Foundational concepts for understanding factor investing

Key takeaways

Factor investing is an investment strategy in which securities are chosen based on certain characteristics with the goal of achieving a given investment outcome or to improve long-term risk and return.

Factor investing is based on rigorously studied investment factors — characteristic, quantifiable features of an asset that can be cost-effectively targeted in a diversified portfolio.

Once understood, factor investing stands as a third pillar of investing, complementary to traditional alpha sources and market-weighted indexing with its own use cases, strengths and weaknesses.

Today, factor investing has established itself as third pillar of investing, offering investors a complementary approach to traditional active and pure passive investing.

Factor investing has a well-established and increasingly important role in investors’ portfolios.

Over 70% of institutional investors surveyed in 2018 were using factor strategies and more than 60% were planning to increase their use of them in the following years, according to the Invesco Global Factor Investing Study, which was carried out by NMG Consulting. Increasingly, however, factor-based investing has also become important for private investors and their advisers.

A growing number of investors are seeking a better understanding of the elements that drive returns and reduce risk. Factors can help investors gain this understanding and thus offer better control and transparency. Today, factor investing has established itself as a third pillar of investing, offering investors a complementary approach to traditional active and pure passive investing.

In this article, you will learn what factors are and what role they can play in a portfolio.

Factors as important indicators of risk and return

There are several reasons why factor investing has gained so much importance recently. First, exciting advancements in the study of asset pricing, largely from academia, have shown the huge potential for factor-based strategies to play a major role in diversified portfolios. Second, factor analysis frequently helps explain portfolio behavior in ways that were previously not well understood; even for portfolios that do not utilize a factor approach. Factors help explain risk and return, allowing greater granularity, control and customization. This transition is supported by decades of empirical research and is likely a permanent advancement in how assets are managed.

As explained earlier, factor investing consists in selecting securities based on certain attributes. But what attributes are we referring to? Factor investors focus on features of securities containing material information about their risk and return. There are two major categories: macro factors and style factors.

The macro factors are well-known and intuitive. They relate to the influence that factors such as economic growth and inflation rates have on security prices. Consider inflation for example. Inflation broadly impacts financial and economic environments. Changes in expected inflation impact prices across stocks, bonds, commodities; just about any asset class. Many markets have options to invest directly in inflation factor strategies such as TIPS or linkers.

Recent focus in research and development has increasingly shifted toward style factors. Therefore, when someone talks about factor investing today, they are often referring to style factors, rather than macroeconomic factors. For this reason, the bulk of the following discussion is focused on style factors.

Insight: What is factor investing?

Factor investing identifies characteristics of securities that can be targeted with investable securities and structuring portfolios to either capture or avoid specific factors in a systematic way. A common objective of factor investing within a rulesbased framework is to position the portfolio in an attempt to outperform the market. In addition, factor-based investing can contribute to portfolio diversification or as a risk control mechanism. Finally, factor strategies are used as a cost efficient way to lower overall portfolio costs. Due to the explanatory power of investment factors, factor investing is becoming a strategic, long-term element of many asset allocations. However, it can also be used in a tactical way. Factor investing is currently receiving much attention, but the approach as such isn’t new — its roots can be traced as far back as the 1930s. In the equity area, the most well-known style factors include value, size, momentum, volatility and quality.

The term “factor” is sometimes used to refer to just about any piece of data, but when Invesco talks about factor investing we mean something specific. An investment factor is one we can pursue in a live portfolio based on directly observable characteristics of securities with large scale of assets, to achieve an investment outcome. An investment factor should have a theoretical rationale and empirical support, that is scalable and expressible using tradeable securities. Investment factors should be persistent, pervasive, robust and distinct.

Value, size and volatility

Value

With value strategies, the emphasis is placed on securities that are priced at a discount to other similar securities. The underlying assumption is that, over the long term, purchasing securities at lower prices will lead to higher returns. But how do you determine value? As it turns out, there are many different approaches that yield similar results. The index provider MSCI, for example, uses dividend yield, price-to-earnings ratio (P/E ratio) and price-to-book ratio (P/B ratio) as criteria. Cash flows and net profit are sometimes used as criteria as well. Price-to-book — as well as size — was used in 1992 by the scholars Eugene Fama and Kenneth French to expand the capital asset pricing model to produce the Fama-French three-factor model1. In the fixed income context, value strategies can measure yield relative to credit rating by industry. However, there are also points of criticism. Quite apart from the fact that value strategies aren’t successful in all market phases, there is the considerable concern that innovative companies that don’t pay dividends and have a high price-to-book value are excluded. For this reason, Invesco often prefers cash flow yield as a measure of value in equities.

