Tsinghua CGFR-Invesco Research: Investing in transition leadership in China

As shared in our ESG 2023 Outlook, as the industry moves from net zero commitments to implementation, climate transition is a key theme to watch out for. COP27 saw the launch of the Transition Plan Taskforce and Net Zero Guidelines as initial developments to guide corporates and governments in making transition plans. Yet recent CDP research also shows that among the 18,600 companies providing data to CDP, only 0.4% (81) were assessed as having credible transition plans1. How then should investors be thinking about investing in transition? Over the past year, Invesco has partnered with Tsinghua’s Center for Green Finance Research (CGFR), specifically looking at pathways for high-emitting sectors in China. The following piece deep dives into transition investing, leveraging on key insights from the research partnership.

On the case for transition investing: opportunities and challenges

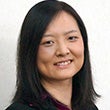

Source: IEA Analysis; CDP, Bloomberg

Broadly speaking there are three approaches to climate investing - investing in climate technologies driving decarbonization, low carbon names with lower climate risks, and high emitters with early transition progress. Market research shows that the majority of sustainability investing in China till date has been focused on climate solutions, notably in renewables, clean energy, and electric vehicles2. At the same time, there has been a steady increase in funds focusing on transition, with assets under management growing eight-fold3. The investment thesis for transition leadership is to identify issuers making early progress on transition that can benefit from global tailwinds towards decarbonization. Key drivers include:

- Economic share of transition sectors: Existing coal-based economy implies that the majority of transition efforts will be driven by high-emitting sectors. Further sectors like power and steel affect corresponding downstream applications and their decarbonization progress can have material implications on the wider economy.

- Policy tailwinds: National policies such as the 1+N framework alongside carbon pricing through the emissions trading scheme (ETS) can create material cost impact for businesses. Earlier decarbonization efforts can offset costlier carbon prices over time.

- Commercial risks: Certain sectors may see regulatory impact on both supply and production (such as on zero emission vehicles) and consumer changes in preferences. Physical risks relating to heat stress or flooding could create price pressures and supply shocks.

- Investor adoption: As we see increases in investors’ net zero commitments globally alongside increases in Chinese PRI signatories, we expect there will be greater consideration of climate risks and potential capital reweighting towards issuers with better resilience (further helped by shift from exclusions to engagement and broad-based integration).

However, challenges relating to standards and greenwashing, data availability, progress evaluation and capital considerations remain:

1] How can we define transition? Transition investing requires a credible framework to assess progress towards address greenwashing concerns; however there has yet to be industry consensus on defining transition standards. The G20’s Transition Finance Framework provides principles-based guidance to think about transition and certain regions have also began developing taxonomies that include transition activities. For instance, Singapore’s Green Finance Industry Taskforce (GFIT) taxonomy proposes a “traffic light” approach4:

- Green activities contribute substantially to climate mitigation aligned to a net zero pathway

- Amber activities are transition activities that help to move towards a green transition pathway within a defined timeframe or facilitate reductions in the short term5; either assessed through:

o Transition plans put in place by companies, or a

o Measures-based approach of eligible technologies or initiatives that can help with short-term emissions

- Red activities are activities that are not compatible with a net zero trajectory

2] How can we measure transition? Additionally, the lack of commonly accepted standards also means fewer existing data disclosures on taxonomy-aligned activities that has made it challenging for issuer identification and analysis on transition progress.

3] How can we evaluate progress? Transition strategy necessitates improving transition outcomes over time, which also requires ways to both engage on transition alongside evaluation if progress is sufficient.

4] Financial and time considerations? Finally, we believe any discussions on transition should not be in isolation but rather be connected to capex or financial implications for the company; time horizons of green capex return on investment (ROI) needs to be balanced against potential gains or losses in revenues captured.

