ETF & ESG: Customizing ESG exposure through ETFs for returns

Demand for exchange-traded funds (ETFs) has continued to grow despite challenging markets in 2022. The industry has seen global assets under management (AUM) in ETFs reach US $10 trillion as of May 20231 and ETFs have become the tool of choice for investors looking to deliver on investment objectives and returns. This piece deep-dives into the world of ESG ETFs covering market growth and dynamics, thematic trends and opportunities, and an overview into investment approaches.

1] Why ESG ETFs

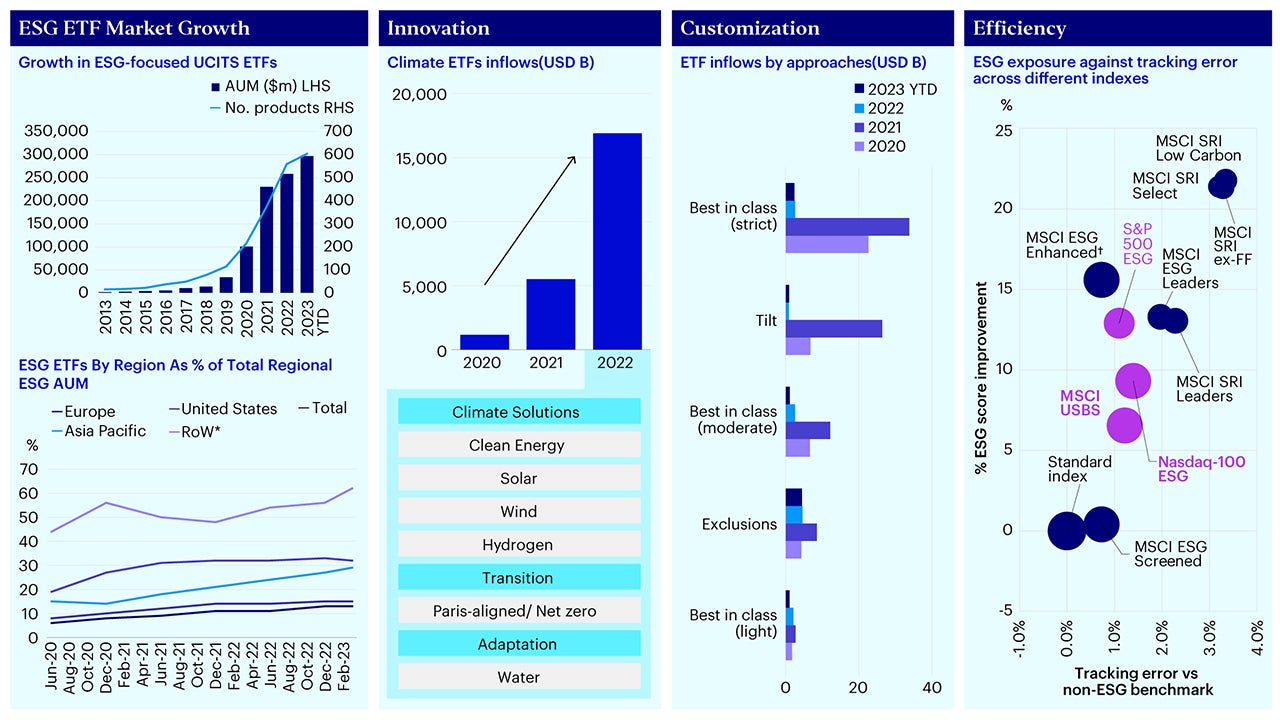

Source: Bloomberg (Apr 2023); Morningstar & MS analysis; Invesco, Bloomberg as at 31 Mar 2023; Nasdaq as at last rebalance, 20 Mar 2023; S&P DJI as at latest annual reconstitution, 30 Apr 2022; MSCI as at latest semi-annual reconstitution, 1 Dec 2022. Standard Index is MSCI USA, except for S&P 500 ESG (S&P 500) and Nasdaq-100 ESG (Nasdaq-100). Tracking Error calculated from common index inception date of 18 Mar 2016. Bubble size shows % market coverage by market cap.

Demand for ESG ETFs has grown considerably in recent years accounting for over US $300 billion in assets as of April 2023, with the majority of flows going into European domiciled ETFs.2 This direction of travel is also consistent globally, where Morningstar data shows that ESG ETFs as a proportion of overall ESG AUM has continued to gain share across different regions3.

