Monthly fixed income update - January 2024

Asset Class Returns

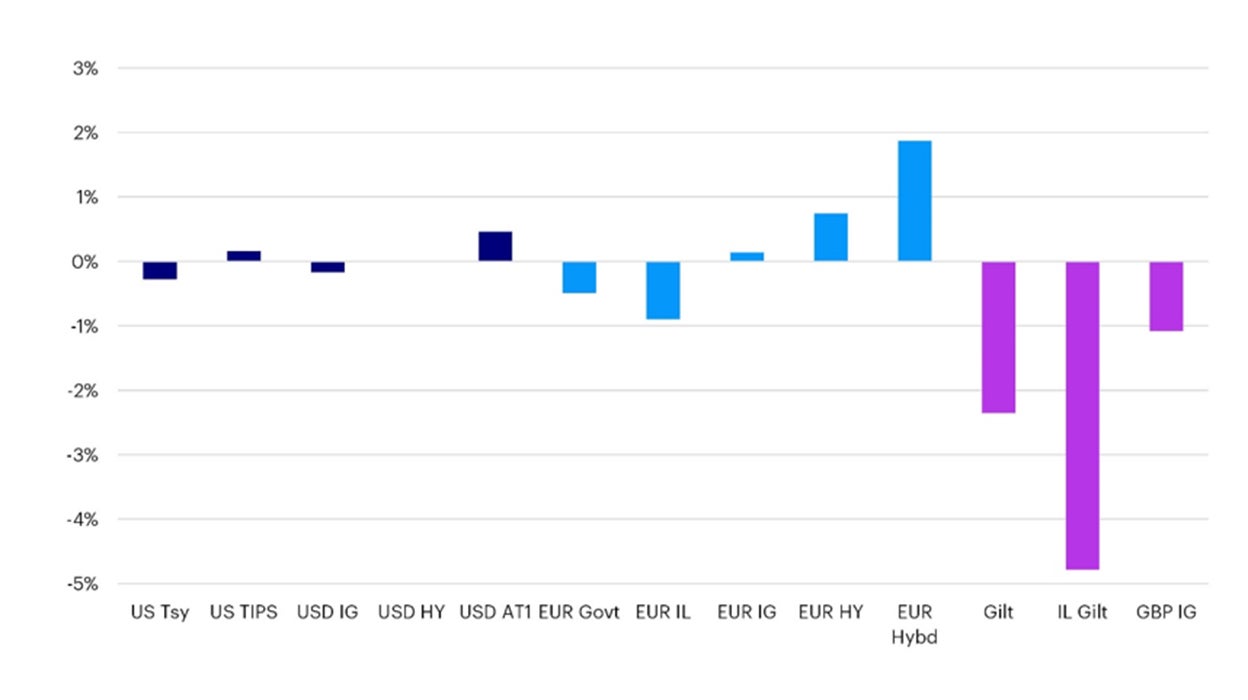

Following the very strong performance in the last two months of 2023, the bond market rally stalled in January. Central bank rhetoric indicated that they felt markets had gone too far by markets pricing amongst imminent easing of monetary policy and pushed back on expectations for the timing of the first-rate cuts. However, while bond yields rose for most of January, they bounced towards the end of the month, helped by US inflation data continuing to trend towards target.

While January is traditionally a heavy month for supply, 2024 set new records. In Europe alone, primary issuance had topped €300bn a couple of days before month end, beating last year’s January total of €293bn, according to Bloomberg. But, while the volume of supply also kept pressure on yields, it was met with incredibly strong demand. Bids for new issues in Europe had topped €1Tn by the middle of the month, around 10 days earlier than the previous record set is 2021. US investment grade credit markets also saw record supply of around $200bn. With rates likely to fall during the coming year, and US and European investors sitting on record levels of cash, demand for new issues is likely to remain strong.

Source: Bloomberg, Invesco as at 31 Jan 2024

With the exception of Euro Corporate Hybrids, which performed strongly over the month, returns across USD and EUR denominated fixed income asset classes were subdued, with yields generally ending the month slightly higher than at the end of December. The UK, however, was the outlier with negative returns across Gilts, linkers and credit, as inflation data was higher than had been expected.