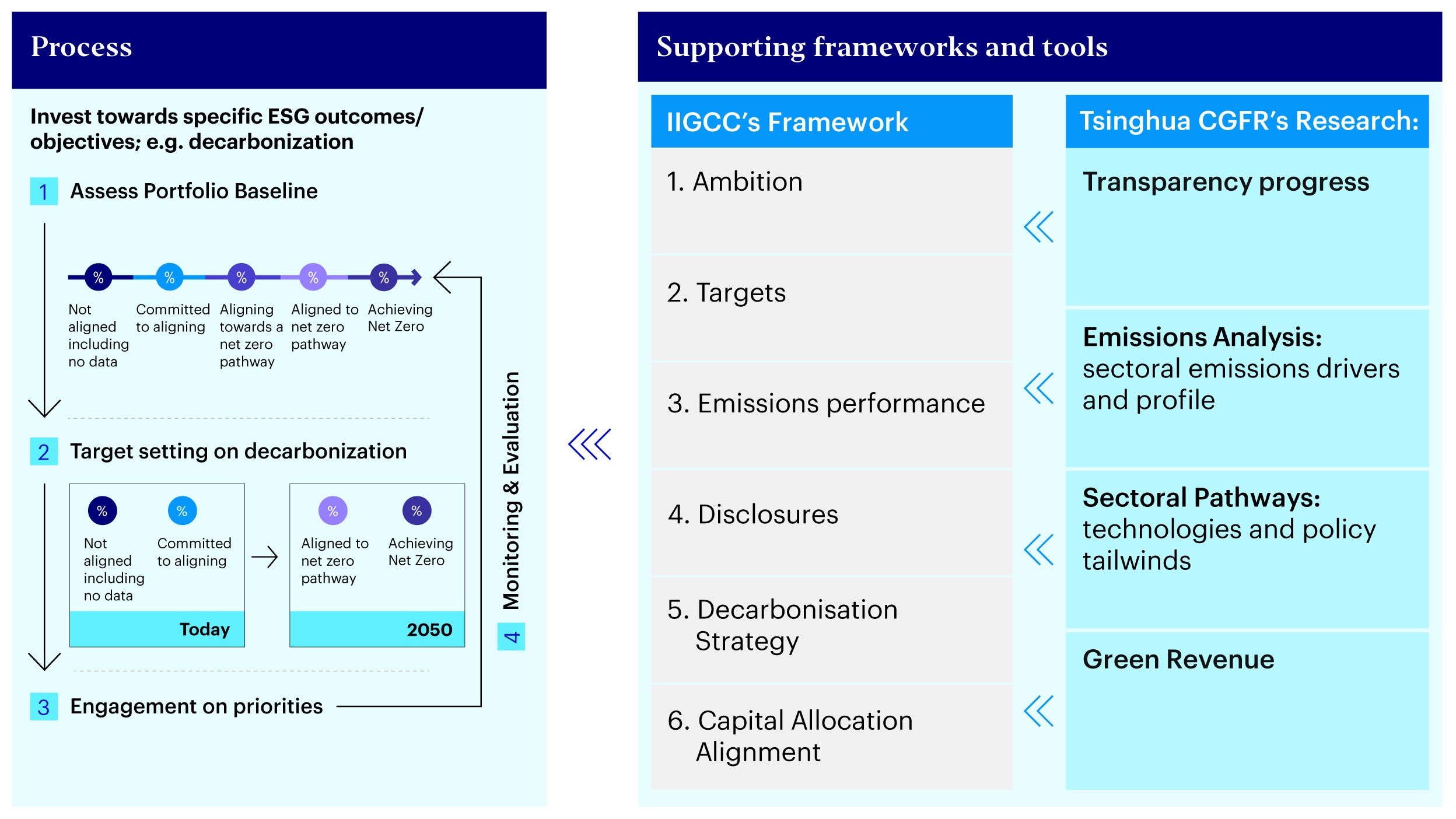

Framework and approaches for investing for Transition Leadership

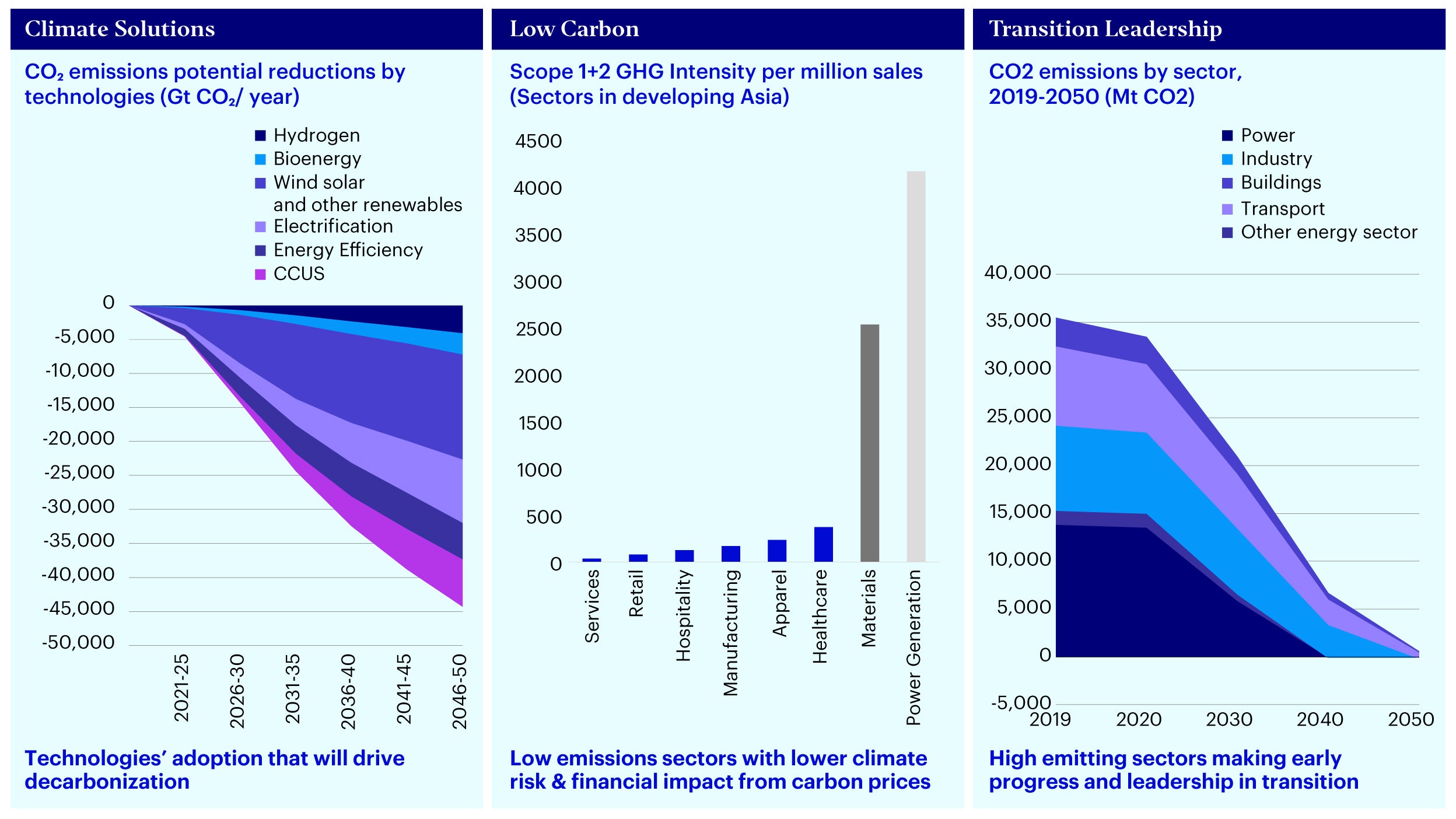

Source: Tsinghua CGFR-Invesco Research Analysis. Note: 1Targets are set in-line with science-based net zero pathways.

Investing for transition requires a framework to assess transition progress, data capabilities supporting the framework and an approach to engagement on transition. The Institutional Investors Group on Climate Change’s (IIGCC) framework defines key areas to evaluate issuers on including targets and emissions, forward-looking strategies and capital allocation. Leveraging from Invesco’s research partnership with Tsinghua’s Center for Green Finance Research, we examine four key areas for consideration when looking at transition investing as covered in the research:

I] Transparency Progress: Current disclosure alignment analysis to evaluate ambitions and targets of each issuer and more broadly understand priority and growth areas for disclosures.

