India – index, income, initiative, interest

Global investor interest in India’s capital markets is gaining traction, driven by the growth of its middle-class population, business-friendly policy reforms, and financial market liberalization measures. In this paper we deep dive into India from the four perspectives of index, income, initiative, and interest, to understand more about the opportunities that are emerging from this booming economy.

Index: Global index inclusion set stage for Indian local bonds to shine

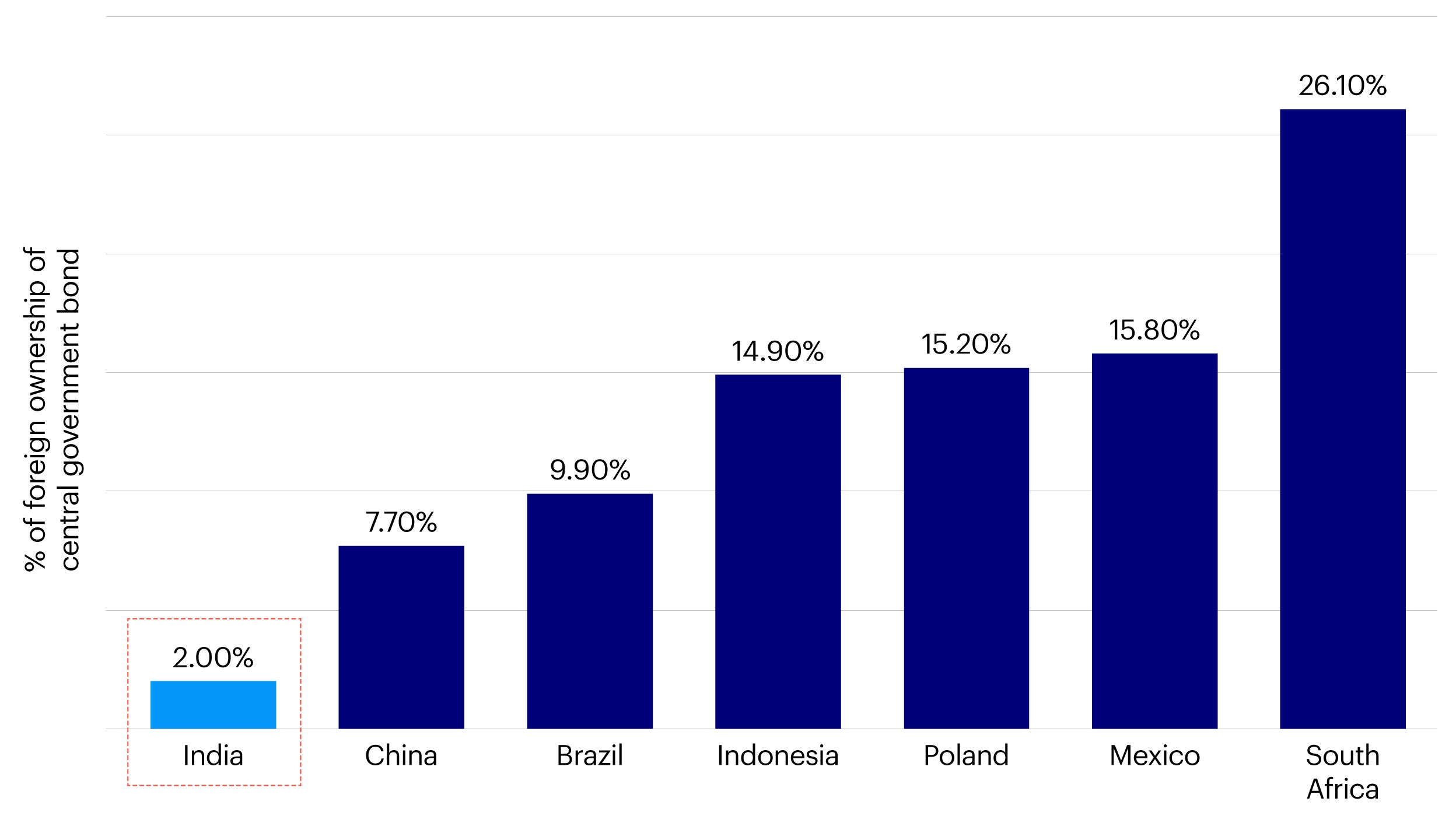

India has proactively explored the inclusion of its government securities into global indexes for the past several years. However, we’ve seen limited progress due to issues around capital gains taxes and local currency settlement, even though India’s US $1.2 trillion government bond market is already the third largest among emerging economies after China and Brazil.1 As such, India’s bond market has struggled for years to rise above the criticism of being seen as insular. Foreign investor ownership of Indian government bonds is currently around 2% 2, well below its emerging market peers (Figure 1).

Source: Bloomberg. The number only includes pure nominal local currency central government bonds, which is a better reflection of foreign ownership. Data as of 30 September 2023.

This changed with the decision by JP Morgan in September 2023 to include India in its emerging markets government bond index3 and its index suite at the end of June 2024.4 These indexes are benchmarked by approximately US $236 billion in global funds. India is expected to reach the maximum weight of 10% in the index by March 2025. 23 bonds with a total value of about US $330 billion are considered eligible.5

The index inclusion is forecast to facilitate about US $24 billion in passive inflows between June 2024 and March 2025. 6 As a reference, China’s first major global index inclusion was in April 2019 and according to the State Administration of Foreign Exchange, net onshore bond inflows from foreign investors amounted to US $440 billion from 2019 to 2021.7

What do we expect index inclusion to mean?

