EM local debt offers rich opportunity set in Q4

Overview

We expect the Fed to continue cutting rates this year, which should be a catalyst for EM central banks to ease to help boost domestic growth.

Recent trips to Egypt, Turkey and Ecuador uncovered interesting EM local debt opportunities.

In Egypt, we came away with a positive view and see opportunities in short-term Treasury bills. In Turkey, we are constructive on the macro policy outlook, as well as the lira and local bonds. In Ecuador, which is dollarized, the macro outlook is improving, and we see value in the sovereign bonds.

Market commentary

Emerging market (EM) central banks lowered interest rates in September in anticipation of the US Federal Reserve’s (Fed) expected rate cut. Indonesia’s central bank cut rates by 25 basis points to 6% ahead of the Fed, while Mexico’s central bank cut rates by 25 basis points to 10.5%, widening the interest rate differential to the US. After pausing for a month, Chile cut its policy rate 25 basis points and provided dovish forward guidance, revealing a preference to reach a neutral stance faster than previously communicated. Colombia cut rates

by 50 basis points in a 4-3 board split, indicating a likely acceleration at the next meeting. South Africa started its easing cycle with a 25 basis point cut, and Hungary and the Czech Republic continued rate cuts, with 25 basis point cuts each. We expect this global rate cutting cycle to broaden, particularly in EM Asia, as external factors ease, and inflation recedes further. One outlier that stood out was Brazil. Brazil started what is expected to be a small hiking cycle in order to re-anchor inflation and inflation expectations in an economy that is running hot with no fiscal anchor. Brazil’s central bank raised rates by 25 basis points, and we expect another two or three hikes, for a total of 100 basis points of hikes over the next four months.

We expect the Fed to continue cutting rates this year, which should be a catalyst for other central banks to ease to help boost domestic growth. Overall, the local debt asset class remains in great shape, in our view based on the following drivers: a more favorable external environment (Fed cuts, China stimulus, lower oil prices), robust carry, healthy growth and attractive interest rate differentials versus developed markets. Differentiated local stories make for a rich EM opportunity set for the rest of the year, in our view.

Notes from the ground

The Global Debt Team travels globally, researching countries and securities and meeting with leading companies, local government officials and other market participants to identify attractive market opportunities. Each analyst and portfolio manager makes several trips per year, visiting each country under coverage at least once a year. In September, the team traveled to Egypt, Turkey, and Ecuador to gain insights into current economic conditions and potential investment opportunities.

Egypt: Macro story on track but reform remains to be seen

In Cairo, the team met with representatives from the Egyptian Central Bank (CBE), the International Monetary Fund (IMF) and Egyptian government officials. Overall, the team remains optimistic on Egypt’s story, despite regional geopolitical risks.

Macro picture improving

Macroeconomic conditions have started to improve since the IMF approved the extension of Egypt’s funding program in March. Foreign exchange shortages have been eliminated and the IMF is happy with the current floating exchange rate policy. Continued shipping disruptions in the Suez Canal remain an issue for the Egyptian economy but the pickup in Egyptian remittances has been offsetting the drop in revenue.

