How can fixed income factors help investors with allocation decisions?

Key takeaways

Factors can enhance a traditional approach to fixed income investing because they are not just a replication of traditional fixed income characteristics such as credit rating, industry or duration.

We walk through ways fixed income factors can decrease the risk of typical investment-grade and multi-sector credit approaches, complement existing portfolios and improve balanced equity-fixed income portfolios.

We demonstrate that fixed income factors are more than just equity factors in disguise.

How can fixed income factors enhance the more traditional credit rating, industry or duration view of portfolio construction? Can adding a factor element improve the risk-return profile of a multicredit portfolio? Do fixed income factors make sense in a balanced equity-fixed income allocation? How can investors complement an existing allocation without significantly disrupting the existing portfolio? In this study, we address these four questions often faced by investors.

To answer each question, we build portfolios using traditional portfolio construction techniques (i.e. allocating along traditional lines such as maturity, industry and rating) and then construct new portfolios adding factors. We find that adding factors improves portfolio outcomes, whether we are constructing an investment grade portfolio, a multisector credit portfolio, a balanced equity-fixed income portfolio or complementing an existing portfolio. In other words, we find that factors reduce risk for given levels of return across a wide range of investment cases.

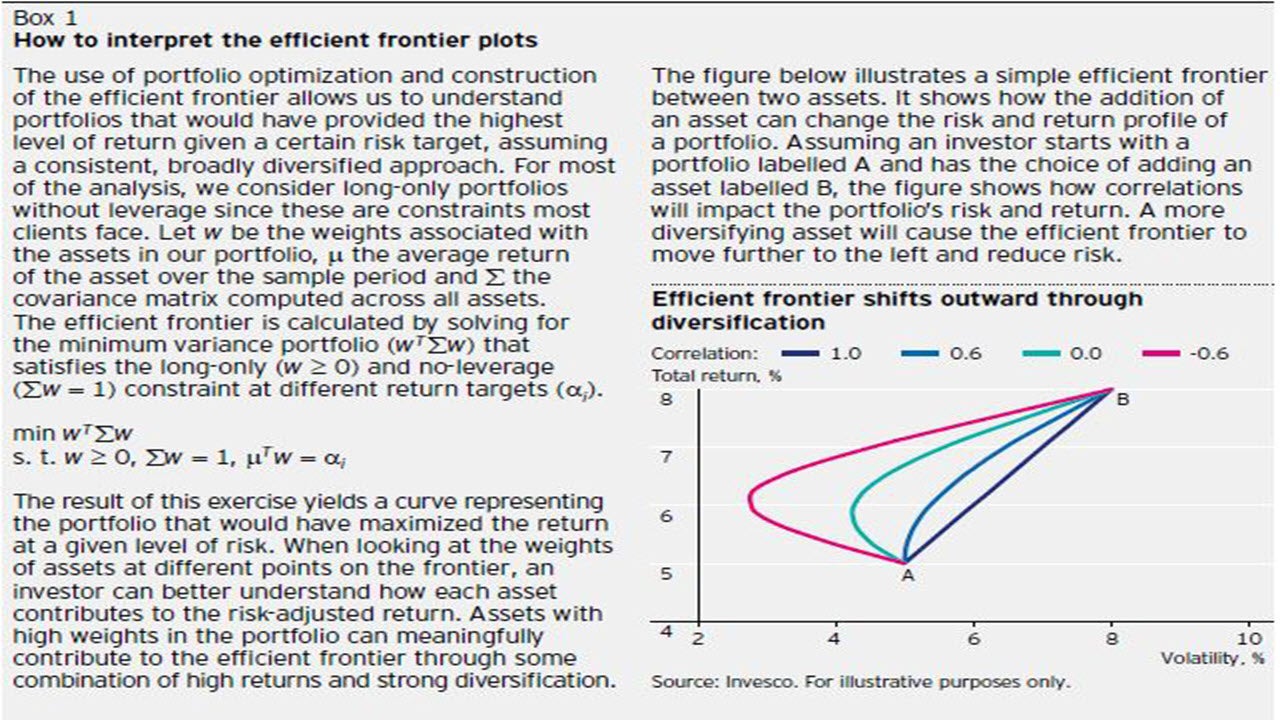

In adding factors to traditional portfolios, we focus on the value, quality and carry factors, based on the methodology from Raol and Pope (2018),1 and apply them to the Bloomberg Barclays US Investment Grade Corporate Index, Bloomberg Barclays US High Yield Corporate Index and the Bloomberg Barclays Emerging Market Hard Currency Index over the period from 1 January 2000 to 31 December 2018. To construct portfolios, we use mean-variance optimization to identify portfolios that minimize risk at a given level of return (efficient frontier). This method highlights those combinations of assets that comprise optimal portfolios for different levels of risk. We find that factors are often present in optimal portfolios, meaning that adding factor allocations to portfolios improves investment outcomes, i.e. shifts the efficient frontier outward.

