The real deal: Misconceptions of ESG ETF investing

Passive Environmental, Social and Governance (ESG) funds continue gathering assets at pace—€74.9bn of inflows over the past 12 months, according to Morningstar as of July 2021. But critics contend that passive funds, particularly exchange-traded funds (ETFs), fall short of providing real ESG benefits.

Common misconceptions about ESG ETFs include: misalignment with investor goals, overreliance on third parties, and a lack of meaningful outcomes.

Alignment of investor goals

ESG investing is subjective, with the most critical ESG issues, such as decarbonisation or gender equality, differing from investor to investor. Consequently, index-based ETFs may appear misaligned to personal investor ESG goals.

However, the full spectrum of ESG ETFs aims to bridge the gap and offers something for everyone.

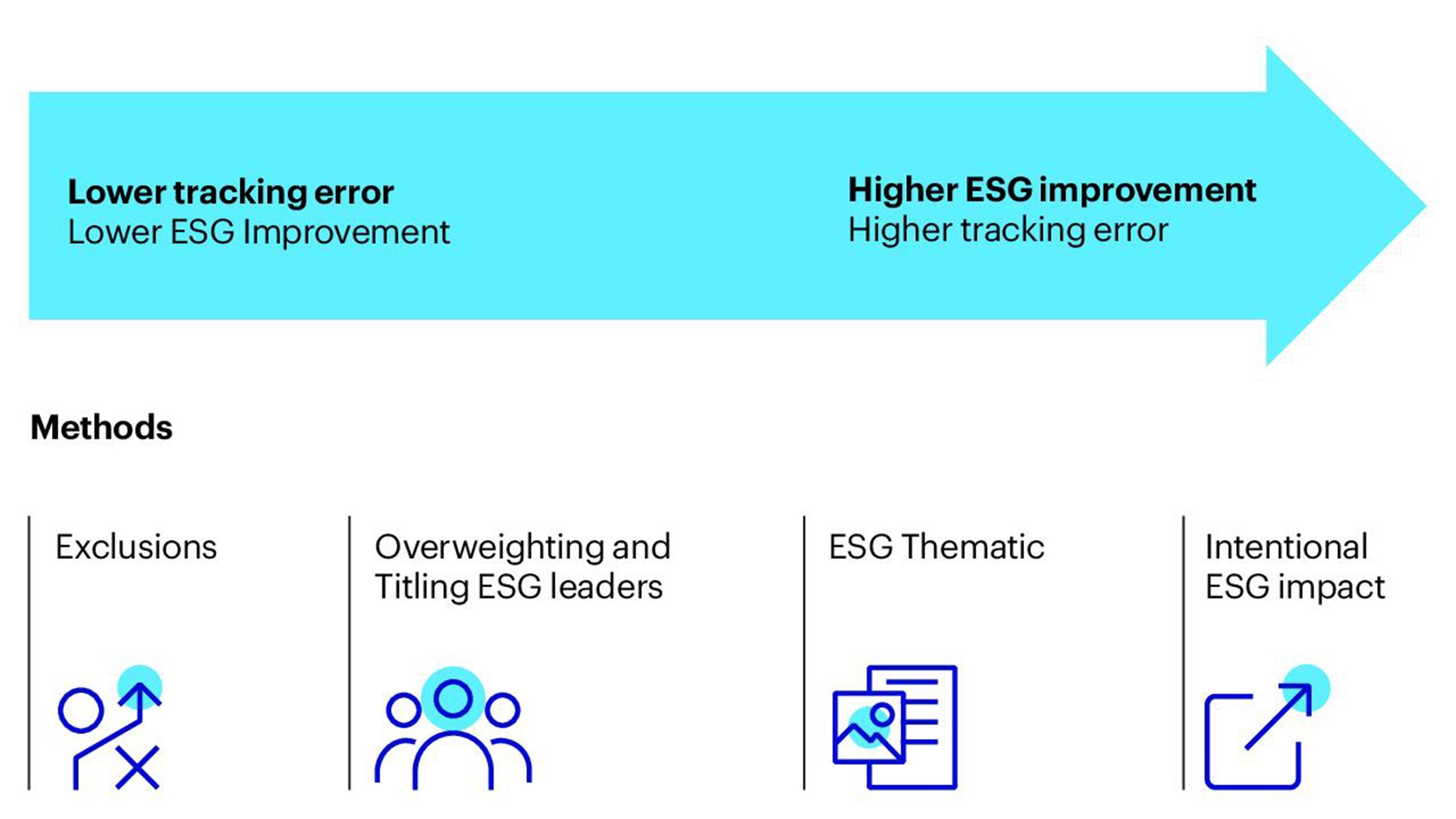

The journey begins with investors determining their own objectives. Which specific ESG issues are most important? Do investors have specific ESG outcomes to achieve? Do they have mandates to closely track a benchmark, or can they tolerate greater tracking error, or variance between portfolio returns and benchmark returns?

Answering these questions can guide investors to choose the appropriate ESG ETF for them from a spectrum of solutions.

For example, investors who need to closely track a benchmark and lack specific ESG targets can utilise a screened or exclusion ESG ETF, as this solution begins incorporating ESG considerations while minimising tracking error by omitting select companies or issuers.

At the other end of the spectrum is the example of an investor with clear ESG targets for a specific issue, like decarbonisation, who is comfortable with greater tracking error. This investor may select an ESG ETF with a thematic focus such as clean energy or an impact ETF.

Investors that are somewhere in between the two ends may find it helpful to consider ESG ETFs that go a step beyond simple exclusions by tilting portfolios more towards ESG leading companies and issuers, but without assuming high levels of tracking error or targeting specific ESG outcomes.

Trust but verify third parties

Critics contend that because ETFs follow indices, many ETF providers are over-reliant on third parties. But this isn’t always the case.

Portfolio models are only as good as the quality of the data fed into them. Indeed, studies have shown a sharp variation of results between many ESG data and index providers.

ETF providers can help ensure ESG ETFs meet high standards by 1) partnering only with well-established index providers, 2) providing full transparency of ESG index methodology and holdings, and 3) verifying ESG data through their own proprietary ESG data platforms and independently pursuing voting and engagement policies.