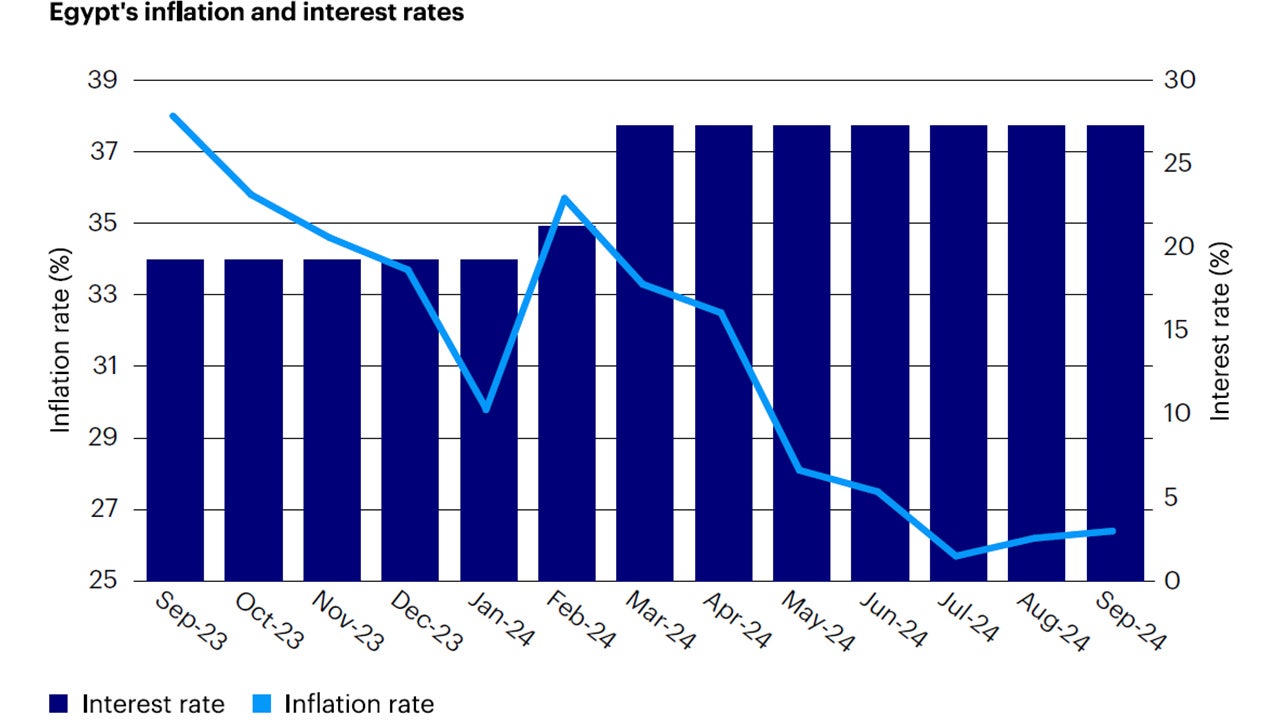

Inflation concerns

Inflation rose for the second straight month in September, to 26.4% up from 26.2% in August.1 This rise came just two months after inflation neared a two-year low in July. The flair-up in inflation was due to a combination of fuel hikes in July, transportation price increases in August and a spike in electricity tariffs in August and September. Although inflation has recently increased, it has been gradually declining since its record high of 38% in September 2023.1 Egypt’s central bank expects inflation to fall significantly in the first quarter of next year.

Fiscal and monetary policies have been disciplined

Egypt’s fiscal performance has remained on track. Its EGP1 trillion limit on public investment to help reduce inflation and create more opportunities for the private sector remains intact. There is consensus that the spending cap is reasonable and can be adhered to. Public and private banks have reported slower spending on current state-sponsored projects and no new project spending. The removal of energy subsidies and a decline in global oil prices have had a positive impact on Egypt’s fiscal accounts as well. The value added tax (VAT) exemption reform, set to be presented in Congress in November, will be key to watch on the revenue side, as it should encourage additional investment.

The CBE has remained cautious in easing monetary policy. It believes policy is sufficiently restrictive but saw the first-round effects of the government’s subsidy removals in August. Inflation surprised to the upside, causing the bank to watch for potential second-round effects. Some observers believe the CBE will have room to cut in the fourth quarter of this year, while others argue that it would be prudent to keep rates higher for longer to ensure that inflation is on track toward the target. Local investors remain pessimistic about the long end of the local yield curve and indicated a preference to hold cash with the central bank or in 3-month Treasury-bills.

Source: Bloomberg L.P. Data as of Oct. 10, 2024.

Risks we are monitoring

Although the monetary and fiscal improvements have been on track, the uncertainty around the scope of the reform agenda and regional conflicts in Gaza, Israel, and the Red Sea are still weighing on private investment.

