ESG labelled bonds: Growth on track for 2022

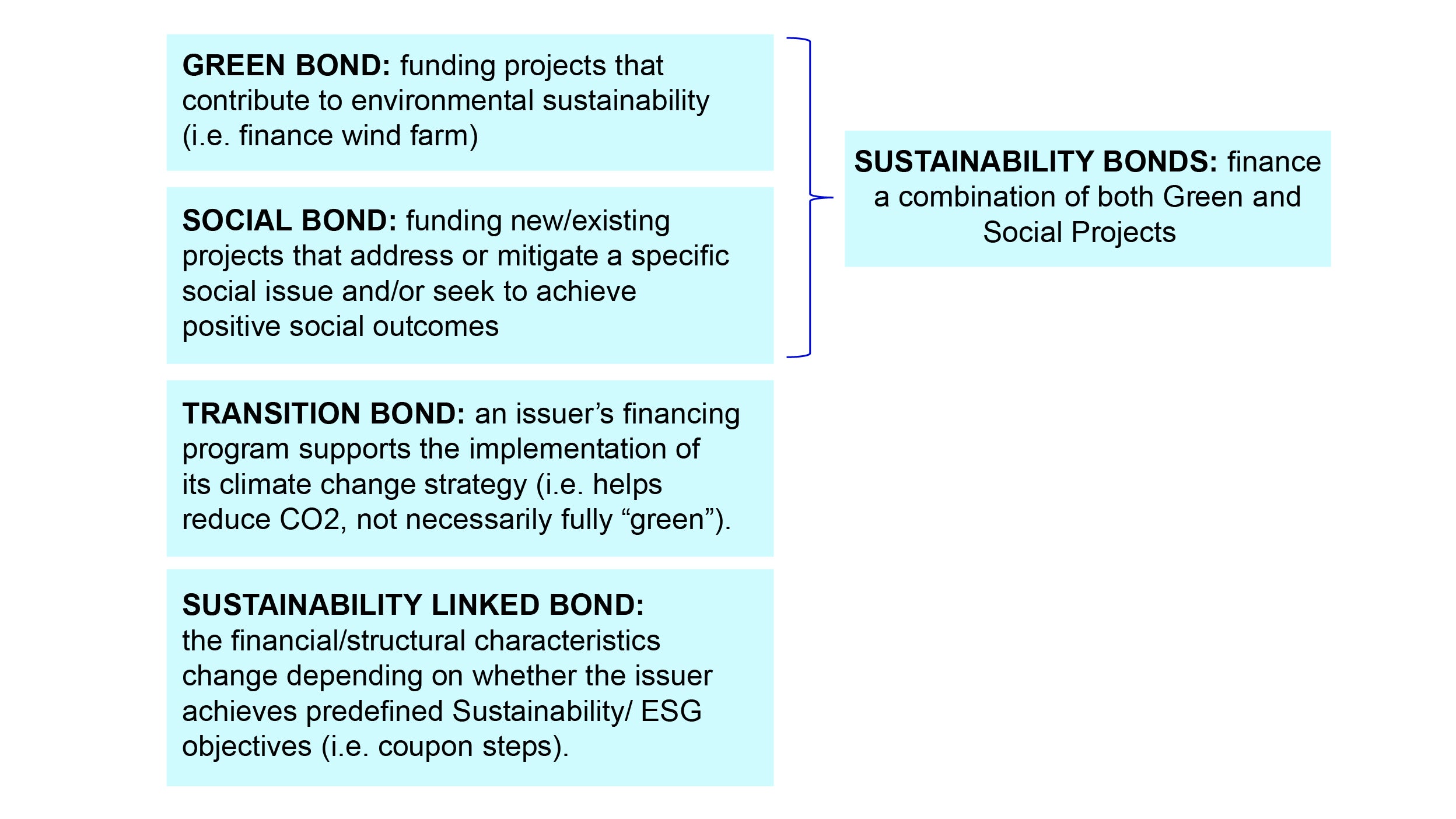

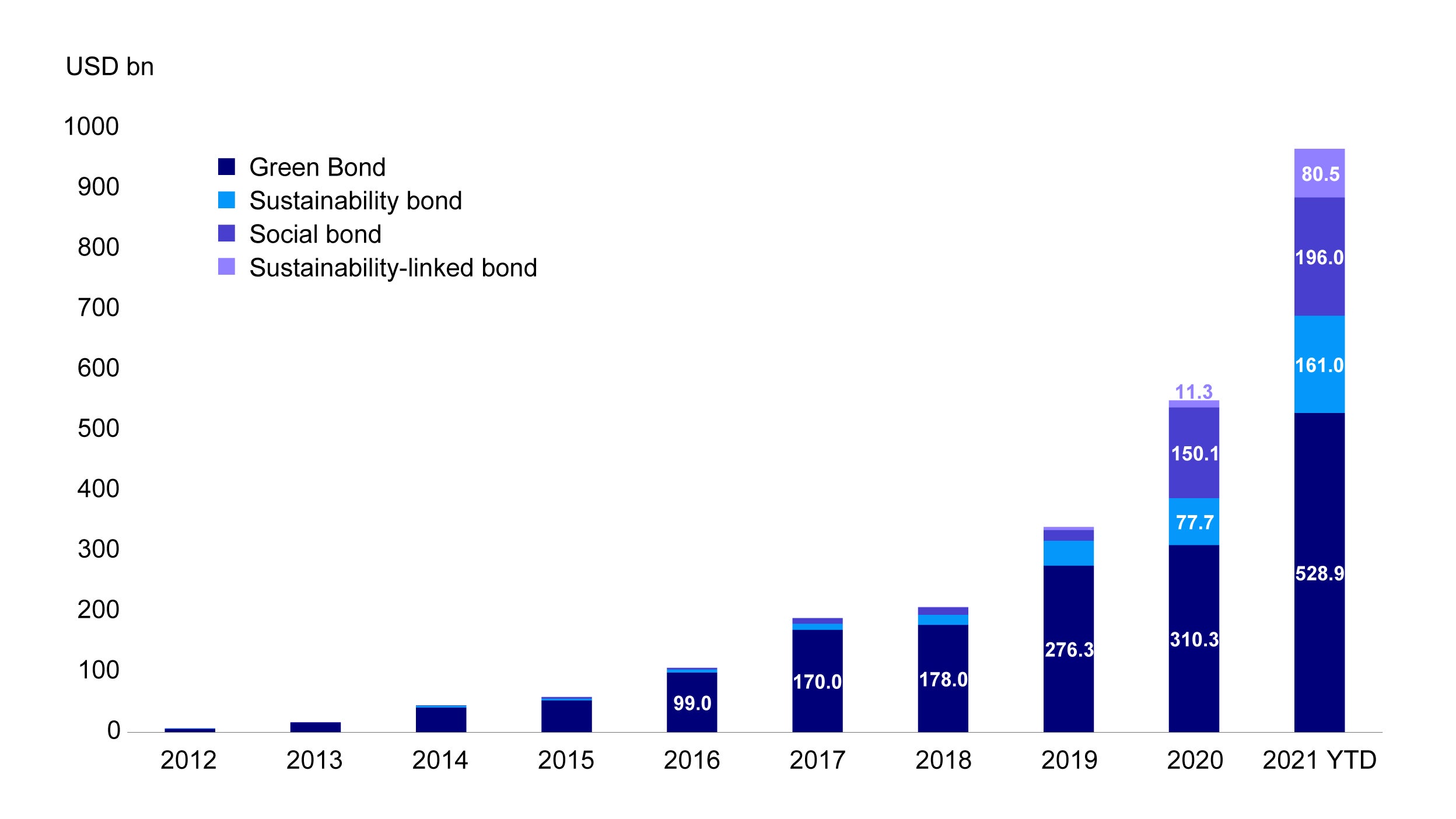

After posting strong growth in 2021, the issuance of ESG labelled bonds reached USD1 trillion in 2021 (Figure 2). Although Green bonds have historically been the dominant driver of growth, the emergence of sustainability-linked bonds has broadened the market and opened it up to a new set of issuers. We expect the ESG-labelled bond market to continue to grow in 2022, as ESG labelled bonds truly globalise. After growing 76% in the first 10 months of 2021, even a slowdown in growth to a projected 50% rate would bring 2022 issuance to USD1.5 trillion, which is plausible, in our view, and would likely cement this segment as a core holding in fixed income portfolios1

Source: ICMA, Invesco. For Illustrative purposes only.

The rise of sustainability-linked bonds

Although 2021 will be remembered for many reasons, from a fixed income perspective, the rise of the ESG-labelled sustainability bond is certainly notable. Figure 2 shows the sharp growth in labelled bond issuance this year from a standing start in 2018. Sustainability-linked bonds, in particular, have been a significant addition to the fixed income toolkit. The features of sustainability bonds (most often the coupons) change depending on the achievement of certain key performance indicators. We have previously commented on the practicalities of adding them to fixed income portfolios in “Sustainability-linked bonds: The new, new thing in ESG fixed income”, May 2021. The reality is that these bonds are becoming an important component of fixed income portfolios and are likely to become more important in 2022.

Source: BNEF. Data from December 31, 2012 to October 31, 2021.

Vigilance required to avoid “greenwashing”

