Monthly fixed income update - April 2024

Asset Class Returns

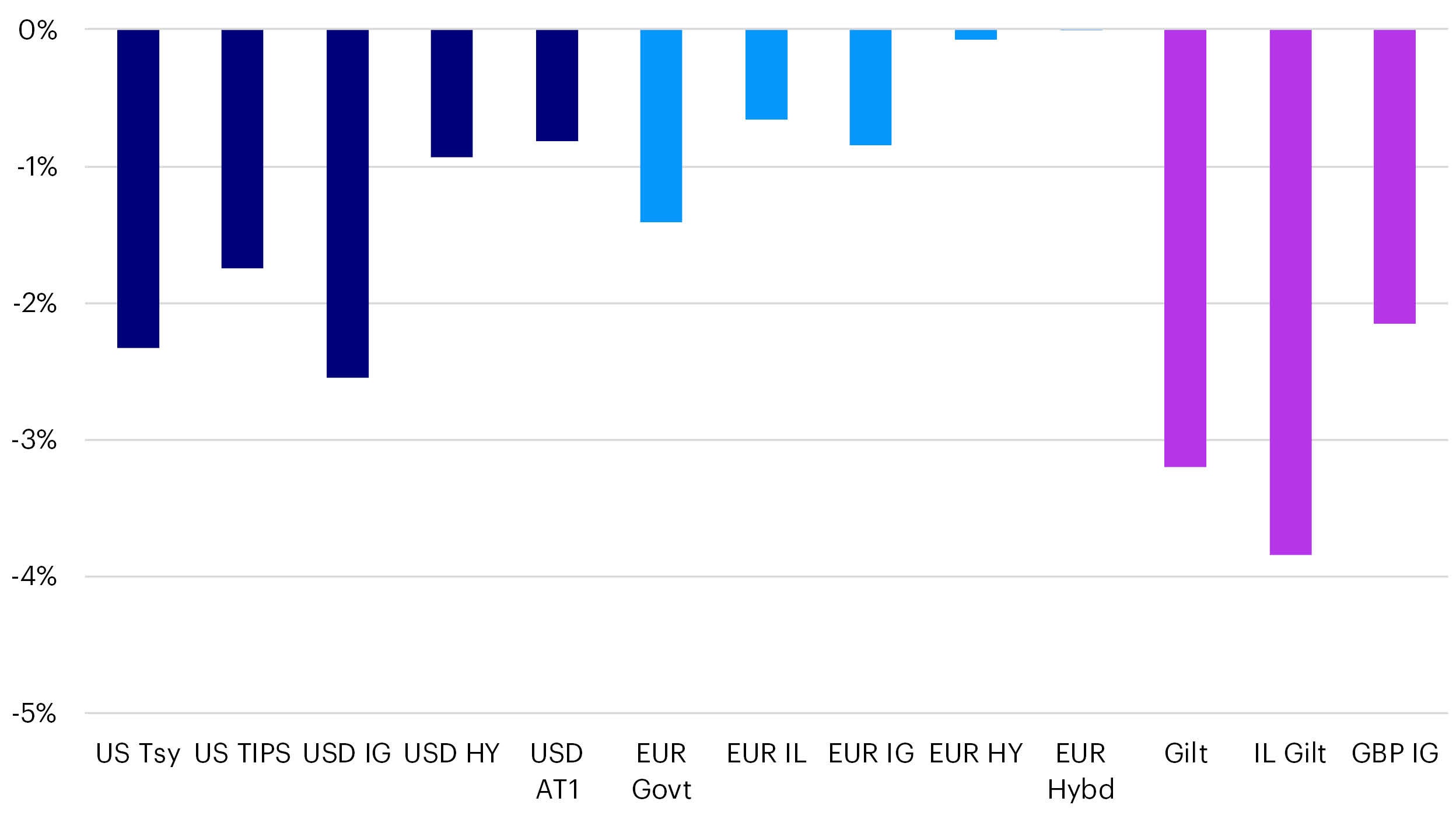

Following the bounce in March, fixed income markets performed poorly in April as rate cut expectations were pushed back once more. Early in the month, stronger than expected US economic data kept upward pressure on US Treasury yields with inflation data in the middle of the month driving yields higher still. Fed Chairman Powell also indicated that rates may need to stay higher for longer given the lack of additional progress on bringing inflation back to target in recent months, which pushed expectations for the first rate cut to the fourth quarter. UK inflation also proved to be stickier than anticipated which backed up the bearish sentiment towards bonds. Over the month, the stronger data and less dovish tone from the Fed supported the US Dollar which strengthened while the Japanese Yen weakened above 160 vs the US Dollar for the first time since 1990.