Government and Inflation-Linked Bonds

Government and inflation linked bonds performed poorly early in the month as rate cut expectations were pushed back, driving yields higher following the strong rally into year-end. However, bond markets bounced into month-end, led by US Treasuries in anticipation of increased dovishness from the Federal Reserve. Whereas equity markets, which had started 2024 positively, gave back some of the gains on weaker earnings.

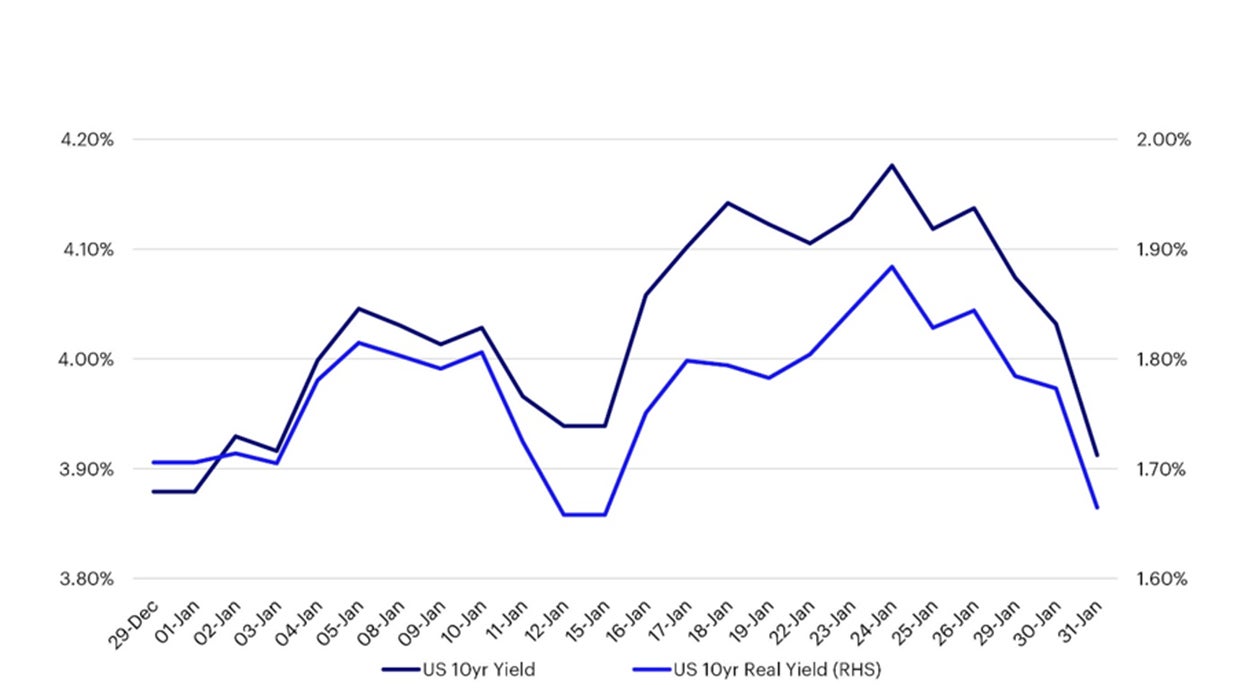

US Rates

A strong US employment report at the start of January set the bearish tone for the US Treasury market and was followed by a higher US inflation print than the market had been anticipating. At the same time, several Fed speakers indicated that rates were unlikely to be cut as quickly as the market was anticipating. Sentiment, however, changed towards the end of the month, with the core PCE1 deflator coming in lower than expected, appearing to be the catalyst. Treasuries rallied further into the end of the month as some technology companies indicated that developments in artificial intelligence may take longer to impact earnings. Whereas the New York Community Bank which had acquired part of Signature Bank last year, reminded investors about the previous concerns with regional banks as the stock price slumped due to reporting a surprise Q4 loss. The Fed held rates at their meeting at the end of January and indicated that rate cuts are unlikely before Q2.