Notable market drivers include:

- Thematic demand: Demand for thematic strategies soared particularly in 2020 and 2021 where growth-driven investment styles and factors drove return. A range of thematic ETFs are available in the market, and we believe this will continue to be a megatrend particularly for long-term investors.4

- Investor mix: Institutional investors have typically favored ETF strategies as a way to “invest large sums while benefitting from lower fees”5 and in regions like Europe or Asia, the regulatory push toward ESG (such as from the Sustainable Finance Disclosures Regulation, SFDR, or climate-risks disclosure requirements) alongside net zero commitments has further driven ESG ETF asset growth. There is also a growing share of retail investors that favor these cost competitive strategies especially as markets have shifted towards value and quality in 2022.

- Need for differentiation: Looking ahead, given the growing regulatory scrutiny on greenwashing alongside crowding of similar ESG strategies, we believe investors will continue to look for more compelling and differentiated ESG strategies and investing in ESG ETFs can provide them with a range of unique offerings.

Against that backdrop, ETFs as investment vehicles have unique features aligned to investor’s needs and ESG objectives:

1] Innovation: ETFs enable investors to buy into a specific theme or themes thus executing on their target investment thesis, be it in clean energy or energy transition.

2] Customization: ETFs can provide access to a range of ESG strategies and approaches that can be customized to meet investor requirements for ESG exposures or other investment objectives.

3] Efficiency: ETFs are relatively competitive from a cost standpoint when balanced against other investment risk adjustments and considerations.

4] Implementation: ETFs can provide investors with access to a wide range of multi-asset class exposures and geographies.

2] How to invest in ESG ETFs

Source: Invesco, for illustrative purposes only.

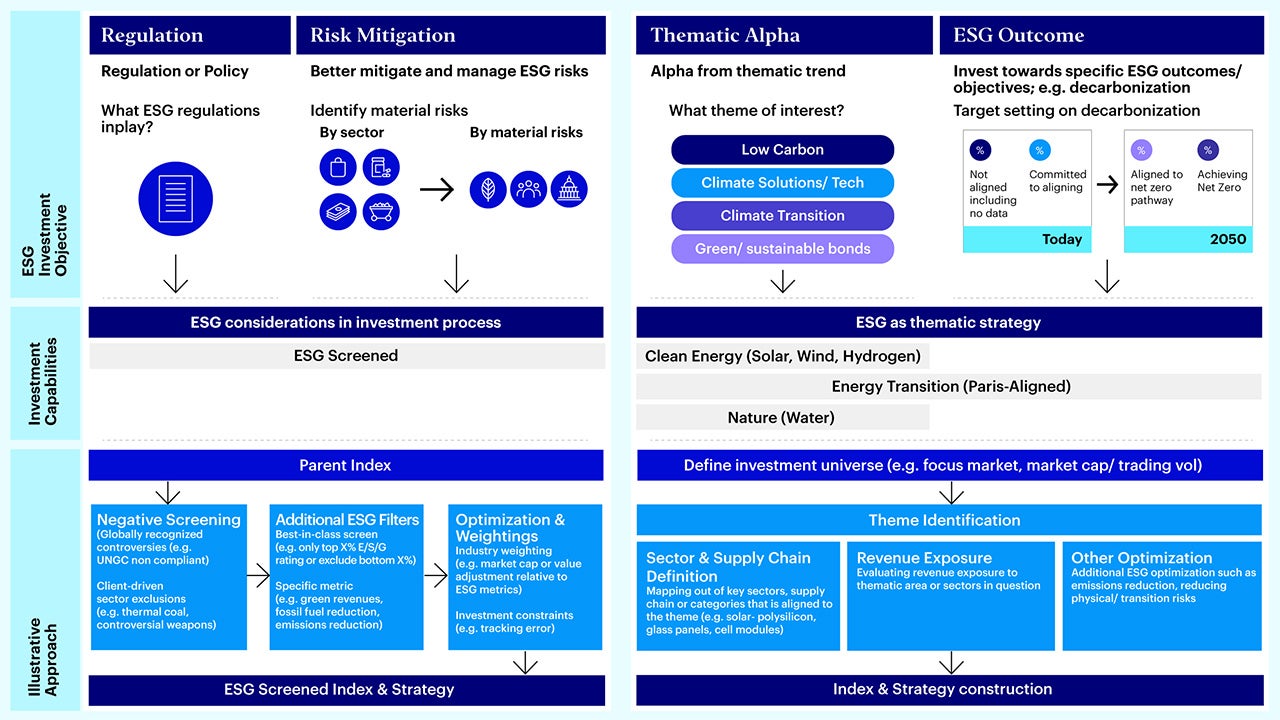

As shared in our previous ESG Asia Playbook piece, we understand that different investors have different motivations and objectives relating to ESG investing. ETFs can allow investors to customize their investment strategies to meet different ESG objectives.

