Nasdaq 100 Index – Commentary - July 2023

Accessing Innovation in the US

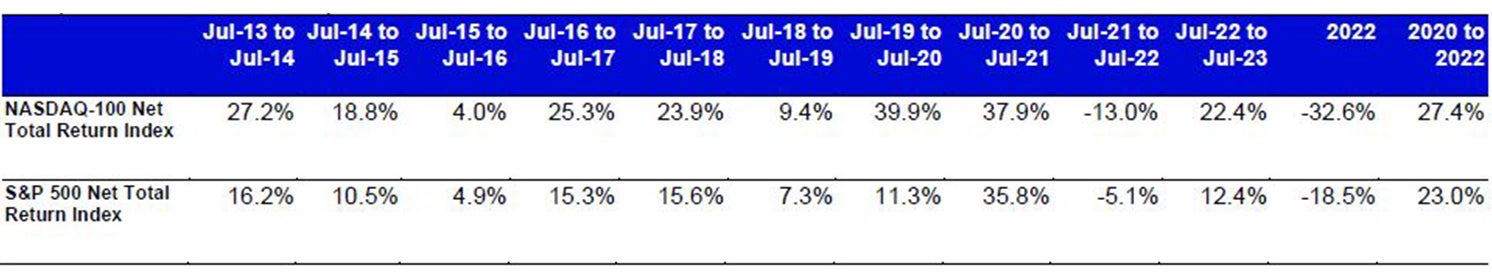

Similar to June, the market continued to see a broadening of this year’s strong performance as Small-Caps outperformed Large-Caps. The Russell 2000 Index, a proxy for Small-Cap companies, returned 6.1% for July, outperforming the S&P 500 by nearly 3%. The rally seen in equities so far this year continued albeit at a slower pace than previous months. Year-to-date NDX has risen 44.5% while the S&P 500 has returned 20.3%.

New inflation readings arrived in July, both the Consumer Price Index (CPI) and the Personal Consumption Expenditures Index (PCE) showed that inflation continued to fall. CPI was released earlier in the month and posted a year-over-year reading of 3.0%, lower than the 3.1% expectation. This was the lowest year-over-year reading of CPI since March of 2021. The month-over-month reading was 0.2%, under the 0.3% expectation, and equated to an annualized rate of 2.4%. Year-over-year CPI has now dropped every month since the peak reading of 9.1% in July of 2022. While the headline CPI reading was a positive sign, attention shift the to the Core CPI number, which excludes the costs of food and energy. The Core CPI reading was reported at 4.8% and raised concerns that inflation with service sectors may be more of a challenge and potentially take longer to decrease.

The Federal Open Market Committee (FOMC) met during the last week of July and raised the upper band of the target rate to 5.50%. This 0.25% increase was much anticipated as Bloomberg showed Fed Fund futures forecasting a 95% chance of the hike prior to the meeting. One new piece of information that Fed Chairman Powel offered was that inflation may not return to the 2% target until the year 2025. He was, however, optimistic that a “soft-landing” of the economy is still possible.

Investors looked to new readings of US GDP and unemployment to gain further insight into the health of the economy. Annualized quarter-over-quarter GDP was reported at 2.4%, higher than the 1.8% expectation and previous quarter reading of 2.0%. The US Unemployment rate also remained low at 3.6%. Expanding GDP combined with strong employment provided support for the soft-landing scenario.

Index performance

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

3.8% | 44.5% | 22.4% | 18.6% |

| S&P 500 | 3.2% | 20.3% | 12.4% | 12.0% |

Relative |

0.6% | 20.1% | 8.9% | 5.8% |

Source: Bloomberg as of 31 July 2023.

An investment cannot be made directly into an index.

Source: Bloomberg as of 31 July 2023.

An investment cannot be made directly into an index. Past performance does not predict future returns.

Data: Invesco, FactSet as of 31 July 2023. Data in USD Sectors: ICB .