Source: Bloomberg, Invesco as at 31 Jan 2024

Eurozone Rates

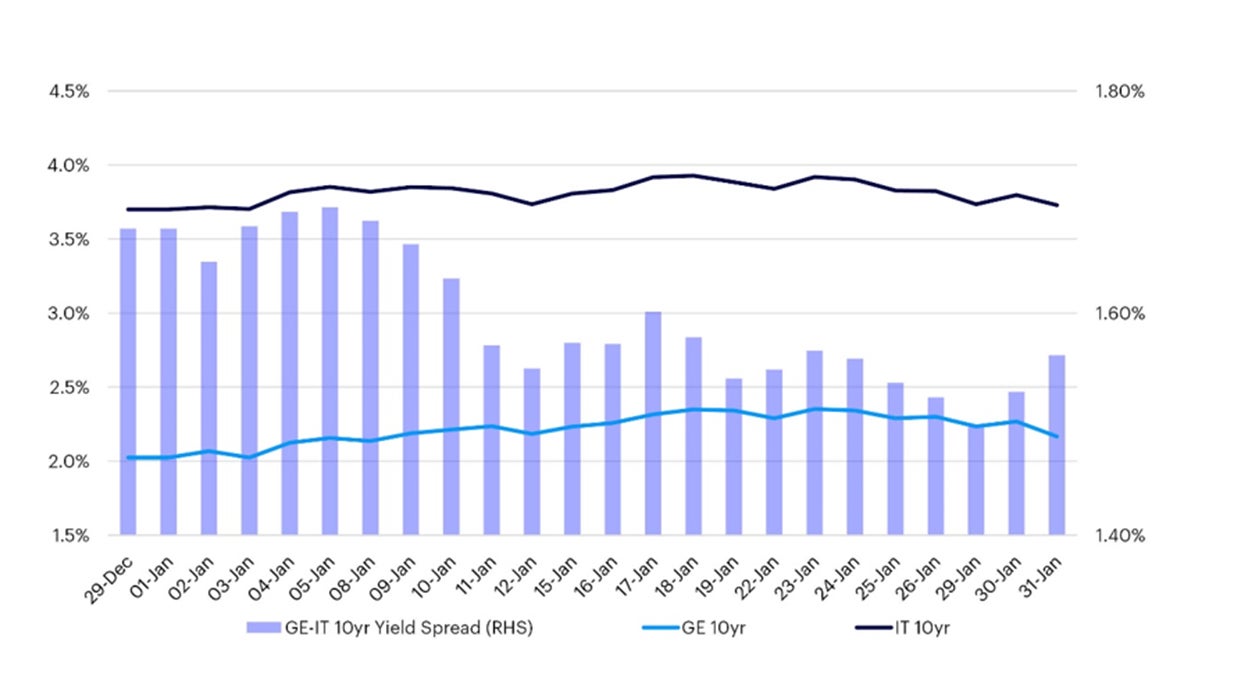

European government bond markets followed a similar pattern to Treasuries, with yields initially rising before rallying later in the month. New issuance from several eurozone governments was met with incredibly strong demand with many deals 10x oversubscribed. Demand was particularly strong for peripheral debt as markets started the year with a risk-on tone, which helped to drive yield spread for Italian bonds over German bonds to the tightest level for 20 months.

