Emerging market economic growth: Moving beyond the Belt and Road Initiative

Looking back: China and the Belt and Road Initiative has been a key driver of EM economic growth

Over the past decade China has cemented its vision to better connect to different parts of the world using its Belt and Road Initiative (BRI). Using this development strategy, China has been a key driver of overall emerging market (EM) growth through its extensive capital and trade flows, investments, and construction projects in these countries. Since the official endorsement of the BRI, China has achieved several tangible accomplishments by promoting the Silk Road Economic Belt and 21st century Maritime Silk Road.

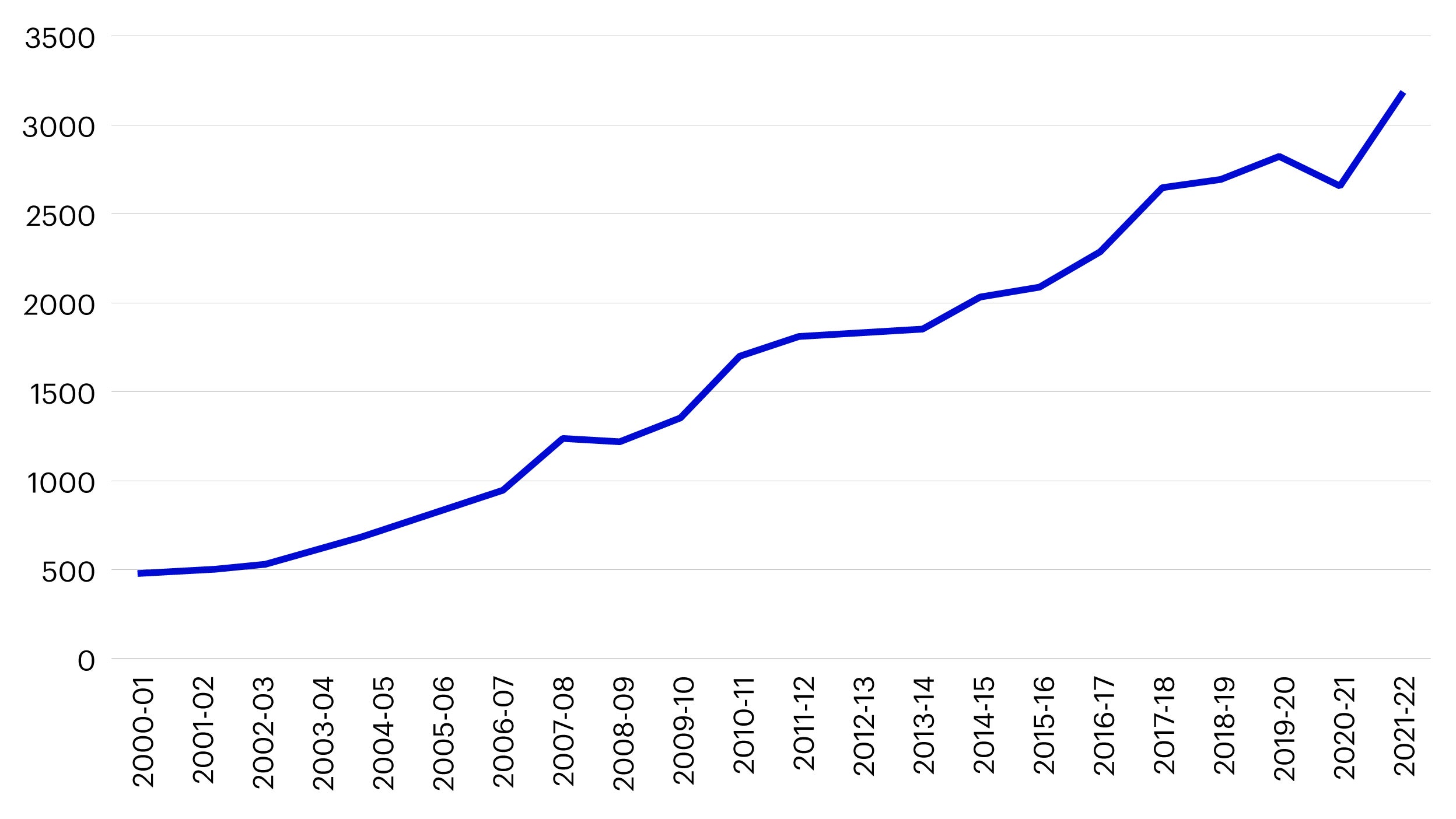

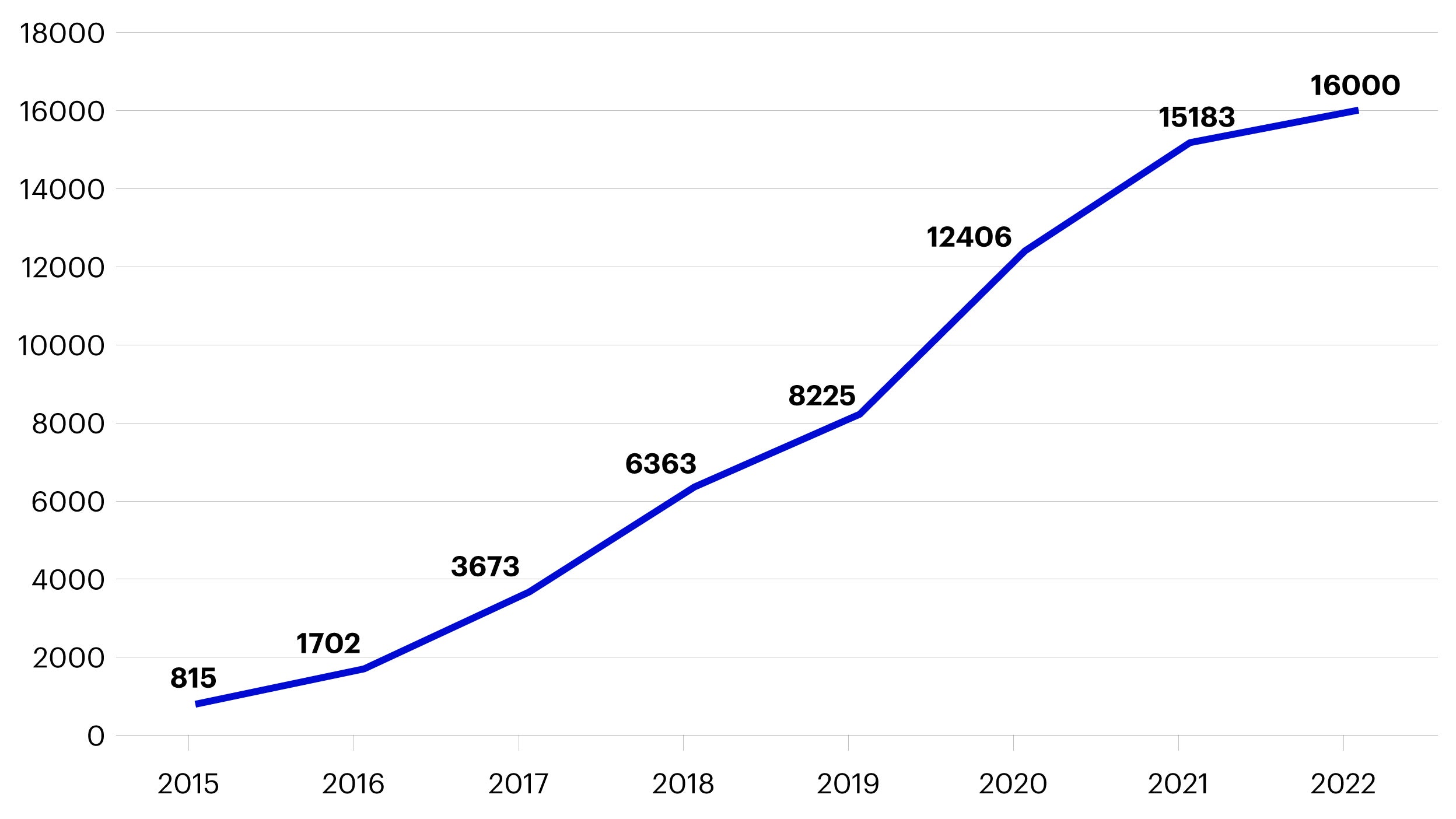

