Nasdaq 100 Index – Commentary - June 2023

Accessing Innovation in the US

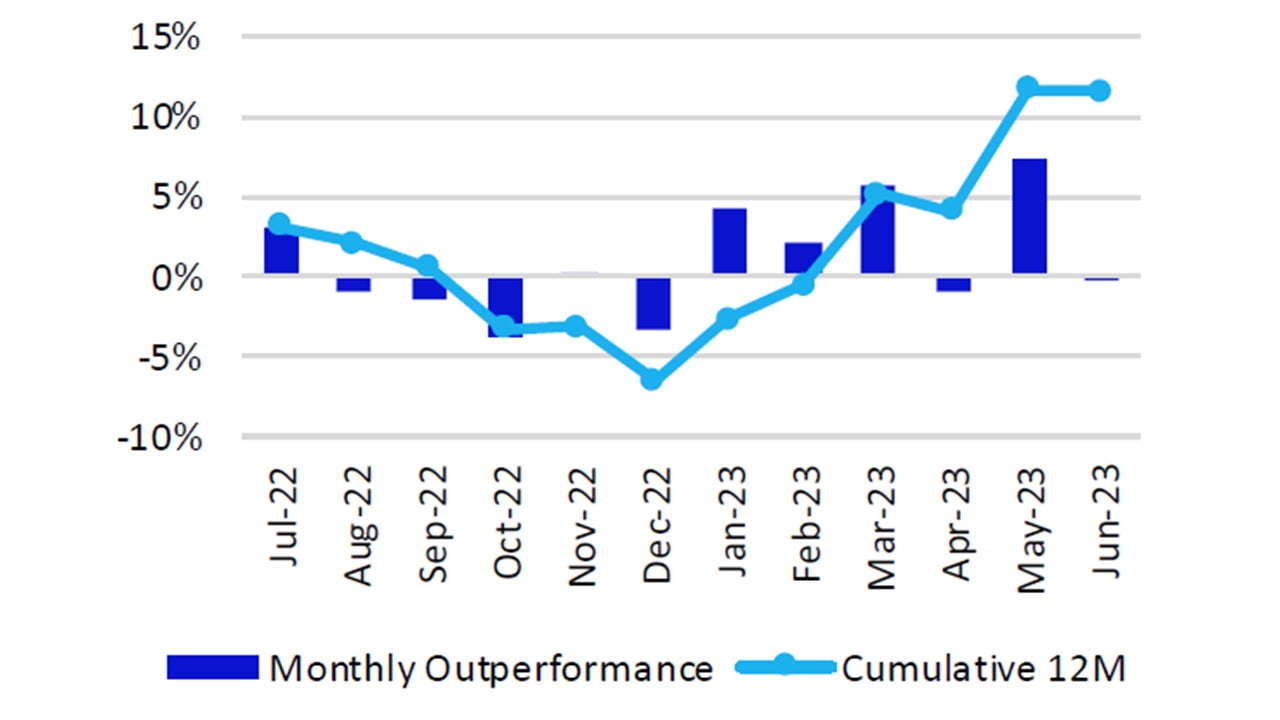

The major equity indices were positive for the month of June as this year’s rally continued. The S&P 500 officially moved into bull market territory, a rise of 20% from the lows, and has returned 25.97% from the October lows through the end of June. NDX has risen 41.65% during the same period. While the primary source of returns in equities during this rally have been driven by Technology and Consumer Discretionary stocks, Industrials and Materials contributed as well in June. Small-Cap companies also started to participate with the Russell 2000 Index returning 8.13%, the best monthly return since January. Several factors contributed to the performance seen during the month: actions from the Federal Reserve, persistent inflation, unemployment data and how sustainable the current outperformance from a few Large-Cap Growth companies may be.

Actions from the Federal Open Market Committee (FOMC) continued to be primary factor of market behavior. The much-anticipated pause in the rate hiking cycle arrived at the June FOMC meeting and was debated if it was a “hawkish pause” or “dovish pivot.” Messaging from the FOMC and Jerome Powell was mixed as the median estimate from Fed officials for the target rate at the end of 2023 was raised to 5.75%, implying that there could potentially be two more 0.25% rate hikes this year.

Inflation remained a concern as the most recent Consumer Price Index (CPI) reading showed how persistent current inflation is. Although headline year-over-year CPI continued to drop, 4.0% vs. the previous reading of 4.9%, Core CPI which excludes, energy and food, remained elevated at 5.3%. The month-over-month reading of Core CPI was 0.4%, implying an annualized reading of 4.8%. The Personal Consumption Expenditure (PCE) reading was announced on the last day of the month with the year-over-year number reported at 3.8%. Similar to CPI, Core PCE remained elevated at 4.6%. With inflation remaining elevated, combined with the FOMC’s commitment to reduce it to its target of 2.0%, investors continued to debate how many more rate hikes may occur.

Index performance

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

6.5% | 39.2% | 32.8% | 18.8% |

| S&P 500 | 6.6% | 16.6% | 19.0% | 12.2% |

Relative |

0.0% | 19.4% | 11.6% | 5.9% |

Source: Bloomberg as of 30 June 2023.

