor confidence and appetite for credit risk assets.

Source: Bloomberg as of October 16, 2024, based on market-implied pricing of policy rates for selected economies. Past performance is not a guarantee of future results. An investment cannot be made directly in an index. Forward-Looking statements are not a guarantee of future results. They involve risks, uncertainties and assumptions. There can be no assurance that actual results will not differ materially from expectations.

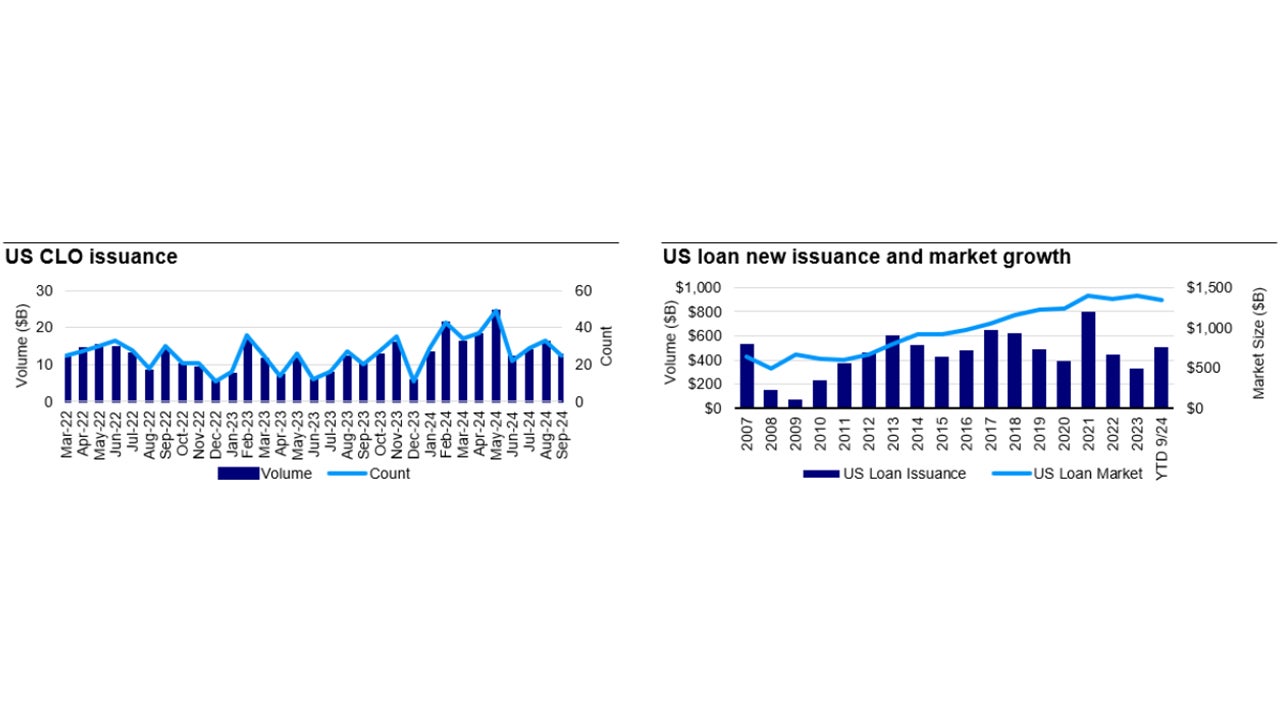

Market technicals

Last year, we saw retail demand for loans soften amidst broader risk-off investor sentiment. However, that trend has abated as some investors are becoming more comfortable with the “soft-landing” scenario for the US economy. There has also been a flow of new CLO creations through 2023 and YTD 2024. This indicates that there is still institutional investor appetite for loans. This steady CLO formation and minimal new issue helped support the loan market technical despite retail outflows and macro concerns. As of September 2024, 312 CLOs have priced $146.8B of issuance YTD in the US, and CLOs represent ~70% of the investor base in the loan market2. CLOs continue to be the major source of institutional demand, and the CLO market is on track for record annual issuance in 2024. Moreover, as demand for loans wanes, new loan issue supply will typically respond in kind to help re- establish equilibrium in the market. For example, year-end 2023 net issuance was $88.04bn, -50% year-over-year, respectively2. This supply/demand imbalance forces CLOs to provide a bid in the secondary market. Having said that, the loan market has still been trading at a discount to par which long term investors can view as an attractive buying opportunity.

Source: PitchBook Data, Inc. and Credit Suisse as of September 30, 2024.

Relative valuations also favor bank loans compared to most fixed income asset classes. Loan spreads are currently wide of their long-term average, while high yield bond spreads are currently tight to their long-term average. Loans have also been outyielding high yield bonds with loan coupons being historically high.

Source: Credit Suisse Leveraged Loan Index & Credit Suisse High Yield Index as of September 30, 2024. Past performance is not a guarantee of future results. Long term medians based on date starting from 01/31/1992.

