Nasdaq 100 Index – Commentary - February 2025

Key Highlights

Equities finished February in negative territory amid elevated volatility.

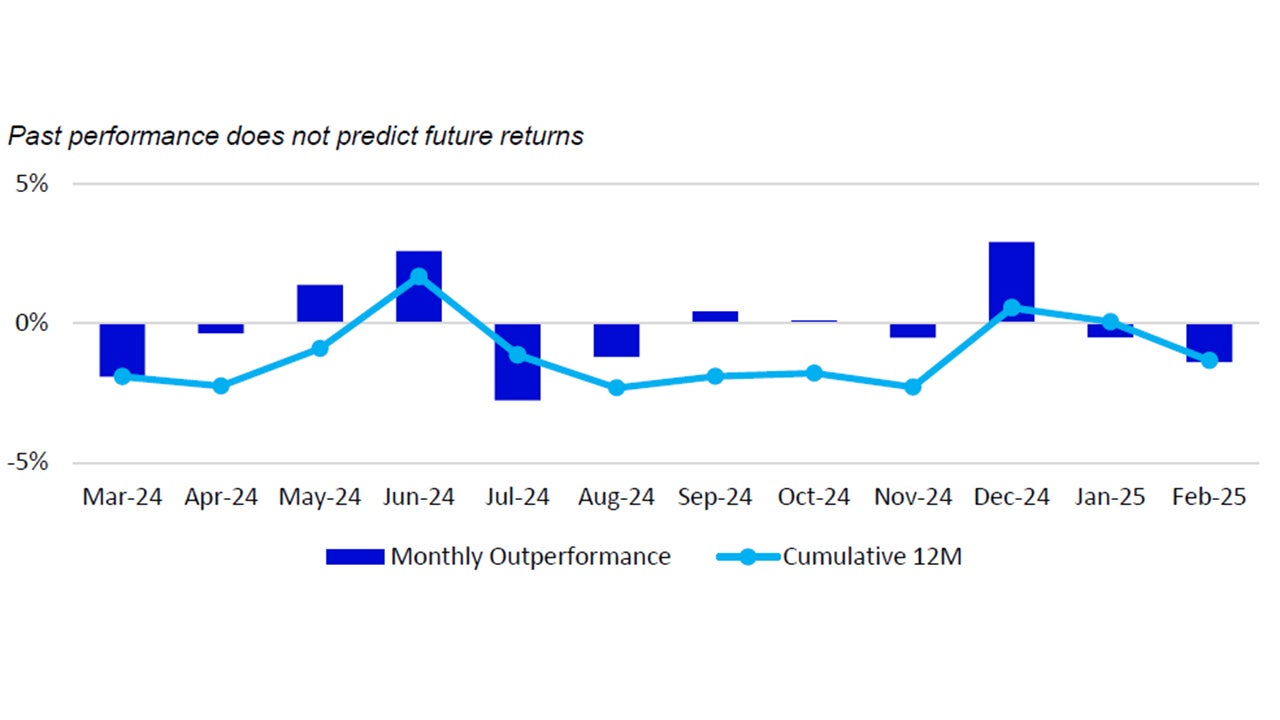

For the month of February, the Nasdaq-100 Index (NDX) returned - 2.7%, underperforming the S&P 500 Index, which returned -1.3%.

US Market Recap

The month of February presented opportunities for both bullish and bearish investors as the S&P 500 set a new all time high on February 19th before pulling back to levels seen at the beginning of January. The major index ultimately finished in the middle of its range seen so far in 2025 at 5954. Concerns around tariffs, rising inflation and earnings growth contributed to the elevated volatility.

Volatility saw a spike at the beginning of the month as shown by the VIX spiking over 20 during the first trading day of February. The following two weeks saw the VIX fall beneath 15 before rising again and finishing the month at 19.63. The wider monthly range on the VIX illustrated that many investors may have had doubts concerning the strength of current market conditions.