II] Emissions Analysis: Tsinghua CGFR’s proprietary analysis of emissions profile in high-emitting sectors

III] Sectoral Pathways: Understanding policy drivers and technology pathways in each sector to evaluate decarbonization strategy

IV] Green Revenue: Evaluating capital allocation alignment through green revenue analysis with reference to taxonomy standards

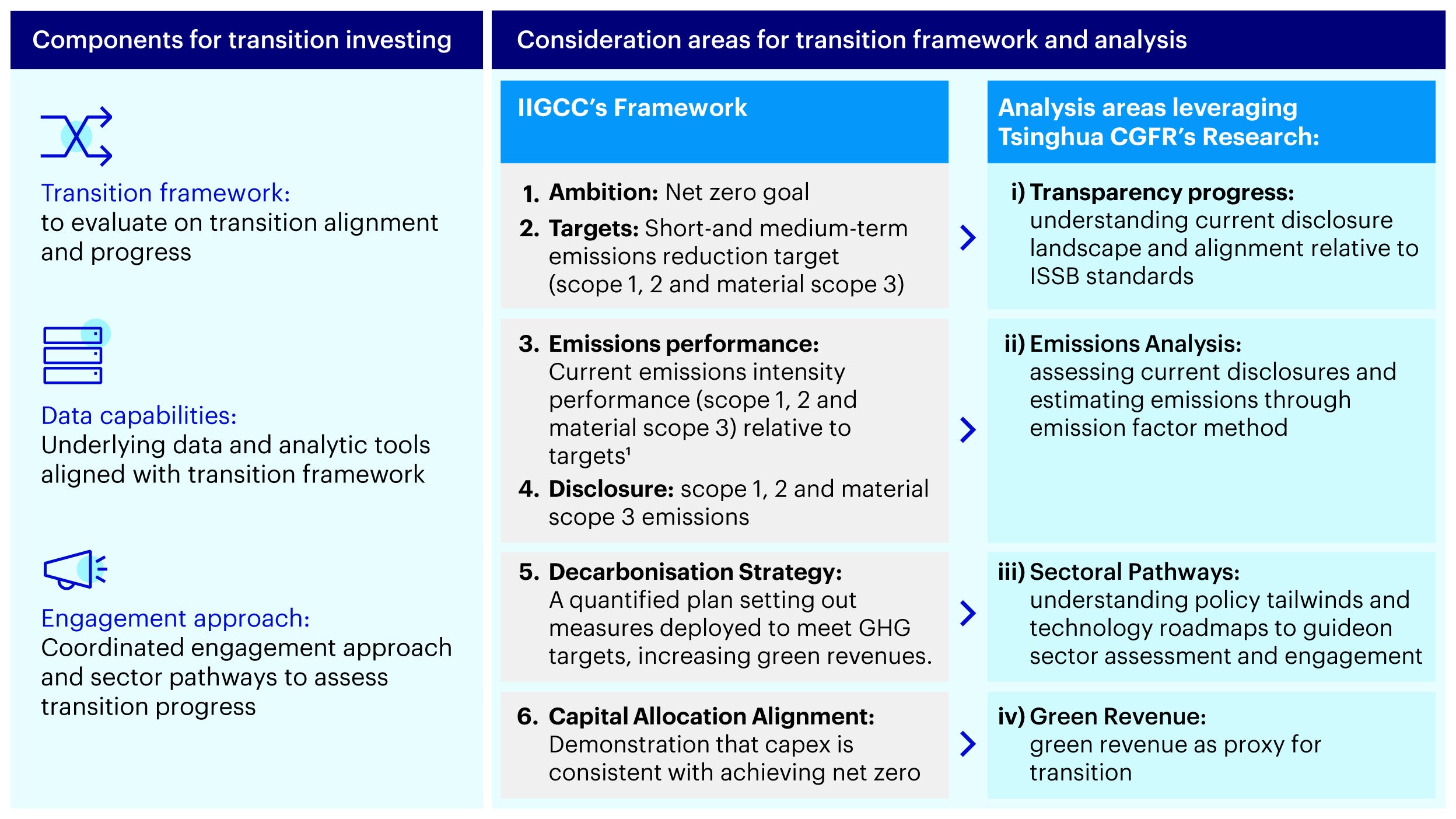

I] Understanding transparency progress

Source: Tsinghua CGFR-Invesco Research Analysis. Note: ISSB Exposure Draft Appendix B refers to the draft standards document published by ISSB (https://www.ifrs.org/projects/work-plan/climate-related-disclosures/appendix-b-industry-based-disclosure-requirements/).

