Nasdaq 100 Index - Commentary - April 2023

Accessing Innovation in the US

With concerns around bank defaults subsiding, investors turned their focus back to economic growth, inflation, and corporate earnings during the month of April. Equity markets bounced in a tight range as neither buyers or sellers could take control for the majority of the month. Gross Domestic Product (GDP), earnings, inflation and employment announcements gave mixed signals as whether economic conditions were improving or deteriorating.

After the issues that faced many banks during the month of March, investors were interested in the earnings announcements that came at the beginning of April. Several smaller, regional banks missed earnings and underperformed the overall market. On the last day of trading in April, speculation that First Republic Bank would soon be taken under FDIC conservatorship ultimately came to fruition during the last weekend of the month.

The GDP reading for the first quarter of 2023 came in underneath expectations. The annualized Q1 reading of 1.1% was not only lower than the 1.9% expectation, but also lower than the prior reading of 2.6%. Declines in private inventory investment and non-residential fixed investment were the primary drivers of the lower-than-expected reading. Consumer spending and exports increased while gross private domestic investment fell.

The preferred Federal Open Market Committee (FOMC) inflation gauge, the Personal Consumption Expenditures Price Index (PCE), was released the same day as GDP with a year-over-year reading of 4.0%, higher than the 3.4% expectation. The Core PCE Index, which excludes food and energy inflation, also came in above expectations, and rose at a year-over-year rate of 4.9% vs. the 4.7% expectation. This reading painted a different picture than the Consumer Price Index (CPI), another commonly used measure of inflation, which was announced earlier in the month. The year-over-year reading of 5.0% was below the 5.1% expectation. With both measures of inflation higher than the FOMC’s year-over-year target of 2.0%, combined with the lower GDP number, investors reignited the conversation around the potential for stagflation.