Driving much of that uncertainty were discussions around the upcoming implementation of tariffs by the new administration. On February 1st, the new administration announced tariffs against some of the largest trade partners of the United States: Canda, Mexico and China. The concerns of tariffs started to affect forecast of future growth. The Federal Reserve’s branch in Atlanta forecasts future GDP growth through the GDPNow Forecast. The central bank lowered their annualized Q1 forecast for U.S. GDP from 2.3% to -1.5%. This indicated that they believed with the data they had, GDP has the potential to contract for the first quarter. If this takes place, it would be the first negative reading since Q1 of 2022. Tariffs were not the only detractor to their estimate. Other detractors were consumer spending due to inclement weather in January, along with lower levels of exports

The US FOMC's preferred inflation measure, the US Personal Consumption Expenditures (PCE), reported a year-over-year increase of 2.5% in February, slightly down from 2.6% previously. Month-over-month PCE rose by 0.3%, equating to an annualized rate of 3.6%, above the FOMC's 2% target. The rise was driven by higher costs in services and non-durable goods, while durable goods costs fell. In February, the U.S. 10-year Treasury yield dropped from 4.6% to 4.2%, coinciding with a decline in equities, indicating a shift of investors from stocks to bonds, seeking safer assets.

Innovator Spotlight

Amazon unveiled Alexa+, an upgraded version of its voice assistant, powered by generative AI technologies. This new iteration represents a complete re-architecture of Alexa, making it smarter, more conversational, and capable of handling a wider range of tasks. Alexa+ can manage smart home devices, make reservations, provide personalized recommendations, and even summarize complex topics. The assistant is designed to feel more like an insightful friend, understanding colloquial expressions and half-formed thoughts, and responding naturally to users' needs12.

The development of Alexa+ involved significant technical breakthroughs, including the integration of large language models (LLMs) and the creation of "experts"—groups of systems and APIs that accomplish specific tasks. Alexa+ can control various smart home products, book appointments, play music, order groceries, and more. It also features visual understanding, allowing it to respond to questions based on video feeds from devices like the Echo Show. This overhaul aims to make Alexa+ not just a general-purpose assistant, but a serious productivity tool that can help users manage their daily lives more efficiently

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

-2.7% | -0.5% | 16.4% | 17.5% |

| S&P 500 | -1.3% | 1.4% | 17.9% | 12.4% |

Relative |

-1.4% | -1.9% | -1.3% | 4.6% |

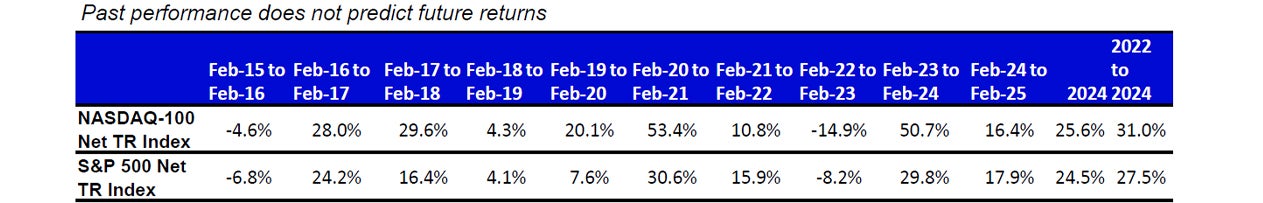

Performance as of 28 Feb 2025. Past performance does not predict future results. Innovator spotlight source: Aboutamazon.com. 26 February 2025

Source: Bloomberg as of 28 Feb 2025.

An investment cannot be made directly into an index.