International Sustainability Standards Board’s (ISSB) upcoming disclosure framework provides a common baseline for global corporates and investors. Interoperability of Chinese standards would be key in facilitating the cross-border flow of sustainable investments. Analyzing existing alignment and disclosure of standards could provide an understanding on current state of targets and disclosures amongst high-emitting sectors as well as provide an additional lens on assessing corporate efforts on transparency and transition planning and identifying areas to prioritize for engagement.

II] Analysis of emissions

Source: Tsinghua CGFR-Invesco Research Analysis

Evaluating companies’ transition trajectory has to begin with an understanding on the current emissions state both of the sector as well as the emissions profile of the company:

1] Sector state of emissions: Understanding the drivers of emissions within each sector and key sources in activities and processes

2] Issuer state of disclosures: High-level assessment of emissions disclosures across a sample of companies in each sector; looking at availability of corporate social responsibility (CSR) reports and annual reports and whether emissions or energy consumption data is included in reporting

3] Emissions analysis: Using “emission factor method”, a framework by the United Nations Intergovernmental Panel on Climate Change (UN IPCC), and following the guidance issued by the National Development and Reform Commission (NDRC) to estimate emissions from sample enterprises across each sector

This analysis also allows for comparison of issuers’ emissions profile both within and across sectors that can help with benchmarking on decarbonization targets and pathways.