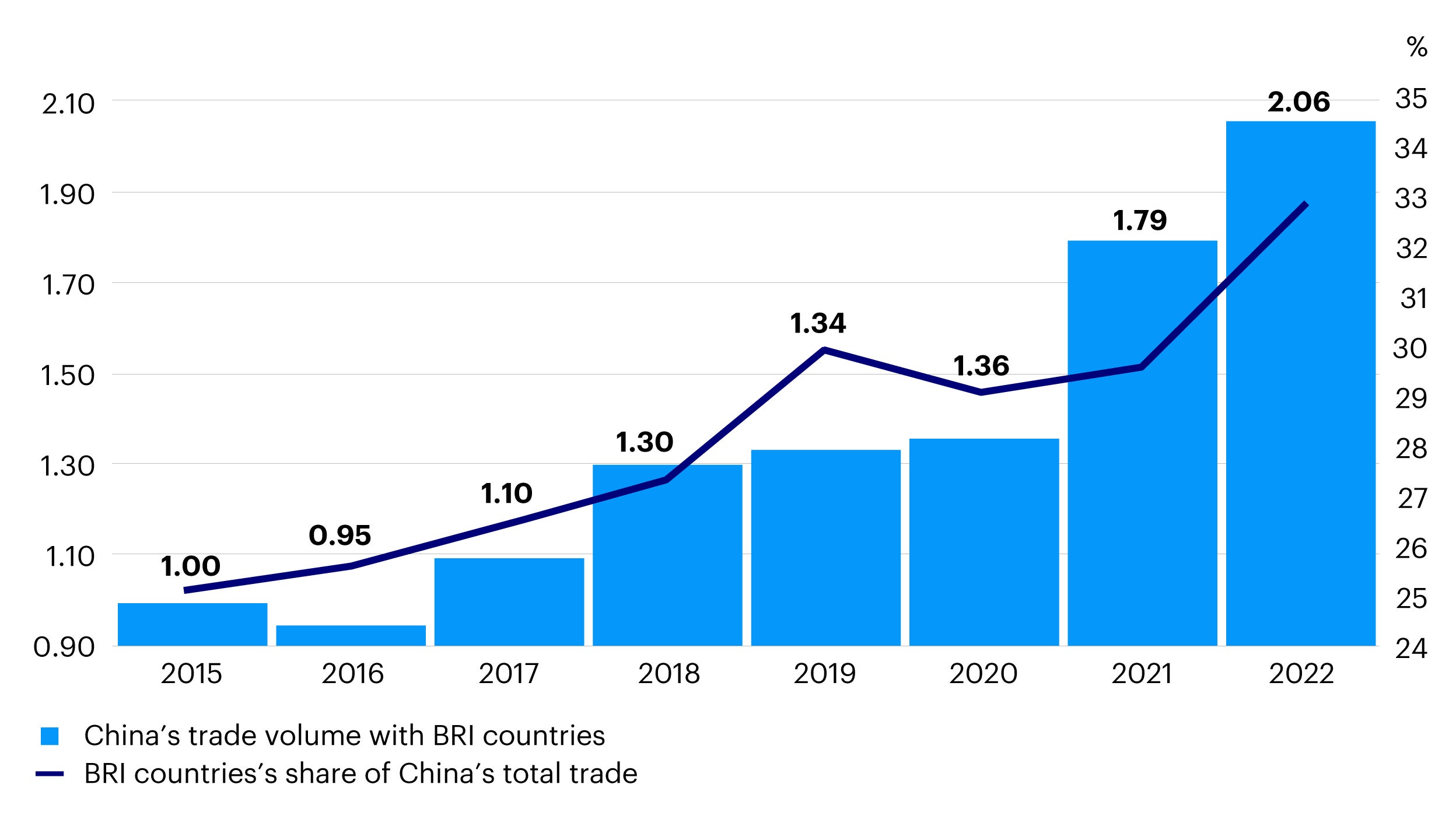

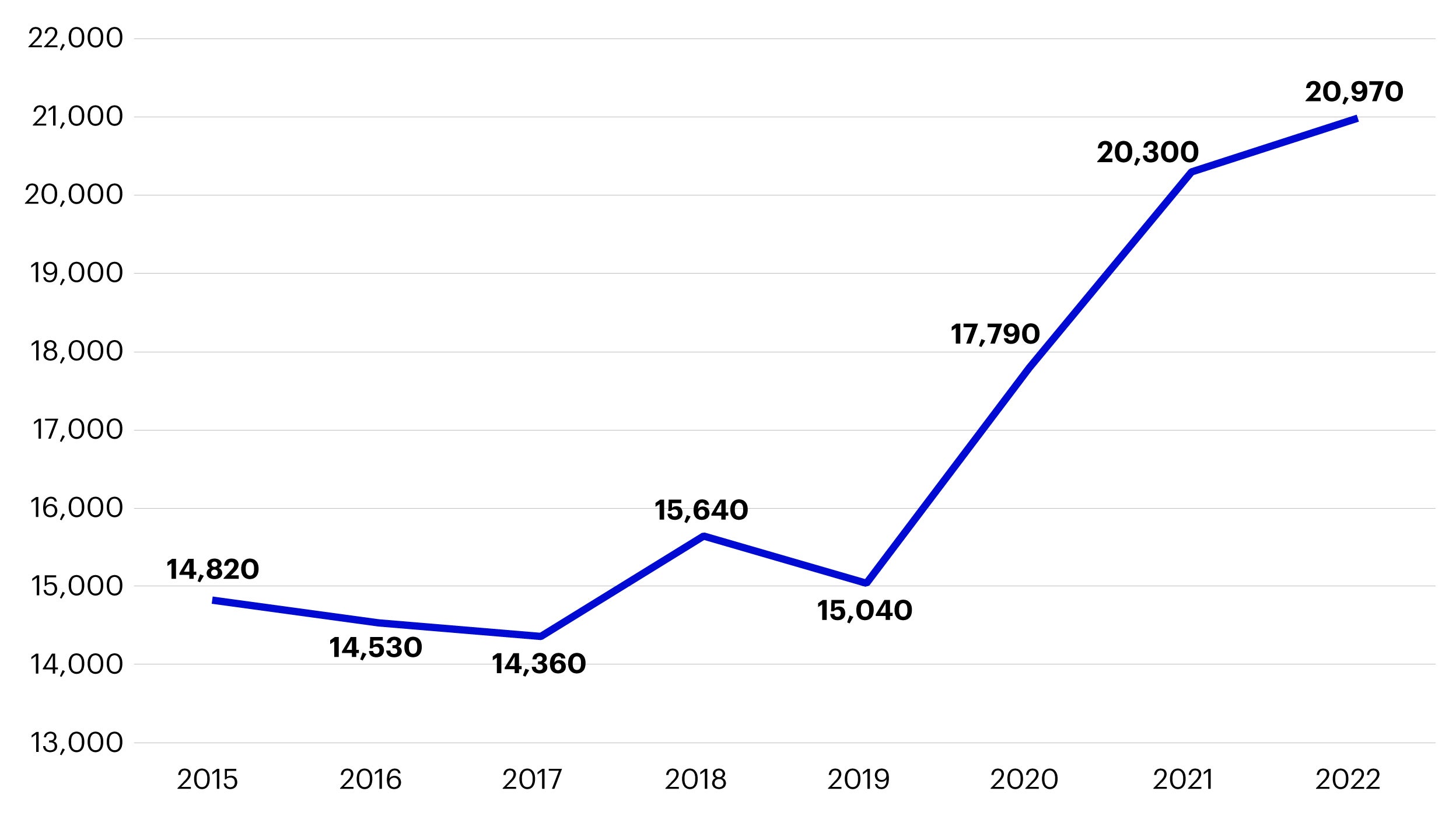

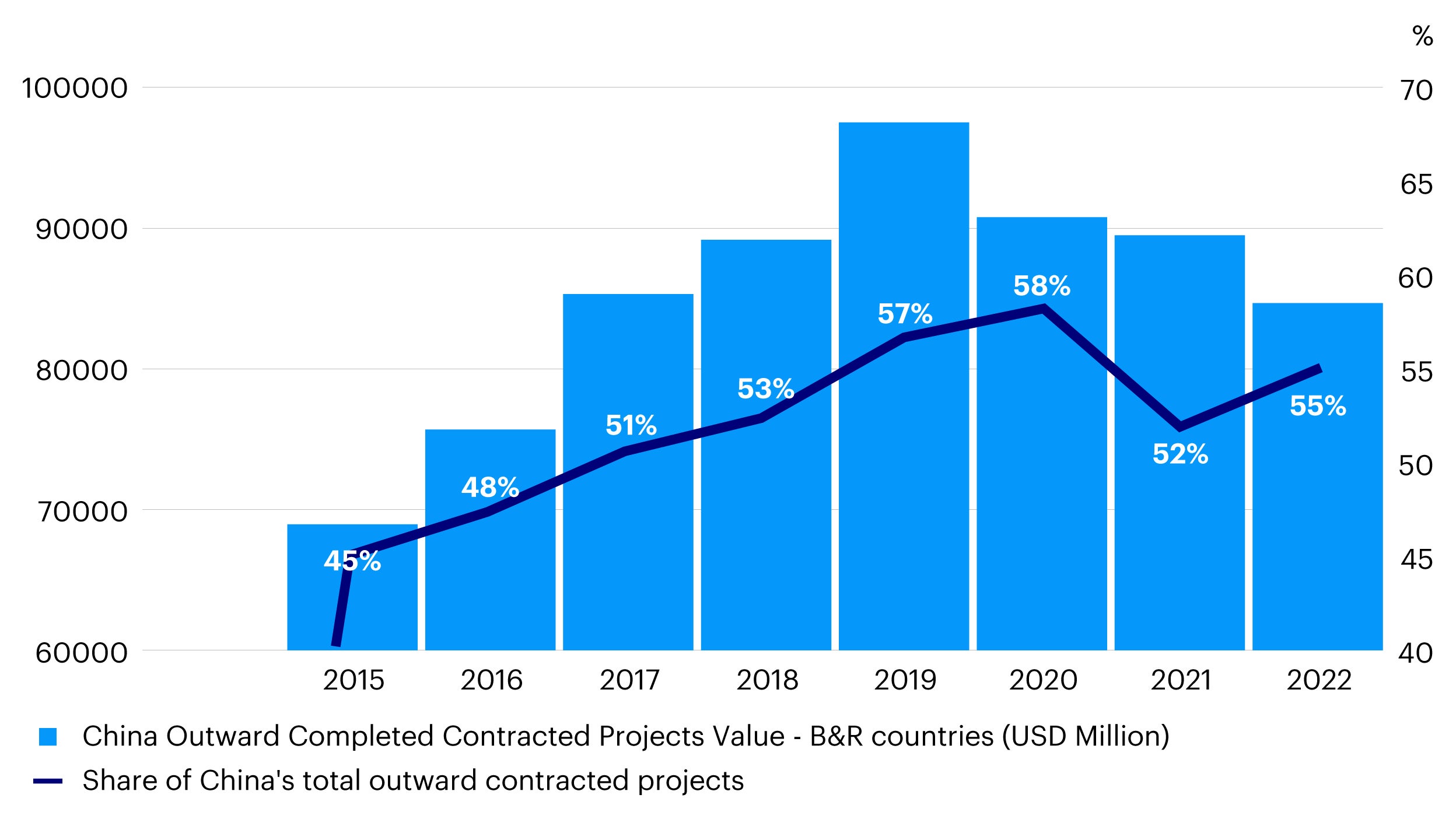

Massive infrastructure projects have improved land and sea connectivity along the Belt and Road. This is apparent from the exponential rise in China-Europe freight train traffic in recent years (Appendix, Figure 6).1 China’s BRI has meant the construction of numerous submarine cables, digital infrastructure projects, ports, railways, highways, and bridges, all contributing to the region’s connectivity. At the same time, trade volume, direct outward investment and the volume of contracted projects within the Belt and Road region have shown a consistent upward trend since 2015 (Appendix, Figure 7-9). In recent years, the BRI has evolved to cover new dimensions where significant progress