Size

With size (i. e. small cap) strategies, the focus is on the shares of small companies in the expectation that they will outperform those of large companies. This relationship was first demonstrated in a study by Rolf W. Banz in 19812. Subsequent studies confirmed these results. There are several explanations for the size factor. On the one hand, it is claimed that small companies have better growth prospects than large established companies. On the other hand, analysts focus less on these companies, which therefore tend to be overlooked. It is also said that the shares of small companies are not as liquid as those of their larger counterparts, with investors preferring the shares of large companies. In some markets, the consistency and magnitude of the size factor is tenuous, but it is often observed that other investment factors seem to work quite well across smaller companies, which increases its usefulness.

Volatility

The volatility factor (also known as minimum volatility or minimum variance) implies that shares associated with lower volatility perform better on a risk-adjusted basis than those with higher volatility. The observation was first described in 1972 by Robert Haugen and A. James Heins3. Later studies also found that low-volatility shares outperformed those with high volatility over the long term on a risk-adjusted basis. What might be the rationale to explain this unexpected phenomenon? One possibility is a difference between reality and the realm of academic research. Given a set of assumptions, theory says investors should be indifferent between low and high volatility stocks because of access to leverage. In reality, investors may not be able to access leverage, or the costs of leverage might be higher than assumed in the research. This practical reality could cause investors to be willing to accept less incremental return as volatility increases. On the other hand, the approach is criticized for its poor sector coverage, with low volatility healthcare stocks overrepresented, for example. One note about the low-volatility factor: The most rigorous studies of this phenomenon find results are largely driven by poor returns of highly volatile securities. This result has important implications when considering a low-volatility investment, but details of this finding are beyond the scope of this introduction.

Insight: Equity style factors

Value, size, volatility, quality, and momentum are among the most established factor strategies in equity investing. The objective of the value strategy is to identify securities that are priced at a discount by some measure. Size strategies focus on the shares of small companies, while low-volatility strategies emphasize securities whose prices fluctuate less than those of other securities. Momentum strategies involve the purchase of equities that have recently recorded an above-average performance, while quality strategies search for companies of superior quality. The distinction is made on the basis of quantifiable metrics such as a price-to-earnings and price-tobook ratio, dividend yield or volatility. While some criteria are generally recognized, the approaches can vary in other aspects. In all cases, however, it is a systematic, rulesbased process.

Momentum and quality

Momentum

Within the framework of momentum strategies, the most known factor is price momentum. Securities are purchased if they have performed well recently, and sold if they have performed badly. The outperformers of the recent past are therefore seen as the outperformers of the future4. This factor was “discovered” by Jegadeesh and Titman in 19935. Momentum strategies are usually justified by the findings of behavioral finance, which focuses on known modes of behavior, such as the herd mentality, or anchoring bias for example. More recent studies find that earnings momentum largely subsumes price momentum. Earnings momentum is commonly defined as the trend in earnings surprises or changes in earnings expectations. The rationale for earnings momentum is similar to price momentum, although the finding impacts how the factor is captured in portfolios. Recent research suggests that the momentum factor also persists for bonds, measured by return over a recent period of time.

Quality

The quality factor entails a focus on the shares of high-quality companies because they tend to outperform those of lesser quality. Robert Noxy-Marx demonstrated in 20126 that the shares of highly profitable companies achieve better risk-adjusted performance than less profitable companies. Other criteria that are used to define quality include cash flows and debt ratios, as well as the quality of the management and business model, along with the market environment, and, with fixed income, a high credit rating, low duration, and low historical volatility. However, it is problematic that some elements of quality often can’t be measured, such as the value of a brand or good reputation. Not least, there is the danger that young high-growth companies — which don’t yet have steady earnings — are excluded, as are companies that are highly sensitive to economic trends.

