Understanding ETF trading and liquidity: Best practices for trading ETFs

Key takeaways

ETFs have democratized the investment process, ensuring similar costs for both retail and institutional investors from investment to sale, driven by increased transparency, competition, and innovation.

ETFs are typically traded either on-exchange or over the counter (OTC), each with its own pros and cons.

Accounting for the pros and cons of these two distinct execution methods, we outline what we believe are seven best practices for ETF trading.

Introduction

This is the third edition of our blog series on understanding ETF trading and liquidity. In the first edition we covered the basics of ETF trading and liquidity including the fact that fair market value can be derived from the underlying basket of securities the ETF is tracking. In the second edition, we assessed premiums and discounts and how investors should be aware of how the ETF arbitrage mechanism works and the various dynamics of ETF pricing. This piece looks at ETF investment implementation, the benefits and pitfalls of different execution methods, and what we believe are the best practices for ETF trading.

ETF investment implementation

Over time, ETFs have significantly democratized the investment process, ensuring that both retail and institutional investors face similar costs from the point of investment to the decision to sell. This democratization has been driven by increased transparency, heightened industry competition, and continuous structural innovation. As ETFs have grown in popularity, the cost associated with holding period or tracking differences has notably decreased. Tracking difference, which measures how closely an ETF follows its benchmark index, has improved due to some factors such as lower fees and more efficient fund management practices.