has been observed, including the Digital Silk Road, Green Silk Road, Health Silk Road, and Polar Silk Road. By advancing the BRI, China has also developed strong economic relationships with Middle Eastern countries.

Belt and Road regions and countries have seen a rise in investment opportunities on the back of growth spurred by China’s BRI. Investors that strategically positioned themselves to take advantage of these developments would have benefitted in this phase.

Looking ahead: Multipolarity and the evolution of EM beyond the BRI

While the BRI has spurred growth in EM economies over the past decade, in recent years the global backdrop has changed. Factors such as Covid-triggered behavioral changes, geopolitical shifts, supply chain transformation, and the rise of new regional powers (e.g., Middle East, India, etc.) have driven the world toward a multipolar setup.

BRI investments have helped EM countries improved their traditional and digital infrastructure significantly. By leveraging on these accomplishments, EM countries have been able to focus on initiatives and partnerships that drive domestic growth. While the BRI remains strategically important in driving EM growth, we are now seeing other long-term investment themes emerge. We believe investors should pivot towards these new investment opportunities to capture attractive returns.

Three long-term investment themes driving EM growth: Global connectivity, regional partnerships and domestic focus

Under the new macroeconomic backdrop, we are seeing three key long-term themes arise with emerging investment opportunities: global connectivity; regional partnerships and domestic focus.

Source: Invesco, for illustrative purposes only.

Global connectivity

Emerging market countries are launching important initiatives to both promote and benefit from global connectivity. Like the BRI, one notable strategic initiative that fits under this investment theme is Saudi Arabia’s Saudi Vision 2030. This program was launched in 2016 with three main objectives - to build a vibrant society, a thriving economy, and an ambitious nation.

Saudi Vision 2030 is a broad initiative that covers many critical areas. The three main pillars are to make Saudi Arabia the “heart of the Arab and Islamic Worlds”, to become a global investment powerhouse, and to transform the country’s location into a hub connecting Afro-Eurasia.