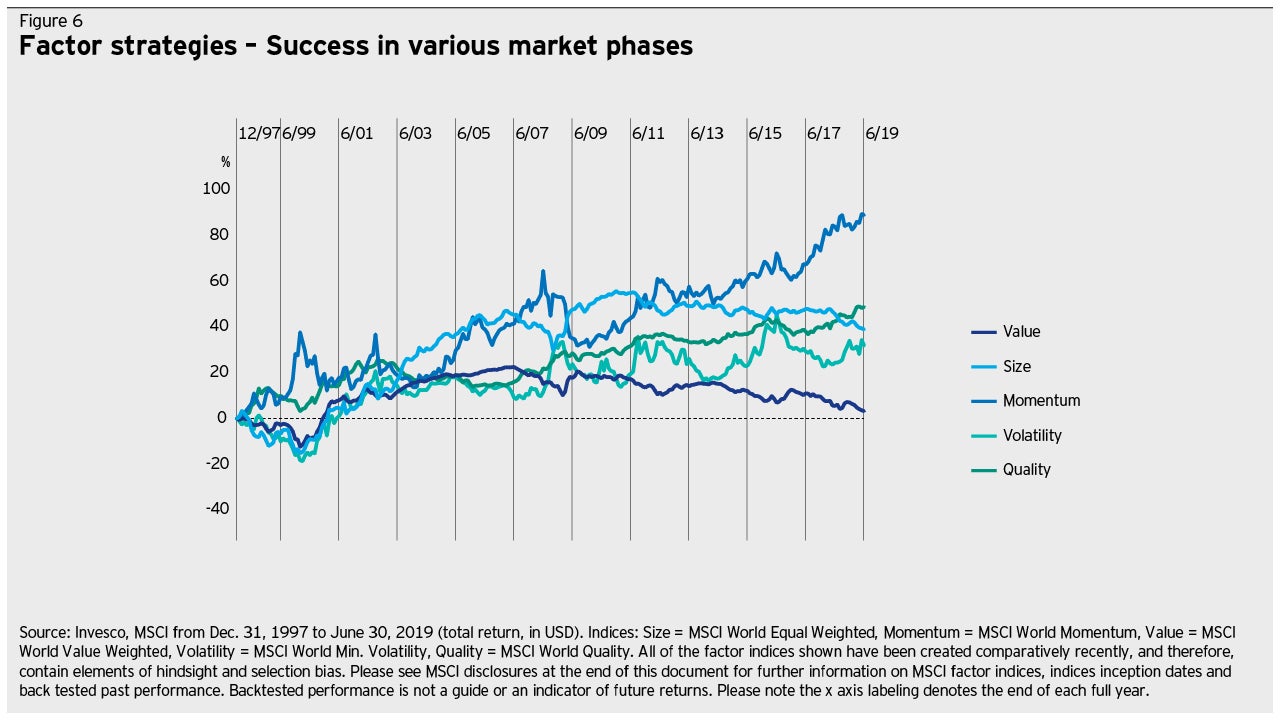

Insight: The crucial issue of weighting according to market capitalization

For global equity investments, the data on the right show that factor investments based on the style factors of value, size, volatility, quality and momentum have generally outperformed the MSCI World Index. In traditional indices, individual equities are allocated to the index portfolio proportional to their market capitalization. This means that — in the MSCI World Index, for example — equities that tend to have high valuations receive a higher weighting than equities with a low valuation. Cap-weighted indices therefore tend to overweight securities whose prices are high relative to their financial characteristics and to underweight those whose prices have fallen. Cap-weighted indices also can be somewhat dominated by large companies, with less exposure to mid-sized and smaller companies compared to a typical factor-based approach.

Factor investing versus stock picking

Professional investors’ special interest in investment factors becomes understandable if the returns on factor-based equity portfoliWhat is the difference between factor investing and traditional stock picking, as it has long been practiced? After all, many traditional fund products have “value” or “size” in their name.

The essential difference is in the security selection process. Stock picking involves leveraging a unique skill or information source to determine which securities are undervalued, and evaluates characteristics of securities based on criteria defined by the investment manager. Factor investing involves a rules-based approach, picking securities that exhibit particular characteristics based on solid and objective rationale drawn from quantitative data and applied using a systematic process. Commonly, stock picking involves deliberately concentrating on the most undervalued securities, while a factor approach maintains broad diversification across securities to reduce security specific risk.s are considered and compared with general market developments. Indeed, factor investing has at times outperformed the market in the long term.