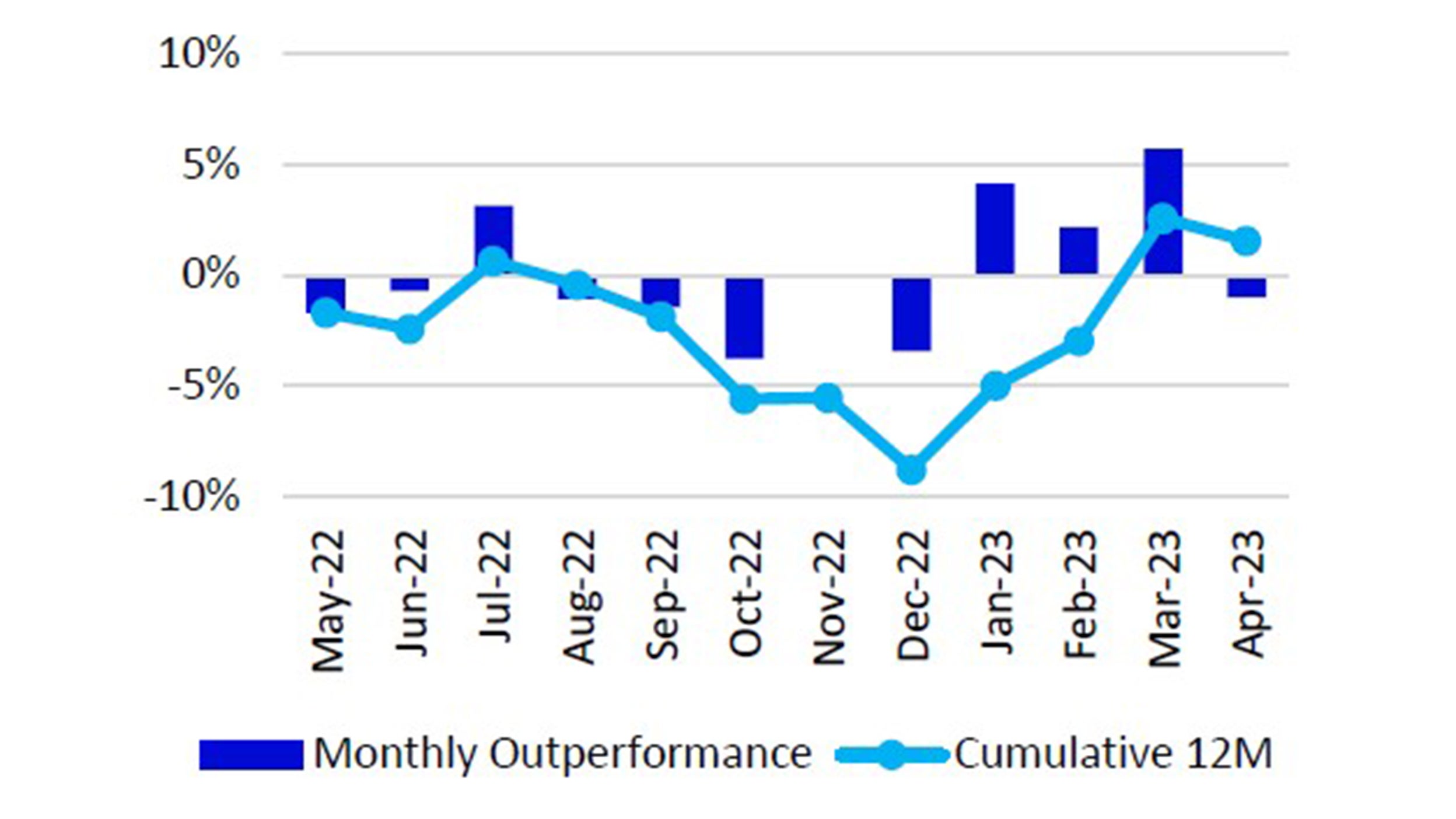

Index performance

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

0.5% | 21.3% | 3.7% | 17.3% |

| S&P 500 | 1.5% | 9.0% | 2.1% | 11.6% |

Relative |

-1.0% | 11.3% | 1.5% | 5.2% |

Source: Bloomberg as of 30 Apr 2023.

An investment cannot be made directly into an index.

Source: Bloomberg as of 30 Apr 2023.

An investment cannot be made directly into an index.

Past performance does not predict future returns.

