A Macro Approach for Integrated Portfolio Management

Our Systematic and Factor Investing research team produced a conceptually simple yet practically powerful framework to guide asset and style factor allocation from a macroeconomic perspective. It rests on two commonly utilized concepts in portfolio management: First, economies tend to cycle through good times and bad; and, second, diversification is of high importance. Investors seeking to maximize portfolio returns per unit risk can do so by investing in a combination of assets with imperfect correlations, building on past correlations and/or some estimates of future economic conditions. Both approaches have caveats. Correlations lack stability, especially through major inflection points in markets, and these inflection points are notoriously difficult to identify before they happen. Similarly, future economic conditions are difficult to anticipate, and even then, the response of security markets seems unexpected at times. For these reasons, a technique that improves the ability to determine which investments are diversifying is useful.

To establish a common understanding, a brief foundational review is necessary. Investing involves forgoing immediate consumption for future consumption. Investments that are likely to provide protection during times of economic stress are desirable because investors are more likely to rely on investments to fund consumption at these times. A so-called “rainy day fund” needs to be there when it rains. All else equal, investments that are highly volatile through the cycle are, therefore, less attractive. Whether or not an investor attempts to time economic cycles, there is a utility in better determining an investment’s reaction to fluctuations in the economic cycle.

Factor investing developed alongside these ideas over the past few decades, starting from the single factor Capital Asset Pricing Model (CAPM) in which beta is the only factor. Improving on the CAPM’s ability to describe security returns, additional “style” factors, such as size, value, quality, and momentum, were developed, improving our ability to control portfolio exposures. These style factors build on sensible rationales, explaining how they might be tied systematically to returns ex-ante as well. To the extent that style factors continue to explain security behavior, adoption by the portfolio management industry is likely permanent. Diversification across style factors is a common way to structure portfolios in an effort to improve risk and return payoffs, not unlike the traditional approach of diversification across asset classes and sectors. In fact, the macro factor framework is a more direct way of determining asset allocation than traditional asset class allocation because of the link between economic state variables and macro factor sensitivities.

This background raises an obvious question: What might we gain by integrating these ideas in a comprehensive way? This is the role of our macro factor framework.

Before delving into the details, it helps to explicitly state key objectives. First, we seek a framework that is useful both at the portfolio level, for asset allocation and analysis, and at the component level, transcending asset classes, investment styles, and economic regimes. Second, the framework should be simple and transparent, so the benefits are achievable despite frictions like trading costs and liquidity constraints. Finally, it should be systematic and scalable such that it remains effective over time, even if widely adopted.