Sources: Credit Suisse Leveraged Loan Index & Credit Suisse High Yield Index as of September 30, 2024.

Market fundamentals

While technicals are finding an equilibrium, market fundamentals for underlying issuers remain relatively strong.

First, defaults remain low relative to historical levels. The trailing twelve-month default rate at the end of September 2024 was 0.80%, while the historical trailing default is more than double that around 2.26%3. The risk of defaults, while small, remains the largest risk to loan investors, but the senior secured nature of loans has historically provided a high recovery rate in the event of default.

High yield bond defaults have risen above loan default rates. While some rise in loan defaults and lower base rates are likely to come, we still see the risk/return opportunity stronger in the loan market than in high yield which has seen spreads compress this year.

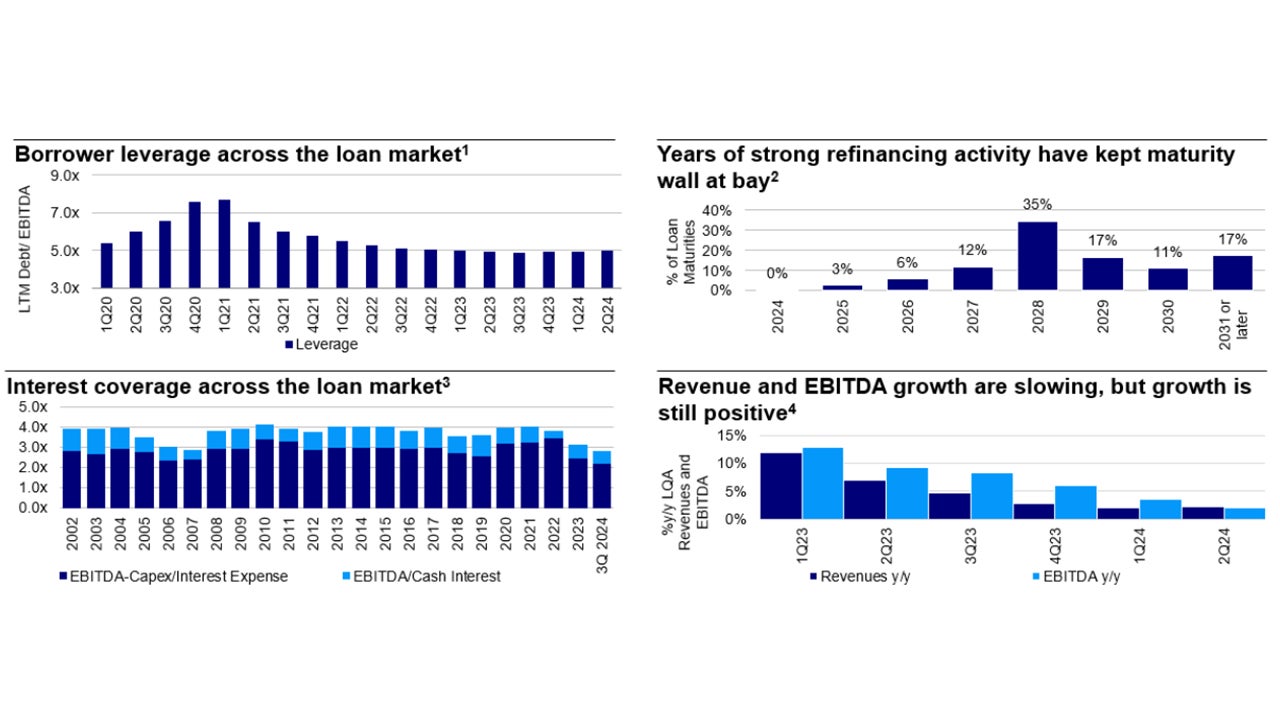

The average leverage of companies in the leveraged loan market serves as an indicator of the financial health of bank loan issuers. The majority of borrowers continue to have healthy balance sheets, and average leverage in the market has returned to pre-pandemic levels. Borrowers have also pushed out their debt maturities. Currently only ~3% of outstanding loans mature in 2025, leaving little refinancing risk in the market.

Another important investor concern is how current rates will impact issuers’ ability to service their debt. The average borrower has entered this cycle with a very strong ability to service their debt. Interest coverage ratios have still been robust, leaving companies with sufficient ability to absorb higher rates. Additionally, we expect interest coverage ratios to improve as interest rates continue to decrease, lowering company interest expenses.

Sources: 1JPMorgan as of June 30, 2024 (data is last 12 months); data is quarter lagged. 2CS LLI as of September 30, 2024. 3PitchBook Data, Inc. Interest coverage ratios of leveraged loans. Data through September 30, 2024. 4JPMorgan as of June 30, 2024 (data is last 12 months); data is quarter lagged.