There are two main implementation approaches to investment:

I] Gaining ESG exposure using screened strategies: For investors that are considering ESG investments to tackle regulatory or risk management considerations, screened strategies allow for some degree of ESG exposure while optimizing and balancing against other investment considerations like minimizing tracking error. These strategies can help improve the ESG profile of holdings while tracking much closer to standard benchmarks. A typical process begins with using a parent index (like MSCI World or S&P500) and then adding consideration layers:

o Exclusionary screen: Exclusions or negative screening often relates to avoiding globally recognized controversies such as non-compliance of United Nations Global Compact (UNGC) or other sector or business activity restrictions such as controversial weapons, thermal coal, or tobacco.

o Additional ESG filters: Additional ESG overlays typically look to conduct best-in-class screening on better performing ESG-rated issuers or negative screening on laggard issuers. At times, there can also be metric-specific overlays for example on ESG momentum or optimizing for emissions reductions or green revenues.

o Optimization and weighting: Finally, index constituents can be weighted such as by using market cap adjustments or balancing against other investment constraints such as tracking error.

II] Targeted ESG objectives through thematic strategies: For investors that might be more interested in thematic alpha or specific ESG outcomes, thematic strategies allow investors to customize strategies that are aligned with their ESG objectives or focus areas. These thematic strategies can be used for tactical allocation or as part of a core-satellite approach with the potential to offer diversified sources of return over the long term. Typical implementation begins with defining an investment universe and then identifying issuers related to the theme in question. This can include:

o Sector and supply chain definitions: Identifying categories relevant to themes can be done through mapping of sectors (e.g., renewable theme could include solar, wind, hydrogen) or mapping of supply chains (e.g., solar supply chain includes polysilicon, glass panels, cell modules, charging stations)

o Revenue exposure: Assessing revenue exposure to the sector, themes or categories defined.

o Other optimization: Certain strategies can also have additional overlays, for example for Paris-aligned strategies, reductions in emissions intensity, reductions in transition and reductions in physical climate risks could also be considered.