Selection of Macro Factors

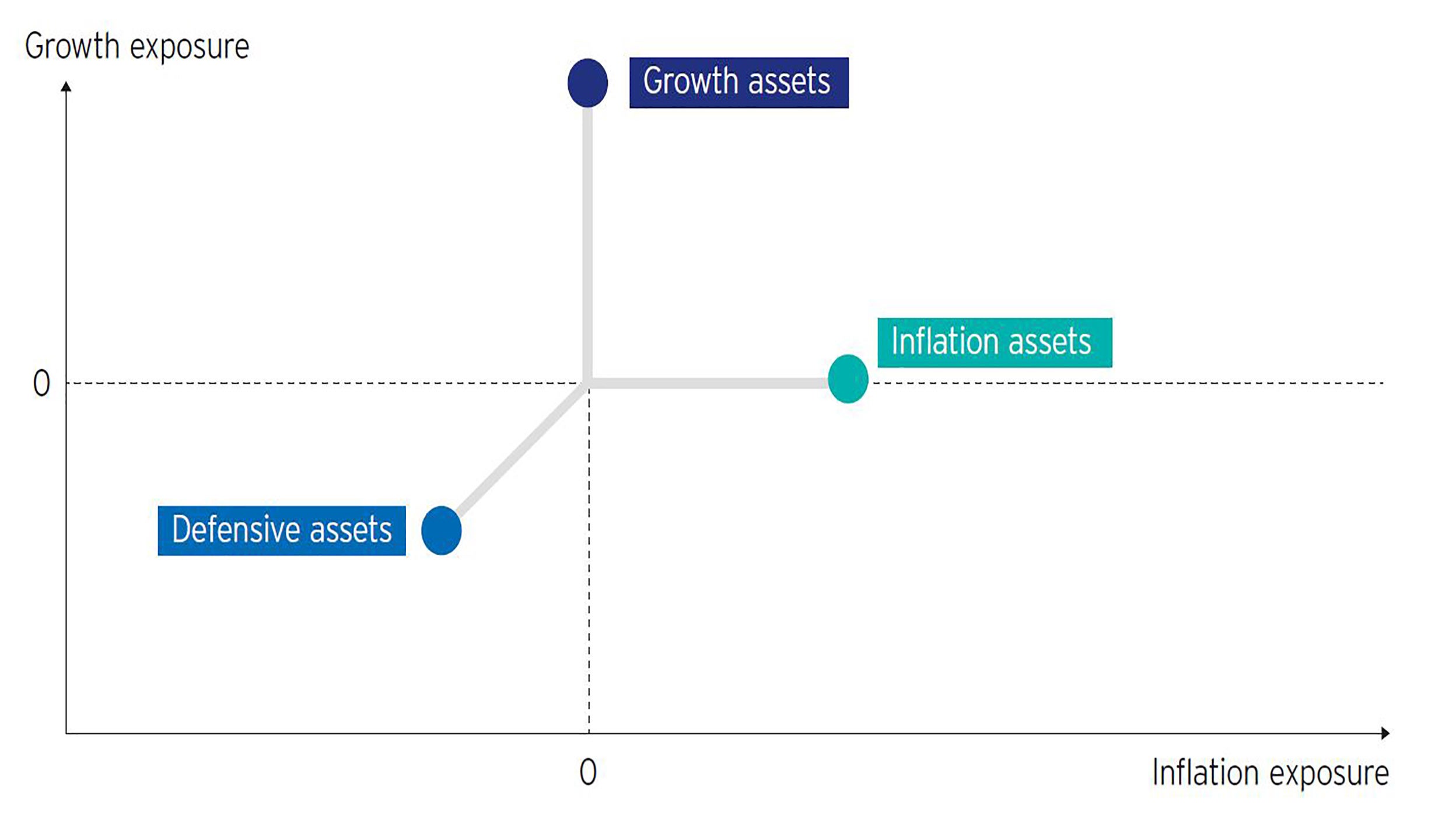

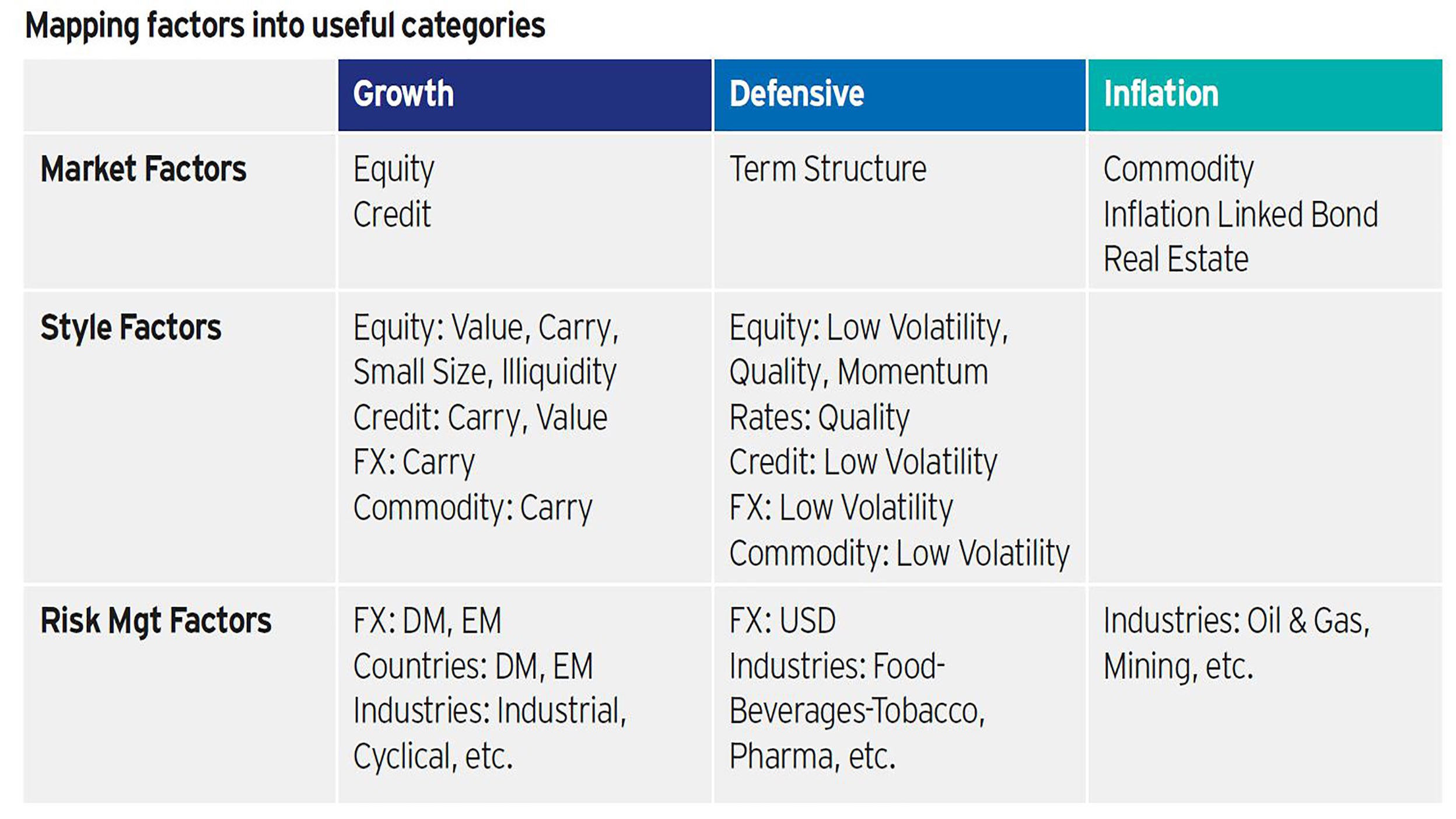

Growth and inflation are two salient macro-level factors and for good reason. Both economic variables relate to core concerns to investors, future expected cash flows and the discount rate (riskiness) of those expected cash flows. Positive growth (expansion) increases potential future cash flows, and negative growth (recession) puts those potential cash flows at risk. Similarly, greater inflation decreases the future value of potential cash flows, reducing its present value all else held constant. Besides growth and inflation, one may wonder which additional variables to add. If the objective is to capture as much of the security price behavior as possible, one may need to add a lot more variables. However, recalling our two foundational concepts above, diversification and economic cyclicality, the most practical next macro factor to add is one that does well when growth and/or inflation do poorly: A defensive factor. A defensive factor represents the most efficient way to diversify our first two macro factors, as visualized in Figure 1. Not only will it effectively diversify exposure to growth and inflation, but it will intuitively connect to the economic cycle. When growth is low or negative and inflation is increasing, our defensive factor can be the hedge buffering losses. These three macro factors are further supported by objective statistical evidence. For instance, a principal component analysis of broad asset classes’ returns affirms the relevance of growth, inflation, and defensiveness, building confidence in the robustness of our analysis.

