Asian green bonds may offer resilience in volatile markets

Highlights

- Global “Green Bond” issuance has increased dramatically in recent years, including in Asia. Growth is set to continue as investors demand “green financing” for major projects like infrastructure and renewable energy.

- The March Covid-19 and liquidity driven market sell-off was arguably the first real test of the Asian Green Bond market and it fared well. During March and April, Asian Corporate Green Bonds significantly outperformed traditional Asian corporate bond indices.

- We believe this outperformance is explained by several factors, including Asian corporate Green Bonds’ more stable investor base, their bias toward less cyclical sectors, their generally higher credit quality relative to benchmark indices and growing investor sponsorship of the asset class.

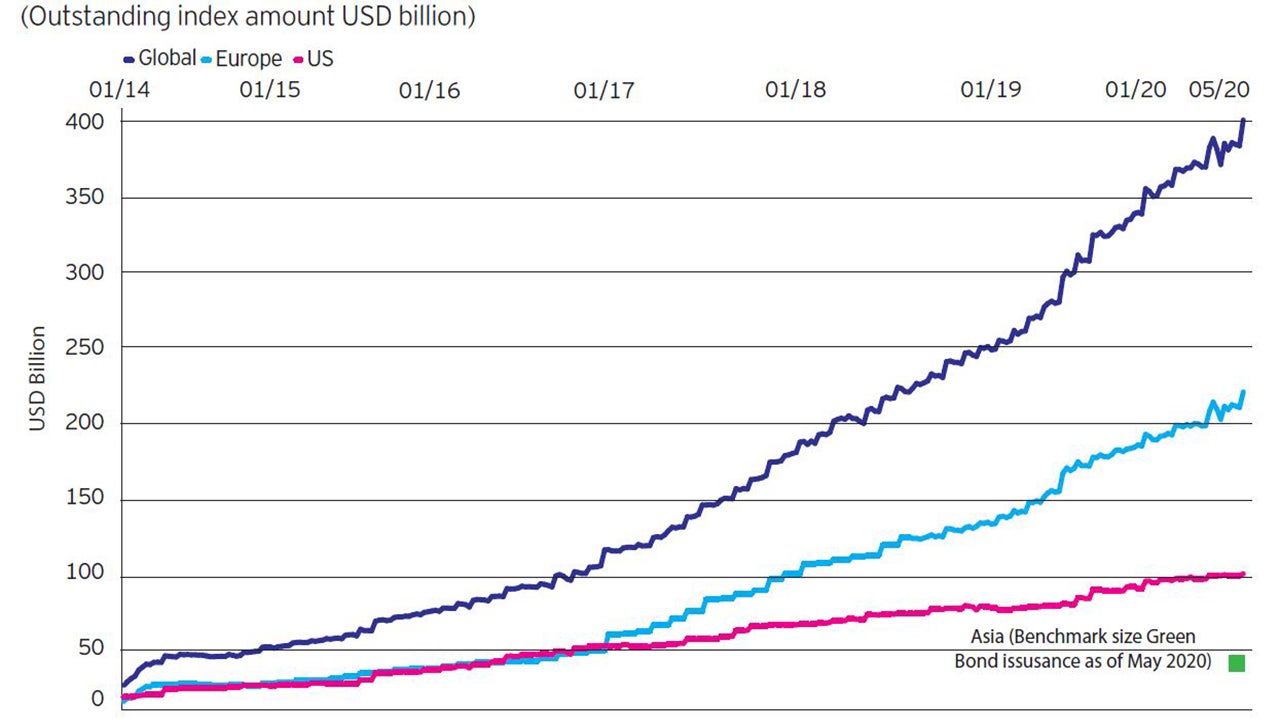

