Investment implications of Asia’s 2024 elections

Political risk has been at the forefront of investors’ minds since late 2023 as several economies around the world head to the polls. We look at what Asia’s 2024 elections could mean for the region’s dollar bond markets.

Recent elections in Argentina1 and Poland2 serve as good reminders that electoral outcomes can often surprise us.

Javier Milei, the right-wing libertarian leader of La Libertad Avanza was elected president of Argentina in November of last year, despite coming second during the first round of elections. His policies for tackling Argentina’s severe and long-lasting inflation problem led to the peso depreciating more than 50% against US dollar on December 13, 2023, as a result.3

While in October of last year, liberal opposition leader Donald Tusk was elected Poland's president after a voter turnout of over 70%, the highest recorded figure in post-communist Poland’s history.4 The WIG20 index jumped 4.9% on October 16, 2023, in reaction to the news.5 The new government ended eight years of rule by the populist Law and Justice (PiS) party, promising promising to uphold EU rules on democracy and rule of law.

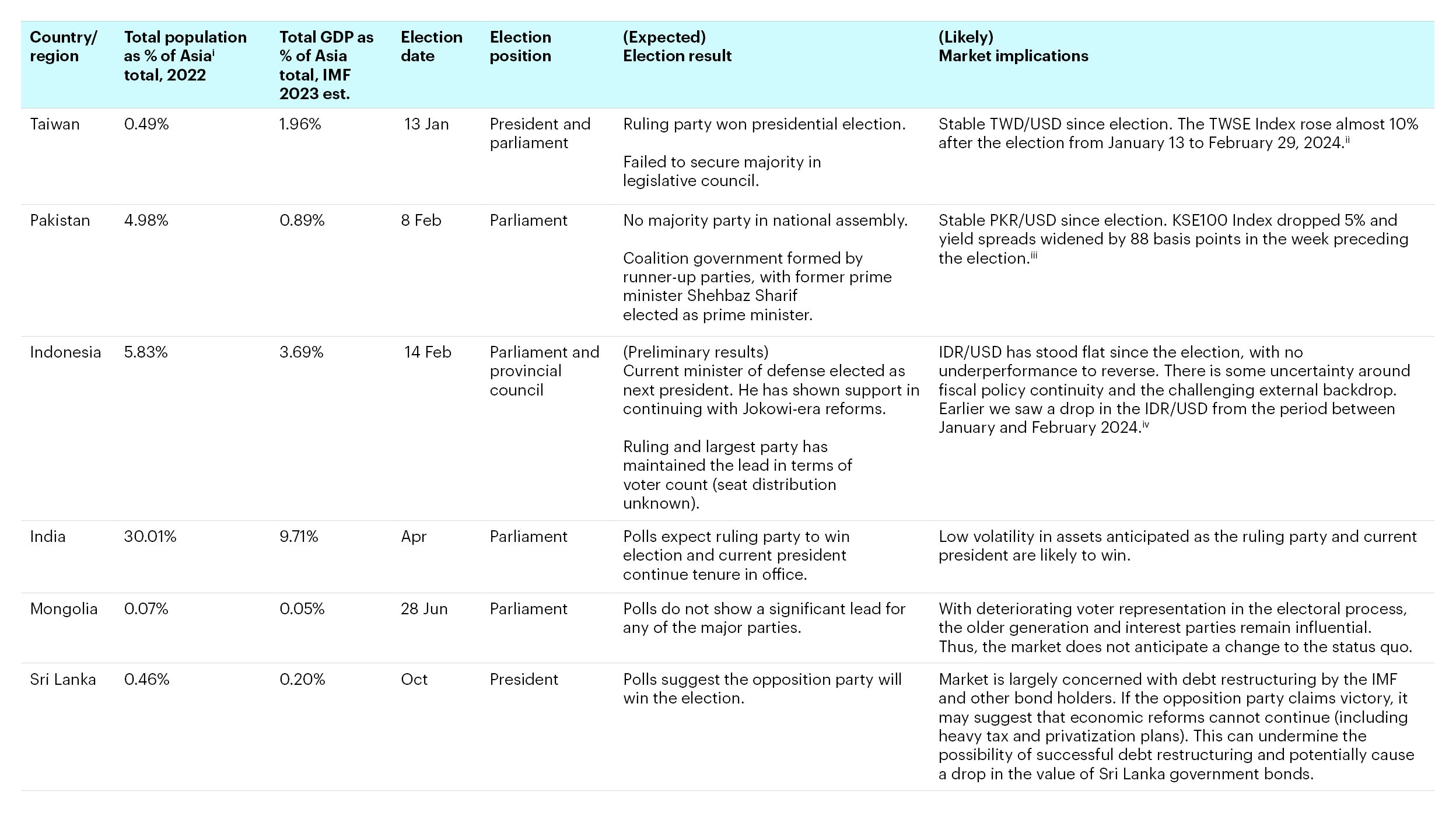

The elections in large Asian economies so far this year have been less unpredictable, and we expect this trend to continue for the most part. We summarize the expected market implications of electoral results for the six Asian sovereign issuers in the J.P.Morgan Asia Credit Index (JACI) universe6. holding elections in 2024. While we cannot rule out possible surprises from smaller countries within the Asia USD bond market, we do not expect significant election result-led credit events to happen in the larger markets in this space.