Source: Bloomberg, Invesco as at 30 Apr 2024

Government and Inflation-Linked Bonds

Government and inflation linked bonds performed poorly in April. While US Treasuries experienced the biggest rise in yields over the month, in total return terms, it was the gilt market that was the worst performer due to having higher interest rate risk. Similarly, inflation-linked real yields rose by less than their nominal counterparts as breakeven inflation rates widened in response to the stronger inflation data, which proved defensive in the US and eurozone markets, but the very long duration nature of the UK index-linked market caused it to underperform conventional gilts.

US Rates

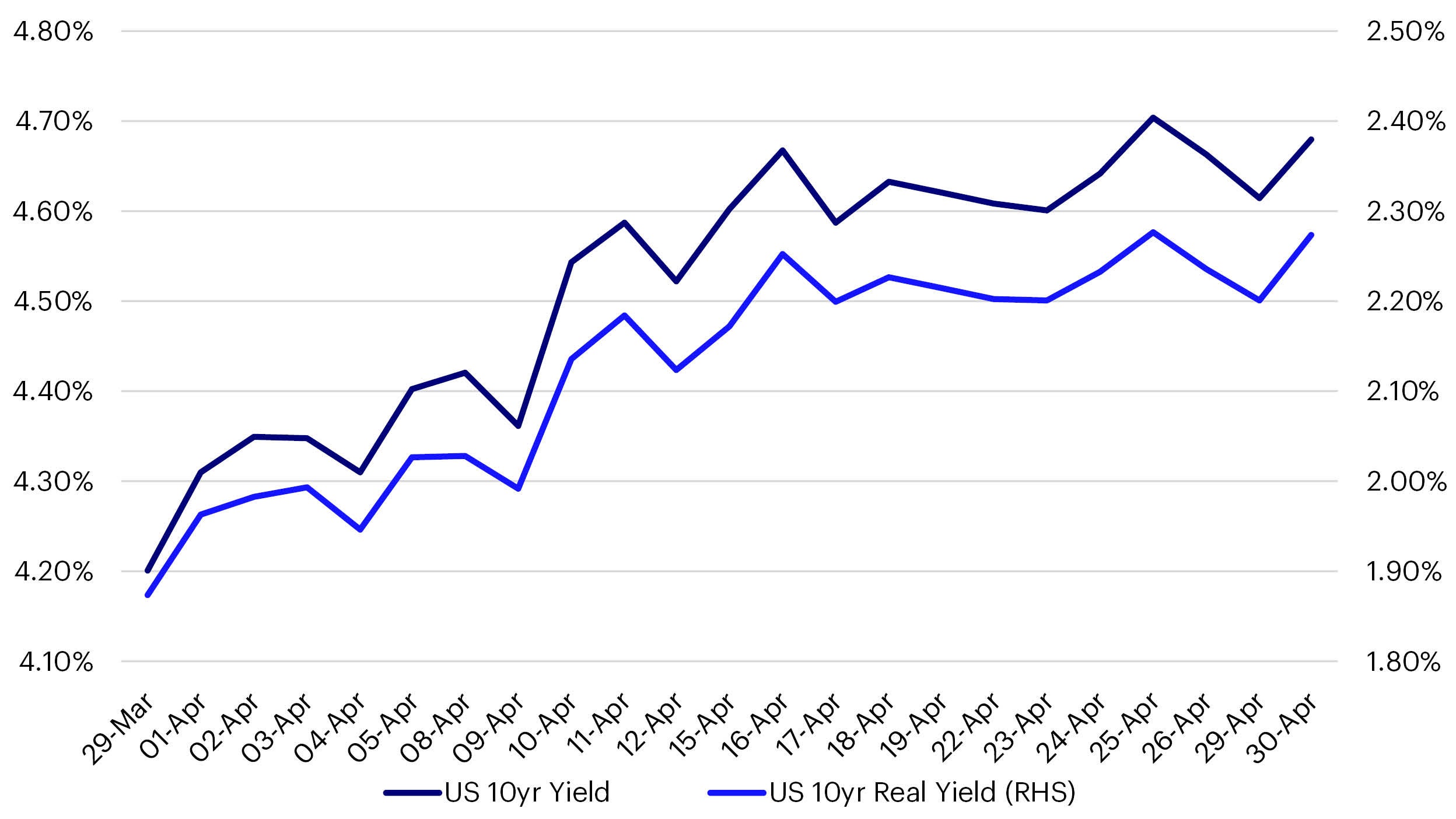

Stronger manufacturing survey data early in the month was followed by a robust employment report and pushed US Treasury yields higher, but it was the inflation data that really changed sentiment over the timing of the first rate cut. Both headline and core CPI prints came above market expectations and showed a lack of progress in inflation falling back towards target. This led to Fed Chairman Powell signalling that rates could remain higher for longer until there is more certainty that inflation is continuing to come down closer to their longer-term goal. Upward pressure remained on Treasury yields into month end with the Core PCE Price Index also rising higher than anticipated. 10-year Treasury yields ended the month 48bps higher having risen above 4.7% during the month for the first time since early November. Although breakeven inflation rates widened, TIPS also performed poorly with 10-year real yields also ending the month 40bps higher.

