2025 Investment Outlook – European Senior Loans and CLOs

Summary

- The European leveraged loan market has returned a strong 7.98% year-to-date for 2024.1

- We foresee a constructive 2025. While growth is expected to be muted, given Invesco Private Credit’s leading market position, enabling access to company management, sponsors, and sell-side participants, we continue to be well placed to navigate credit-risk.

- We expect a total return of approximately 6.5-7% in 2025.2

2024 recap

The European leveraged loan market has returned 7.98% at the end of November,3 in line with our full calendar year 2024 expectations of around 8%.

Loan prices have appreciated about one-point year-to-date, to an average index price of 97.744 in tune with an improving macroeconomic landscape that solidified throughout the year. European data such as PMI and GDP metrics have reflected growth (albeit subdued, at below 1%), with the service-side sectors outperforming. Germany remained a relative underperformer, and continued to experience headwinds from the gas/energy shocks of prior years.

Importantly, disinflation trends improved throughout the year, moving towards the key 2% level, enabling the European Central Bank (ECB) to start cutting deposit rates in June. Three cuts have occurred year-to-date (75 basis points (bps) total), taking rates to 3.25%. Furthermore, in the US the “soft-landing” narrative gained momentum, resulting in a broad-based (global) risk-on tone that drove major equity indices higher and similarly supported credit markets.