Nasdaq 100 Performance Drivers

July performance attribution of the Nasdaq 100 vs the S&P 500 Index

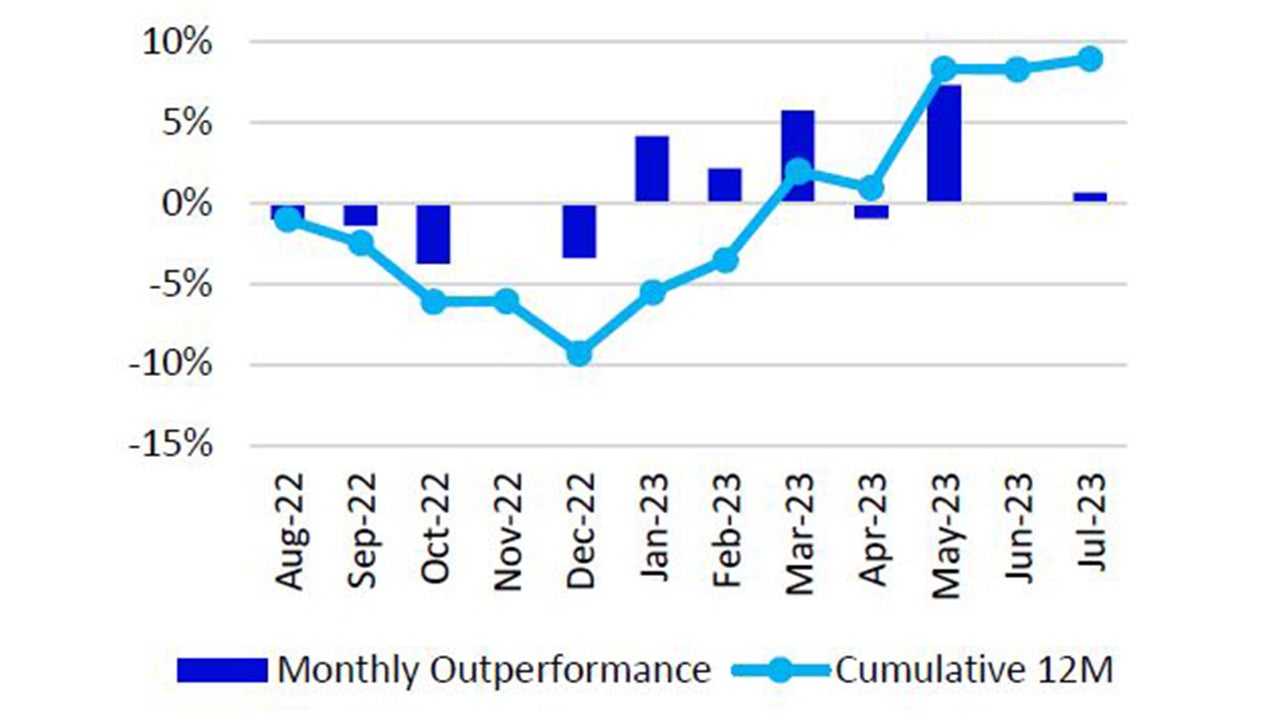

For the month of July, he Nasdaq 100 Index (NDX) returned 3.8%, outperforming the S&P 500 Index, which returned 3.2%. From a sector perspective, Energy, Technology, and Industrials were the best performing sectors in NDX and returned 6.32%, 4.90% and 4.06%, respectively. The bottom performing sectors in NDX were Real Estate, Basic Materials and Health Care with returns of -5.65%, -0.05%% and 0.25%, respectively.

