Exploring the latest global ETF trends and growth factors

As part of Invesco’s recent Asia Forum 2024, Tom Digby and Matthew Tagliani from Invesco’s ETF team had a fireside chat on the latest trends in exchange traded funds (ETFs) and potential drivers of future growth. Below are some excerpts from this insightful session.

Q: How has the global ETF market grown in recent years?

A: The global ETF market has seen significant growth over the past decade and net inflows into ETFs surpassed US $1 trillion in 2024.1 The US and Canada has over US $10 trillion in ETF assets under management (AUM) and saw about US $750 billion of net inflows this year.2 EMEA has around US $2.25 trillion US in assets with US $200 billion of inflows year-to-date while Asia Pacific has US $1.2 to 1.3 trillion with around US $100 billion of inflows.3 These are record inflows and AUM numbers in all three regional markets.

The main driver behind this growth has been the expansion of clients investing in this space as well as the breadth of products on offer. An ETF is essentially a mutual fund wrapper or investment vehicle that can be leveraged by investors to express a particular investment view. If you look back ten years ago, most people thought of ETFs as predominantly being focused on equity exposure. Since then, we’ve seen the advent of commodities products, and over the last five years phenomenal growth in the fixed income ETF space. The most recent evolution has been the boom in active ETFs.

Q: How do you expect ETF markets to grow in the future?

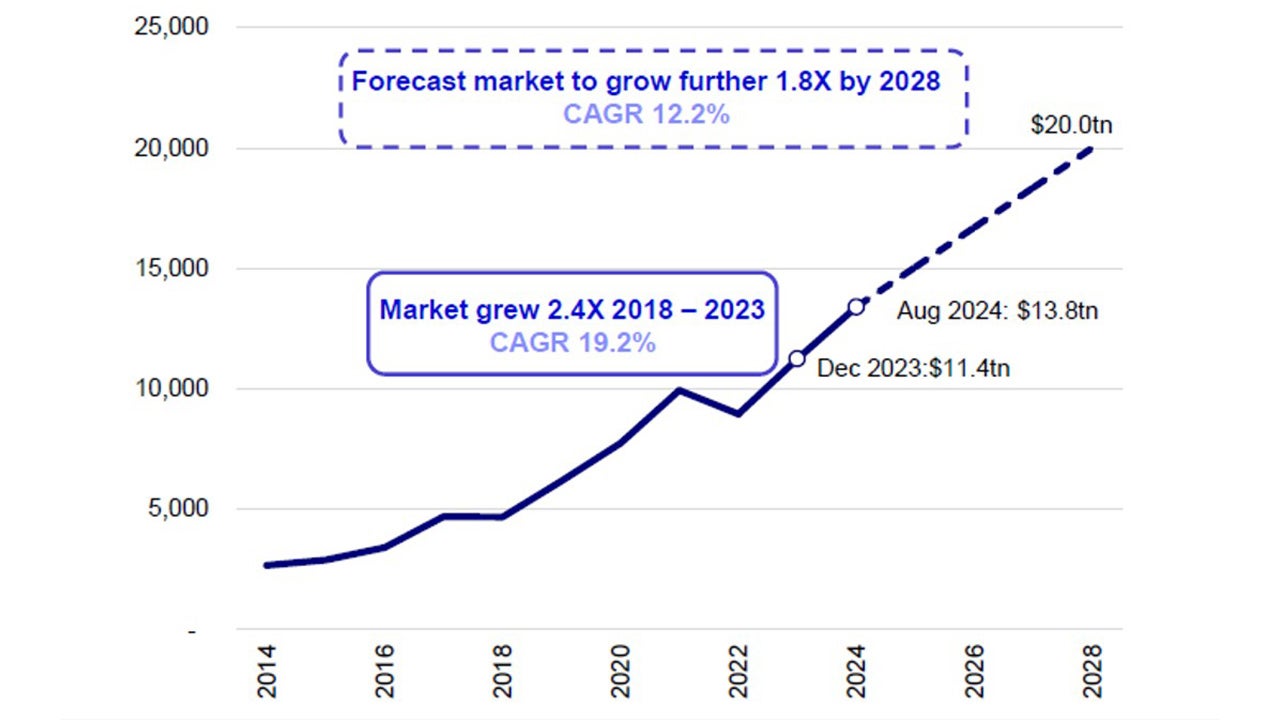

A: The global ETF market is projected to reach US $20 trillion by 2028, up from $13.8 trillion as of August 2024 (Figure 1). The compound annual growth rate (CAGR) over the last five years has been an astounding 19.2% and we project continued strong growth going forward of around 12%. This projection may appear conservative but actually assumes an acceleration in inflows into ETFs. The slower overall AUM growth rate is simply the result of more modest market growth projections relative to the exceptionally strong equity markets of recent years.