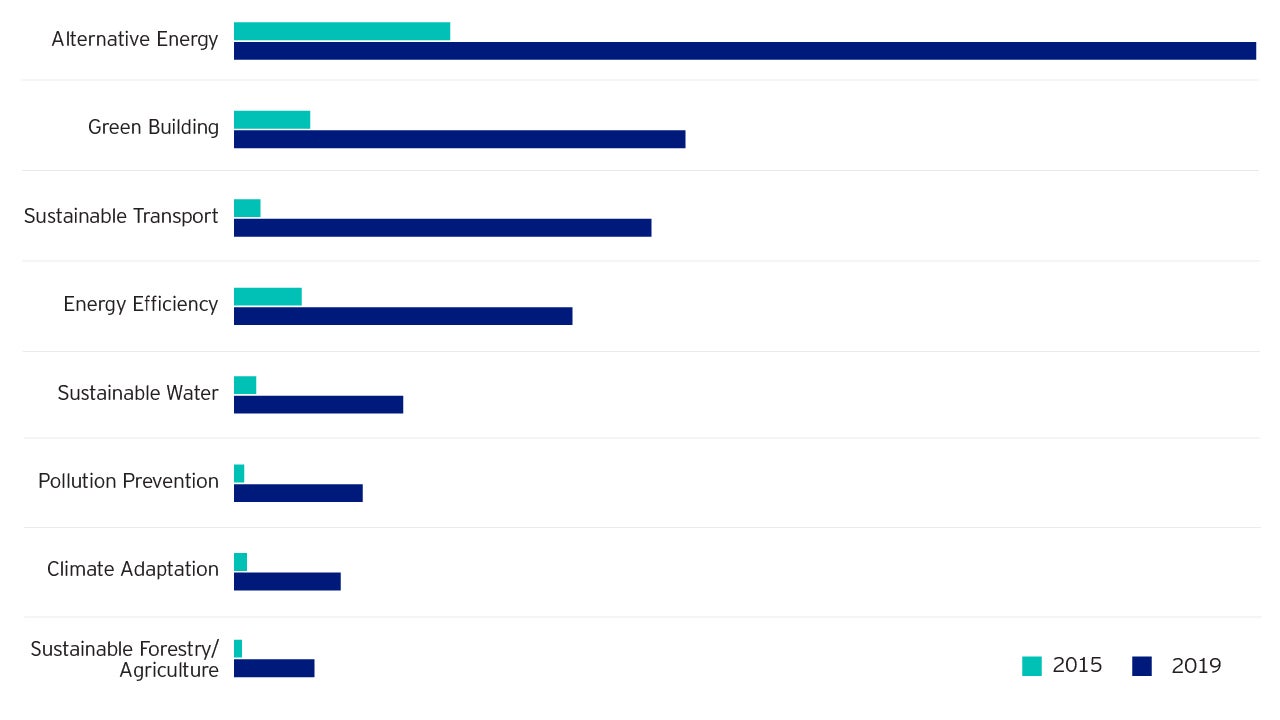

The global issuance of “Green Bonds” (intended to finance sustainable and environmentally sound projects) has soared in recent years. A record USD258 billion of Green Bonds and Green Loans were issued globally in 2019, representing a 51% increase versus 2018.1 The environmental, social and governance (ESG) think tank, Climate Bonds Initiative, expects Green Bond issuance to reach USD350-USD400 billion by the end of 2020.2 US and European issuers have been at the forefront of Green Bond issuance, but Asian issuers are closing the gap. The total amount of Asian Green Bonds outstanding reached USD45 billion as of May 2020 (including corporate and sovereign Green Bonds) (Exhibit 1). We expect Asia to play a vital role in the Green Bond market going forward, fueled by the region’s high demand for renewable energy, new infrastructure and a growing preference for “green” financing.