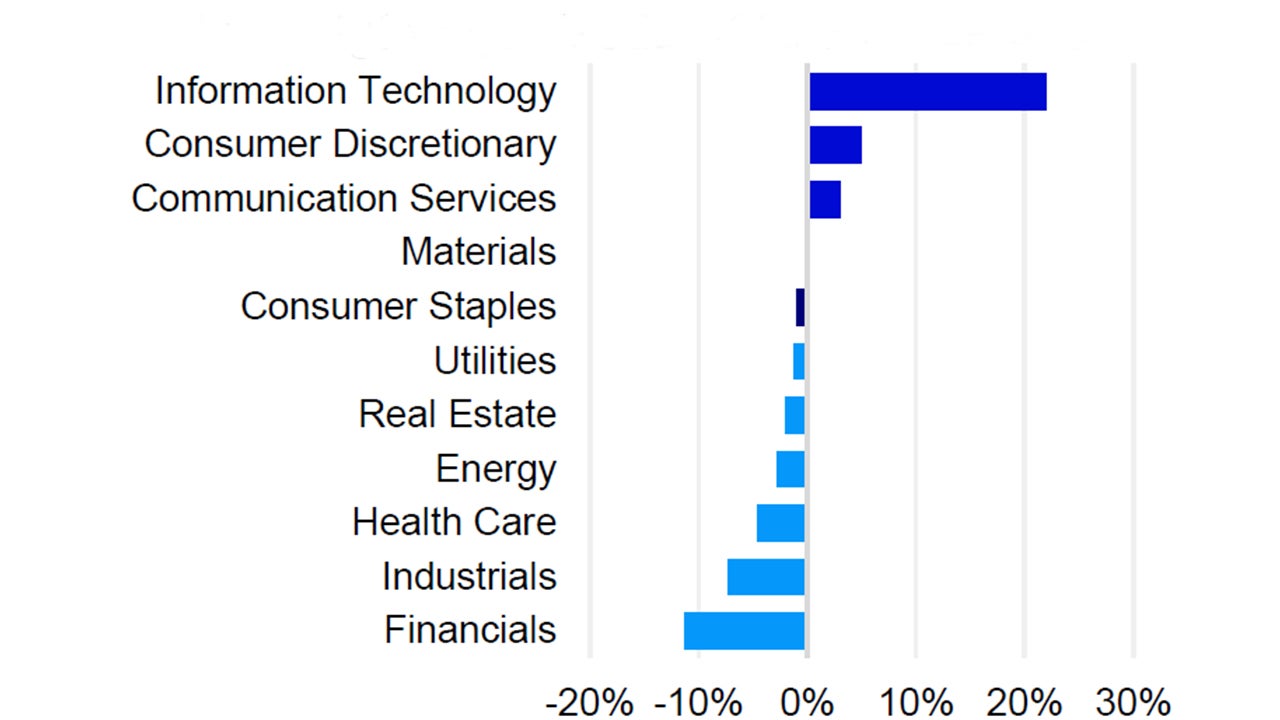

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

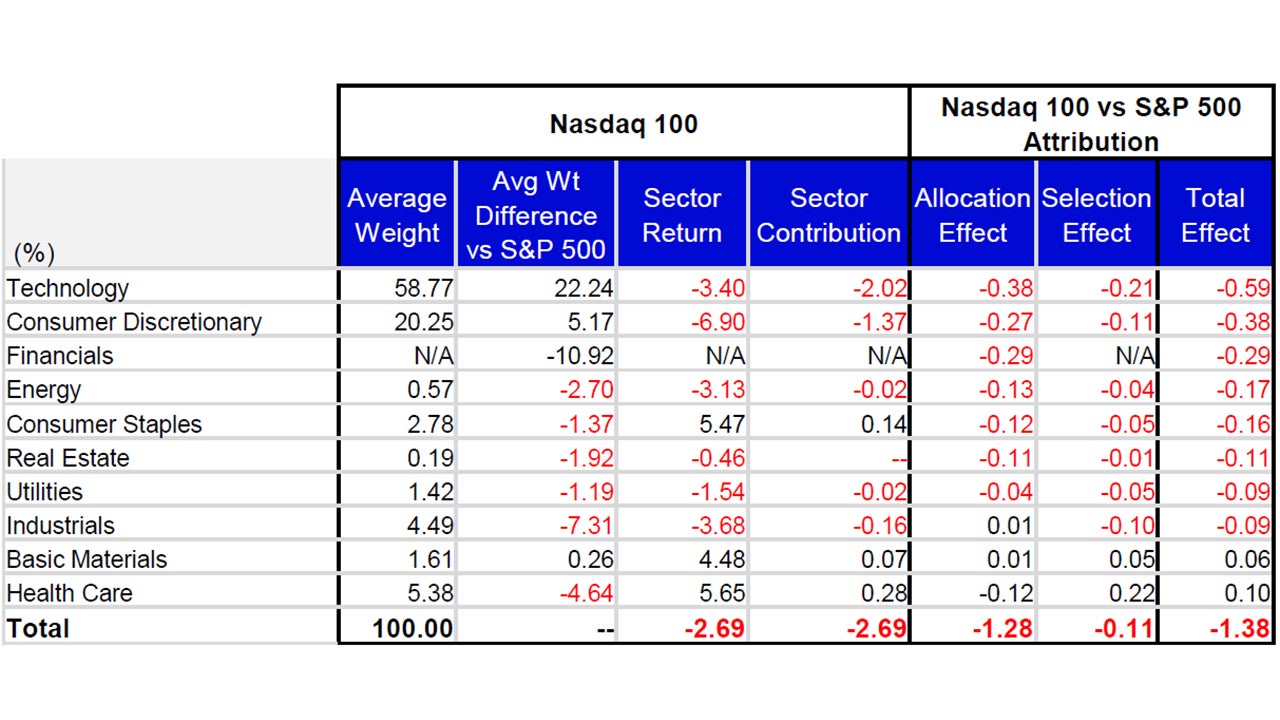

Source: Invesco, FactSet as of 28 Feb 2025. Data in USD. The Index uses the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

Nasdaq-100 Performance Drivers

February’s performance attribution of the Nasdaq-100 (NDX) vs the S&P 500 Index

From a sector perspective, Telecommunications, Health Care and Consumer Staples were the best performing sectors in NDX and returned 9.96%, 5.65% and 5.47%, respectively. During the month, these three sectors had average weights of 4.53%, 5.37% and 2.78%, respectively. The bottom performing sectors in NDX were Consumer Discretionary, Industrials and Technology which had average weights of 20.23%, 4.48% and 58.74%, respectively. Consumer Discretionary returned -6.90%, Industrials returned -3.68% while Technology returned -3.40%.

NDX’s underperformance vs. the S&P 500 was driven by its differentiated holdings and overweight exposure in the Technology sector. Differentiated holdings and overweight exposure to the Consumer Discretionary sector was the second largest detractor to relative performance. The index’s lack of exposure to the Financials sector also detracted from relative performance. Differentiated holdings and overweight exposure in the Telecommunications sector was the top contributor to relative performance vs. the S&P 500. Health Care also contributed because of its differentiated holdings. The third and final contributor was Basic Materials due to its overweight exposure and differentiated holdings.