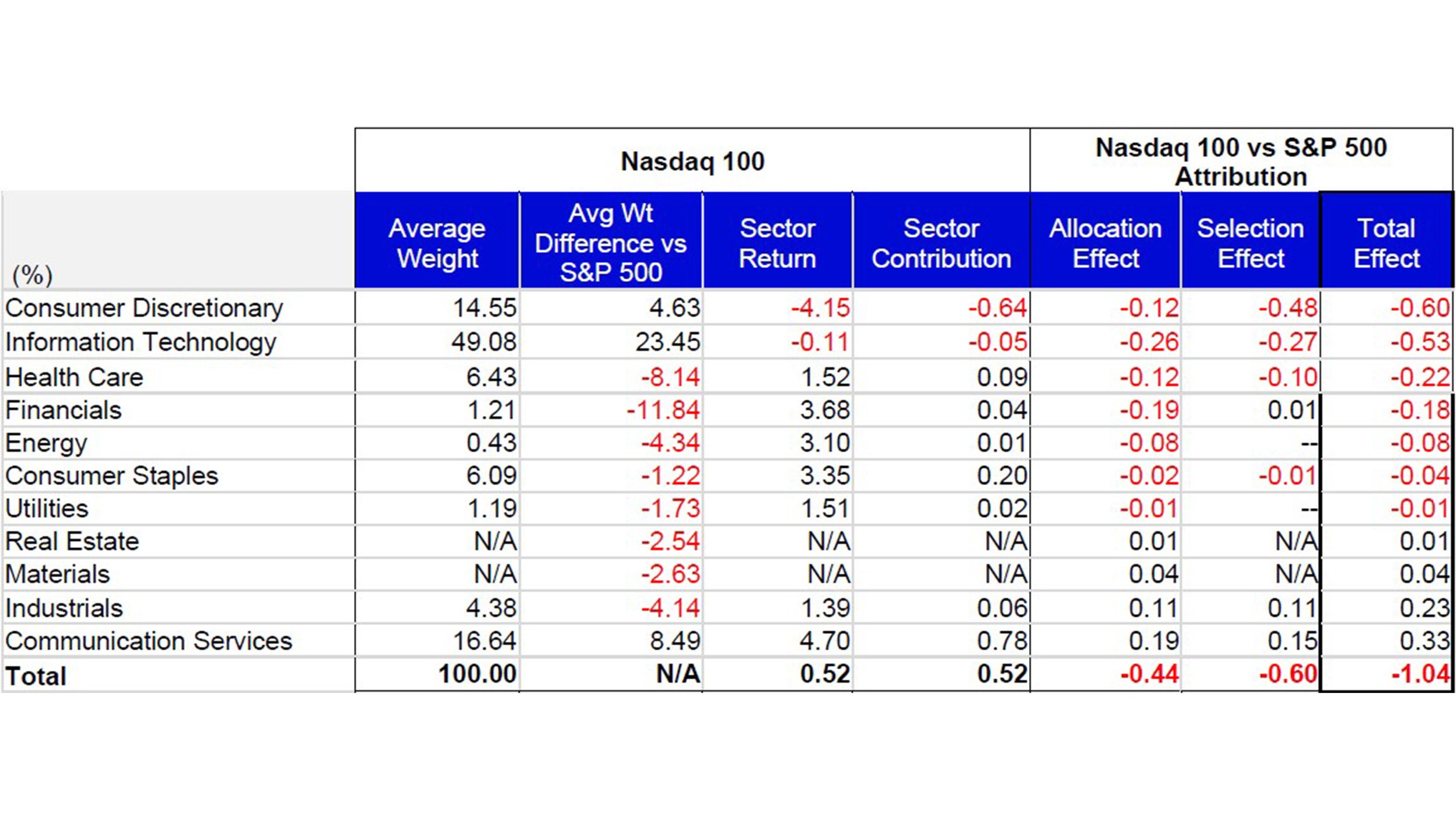

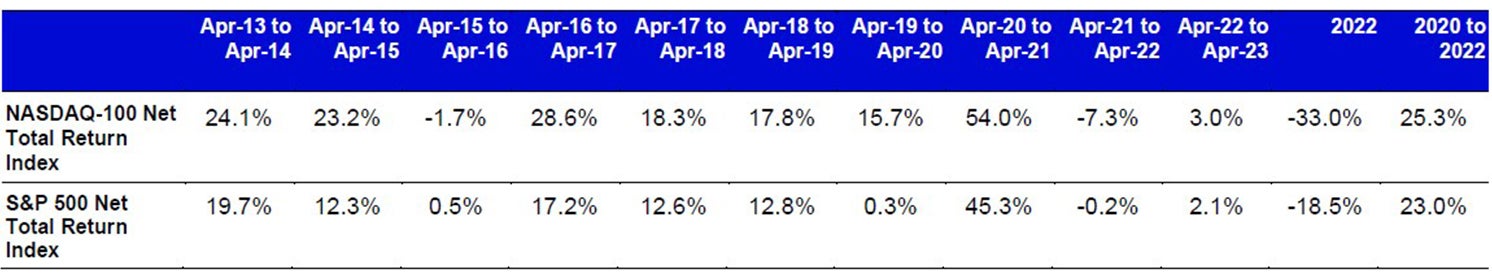

Data: Invesco, FactSet as of 30 Apr 2023. Data in USD.

Whilst the Nasdaq-100 specifically excludes Financials (incl. Real Estate), it also currently offers no exposure to Materials or Energy

