Nasdaq 100 Index September - Commentary

Accessing Innovation in the US

The downward move in equities that started in August continued through the month of September. From the recent peak on July 18th, the S&P 500 has dropped 5.55% while NDX has dropped 6.94%. September brought a “hawkish skip” from the Federal Open Market Committee (FOMC), persistent inflation, low unemployment, and higher interest rates.

One of the primary drivers of market action for the month was the FOMC meeting that occurred on September 20th. The decision to keep rates where they were from the prior meeting, the upper band of the Fed Funds rate set at 5.50%, was anticipated by investors. During the news conference following the meeting, Fed Chairman Jerome Powell also stated that there still could be the possibility of another rate hike in one of the two remaining meetings this year. The hawkish tone of the comments from Powel, combined with the shift up in the dot plot caused investors to view the decision to not raise rates at this meeting as a “hawkish skip.”

The Fed continued to maintain their dual mandate of lowering inflation and maintaining a reasonable unemployment level. The most recent Consumer Price Index (CPI) reading was reported on the 13th and showed a year-over-year reading of 3.7%, higher than the 3.6% estimate. The Core CPI reading, showed a year-over-year reading of 4.3%, in line with expectations. Over half of the monthly increase was attributed to the rise of energy prices. Oil prices, as measured by Brent Crude and West Texas Intermediate (WTI) Crude Oil futures, rose around 10% for the month as Brent Crude rose to over $95 per barrel. The increase was also seen in other fuels such as gasoline.

Initial jobless claims, a reading showing how many new people filed for unemployment, continued to show strength in the job market. The September readings, which were released on a weekly basis, were all underneath 230k with the lowest reading of 201k coming in the last week of the month. Moreover, all four readings in September came in well below the median analyst estimates. With unemployment being one of the primary mandates of the FOMC, lower readings may be interpreted by the FOMC that there is still room to raise rates to combat inflation.