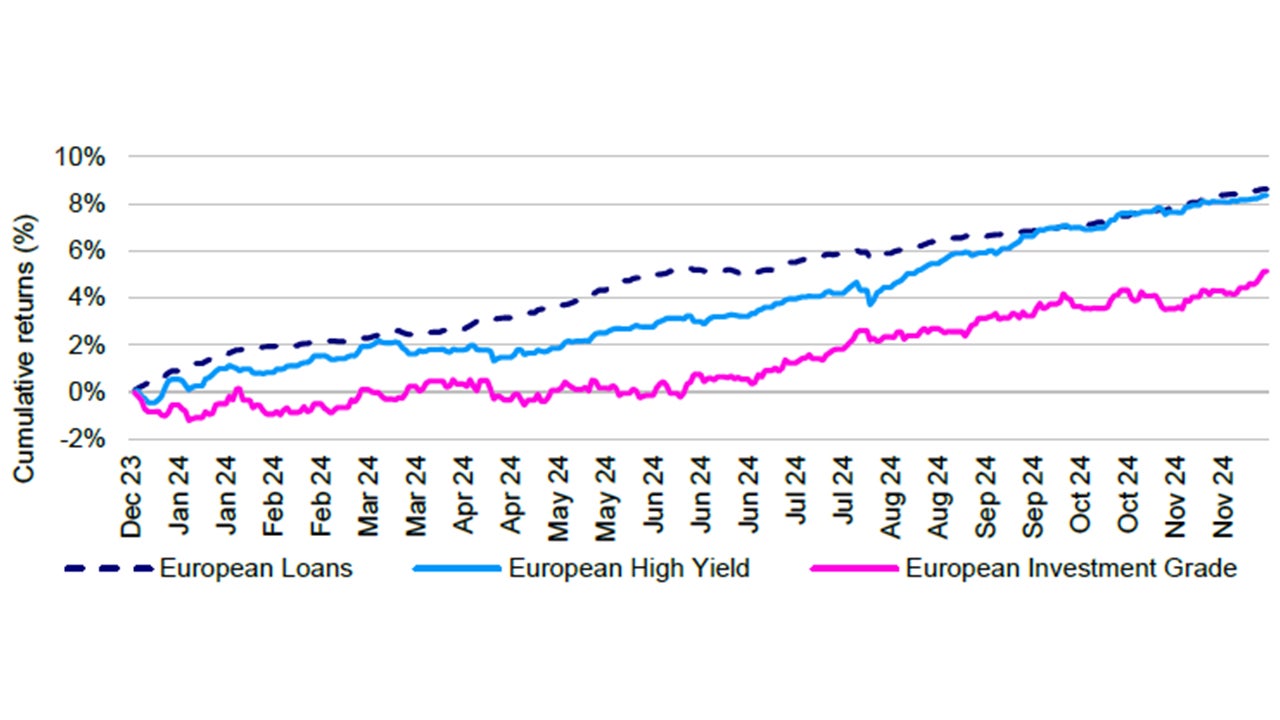

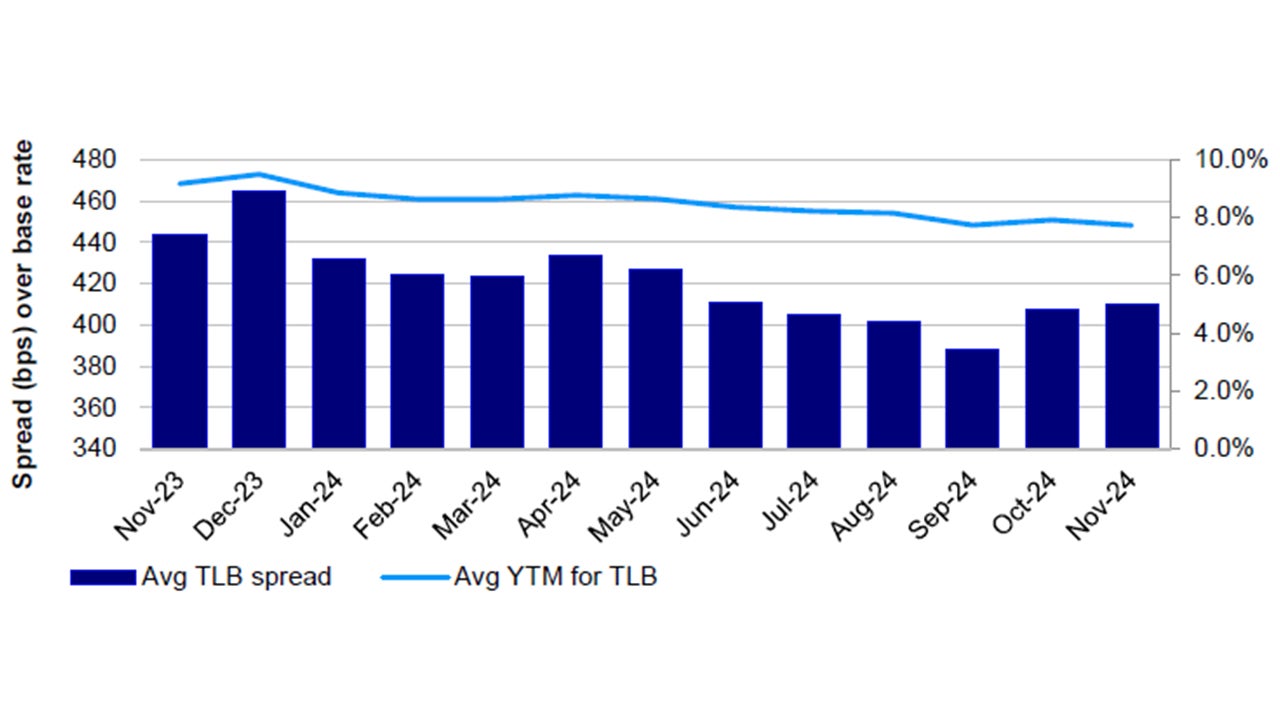

The Credit Suisse Western European Leveraged Loan Index posted positive total returns each month throughout 2024, as demonstrated in Figure 1 below.5 Index spreads have remained largely unchanged over the year at EURIBOR + 388bps; with all-in coupon levels compressing by approximately 76bps to 7.54%, in tune with ECB policy.6 Moreover, total YTD returns in the lower-rated CCC segment of the market of 20.10%7 highlights the improved credit environment. Idiosyncratic factors in March (Altice/SFR regarding refinancing options) were a key event and caused a brief pull-back in index prices that month.

