Tsinghua CGFR-Invesco Research: ISSB’s investment implications for China and Asia

The International Sustainability Standards Board (ISSB) has arrived. In June 2023, ISSB issued its inaugural S1 and S2 global standards. Amidst an alphabet soup of regulations, the standards aim to create a common language and global baseline for disclosure of sustainability information to better inform investment decisions. Tsinghua Center for Green Finance Research (CGFR) has done analysis on ISSB’s impact on China and the following piece examines the regional developments around ISSB in Asia and China and looks at the potential investment implications of the standards.

What is ISSB?

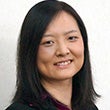

Source: IFRS (project-summary.pdf (ifrs.org) )

Given both increasing investor interest for material sustainability information alongside a backdrop of an alphabet soup of sustainability standards and frameworks, the ISSB was established by International Financial Reporting Standards (IFRS) to build a global baseline of sustainability related disclosures.

Key features include:

- Principles: Focus on financial materiality where companies need to disclose material information relating to “sustainability risks and opportunities that could reasonably be expected to affect its prospects”. Global baseline signifies creation of a “building block” framework that each jurisdiction can adopt for their region and purposes. The standards are also built on established frameworks (including the coming together of Taskforce on Climate-related Financial Disclosures (TCFD), Climate Disclosure Standards Board and Value Reporting Foundation). The standards are also designed for proportionality with the goal of “reasonable and supportable information without undue cost or effort”1 including having phased requirements in form of transition reliefs in first year of application.

- Standards: Design of standards aligned to TCFD framework- relating to governance, strategy, risk management, metrics, and targets.

o S1 focuses on General Requirements for Disclosure of Sustainability-related Financial Information. The key is in identifying material sustainability related risks and opportunities, with sources of guidance specified such as Sustainability Accounting Standards Board (SASB) standards and other standards.

o S2: Climate-related disclosures- standards for issuers to identify and disclose material information about its climate-related risks and opportunities. Includes cross-industry metrics (including transition and physical risks, opportunities, capital deployment, internal carbon prices and remuneration) and industry-based metrics.

- Implementation: Implementation discretion is up to individual regulators, with the target timeline for reporting periods beginning on/ after Jan 2024; with first reporting in 2025.