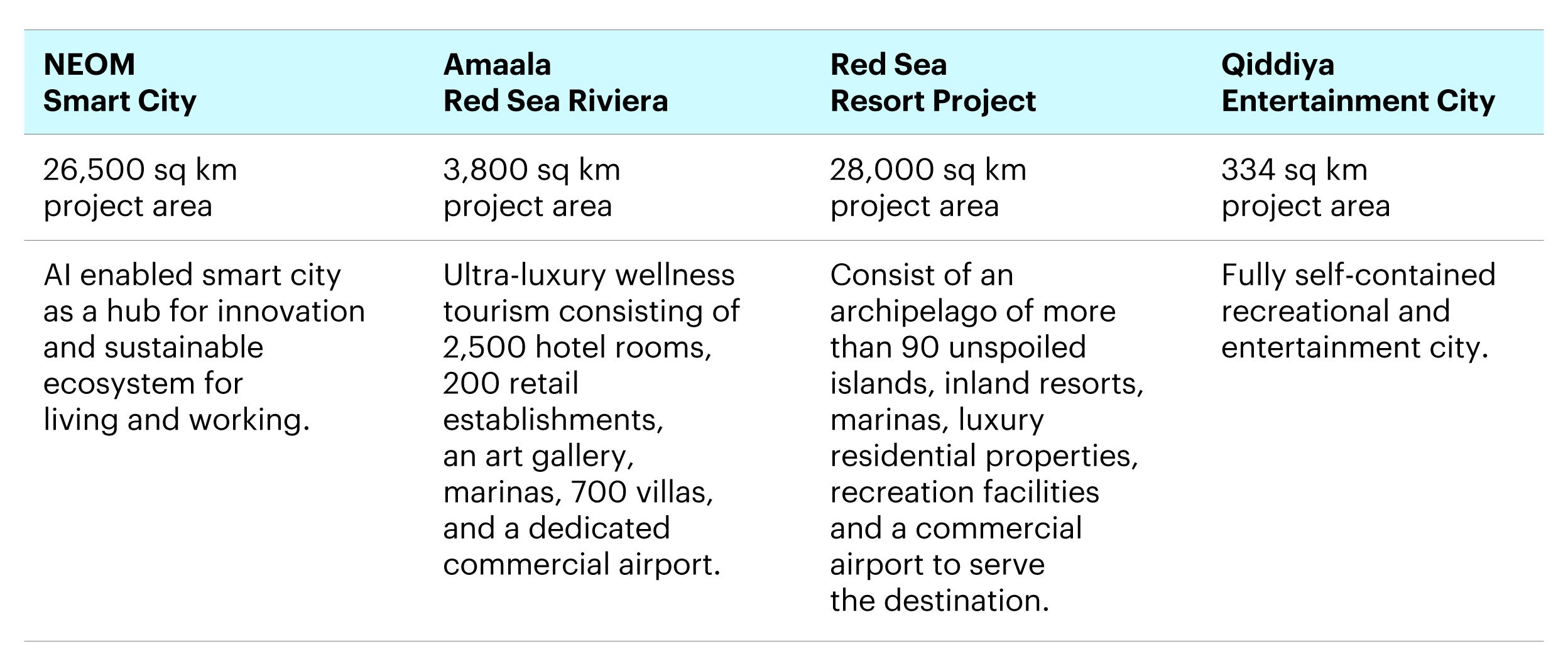

Several iconic giga-projects are being constructed as part of this program, funded by the government’s Public Investment Fund. These infrastructure projects are set to further boost the fast-growing tourism market in the country, drive demand in new sectors, and diversify the country’s economic reliance away from oil.

Source: The ‘Giga-Projects’ of Saudi Arabia, https://www.driver-group.com/en/europe/news/the-giga-projects-of-saudi-arabia, data as of October 2019.

Under the initiative, multiple new shipping lines serving the Middle East and North Africa, West Africa, the Eastern Mediterranean, Northern Europe, and the Indian subcontinent have also been launched to increase the connectivity of the Kingdom’s ports to global markets. The Arar Port between Saudi Arabia and Iraq has been reopened to increase the capacity for goods and passengers and to improve the local, regional, and international connectivity of trade and transport networks. It’s clear that achieving better global and regional connectivity and riding on that to bring benefits to the Kingdom is key for the initiative to succeed. We believe the recent admission of Saudi Arabia into the BRICS bloc (Brazil, Russia, India, China, and South Africa) will further support this ambitious program.

In our view, Saudi Vision 2030 will be a critical driver of Saudi Arabia’s economic growth as well as that of other Middle Eastern economies and their allies. We believe Middle Eastern sovereign and consumer issuers in the region will be direct beneficiaries of this initiative.