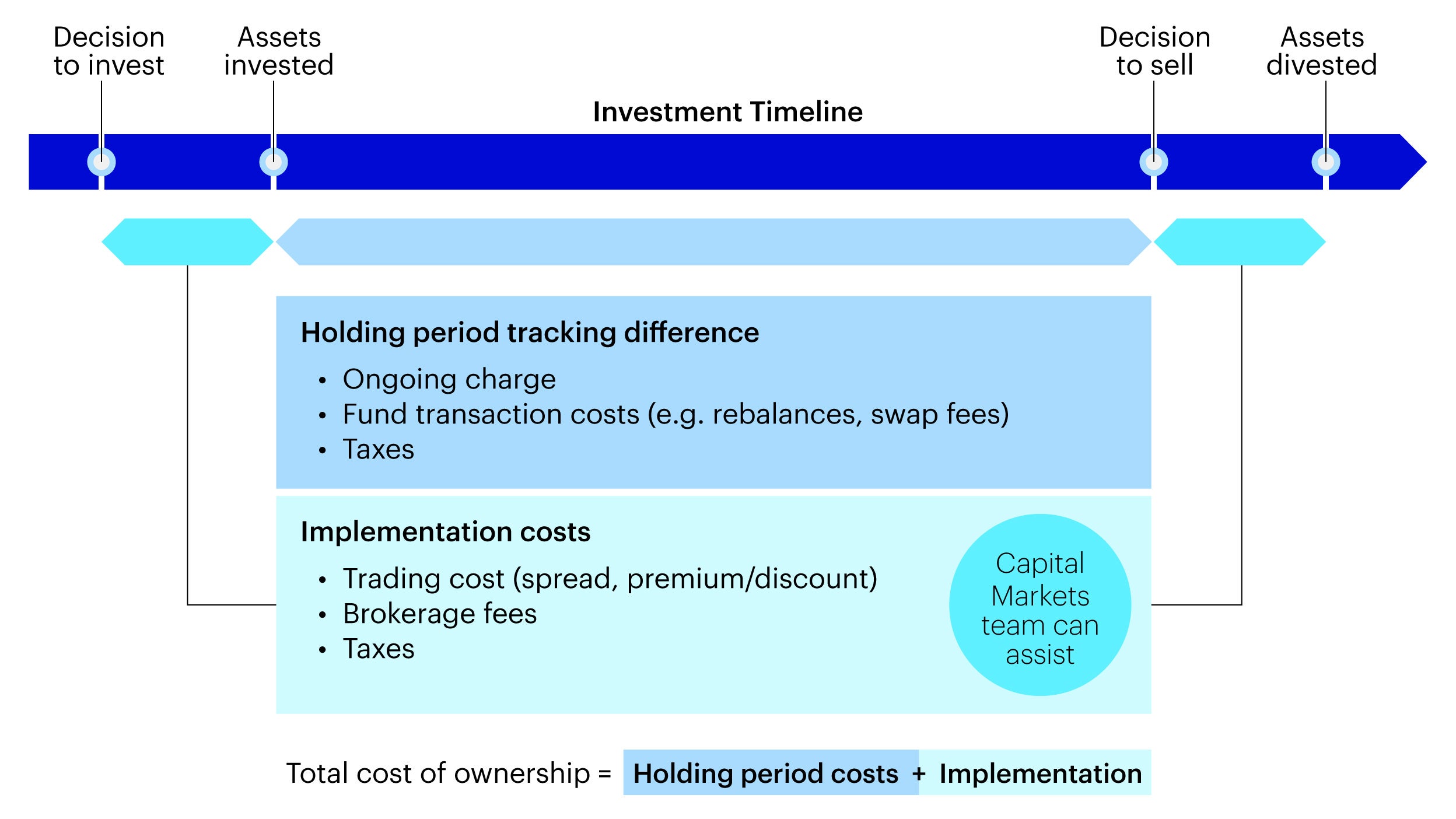

While most investors focus on analyzing holding period costs and tracking difference, the primary distinction between retail and institutional investors lies in their access to and the costs associated with buying and selling the ETFs (implementation costs). Institutional investors often benefit from lower transaction costs and better access to liquidity (due to larger trade volumes and direct relationships with liquidity providers), whereas retail investors may face higher costs and less favorable execution. This disparity highlights the importance of understanding both the holding period performance and the implementation costs when trading these investment vehicles (Figure 1).

Source: Invesco, for illustrative purposes only.