Source: Bloomberg, Invesco as at 30 Apr 2024

Eurozone Rates

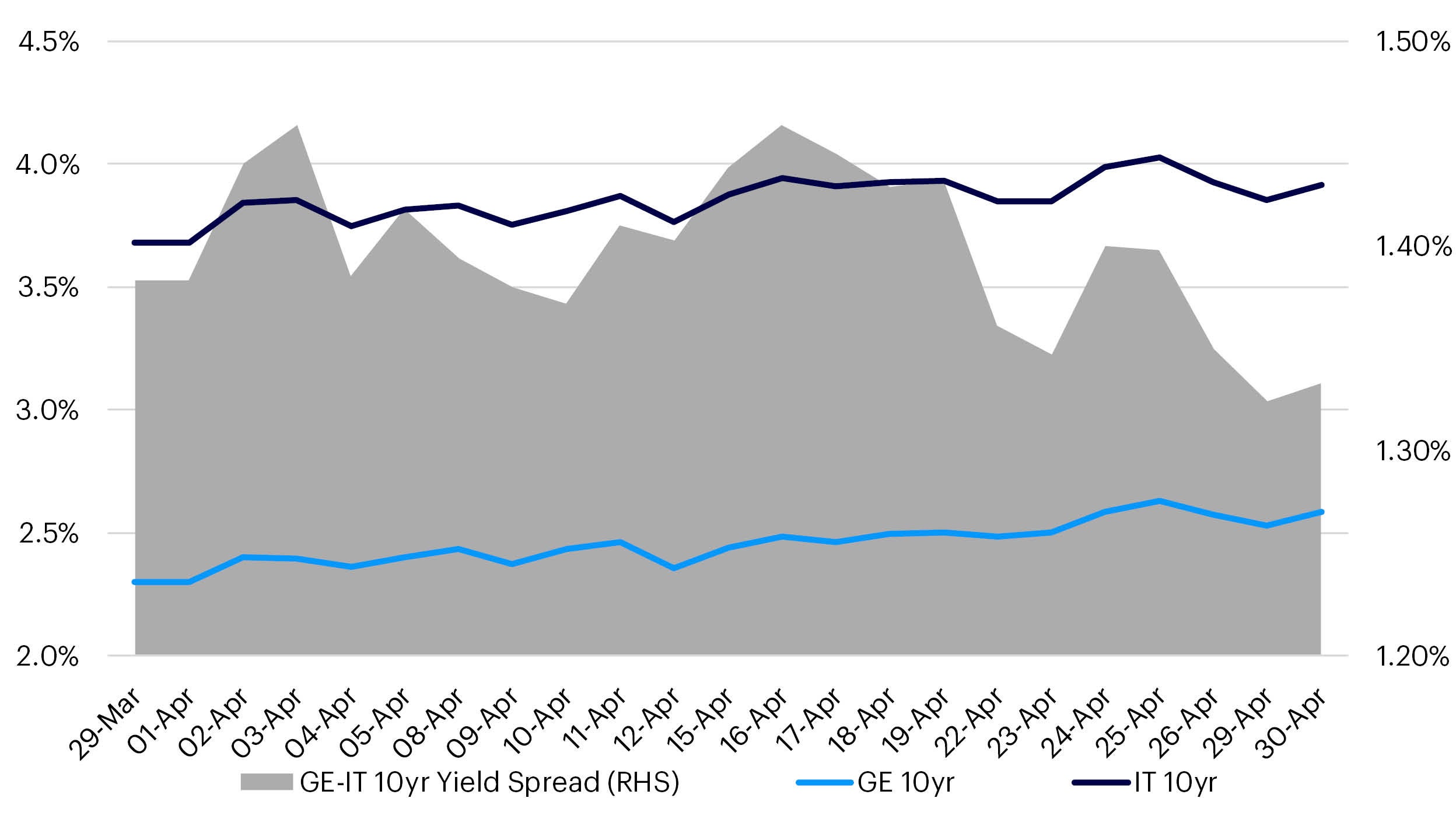

Eurozone rates markets also sold off in April, although with inflation data being in line with market expectations, yields rose by less than US Treasuries. 10-year German yields sold off by 29bps while Italian bonds held in slightly better with yields ending the month 24bps higher. However, while eurozone inflation was better behaved than in the US and UK, breakeven inflation rates on eurozone bonds also widened, as is often the pattern in a rising rate environment.

