Opportunity in real estate credit

The past 2½ years of elevated interest rates have supported higher yields for commercial real estate (CRE) credit investments. Higher rates have coincided with proposed regulatory changes for banks, who have traditionally been the largest providers of credit commercial real estate around the globe, typically providing roughly 50% of CRE credit in the US, 60% in the UK, and over 80% in Europe and Australia.1 With recent shifts in central bank policies to reduce interest rates and continued evolution of bank lending, now's a good time to revisit our outlook for private CRE credit.

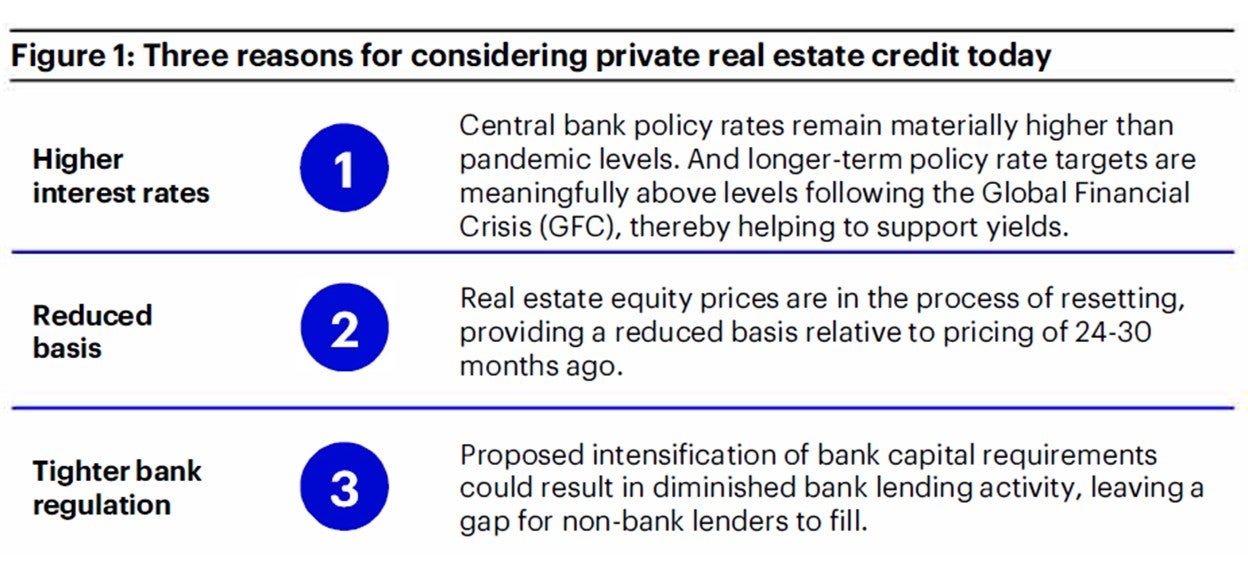

This paper focuses on three reasons for considering real estate credit today (Figure 1):

Source: Invesco Real Estate as of October 2024. Past performance is not a guarantee of future results.

Higher interest rates than post-GFC.