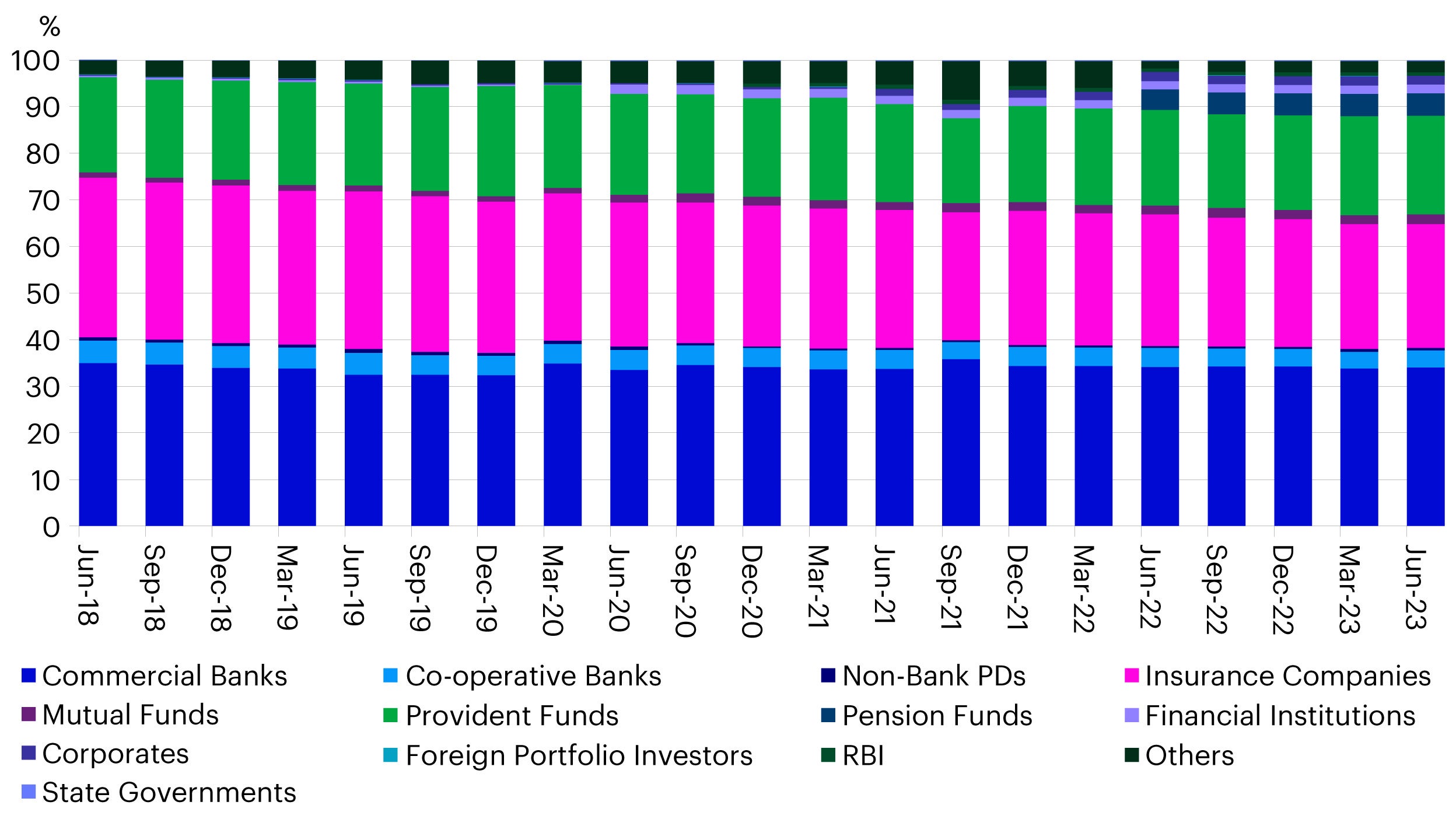

We expect the most direct impact of global index inclusion will be to attract more foreign fund inflows into Indian local government bonds, which can help to diversify the investor base. The Indian government’s quarterly report for Q2 2023 showed that more than 60% of outstanding government securities are held by commercial banks and insurance companies.8 This investor base is highly regulated and are subject to regulations on their minimum holdings of government securities. At the same time, the proportion of holdings of central and state government securities by other institutions, apart from commercial banks and insurance companies, has been growing gradually over the past five years (Figure 2). We expect index inclusion to speed up the progress of investor base diversification significantly.

Source: HSBC, data as of June 2023.

Apart from foreign inflows, the higher demand for government bonds from foreign investors will likely result in a lower cost of borrowing. This can aid in lowering the cost of borrowing for the corporate sector. Foreign participation in India’s bond market could also have a favorable impact on India’s macroeconomic indicators. Portfolio inflows can help to contain the balance of payments deficit and improve domestic liquidity. At the same time, we still expect higher volatility in the domestic bond market after inclusion given the deeper alignment with global financial markets.

We also expect index inclusion to prompt Indian policymakers to further liberalize controls on foreign investment in the local bond market. JP Morgan’s decision to include India in its index was supported by the government’s introduction of the FAR (Fully Accessible Route) program and additional market reforms for aiding foreign portfolios.9 We expect the Indian government to further reform India’s financial markets in areas such as foreign exchange policies and to work toward enhancing the country’s macroeconomic fundamentals and regulatory infrastructure.

What’s next?

After the recent index inclusion by JP Morgan, the next question is when the other two major bond indices, namely the Bloomberg Barclay’s Global Aggregate Index and the FTSE Emerging Markets Government Bond Index, will follow suit. FTSE Russell has kept India on its watchlist till date and has held off from including Indian bonds, citing operational issues as the main concern as of September 2023. While in January of this year, Bloomberg Barclays proposed including eligible Indian bonds into its emerging market local currency index from September 2024, seeking feedback from the users of its indexes.

While timing for FTSE index inclusion remains uncertain, we expect Indian policymakers to improve the government bond market structure going forward. Taking China onshore bonds as an example, the first move toward index inclusion was by Bloomberg Barclays in April 2019, while JP Morgan and FTSE Russell included China in February 2020 and October 2020 respectively. We anticipate it could take more than a year before the remaining index providers decide to include Indian government bonds into their indices.

Income: National income growth story propels investment

National income

India’s national income growth story has astounded in recent years. India is currently the fifth largest economy in the world by nominal GDP, behind the US, China, Germany, and Japan. It surpassed the UK which earlier held this rank in 202210, however a decade ago India was not even in the top 10. Based on the latest IMF Regional Economic Outlook, India is set to become a US $5 trillion economy and the third largest in the world by 2027.11

We believe the Indian economy is well positioned to sustain its growth given recent economic reforms in key sectors like infrastructure and digitalization. Despite the headwinds arising from global central bank policy tightening, the Russia-Ukraine war, and other sources of market volatility, India’s real GDP growth in 2023 was around 7.3%, higher than the 7% growth projection by the Reserve Bank of India.12 According to the IMF, India is currently expected to be contributing around 15% of global growth.13 Looking ahead, we expect the growth story remain robust, supported by macroeconomic and financial stability. Real GDP growth is projected to be 6.3% for the 2024 fiscal year.14