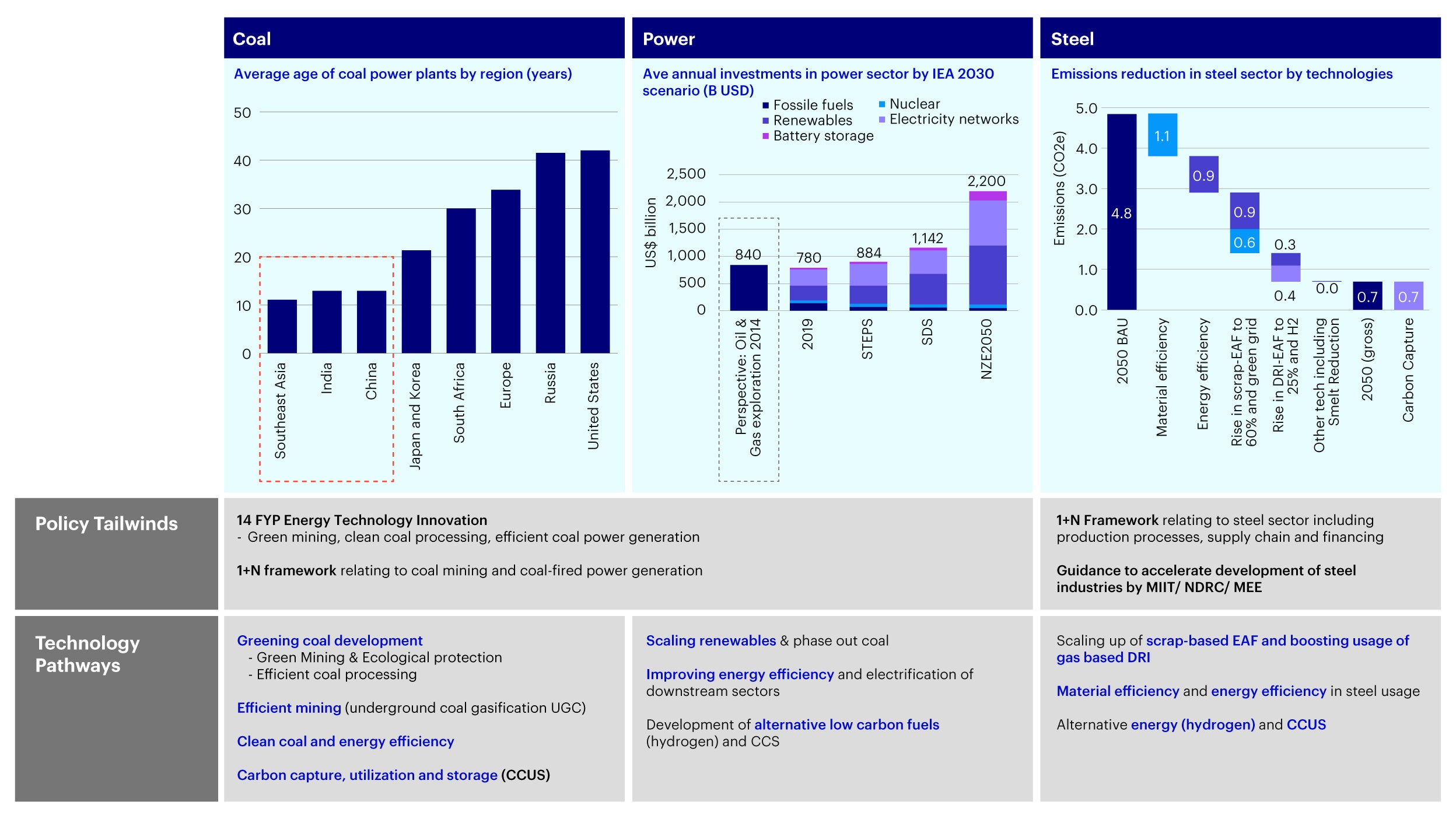

III] Sectoral pathways as framework for engagement priorities

Source: IEA (https://www.iea.org/data-and-statistics/charts/average-age-of-existing-coal-power-plants-in-selected-regions-in-2020); IIGCC Power Sector Paper (https://www.iigcc.org/download/iigcc-background-paper-accelerating-power-sector-decarbonisation/?wpdmdl=4007&refresh=62e3a403104351659085827.html); CA100+ Steel (https://www.climateaction100.org/wp-content/uploads/2021/08/Global-Sector-Strategy-Steel-IIGCC-Aug-21.pdf); Tsinghua CGFR-Invesco Research Analysis. Note: Carbon capture and storage (CCS).

Assessing the decarbonization strategy of a company is highly tied to the corporate’s industry context. Within China’s context, understanding the supporting policy tailwinds alongside the technology roadmap is critical:

- Coal: Near-term transition is focused on optimization whether in terms of technology upgrades in greening coal processing or improving energy efficiency or carbon capture.

- Power: Pathway is centered upon scaling up renewable energy and adoption; 2030 renewable targets are likely to be met ahead of time6.

- Steel: The industry is moving towards a platform approach with a consolidation wave likely; research estimates that 60-70% of steel capacity will be concentrated among the top ten players by 20257. Increasing production efficiency through greener production like scrap based electric arc furnace (EAF) will be key.

Sectoral roadmaps give an indication of technologies that we expect will drive emissions reductions in each sector and the supporting underlying policies. These pathways also provide a forward-looking lens that can feed into engagement priorities with issuers on their decarbonization plans and also support on evaluating progress.

