What's next for AI, US tech innovation and thematic ETFs?

Key takeaways

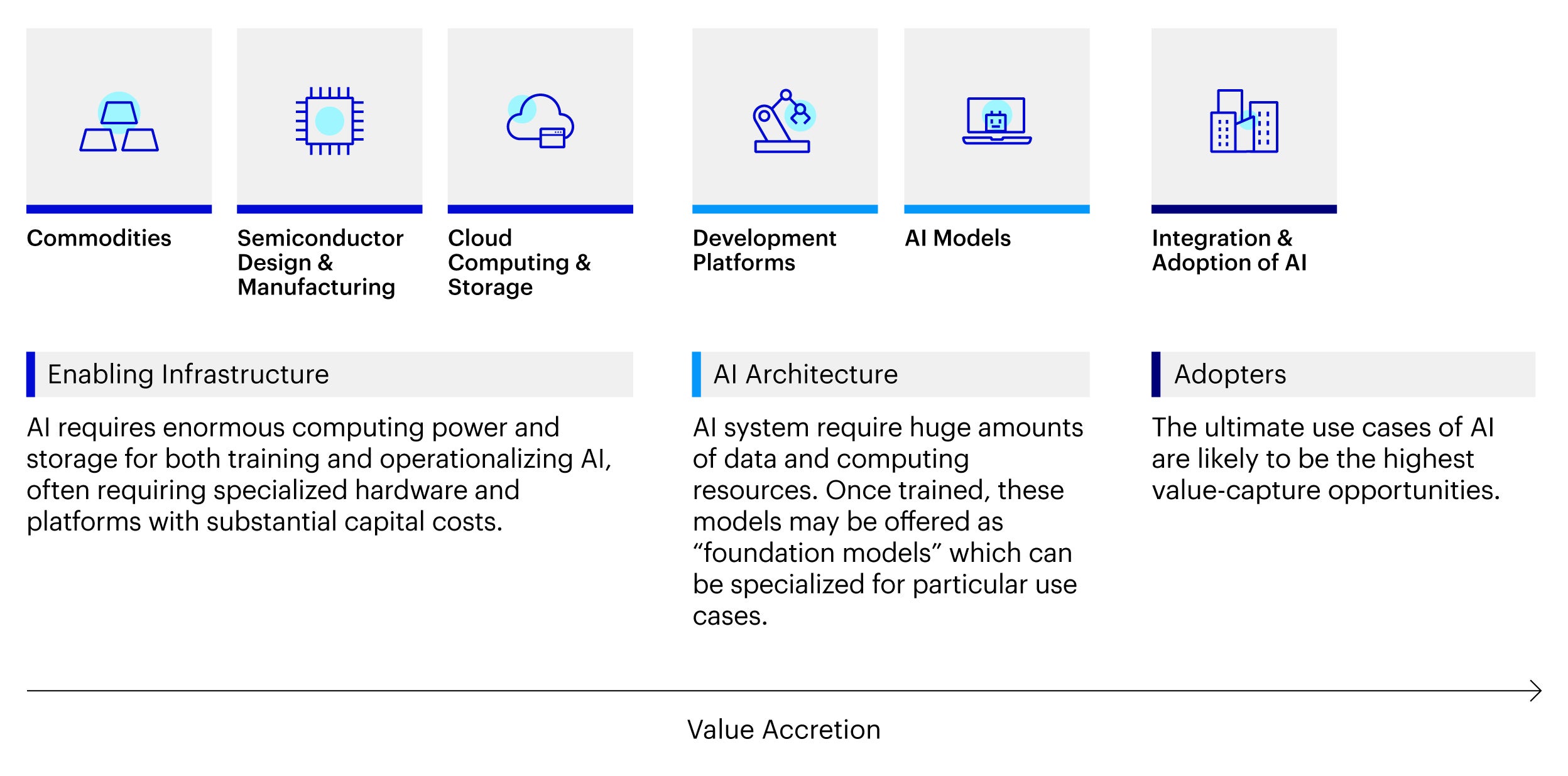

We are currently in the wake of an AI era and believe the main drivers of this market are in the enabling infrastructure and architecture components.

