Macro factors and asset allocation decisions: Invesco Fixed Income Global Investors' Summit November 2019

Over 80 investors gathered in Houston in November 2019 to discuss and debate Invesco Fixed Income’s views on global macroeconomic trends. Macro themes play an important role in Invesco Fixed Income’s investment process and our framework of “macro factors” helps us project macro trends and interpret market movements.

We believe changes in macro factors such as growth, inflation and policy drive much of market performance. Understanding macro factors helps us understand market conditions and price action across rates, currencies and credit. We believe our macro factor framework can help improve asset allocation and the risk-return profiles of portfolios. Below we discuss some of the major developments that we believe are currently driving these factors and how they influence our asset allocation decisions.

Key macro conclusions

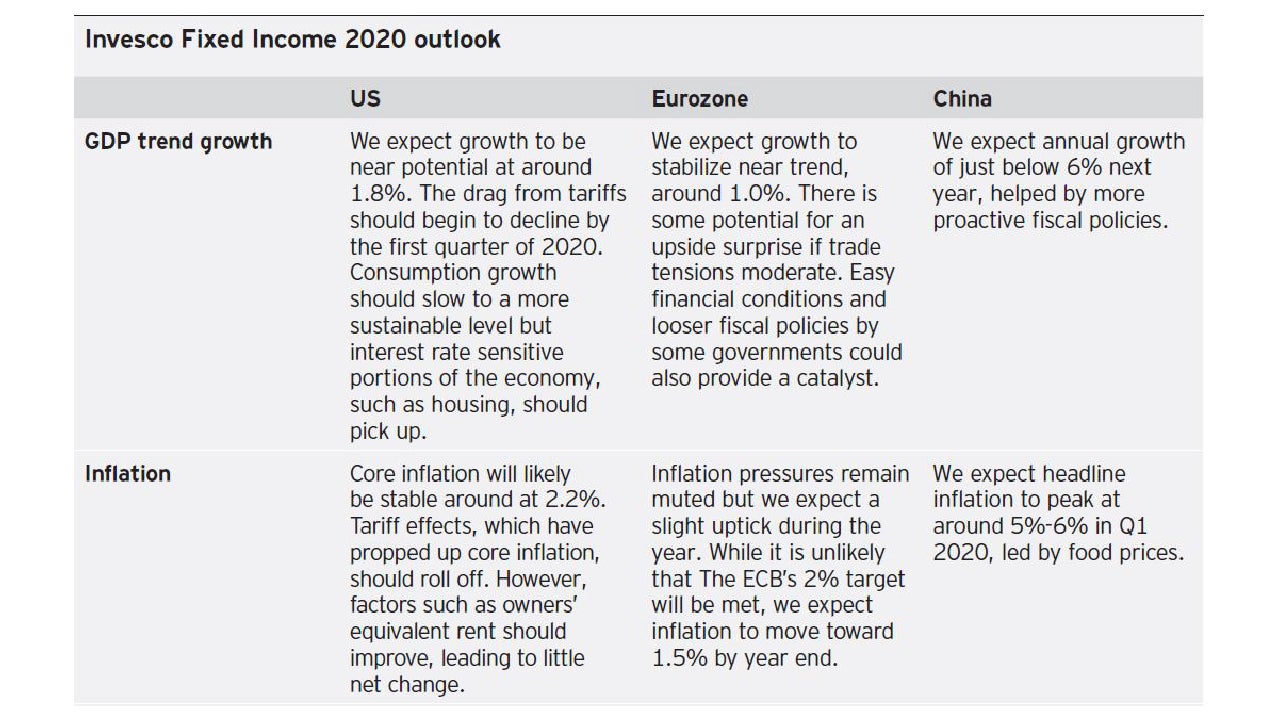

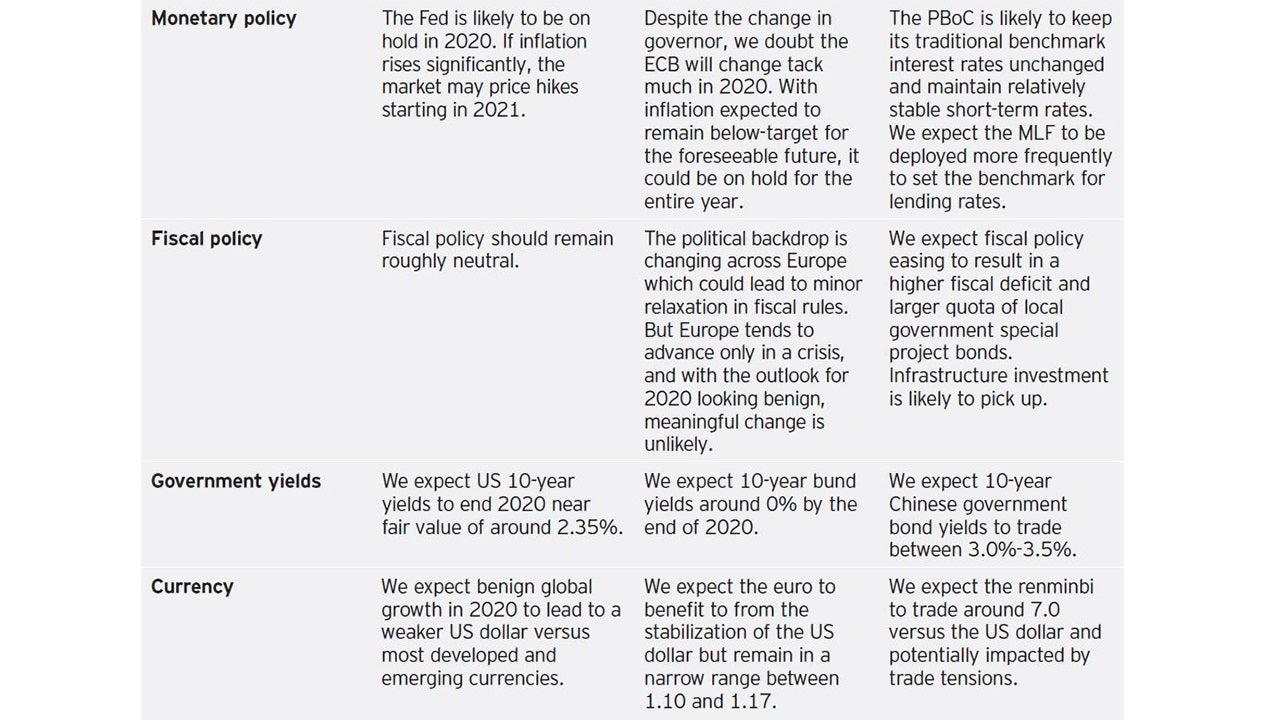

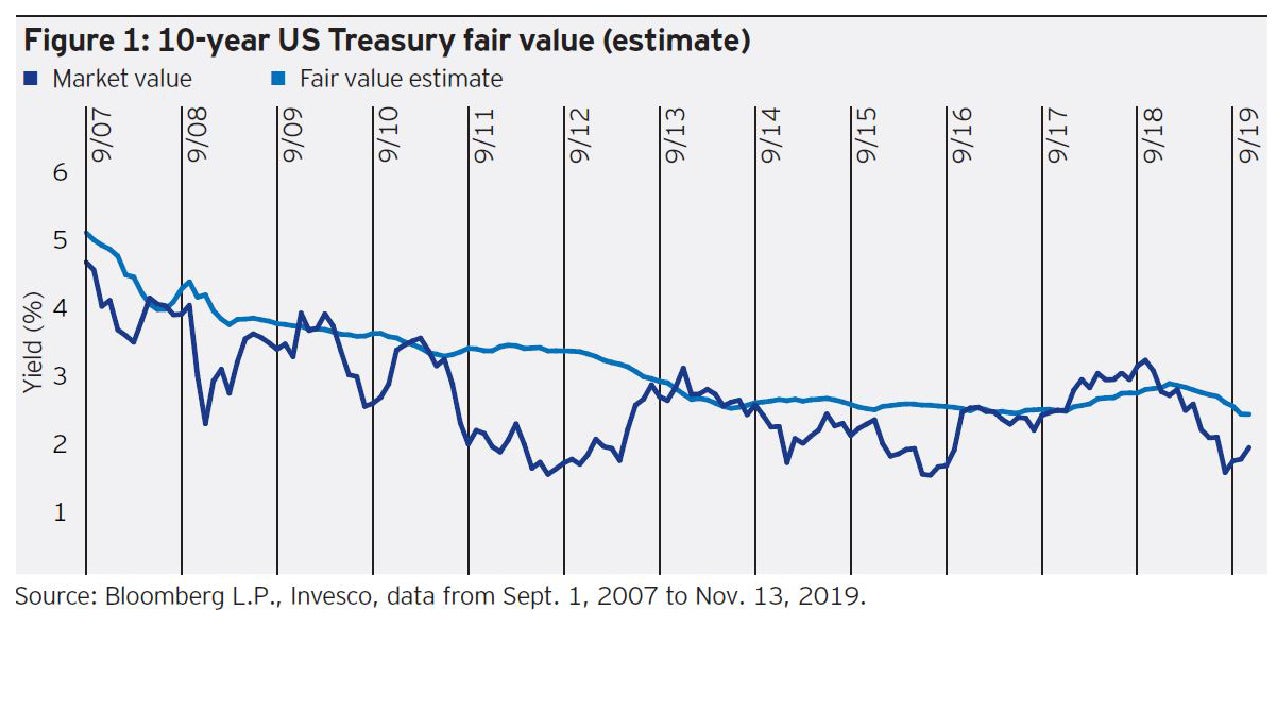

US: After a slowdown in 2019, we expect 2020 to be a year of stabilization, with annual growth returning to around 1.8%. Recent downdrafts have been due mainly to trade uncertainty, especially in manufacturing. A US-China “Phase 1” deal would improve growth prospects. We expect consumer price inflation to remain benign at around 2.2%-2.5% per year, in line with the post-crisis period. We believe the US Federal Reserve (Fed) is done cutting interest rates for the next six months and will not cut further unless growth slows significantly. On the other hand, we do not expect rate hikes until there is a substantial rise in inflation. We expect the 10-year Treasury to rise toward a fair value of around 2.35% over the next year.