Source: United Nations, IMF, Invesco, Bloomberg. Data as of March 8, 2024. Notes: i Asia is defined based on the United Nations geographic region definition with reference to United Nations Statistics Division (UNSD) methodology, https://unstats.un.org/unsd/methodology/m49/. iiData as of February 29, 2024.iiiData as of February 16, 2024. ivData as of February 29, 2024.

Asia’s elections so far in 2024 have been less eventful than their emerging market counterparts and we expect this to largely continue to be the case, due to the following contributing factors:

1. A stable democratic environment

Asia's democratic history is notable, with countries such as India and South Korea demonstrating long-standing democratic governance. The region showcases a diverse range of democratic systems, including parliamentary democracies such as India and Japan, as well as presidential democracies like Indonesia and the Philippines. This diversity highlights the adaptability and resilience of democratic principles in Asia. Several Asian countries have a proven record of peaceful transitions of power via democratic means, evident through peaceful elections, regular transfers of power, and adherence to constitutional processes. Moreover, many Asian countries have robust protections for freedom of expression and press freedom, facilitating a diverse range of voices, open dialogue, and public debate.

The presence of a stable environment for democracy to flourish over the long term is evident in several JACI markets with elections this year, such as India, Indonesia, Mongolia, and Taiwan. These economies have maintained relatively stable performance as demonstrated by the World Bank’s political stability governance indicator7 (Figure 1). However, challenges persist in countries like Pakistan and Sri Lanka. These markets exhibit lower and more volatile index scores, highlighting the need for further efforts to enhance their democratic processes.

2. Continuous improvement in the quality of institutions and rule of law

We have observed steady improvements in the quality of institutions and rule of law in some of the earlier mentioned Asian economies. Markets such as India and Indonesia have made solid progress based on the World Bank’s rule of law governance indicator in recent years, again compared to lagging countries such as Pakistan and Sri Lanka.

3. Recent economic and political reforms promoting market stability

Policymakers in several developing JACI markets continue to enact reforms to support economic growth and social welfare improvements in order to ensure sustainable medium to long-term growth.

Indonesia

Indonesia’s government has progressed significantly in terms of economic and political reforms in recent years. Under the leadership of President Jokowi, significant strides have been made in infrastructure development and downstreaming initiatives.

- Infrastructure spending has increased substantially in the country from 2014 to 2023, soaring from approximately IDR 150 trillion to 400 trillion.8 Policymakers have also proactively eliminated foreign investment restrictions and streamlined licensing procedures to attract more foreign direct investment (FDI).

- The implementation of a commodity downstreaming strategy has yielded positive outcomes as Indonesia now boasts a higher volume of processed metal exports (rather than solely relying on raw material exports).

- Reforms have also promoted macroeconomic stability. Since 2021, Indonesia’s economic growth has remained steady with low inflation. FDI inflows have also helped improve the current account over the past five years from a deficit of 3% to a surplus of 0.3% of Indonesia’s GDP.

Prabowo Subianto, the winner of Indonesia’s 2024 presidential election, has expressed support for the reform initiatives initiated during the Jokowi era.9 This bodes well for the nation's sustained progress on the economic and political front.

India

India’s development trajectory has been much like Indonesia’s, with more focus placed on economic development. President Narendra Modi launched the Digital India program in July 2015, aimed at promoting digital literacy, developing digital infrastructure and digitalizing government services. In the same year, the government launched the National Smart Cities Mission, an urban renewal and retrofitting program with the mission to develop smart cities across the country. Modi also launched the Make in India initiative in September 2014, with the aim to attract foreign direct investment, create job vacancies and position India as a global manufacturing hub. We’ve observed a gradual increase in development expenditure following the implementation of President Modi’s various initiatives (Figure 5). India’s FDI has also been on the rise since 2019 as investor confidence has been buttressed by the steadily improving socio-economic situation (Figure 6).10

Mongolia

The mining and quarrying industry has accounted for one-fourth of Mongolia’s nominal GDP for nearly a decade. The industry played a significant role in Mongolia’s post-Covid recovery, as increased mining and export transportation services contributed to 90% of year-on-year economic growth11 in the first half of 2023. However, this overreliance on a single industry is also a source of systemic risk to Mongolia’s economic development. The Vision-2050 policy aims to diversify Mongolia into a multi-pillar economy-state promoting social and economic development. Tourism is one of the areas the country is looking to develop with direct flights between the U.S. and Mongolia starting in this year and the provision of visa-free access to the nationals of 34 countries. A recovery in tourist arrivals was recorded in 2023 (Figure 8).