Source: August 2024 data is from Morningstar as of August 31, 2024. All other data is from Invesco as of 31 Aug 2024. AUM figures are in USD. Projections assume market move of 2% p.a. There is no guarantee that the projections will be reached.

Q: What are the regional drivers of growth in ETF markets going forward?

A: In the US, the ETF market was first dominated by retail clients and has now expanded across all investor types. In Europe, while initial growth was driven by private banks and wealth managers, there has since been a boom in retail distribution and institutional use, including among pension funds and central banks. In Asia Pacific, the market is more fragmented, and we’ve seen significant growth in Taiwan, Australia, Hong Kong, and Mainland China markets. Asian investors are also increasingly buying ETFs listed in other regions for tax efficiency and liquidity reasons.

Source: Invesco, for illustrative purposes only.

Q: What are the emerging trends in the ETF space?

A: Looking ahead, we expect to see both a greater product diversity and a continued expansion of the use cases for ETFs. In terms of products, we are seeing explosive growth in active ETFs, particularly in the US, and continued expansion of the fixed income product offering. Thematic ETFs focussing on specific market segments and trends like solar energy, remain an area of keen client interests. In terms of clients, ETFs are increasingly being used by investors across the spectrum, from retail investors looking for simple, low-cost tools for their investments, through to the largest institutional investors for whom ETFs are increasingly attractive for their liquidity and cost efficiency.

Q: How are active ETFs evolving and what role do they play in the market?

A: Active ETFs are evolving across a wide range of strategies. The growth in active ETFs in the US is closely tied to certain structural tax advantages of the ETF structure relative to traditional mutual funds. At Invesco, we’ve offered active ETFs since 2008 and these products are managed by the same teams that manage the active funds, ensuring the same investment expertise is applied. Active ETFs offer a way to deliver active management strategies in a more accessible and cost-efficient format. We expect these products to continue to grow in popularity.

Q: What is the role of new index providers in the ETF market?

A: New index providers are bringing value by offering specialized knowledge in areas like thematic investing. For example, understanding the solar value chain requires expertise that traditional index providers may not have. These new providers help create more targeted and innovative ETFs that can capture specific trends and sectors, providing investors with more tailored investment options.

Q: How does Invesco's ETF offering stand out in the market?

A: Invesco manages over US $700 billion in ETFs and index strategies globally, making up about 40% of the firm's assets.4 We have been active in the ETF industry since 2003 and are one of the few ETF providers with substantial franchises in both the US and Europe, offering a full spectrum of products across different domiciles. We look to provide a comprehensive toolkit for investors to meet diverse investment needs and preferences.

Q: What are some of Invesco's key ETF strategies?

A: Invesco has strong franchises in areas like Nasdaq (capturing US growth and innovation) and equal weight strategies (offering diversification and reducing equity market concentration risk). We also offer active ETFs in areas like ultra-short duration, systematic quant factors, and options overlay strategies. These products leverage the firm’s expertise and provide investors with more nuanced and efficient investment options. We also work together with external experts and specialized index providers to create thematic ETFs. This collaboration helps Invesco offer innovative and well-researched products in areas like blockchain, clean energy, and financial services.

Q: How does Invesco plan to expand its ETF offerings in the future?

A: We plan to continue expanding our ETF offerings by leveraging our expertise across different investment strategies and asset classes. This includes bringing more active management strategies into the ETF format and developing new thematic and innovative products.

With contributions from Monica Uttam, Thought Leadership and Insights, Asia Pacific

Investment risks

Investment involves risks. The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

There are risks involved with investing in Exchange-traded Funds (“ETFs”), including possible loss of money. Index-based ETFs are not actively managed, and the return of index-based ETFs may not match the return of the underlying index. Actively managed ETFs do not necessarily seek to replicate the performance of a specific index. Both index-based and actively managed ETFs are subject to risks similar to those of stocks, including those related to short selling and margin maintenance requirements. Ordinary brokerage commissions apply.

Footnotes

-

1

Source: Morningstar August 31, 2024. AUM and Flows rounded to nearest billion. Not all products are available in all jurisdictions. *China data through June 2024.

-

2

Ibid.

-

3

Ibid.

-

4

Source: Invesco Ltd. AUM of $1,751.8 billion, client-related data, investment professional and employee data as of 31 Aug 2024. AUM includes all assets under advisement, distributed and overseen by Invesco. Invesco ETF AUM includes both active and passive ETFs and indexed strategies across US, UCITS, and Canada ETFs.