On-exchange and over-the-counter order types

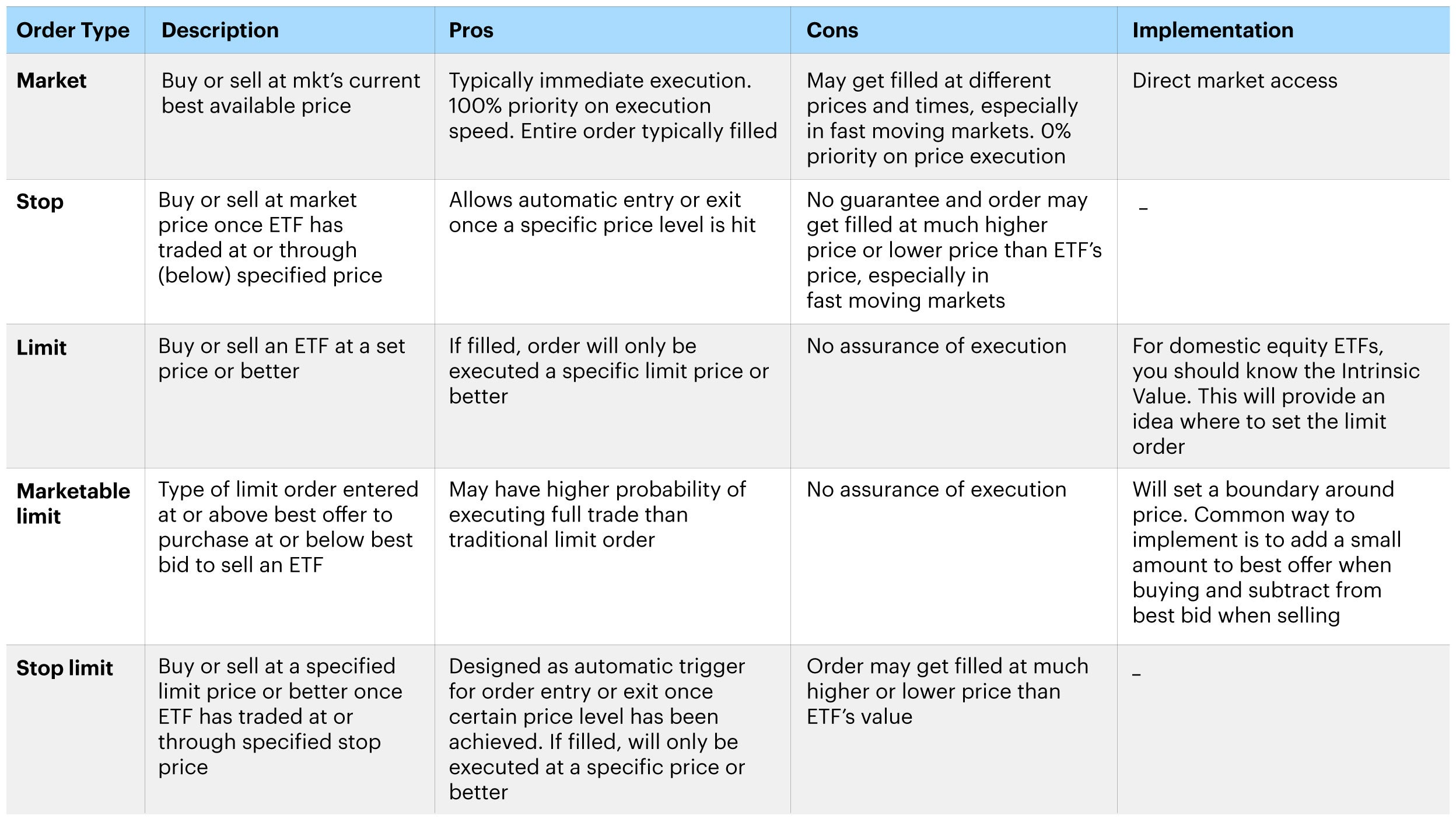

ETFs are typically traded either on-exchange or over the counter (OTC). On-exchange trading involves buying or selling ETFs through a stock exchange, where transactions are executed at market prices. The below table outlines the order types for on-exchange ETF trading and the associated pros and cons (Figure 2). The primary advantage of on-exchange trading is its transparency and liquidity, as prices are publicly available, and trades can be executed quickly. However, on-exchange trading can be subject to higher volatility and wider bid-ask spreads, particularly during market open and close.

Source: Invesco, for illustrative purposes only.