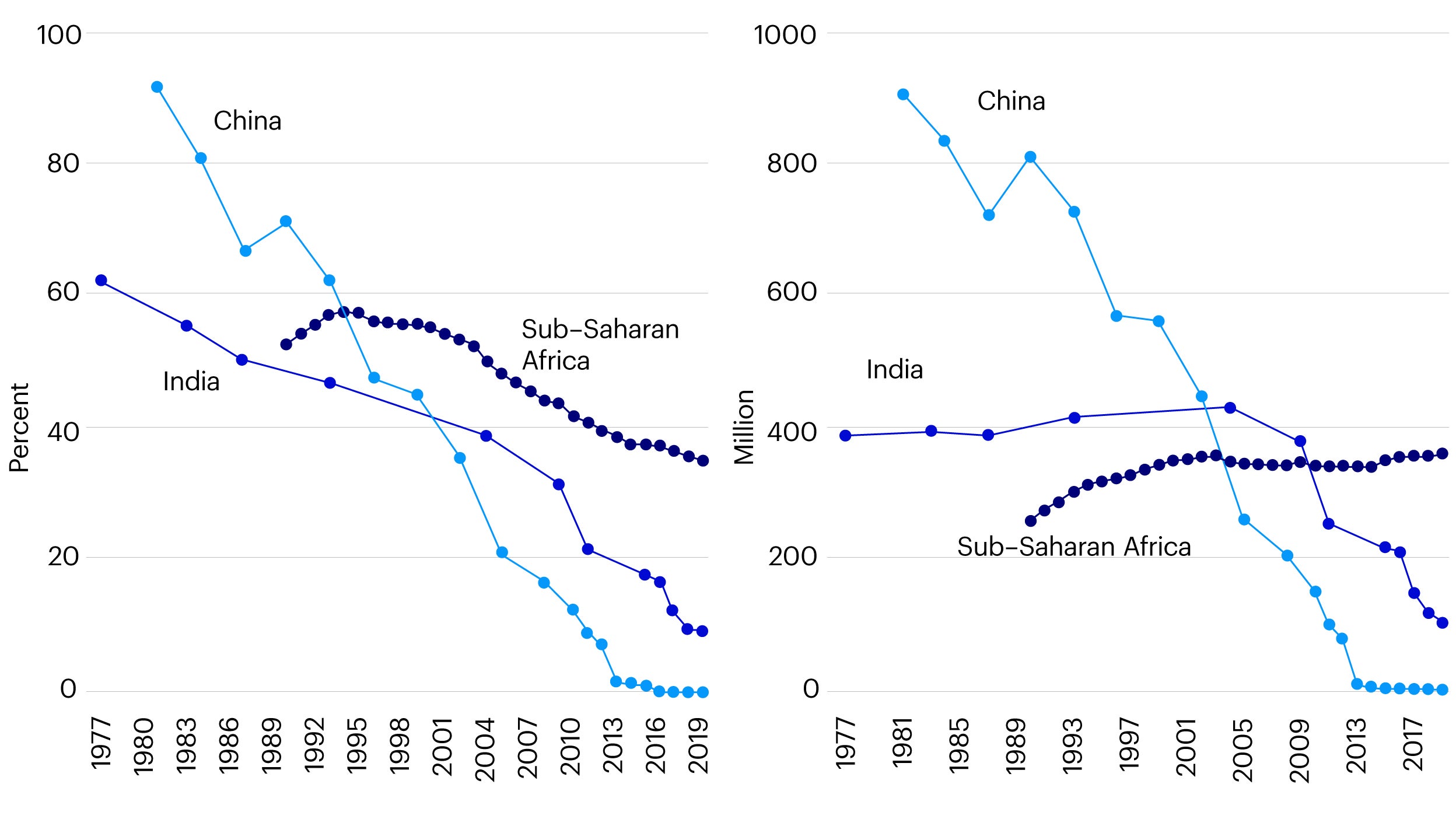

India’s income has grown not only at the national level, but also on a per capita basis. The country’s living standards have significantly improved in recent decades and poverty has reduced. According to the latest report from United Nations Development Programme, between 2000 and 2022, per capita income soared from $442 to $2,389. Over the period from 2004 to 2019, poverty rates (based on the international poverty measure of US $2.15 per day), plummeted from 40 to 10 percent (Figure 3). Moreover, between 2015-16 and 2019-21, the share of the population living in multidimensional poverty fell from 25 to 15 percent.

Source: 2024 Regional Human Development Report - Making Our Future: New Directions for Human Development in Asia and the Pacific; Data from World Bank, World Development Indicators. Note: Annual data are available only after 2010 and 2015 for China and India respectively. Data before that are connected linearly only for ease of reading.

