How can synthetic ETFs enhance A-shares returns?

Demand for China equities is high. Goldman Sachs expects onshore stocks to surge by as much as 24% by end of 2023.1 China’s unique structural dynamics means that A-share indices performance can be enhanced through synthetic ETFs.

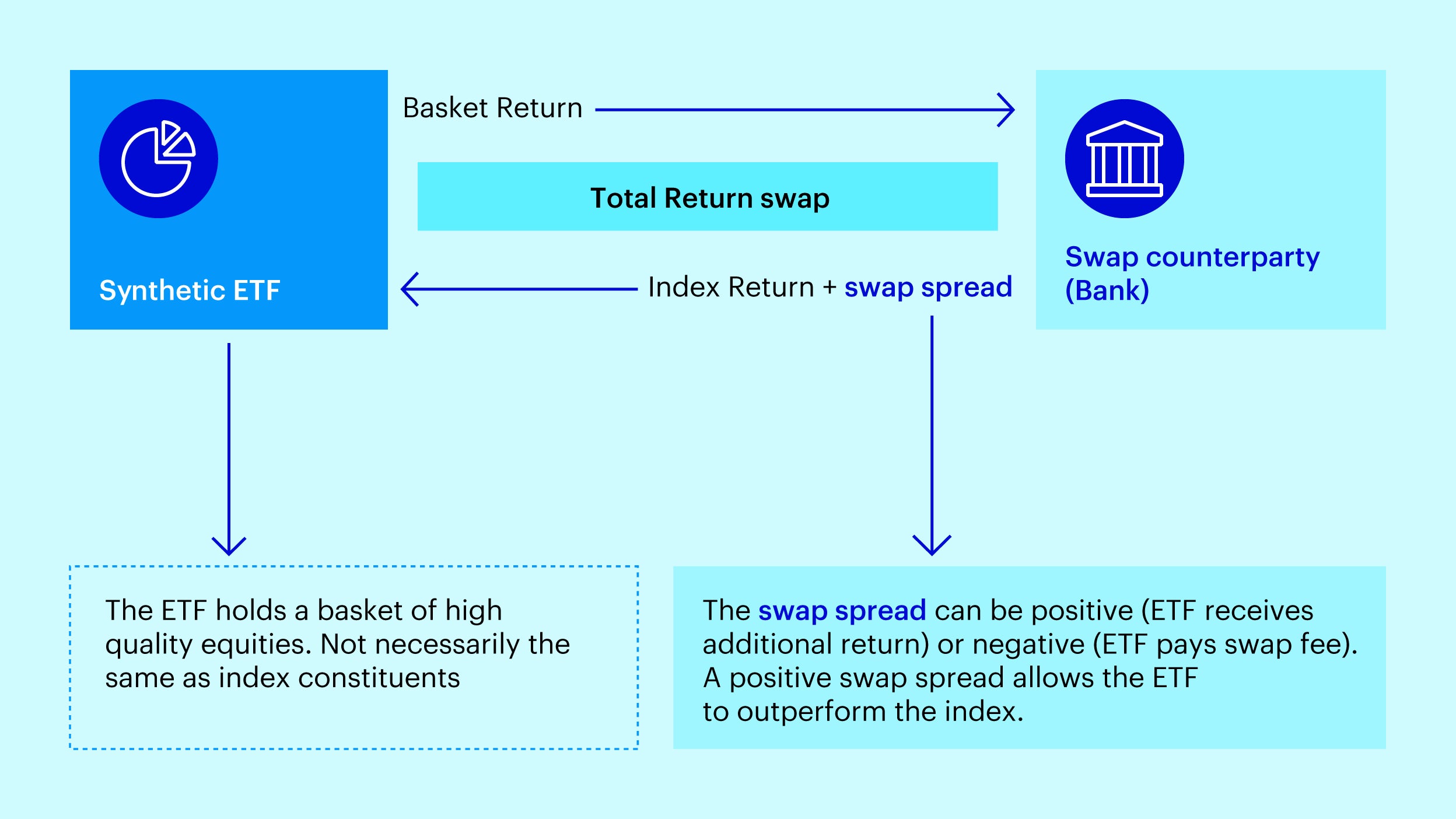

While a physical ETF directly replicates an investment into the underlying stocks or bonds, synthetic equity ETFs hold a basket of physical developed market stocks and then use a derivative such as a total return swap to gain exposure to the underlying assets.

Source: Invesco, for illustrative purposes only. Note: The figure is a highly simplified schematic of the difference between physical and synthetic replication strategies in ETFs and is not intended as a complete representation of the structure, benefits, or risks of either approach.

By investing in synthetic ETFs, investors can take advantage of ongoing structural dislocation in the China A-shares market. Like many other global stock markets such as the US and Europe, China has an extremely liquid equities market with high retail participation. This is an attractive environment for offshore quant funds and hedge funds to run market neutral strategies. Index derivatives can provide a good way for these funds to hedge their market risk.

At the same time the supply of China A-shares for hedging purposes is limited for offshore investors. There is no offshore physical securities lending market or broad-based futures contracts for A-shares available offshore. Even qualified foreign institutional investors (QFIIs) face quotas for futures contracts and high costs of borrowing. Currently the only inventory available is through an index portfolio.

These regulatory constraints (no stock lending and market restrictions), create an imbalance for shorts. This means that offshore participants such as quant funds, hedge funds and active managers who want to hedge against A-shares, are required to do so through swaps, at a premium. As a result, banks as the swap counterparty are typically willing to pay a similar premium to a swap-based ETF to hedge these trades.

