Bridging the climate adaptation gap through blended finance

The trend toward global warming has maintained its momentum over the years, with no let-up this year. The Copernicus Climate Change Service reported that March 2024 was hotter than any previous March on record. It was also the tenth month in a row to be the warmest on record. While El Nino may have temporarily exaggerated the trend in recent months, unfortunately, future climate change is likely already entrenched.

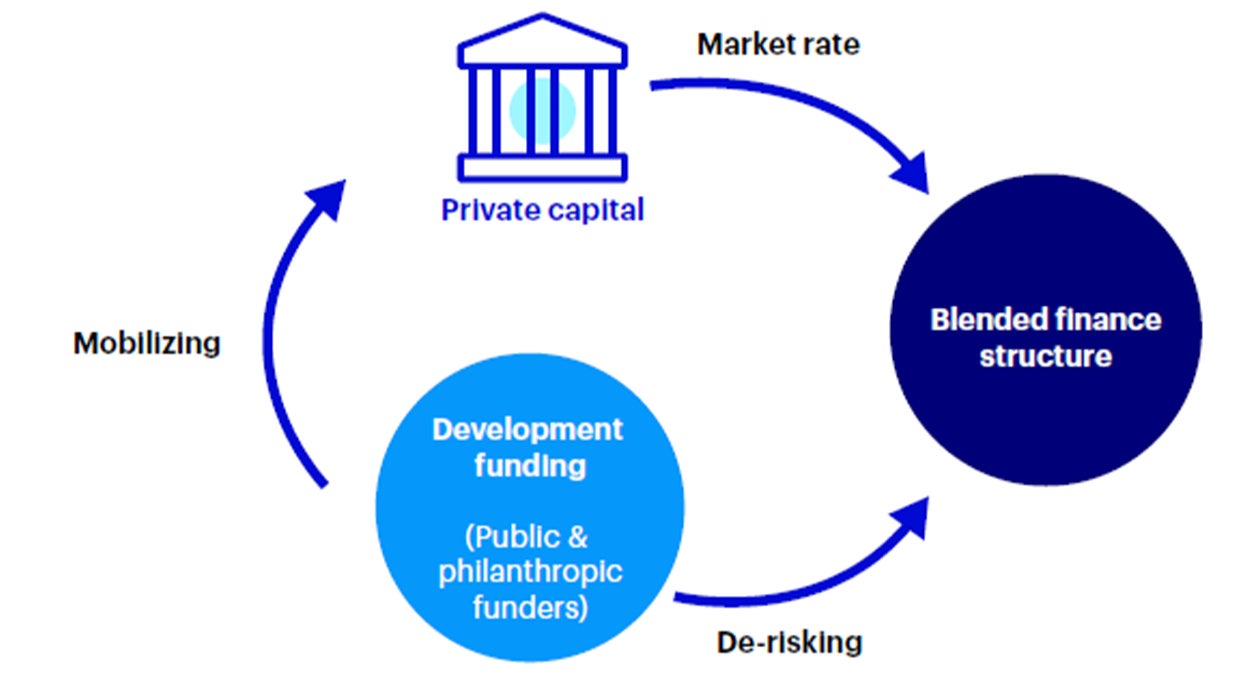

Sufficient investment capital and technical assistance for climate adaptation and mitigation could empower project developers and developing countries to implement climate-resilient infrastructure, technology access and sustainable practices across sectors. Investors can participate in these solutions through innovative blended finance vehicles that use development finance and philanthropic funds to mobilise private capital to emerging and frontier markets.

The wide-ranging impacts of global warming

United Nations (UN) population estimates and our assumptions about future economic growth and technological innovation (i.e., the pace of CO2 reduction), suggest that global temperatures will likely rise by 3.9°C above the 1850-1900 period average by the end of the century — which would well exceed the Paris Agreement’s goal of 2˚ C above the pre-industrial period.

This level of temperature change will likely affect global weather patterns dramatically. Previous UN reports suggest that such temperature changes could cause large increases in climate-related deaths and migration flows that could run into the hundreds of millions of people. Certain regions, such as low-lying coastal areas, could become uninhabitable. The scale and wide-ranging potential effects of these impacts are clear, considering that most financial centers, including New York, London, Tokyo, and Hong Kong, are located in coastal areas.

The need to adapt is exemplified by Africa

Climate adaptation is the ability to change processes, practices and structures in response to actual or expected climate impacts and the ability to recover from and be resilient to climate-related disasters. One region exemplifies the urgent need to adapt to the potential repercussions of a much warmer planet: Africa.