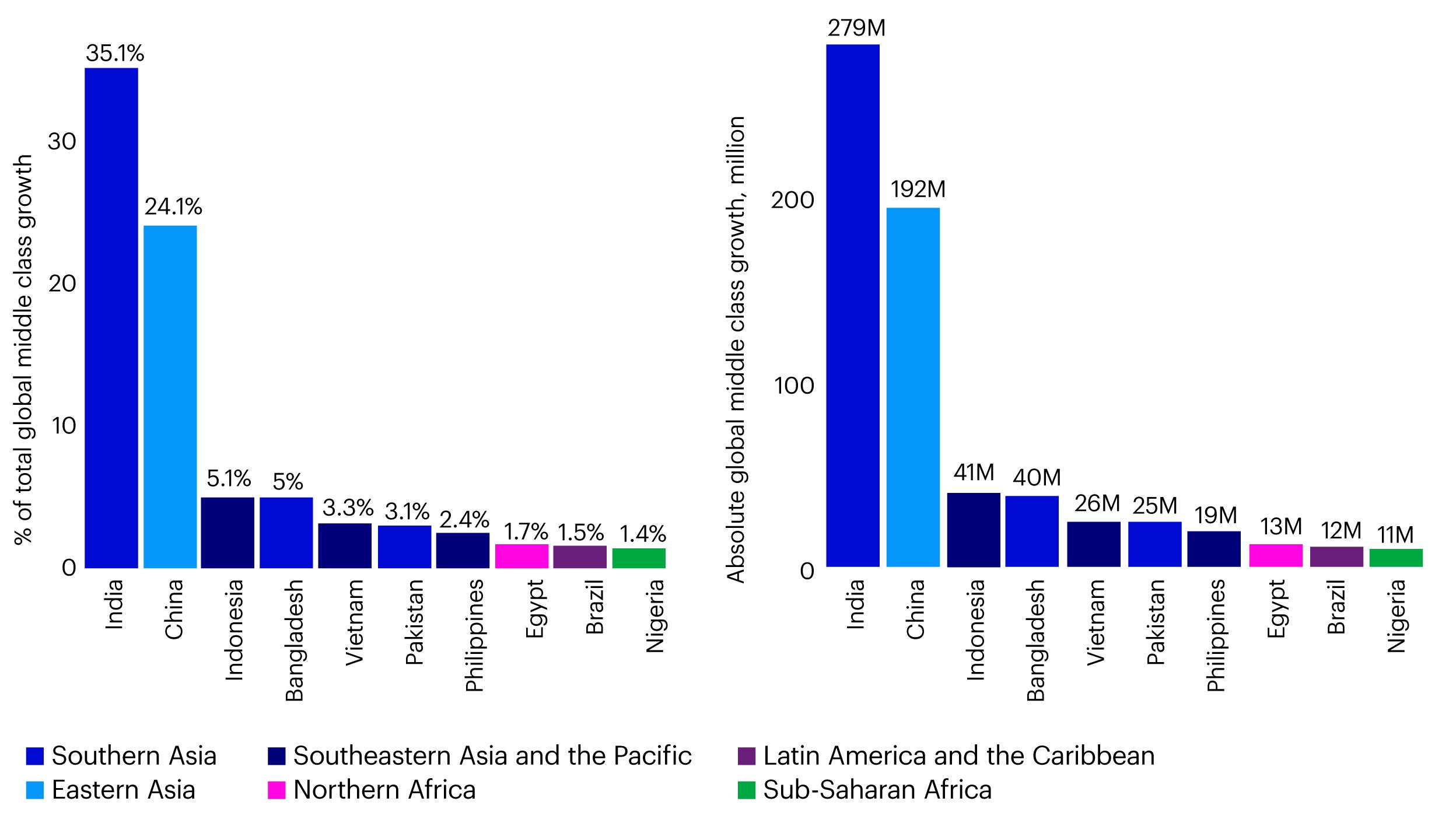

As a result of India’s per capita income growth, it is expected to be the largest contributor to global middle-class growth in the current decade. We expect this growing middle-class population to further drive consumption, job creation and income growth in the country.

Source: 2024 Regional Human Development Report - Making Our Future: New Directions for Human Development in Asia and the Pacific, UNDP; World Data Pro. Note: Middle class $12-120 a day (2017 PPP). Sub-regional country classification of World Data Pro.

At the same time inequality remains a problem. Modi’s government has enacted several pro-poor schemes to ensure state benefits directly reach the citizens that need it. These measures include a mega financial inclusion drive including opening Jandhan accounts and the MUDRA loan scheme, a focus on digitization, and free distribution of rations under the Right to Food program.