Developments in Asia and China

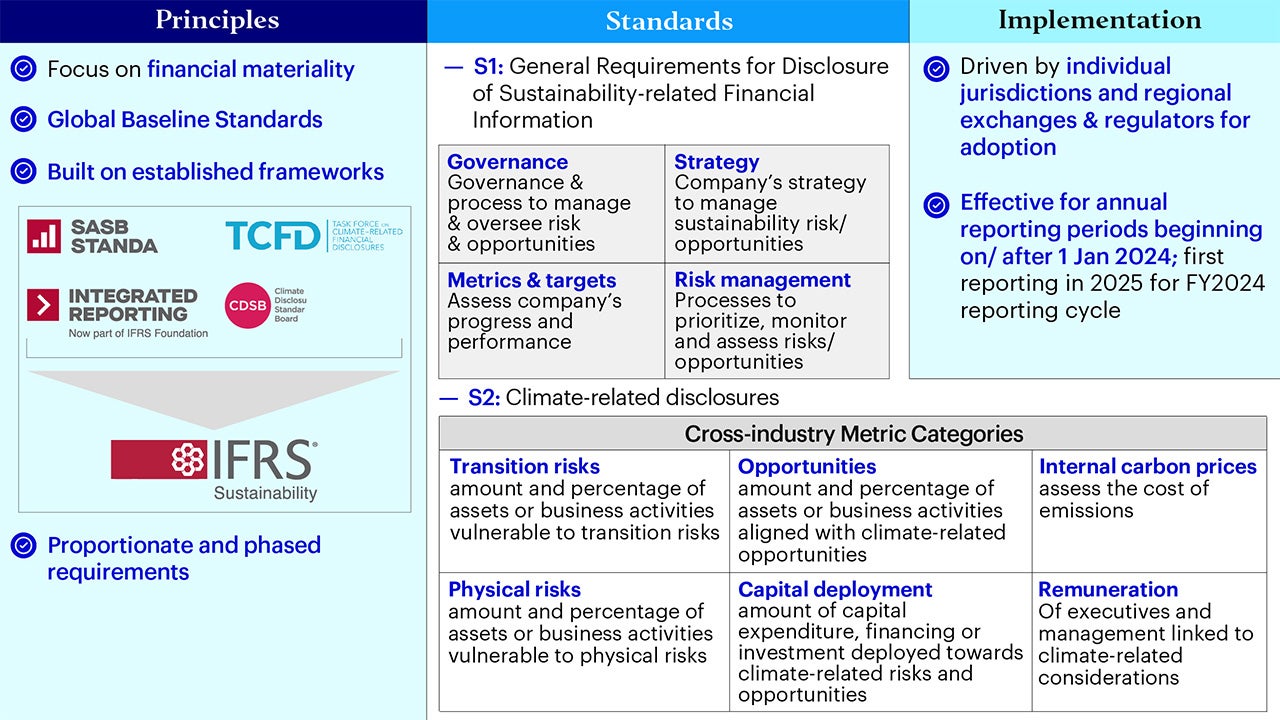

Developments in Asia and globally

Given ISSB’s positioning as a global baseline standard, it is expected that regional uptake will be significant. Hong Kong for instance has become of one of the first regions to release updated standards aligned with ISSB. Other notable regional developments include:

China deep dive

Regulators have progressively been stepping up guidance on relevant disclosures and companies’ sustainability disclosures have been increasing. The China Securities Regulatory Commission (CSRC) Vice Chairman Fang Xinghai mentioned during Boao Asia Forum Annual Conference in April 2022 that ISSB could have a significant impact on Chinese companies especially ones listed overseas2 The industry has also been closely monitoring developments in China, particularly following the signing of an MOU between IFRS Foundation and Ministry of Finance China in December 2022 and the establishing of a Beijing office for IFRS3