Source: PitchBook Data, Inc.; Bank of America Merrill Lynch; Bloomberg as of November 30, 2024. The Morningstar European Leveraged Loan Index represents European Loans, the Bloomberg Euro Aggregate Corporate Total Return Index represents European Investment Grade, and the Bloomberg Pan-European High Yield Total Return Index represents European High Yield. All Euro-based indices are hedged to EUR. An investment cannot be made directly in an index. All Euro-based indices are hedged to EUR. An investment cannot be made in an index. Past performance is not a guarantee of future results.

Sanguine economic data, disinflationary trends and easing monetary policy helped to fuel a strong primary market.

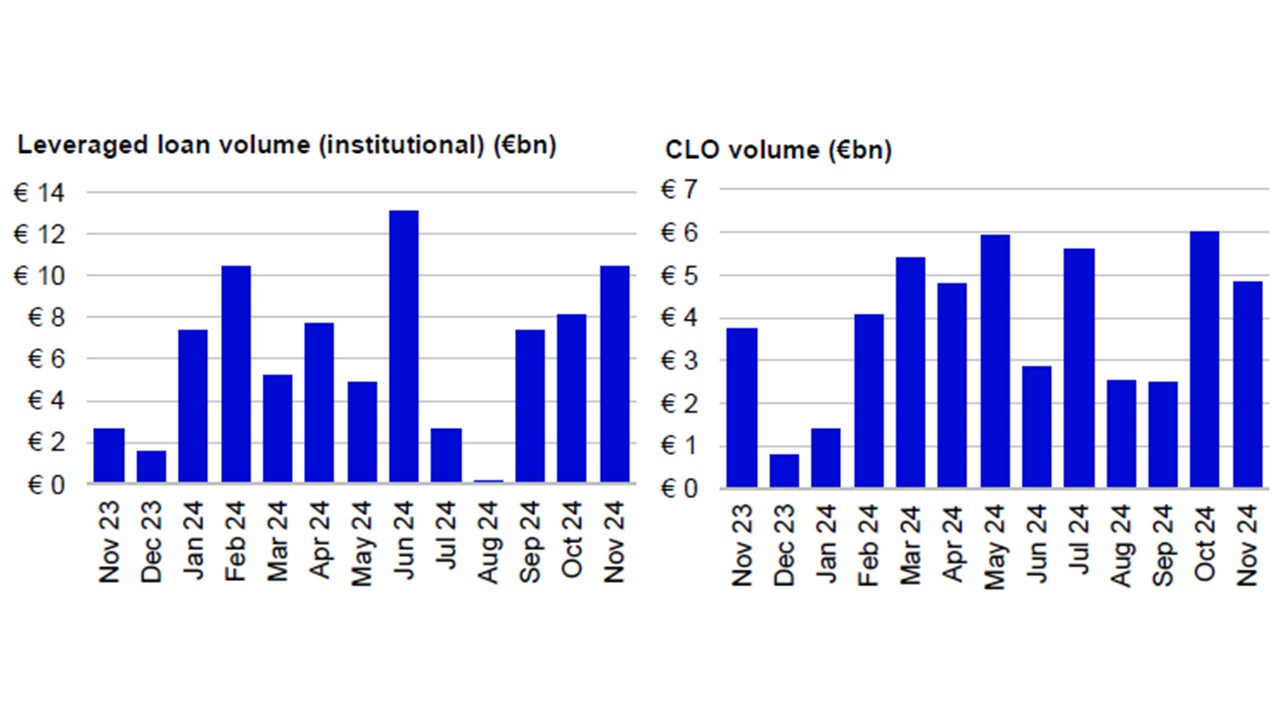

CLO origination/demand – by far the largest buyer-base of loans – showed substantial growth throughout the year, driven by AAA-liability spreads tightening by around 75bps to EURIBOR + 130bps.8 3Q24-YTD CLO issuance stands at €35 billion (bn) and full year issuance is likely to surpass the €39bn record seen in 2021.9

