2024 Investment Outlook – Asia Fixed Income: ESG

ESG investing in Asia fixed income is here to stay and Asia has a unique role in driving climate transition to help the world hit the 1.5-degree scenario. 2022 was a landmark year globally as spending on energy transition caught up with traditional fossil fuel investing for the first time.1

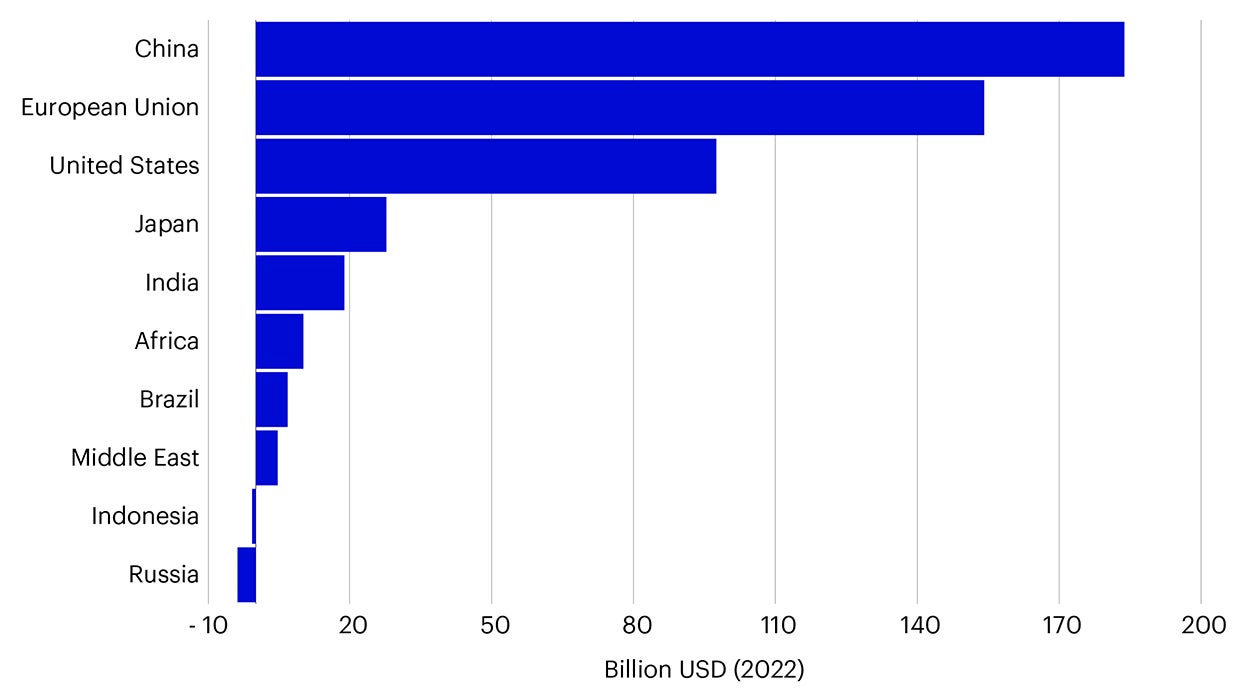

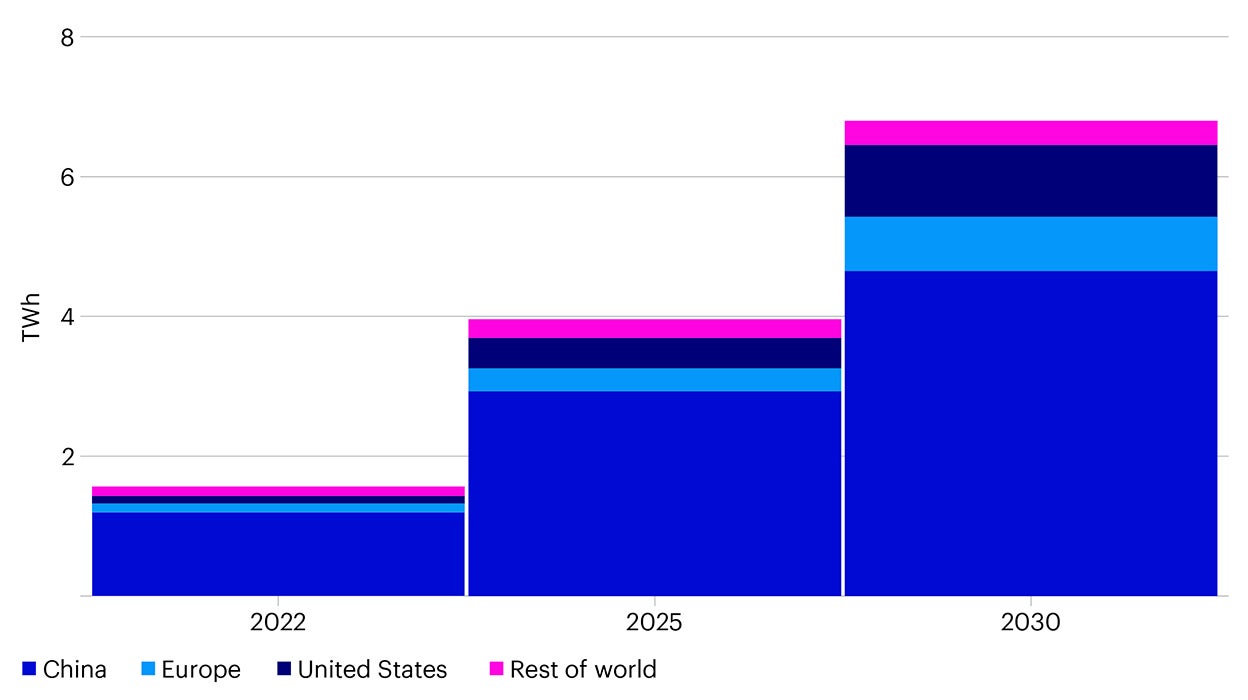

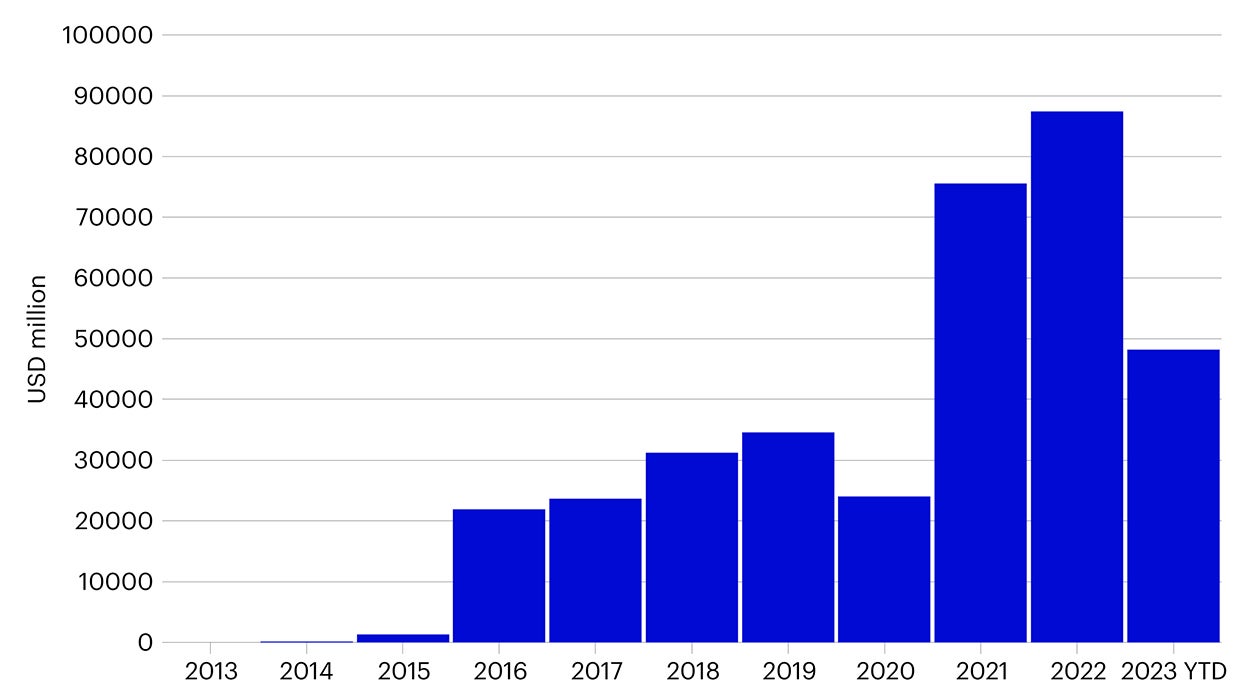

China is leading the way in spending and transforming its economy to be a truly net zero economy in the long run, investing over $170 billion annually in past four years (Figure 1). Importantly, China is also a key global leader in clean energy and battery technology manufacturing, which has outpaced both the European Union and the US in the last three years (Figure 2). This has also contributed to the rapid growth of China’s green bond market. These ongoing investments are a structural driver in the growth of the Asia’s green bond market. Green bonds are now mainstream with China being the leading player. For investors that are looking to make an impact on decarbonization, China bonds offer many varied investment opportunities.