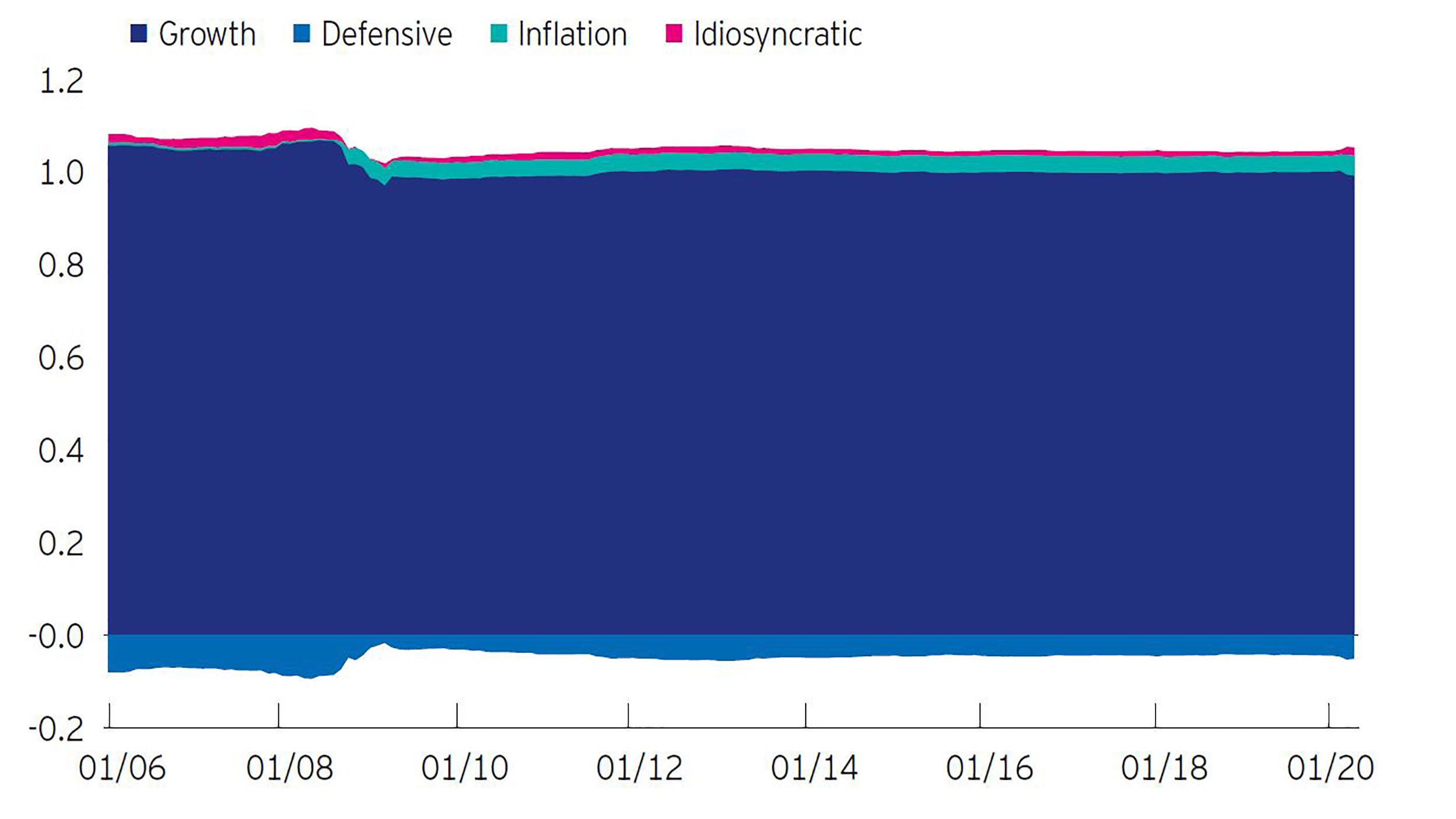

This framework has comprehensive portfolio management applications. A basic market-weighted portfolio of 60% world equities and 40% bonds shows that the growth macro factor has dominated portfolio volatility over the last 15 years through 2020. The result is obvious in hindsight, as we know this period was one of low or falling inflation, multiple periods of unprecedented fiscal and monetary intervention, and generally positive economic growth. The 60% equity allocation is represented by the MSCI ACWI index, and the 40% bond allocation splits into 30% Bloomberg Barclays US Agg Corporate and 10% Bloomberg Barclays US corporate High Yield. From a risk management perspective, more than 90% of total volatility stems from the growth macro factor. Whether the next 15 years will be similar or not, it is prudent to consider other states of the world. With our framework, we can expand our planning to consider all the iterations of growth and inflationary environments, as well as a vast array of investment options beyond the market-weighted 60/40 portfolio. We can think about sub-geographies, sectors, style factors like value, quality and momentum, as well as other asset classes like real estate or commodities: Knowing its sensitivity to the three macro factors will tell us how it might perform in different macroeconomic environments and how it may or may not diversify the rest of the portfolio.