Accordingly, supply has followed - arrangers bringing to market significant gross-deal flow: 3Q24-YTD total institutional loan volume stands at approximately €160bn, the most on record. The majority, approximately 60% or €90 million were repricing and/or extension transactions, the former supported by CLO-arbitrage remaining feasible via lower weighted average cost of debt (WACD). Positively, the latter has helped mitigate the “maturity-wall” risk identified in our outlook last year; moreover, extensions all other things being equal typically price with at least a neutral or improved margin.

Source: Pitchbook Data Inc. as of November 30, 2024.

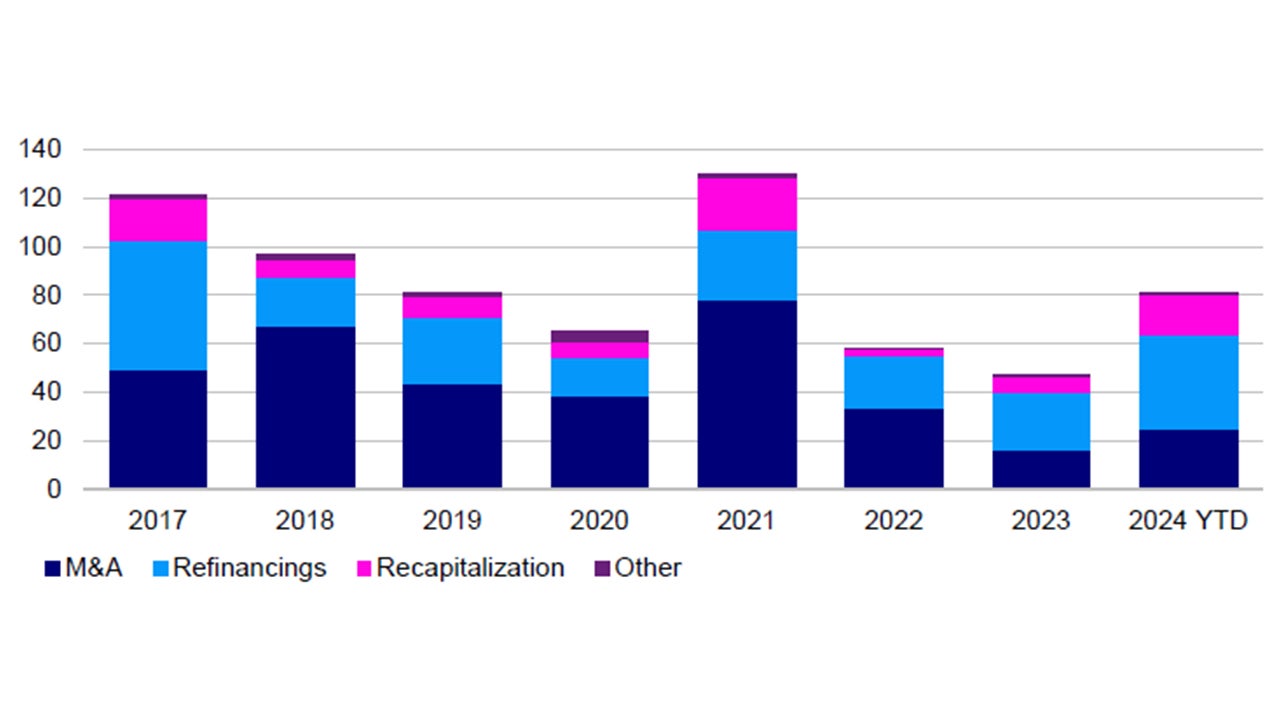

Collectively, the market technical has been resilient throughout the year, with demand exceeding supply and thus providing a strong bid for assets and creating repricing “waves” as loan prices were lifted above par. Merger and acquisition/leveraged buyout (M&A/LBO) transactions remained below trend (as we expected and noted in last year’s outlook).