An investment cannot be made directly into an index.

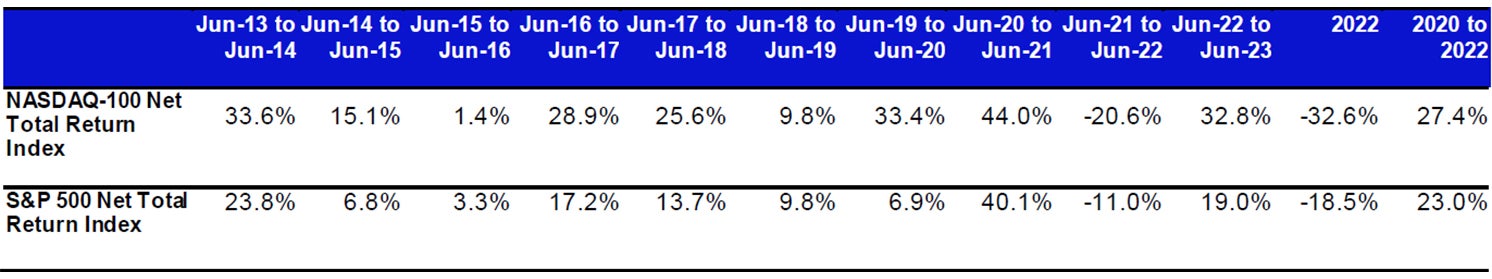

Source: Bloomberg as of 30 June 2023.

An investment cannot be made directly into an index.

Past performance does not predict future returns.

Data: Invesco, FactSet as of 30 June 2023. Data in USD

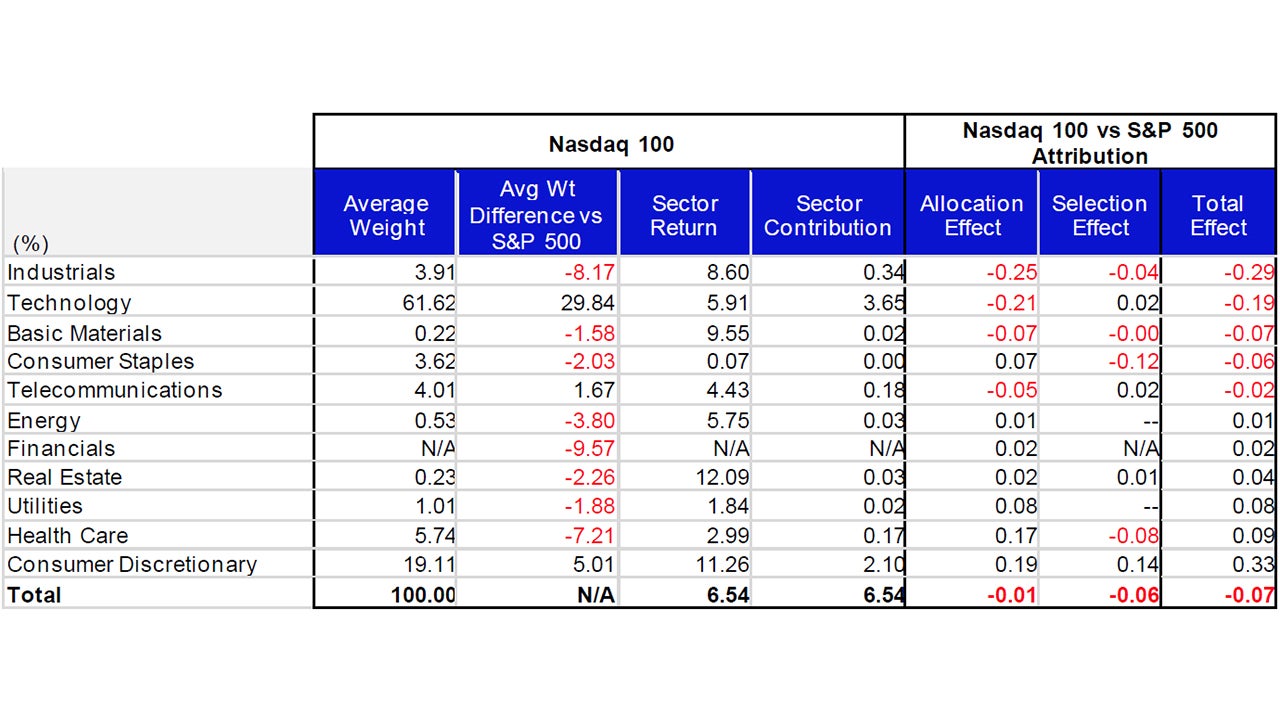

Whilst the Nasdaq-100 specifically excludes Financials (incl. Real Estate), it also currently offers very little exposure to Basic Materials or Energy

