The EV long game: longer-term sector growth amidst near-term competitive intensity

The Electric Vehicle (EV) price wars

Background

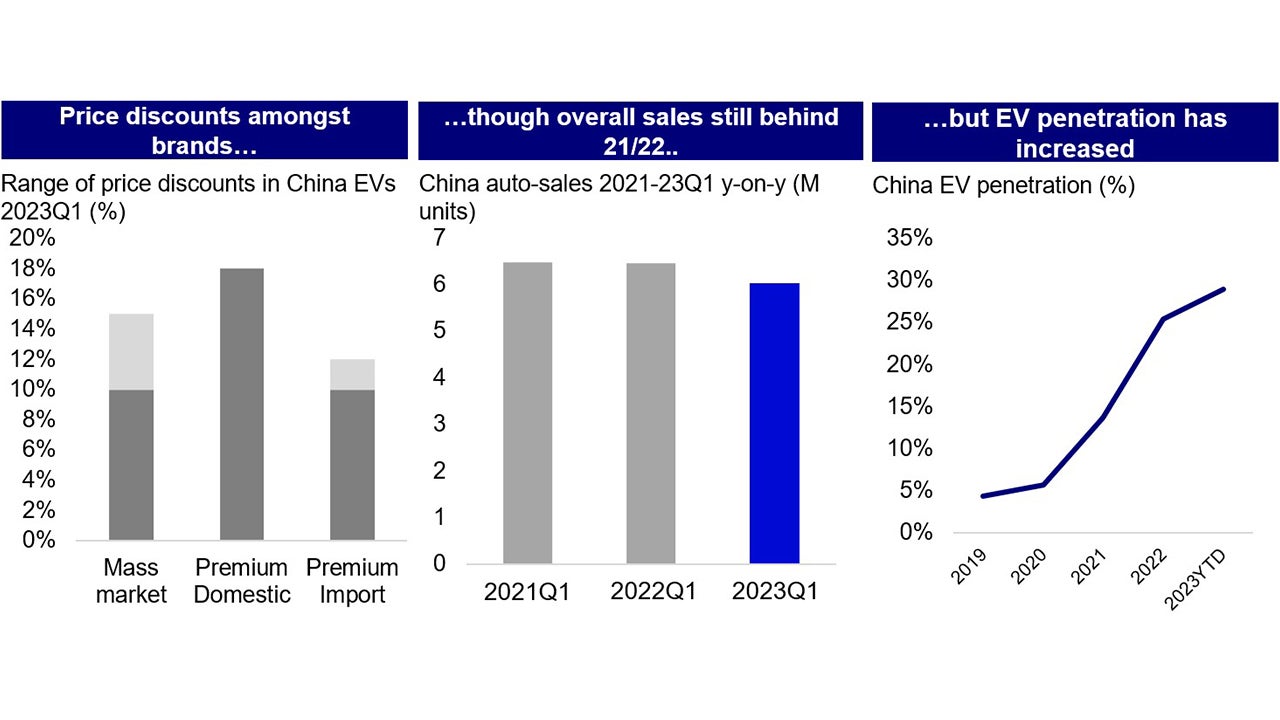

Since the start of this year, more than 40 car brands in China have made price discounts with passenger car brands seeing reductions of 10 to 20% in 2023 Q11. Similar price wars have also been shaking up in other parts of the world including US, key drivers include:

- Market sentiment: macroeconomic impact in 2022 caused slower sales and resulted in excess inventory buildup.

- Competitive intensity: growing competition in the space especially with more traditional OEMs (original equipment manufacturers) entering electric vehicle (EV) market in China led to efforts to increase market share. Beyond EVs, many ICE (internal combustion engine) manufacturers also cut price to clear inventories of vehicles not conforming to national emissions standard 6B that can no longer be sold after June 2023. Globally, there has also been increased pressure from growing Chinese EV exports to markets like Europe.

- Government subsidies: Chinese government EV subsidies also concluded after 2022.