Source: Bloomberg, Invesco as at 31 Jan 2024

UK Rates

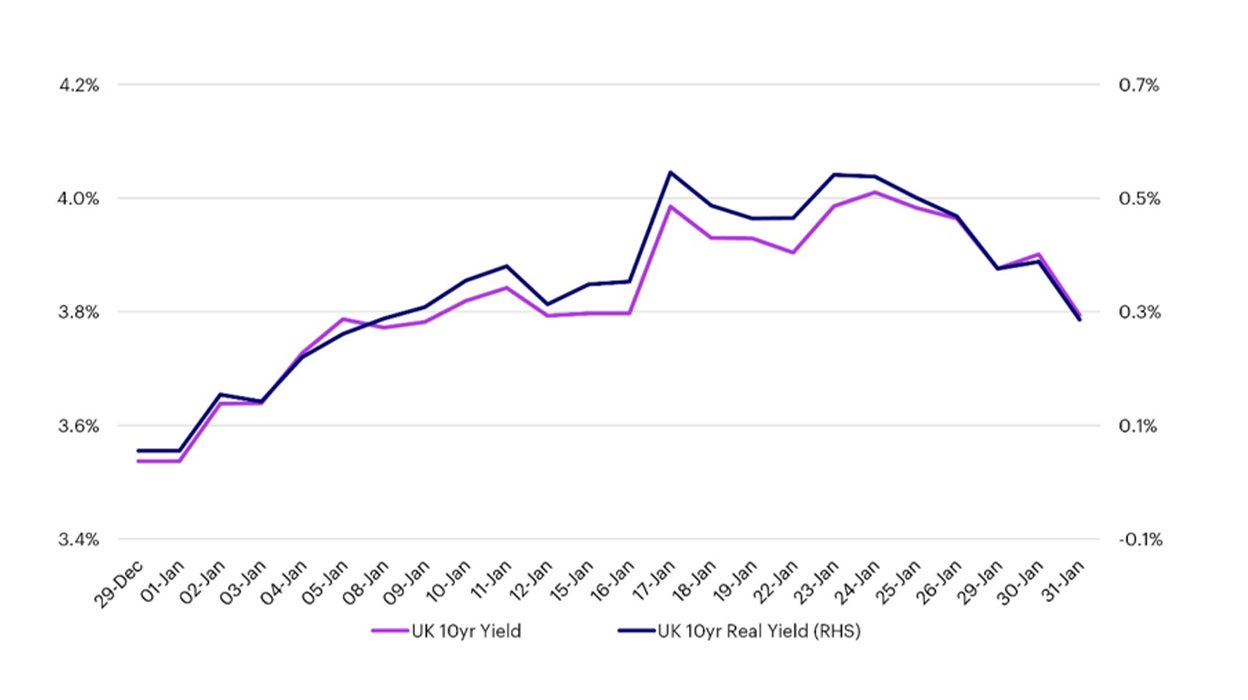

The Gilt market underperformed relative to US Treasuries and eurozone government bonds in January. While yields followed a similar pattern, UK bond markets sold off by more and then rallied less. The main reason for the underperformance was the inflation data released in the middle of the month which showed both CPI and RPI ticking up having been expected to fall, causing the market to push back the expected timing for the first rate cut and to reduce the amount of easing expected during the year.

Source: Bloomberg, Invesco as at 31 Jan 2024

Keep an eye on…inflation data which will be key to the timing and extent of rate cuts