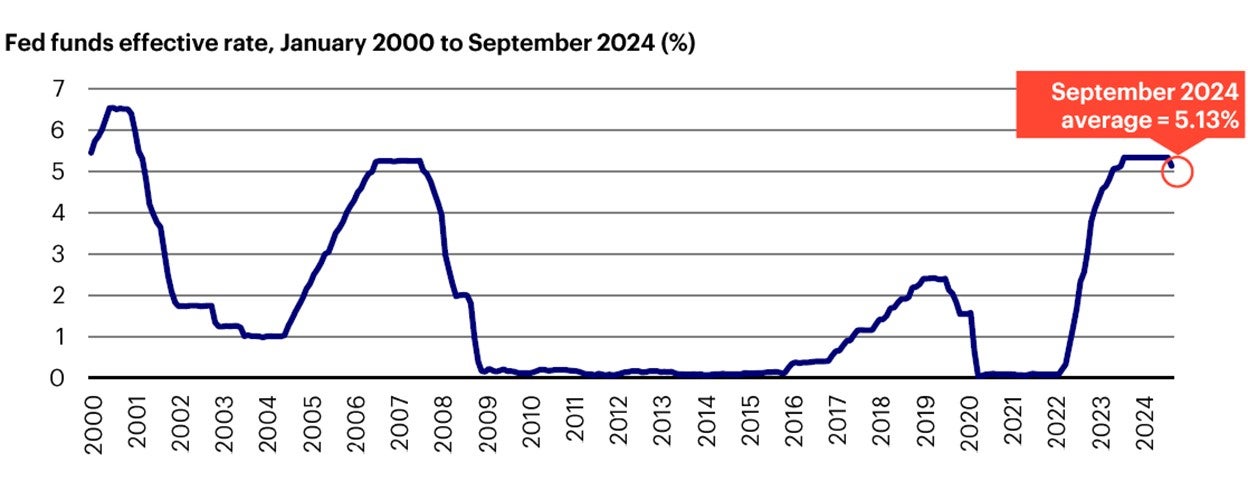

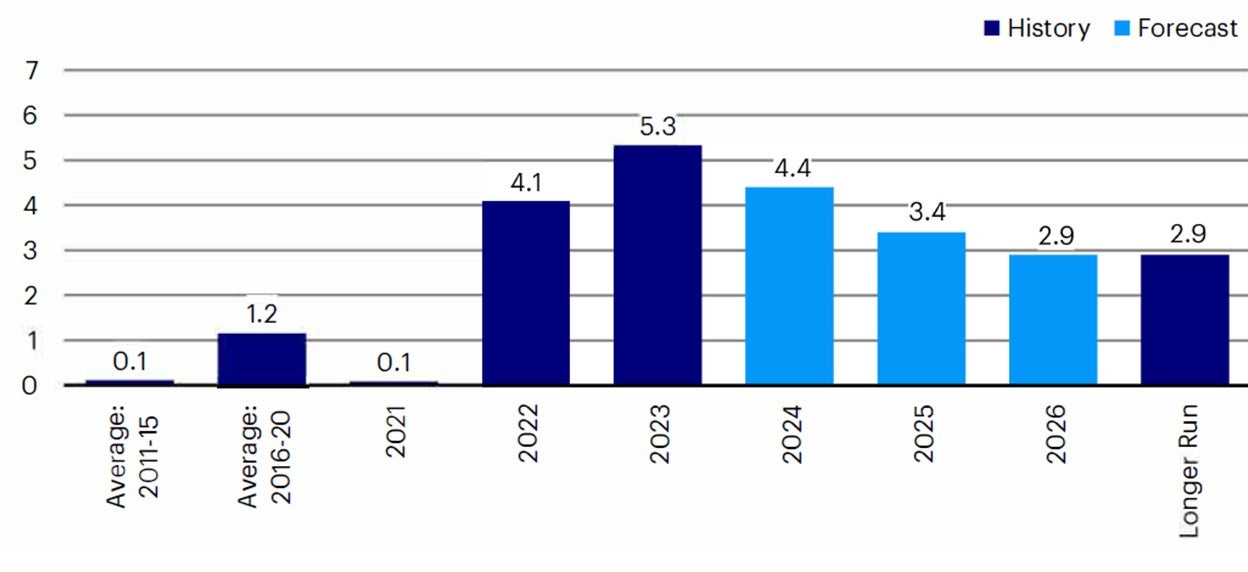

The Federal Reserve's (Fed) 525-basis-point2 increase of the Fed Funds rate3 from March 2022 to July 2023 represents one of the most aggressive periods of rate escalation in US history. Additionally, the Fed's moves are matched by similar increases in other key global markets, for example in the Eurozone (450 basis points), UK (515 basis points), Australia (425 basis points) and South Korea (300 basis points). This escalation follows several years of record-low central bank policy rates following the 2008-09 (GFC) and the more recent 2020-21 COVID-crisis period (see Fed data as an example on Figure 2). Near-zero policy rates were adopted in these periods in response to severe threats to global economies, and those policies were part of broader initiatives by central banks to provide liquidity and calm anxieties. These policies have largely accomplished their intended effect, as most of these central banks began reducing policy rates this summer and fall.

Going forward, while policy rates are likely to moderate from currently elevated levels over the next few years, guidance from central banks makes clear that the likelihood of policy rates returning to near-zero levels is extremely low (see Fed data, as an example, on Figure 2). This means that policy rates going forward are highly likely to remain meaningfully above where levels were prior to the commencement of global rate escalation in early 2022, thus helping support higher real estate debt yields going forward.