Sri Lanka and Pakistan are the exceptions to our analysis thus far as election surprises in these countries can or have resulted in market volatility

Sri Lanka and Pakistan have scored poorly in terms of the Worldwide Governance Indicator at -0.41 and -0.96 respectively with none of their sub-indices exceeding 0 (Figure 9). These countries scored poorly on the three factors we covered earlier, namely political stability and absence of violence/terrorism, rule of law and presence of economic and political reforms promoting market stability.

On March 3, Shehbaz Sharif was elected Pakistan’s new prime minister for the second time amid alleged rigging in the early February election.12 Investors are worried that the political turmoil will complicate the government’s negotiations with the IMF as their existing bailout will expire by March-end.13 A higher default risk is priced into the market with a rising yield spread with US treasuries and retracement in the stock index.

Sri Lanka has experienced political turbulence and instability over the past several years, with frequent changes in leadership and shifts of political power. The 2022 World Governance Indicator (WGI) political stability score of -0.8 is in stark contrast with the JACI average of 0. The absence of a long-standing democratic environment has hampered the country's ability to formulate consistent policies and reforms to promote economic stability. The lack of progress in economic and political reforms has heightened market concern, particularly in the context of debt restructuring, and is likely to deter investors looking at this market.

We believe that investors looking at emerging market credit in an election-packed 2024 will need to pay more attention to political risk. Apart from two outliers, Pakistan and Sri Lanka, which account for less than 2% of the JACI’s market value, Asian markets undergoing general elections this year have exhibited or are expected to exhibit low volatility. We believe investors may not encounter as much risk in Asia credit investments, given the recent improvements in governance quality and stability coupled with continued reform efforts in these economies. These advancements are likely to render Asian markets more resilient than their emerging market counterparts.

With contributions from Sigmund Au.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Footnotes

-

1

Argentina markets want fiscal 'kick' to economy as Milei shock plan readied, Reuters, December 2023.

-

2

Source: EUphoria! Poland election surprise spurs investor hope, Reuters, October 2023.

-

3

Argentine peso opens down over 50% vs dollar following devaluation, Reuters, December 2023.

-

4

Poland election: Law and Justice party on course to be ousted from power, The Guardian, October 2023.

-

5

Polish stocks and zloty rally after exit poll, The Guardian, October 2023.

-

6

The J.P. Morgan Asia Credit Index (JACI) consists of liquid US-dollar denominated debt instruments issued out of Asia ex-Japan. Market constituents as of February 2024 consist of China, Hong Kong, India, Indonesia, Korea, Macau, Malaysia, Maldives, Mongolia, Pakistan, Philippines, Singapore, Sri Lanka, Taiwan, Thailand, Vietnam.

-

7

Daniel Kaufmann and Aart Kraay (2023). Worldwide Governance Indicators, 2023 Update (www.govindicators.org), Accessed on 10/19/2023. Note: Political Stability and Absence of Violence/Terrorism Indicator is a subindex from the Worldwide Governance Indicators (WGI) developed by the World Bank. WGI also reports on five additional dimensions of governance including: Voice and Accountability, Regulatory Quality, Rule of Law, Government Effectiveness and Control of Corruption. Scoring in the charts are based on an estimate of governance which ranges from approximately -2.5 (weak) to +2.5 (strong) governance performance. The average is calculated by equal contribution of individual countries’ scoring.

-

8

Government budget for infrastructure in Indonesia from 2014 to 2023, February 2024, https://www.statista.com/statistics/1147908/indonesia-government-infrastructure-budget/

-

9

Indonesian elections - Prabowo takes command, February 2024, https://www.research.hsbc.com/R/20/7qqMh7wvh2wz

-

10

Goldman Sachs Top of mind - 2024: The year of elections, February 2024, https://www.goldmansachs.com/intelligence/pages/2024-the-year-of-elections-f/report.pdf

-

11

Mongolia's Economy Continues to Pick Up, But Growth Remains Uneven, November 2023, https://www.worldbank.org/en/news/press-release/2023/11/28/mongolia-s-economy-continues-to-pick-up-but-growth-remains-uneven

-

12

Shehbaz Sharif returns as Pakistan's prime minister, as protests hit parliament, March 2024, https://www.npr.org/2024/03/03/1235590139/shehbaz-sharif-returns-pakistan-prime-minister-protests-parliament-imran-khan

-

13

Pakistan swears in new parliament amid chaotic scenes as Imran Khan’s followers protests vote count, February 2024, https://apnews.com/article/pakistan-parliament-protest-imran-khan-126fd56bc43edbf2ae9a8499fe79867a