Natural language processing (NLP), machine learning (ML) and other sophisticated AI technologies have contributed to the construction of thematic ETFs.

Apart from using AI in index construction, we are positive on this investment theme as AI is incorporated into companies’ products, services and business activities.

Artificial intelligence (AI) is an investment theme with legs

We are currently in the wake of an AI era and believe the AI investment theme has a multi-year tail and much more room to run. AI is expected to lead to substantial improvements in total factor productivity gains globally, although the timing and impact could vary from country to country.

The main drivers of this thematic market are in the enabling infrastructure and AI architecture components. We believe that these sectors will continue to be catalysts of the AI market across both developed and emerging market economies in the near term.

The US stock market has been concentrated with mega cap AI winners recently and we believe there is more room for these companies to grow as they have plenty of cash to fund new opportunities. Despite the speculation of a potential tech bubble with the largest US tech stocks surging to record levels in recent years, we believe such a scenario is unlikely, at least in the short-term.

While the US tech sector is hot, the Magnificent 7 group of companies currently trade at a P/E ratio of nearly 40x, half of that of the Four Horsemen (Dell, Microsoft, Intel, Cisco) which traded at more than 80x trailing earnings during the peak of the 2000s Dot-com bubble.1 The top six companies by market capitalization during the Dot-com bubble traded at 64x P/E at their peak.2

Over the next few years, we expect cash flows to flip for AI companies, from outflows or spending on AI infrastructure to inflows or selling AI cloud products and services to the majority of publicly traded companies.

AI’s role in the construction of thematic ETFs

AI has already made an important contribution to investing by aiding in the construction of thematic ETFs. Thematic investments were once almost exclusively the domain of actively managed funds, but increased investor demand has seen passively managed ETFs tracking new thematic indices gain popularity. As of late 2024, there were more than 200 thematic ETFs available in Europe with combined assets of more than $50 billion.3

The biggest difference between thematic and sector ETFs is that sector ETFs group companies together by specific fields of business activity, while thematic ETFs seek to identify companies that are involved in a specific theme or global trend irrespective of their economic sector. A theme is often associated with disruptive technologies, such as clean energy, blockchain, robotics or other technological innovations.

As thematic ETFs follow indices designed to select stocks based on characteristics other than sector classification, an index provider needs an efficient way to screen the universe of stocks for those meeting the theme’s definition.

Natural language processing (NLP), machine learning (ML) and other sophisticated AI technologies can be used to quickly and objectively search through thousands or potentially millions of corporate documents and communications to flag occurrences of relevant key words and phrases to identify potential candidates for inclusion in that theme.

The use of these technologies offers a powerful complement to more traditional subject-matter-led approaches to identifying thematic exposures and some strategies look to combine both.

AI as a thematic investing opportunity

The use of AI in index construction is just one example of the potential this technology has. Experts expect there to be examples of companies in most industries incorporating some form of AI into their products, services and business activities in the short to medium term. This enormous growth potential means that AI is an exemplary case study of what makes a good investment theme.

Source: Invesco, for illustrative purposes only.

AI-enabled applications are predicted to contribute potentially US$15.7 trillion to the global economy by 2030.4 The largest part of this market is expected to be NLP followed by ML, with other potential growth areas including AI-enabled robotics and automation, and generative AI. Demand is being driven by the desire for greater efficiency and productivity from data-intensive devices that are such a critical part of our daily lives.

The concepts underpinning today’s AI date back to at least the 1950s, when scientists, mathematicians and even the Hollywood industry envisioned the potential for machines to formulate ideas. However, AI began taking shape in the ‘90s and has gathered pace more recently with more scalable applications. Nvidia dominates the specialist chip market that is fundamental to the growth in AI-enabled applications, but the broader AI space includes more than enough diversity to construct indices, from broad to more specifically focused exposures.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Securities mentioned above are for illustrative purpose only. It does not represent a recommendation to buy/hold/ sell the securities. It must not be seen as investment advice.