Sources: Invesco Real Estate, utilizing historical data from Moody's Analytics as of October 2024 and the Federal Open Market Committee (FOMC) median forecast as of September 18, 2024 (most current available). Based on FOMC the longer-run projections represent each participant's assessment of the value to which each variable would be expected to converge, over time, under appropriate monetary policy and in the absence of further shocks to the economy. Single-year estimates and forecasts are for the end of calendar years. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions, there can be no assurance that actual results will not differ materially from expectations.

Reduced basis.

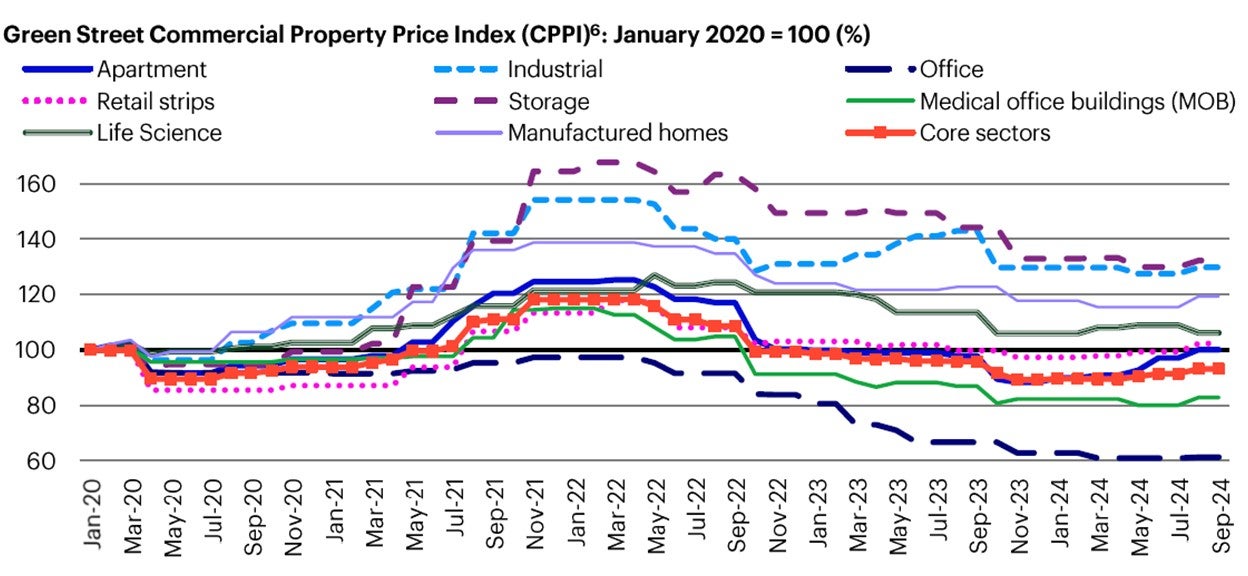

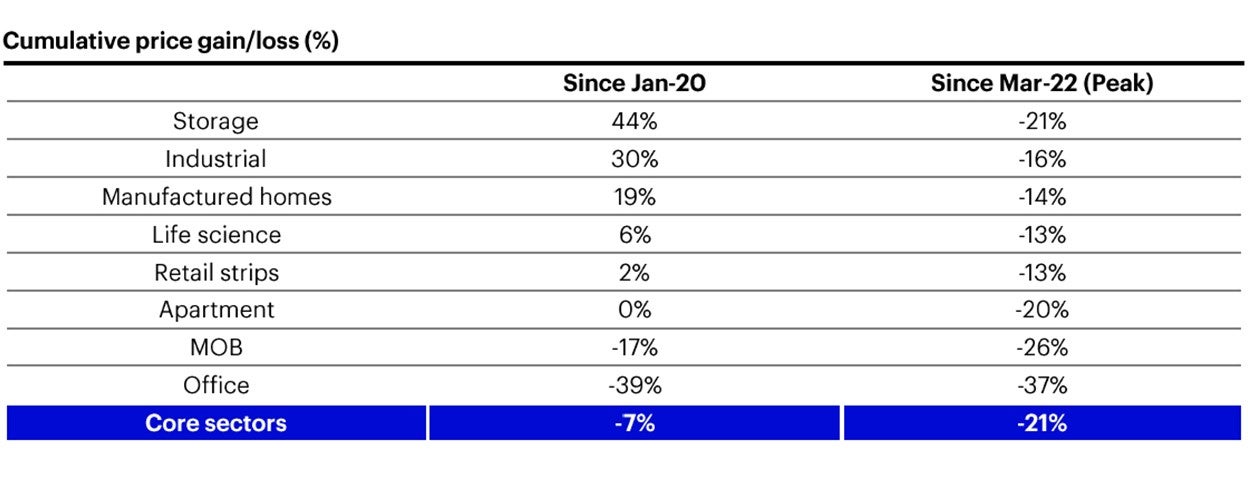

Real estate asset values have fallen in almost all key global markets since early 2022 due to elevated interest rates and easing economic growth. As an example, in the US, Green Street data shows commercial real estate prices held in private markets peaked in March 2022 and have since fallen through August of this year by 21% on average, with variation by property type. A similar magnitude of correction has been seen across European markets, with slightly less change in the Asia Pacific region (due to stability of Japan interest rates during this period). For those investing in real estate debt today, this means that new vintage loans will be sized against collateral values that are lower than peak values of early 2022, which may result in less risk within the capital stack.4

Prices appear to have bottomed for most US property types in July with the anticipation of policy rate cuts by the Federal Reserve that eventually occurred on September 18th. The recent pivot to start loosening monetary policy and cut interest rates reflects that inflation risks have eased and that employment risks have increased. For real estate, reduced interest rates should impact property prices positively, whereas easing employment growth could temper short-term leasing momentum. This possibility highlights the importance of the quality of a loan's underlying collateral, tenant credit, and sponsorship strength, as well avoiding vulnerable sector exposures (e.g., office) and developing an appropriate view of current market value in the underwriting process. It also highlights what Invesco views as the attractiveness of the credit slice of the real estate capital stack. New loan amounts at 50% to 65%5 of recently reduced values provide a sizable cushion should any further short-term price declines occur.

Source: Invesco Real Estate using data from Green Street as of September 2024, "Core sectoes" consists of 25% apartments, 25% industrial, 25% office, 12.5% malls, and 12.5% strip retail. Past performance does not guarantee future results.

Tighter Bank regulation.

Since the GFC, successive interations Basel guidelines7 have increasingly strengthened the lending practices for all internationally active banks, which has removed some of the more aggressive real estate financing activity seen prior to the GFC.