Nasdaq 100 Performance Drivers

June performance attribution of the Nasdaq 100 vs the S&P 500 Index

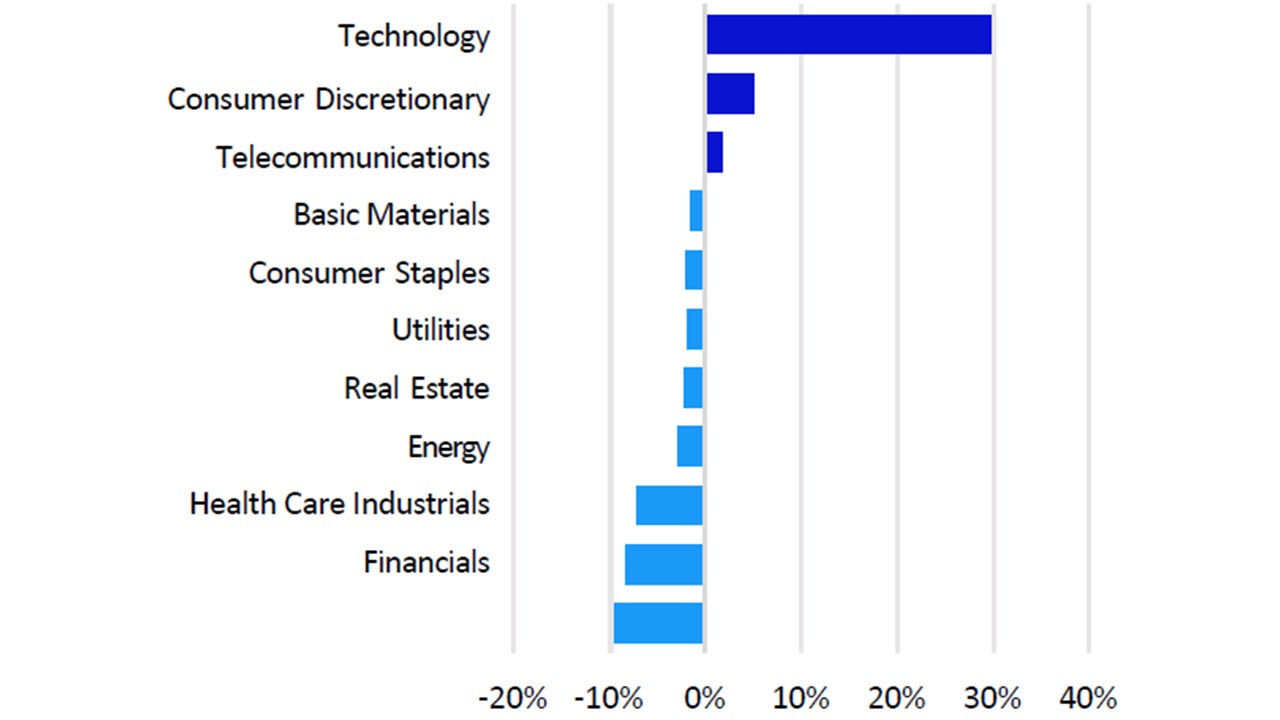

For the month of June, all sectors had positive performance. The Nasdaq 100 Index (NDX) returned 6.5%, underperforming the S&P 500 Index, which returned 6.6%. From a sector perspective, Real Estate, Consumer Discretionary and Basic Materials were the best performing sectors in NDX and returned 12.09%, 11.26% and 9.55%, respectively. The bottom performing sectors in NDX were Consumer Staples, Utilities and Health Care returning 0.07%, 1.84% and 2.99%.

NDX’s underperformance vs. the S&P 500 was largely driven by its underweight exposure and differentiated holdings in the Industrials sector. The ETF’s overweight exposure in the Technology sector also detracted from relative performance. The fund’s underweight exposure in the Basic Materials sector was the third largest detractor to relative performance vs. the S&P 500. Consumer Discretionary contributed the most to relative performance and was driven by overweight exposure and differentiated holdings. Health Care and Utilities also contributed to relative performance, both driven by underweight exposure when compared to the S&P 500.

Data: Invesco, FactSet, as of 30 June 2023 Data in USD. Sectors: ICB Classification

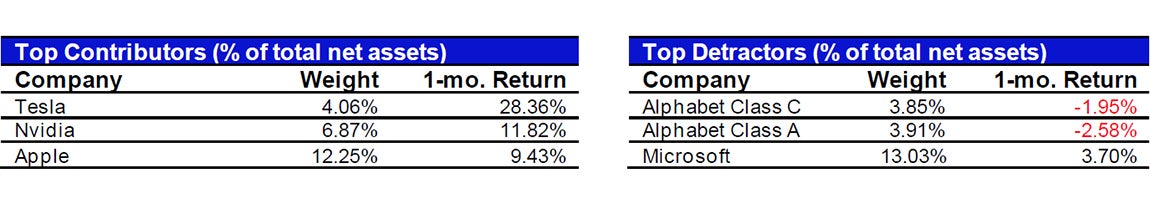

Source: Bloomberg, as of 30 June 2023. Past performance does not predict future returns. Top and bottom performers for the month by relative performance.

Past performance does not predict future returns

Data: Invesco, Bloomberg, as of 30 June 2023. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.