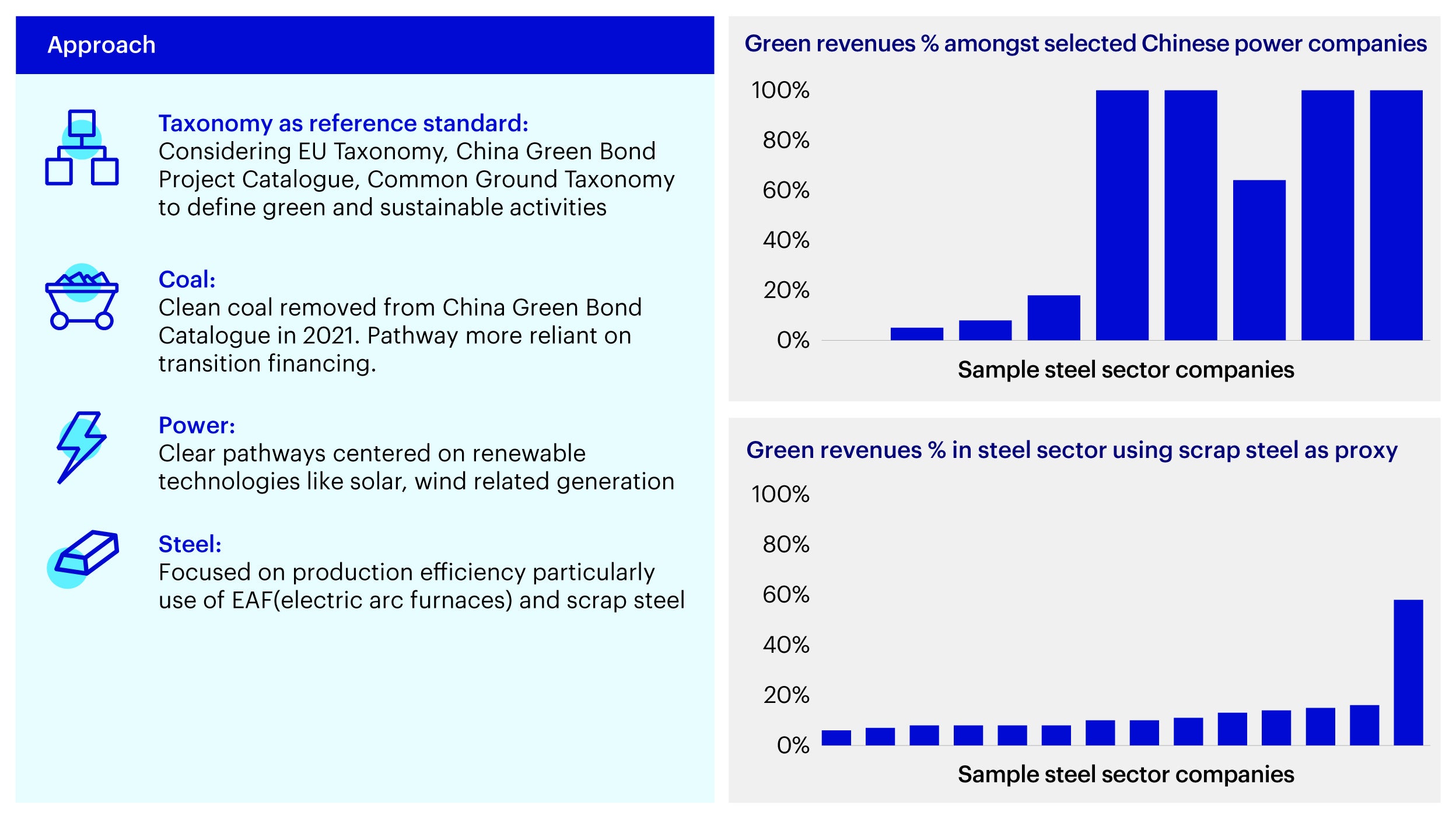

IV] Green Revenue as indicator on transition leadership

Source: Tsinghua CGFR-Invesco Research Analysis

In assessing issuers’ transition progress, green revenue is a valuable indicator of an enterprise’s sustainable activities and correspondingly a good lens with which to understand the depth of measures in environmental risk management. The EU-China Common Ground Taxonomy can serve as a good reference standard in defining green activities with clearer roadmap in power sectors and more complex production-related activities for the steel sector. Green revenue is also closely aligned with green capex required and impact on future cash flows as enterprises transition to lower-carbon methods of income generation.