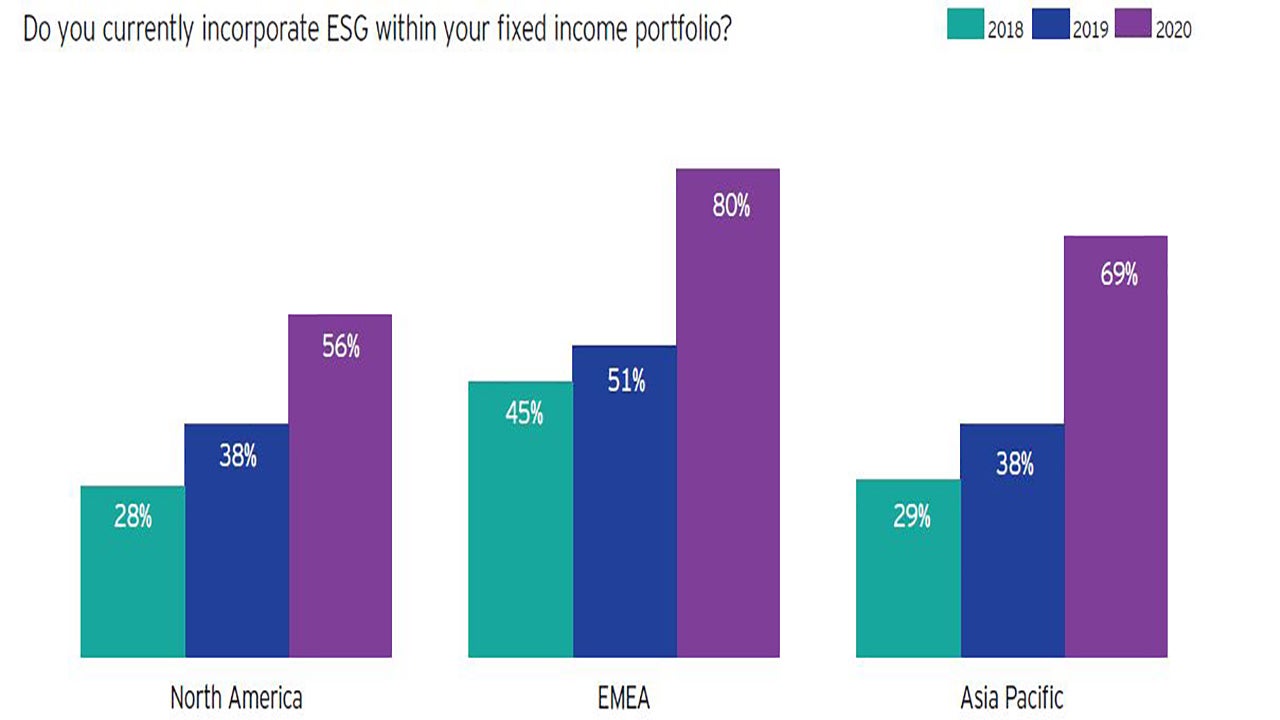

Across Invesco Fixed Income’s global platform, we see growing client interest in ESG-related mandates and products, especially in Asia. According to the 2020 Invesco Global Fixed Income Study (a survey of over 150 fixed income investors around the world), Asia has witnessed the most significant uptick in ESG adoption over the past three years, with investors in that region overtaking their North American peers and catching up to Europe (Exhibit 2).