Macro Factor Framework Use Cases

Asset Allocation

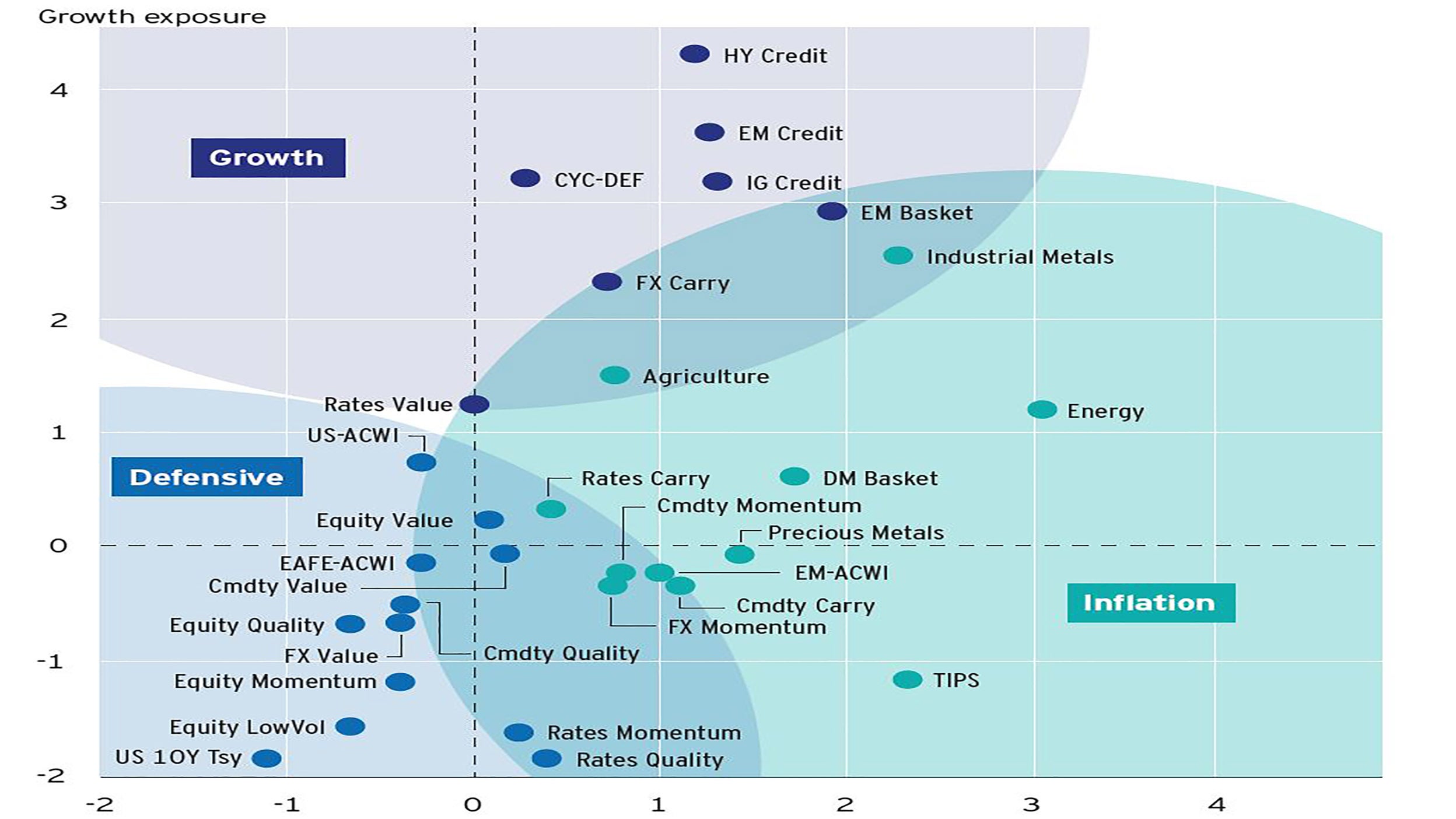

By connecting investment options directly to economic state variables and stages of the economic cycle, we can assess asset allocation more granularly and consider the full ramifications of each decision in the portfolio. Within equities, for instance, we can be more defensive by tilting toward quality or low volatility stocks. At the same time, we recognize this may increase the portfolio’s sensitivity to inflation shocks. There is concrete evidence helping us think about credit bonds very differently from government bonds, the former offering significant growth exposure while the latter being quite defensive. So, while traditional asset class allocations are still relevant, information about macro factor exposures can help refine allocations across and within asset classes and better plan for macroeconomic shocks. Figure 2 details the outcome from the research paper by plotting an array of asset classes, style factors and investment options across their sensitivity to each of the primary macro factors during the study period.1