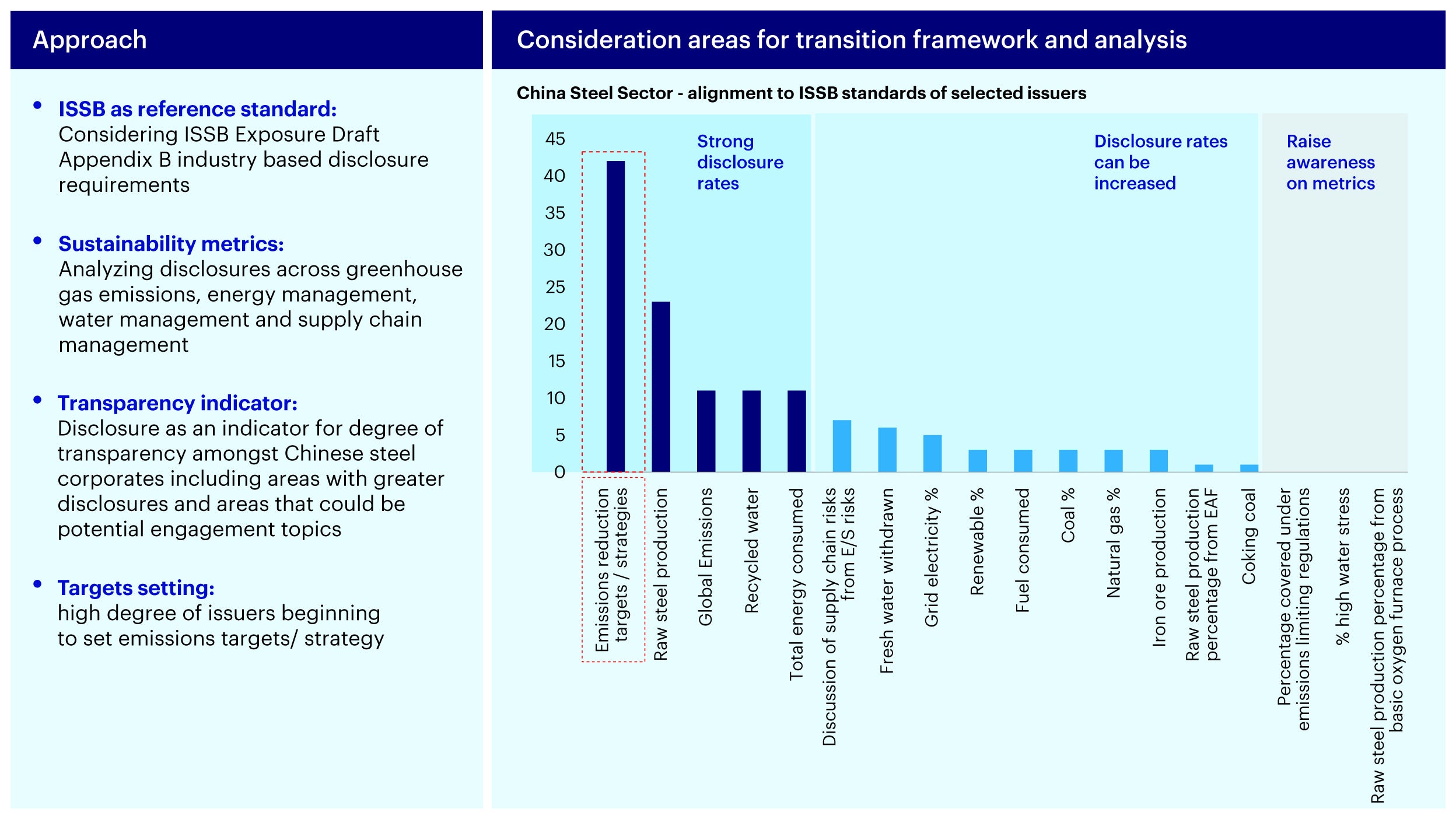

Putting together an approach for transition investing

Source: IIGCC; Invesco Analysis; Tsinghua CGFR-Invesco Research Analysis

A transition investing strategy could start by understanding the baseline of where issuers are at and setting transition targets such as using the framework shared above. Evaluating progress could then be assessed by performance and initiatives that the issuer is making across the various dimensions such as on actual emissions, disclosures, or green revenues - allowing for assessment on both emissions outcomes as well as forward-looking initiatives. The dimensions covered especially on sector technology pathways could also help feed into an investors’ engagement priorities on areas that can support issuers for transition.

Investment implications: growth in transition strategies, flows, opportunities

The growth of transition as a thematic creates opportunities to invest in transition leaders as well as climate solutions that benefit from adoption. In the longer term, we see the following investment implications:

- Capital shift to sustainability: Companies with greater climate disclosures (e.g., taxonomy-aligned disclosures) and progress (e.g., green revenue and green capex) could see increased flows. We expect that increasing clarity on taxonomy standards and transition needs will also drive growth in sustainability bonds being issued.

- Transition financing opportunities: Beyond conventional equity and fixed income, there could also be a diversification of financing instruments to support transition. The recent COP27 saw the launch of Just Energy Transition Partnership in Indonesia enabled by blended financing instruments with the goal to catalyze more private capital through more innovative financing vehicles.

- Role of stewardship: Finally, there would be a continued focus on the role of stewardship, particularly in driving towards more outcomes-based engagements over time.

As shared in our previous research on China’s Transition Story, China plays a critical role in the global shift towards decarbonization. Transition investments enabled by policy tailwinds and technological pathways is a key theme to watch going forward.