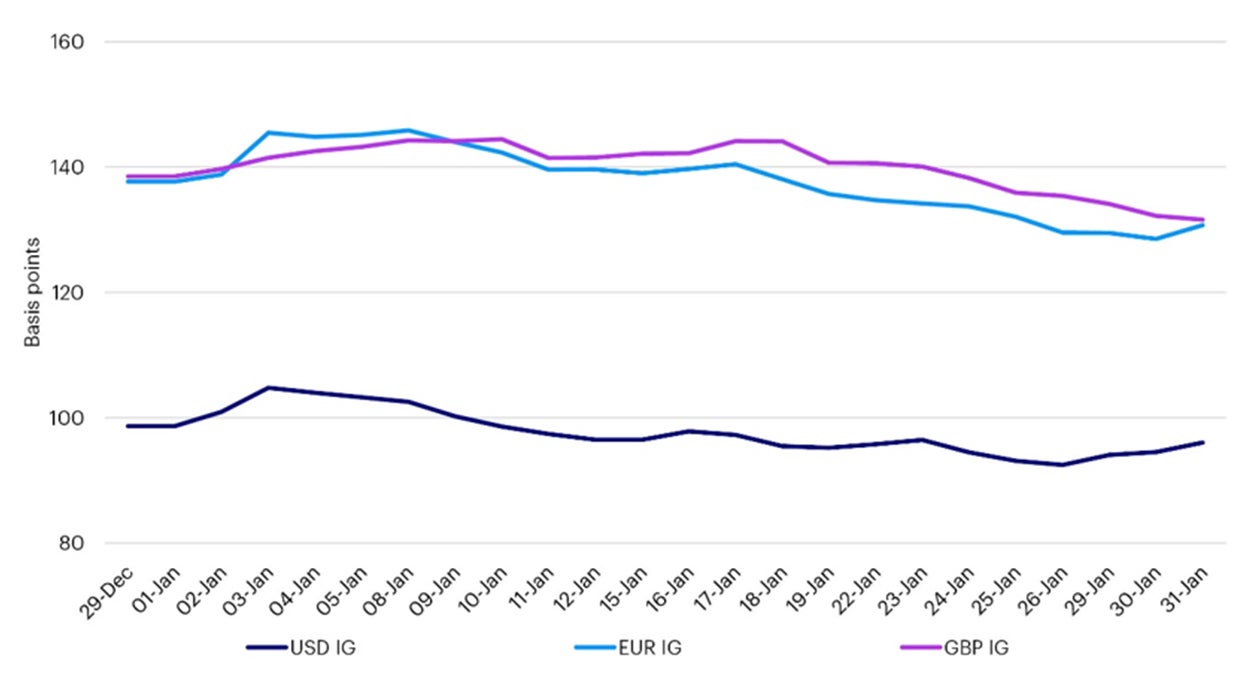

Investment Grade Credit

Investment grade credit markets had to digest a huge amount of new issuance, but there was plenty of demand to absorb that supply as markets started the year with a broadly risk-on tone. While spreads on EUR-denominated credit are in line with the long-term average, spreads for USD and GBP credit markets are tight relative to their average. However, the yield offered by credit markets at a time when rates have peaked remains appealing, particularly with investors sitting on a record amount of cash in both Europe and the US.

Source: Bloomberg, Invesco as at 31 Jan 2024

Keep an eye on…economic data as spreads could be vulnerable to a hard landing

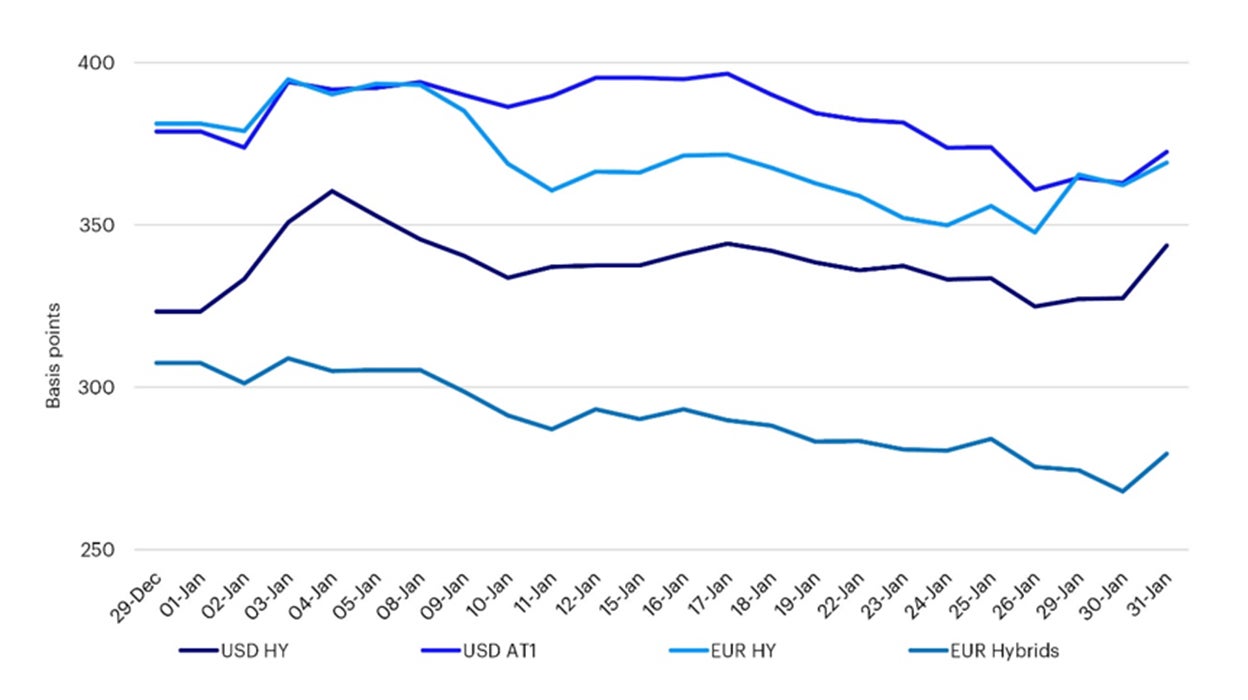

High Yield and Subordinated Credit

Lower rated credit had mixed fortunes over the month. USD-denominated high yield spreads widened by 20bps,leaving returns flat for the month, while EUR-denominated high yield spreads rallied by 12bps and returning 0.7% in January. AT1 spreads were slightly tighter in January but it was Euro corporate hybrids that were the best performer, with spreads tightening by 28bp and the asset class returning 1.9% for the month.