Given each piece of a total portfolio allocation may involve unique elements, we can modulate various pieces to better position the whole. By bucketing investment options among the macro factors, building a portfolio well-diversified across the stages of the investment cycle, regardless of asset class, is straightforward.

Strategy Selection

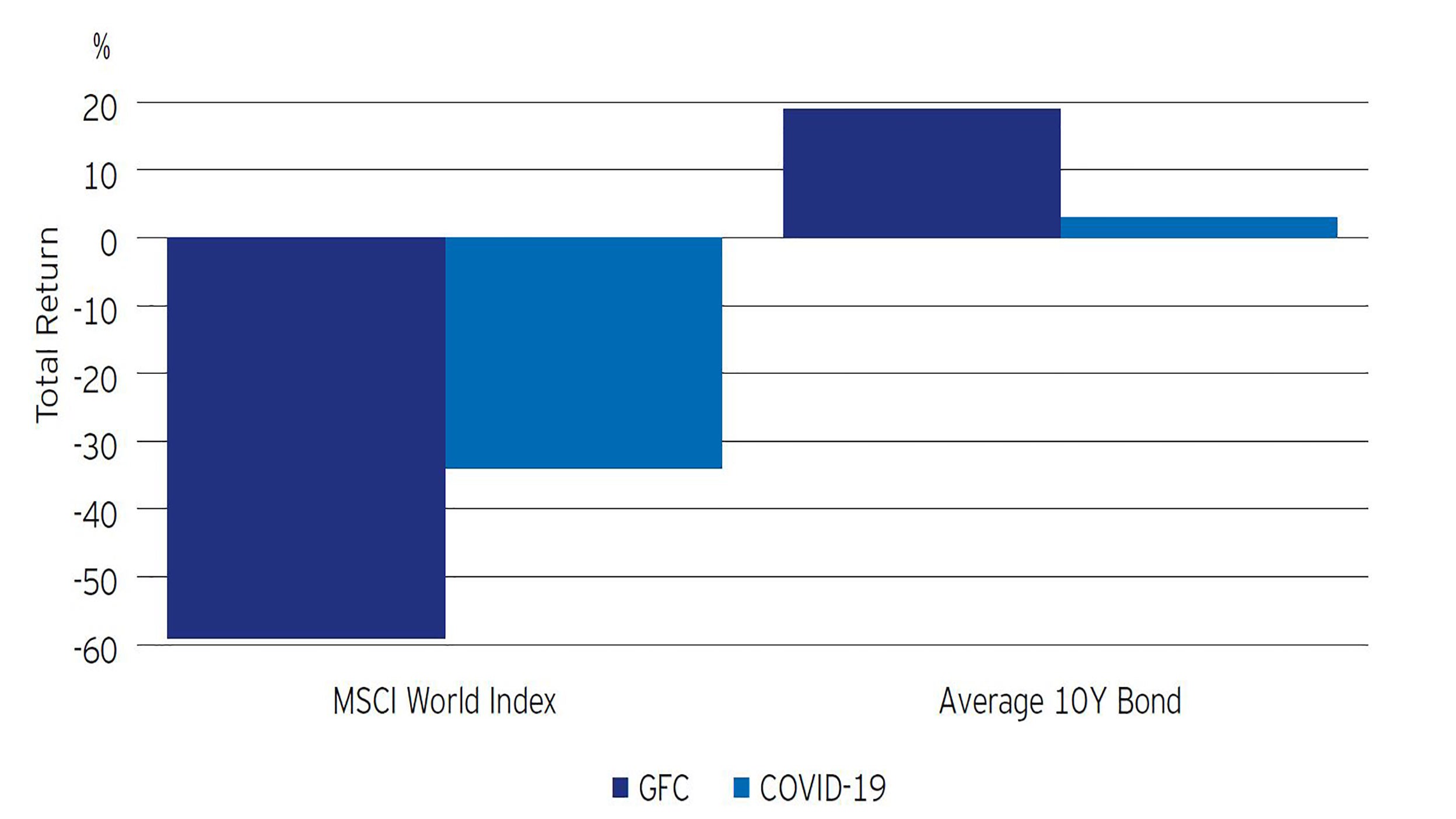

Organizing assets as outlined above helps us know when to change investments that no longer fit their objectives. Consider government bonds. Historically, government bonds have played a valuable defensive role in portfolios, counterbalancing declines in equities with price increases on top of interest income. Yields on government bonds have fallen for much of the past 40 years. Prices are so high that trillions in government debt obligations trade at negative yields. Looking forward in such an environment, can we still expect government bonds to provide the defensive characteristics they have had over the last few decades? We think not. In fact, if we compare the reaction of government bonds during the COVID-19-driven market volatility in Q1 2020 to the market movement of the global financial crises, we see evidence that fits the intuition (see Figure 3). Stretching for yield into credit bonds increases the portfolio’s exposure to growth, making this option a risky one. There are no easy answers, but we have a sensible perspective to think about other options, some of which would entail quite material changes in allocation. For a detailed explanation of a proactive measures that can be taken, see “Portfolio Defense and Low Bond Yields.”2

Tactical Overlay

All else equal, greater granularity and control are even more valuable for tactical applications than strategic ones because of the higher turnover and trading costs involved. Tactical overlays that seek to benefit by anticipating the economic cycle are a well-known investing technique. This macro framework offers nothing new about predicting economic shocks. But tactical applications very often suffer from the same issues mentioned above. They may move tactically between less granular investment options like asset classes or sectors. We understand from the framework that diversifying between stocks and bonds may not be particularly efficient. Very low yielding government bonds may not provide the risk mitigation they did when interest rates were higher and credit bonds are sensitive to the growth factor like equities. Tactical moves may also inadvertently increase risk exposure in one macro factor by shifting exposure to another macro