Insight: How to differentiate factor investing

Although traditional stock picking and factor investing often apply similar criteria, there are tangible differences between the two. Traditional fund managers select individual securities that seem attractive due to a multitude of fundamental features. These could be specific features, meaning those that apply only to the individual company — such as changes in management or new patent registrations. However, they could also be features that are assigned to factors such as value and size or to general market factors. It requires rigorous stock specific research, subjective decision making and, to pursue alpha, high stock specific conviction. In contrast to the usual stock-picking strategies, factor strategies consistently view individual securities just as a means of implementation of the factor strategy. Factor investing relies on the rationale for the factor itself to continue to explain returns in the future. If the rationale holds, the factor should continue its usefulness. For these strategies, the crucial issue is how best to define the factors and implement them in live portfolios to achieve the desired outcome net of fees over time. The skill set and process is different even if the desired outcome, outperforming an index for example, is the same.

How the effectiveness of factors can be explained

Empirically speaking, the data of global style factor indices show that factors have generated a better return than the market over the long term. However, investors who make their investment decisions for the future also want to understand the reasons for this phenomenon. This is why the rationale is so important.

Insight: How factors can be explained

There are various approaches to explain the effectiveness of factors. One of them is to attribute factors to risk premiums. According to this approach, investors take on special risks for which they should be rewarded through higher returns (risk premiums). Therefore, the effectiveness of the size factor, for example, can be explained by the fact that the shares of smaller companies with low market capitalization can be harder to sell in falling markets (liquidity premium). Other factors can be explained by the findings of behavioral finance. The momentum effect, for example, can be attributed to herd behavior or to the tendency to only take note of information that conforms with one’s own assessment (confirmation bias). Complex game theory (population games) can explain the drivers of temporary stable trends supporting the momentum factor as well.

Factors: Not always superior

Factors: Not always superiorWhile it can be demonstrated relatively easily that factor investments produce above-average returns over the very long term, large fluctuations and differences in returns are possible in the short and medium term. Different factors display strengths and weaknesses in different economic and market environments, with one factor outperforming in one environment and the other doing better in another environment. Successful predictions (timing) are exceedingly difficult.

The different return patterns of factors during different market phases also offer opportunities. As mentioned before, enhanced diversification is one potential benefit of factor investing. Over the long term, investment factors have captured a premium over market cap-weighted indices. Since factors often perform differently at different points in the economic cycle, factor investing can enhance diversification. Multi factor strategies seek to exploit this benefit within the portfolio while single factor strategies can complement the broader client portfolio.

Insight: When different factors are successful

Factor strategies often perform quite differently in the various phases of the economic cycle. During economic recovery phases characterized by weak or accelerating growth, smaller and more flexible companies (size) tend to perform better, as do value stocks that are already trading at a discount. If growth is strong, but decelerating, quality stocks — i.e. companies with solid balance sheets — score more points. In the second half of the 1990s, for example, value strategies performed badly when technology stocks rallied. Momentum strategies showed their strength in the past five years during a long-running bull market. Quality and low-volatility factor strategies, on the other hand, have worked particularly well during times of crisis. However, active timing of factor investments is very difficult in practice and is not recommended for most private investors. It is very easy to understand the behavior of factors looking back in time when the economic cycle is known. Looking forward, it is much more difficult to predict phases in the economic cycle consistently particularly at or near inflection points. This challenge may be best left to traditional active managers who possess this skill and seek to exploit it through high-conviction security selection.

Factor strategies: active or passive?

Factor strategies that are implemented with rules-based ETFs have recently attracted a lot of attention and have managed to pool significant amounts of investor capital. This can create the impression that factor strategies are always best suited to passive investment products. But a closer look reveals that factor strategies — even as rules-based ETFs — can entail a high level of activity in terms of the steady turnover of securities. For example, the momentum strategy naturally involves changing large portions of the investment portfolio, such as when a steady trend shifts after being effective for a long period of time.

In any case, factor investments aren’t only reserved for passive investment products and ETFs. Quite the opposite, in fact: Active management teams have been using factors for decades to assemble and structure their portfolios — even though these often don’t carry the “factor investing” label. A look at the history of factor research also shows that factors in active management are much older than ETFs.