Source: Bloomberg, Invesco as at 30 Apr 2024

UK Rates

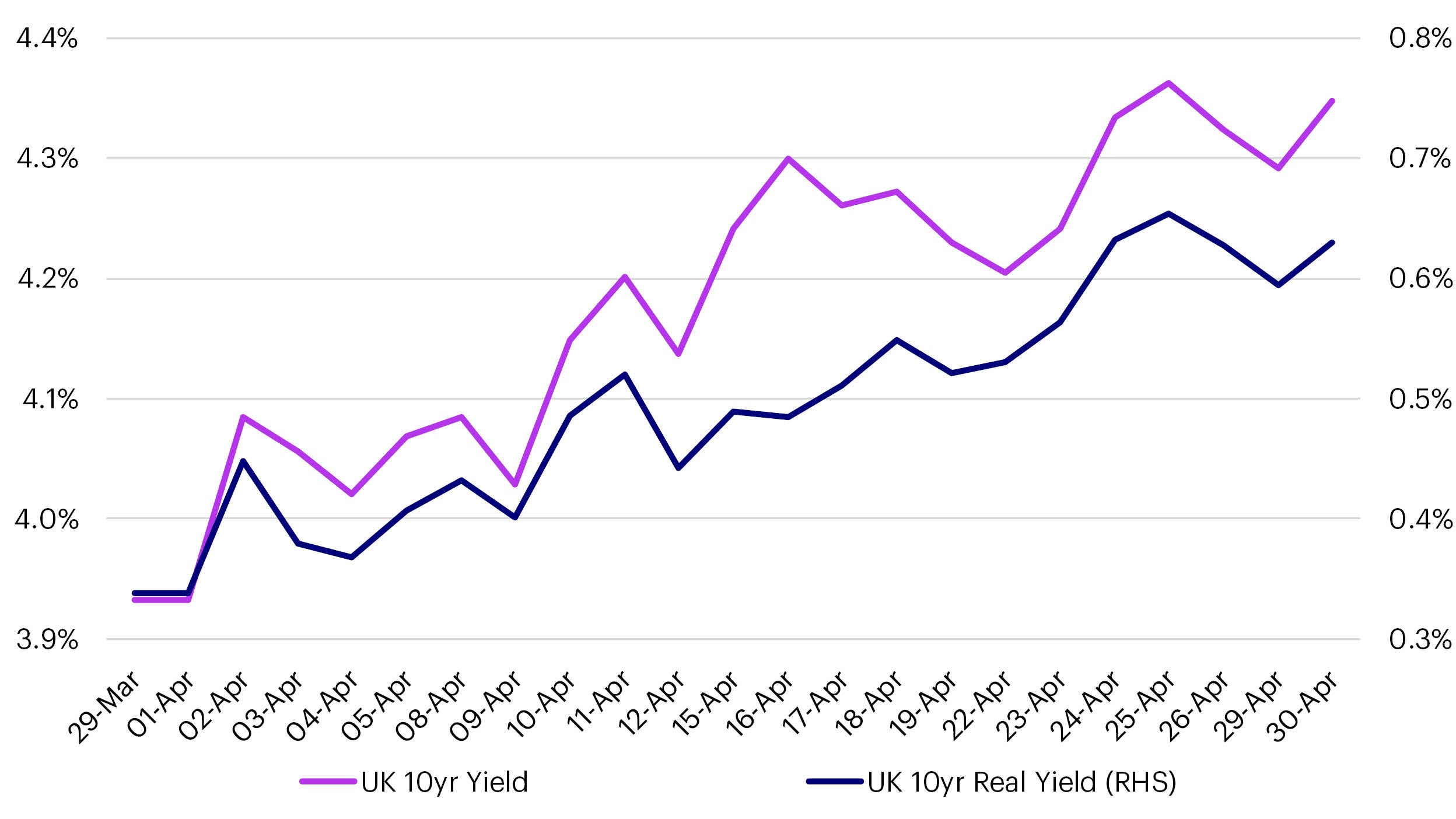

The gilt market also sold off in April and was the worst performing of the major government bond markets in total return terms due to having higher interest rate risk. While the US data and the Treasury market set the tone for global bond markets, UK inflation also surprised to the upside. Although CPI at 3.2% is the lowest since late 2021, it was higher than expected, as was the core measure which may be more concerning to policymakers. 10-year gilts yields ended the month 41bp higher while real yields on 10-year index-linked gilts sold off by 29bps.

Source: Bloomberg, Invesco as at 30 Apr 2024

...inflation data as bearish bond market sentiment could turn quickly.