Eurozone: We expect eurozone growth to bottom in 2020 but remain weak at around 1.0%. The trade outlook is uncertain, but we believe US tariffs on European car manufacturers will be avoided and resolution of Brexit should reduce headwinds for German car manufacturers, which is positive for overall eurozone growth. Low levels of eurozone inflation are a concern. We do not expect structural improvement in inflation and expect it to remain stable at around 1% in 2020. Monetary policy is likely on hold. There have been calls for fiscal expansion, but some budget surplus countries are reluctant and other countries lack fiscal flexibility. We believe macro conditions would have to worsen significantly for concerted fiscal loosening, which is not our base case. We believe we have seen the lows in negative government bond yields.

China: We expect Chinese growth to be just below 6% in 2020, and the official growth target is likely to be lowered to 5%-6% in the next few years. We see more flexibility for monetary policy in the second half of 2020, as rising headline inflation, driven by rising food prices, currently constrains monetary policy. Fiscal policies are expected to be more proactive in 2020, especially related to infrastructure investment. We expect the renminbi to be event-driven and impacted by trade tensions. We do not expect government bonds to outperform until inflation peaks.

Emerging markets: Consensus growth expectations for emerging markets (EM) have been revised down through the last year. We expect growth in 2020 to improve relative to the disappointing outcomes in 2019. EM inflation is expected to remain benign and edge lower in 2020. We believe EM policy stance will be an important theme in 2020. In our view, countries that can implement countercyclical policies without pressuring their currencies or creating other imbalances will distinguish themselves. We believe currency valuations across EM are generally neutral-to-cheap (adjusted for productivity and inflation), but inflation could erode competitiveness for some.

Is globalization over? The dramatic rise in global trade flows (especially manufactured goods) witnessed over the last three decades may have reached its zenith. A peak in global trade may have far reaching implications for global growth potential, especially for EMs and their current growth models.

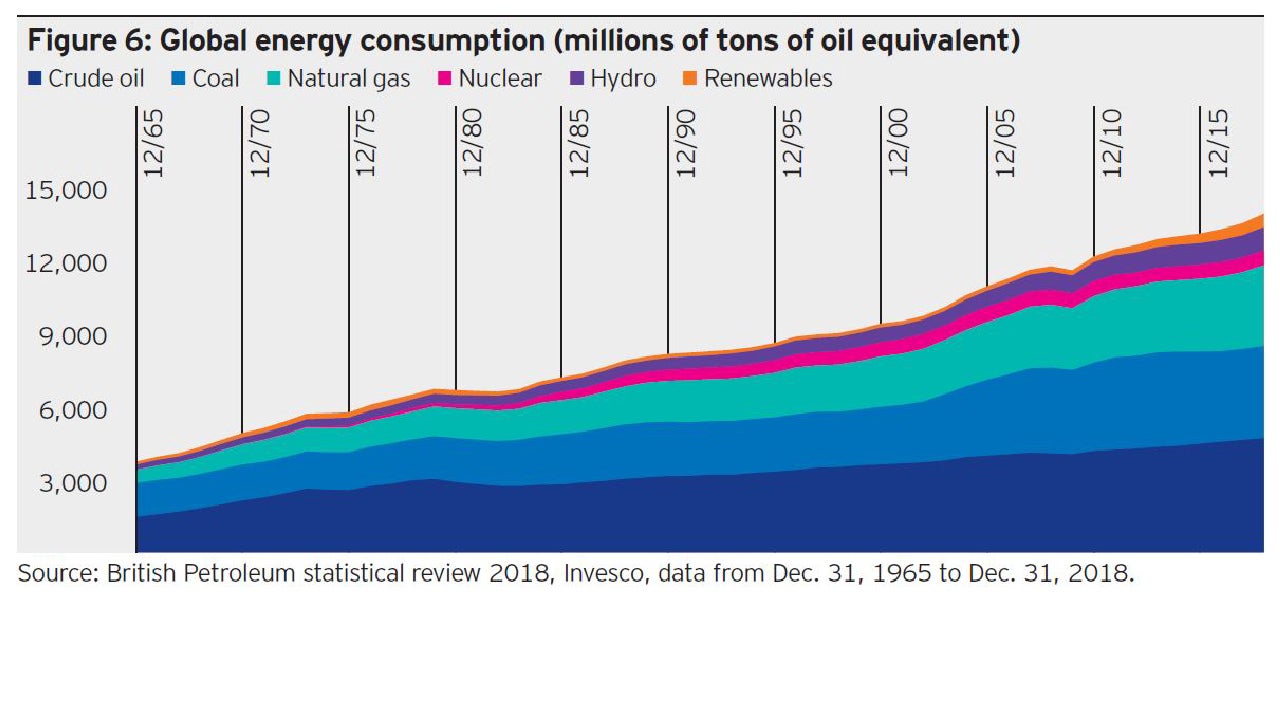

From fossil fuel to renewable energy: The global effort to transition away from fossil fuels toward renewable energy may have unexpected consequences for global macro and political outcomes. Without careful coordination, the transition away from fossil fuels could result in higher energy prices, lower economic growth and, ultimately, increased geopolitical tensions, especially in emerging markets.