Insight: The roots of factor investing

The formal foundations for factor investing were laid in the 1960s with the Capital Asset Pricing Model (CAPM) developed by William F. Sharpe, John Lintner and Jan Mossin. It made a distinction between alpha as a measure of excess return compared with a benchmark, and beta as market risk. In the Fama-French three-factor model (1992), developed by Eugene Fama and Kenneth French, the size and value premia were combined with market risk for equities. In 1997, Mark Carhart expanded the model to produce the four-factor model by adding the momentum factor. However, studies on the size and value factors were first conducted in the early 1980s, and the first studies on the low-volatility factor date back as far as 1972. Security Analysis, the famous book by Graham and Dodd, first published in 1934, touches on many of the same concepts at the heart of factors such as value and quality. Therefore, factor strategies have long been used in active fund management as well — just not under the “factor” label or in the systematic way used today.

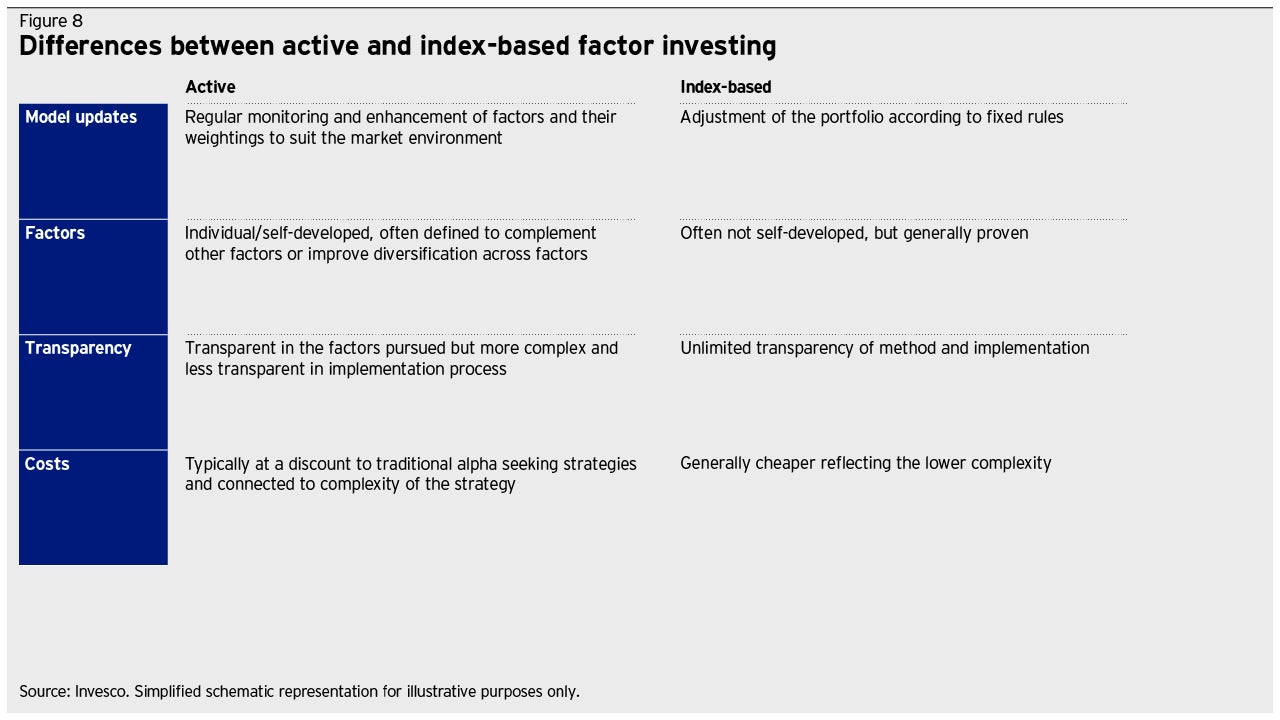

The core differences between active and index-based factor investing

Active quantitative managers typically use self-developed factors or multi-factor models that are constantly monitored and enhanced. The active manager’s work is at the core of the optimization process. As a result, these strategies often lack transparency for investors — except when it comes to the main features and objectives. Index-based products on the other hand are fully transparent, and their rules governing how securities are selected are set once the index has been launched.

Insight: Factor investing through actively management funds versus ETFs

Factor investing can be conducted through actively managed funds and ETFs, both of which have advantages and disadvantages. ETFs commonly carry lower costs7 and may have greater transparency8 of methods and positions and certain tax and liquidity advantages. Actively managed factor strategies can have an advantages through their flexibility; continued research has lead to a number of advancements over time and ongoing study and modification is a valuable element of maintaining best practices in the field. In addition, actively managed funds can pursue a multi-factor approach to assign different weightings to factors, depending on the market environment. The objective is to make better use of the advantages offered by individual factors under particular market conditions and evolve as new breakthroughs occur.