Conclusion

As shown above, we believe senior secured loans are poised to perform well in our base case scenario, where resilient economic growth and gradual rate cuts bolster loan fundamentals. This should prevent a sharp increase in defaults, sustain CLO demand, and enable investors to benefit from historically above-average coupon income. In this scenario, we expect 8% loan returns in 20244, powered by strong carry partly offset by expected price erosion at the lower end of the credit quality spectrum. Loans should deliver higher returns compared to bonds unless: (i) there is a significant risk- off move due to growth concerns, leading to significant spread decompression and lower rates; or (ii) loan default rates rise materially relative to those in the bond market. Neither of these scenarios are Invesco’s base case.

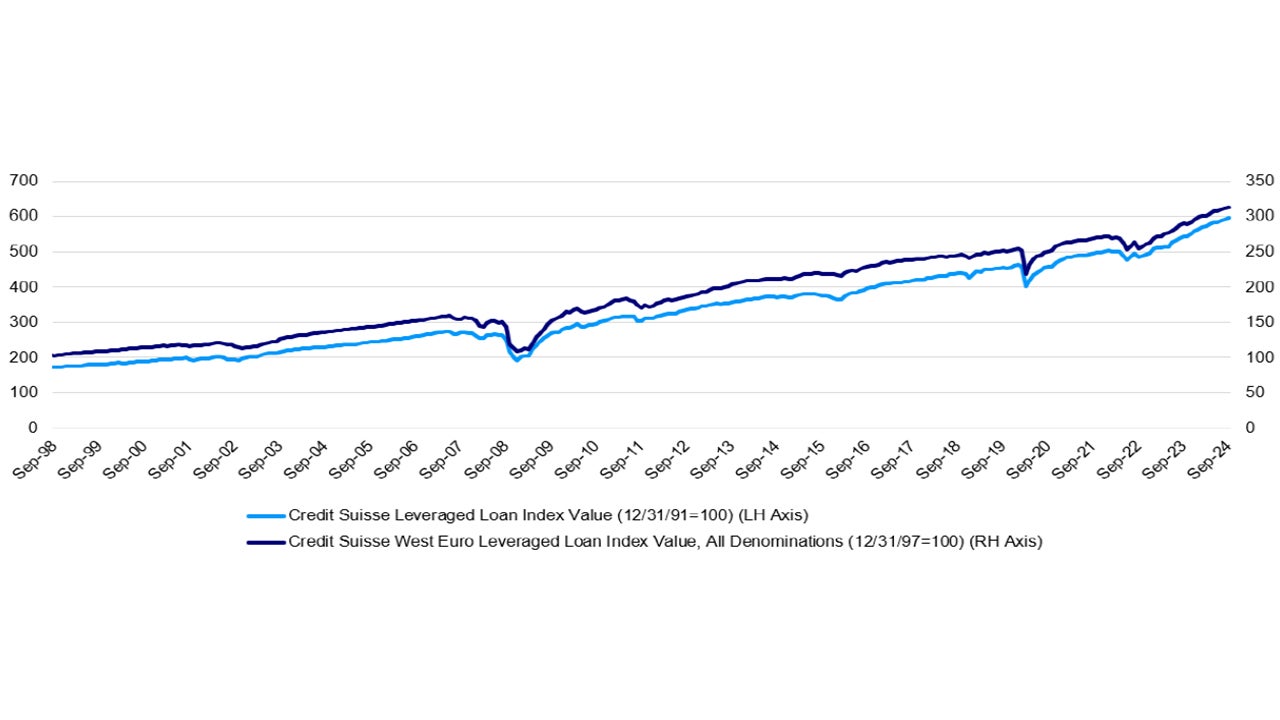

In conclusion, the loan asset class has consistently proven to be a reliable source of returns for investors, regardless of market fluctuations. As evidenced below, any decreases in loan values have typically been temporary. Regardless of whether interest rates are increasing or decreasing, loans have historically provided investors with a worthwhile return on investment.

Source: Credit Suisse as of September 30, 2024.

Investment risks

Many senior loans are illiquid, meaning that the investors may not be able to sell them quickly at a fair price and/or that the redemptions may be delayed due to illiquidity of the senior loans. The market for illiquid securities is more volatile than the market for liquid securities. The market for senior loans could be disrupted in the event of an economic downturn or a substantial increase or decrease in interest rates. Senior loans, like most other debt obligations, are subject to the risk of default. The market for senior loans remains less developed in Europe than in the U.S. Accordingly, and despite the development of this market in Europe, the European Senior Loans secondary market is usually not considered as liquid as in the U.S. The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

Footnotes

-

1

Credit Suisse as of September 30, 2024.

-

2

Pitchbook LCD, Intex, Bloomberg, Credit Suisse.

-

3

Morningstar as of September 30, 2024.

-

4

Invesco. There is no guarantee that the forecast will be realized. Forecast is based on coupon plus wider nominal spreads minus base rate declines minus price erosion.