Regional macro views

US

Presented by James Ong, Director Derivative Portfolio Management.

Growth: US growth slowed in 2019, but we expect 2020 to be a year of stabilization, with annual growth returning to around 1.8%, near our estimate of US potential growth. Recent downdrafts have been due mainly to trade uncertainty, especially in the manufacturing sector. A US-China “Phase 1” deal would likely improve growth prospects, even in manufacturing. We expect job growth to slow next year but the economy should add around 100,000 new jobs per month, which is consistent with around 2% growth. Consumption looks relativity solid, and interest rate-sensitive areas of the economy, like housing, have improved. If the trade dispute is resolved, we would expect growth to stabilize through the end of 2020 – including manufacturing.

Inflation: We expect inflation to look much like it has during the post-crisis period, at around 2.2%-2.5% per year. Our model framework separates prices into core sticky and flexible prices. Flexible prices have been the most affected by tariffs, but their impact should wane by the end of 2020. Certain other price bumps have been due to new healthcare changes and not indicative of broader macro trends. A major component of the Consumer Price Index, owner’s equivalent rent, has been low and stable, suggesting that overall inflation should remain low and stable in 2020. The Fed has been clear that the current rate of Personal Consumption Expenditures (PCE) inflation (1.6%-1.8%) is fine and should not lead to rate cuts or hikes. Forward inflation breakevens reflect the bond market’s expectation that inflation will not return to 2% until 2028. Translating that expectation to the Fed’s 2% core PCE target (the Fed’s preferred measure of inflation), the timeframe is far longer.

Policy: We believe the Fed is done cutting interest rates for the next six months. It has communicated that it is relatively comfortable with the current pace of economic growth and sees limited inflation pressures. For the Fed to cut further, growth must slow significantly. On the other hand, the Fed is unlikely to raise rates in the near future as it has committed to not raising rates unless there is a substantial increase in inflation. The bond market is pricing in around one cut by the end of 2020, which we think is appropriate. If the next Fed move is a hike, it would likely be due to rising inflation (i.e. core CPI above 2.5%) and would probably not be until 2021.

Markets: We expect the 10-year Treasury to rise toward a fair value of around 2.35% over the next year. It could breach fair value if the Fed begins to hike rates, inflation accelerates or supply-demand technicals deteriorate.

Eurozone

Presented by Gareth Isaac, Head of Multi-sector Portfolio Management.

Growth: The impact of trade tensions has been notable on European growth and inflation. We expect growth to bottom in 2020 but remain weak at around 1.0%. The US, China and UK are key markets for European exporters, making the eurozone, especially Germany, vulnerable to the effects of Brexit, a China slowdown and the risk of US auto tariffs.

While the tariff outlook remains uncertain, we believe US tariffs on European car manufacturers will be avoided and resolution to Brexit should reduce headwinds for German car manufacturers, which would be positive for Europe’s overall growth outlook. Recent data suggest that car exports may be beginning to pick up and we expect improvement in fourth quarter car manufacturing, especially in Germany. Similar to the US, the European services sector represents the bulk of eurozone output and remains healthy. The European consumer also remains in solid shape, based on rising real wages and house prices, low inflation and falling unemployment, which should support the service sector.

Brexit is a key risk factor for the UK. The UK is likely to be weaker under any type of Brexit – whether a “hard” Brexit or under a Boris Johnson deal. Either way, Brexit will likely be a headwind for the UK economy over the next decade irrespective of the type of deal that is finally decided due to increased friction caused by regulatory and tariff divergence among trading partners. Political uncertainty will also be heightened, including the risk of a potential break-up of the UK, if Scotland opts to leave. The reduced probability of a hard Brexit is a positive for global risk markets and removes some of the negative tail risks for European growth.

Inflation: Low levels of European inflation are a concern. Inflation expectations have continued to collapse, and we expect credit growth to remain anemic. With growth around potential, we do not expect structural improvement in inflation and expect it to remain stable at around 1% in 2020. While Europe’s current level of inflation does not concern the European Central Bank (ECB) per se, it is wary about the eurozone’s ability to withstand external shocks, such as a global downturn, which could leave the bank with limited policy options. We do not expect a recovery in the market’s inflation expectations (as reflected in the pricing of inflation-linked securities) unless global growth takes off, which is not our base case.

Policy: We expect monetary policy to remain on hold, with ECB policy essentially tapped out at negative interest rates of -0.50% and the recent resumption of quantitative easing. There have been calls for fiscal expansion, but there is limited desire among budget surplus countries, such as Germany and the Netherlands, and the efficacy is uncertain. Others have less room due to budget deficits. Given very low interest rates, we believe fiscal policy could play a successful role in future stimulus if it gains political traction, but we believe economic conditions would need to become more dire before political appetite grows to increase spending and we believe this is unlikely in 2020.