factor without considering the totality of effects to the portfolio across each major macro factor. Choices between using TIPS or commodities as an inflation hedge have a quite different impact to growth exposure. Comprehensive consideration across each macro factor likely increases overall effectiveness of tactical overlays, especially if improved efficiency leads to reduced turnover. The incremental nature of this macro framework may mean it is compatible with existing tactical processes even though the challenge of successful timing remains. There are numerous approaches to tactical overlays requiring case-by-case analysis to determine whether this macro framework would improve outcomes or not.

Conclusion

The new elements of this enhanced macroeconomic framework are clearly evolutionary rather than revolutionary. We have volumes of research about the connection between economic cycles and asset performance. But we can always do better. For some investors, a sense of complacency may have set in over the past 10-15 years. Many portfolios are built around asset classes only. Components of portfolios are selected with an asset class allocation already determined or without consideration of the multiple ways each component may impact the rest of the portfolio. Factor strategies are likewise often designed as stand-alone strategies without broader consideration of the portfolio level impact. This macro framework offers more granularity and greater control by combining asset classes, investment factors, sectors, etc., into a holistic model. It offers a systematic method to break macroeconomics down beyond and within asset classes, offering greater clarity to risks embedded in each.

With fixed income markets more expensive than ever and some equity valuations pushing into the realm of fantasy, we think it is prudent to consider how the next cycle might differ from the last. We see the utility in a macro framework that breaks down arbitrary asset class boundaries and looks holistically at the portfolio and its sensitivity to shocks across growth and inflation possibilities. An analysis of the portfolio with this perspective may be enlightening, and the actionable options that result could be critical in preventing an undesirable outcome. It’s during shocks that we truly learn how diversified the portfolio is and how prepared we are for the turn of the cycle.

^1 See “Investing through a macro factor lens.” Risk & Reward #04. 4th Issue 2020 pp.28-35.

^2 “Portfolio Defense and Low Bond Yields.” Invesco Global Asset Allocation Team. Invesco White Paper Series. November 2020.