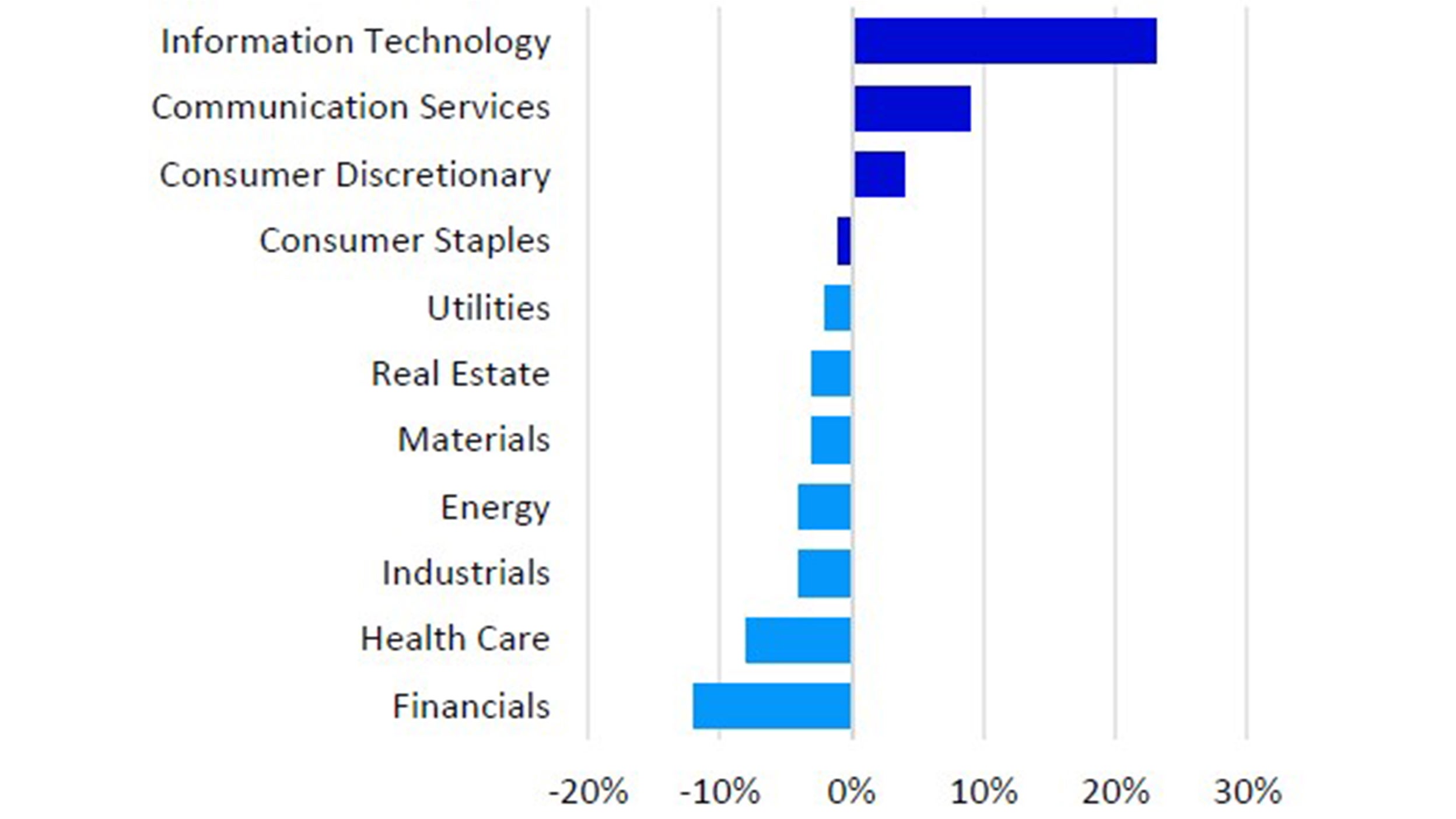

Nasdaq 100 Performance Drivers

April performance attribution of the Nasdaq 100 vs the S&P 500 Index

For the month of April, the Nasdaq 100 Index (NDX) returned 0.5%, underperforming the S&P 500 Index, which returned 1.5%. From a sector perspective, Consumer Discretionary and Information Technology were NDX’s worst performing sectors, returning -4.15% and -0.11%, respectively. The Communication Services sector was the biggest contributor to NDX’s performance in April.

NDX’s underperformance vs. the S&P 500 was largely driven by its overweight exposure and differentiated holdings in the Consumer Discretionary sector. The index’s underweight exposure and differentiated holdings in the Health Care and Consumer Staples also detracted from relative performance. NDX’s underweight exposure and differentiated holdings to the Communication Services sector contributed to relative performance.

Data: Invesco, FactSet, as of 30 Apr 2023 Data in USD. FactSet shows GICS sectors which recognized the reclassification of Fiserv and PayPal to Financials on March 20th.

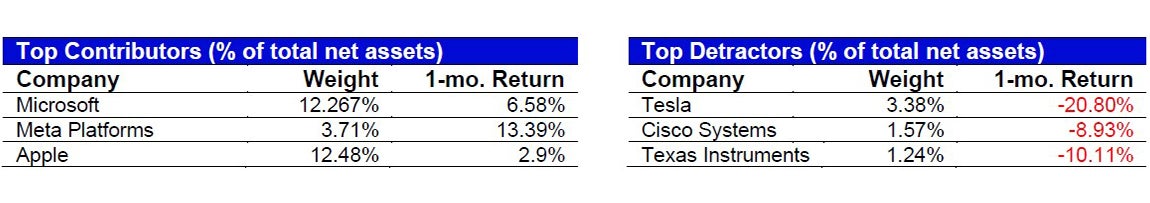

Source: Bloomberg, as of 30 Apr 2023. Past performance does not predict future returns. Top and bottom performers for the month by relative performance.

Past performance does not predict future returns

Data: Invesco, Bloomberg, as of 30 Apr 2023. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.