Just as for all other swap-based ETFs, these synthetic ETFs hold a basket of high-quality securities (not necessarily the same as what is in the index) and use a swap to deliver the index performance plus any swap spread.

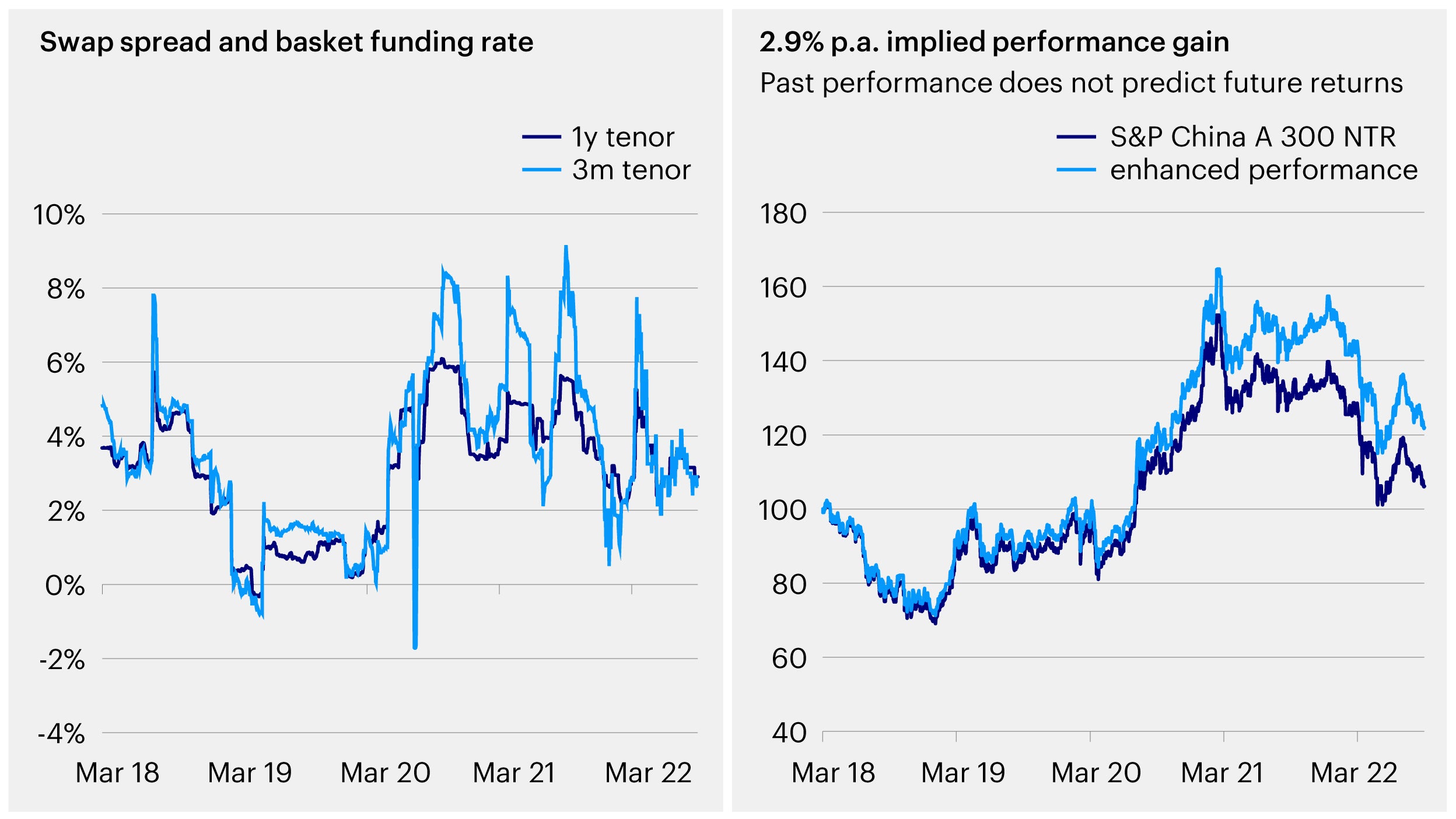

Source: Invesco, for illustrative purposes only.

On other indices such as Emerging Markets or even the US this swap spread would normally be negative and associated with the hedging cost the bank would undertake for the index position. However on China A-Shares indices such as S&P China 300 and S&P China 500 this swap spread figure can be positive meaning the ETF would receive performance enhancement above the index return.

The supply restrictions enable this attractive level of swap pricing, which is passed through to investors as a performance enhancement. The synthetic ETF structure on China can then deliver accurate performance in terms of tracking error as well as enhanced returns relative to the index.

For example, since March 2018, this swap pricing has equated to an average of 2.9% p.a. implied outperformance for the S&P China A 300 (Figure 3).2 These figures increase even further on S&P China 500 to around 8.2% p.a.

Of course, market participants are questioning how long this will last and are paying close attention to the pace of liberalization in China’s futures and securities lending market for offshore investors. For the moment reform is slow-moving and thus we expect this to be a persistent trade in the short to medium term.

Source: Invesco, Goldman Sachs, Bloomberg, as at 31 Aug 2022.

With contributions from Monica Uttam, Thought Leadership and Insights, Asia Pacific

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Footnotes

-

1

Goldman Strategists See 24% Jump in China Stocks by Year-End, February 2023, https://www.bloomberg.com/news/articles/2023-02-19/goldman-strategists-see-24-jump-in-chinese-stocks-by-yearend

-

2

Source: Invesco, Goldman Sachs, Bloomberg, as at 31 Aug 2022.