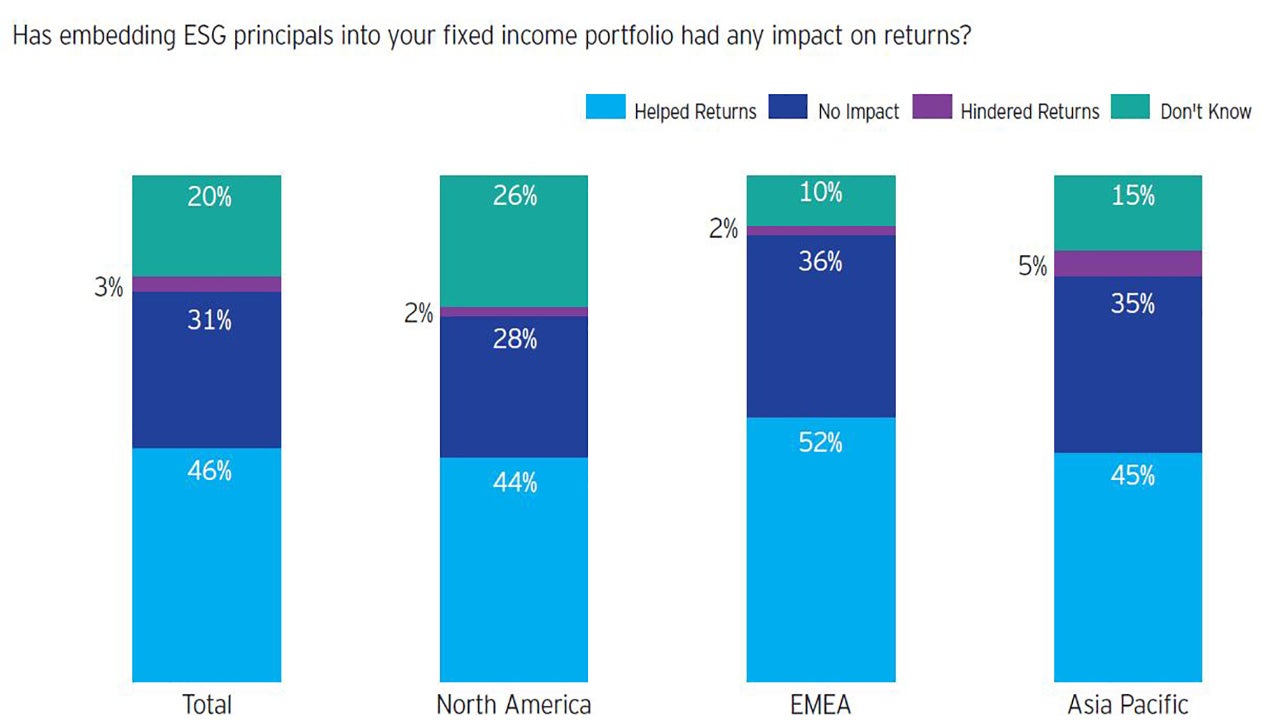

ESG has come to be viewed as a competitive advantage from an investor perspective, versus the issuer driven topic it was only a few years ago. In our 2019 Study, many investors asserted that they were not willing to sacrifice returns to integrate ESG considerations. However, the debate has shifted rapidly and a year later, most investors believe ESG enhances, or at least has no impact on, returns (Exhibit 3). On top of growing volume, the Asian Green Bond universe has meaningfully expanded in terms of the range of its investable sectors and credit quality.

Asian Corporate Green Bonds Proved Resilient During March Sell-Off

In studying the characteristics of the growing Asian Green Bond universe, we have observed various benefits to investors – not only the attraction of the “green” label but also market resilience. This was especially true during the March Covid-19 and liquidity-driven market sell-off, which was, arguably, the first real test of the Asian Green Bond market.