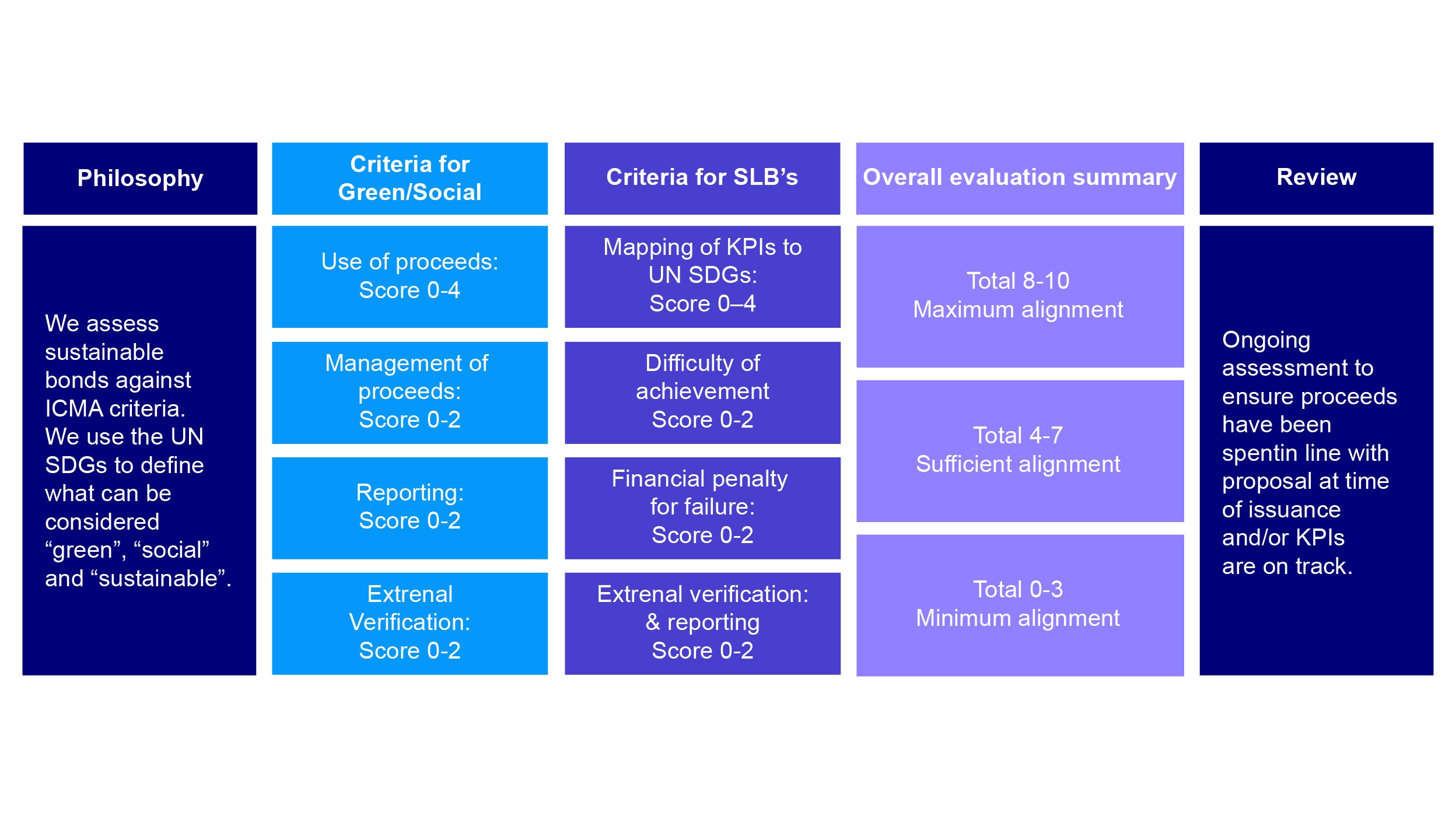

Ultimately, we think the increased availability of ESG labelled sustainability bonds is a positive development for fixed income investors. Improvements in the disclosure of issuers’ sustainability actions and ambitions is generally an advantage. However, we believe we need to be vigilant because the risk of “greenwashing” (bond issuers misrepresenting their ESG credentials) has never been greater. In reality, the majority of ESG labelled bonds we have seen is well-intentioned, but we have met the odd management team that is unsure of how it will allocate the proceeds (a red flag) and issuers looking to re-badge existing issuance as “green” (another red flag). In order to mitigate against the risk of “greenwashing”, we use the Invesco Fixed Income Sustainability and Sustainability-Linked Bond Framework to determine whether an ESG labelled sustainability bond is sufficiently aligned with the UN Sustainability Development Goals.

As we have previously discussed in, “Sustainability bonds: adding more than color to the investor palette”, March 2021, the high level of differentiation within the asset class means that we believe it is vital to assess an issuer’s sustainability bond program before investing. This allows us to validate the ESG credentials of these bonds before adding them to a portfolio. We have observed that relying on (paid) second party opinion providers is not practical, given the clear conflicts of interest that exist. We believe our internal assessment will be of increasing importance as the ESG labelled sustainability bond sector globalises in 2022.

Source: Invesco. The International Capital Market Association (ICMA) is a trade body that sets guidelines for participants in the international debt capital markets.

Avoiding the “free-rider” problem

From a broader market perspective, we believe sustainability-linked bonds have significant growth potential, as issuers are not constrained by the need to allocate proceeds to specific projects (sustainability-linked bonds are not “use of proceeds” instruments). This makes the bonds more flexible from the issuer’s perspective and open to a much broader group of issuers. However, there is a “free-rider” problem that is more obvious in sustainability-linked bonds than other labelled bond segments. All bondholders (not only sustainability-linked bondholders) benefit from the issuer’s commitment to achieving ESG targets. In our view, this should limit the “greenium” (the price differential between sustainability and non-sustainability bonds from the same issuer) that investors are prepared to pay for sustainability-linked bonds.

IFI is closely monitoring ESG risks across its portfolios and especially in the sustainability bond space. Having a well-resourced and experienced credit team is important for assessing the issues raised here and to inform our investment decisions. IFI seeks to ensure that credit spreads adequately reflect downside risks, including ESG factors, or, where this is not the case, that “at-risk” names are avoided.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Past performance is not a guide to future returns.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

1 Source: Bloomberg L.P. Data as of October 31, 2021.