In response to bank failures that occurred in early 2023, Federal Bank regulatory agencies issued a proposal in July 2023 that would require large U.S. banks with total assets of $ 100 billion or more to more meaningfully increase capital reserves, standardized assessment of various risks, and required the inclusion of unrealized gains and losses from certain securities in their capital ratios.8 These proposals faced a comment review period of more than a year. Then on September 10, 2024, Federal Reserve vice chair Michael Barr announced he would be recommending changes to the proposal.9 select highlights from the bar announced include:

- Require global systematically improvement banks (G-SIB's) to increase common equity tier 1 capital10 reserves by 9% (affects several of the nation's largest banks).

- Required banks with $100 billion in assets and higher to include unrealized gains and losses from certain securities in their bank their capital ratios. The exclusion of unrealized gains represented a key aspect of hidden risk among the bank failures of 2023.

- Risk weights were reduced for several asset classes in Barr's re-proposal. But no such reductions were made for commercial real estate.

if the contents of the re-proposal are adopted, the enhancements to bank resiliency will likely come at a cost to banks that could result in dampened commercial real estate lending activity. Given that bank lending accounts for roughly half of US real estate loan and volume outstanding11 and a higher proportion in the Asia Pacific and EMEA regions, a pullback by banks would open opportunities for non-bank lenders to fill the gap.

Summary.

Taken together, the potential for yields above post-GFC levels at a reduced basis are attracting attention to private real estate credit investing. And access to opportunities could expand as the escalation of currently proposed bank regulations could dampen bank lending activity in commercial real estate, leaving a gap for alternative lenders to fill.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Property and land can be difficult to sell, So investors may not be able to sell such investment when they want to. The value of property is generally a matter of an independent valuer's opinion and may not be realized.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refer to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer's credit rating.

Generally, real estate assets are liquid in nature. Although certain kinds of investments are expected to generate current income, the return of capital and realizations of gains, if any, from an investment will often occur upon the partial or complete disposition of such investment.

Investing in real estate typically involves in moderate to high degree of risk. The possibility of partial or total loss of capital will exist.

Investing in commercial real estate assets involve certain risks, including but not limited to: tenants inability to pay rent; increases in interest rates and lack of availability of financing; tenant turnover and vacancies; and changes in supply of or demand for similar property types in a given market