Rethinking alpha opportunities in China A shares using ETFs

Global investors are increasingly allocating to China A shares, yet many are still underweight China as part of their portfolios. If we take the MSCI All Country World Index as a reference point, an allocation to China A shares would represent 3.34% of a global equity portfolio1; however, taking a GDP approach, where China is the world’s second largest economy, would suggest an allocation of closer to 20% is required2. Earlier this year we saw China’s reopening after nearly three years of Covid-related restrictions, prompting investors to rethink their China A allocations.

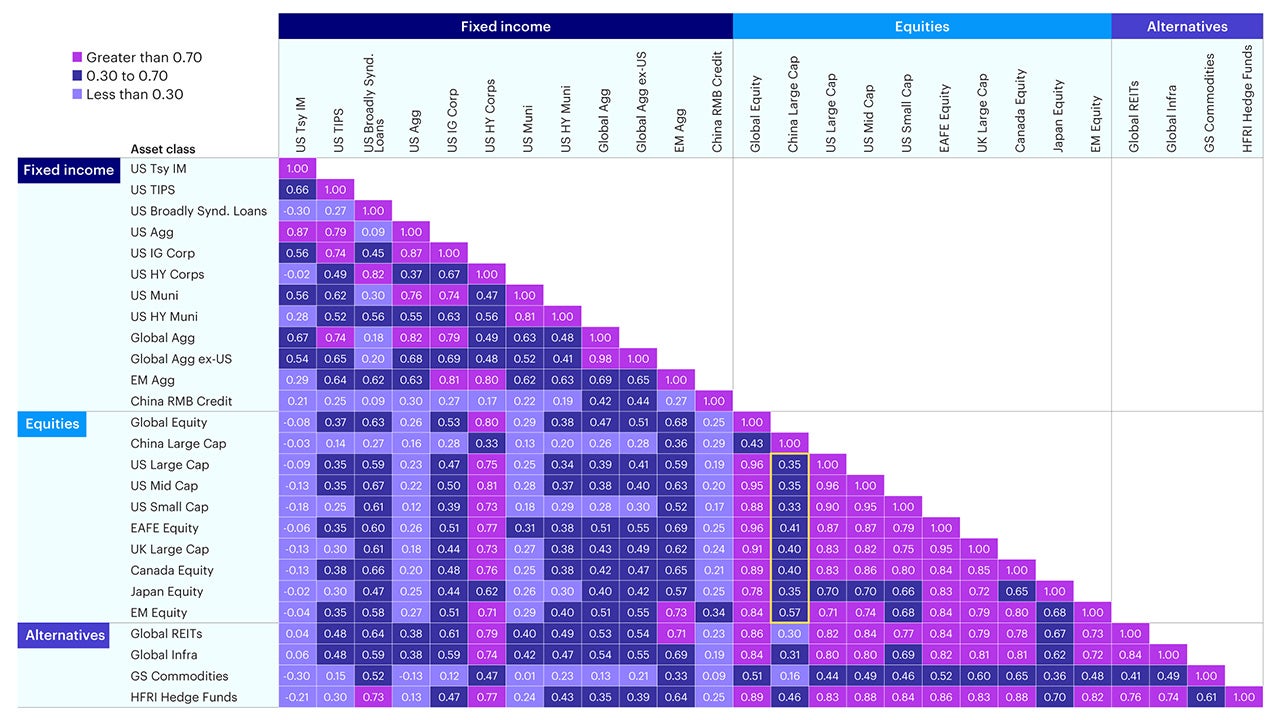

Large-cap China A shares are obvious portfolio diversifiers with average correlations to developed market equities of 0.37 and with emerging market equities of 0.573. Further, due to the high retail participation and momentum driven nature of the China A share market, it’s a segment of the market that lends itself well to investors seeking alpha opportunities (returns generated through manager skill above average returns achieved by index benchmarks, which are easily accessed via low cost ETFs).

Source: 2023 Long-Term Capital Market Assumptions – Q1 Update. Estimates as of December 31, 2022. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions. These estimates reflect the views of Invesco Investment Solutions, the views of other investment teams at Invesco may differ from those presented here.

Alpha can be generated in a variety of ways, the most common of which being outsourcing a portion of a portfolio’s capital to active managers. These managers will typically take either a concentrated stock picking approach, selecting companies based on favourable balance sheet fundamentals; or, through taking a slower moving systematic, or signals based, active management approach.

Thanks to the unique and ongoing structural dislocation in the China A-shares market, China A-share index performance can be enhanced through synthetic ETFs. This offers investors an additional avenue to generate outperformance in their China A share portfolio sleeves.

Since March 2018, this enhancement has equated to an average of 2.7% p.a. implied outperformance over the China A large-cap index and to 4.7% over the China A mid-cap index4.

This enables investors to rethink alpha opportunities. They can complement their existing active managers with synthetic, indexed China A ETFs, accessing different sources of enhanced returns. Not all active managers are the same and true skill is hard to come by. Where two managers are delivering genuine alpha, it’s likely these sources of alpha will be different and deliver diversification to the portfolio. Similarly, outperformance delivered by synthetic, indexed China A ETFs is another differentiated source of enhanced return and introduces further diversification into portfolios.