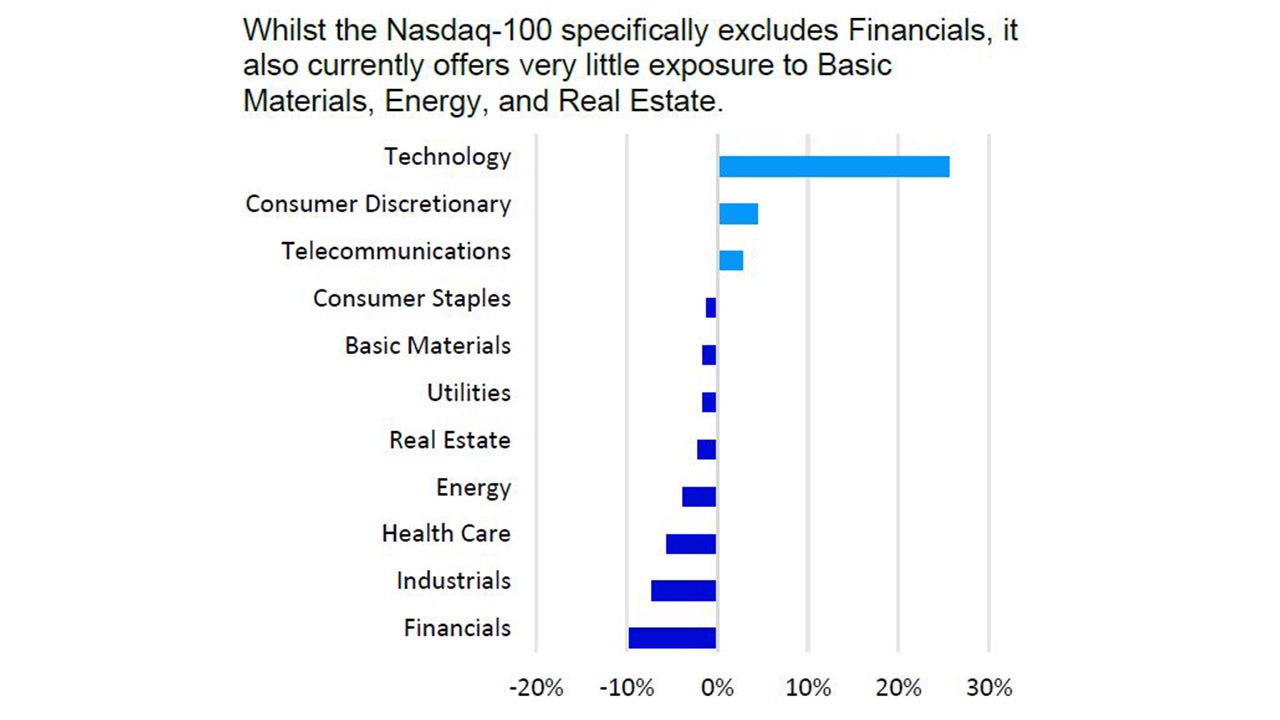

NDX’s outperformance vs. the S&P 500 was largely driven by its overweight exposure and differentiated holdings in the Technology sector. The index’s differentiated holdings in the Consumer Discretionary sector also contributed to relative performance. The fund’s underweight exposure in the Health Care sector was the third largest contributor to relative performance vs. the S&P 500. Energy detracted the most from relative performance and was driven by its underweight exposure and differentiated holdings. Basic Materials and Financials also detracted from relative performance, both driven by underweight exposure when compared to the S&P 500.

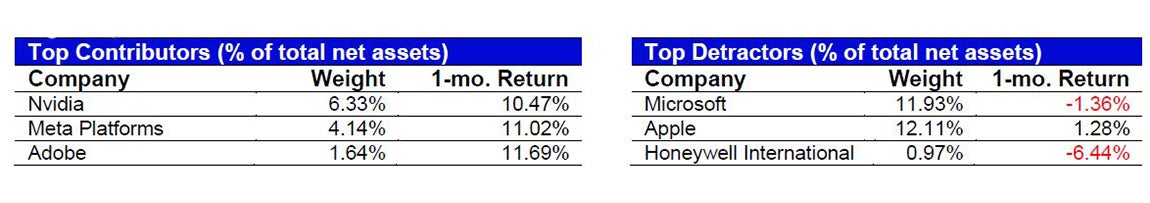

NDX underwent a special rebalance during the month of July. The rebalance was triggered by the index methodology, specifically, the portion driven by the Regulated Investment Company (RIC) diversification rules. The index changes were announced on Friday, July 14th and were based on the index securities and shares outstanding as of July 3rd. The special rebalance went effective for NDX before market open on Monday, July 24th. Seven companies saw weight reductions because of the rebalance: Apple, Microsoft, Amazon.com, Nvidia, Meta Platforms, Tesla and Alphabet (both Class A and Class C shares). The total reduction of these companies equated to approximately 12% of the portfolio being redistributed to the remaining 93 companies. The Technology sector saw the largest decrease of 4.50%, while Health Care saw the largest increase of 1.36%. NDX has seen two other special rebalances, once in 1998 and another in 2011.

Data: Invesco, FactSet, as of 31 July 2023 Data in USD. Sectors: ICB Classification. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 31 July 2023. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations.

Past performance does not predict future returns

Data: Invesco, Bloomberg, as of 31 July 2023. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.