Not every ETF provider can offer independent data, voting and engagement, as research and data into ESG subjects requires considerable resources and expertise.

Demonstrate real ESG outcomes

The last and perhaps greatest misconception about ESG ETFs is that they don’t yield real ESG outcomes. Critics claim that ESG ETFs cannot divest from poor ESG companies because ETFs are forced to track benchmarks that are biased to large-capitalisation, mature and developed-market companies and issuers. Criticism increases when some point out that the three-largest global ETF providers hold a disproportionate amount of ineffective voting power, relative to end investors or smaller investing professionals.

ESG investing is more than just a box-ticking exercise. As noted earlier, it begins with being fully aligned with investor goals. Providers can help by matching investor preferences to the right ESG ETFs from the spectrum of solutions, and by making sure investors understand the index methodology behind each ESG ETF. Through these steps, investors in pursuit of more specific ESG outcomes (and comfort with more tracking error) can be matched with ESG ETFs that divest away from poor-scoring firms and perhaps even tilt towards ESG leaders.

“ETF providers must demonstrate ESG outcomes with action, specifically through active proxy voting and company engagement.”

Besides proper alignment, ETF providers must also demonstrate ESG outcomes with action, specifically through active proxy voting and company engagement. This part of the investment process should not be outsourced to third parties, as it risks ceding control and taking a one-size-fits-all approach to affecting change at the company and issuer level.

Proxy voting and engagement require a detailed and nuanced approach, given the complexity of ESG issues. In addition, providers can prove outcomes through voting and engagement statistics and case studies, including the numbers of votes against management or dissident proxy votes.

Finally, long-term asset owners, such as ETF providers, are also well-placed to affect change because they pursue company engagement over a multi-year period rather than a de-facto divesting stance.

Benefits of ESG ETFs

Increasing numbers of investors are realising the benefits of ETFs: liquidity, accessibility, transparency and low costs. Now ESG investors are realising the benefits of ETFs too.

ESG ETFs can help meet investors’ needs if they align with their ESG goals and if providers can offer independent ESG data, voting and engagement capabilities. Lastly, effective ESG ETFs require providers to demonstrate real ESG outcomes through reporting, including voting and engagement statistics and case studies.