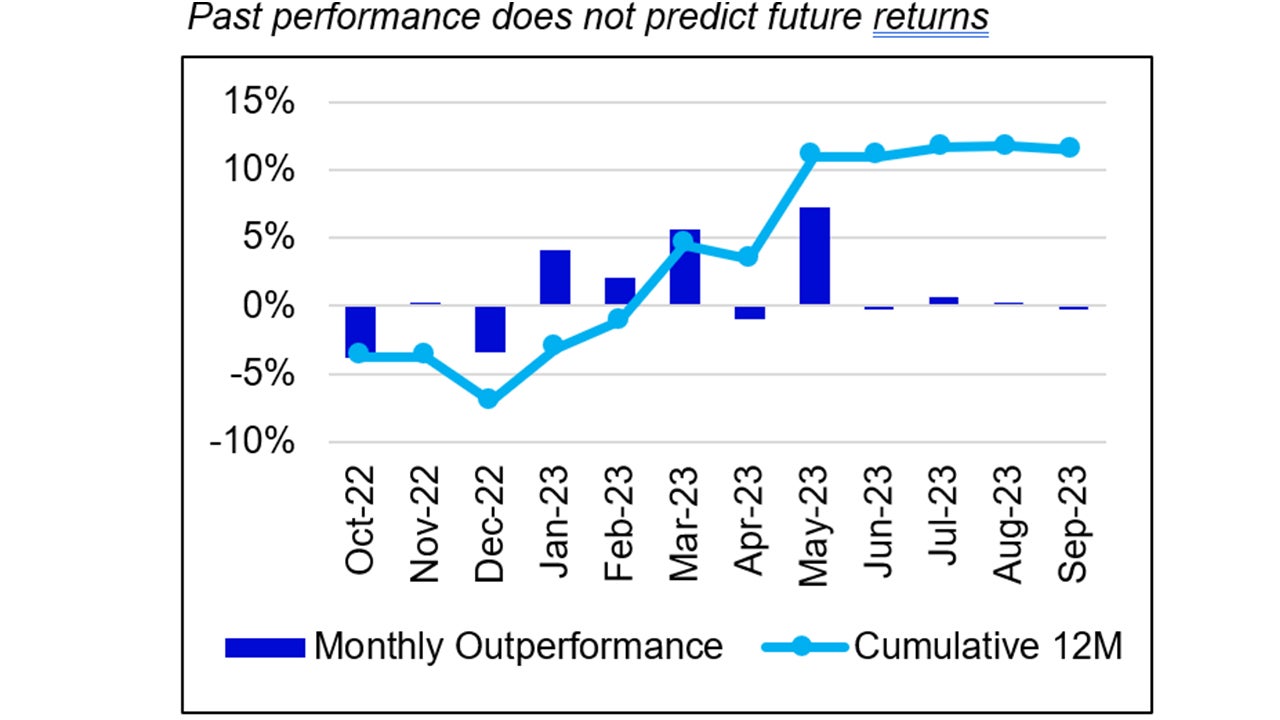

Index performance

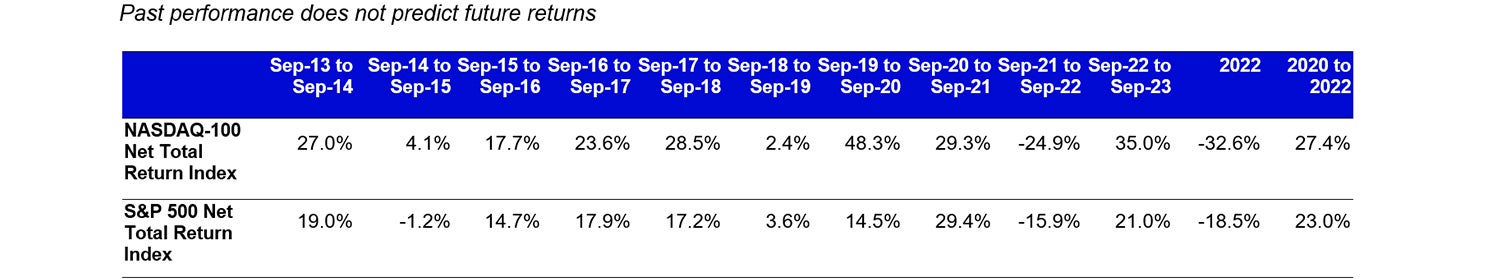

Past performance does not predict future returns.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

-5.0% | 35.1% | 35.0% | 17.3% |

| S&P 500 | -4.8% | 12.7% | 21.0% | 11.3% |

Relative |

-0.2% | 19.9% | 11.5% | 5.4% |

Source: Bloomberg as of 30 Sep 2023.

An investment cannot be made directly into an index.

Source: Bloomberg as of 30 Sep 2023.

An investment cannot be made directly into an index.

Data: Invesco, FactSet as of 30 Sep 2023. Data in USD

Nasdaq 100 Performance Drivers

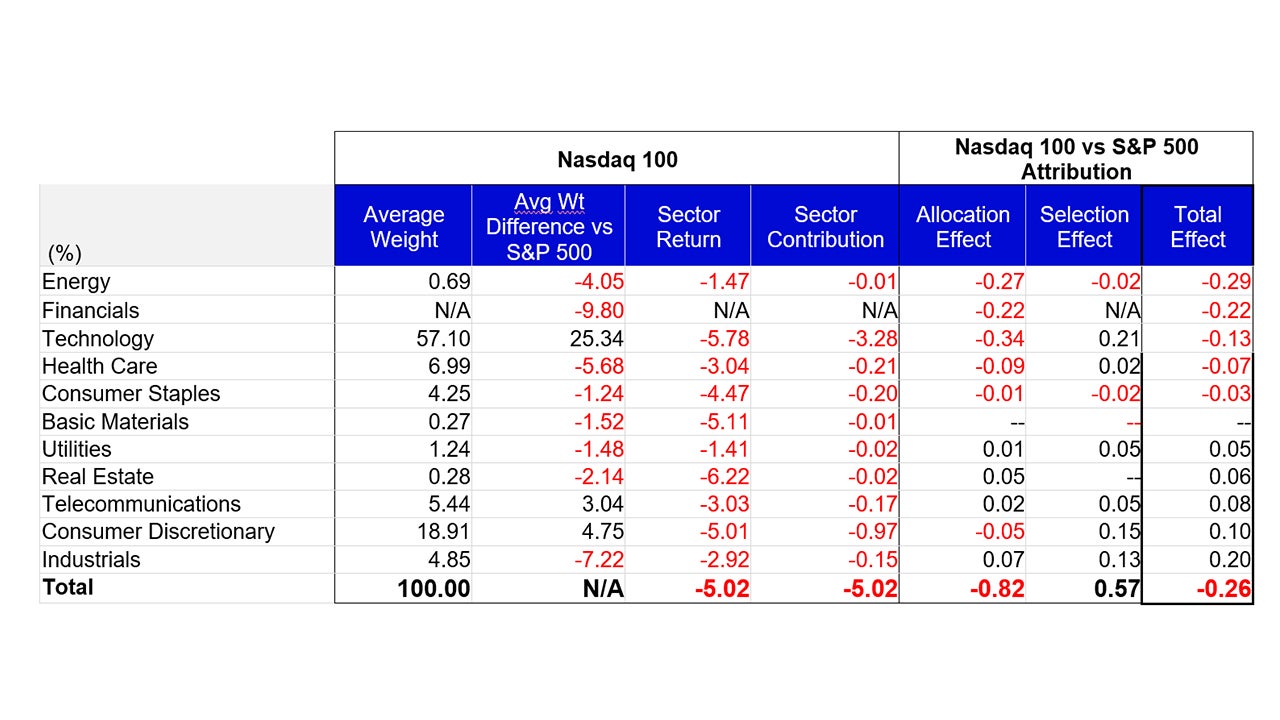

September performance attribution of the Nasdaq 100 (NDX) vs the S&P 500 Index

From a sector perspective, there were no sectors within NDX that had positive performance for the month. Utilities, Energy, and Industrials were the best performing sectors in the index and returned -1.41%, -1.47% and -2.92%, respectively. During the month, these three sectors had average weights of 1.24%, 0.69% and 4.85%, respectively. The bottom performing sectors in NDX were Real Estate, Technology and Basic Materials with average weights of 0.28%, 57.10% and 0.27%, respectively. Real Estate returned -6.22%, Technology returned -5.78% while Basic Materials returned -5.11%.