Market total returns have been in line with our forecasts provided last year10 – a year that could be summarized by improving fundamentals and confidence. A rate cutting cycle has begun without the normally associated recession. We expect the loan market to continue to benefit from this positive dynamic next year.

Source: PitchBook Data, Inc. as of November 30, 2024. Term Loan B (TLB).

2025 outlook

From a macroeconomic perspective, we expect the Euro area (EA) to continue its low-but-positive growth trajectory. The US election has introduced additional uncertainty into growth forecasts, via the form and timing of tariffs, which are likely to lower (pre-election) GDP potential; nevertheless, consensus is for growth to remain positive.11 Germany having a large automotive sector, will remain a focus for the broader credit markets.

An increase in domestic demand was seen in the latter parts of 2024, fueled by a rise in disposable incomes and a less restrictive ECB. With disinflation on track and likely negative tariff implications, an accelerated front-loaded rate cutting cycle and thus increased monetary stimulus across the EA is expected. Therefore, we envision corporate fundamentals to remain constructive. Positive GDP and easing inflationary pressures bode well for EBITDA growth and to delever balance sheets. Monetary easing should reduce interest expense risk and improve interest coverage ratios/tests. We believe these factors should keep idiosyncratic risk in check and create a relatively benign environment for corporate distress.

A cautious, risk-on tone should continue to support CLO issuance, which we believe can exceed recent record levels. The cohort of established long-term experienced managers should continue to each bring several deals to market throughout the year, supported by robust CLO investor demand. Issuance could meaningfully grow if WACD tightens alongside increased supply of assets – and normalize the demand/supply dynamic discussed in the recap section.

In regards to loan supply, we are constructive. M&A activity has remained at multi-decade lows. However, there have been positive signs of a return of deal flow. Momentum has been encouraging as we enter 2025, with the pipeline of deals twice that of a year ago,12 driven by lower financing costs and increased C-suite confidence as near-term recessionary fears fade. Similarly, while LBO activity has been lacklustre of late,13 we believe an increase in transactions is likely for 2025 given the ever-growing pressure on private equity (PE) sponsors to exit investments and return capital to their Limited Partners (LPs). From a credit perspective, we have seen positive shifts in deal structures, with average equity contributions increasing throughout 2024 to their highest level in over a decade.14 We do not expect rapid acceleration in new money deal flow, but a normalization that will be well received by loan investors and should provide positive pressure on loan spreads. M&A/LBO supply of around €30-40 billion is expected.

Source: PitchBook Data, Inc. as of September 30, 2024 in Euro billions. Updated quarterly.

Loan refinancing is likely to moderate to around €10-15bn in 2025. The near-term maturity wall in the loan market has fallen significantly (by about 70%); total maturities across 2025 and 2026 are €16bn, while the equivalent at the end of 2023 was €58bn.15 We also expect a continuation of refinancing of uni-tranche deal (private credit) structures back into the leveraged loan market. Dividend recapitalization transactions supply should be of similar cadence to recent years at around €10-15 billion, as private equity sponsors look for opportunities to return capital to limited partners.

Repricings should likely continue in the first quarter of the year, with those loans trading above par (approximately 25% of the market at the time of writing) looking to optimize spreads before increased supply returns the market-technical in favor of investors (rather than borrowers).