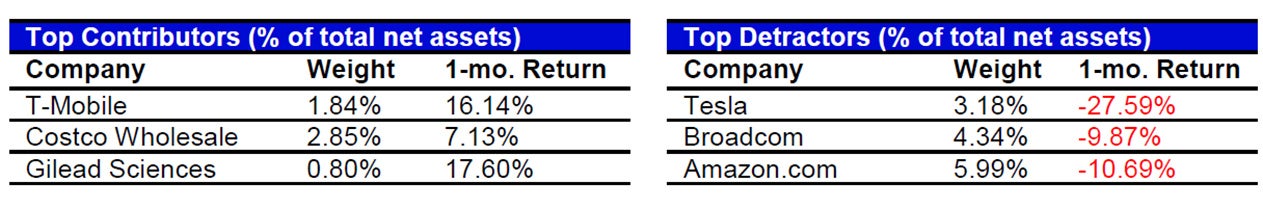

NDX Contributor/Detractor Spotlight- Broadcom: Nivida announced earnings on February 26th and beat estimates on both the top and bottom line. Revenue was announced at $39.33 billion vs. the estimate of $38.24 billion while adjusted earnings-per-share came in at $0.89 vs. the estimate of $0.84. The options market was estimating around a 9% move, up or down, in the company’s stock after the announcement. However, the stock did not fluctuate to that extent in afterhours trading. The stock closed the regular session at $130.98 a share and ranged between $125.54 and $136.60 before settling at $129.30. However, the following day, February 27th, Nvidia led the market down and fell over 8.48%. Many investors raised concerns over shrinking gross margin. Gross margin fell 4% for the most recent quarter. Nvidia issued guidance for the next quarter showing that gross margin may fall up to 9%. The company also estimated that next quarter’s revenue would be $43 billion, plus or minus 2%. While the revenue growth expectation was still higher, the pace at which it was expected to grow was at a slower pace than previous quarter’s. Nvidia’s stock finished the month up 4.04%.

Data: Invesco, FactSet, as of 28 February 2025. Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 28 Feb 2025. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 28 Feb 2025. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.