Previously, state or military-owned companies could receive preferential interest rates on loans from state banks, but as part of the reform agenda to encourage private companies to invest, the Egyptian authorities changed preferential lending. The change in preferential lending to state-owned enterprises has been positive but has not sparked much interest from foreign companies to enter the market, except deals like the development deal with the United Arab Emirates (UAE) to build a new state-of-the-art city in Raz El-Hekma. The Ministry of Finance released a list of companies that were for sale last year, but there was no real interest from abroad to buy them.

Conclusion

Overall, we are positive on Egypt. On the currency side, we believe Treasury bills offer attractive carry, with 3-month bills yielding around 30%.2 We believe the CBE will be able to cut rates in the near future, but still favor short-term Treasury bills over longer duration bonds, as liquidity is not as robust as for short-term Treasury bills. As discussed earlier, local banks and companies prefer to hold Treasury bills, so those instruments tend to be more actively traded.

Turkey: Volatility expected but rates and currency look attractive

Policy outlook improving

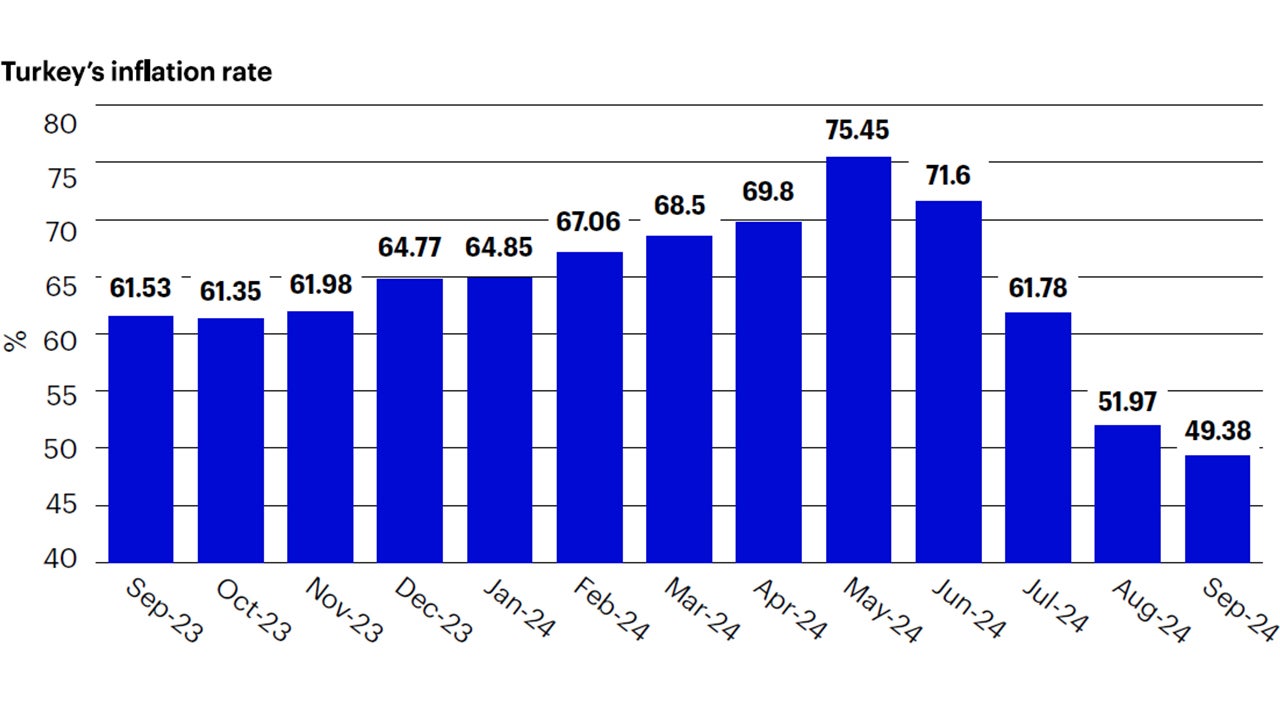

Turkey has been struggling with high inflation and a large current account deficit for the past few years.