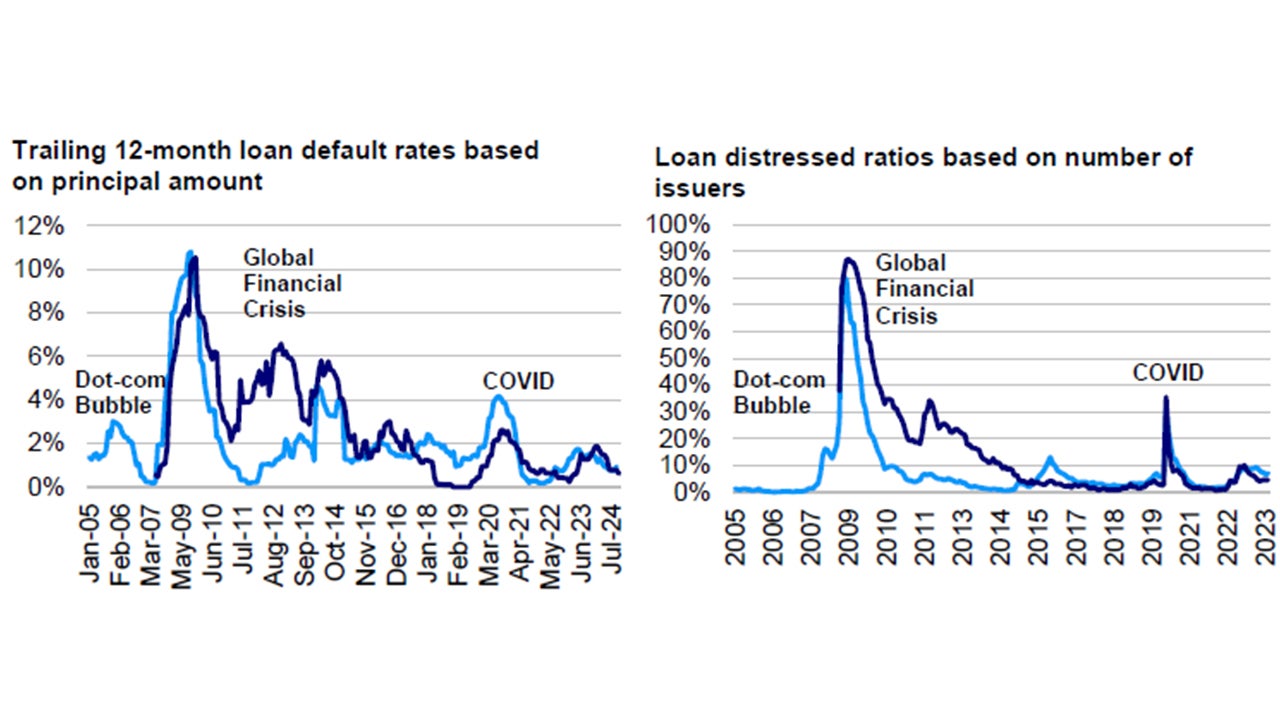

Default rates in European credit remain relatively benign. The Morningstar European Leveraged Loan Index (based on principal amount) trailing 12-month principal amount weighted default rate stands below 1%, down from its January peak of almost 2%.16 This metric has fallen or remained unchanged in each of the last ten months. Overall, we think the default outlook appears manageable and is likely to stay below non-recessionary averages. This is primarily because of the limited volume of maturities in the next two years. Distress ratios remain low – less than 3% for loans, or almost half than the high yield market – and the availability of alternative sources of capital (e.g., rescue financings).17 Furthermore, only 3% of the loan universe is rated CCC, with the proportion decreasing throughout 2024.18

Source: PitchBook Data, Inc. as of November 30, 2024. Morningstar European Leveraged Loan Index represents European loans; Morningstar LSTA US Leveraged Loan Index represents US loans.

The definition of defaults is becoming more subjective across leveraged finance markets, with “liability management exercises” (LME) becoming more prevalent in restructuring to maximize creditor value. “Distress exchanges” are often (but not always) included in metrics and can add (anecdotally) about 2% headline par-weighted default rates, therefore making comparisons to historical numbers difficult. We do not foresee any meaningful increases in loss-given-default in the medium term, as asset selection and active credit management to buffer potential risks associated with credit downgrades and defaults remains fundamental to loan investment.