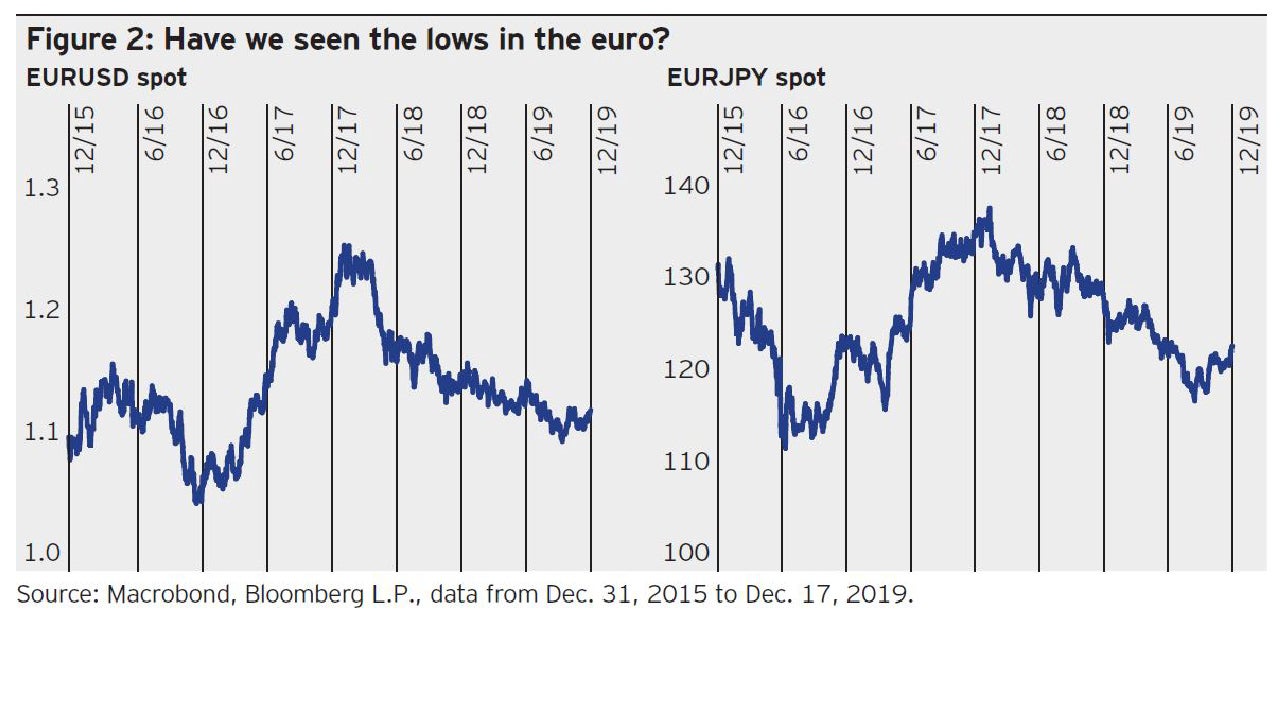

Markets: European bond markets have priced in a negative outlook with little term or inflation premium implied in government bond yields. However, we believe we have seen the lows in negative government bond yields, as German manufacturing is set to rebound and even a “muddle-through” scenario could reverse sentiment. With improved growth prospects and a potential resolution to Brexit on the horizon, the euro could rise to 1.15-1.20 by the end of 2020.

China

Presented by Yi Hu, Head of Asia Credit Research.

Growth: Chinese growth has downshifted in the last several years, from 8% in 2012 to around 6% currently. The official growth target will likely be lowered to 5%-6% in the next few years. We expect growth next year to be just below 6%. As the official growth target has fallen, the composition of growth has also changed, from investment-led, centered around infrastructure, to consumption-led. We expect that trend to continue in the years ahead.

Local investors appear more confident in a resolution to the US-China trade war but remain wary about a potential tech and financial war. There is local optimism that regional trade agreements and the Belt and Road Initiative could open new avenues for international trade.

Inflation: We expect monetary easing in the second half of 2020, but for now, rising headline inflation, driven by rising food prices, constrains monetary policy. Inflation hit 3.8% in October (versus an official desired level of 3%) and could reach 5%-6% in the first quarter of 2020.