Regional partnerships

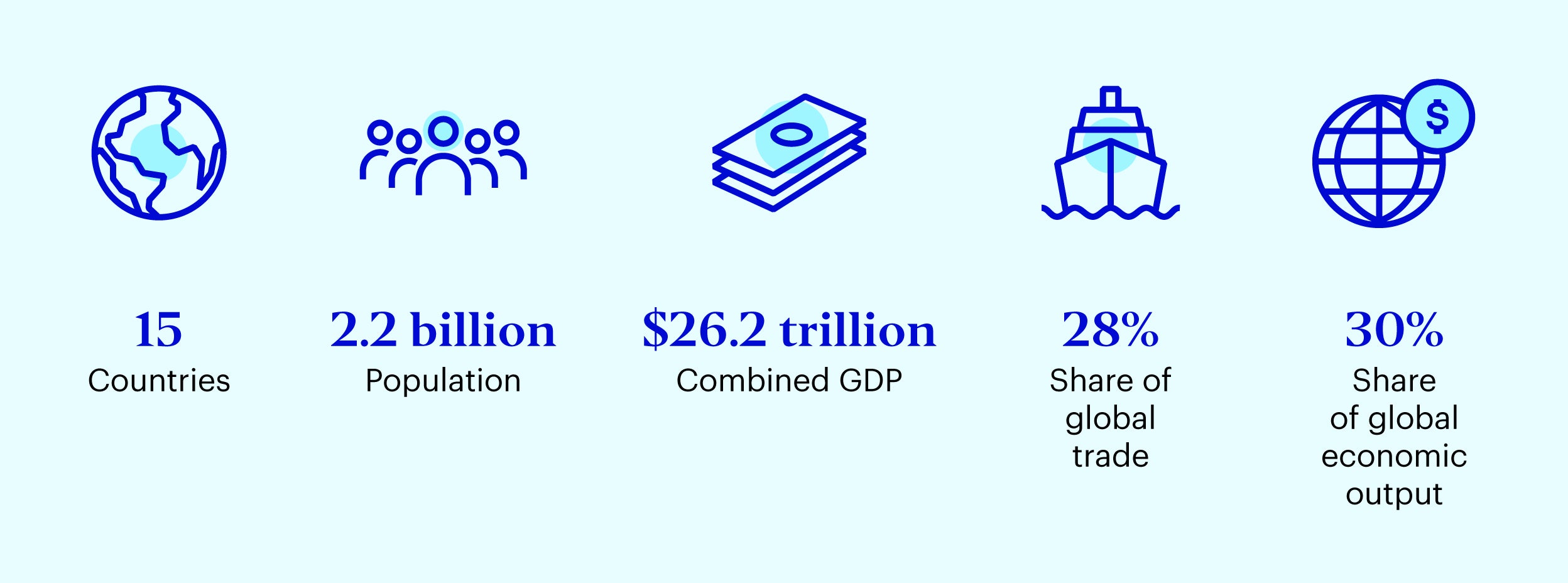

Developing regional partnerships is also instrumental for emerging markets to drive economic growth and development. The RCEP (Regional Comprehensive Economic Partnership) is a good example of this investment theme. The free trade agreement was signed by 15 Asia Pacific nations in 2020. It is the largest trade bloc in the world, given member countries account for around 30% of the world’s population and 30% of global GDP.2 The RCEP includes chapters covering trade in goods, services, investment, and economic and technical cooperation. It establishes lower tariffs on products that are sourced and traded in member markets and focuses on the reduction of non-tariff barriers.

Source: Bloomberg, The Guardian, Statista, data as of November 2020, https://www.statista.com/chart/23497/key-facts-about-the-regional-comprehensive-economic-partnership/

This trade deal is a powerful tool that has boosted business connectivity in the region. Better integration and stronger networks have fostered more business transactions between members. Bond issuers in the participating countries in various areas such as e-commerce or telecommunications stand to benefit. We believe that using these regional partnerships as a starting point to identify investment opportunities can lead to better long-term outcomes.

Another example of such a regional partnership at a wider scale is the BRICS bloc of developing nations. In late August, member states agreed to add Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates (UAE) as new member countries. We believe the latest BRICS expansion will further strengthen the ongoing collaboration of BRICS countries on the BRI and other projects and serve as a bridge for better future cooperation.

For example, we are now seeing more public and private sector collaboration between South Africa and the newly added countries. We expect these efforts to positively impact the sovereign credit fundamentals of the countries in question as well as their corporates operating in South Africa.

Domestic focus

This investment theme identifies important strategic initiatives by EM countries that are targeted primarily at boosting domestic economic growth. One example is the Make in India initiative which was launched in September 2014 as part of a wider set of nation-building priorities. The program was launched to transform India into a global design and manufacturing hub; however it also covers other sectors aiming to boost overall entrepreneurship and employment opportunities in the country. India’s government is highly motivated to advance this initiative given India’s growth story has largely been led by the services sector in the past. In the nineties, India was often referred as the “back office of the world” given its huge leap in IT and its business process outsourcing (BPO) sector. However, the manufacturing sector in India was seen as relatively less advanced, partially due to lack of infrastructure, while at the same time still important for job creation.