3] What are ETF thematic opportunities

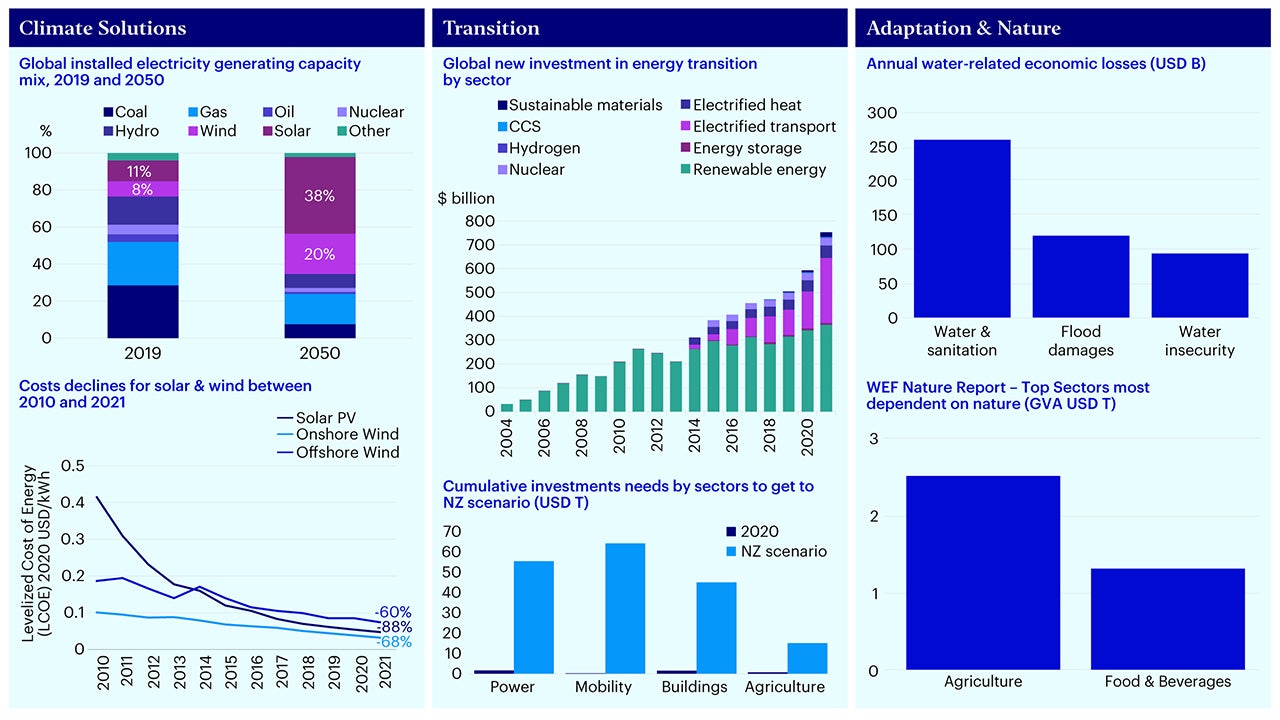

Source: Bloomberg NEF, New Energy Outlook 2020, forecast under the economic transition scenario; BloombergNEF, Energy Transition Investment Trends Report, Jan 2022. OECD (Policy-Paper-Financing-Water-Investing-in-Sustainable-Growth.pdf (oecd.org) )

ESG-related themes present interesting thematic opportunities for investors. Some themes that have emerged in recent years include:

- Clean Energy: As detailed in our piece on clean energy investments, clean energy ETFs have gathered over US $24 billion in new assets since 2020.6 Global signatories to the Paris agreement have adopted renewable targets and subsidies, further strengthened by their strategic plans to increase energy security following geopolitical supply shocks in 2022. Cost declines from technological gains as well as the growing transition away from traditional energy sectors has further increased clean energy adoption.

- Solar: Forecasts expects solar power to generate more than 35% of all electricity globally by 20507. Solar power costs have dropped by 85% since 2010 with further declines of 71% expected by 2050.8 Access to storage is key in addressing intermittency challenges. Interesting opportunities exist across supply chain from polysilicon, wafer, cells, and inverters.

- Wind: Similar direction of travel as solar, with wind’s share of installed electricity capacity expected to reach 20% by 20509 with costs having come down by 60% since 201010. Opportunities exist across the supply chain including wind farms, wind-related raw materials, new component manufacturing and smarter grid and distribution systems.

- Hydrogen: Hydrogen is expected to replace oil and gas in hard-to-electrify use cases such as shipping. The key is to develop a broad hydrogen economy which includes fuel cells, hydrogen generation, storage, and transportation.

- Transition: As shared in our research partnership with Tsinghua CGFR on Transition Leadership, traditional industries that account for a material share of economic output today can play a key role in the transition to a low carbon economy. Continued increases in carbon pricing policies (whether taxes or emissions trading schemes) alongside technological adoption can drive material financial impact on valuations. Companies that are making early initial progress on transition could benefit from financial upside, especially in mitigating transition risks and capturing productivity gains. Investing in transition requires assessing risks and progress. Looking at areas such as quantification of physical and transition risks, green revenues share, and temperature alignment, can all help in capturing transition upside.

- Adaptation and nature: Increasing physical risks and El Nino in 2022 has brought an increasing focus on adaptation and nature. Regulatory developments like the Taskforce on Nature-related Financial Disclosures (TNFD) have also accelerated investor attention on nature-related risks and opportunities. From an investment perspective, taking a thematic approach presents unique opportunities such as in water and agriculture.

- Water: Water scarcity remains a critical global challenge; The World Economic Forum projects that more than US $20 trillion will need to be spent on water provisions by 2030 alone.11 Key investment themes include investing in water-related infrastructure whether for conservation, purification, or sanitation. This thematic also serves as a more stable complement to renewables.

- Agriculture: This sector is heavily dependent on nature with linkages to themes like water and climate risks. Potential investment themes relate to agrifood security, health and nutrition, and emissions reduction.

Towards ETF ESG Investing

At its core, we believe that ESG doesn’t have a “one size fits all” solution and different investors have corresponding preferences in various ESG objectives and investment considerations. The use of ETFs as an investment vehicle can support the implementation of relevant strategies aligned to investor’s ESG and financial considerations.