1. How do fixed income factors fit with the more traditional credit rating, industry or duration view of portfolio construction?

To answer this question, we narrow complex fixed income portfolio construction to a simple analysis of how to use factors within US investment grade credit. An investment grade credit portfolio must balance the wide ranges of risk and return across the bond universe. In order to represent different investment choices, we divide subsets of the universe into sectors according to rating, maturity and industry using the following market value weighted indices, hereafter referred to as traditional indices: the Bloomberg Barclays US Corporate Index, Intermediate Corporate Index, Long US Corporate Index, US Corporate Industrial Index, US Corporate Utility Index, US Corporate Finance Index, US Corporate AAA Index, US Corporate AA Index, US Corporate A Index and the US Corporate BBB Index. We construct the efficient frontier as combinations of sectors and plot it as a dotted line throughout. Next, we include factors and recompute the efficient frontier as a solid line (figure 1).

As can be seen, the addition of factors shifts the efficient frontier outward, meaning that factors reduce risk for a given level of return. In addition, factors significantly lower the volatility of the least risky portfolio (minimum variance portfolio). This means the addition of factors expands the universe of potential outcomes for investors.

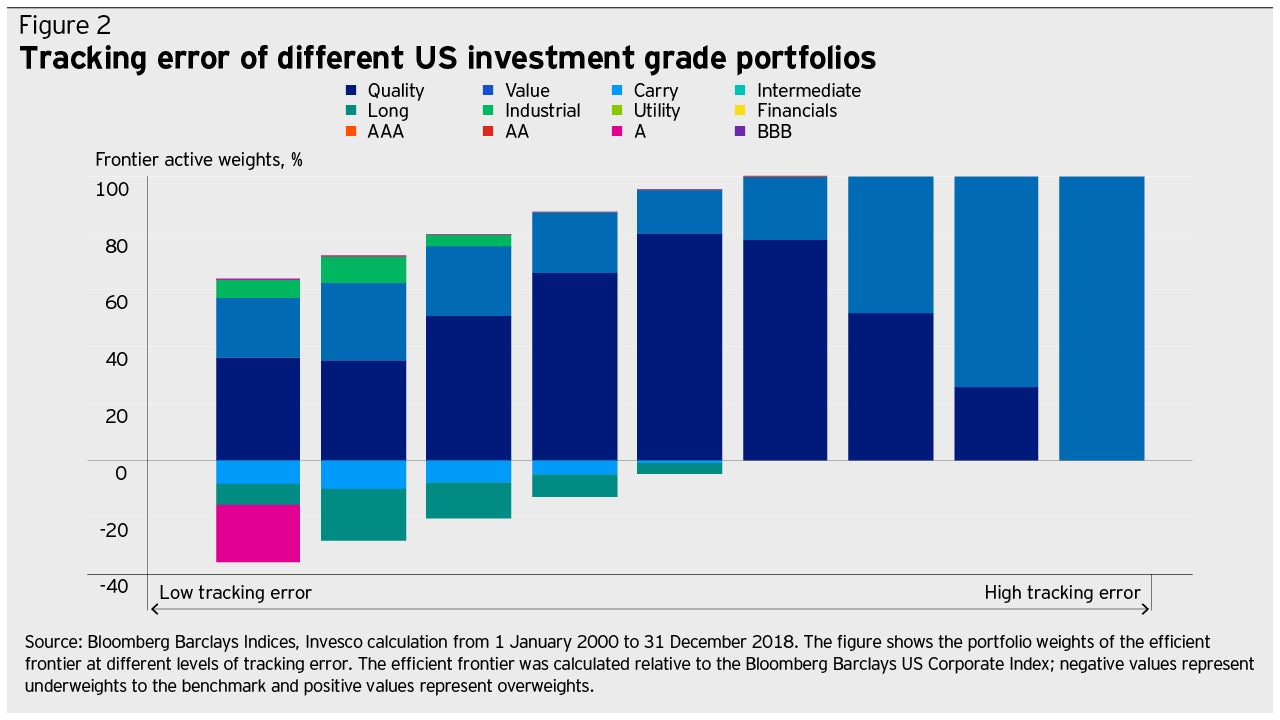

We now take a closer look at a benchmark-centric approach. Table 1 shows the active returns, active risks (skew and expected shortfall) and the information ratio relative to the Bloomberg Barclays US Corporate Index (benchmark) for the factor and traditional portfolios. Figure 2 shows the active weights of the portfolios at the efficient frontier relative to the benchmark. First, we can see that factor weights dominate traditional metrics like maturity, rating and industry, in terms of minimizing risk at different levels of return. Even more surprising, the quality factor is selected for the efficient frontier at almost all levels of risk, except the riskiest. The reason can be found in table 1: while quality has a low expected return against the benchmark, it has positive skew – i.e. a small number of large gains which tend to coincide with large losses in value. This negative correlation to value makes quality generally very useful for investors with low risk budgets.