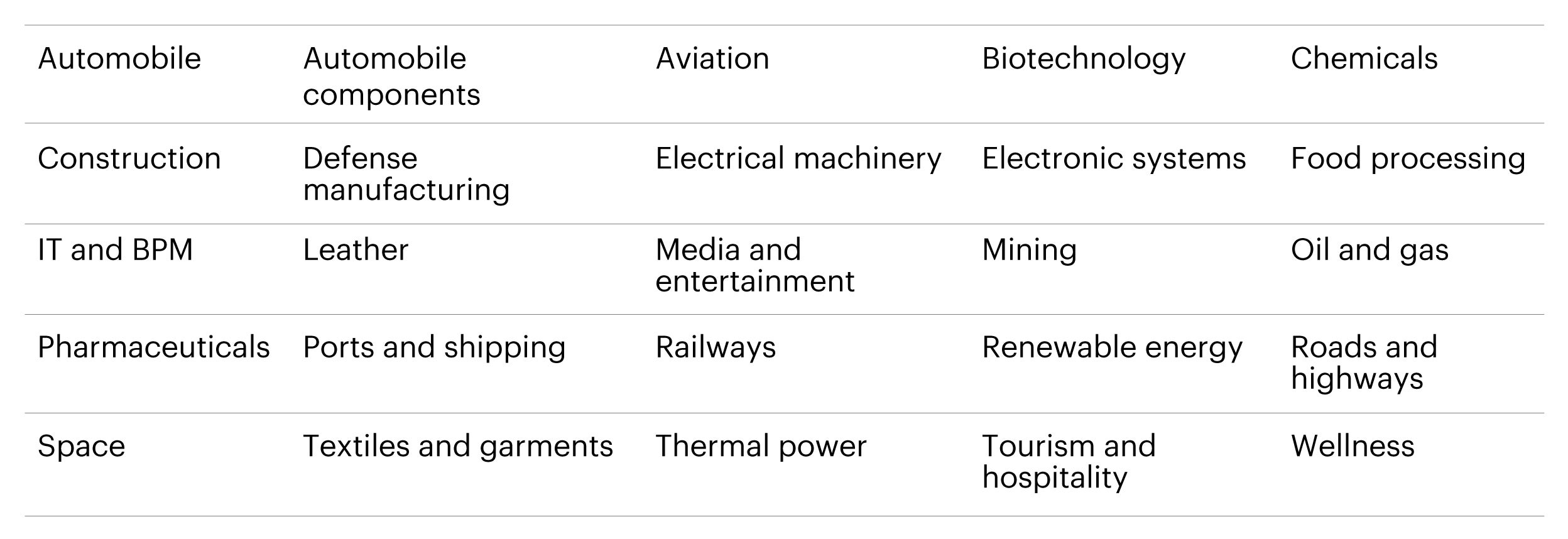

The initiative places emphasis on promoting the ease of doing business in the country and aims to do this by modernizing existing infrastructure. It has four pillars: new processes, new infrastructure, new sectors, new mindset. The program has identified 25 focus sectors and has implemented government schemes for each sector in areas such as foreign direct investment, intellectual property rights, financial support, and sector-specific policies.

Source: Make in India, https://www.makeinindia.com/sectors

Source – CMIE, Ministry of Statistics & Program Implementation (India), https://global.matthewsasia.com/insights/india/2023/make-it-india/

China and India have cooperated significantly in the infrastructure upgrading process. Historically, India’s renewable sector relied heavily on China with nearly 90% of solar energy equipment being imported from China.3 However under the new program, India has been focusing on building domestic capacity. In the first half of 2023, India’s solar module imports from China reduced nearly 80% by US $2 billion.4

In our view, investors could take advantage of the opportunities emerging from sectors under the Make in India program. Given the strong government support, we are positive on the growth outlook of these sectors and believe investments in these sectors can result in attractive long-term returns. For example, there are several supportive policies being enacted for India’s renewable energy sector such as 100% FDI permission without the need for government approval, numerous renewable energy schemes and programs, and a significant financial budget allocation to this sector. Major bond issuers from India’s renewable sector are set to benefit from this policy support and the overall sector growth potential.

Other EM countries have implemented similar domestic initiatives. We believe that by using domestic policy direction as a guide for potential investment opportunities, investors can generate better returns in the long-term.

Conclusion

While the BRI remains a key factor impacting EM growth, the global backdrop has evolved dramatically giving rise to new themes that are driving long-term investment opportunities in this space. We believe that by taking advantage of the three long-term investment trends propelling EM growth (global connectivity, regional partnerships, and domestic focus) investors can better generate positive long-term investment outcomes.

Appendix

Source: Belt and Road Portal, Xinhua Net, The Ministry of Commerce of the People’s Republic of China, data as of 31 December 2022.

Source: Belt and Road Portal, The Ministry of Commerce of the People’s Republic of China, data as of 31 December 2022.

Source: Belt and Road Portal, The Ministry of Commerce of the People’s Republic of China, data as of 31 December 2022.

Source: Belt and Road Portal, The Ministry of Commerce of the People’s Republic of China, data as of 31 December 2022.

Footnotes

-

1

Source: Belt and Road Portal, Xinhua Net, The Ministry of Commerce of the People’s Republic of China, data as of 31 December 2022.

-

2

The Regional Comprehensive Economic Partnership: a new mega trade bloc for Asia, July 2022, https://www.swissre.com/institute/research/topics-and-risk-dialogues/economy-and-insurance-outlook/mega-trade-bloc-asia-rcep.html#:~:text=Signed%20in%20November%202020%20among,both%20global%20GDP%20and%20population.

-

3

Has the sun finally started shining on India's solar industry?, September 2023, https://economictimes.indiatimes.com/industry/renewables/has-the-sun-finally-started-shining-on-indias-solar-industry/articleshow/103686223.cms

-

4

Ibid.