Investment income

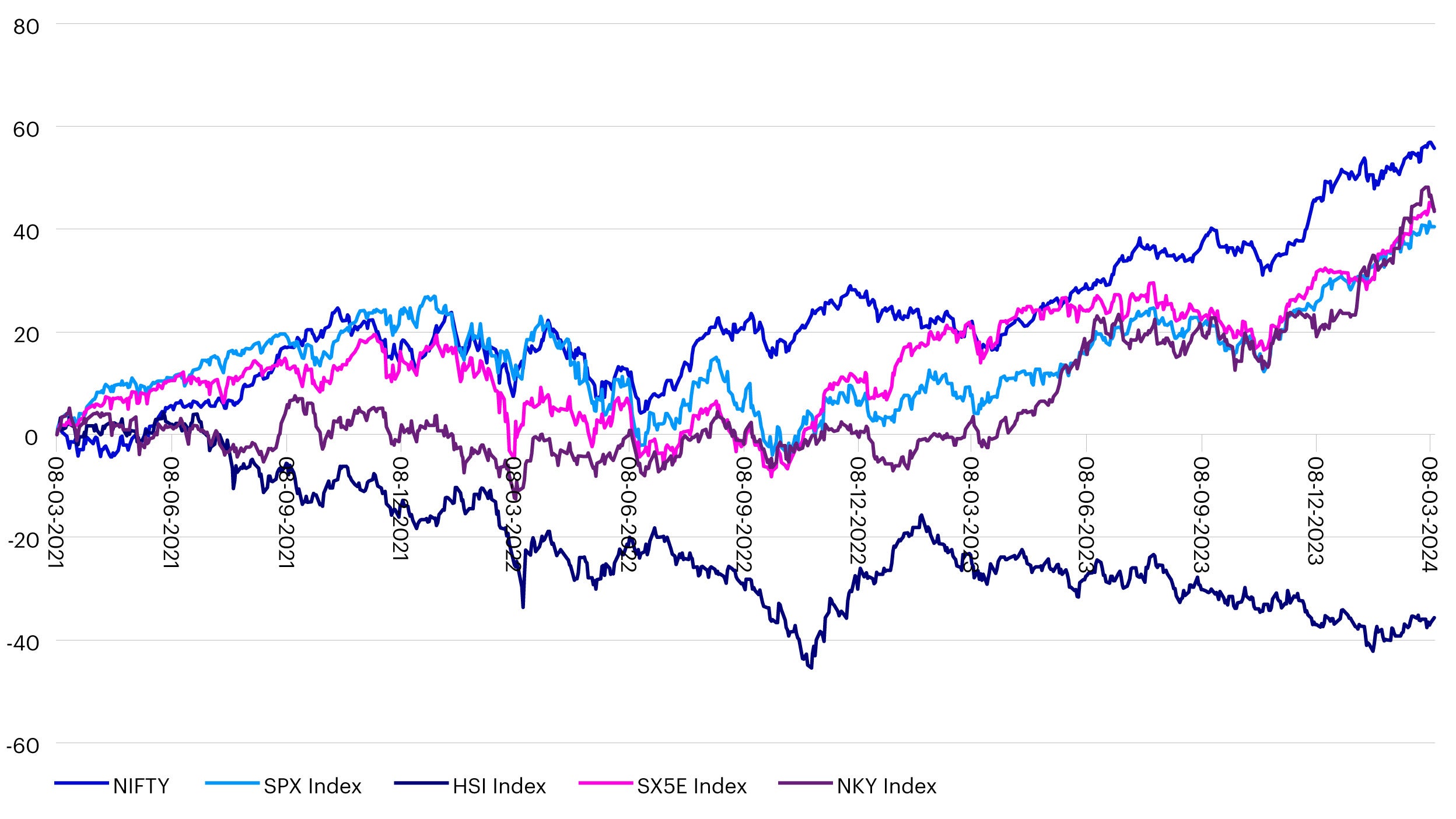

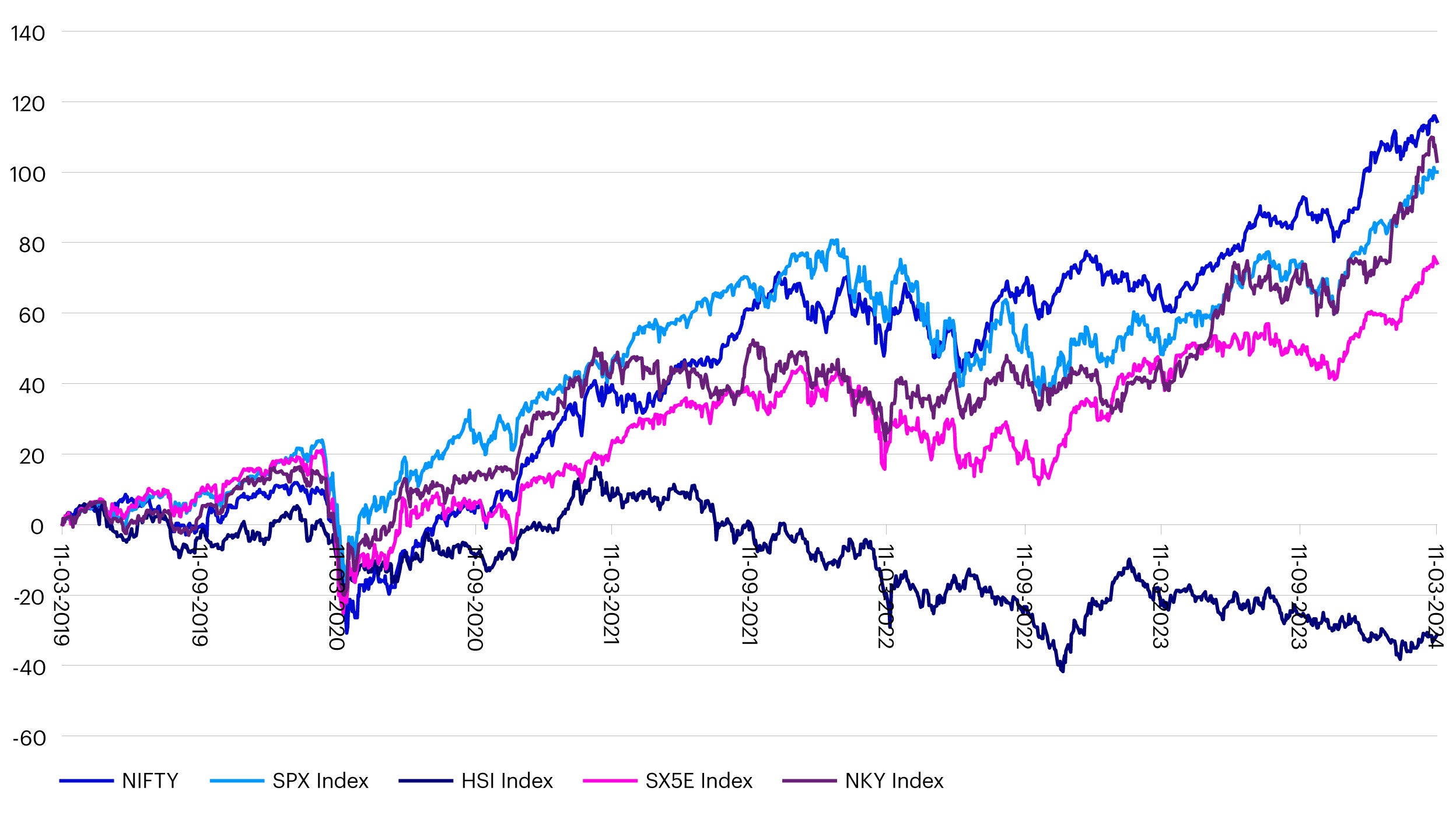

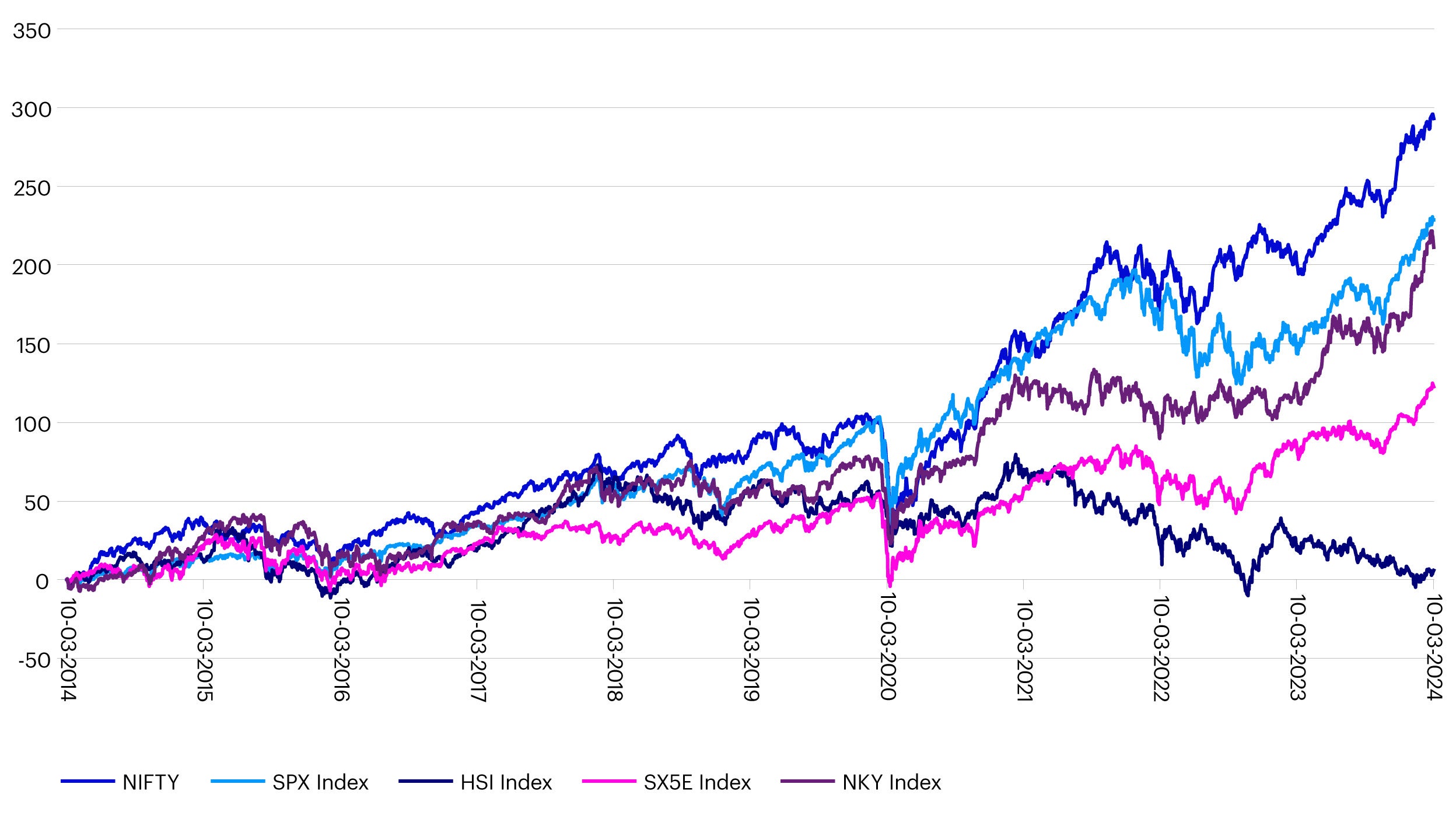

Apart from the growth in national income, we have seen a boom in investment income from capital market assets. India’s stock market has outperformed major markets around the world on a 3-year, 5-year, and 10-year basis.15

Source: Bloomberg, data as of January 12, 2024. Past performance is not a guarantee of future results.