Factor investing in the fixed income area

In the bond area, factor investing is in the earlier stage of adoption, as compared to equities. In recent years, however, many papers have been written by both academics and practitioners. Further, since the rationale at the core of investment factors are not asset class specific, satisfied equity factor investors are increasingly moving on to factor applications with bonds.

When it comes to government and corporate bond indices, the usual weighting of securities based on market capitalization causes special problems — because it means that high weightings are assigned to the most highly indebted countries and companies, respectively. Investors will therefore disproportionately be invested in issuers with the highest debt burden. This will generally be undesirable. Instead, issuers that can pay back their debts should be more in demand.

Furthermore, the indices are often even less balanced than equity indices. For example, many global government bond indices have a strong US and Japan bias, while many corporate bond indices primarily contain bonds from the financial sector.

Today, there are also some promising approaches to apply well-known style factors to fixed income strategies. In very general terms, value can be interpreted as meaning that a financial asset is cheap relative to other bonds by some measure. The application of the quality factor to the bond sector is viewed as particularly promising, as is the size factor by focusing on smaller issuers.

Insight: Factor investing in the fixed income area

Factor investing is becoming more advanced in the fixed income area, as live strategies continue to become more common. Since bonds trade over the counter without central exchanges, and many bond issues don’t trade every day like stocks, identifying valuable insights from bond markets can be harder than in the equities area. In some ways, implementation may be critical and more difficult than in equities. Nevertheless, there are promising approaches that indicate factor investing will become increasingly important in the fixed income area as well. Much of the same rationale that forms the basis of equity factors applies in bonds and much research in this area is ongoing.

Factors in an investor’s portfolio — for good reasons

Now that we have gained a general understanding of factors, the key question is how factor investing is used in investor portfolios and what its objectives are. In general, a strategic portfolio that is diversified according to factors may reduce the risk and enhance the return potential in the long term compared with the broad market. Depending on their individual starting point and investment portfolio, investors may use factor strategies for different reasons.

Some of the key considerations are:

- In a portfolio with traditional market-weighted strategies, index-based factor strategies (frequently referred to as “smart beta” strategies) can offer a cost-efficient means of increasing return potential of the portfolio or used as a tool to balance overall factor exposures.

- Investors with a portfolio consisting of market-weighted strategies may use active quantitative factor strategies to apply customized objectives like ESG to pursue excess return or achieve a more effective risk diversification.

- Investors who have traditionally invested in fundamental active strategies may decide to add factor strategies to increase diversification, smooth allocations, directly target factor premiums or lower total investment costs.

- Investors who already use index-based factor strategies might switch to active factor strategies to achieve more efficient implementation, allow for advancements in techniques or increase effective risk diversification.

In the process, the decision to use factor strategies in a portfolio does not have to be strategically motivated. As the following chart shows, factor strategies can also be used tactically.

Insight: Tactical use is also possible

he objective of factor investing is normally strategic due to the long term nature of investment factors. However, a tactical use of factors is also possible, for example, in order to express a market view. In this way, investors who expect a positive equity market trend to continue can focus on momentum strategies. Other investors, who may expect heavy volatility in equity markets in the future, can hedge their bets with low-volatility strategies instead. Last but not least, factor investing can also be used in a targeted way to reduce portfolio risk – with the objective of giving the investment additional diversification. A note of caution, however; applying factors that have historically delivered a premium in the long term creates an additional hurdle that must be overcome when used tactically. Market trends and economic cycles can change quickly and, sometimes unexpectedly. In order to benefit from tactical applications, investors must know when to get in and when to get out.