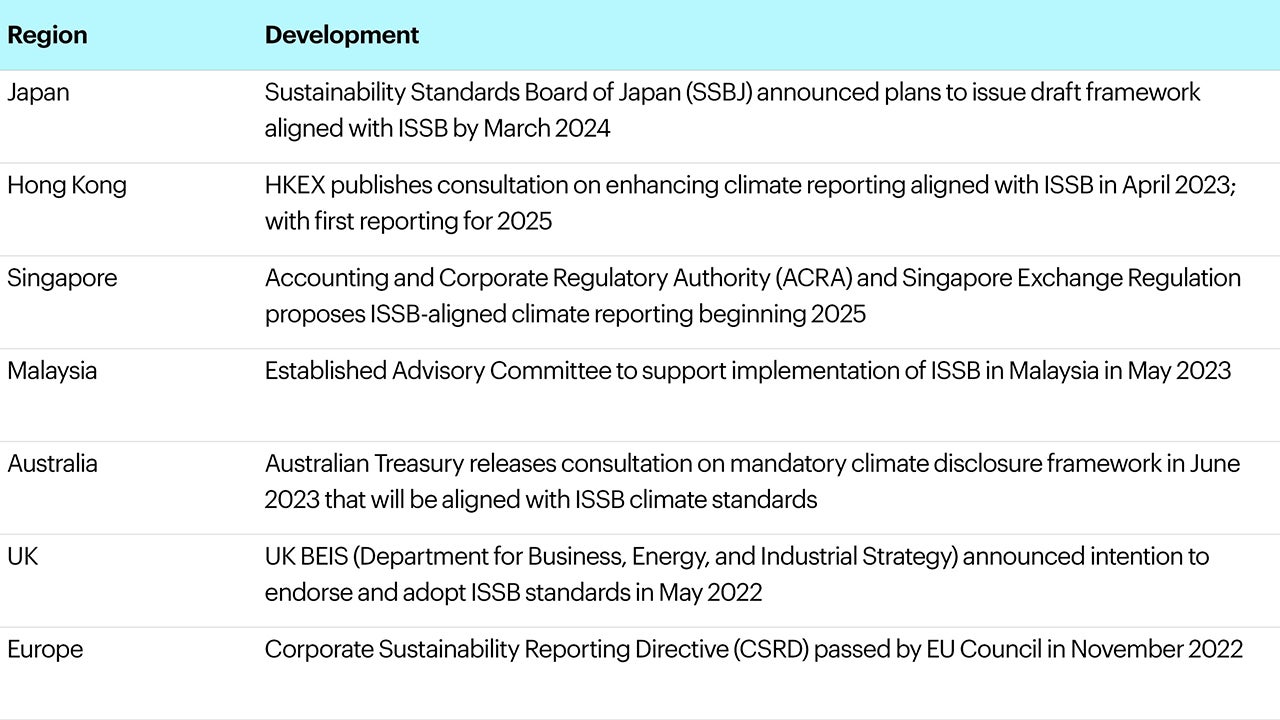

Source: Tsinghua CGFR-Invesco Research Analysis. Note: ISSB Exposure Draft Appendix B refers to the draft standards document published by ISSB (https://www.ifrs.org/projects/work-plan/climate-related-disclosures/appendix-b-industry-based-disclosure-requirements/).

Based on IFRS ISSB Standards published in 2022, Tsinghua CGFR has undertaken preliminary research to analyze how Chinese companies’ existing disclosures align with ISSB in a sample of companies in steel sector. Some of the key highlights include:

- High alignment on emissions: Most listed companies (42 out of 45) disclose information related to “discussion of long- and short- term strategy or plan to manage Scope 1 emissions”.

- Disclosure varies across companies: Industry leader’s disclosure covers almost all the required metrics and is well aligned with standards.

- Disclosure varies across metrics: Disclosure is relatively better for the metrics that are more pronounced in the Chinese market (e.g., Scope 1 emissions and total energy consumption). Disclosure is relatively insufficient for metrics that are less acknowledged or required (e. g., percentage of water consumed in regions with high or extreme high baseline water stress and percentage from different furnace processes in raw steel production).

Implications for investors and issuers

As standards start to come live in different regions, we believe many investors will naturally examine potential implications for investment and issuers. From an investor’s perspective, the adoption of the standards will likely drive:

- Enhanced transparency: particularly for climate-related metrics initially that will likely allow further pricing in of climate and sustainability data in valuations. Data availability and quality can increase, allowing for greater standardization and comparability for investor usage and for identification of leaders versus laggards and the factoring in of improving ESG momentum.

- Materiality and risk integration: Overall emphasis on financial materiality will further deepen approaches to ESG integration with disclosures helping to provide more sector-specific identification of investment risks and opportunities that can factor into investment processes.

- Focus on transition: S2 requirements on climate transition risks and opportunities will increase emphasis on transition planning of companies and as more companies report on transition plans and quantification of climate risks and opportunities, transition leadership as an investment thesis will continue to grow.

For issuers, we believe the standards will also signify:

- Focus on transition planning: S2 standards requirements can serve as a reference framework for issuers to consider climate risks holistically, including encouraging the setting of internal carbon prices, conducting scenario analysis, and setting in-place transition plans with suitable capital deployment. Relevant capacity building in these areas would be required especially for small and medium enterprises.

- Improved ESG ratings: Adoption of globally recognized standards can increase alignment in reporting metrics that could potentially help improve ESG ratings from foreign rating providers for Chinese issuers4

- Capacity building: It is becoming imperative for Chinese entities to devote attention to understanding the ISSB and related general disclosure guidance. More attention can be devoted to capacity building on board and management oversight and activities around ESG strategies. Preparation could begin with identifying and assessing the gaps between current voluntary reporting and ISSB requirements.

Towards ISSB adoption

ISSB’s arrival is a key industry milestone in supporting sustainability reporting so that it becomes more standardized and robust globally. As various regions start to implement the standards into disclosure requirements, we believe this could create meaningful investment opportunities particularly with regards to transparency and the transition ahead.

Footnotes

-

1

IFRS project-summary.pdf (ifrs.org)

-

2

ESG Investor China Plans Adoption of ISSB Standards – ESG Investor

-

3

IFRS IFRS - IFRS Foundation and MoF China sign an MoU to establish an ISSB office in Beijing

-

4

Ignites Ignites Asia - Chinese exchanges weigh up own ESG disclosure guidelines after new ISSB standards