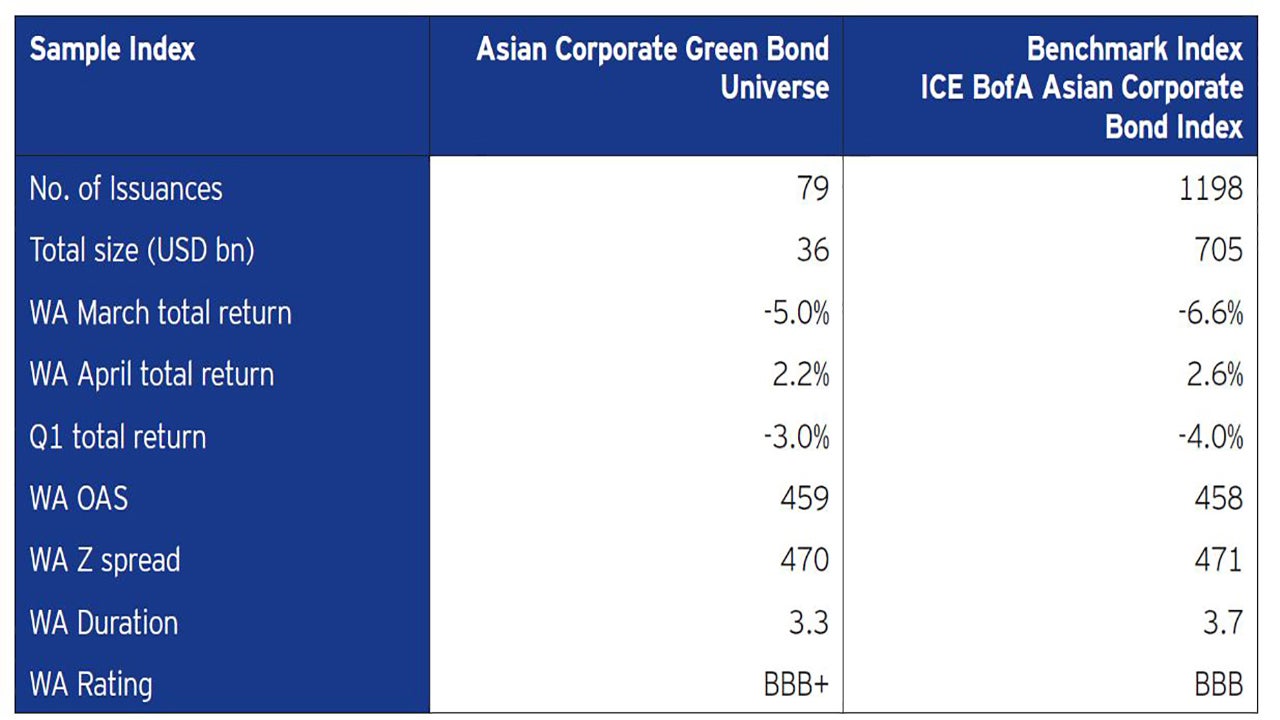

While the March sell-off hurt global credit markets from US Treasuries to emerging markets, we observed greater price resilience of the Asian Corporate Green Bond asset class in March and a strong recovery in April, relative to conventional indices. To compare, we constructed an Asian Corporate Green Bond universe (see Appendix below) using 79 “benchmark size” corporate bonds (bonds with a minimum of USD250 million in size) extracted from the BofA Green Bond Index and the Bloomberg Green Bond universe, which includes high yield issues.3 The resulting Asian Corporate Green Bond universe returned -5% in March and 2.2% in April, compared to the ICE BofA Asian Corporate Bond Index returns of -6.6% and 2.6%, respectively, a 120-basis point outperformance over this volatile period.4

We believe three factors help explain the outperformance of Asian Corporate Green Bonds: 1) their more institutional and ESG-oriented investor base typically holds Green Bonds to maturity; 2) issuers of Green Bonds tend to be biased toward less cyclical sectors, such as utilities and financial institutions; 3) issuers in the Green Bond universe tend to have, on average, higher-quality credit profiles (BBB+ versus BBB), and shorter duration bonds (3.3 years versus 3.7 years) compared to the benchmark index (Exhibit 5).