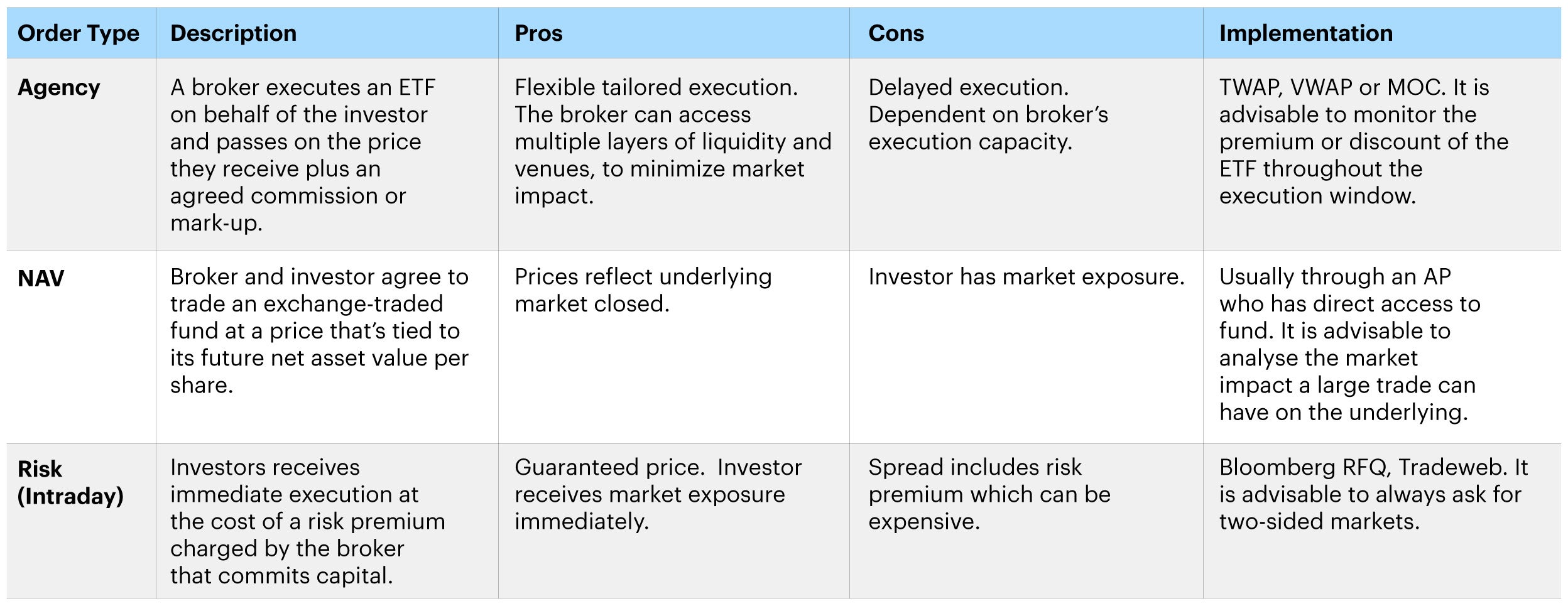

OTC trading, on the other hand, involves direct transactions between buyers and sellers, often facilitated by brokers. OTC trades can offer more flexibility and potentially better pricing, as they are not subject to the same market fluctuations as on-exchange trades. However, OTC trading can lack transparency and may involve higher transaction costs due to broker fees. The below table outlines the order types for OTC trading and the associated pros and cons (Figure 3).

Source: Invesco, for illustrative purposes only. Note: TWAP - Time-Weighted Average Price, VWAP - Volume-Weighted Average Price, MOC - Market On Close. Bloomberg RFQ and Tradeweb are global trading platforms supporting ETF trading.

Best practices of ETF trading

Accounting for the pros and cons of the two distinct execution methods, we outline seven best practices for ETF trading:

1. Use limit orders

When trading ETFs on exchange, using limit orders is crucial. A limit order allows you to set the maximum price you're willing to pay for a buy order or the minimum price you're willing to accept for a sell order. This helps prevent unfavorable trade executions that can occur with market orders, particularly in less traded ETFs.

2. Avoid trading at market open or close

Bid/ask spreads tend to be wider at market open and close due to lower liquidity and price discovery challenges. It's advisable to trade ETFs during regular market hours when spreads are narrower, and liquidity is higher.

3. Monitor market conditions

Keep an eye on market conditions, earnings reports, economic releases, and other events that may impact ETF prices.

4. Understand ETF liquidity

An ETF's average daily volume is not the only indicator of liquidity. Consider the bid/ask spread and the liquidity of the underlying securities. Differences in trading hours for an ETF's underlying assets can also affect its liquidity.

5. Have a diverse set of counterparties/liquidity providers

ETFs can trade differently based on their underlying asset class. If trading OTC, counterparties with expertise in specific types of ETFs can provide valuable insights and a better trading experience. Reach out to an ETF's capital markets teams for referrals to liquidity providers that specialize in the ETFs in question.

6. Be mindful of costs

While ETFs are generally cost-efficient, trading costs can add up. Pay attention to transaction fees, bid/ask spreads, and other costs associated with trading ETFs. Using limit orders and trading during optimal times can help minimize these costs.

7. Stay informed

Continuous learning and staying updated on market trends and ETF developments are essential. Utilize resources like financial news, market analysis, and expert opinions to make informed trading decisions. An ETF issuer’s capital markets team can be a great place to start.

Conclusion

ETF trading offers a range of execution methods, each with its own benefits and pitfalls. On-exchange trading provides transparency and liquidity, while OTC trading offers flexibility and potentially better pricing. By understanding the pros and cons of different order types and adhering to best practices, investors can optimize their ETF trading strategies and minimize costs. Continuous learning and staying informed about market trends are essential for successful ETF trading. As the ETF market evolves, we believe investors need to adapt their strategies to navigate these complexities and maximize their investment outcomes.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.