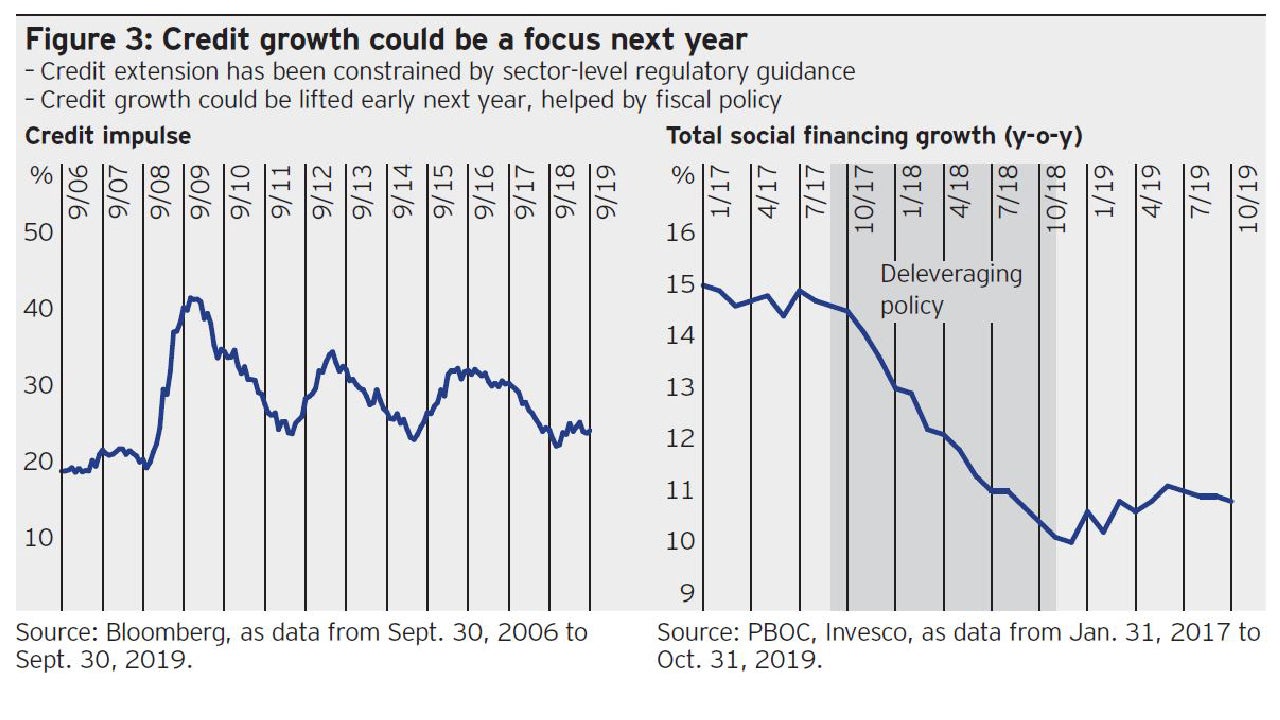

Policy: We expect fiscal policy to be more proactive in 2020, which could result in a higher fiscal deficit and larger quota for local government special project bonds. Credit growth is expected to pick up in early 2020, partly helped by the fiscal push.

We are watching the proposal of new monetary tools aimed at increasing the money supply for its potential impact on economic and market performance. For example, the medium-term lending facility (MLF) could be deployed more frequently by the central bank to inject liquidity and set the benchmark for pricing bank lending rates.

Markets: We see limited room for outperformance of government bonds before headline inflation peaks. We expect the renminbi to be event-driven and especially impacted by trade tensions. Credit performance may be uneven, with private companies potentially facing difficulties.

Emerging markets (ex-China)

Presented by Stanislav Gelfer, Emerging Markets Sovereign Analyst, and Sean Newman, Portfolio Manager.

Growth: Consensus growth expectations have been revised down for emerging markets (EM) through the last year. We expect growth in 2020 to improve relative to the disappointing outcomes in 2019. Our confidence in a modest rebound is based on recent improvements in key economic data and optimism over a US-China Phase 1 trade deal. That being said, EM growth trends are uneven across countries, with commodity-based economies underperforming. The prospect for a pick-up in EM growth without a pick-up in Chinese growth is also in question.

Overall, we expect growth stabilization in 2020 to be led by a few countries, including Turkey, Brazil, India and Russia. We believe high-yielding, commodity-based EMs, often favored for their yield, are not as desirable from a fundamental standpoint. Their growth tends to be slower, their exports are often not competitive and some are at the limits of monetary and fiscal policy.

The composition of exports and terms of trade will continue to be important drivers of EM economic performance, especially a country’s sensitivity to oil prices. Those that export consumer goods and import oil are likely to do well. Mexico, Central Europe, Turkey, Thailand and Taiwan benefit from lower oil prices. Exporters of commodities and capital goods may not do as well due to weak commodity prices amid the global slowdown and the shift in China’s growth model away from heavy investment.

Inflation: EM inflation is expected to remain benign and edge lower in 2020. Outside of Asia, EM inflation is roughly in line with central bank targets. In Asia, inflation is generally below-target and expected to fall further.