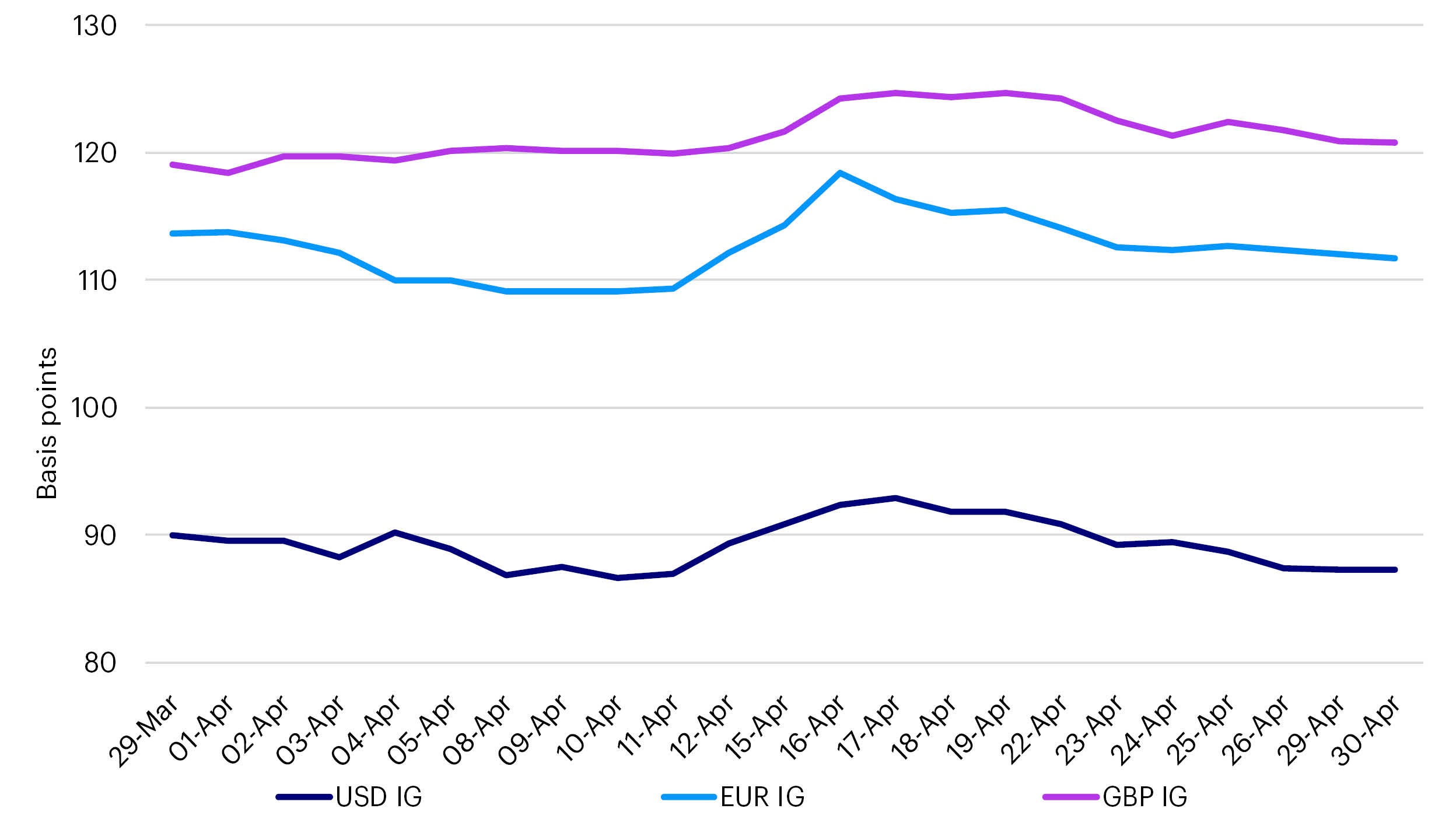

Investment Grade Credit

Investment grade credit spreads were rangebound during April as inflation and monetary policy were the main focus. Concerns about the impact that higher for longer monetary policy would have on the economy did cause some spread widening mid-month. Equity markets also experienced a small sell off, but volatility declined in the second half of the month with risk assets bouncing and credit spreads tightening to end the month close to where they were at the end of March.

Source: Bloomberg, Invesco as at 30 Apr 2024

...economic data as spreads could be vulnerable to a hard landing.