President Erdogan has pushed unorthodox economic policies in the past, such as opposing high interest rates to combat inflation, but has now backed Finance Minister, Mehmet Simsek, who has introduced more orthodox policies. Minister Simsek’s focus is on controlling inflation, fiscal discipline and attracting foreign investment to stabilize Turkey’s economy. The consensus during our meetings with government officials, local industry, opposition leaders and the central bank was that the current macro policy is here to stay.

Turkey’s economy was resilient in the first half of 2024, but there are signs that the real economy is slowing. While it has not yet shown up in the official data, early indicators suggest an increase in business closures, unemployment, and a pickup in non-performing loans, mainly credit card and general-purpose loans. Real local interest rates have recently turned positive, and inflation is cooling, but a major question remains: When and how much of the local deposit base will be de-dollarized?

Dollarization concerns

The local population continues to have little faith in the Turkish lira. Having seen the lira depreciate over the past few years, most locals immediately convert their local currency into US dollars or gold to protect against devaluation. This conversion has left Turkey’s central bank (TCMB) with insufficient reserves to protect against currency shocks. If locals would sell their US dollar holdings and buy lira, it would allow the central bank to let the currency appreciate or accumulate reserves. A stronger currency could help reduce inflation, as imported goods, such as food products and energy, would likely be cheaper.

Inflation still elevated, but coming down

The stickiness of service price inflation is a concern for the TCMB, but the absence of a mid-year minimum wage adjustment is an encouraging factor in the potential continuation of the disinflation process. Inflation fell sharply in September for the fourth consecutive month, to its lowest level since last July. Although household inflation expectations remain elevated, the TCMB is focused on corporate and financial sector expectations, which are more aligned with official forecasts.

Source: Bloomberg L.P. Data as of October 10, 2024.

Monetary policy normalization

The TCMB recently shifted its policy stance from “tightening” to “normalization”. This move suggested that it must be confident that it can deliver a sequence of consecutive cuts, as a pause would probably be difficult to communicate. We agree that the TCMB’s communication around a potential rate cutting cycle will be important, as domestic de-dollarization is still key for policy success.

Most of our conversations eventually returned to the topic of the currency. With interest rates already high and inflation coming down, hiking rates further is unlikely to have the desired impact. To combat inflation and currency depreciation, the TCMB has intervened in the currency market with so-called KKM deposits (currency-protected deposits).3 While offshore positioning is less than what it was in June and July, there are still concerns about the local de-dollarization effort and rollover of the currency-protected deposits. With recent inflation reaching near 50% and forecasts for year-end inflation at 40-45%, real Turkish lira deposit rates should be sufficiently positive to continue the de-dollarization trend. The spot lira’s current pace of depreciation is believed to be reasonable, as it is not likely to trigger any KKM payouts. Separately, we noted some concern about the strength of the lira among exporters, and the impact it may have on growth.

Conclusion

Overall, we are constructive on Turkey. We believe the macroeconomic policy plan put in place with President Erdogan’s backing will yield positive results. We favor being long Turkish lira and have recently become more optimistic on the local bonds, favoring an overweight position.

Ecuador: Eyes on the presidential election and outside support

Last month the team also traveled to Quito, Ecuador to meet with government officials, members of the central bank, political and economic consultants, multilateral institutions and diplomatic representatives.

Macro outlook improving

As Ecuador heads toward an electoral cycle next February, we see both challenges and opportunities. The potential for a renewed government with a positive reform agenda backed by strong multilateral and bilaterial support made us come away with a more constructive view about the current risks Ecuador is facing. The largest risk continues to be electricity blackouts imposed by the government to conserve energy. The decision was made due to the worst dry season in 60 years which robbed Ecuador of essential hydroelectricity generation. Current president Daniel Noboa still leads in the polls but needs to balance the electricity crisis and the security situation to protect his popularity among voters.