Source: Bloomberg, Invesco as at 31 Jan 2024

Keep an eye on…the outlook for interest rates as spreads have rallied on expectations of rate cuts

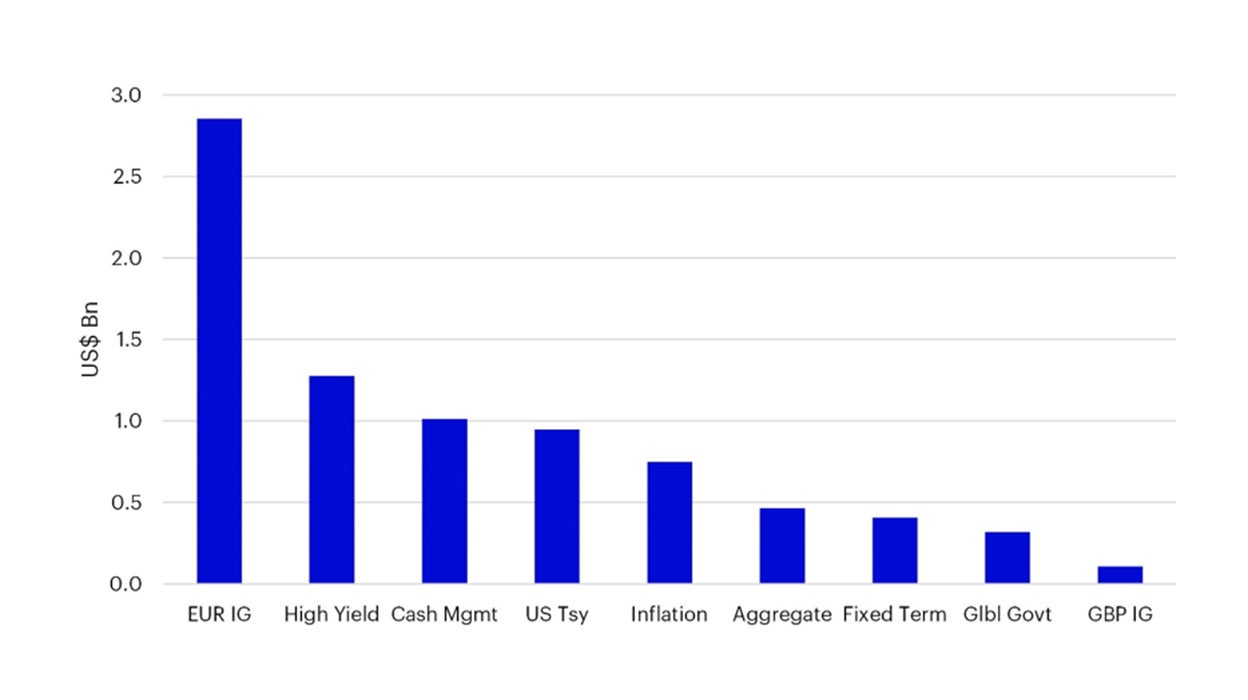

Fixed Income ETF Flows

Fixed income ETFs saw strong inflows in January with $8.3bn NNA2 being the best month since last July, although not quite as strong as the $9.4bn seen last January. While net inflows into fixed income ETFs are unlikely to continue at January’s pace going forward, 2024 is likely to be a strong year for fixed income ETFs now that rates have peaked in most developed markets and with record levels of cash waiting to be put to work.

EUR investment grade credit ($2.9bn) was the strongest category for inflows in January. High yield ($1.3bn) also experienced high demand, with inflows going almost entirely into EUR-denominated ETFs. Cash Management ($1.0bn), US Treasuries ($0.9bn), Inflation ($0.7bn) and Aggregate bond ETFs ($0.5bn) also saw high levels of net inflows. Flows into Fixed Term ETFs ($0.4bn) remained strong, taking AUM for this relatively new category above $2.5bn. In a month of high demand for fixed income across the board, no single category saw net outflows above $100m.

As appeared likely, following the rally into year-end, fixed income markets stalled in January. Although demand remained high, the combination of less dovish central banks and high supply put upward pressure on yields. However, the backdrop for fixed income remains supportive with interest rates likely to start coming down in the middle of the year. It therefore seems likely that investors will see pull backs as opportunities to put cash to work in bond markets, and increasing duration to lock in yields before central banks start easing policy.

Source: Bloomberg, Invesco, as at 31 Jan 2024

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Footnotes

-

1

Personal Consumption Expenditures

-

2

Net new assets