The potential areas of capital appreciation of loan prices are concentrated to lower-rated credits. Single B rated credits account for about 60% of the index and have an average price of approximately €98.19 CCC rated loans trade in the low €80s, although as mentioned, account for a small proportion of the loan market (about 3%).20 Thus overall, the scope for average-loan prices to increase throughout the year is low.

We expect the supply dynamic to keep margins/spreads at approximately current levels, with a slight compression bias; however, if meaningful M&A/LBO activity occurs, spreads could widen, although this is not our base case. Overall coupons21 will thus reflect the expected path of monetary easing over the year. Loan volatility should remain low, as CLOs (the main buyers) remain largely buy-and-hold investors, and the asset class tends to attract long-term institutional investors because of the longer cash settlement period.

We acknowledge that if a greater-than-anticipated slowdown in economic growth occurs and/or geopolitical risks in Ukraine or the Middle East escalate, credit spreads are likely to widen. However, overall, we believe risks such as tariffs or energy shocks are more likely to impact specific corporate borrowers or sub-sectors rather than weighing down the broader market.

We anticipate another year of strong risk-adjusted returns and forecast the loan market to deliver total returns of approximately 6.5-7% in 2025.22

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Many senior loans are illiquid, meaning that the investors may not be able to sell them quickly at a fair price and/or that the redemptions may be delayed due to illiquidity of the senior loans. The market for illiquid securities is more volatile than the market for liquid securities. The market for senior loans could be disrupted in the event of an economic downturn or a substantial increase or decrease in interest rates. Senior loans, like most other debt obligations, are subject to the risk of default.

Footnotes

-

1

Credit Suisse Western European Leveraged Loan Index (EUR-hedged) as of November 30, 2024.

-

2

There is no guarantee that the forecast will be realized. Forecast is based on coupon plus wider nominal spreads minus base rate declines minus price erosion.

-

3

Credit Suisse Western European Leveraged Loan Index (EUR-hedged) as of November 30, 2024.

-

4

Credit Suisse Western European Leveraged Loan Index (EUR-hedged) as of November 30, 2024.

-

5

Credit Suisse Western European Leveraged Loan Index (EUR-hedged) as of November 30, 2024.

-

6

Euro-hedged.

-

7

Credit Suisse Western European Leveraged Loan Index (EUR-hedged) as of November 30, 2024.

-

8

Invesco as of November 30, 2024.

-

9

PitchBook Data, Inc. as of September 30, 2024.

-

10

"We anticipate another year of strong risk-adjusted returns for 2024 of approximately 8%."

-

11

Chinese tariffs are also an addition to US tariff headwinds.

-

12

Barcap M&A/Outlook, October 2024.

-

13

€16bn deals as at October 2024, approximately twice that of the same period in 2023, but €7bn less than 2022 (Source: Barcap M&A/Outlook, October 2024).

-

14

PitchBook Data, Inc. as of November 30, 2024.

-

15

PitchBook Data, Inc. as of November 30, 2024.

-

16

Morningstar European Leveraged Loan Index, average default rates covering June 1, 2007, through November 30, 2024. Excludes distressed exchanges.

-

17

Loans represented by Credit Suisse Western European Leveraged Loan Index (EUR-hedged); high yield represented by BoA European High Yield Index. Distressed defined as priced below €80. Data as of November 27, 2024.

-

18

Credit Suisse Western European Leveraged Loan Index (EUR-hedged) as of November 30, 2024.

-

19

Credit Suisse Western European Leveraged Loan Index (EUR-hedged) as of November 30, 2024.

-

20

Credit Suisse Western European Leveraged Loan Index (EUR-hedged) as of November 30, 2024.

-

21

Base-rates plus spread/margin.

-

22

There is no guarantee that the forecast will be realized. Forecast is based on coupon plus wider nominal spreads minus base rate declines minus price erosion.