Figure 2 also shows some non-intuitive results when constructing lower risk portfolios: while value has a high risk-adjusted return, it also has high risk. To achieve relatively low levels of risk in a portfolio while including value, the mean-variance optimization suggests removing long-dated bonds and bonds with high carry exposure since they are riskier and offer only minor diversification benefits relative to their historical returns. Figure 2 shows that value-tilted portfolios would maximize return for investors with large risk budgets.

Figure 3 shows the analogous efficient frontiers with and without factors in the US investment grade, US high yield and emerging markets (EM) hard currency universes. Like investment grade, we use traditional market value weighted indices broken down by maturity, rating and industry for each credit sector. We see a similar pattern across all three sectors, where factor-based portfolios consistently lead to better outcomes at most levels of risk.

2. Can adding a factor element improve the risk- return profile of a multi-credit portfolio?

We now increase the level of complexity and consider multi-sector credit portfolios. Figure 4 shows the efficient frontier that can be achieved by looking across credit sectors using the traditional asset class breakdowns found in typical multi-sector credit (MSC) portfolios.

3. Do fixed income factors make sense in a balanced equity and fixed income allocation?

Finally, we look at how credit factors can complement a balanced portfolio of equities and bonds even when equities already benefit from a factor-based approach. We construct the equity portfolio from MSCI USA factor indices that include value, quality, size, momentum and minimum volatility. We then construct the efficient frontier and plot the associated weights for each asset, aggregating the fixed income factors, the traditional fixed income sectors (US Treasuries, US investment grade corporates and US high yield corporates) and the MSCI equity factor weights (figure 5).

At almost all levels of risk, the most efficient portfolio includes a significant allocation to fixed income factors. It is important to understand that fixed income factors are not subsumed by equity factors. While fixed income and equity factors have some correlation to each other, they are more often diversifying. In addition, it is not surprising that fixed income factors have their highest allocation around the 7% volatility level. This represents the level of risk at which factors can be harvested most efficiently across rating and geography since multiple credit sectors overlap at this risk level. This is another powerful data point suggesting the advantages of a multi-sector and multi-factor portfolio.

4. How can factors complement an existing portfolio without significantly disrupting the existing portfolio?

We consider the case of an investor seeking to improve risk-adjusted returns without major disruption to an existing carry portfolio. As a proxy for a typical investor, we consider the portfolio of the median active bond manager whose active returns have been shown to be primarily driven by carry,3 (this proxy should reasonably approximate a true portfolio). We compute the efficient frontier given an existing, static 75% allocation to investment grade carry. Figure 6 shows that the pure carry portfolio can be improved by allocating along the spectrum to either quality or value with the overall risk varying between the minimum risk portfolio (carry + quality), with an allocation of 25% to quality, and the maximum return portfolio (carry + value), with an allocation of 25% to value.

Case study: US bond managers perform better with factors

While the previous example represented a theoretical problem, we use actual investment manager data here to show how quality and value factors can improve the risk-adjusted performance of carry portfolios.

We construct quality and value-tilted core bond funds which each own securitized and US Treasury allocations with similar weights to the Bloomberg Barclays US Aggregate Index. Credit factors are added at weights similar to credit in the aggregate index – one with most of the allocation to quality and the other with most of the allocation to value. We then create a new portfolio by combining 90% of an existing active manager portfolio with a 10% allocation to one of the factor portfolios. Figure 7 shows that the majority of existing managers’ information ratios are improved with an allocation to one of the two factors, even at the low 10% weight. The result is consistent with figure 5 – i.e. the risk-adjusted returns of carry-based portfolios can be improved with a diverse factor allocation.

Conclusion

By analyzing the addition of factors to four common use cases in fixed income investing, including: (1) using factors to improve on a portfolio diversified across rating, maturity and industries, (2) adding factor exposure to a multi-sector credit allocation, (3) utilizing factors in a balanced stock and bond portfolio and (4) completing or risk-controlling an existing active approach, we show that managed factor exposure can potentially improve results across risk and return objectives. Both academic and practitioner research has shown that investors have a meaningful amount of factor exposure, whether they employ a factor investing strategy or not.4 We believe a natural conclusion is for investors to adopt a more explicit approach to the monitoring and managing of their fixed income factor exposures.

This article was first published in Risk & Reward - Q2 2019. Jay Raol, PhD, is Director of Quantitative Research for Invesco Fixed Income.

^1 Raol, J. and Pope, S. (2018), “Why should investors consider credit factors in fixed income?”, AIAR Vol. 7(3)

^2 For example: Frazzini, Andrea and Pedersen (2014), “Betting Against Beta”, Journal of Financial Economics, 111, 1-25. Low volatility bonds are typically characterized as bonds with short maturities and low default risk.

^3 Raol, J. and Quance, S. (2019), “Active bond funds – powered by factors”, Risk & Reward #1/2019, pp. 4-8.

^4 See also footnote 2 and Ang, Goetzman and Schaefer (2009), “Evaluation of Active Management of the Norwegian Government Pension Fund – Global”.