Figure 1 – The increase in clean energy spending in recent years is impressive but heavily concentrated in a handful of countries

Source: World Energy Investment 2023, International Energy Agency. Note: 2023e indicates estimated values for 2023.

Figure 2 – Lithium-ion battery manufacturing capacity

Source: World Energy Investment 2023, International Energy Agency.

We would emphasize having a proprietary approach based on international standards to analyze the ESG characteristics of bond issuers and evaluate sustainable labelled bonds to drive capital towards the highest impact and avoid green washing.

Figure 3 – Climate Bonds Initiative certified green bond issuance

Source: Climate Bonds Initiative, Invesco, data as of 30 Sept 2023

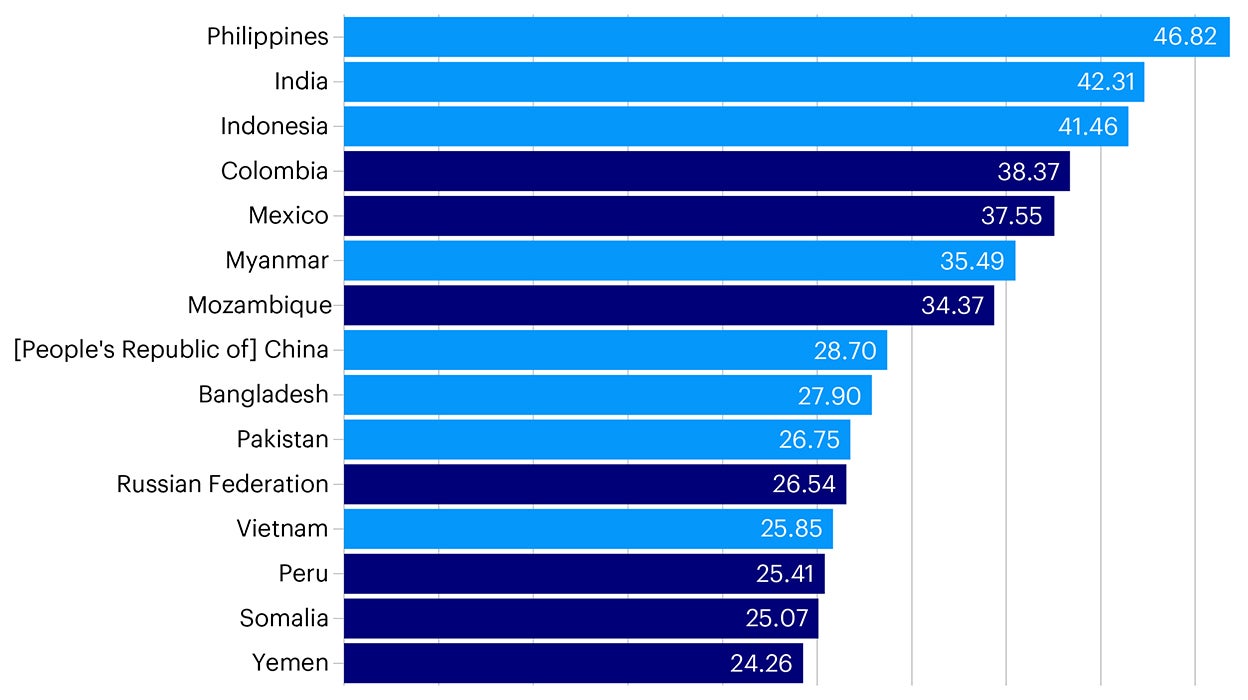

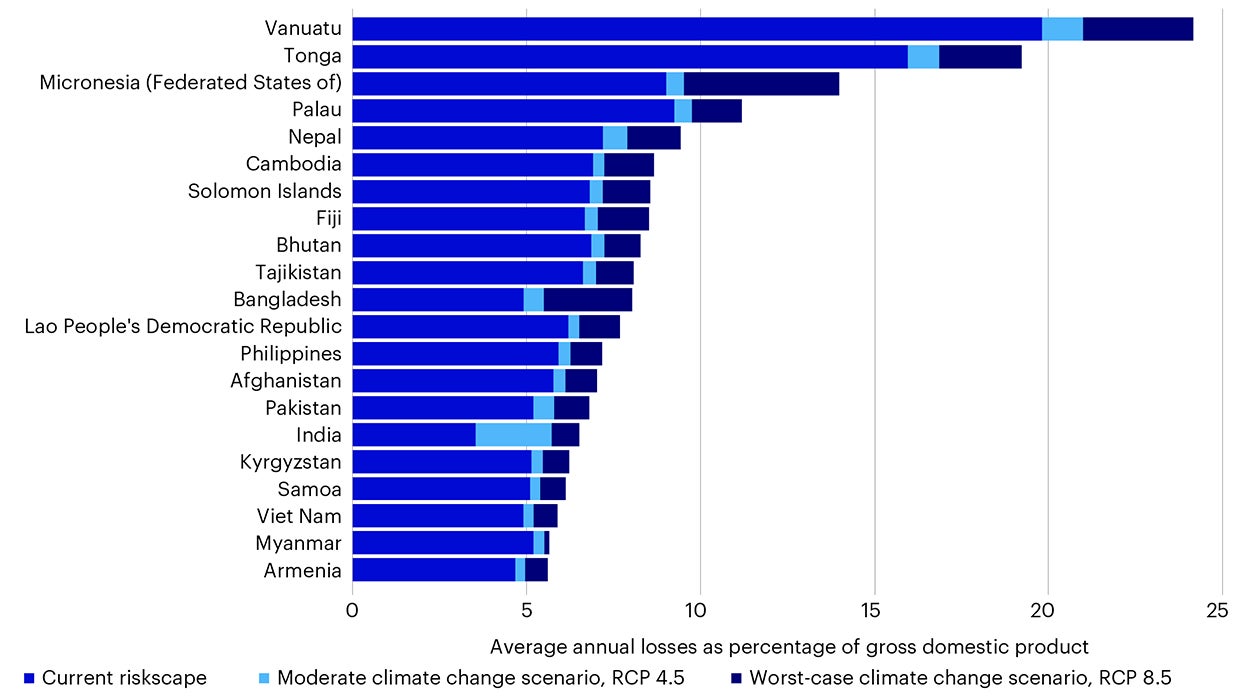

High climate adaptation investing needs in Asia and bond markets can help mobilize capital

Eight out of the 15 most affected countries by extreme weather are in Asia Pacific and the adverse impact climate change has had on the region is already very profound. The impact of climate change on the annual GDP of the most vulnerable Asia Pacific countries ranges from between 5% to over 20%. Improving climate resilience is critical in reducing economic losses from climate risks, creating positive economic gains, and delivering on additional environmental and social benefits. Achieving these benefits require supporting key projects improving climate resiliency including systems producing food, protecting and managing water and the natural environment, building of cities and infrastructure and disaster protection.

Adaptation investing can provide a triple dividend by avoiding economic losses, bringing impact and positive gains, and delivering additional social and environmental benefits. We can achieve those benefits by focusing on the key systems affected by climate change, ranging from access to safe water and sanitation to more urgent topics relevant to the geopolitical environment such as investment in food security by using key agriculture and food technologies to innovate and improve how we develop, produce, and consume food in developing countries. We expect further growth in bond issuances that explicitly target climate adaptation in both green and blue bond formats in the Asia Pacific region.

Figure 4 – Disaster risk index, 2022

Source: World Risk Report 2022. Note: Maximum value = 100, classification according to the quintile method.

Figure 5 - Average annual loss due to natural and biological hazards

Source: The race to net zero: accelerating climate action in Asia and the Pacific, ESCAP.

Conclusion

We believe that an ESG-led investing approach can lead to better risk adjusted returns in the long term. The use of proprietary ESG analysis is key to adding an active view and lens to investments. This positive tilt and alignment to mega trends such as China’s climate transition and increased climate adaptation spending are thematic investment opportunities that we believe Asian fixed income investors should have as a core part of their portfolios.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.