Source: Bloomberg, data as of January 12, 2024.

Source: Bloomberg, data as of January 12, 2024.

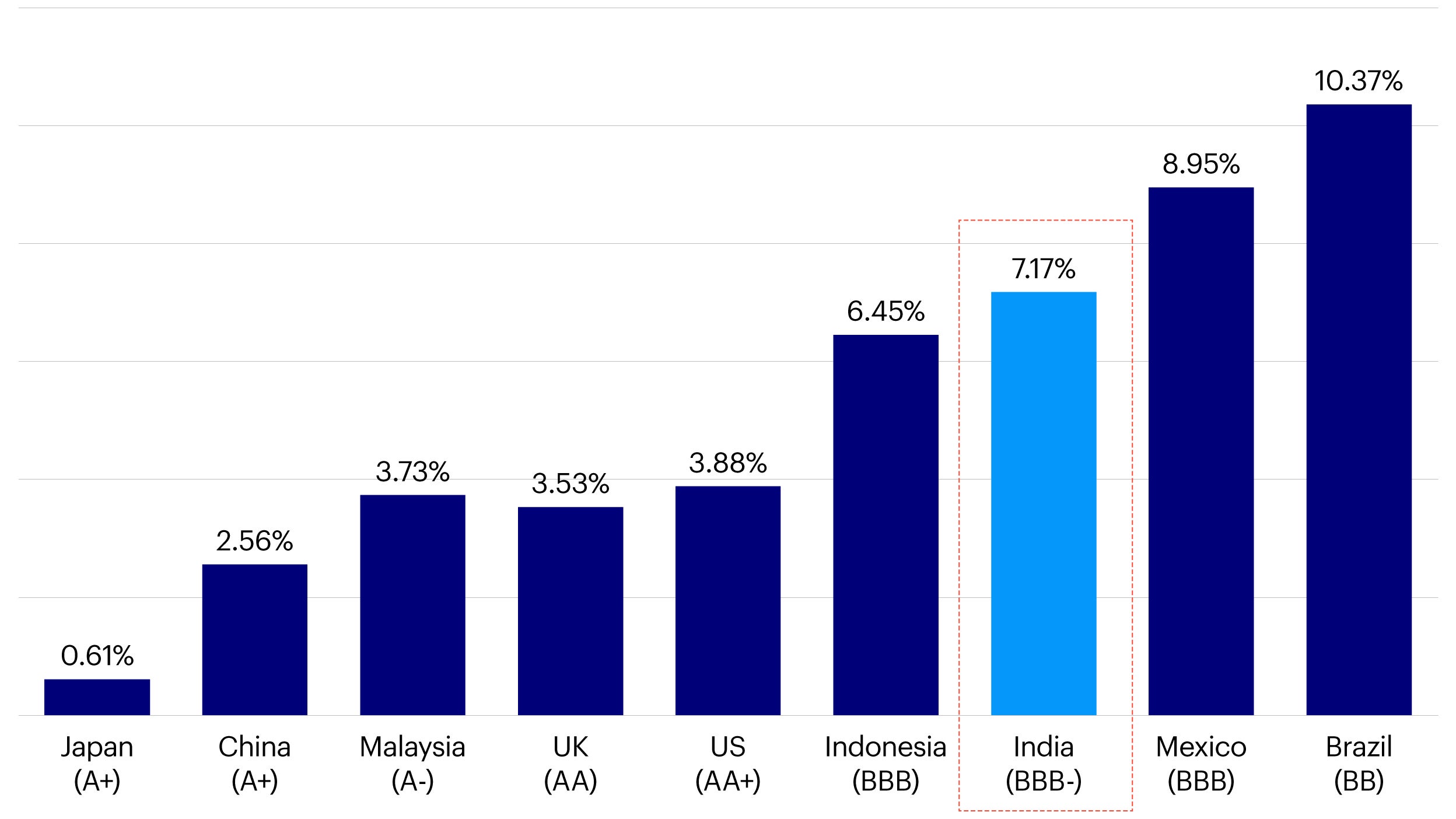

India’s bond market also looks promising. Indian local government bond yields are at attractive levels compared to government bonds of other countries with similar ratings (Figure 8). As mentioned earlier, the foreign ownership of Indian government bonds is currently at low levels. If we account for passive inflows by foreign investors arising from index inclusion, we expect returns driven by capital inflows to be attractive going forward. We also believe India is at the peak of its rate cycle with higher positive real rates and higher absolute government bond yields compared to its major emerging market counterparts.

Source: Bloomberg. Data as of 30 September 2023. Note: S&P Rating in brackets.

Initiative: National programs to drive economic development

Indian policymakers have actively been setting up national policies to combat domestic and regional issues. Major initiatives in the country include Swachh Bharat Abhiyan, a country-wide cleanliness campaign, Atal Mission for Rejuvenation and Urban Transformation (AMRUT), a program to improve urban infrastructure with a focus on sewage networks and water supply, and Pradhan Mantri Jan Dhan Yojana, a program that promotes financial inclusion. Apart from these, the government launched the Make in India initiative in September 2014 as part of a wider set of nation-building priorities. The program aims to transform India into a global design and manufacturing hub and boost overall entrepreneurship and employment opportunities in the country.

India’s government is highly motivated to advance the Make in India initiative given India’s growth story has largely been led by the services sector in the past. In the nineties, India was often referred as the “back office of the world” given its huge leap in IT and its business process outsourcing (BPO) sector. However, the manufacturing sector in India was seen as relatively less advanced, partially due to lack of infrastructure, while at the same time still important for job creation.