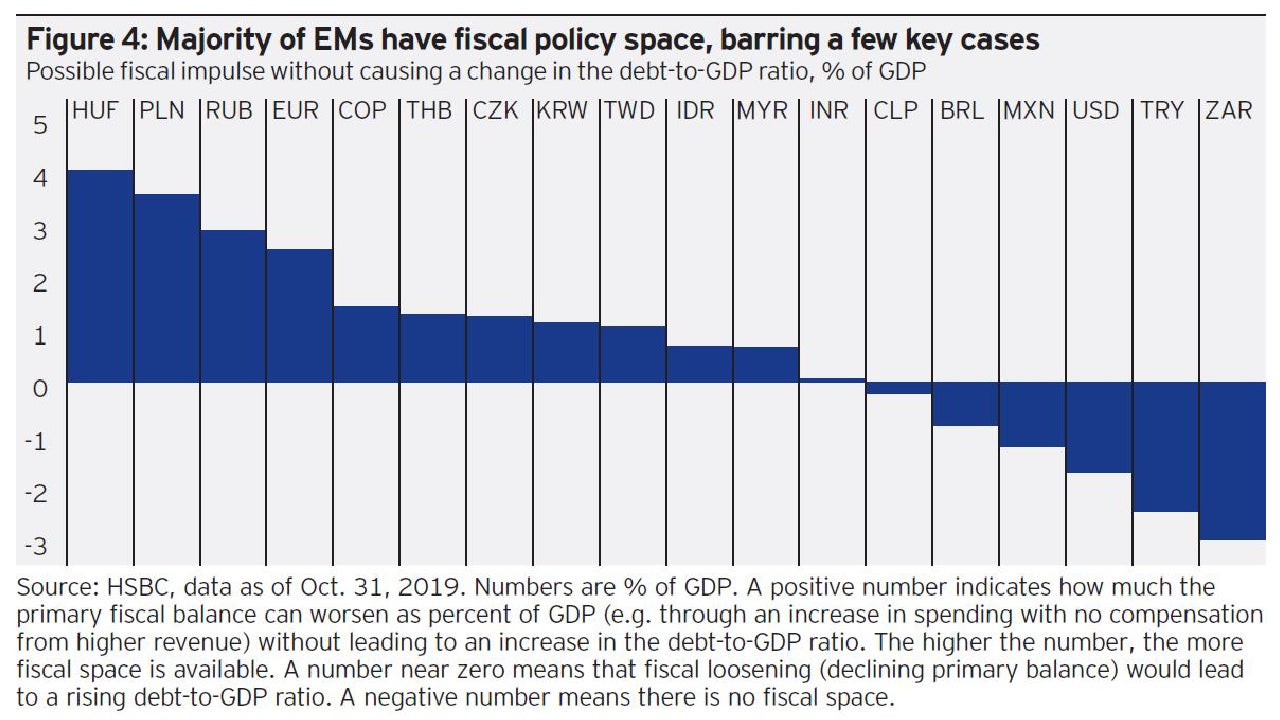

Policy: Monetary policy differs across countries, but most EMs have cut rates in the past year. Most EMs are likely done cutting for the next 12 months, with the exception of Mexico and Russia, which still plan to cut by sizable amounts, and Brazil and India, which may make marginal cuts. In aggregate, there is generally room for more monetary easing if needed among most EMs. Most EMs also have room for fiscal easing without jeopardizing debt metrics. We believe EM policy stance will be an important theme in 2020. In our view, countries that can implement countercyclical policies without pressuring their currencies or creating other imbalances will distinguish themselves.

Markets: We see opportunities in EM currencies in 2020 as we expect the US dollar to decline somewhat, but see few opportunities in local interest rates, given the strong rallies this year. We believe currency valuations across EM are generally neutral-to-cheap (adjusted for productivity and inflation), but inflation could erode competitiveness for some. EM current accounts are generally in good shape with few deficits above 3% of GDP. Being selective is important, however, since capital inflows to finance deficits could become scarce. Uncertainty could be fueled by the US presidential election and trade policy. In hard currency markets, we are positive on high yield credits with strong reform anchors, such as Ivory Coast, Senegal, Ukraine and Egypt.

Is globalization over? Implications for emerging markets and global growth

Presented by Meral Karasulu, Director Fixed Income Research, and Turgut Kisinbay, Director Fixed Income Research.