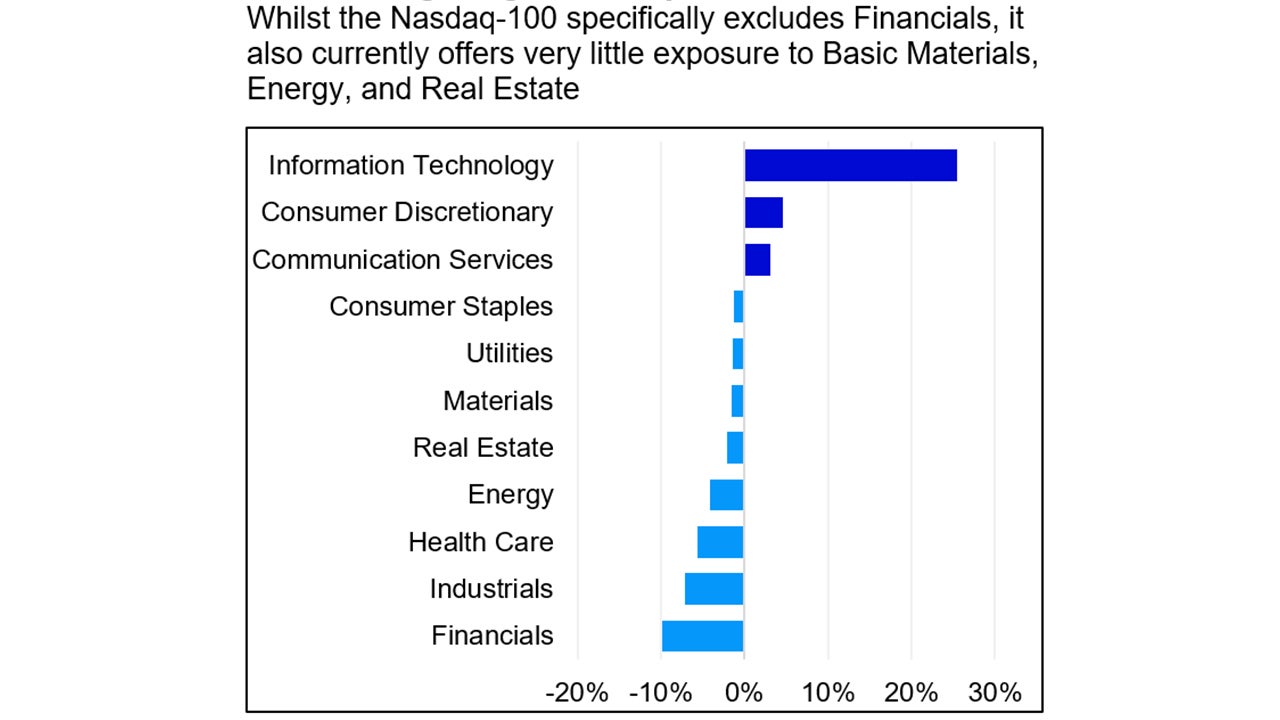

Despite being the best performing sector for the month, NDX’s underperformance vs. the S&P 500 was largely driven by its underweight exposure in the Energy sector. The index’s lack of exposure to Financials also detracted from relative performance. The NDX’s overweight exposure in the Technology sector was the third largest detractor to relative performance vs. the S&P 500. The Industrials sector contributed the most to relative performance and was driven by its overweight exposure and differentiated holdings. Consumer Discretionary and Telecommunications also contributed to relative performance. Relative performance in Consumer Discretionary was driven by its differentiated holdings while Telecommunications was driven its overweight exposure and differentiated holdings.

Data: Invesco, FactSet, as of 30 September 2023 Data in USD. Sectors: ICB Classification. All figures in percentage terms

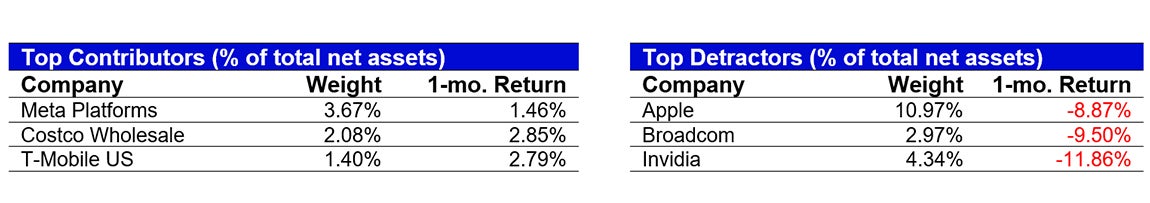

Source: Bloomberg, as of 30 Sep 2023. Past performance does not predict future returns. Top and bottom performers for the month by relative performance.

Data: Invesco, Bloomberg, as of 30 Sep 2023. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.