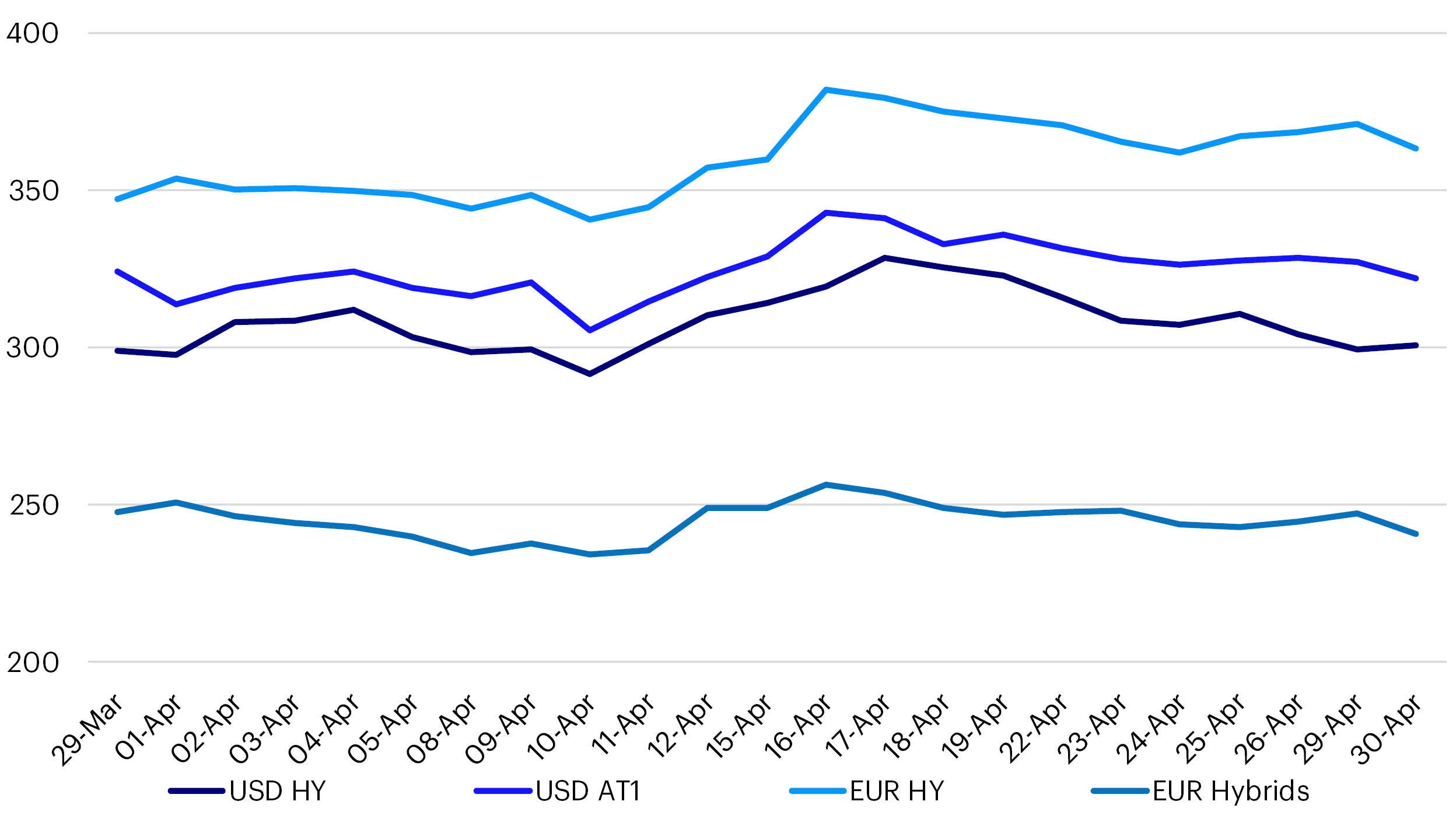

High Yield and Subordinated Credit

Some idiosyncratic risks within the European high yield market have caused spreads to widen more broadly from the tightest levels seen during March which, combined with the changing monetary policy outlook saw spreads widen mid-month. Although they partially recovered in the second half of the month, EUR high yield spreads ended April 16bp wider. US high yield spreads were less volatile, ending the month just 2bp wider. For subordinated debt, while the spread rally was relatively subdued, spreads on AT1s (-2bp) and Euro Hybrids (-7bp) continue to hold in well at relatively tight levels.

Source: Bloomberg, Invesco as at 30 Apr 2024

...the outlook for ratings on high yield issuers.