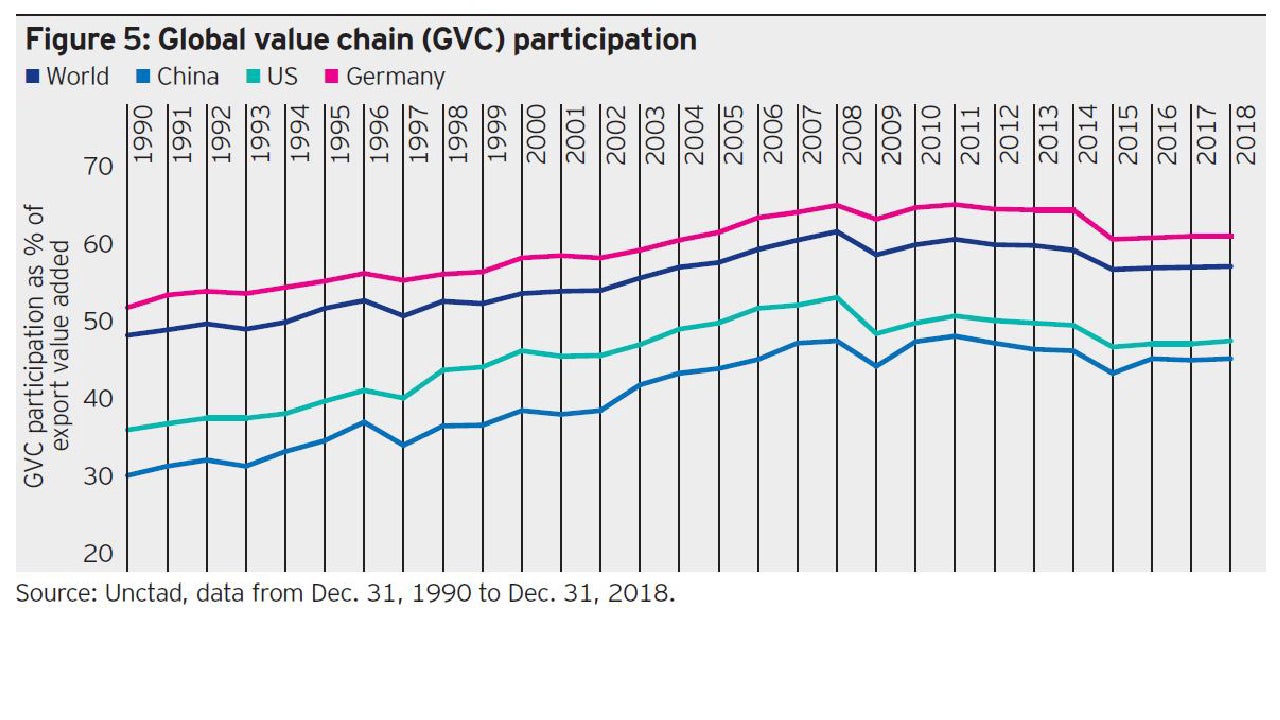

- The dramatic rise in global trade flows (especially in manufactured goods) witnessed over the last three decades may have reached its zenith. This is not a new phenomenon – or related only to recent trade tensions – but rather the continuation of a trend underway since the global financial crisis.

- Declining global trade may have far reaching implications for global growth potential, especially for EMs and their current growth models. The globalization trend has impacted global productivity, EM growth and generated deflationary forces in developed market economies. The end of globalization may mark the easing of some of these trends.

- Since the global financial crisis, we have seen a discernable downward trend in foreign direct investment flows to EMs and global trade in general. Demand for highly traded goods such autos and electronics is becoming satiated and there may be only so much growth that can be generated externally. EMs may need to increasingly generate growth domestically.

- Can EM economies grow without relying on exports? We believe the answer is a qualified yes. But most important for long-term growth is productivity growth, achieved through more physical and human capital and greater efficiency.

- Despite our optimism for the long-run, current trade tensions and trade policy uncertainty are disrupting existing growth models and production structures and will likely require painful adjustments. We, therefore, expect continued softness in global fixed investment with a negative impact on potential global growth.

- Despite expectations of a first stage deal with China, we think geopolitical issues extend beyond mere trade in goods. In recent years, the rise of global value chains has led to the segmentation of the manufacturing process in which production is allocated to various countries based on cost minimization. Broader political issues could lead to technological de-coupling and the regionalization of technology and trade, with significant negative implications for potential global growth.

From fossil fuel to renewable energy: Reducing CO2 while preserving growth

Presented by Fabrice Pellous, Senior Credit Analyst.

- The global effort to transition away from fossil fuels toward renewable energy may have unexpected consequences for global macro and political outcomes. We believe a well thought out transition toward competitive and sustainable renewable energies will be critical to preserving economic growth and avoiding geopolitical repercussions.

- Without careful coordination, the transition away from fossil fuels could result in higher energy prices, lower economic growth and increased geopolitical tensions, especially in emerging markets. It could also reinforce an already growing sense of disenfranchisement among the middle class in developed countries, weakening democratic institutions.

- By 2050, the US and Europe are expected to continue altering their energy consumption mix, but we expect their strategies to differ. This divergence could have technological and social consequences.

- While the EIA expects the US to manage its energy transition without a significant electricity price increase due to its reliance on natural gas and solar, the European Commission expects increases in European electricity generation to be based on

- less competitive (and less reliable) wind and photovoltaic sources. We would expect

- US productivity to improve relative to the EU, based on lower energy costs.

- As the transition from fossil to renewable energies potentially impacts countries’ relative competitiveness and reduces economic growth (due to lower energy consumption and rising energy prices), we could see increased polarization of the middle class, a surge in populist governments and rising policy risks.

- With oil and gas reserves located primarily in the Middle East, Russia and Venezuela, geopolitical pressures could also build in the coming decades as the four major economic blocs (the US, EU, China and Russia) seek to secure their energy supplies.

- The success of the transition toward renewable energy will depend on the ability to develop scalable storage capacity to lower the cost of alternative renewable electricity, and also on the development of new sources of energy generation (nuclear fusion, quantum dot solar cells, core geothermal energy and space-based solar farms).

- Overall, we believe the more widely available - and cheaper - that global energy sources become, the more likely geopolitical tensions will be eased by the prospect of steady global growth and, in turn, the potential for global social and institutional stability.