Some positive macro factors underpin the economic outlook, such as a current account surplus, a relatively low debt-to-GDP ratio and solid remittances. There is a good chance that Noboa will win the upcoming election in the first or second round of voting and continue his reform agenda. A more bearish view would be a recession outcome, which would make it more difficult to raise taxes and cut expenditures and subsidies, including diesel subsidies. In addition, IMF fiscal targets may be hard to achieve, even if President Noboa is re-elected.

Social change may help improve fiscal policy

Ecuador’s fiscal position has improved this year due to several measures implemented by the government, including the elimination of gasoline subsidies, tax withholding, a VAT increase, temporary taxes on large corporations and banks, tax amnesty and exceptional central bank dividends. While 2025 IMF targets could be met through successful policies, this could be more challenging in 2026, unless diesel subsidies are reduced, which may be politically challenging.

However, the local mood is calm surrounding the fiscal and security situations, and there is a chance that the fiscal numbers will be better than anticipated, including the availability of an untapped fiscal revenue source that could support the country’s outlook. Both the IMF and the Finance Ministry see the scope for increased revenues, and they are exploring ways to obtain them. At first, these sources may be related to reduced tax exemptions, but we may need to get past the elections to see more details about the government’s agenda. There are signs that the social contract in Ecuador has changed, as memories of insecurity are still fresh in people’s minds, and there may be more incentive to support President Noboa’s efforts on both the security and fiscal fronts.

IMF program on track

Ecuador’s IMF program is progressing well. The government is likely outperforming the program targets by a wide margin, which could be a strong catalyst for additional financing from other multilateral organizations. The IMF has supported the country’s efforts and has included financing contingencies if market access cannot be restored in 2025, as assumed under the program. Additional IMF funding includes the Fund’s Resilience and Sustainability Trust (RST) program and the reduction of surcharges.

Growth concerns

Growth is weak and may be negative this year, exacerbated by the energy crisis. To ensure sustainable growth, we believe Ecuador needs to address the structural challenges to growth, but we are less confident in the prospects for the type of major structural reform that could improve the long-term growth outlook. For now, electricity blackouts remain the main concern for the rest of the year and the main risk to President Noboa’s popularity. The shutdown of a controversial oil drilling block in Yasuní National Park in the country’s Amazon reserve will likely also have an impact, as oil represents nearly one-third of Ecuador’s GDP. The shutdown is expected to occur gradually over a five-year period, impacting oil revenues, jobs, and government finances.

Risks we are monitoring

The mining sector offers Ecuador perhaps its most promising economic opportunities. Related fiscal revenues could be significant if they live up to the level of business interest on the ground. But although conversations with mining companies reveal eagerness to invest, many remain in “wait-and-see” mode until after the elections. The government recognizes the urgency of activating mining projects and has shown some encouraging signs, especially within the Ministry of Energy, which aims to create more investor-friendly contracts. The Ministry of Environment is also seen as pro-business, in terms of licensing mining projects, with the Inter-American Development Bank ready to underwrite guarantees.

Conclusion

There is no currency play in Ecuador as it adopted the US dollar as its currency in 2000, but we find the carry on the sovereign bonds attractive. Overall, we believe Ecuador’s challenges are manageable in the short term, and the IMF is vested in the country, providing momentum for the government to generate practical solutions that it can pursue. In addition, the IMF program goes a long way toward unleashing significant multilateral financing and important technical assistance, which provides fiscal and other policy tailwinds. Moreover, the US is politically invested in Ecuador’s success and has demonstrated strong and growing support through its various agencies on the ground.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Non-investment grade bonds, also called high yield bonds or junk bonds, pay higher yields but also carry more risk and a lower credit rating than an investment grade bond.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The performance of an investment concentrated in issuers of a certain region or country is expected to be closely tied to conditions within that region and to be more volatile than more geographically diversified investments.