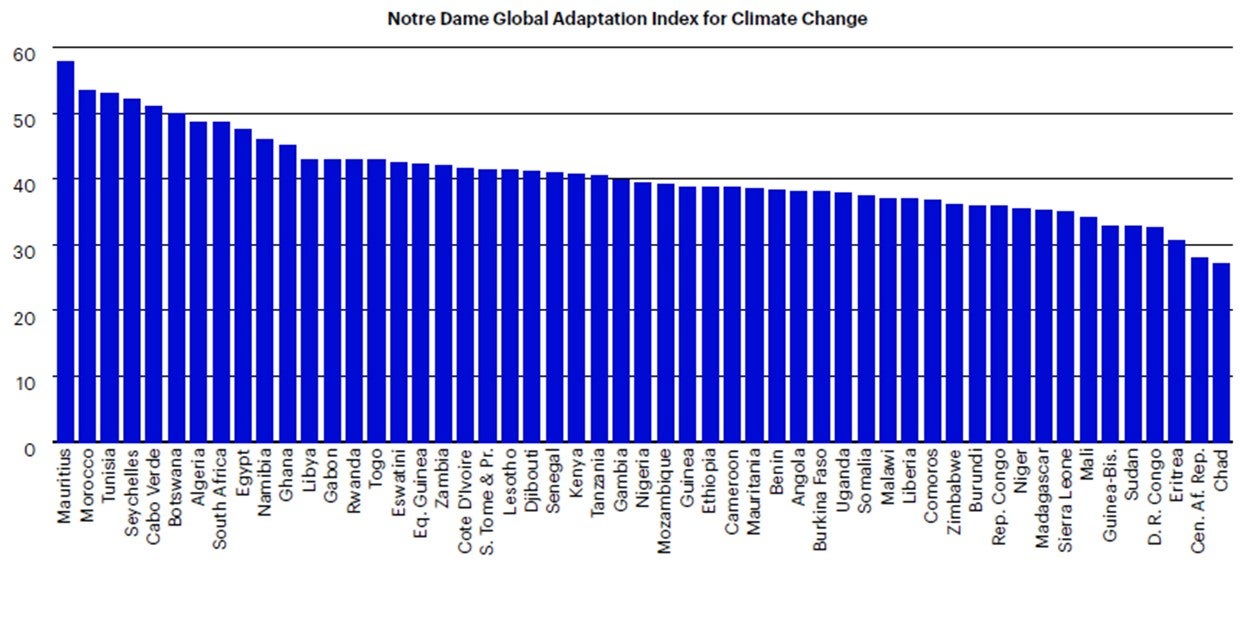

Source: University of Notre Dame, LSEG Datastream and Invesco Global Market Strategy Office

Notes: Notes: The index summarises a country’s vulnerability to and readiness to deal with climate change (range from 26.9 for Chad to 75.0 for Norway; lower implies greater vulnerability). No data for South Sudan. Abbreviations used: Cen. Af. Rep. = Central African Republic; D. R. Congo = Democratic Republic of The Congo; Eq. Guinea = Equatorial Guinea; Guinea-Bis. = Guinea-Bissau; Rep. Congo = Republic of the Congo; S. Tomé & Pr. = São Tomé & Príncipe.

While Africa has contributed less than 3% of cumulative CO2 emissions as of 2022, it seems destined to suffer the worst consequences of global warming. The Notre Dame Global Adaptation Index for Climate Change measures a country’s vulnerability to and preparedness for climate change (lower scores indicate greater vulnerabilities). Out of the 185 countries in the index, 41 African countries dominate the most vulnerable third, 11 African countries are in the middle third, and only one African country, Mauritius, is in the top third. Chad faces the lowest score of any country in the world.

Additionally, the UN estimates that Africa will account for 41% of the world’s working age (15-64 years) population by 2100, compared to 15% in 2020. Today’s workers may already be seeking opportunities outside of the region, in advance of potential mass migration, as large parts of Africa could become uninhabitable.

However, it is not too late, and action now can limit future damage. Investors can participate in the solution, and climate change will likely become a dominant investment theme for the rest of the century at a minimum.

Blended finance provides green shoots of hope

The enormous vulnerability of Least Developed Countries and Small Island Development States to climate change means they require significant and rapid deployment of capital at scale for climate adaptation. Their vulnerability to economic distress and limited public budgets, combined with the rapid increase in temperatures and sea level rise, call for urgent support to deploy capital. However, private sector and institutional investors tend to be risk averse, making it difficult to mobilize sufficient capital to meet climate mitigation needs and particularly climate adaptation solutions. Harnessing sufficient capital requires innovative commercial structures to close the gap between the climate objectives of vulnerable countries and the risk-return profile that investors typically seek.

Sufficient investment capital and technical assistance for adaptation and mitigation could empower project developers and developing countries to implement climate-resilient infrastructure, technology access and sustainable practices across sectors. These investments could fund impactful projects that enhance climate resilience and contribute to the reduction of greenhouse gas emissions, which could create a favorable environment for attracting additional investment and mobilizing financial resources at a reasonable cost. This dynamic could strengthen the capacity of communities and countries to address the challenges of climate change, promote sustainable development and achieve countries’ adaptation and mitigation goals.

Conclusion

We believe that investing in climate adaptation can provide a triple dividend: avoiding economic losses, providing positive gains and delivering social and environmental benefits. And we believe those dividends can be achieved by focusing on the key systems affected by climate change: systems that produce food, protect and manage water and the environment, plan and build cities and infrastructure, and protect people from natural disasters.

As a large global asset manager, Invesco can help investors complement the public sector in sharing the costs and benefits of adaptation investments through innovative, blended finance debt strategies that invest primarily in climate adaptation-focused fixed income securities, particularly those targeting adaptation and resilience projects in developing countries. By doing so, we help to increase climate-resilient investment across all sectors and build access to adaptation technology, providing financing for a more resilient future.

Investment risks

There is no guarantee that forecasts will come to pass.

All investing involves risk, including the risk of loss.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Many products and services offered in technology-related industries are subject to rapid obsolescence, which may lower the value of the issuers.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.