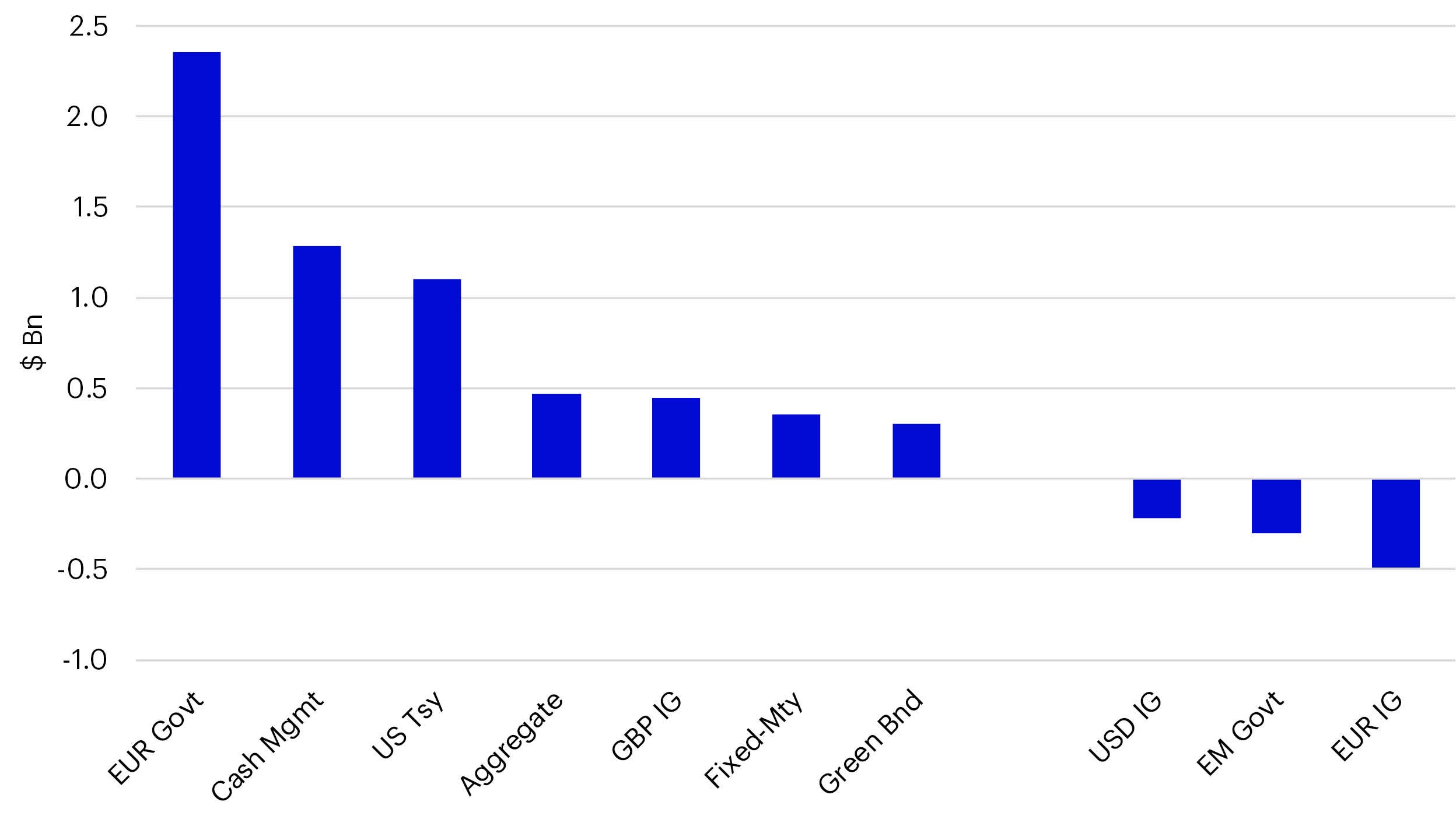

Fixed Income ETF Flows

Inflows into fixed income ETFs picked up in April, with Net New Assets (NNA) of $5.7bn taking net inflows for the year to $17.9bn. Safe-haven asset classes were the main beneficiaries over the month with EUR Govts ($2.4bn), Cash Management ($1.3bn) and US Treasuries ($1.1bn) the leading categories for inflows. Outflows were relatively light during April, although EUR (-$0.5bn) and USD (-$0.2bn) IG Credit ETFs made up two of the three main categories that experienced net selling, while EM Govts (-$0.3bn) remained out of favour.

Following the March rally, fixed income markets sold off once more in April. Having started the year anticipating 6-7 rate cuts from each of the Fed, ECB and BoE, markets have pushed back both the timing and the extent of rate cuts expected during 2024. For the Fed, markets now only expect the first cut in November and are only 50:50 for a second cut to come in December. For the Bank of England, the first cut is expected in Q3 with a further cut likely in December, while markets anticipate that the ECB will cut rates three times before year end. 10-year government bond yields are currently close to the highest levels for six months which, with little easing being discounted by the market, may provide an opportunity for investors to increase interest rate risk in their portfolios.

Source: Bloomberg, Invesco as at 30 Apr 2024

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. All figures in USD