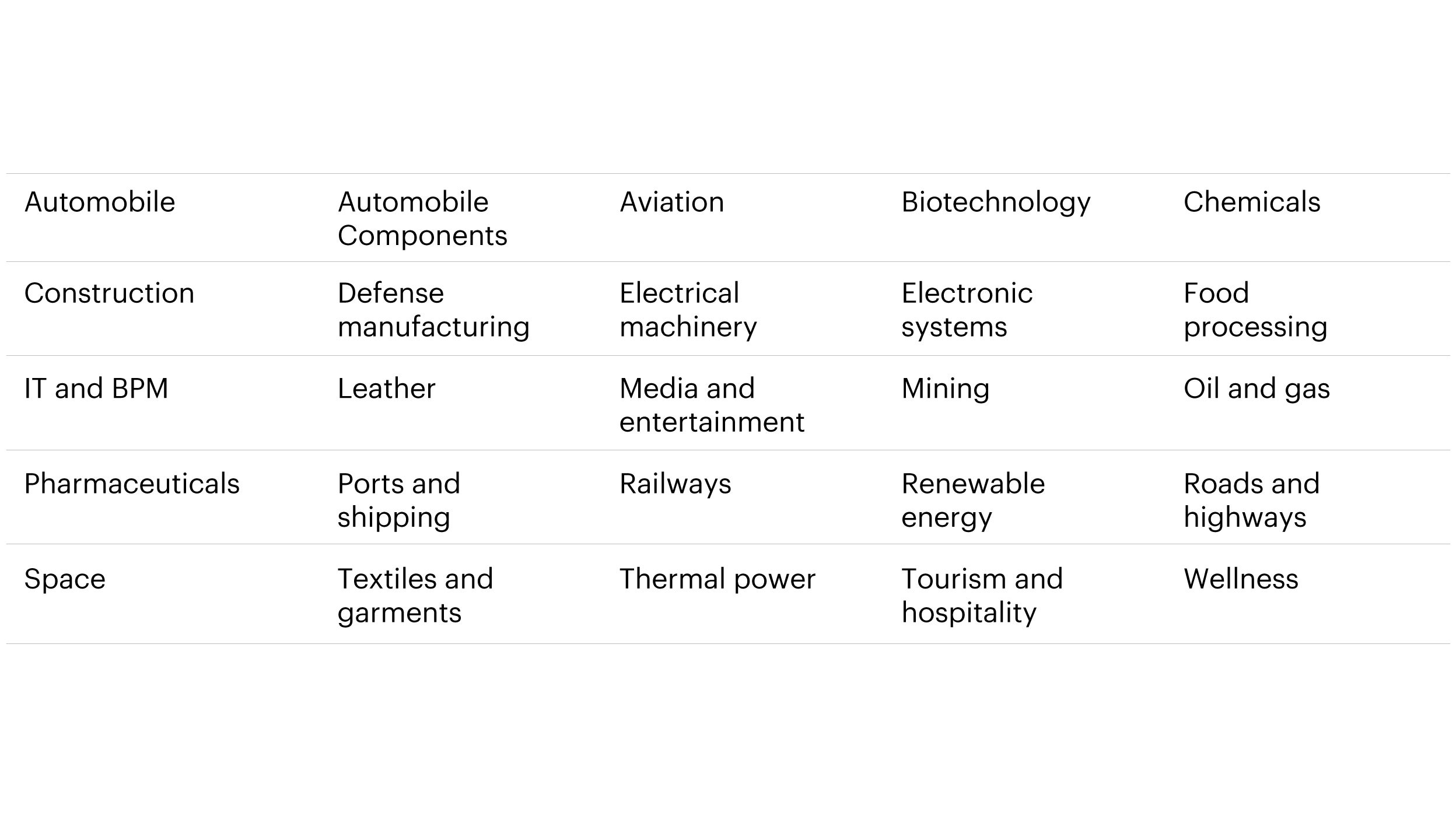

The initiative looks to promote ease of doing business in the country by modernizing existing infrastructure. It has four pillars, new processes, new infrastructure, new sectors and new mindset. The program has identified 25 focus sectors and has implemented government schemes for each sector in areas such as foreign direct investment, intellectual property rights, financial support, and sector-specific policies (Figure 9).