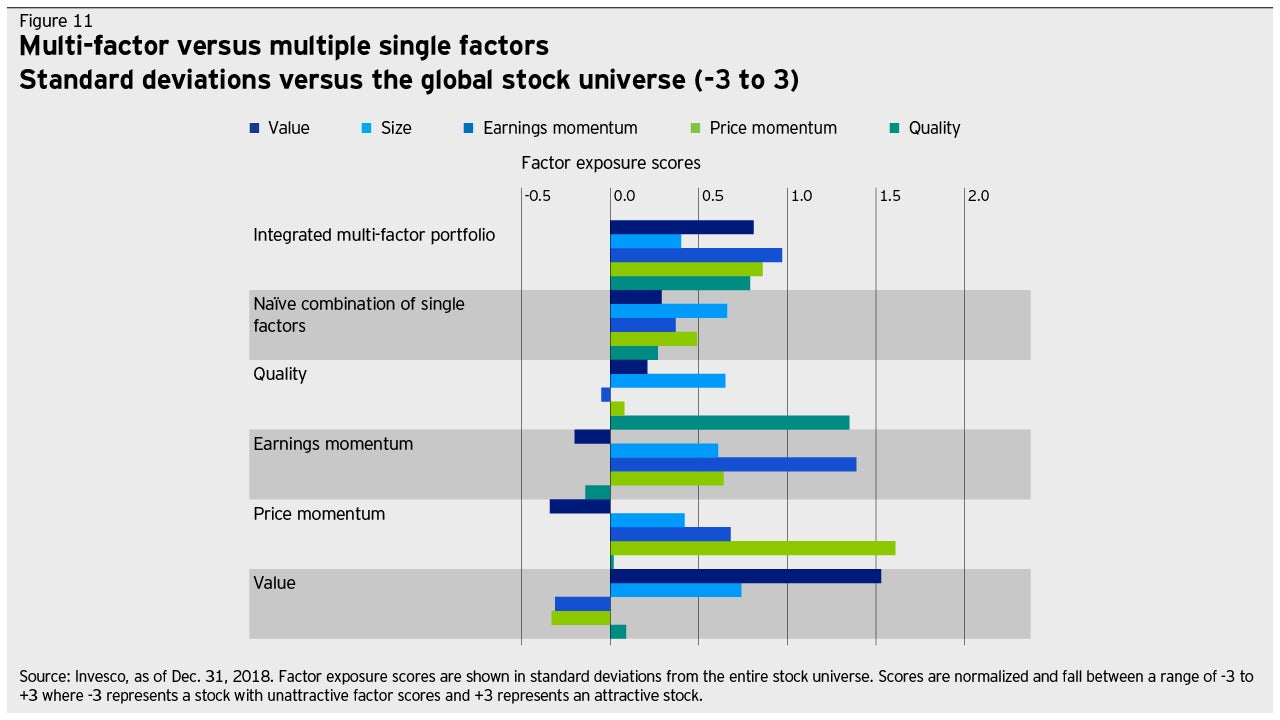

Multi-factor investing: Relevant solutions for different investor needs

The case for multi-factor:

- Single-factor portfolios are not neutral to other factors due to cross-effects between factors

- A holistic approach in constructing multi-factor portfolios results in higher desired factor exposures compared to a naive (equal weighted) allocation of multiple single factors

- Multi-factor construction can lead to improved efficiency of the overall portfolio

Insight: Typical applications of multi-factor investing

The benefits of multi-factor investing are as manifold as the options to combine factor strategies to meet investor needs. Distinct factors offer diversification benefits when combined in a multi-factor strategy. For example, investors seeking to build a core portfolio offering exposure to equities can use a multi-factor approach to obtain a highly robust and consistent investment process with high capacity limits. Another example: Many investors use strategies managed by different managers in their portfolios (for example, by investing in different funds). Adding a multi-factor strategy to such a portfolio can offer particular benefits because of the frequently low correlations between such a strategy and other equity strategies.

Blaise Warren is Chief Operating Officer for Global Factor Investing at Invesco. Stephen Quance is Global Director of Factor Investing at Invesco.

Factor investing at Invesco

^1 Fama, E, and French, K: ‘The Cross-Section of Expected Stock Returns’, Journal of Finance, 1992; Fama, E, and French, K, ‘Common risk factors in the returns on stocks and bonds’, Journal of Financial Economics, 1993.

^2 Rolf W. Banz, Journal of Financial Economics, 1981.

^3 Robert A. Haugen, A. James Heins, Wisconsin working Paper, 1972.

^4 Actual events are difficult to predict and may substantially differ from those assumed. There can be no guarantee that the assumptions discussed will come to pass.

^5 Narasimhan Jegadeesh and Sheridan Titman, Journal of Finance, 1993.

^6 Robert Novy-Marx, Quality Investing; Working Paper, December 2012, revised May 2014.

^7 Since ordinary brokerage commissions apply for each buy and sell transaction, frequent trading activity may increase the cost of ETFs.

^8 ETFs disclose their full portfolio holdings daily.