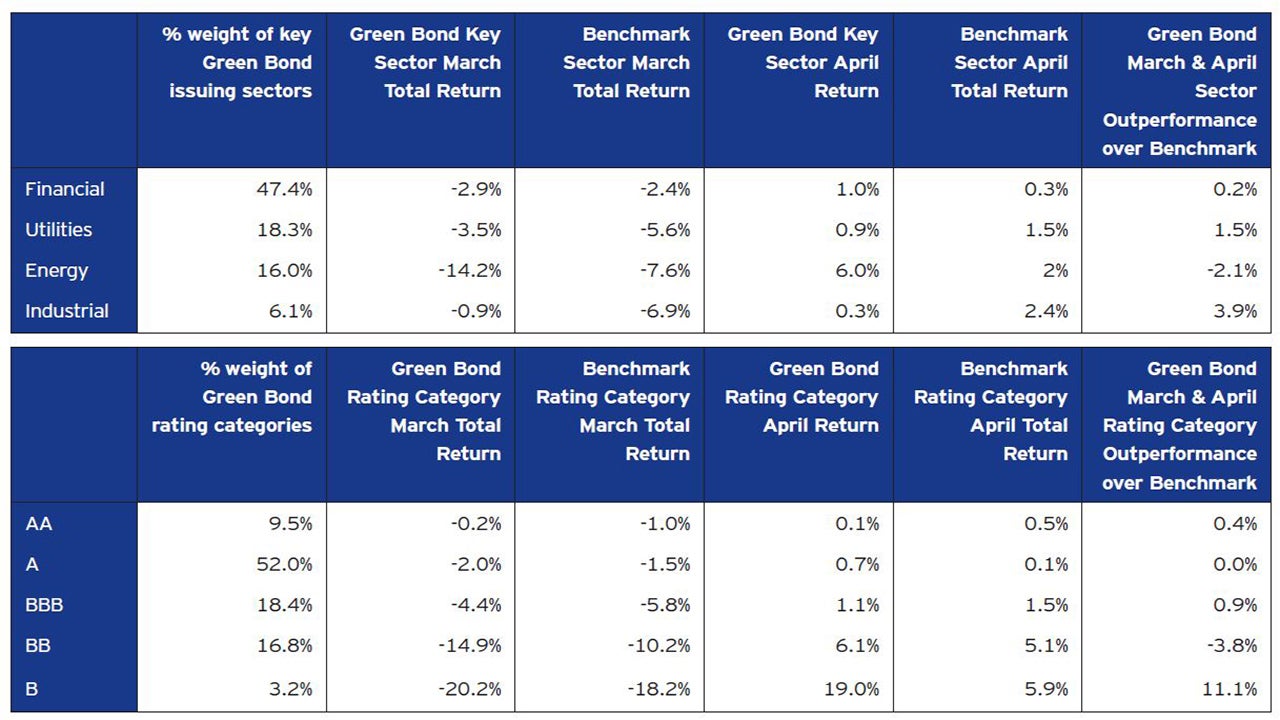

We also compared the total return performance of our Asian Corporate Green Bond universe by sector and rating category to the performance of the Credit Suisse Asian Corporate Bond benchmark index (as this index provides a performance breakdown, as shown in Exhibit 6). In three out of four issuing sectors and four out of five rating categories, Green Bonds significantly outperformed the conventional corporate bond index in March and April (Exhibit 6). The only underperformers - the energy sector and BB rating category - can be explained by Asian Corporate Green Bonds’ highly concentrated exposure to Indian high-yield renewables, which underperformed the market during the period.

Our findings are consistent with the performance of the MSCI family of indices. MSCI’s ESG fixed income indices outperformed the MSCI USD Investment Grade Corporate Bond Index, not only in the recent first-quarter sell-off but also on a one-, three- and five-year basis. The MSCI ESG Universal Fixed Income Index outperformed the MSCI USD Investment Grade Corporate Bond Index by 0.5% (-2% versus -2.5%) in the first quarter and by 0.6%, 0.4% and 0.2%, respectively, over one, three and five years (Exhibit 7).

Conclusion

We expect the pace of Asian Green Bond issuance to accelerate in the coming quarters, leading to an expansion in the investment universe. Green Bonds not only provide Asian corporates with essential funding for infrastructure and environmentally friendly capital expenditures, they also provide investors with a wide range of yield choices and potential value resilience amid volatile markets.

Appendix:

This paper sought to construct an Asian corporate Green Bond universe to enable an unbiased comparison between the universe and traditional Asian corporate bond indices. We achieved this by extracting 79 eligible bonds from the ICE BofA Green Bond Index and the Bloomberg corporate bond universe.

Step 1: We first extracted Asian investment grade Green Bonds from the ICE BofA Green Bond Index. The ICE BofA Green Bond index contains 561 investment grade global Green Bonds of benchmark size, as defined by the Index according to currency denomination (e.g. US dollars minimum size is 250 million, euro is 250 million, British pound is 100 million, etc.). Of the 561 global issues, 78 are issued by Asian issuers. Of these,16 sovereign and quasi-sovereign issues were removed to allow comparison against traditional corporate indices. The extraction process resulted in a universe of 62 investment grade Asian corporate Green Bonds.

Step 2: We then added Asian high yield Green Bonds to make the comparison complete and informative. We sourced Asian high yield Green Bonds from the Bloomberg active corporate bond universe, which is one of the largest fixed income data bases in the world. We selected 17 bonds based on the following four criteria: a) Green Bond status; b) corporate bond; c) risk domiciled in Asia, and d) rated below investment grade by one of the three international rating agencies.

Step 3: We combined the 62 investment grade corporate Green Bonds with the 17 high yield corporate Green Bonds that we identified to form our Asian Corporate Green Bond universe of 79 bonds. We compared this universe against two traditional benchmark indices – the ICE BofA Asian USD Corporate Bond Index and the Credit Suisse Asian Corporate Bond Index.

1 Source: https://www.climatebonds.net/files/reports/2019_annual_highlights-final.pdf, Feb. 2020.

2 Source: https://www.brecorder.com/2020/01/20/563003/green-bond-issuance-hitrecord-255-billion-last-year/, Jan. 20, 2020.

3 Green Bonds were included in accordance with the minimum size requirements of the ICE BofA Green Bond Index benchmark definition.

4 Sources: BofA Green Bond Index, ICE BofA Asian Corporate Bond Index, data from March 1, 2020 to April 30, 2020.