Source: Make in India. https://www.makeinindia.com/sectors

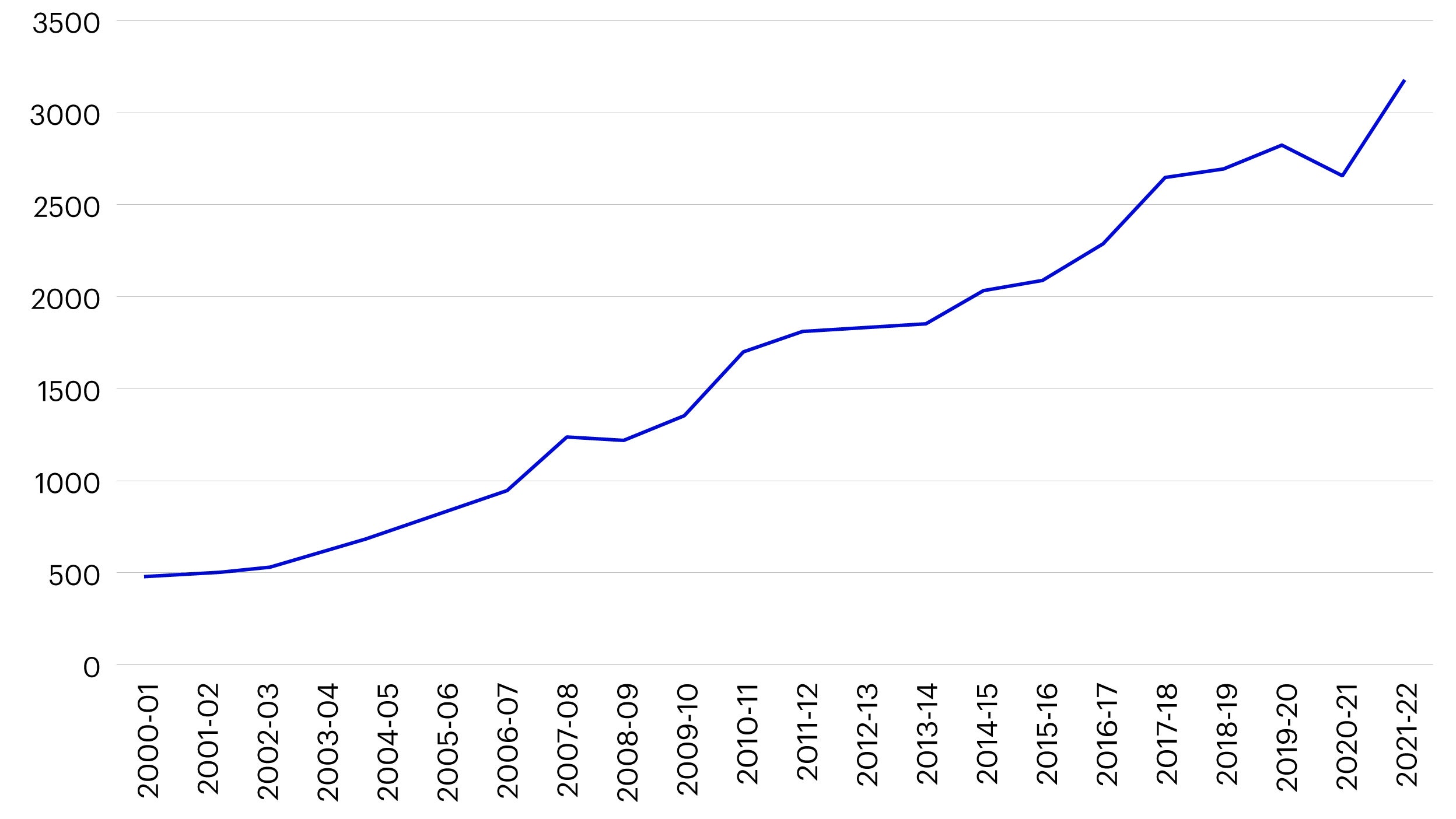

As a result of the advancement of this initiative, we’ve witnessed a boost in India’s manufacturing sector in the past decade. This has also led to a diversification of India’s exports. More than half of India’s total exports in FY23 were merchandise exports and service exports made up a smaller proportion, while 10 or 15 years ago the majority of exports were from the service sector.16

Source: CMIE, Ministry of Statistics & Program Implementation (India).

https://global.matthewsasia.com/insights/2023/make-it-india/

We believe the successful adoption of the Make in India initiative offers a strong case for the Indian economy to benefit from other government initiatives in the future.16

Interest: Global interest is rising as investors look for growth certainty from the uncertain global backdrop

In recent years, interest in India’s capital markets has been heating up and global investors are taking a closer look at Indian stocks and bonds. Foreign investor interest has been propelled by India’s strong growth story, as the country presents attractive opportunities for sustained growth, driven by robust investments in infrastructure, young demographics, and rising discretionary consumption. India has also been a beneficiary of corporates’ supply chain diversification amid the rise in geopolitical volatility.

Another key reason for global debt investors to shift their focus to India is because the country is a stable option for investors seeking emerging market exposure. The Russia-Ukraine war has meant that for most global investors, Russia is now outside of their investible universe. At the same time, weaker than expected growth momentum in China and the country’s property sector turmoil has also limited global investor appetite for China fixed income assets. Against this backdrop we believe Indian local government bonds are set to benefit particularly as there have been no US dollar bond issuances from the Indian government.

Conclusion

To conclude, India’s government-led initiatives and rising income have contributed significantly to its growth story and has spurred demand for Indian assets. JP Morgan’s inclusion of Indian government bonds further serves as a medium-term catalyst to drive global interest in this market. Over the long term, we hold a positive outlook on India and believe that this market can present attractive investment opportunities for global investors.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Footnotes

-

1

J.P. Morgan includes Indian government debt in global bond index, September 2023. https://asia.nikkei.com/Business/Markets/Bonds/J.P.-Morgan-includes-Indian-government-debt-in-global-bond-index

-

2

India gets green light to join JPMorgan bond index; rupee, bonds gain, September 2023. https://www.reuters.com/markets/rates-bonds/india-local-government-bonds-added-key-jpmorgan-index-trigger-billions-inflows-2023-09-22/

-

3

GBI-EM (Government Bond Index – Emerging Markets).

-

4

India’s inclusion in JPMorgan bond index could bring $23-bn inflows, says FM Sitharaman, October 2023.

https://www.businesstoday.in/latest/economy/story/indias-inclusion-in-jpmorgan-bond-index-could-bring-23-bn-inflows-says-fm-sitharaman-400862-2023-10-05 -

5

Ibid.

-

6

India’s Inclusion in Bond Index Positive at the Margin for Financing Flexibility, September 2023. https://www.fitchratings.com/research/sovereigns/indias-inclusion-in-bond-index-positive-at-margin-for-financing-flexibility-27-09-2023

-

7

Source: State Administration of Foreign Exchange, China. Foreign investors increased their holdings of domestic bonds in 2021 to reach US$166.6 billion, data as at January 2022; , https://www.gov.cn/xinwen/2022-01/21/content_5669786.htm; Foreign investors’ net increase in domestic bond holdings in 2020, size US$186.1 billion, data as at January 2021; https://www.gov.cn/xinwen/2021-01/22/content_5581956.htm; In 2019, foreign investors’ net increase in domestic bond and stock holdings was close to US$1,300 billion, data as at January 2020; https://www.gov.cn/xinwen/2020-01/17/content_5470322.htm; Foreign investors net increased their holdings of domestic bonds and stocks in 2019, nearly US$130 billion, data as at January 2020.

-

8

How inclusion of Indian bonds in global indices could unleash potential of India’s financial market, October 2023. https://theprint.in/macrosutra/how-inclusion-of-indian-bonds-in-global-indices-could-unleash-potential-of-indias-financial-market/1791341/

-

9

How India Gains From Inclusion In JPMorgan EM Bond Index—Morgan Stanley’s Take, September 2023. https://www.ndtvprofit.com/markets/how-india-gains-from-inclusion-in-jpmorgan-em-bond-indexmorgan-stanleys-take

-

10

India set to become 3rd largest economy by 2030, GDP to be around 7% in 2026-27: S&P Global Ratings, December 2023. https://www.businesstoday.in/latest/economy/story/india-set-to-become-3rd-largest-economy-by-2030-gdp-to-be-around-7-in-2026-27-sp-global-ratings-408245-2023-12-05

-

11

India to become USD 5 trillion economy, third-largest by 2027: RBI DG Patra, September 2023.

https://economictimes.indiatimes.com/news/economy/indicators/india-to-become-usd-5-trillion-economy-third-largest-by-2027-rbi-dg-patra/articleshow/103844727.cms?from=mdr -

12

India’s real GDP growth for 2023-24 estimated at 7.3%, January 2024. https://www.thehindu.com/business/Economy/economy-to-grow-by-73-in-current-fiscal-against-72-expansion-in-fy23/article67709699.ece

-

13

IMF Executive Board Concludes 2023 Article IV Consultation with India, December 2023.

https://www.imf.org/en/News/Articles/2023/12/18/pr23458-india-imf-exec-board-concludes-2023-art-iv-consult -

14

Ibid.

-

15

At 10.9%, Indian stock market delivered higher returns than US, China, others in last 10 years: Report, September 2023. https://www.livemint.com/market/stock-market-news/at-10-9-indian-stock-market-delivered-higher-returns-than-us-china-others-in-last-10-years-report-11693916022376.html

-

16

More jobs, boost to manufacturing, toys export: Union Minister Ashwini Vaishnaw explains Make in India success, December 2023. https://www.livemint.com/news/india/more-jobs-boost-to-manufacturing-toys-export-union-minister-ashwini-vaishnaw-explains-make-in-india-success-pm-modi-11701944473483.html