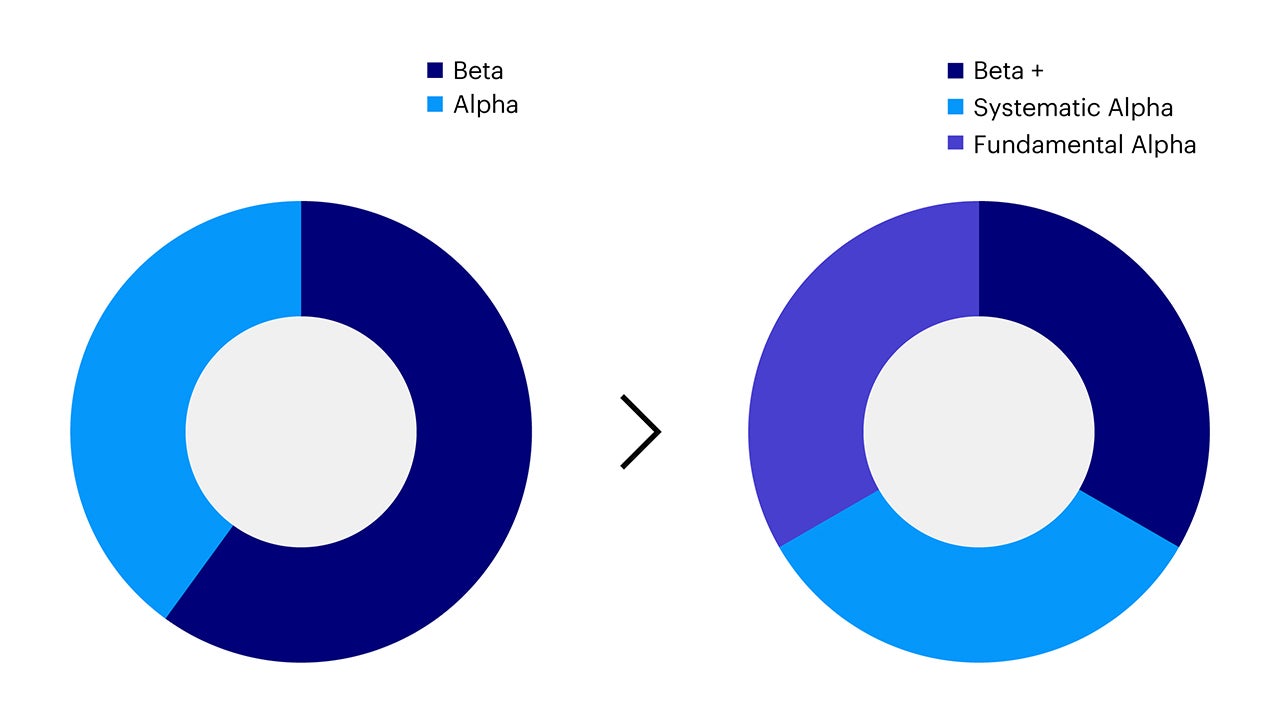

Source: Invesco, for illustrative purposes only.

Rethinking how to position China A share asset mixes across beta and alpha strategies can introduce diversification benefits and enhance return outcomes. Investors can consider allocating to differentiated sources of alpha generators i.e., systematic and fundamental, whilst also enhancing beta allocations (Beta +) utilizing synthetic, indexed ETFs.

Where an investor holds an equally weighted portfolio of two active managers (Active), one taking a fundamental approach and another taking a systematic approach, they can enhance their returns whilst also reducing volatility via diversification by incrementally incorporating synthetic, indexed China A ETFs.

In the below chart, the hypothetical Active portfolio is improved by first including a 10% allocation to a synthetic China A large-cap ETF (Active + CSI 300 ETF) and further by including another 10% allocation to a synthetic China A mid-cap ETF (Active + CSI 300 ETF + CSI 500 ETF), in both cases proportionally re-weighting the two, equally weighted, active funds.

These adjustments to the alpha-seeking asset mix result in 1.5% and 3.9% increases respectively in cumulative performance with associated volatility reductions of 0.5% and 1% relative to the original Active portfolio.

Source: Invesco and Bloomberg using fund Net Asset Values in USD using daily data. For illustrative purposes only. There can be no assurance that any estimated returns or projections can be realized.

All asset allocation decisions are active ones and by incorporating ETFs into portfolios, investors give themselves tools to re-think alpha opportunities in the China A shares space and to actively manage and improve on their risk adjusted return outcomes.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

FOOTNOTES

-

1

MSCI ACWI Index (USD), April 2023, https://www.msci.com/documents/10199/a71b65b5-d0ea-4b5c-a709-24b1213bc3c5

-

2

MSCI ACWI GDP Weighted Index (USD), April 2023, https://www.msci.com/documents/10199/a195824c-2ec7-488b-96c2-7d840a7a9186

-

3

Invesco Investment Solutions, 2023 Long-Term Capital Market Assumptions in USD, Q1 Update: https://www.invesco.com/content/dam/invesco/emea/en/pdf/long-term-capital-market-assumptions-USD-1.pdf.

-

4

Invesco, Goldman Sachs and Bloomberg as at 8 February 2023. Indexes referenced are the S&P China A 300 Index and the S&P China A MidCap 500 Index.