Implications

Consumer uptake: moderate uptake as seen from the increase in China’s auto insurance volumes that have slightly improved EV penetration but muted by continued uncertainty in prices and macroeconomy concerns.

Source: Marklines (China - Flash report, Automotive sales volume, 2023 - MarkLines Automotive Industry Portal) ; Bernstein (Chinese Autos: March retail/insurance vol +11.2%, premium +19.4%, EV penetration 32.6%. Green shoots spotted, aside from easy comps. (bernsteinresearch.com))

- Margin positioning: cost positioning remains critical as more established names with better manufacturing maturity and scale along with direct sales have higher margin buffer whereas there’s greater margin pressure on smaller domestic OEMs or new startups. Larger players with a wider product lineup (from value to higher margin models) will also be more resilient.

- Excess capacity: excess inventory levels remain a concern that will continue to impact pricing and profitability for the sector going forward.

EV outlook: longer-term growth expected

Market forecast

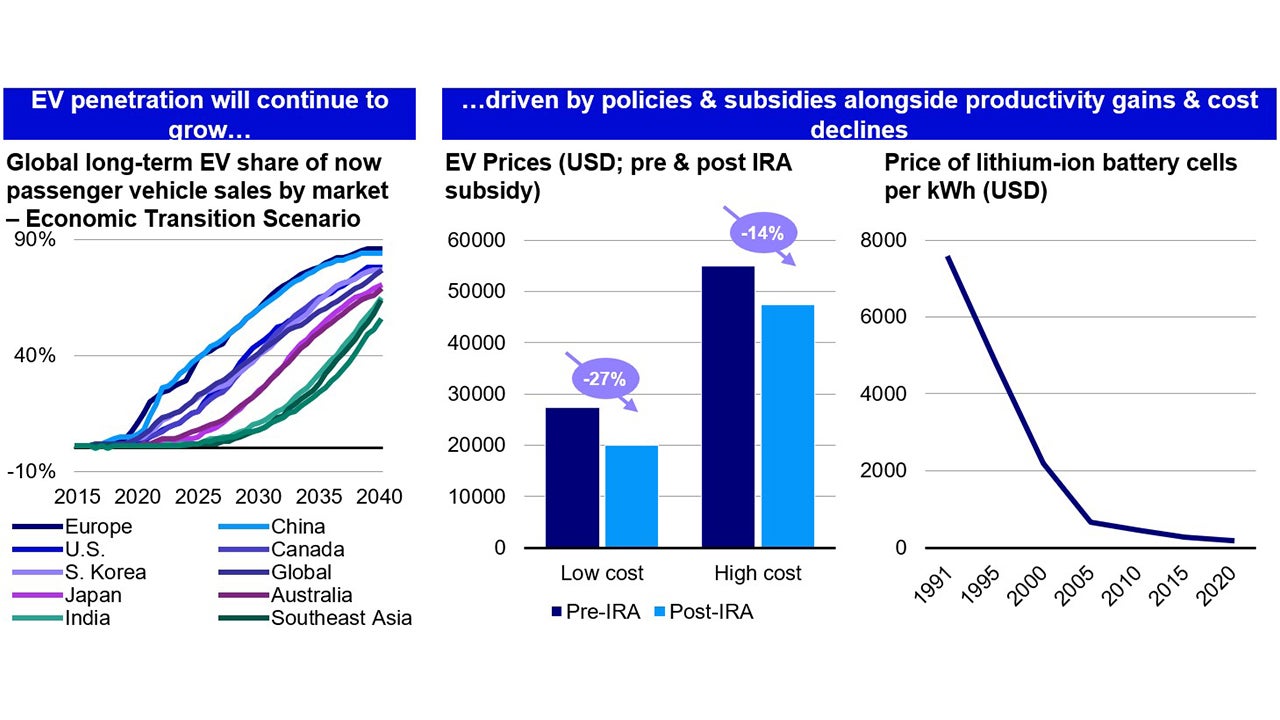

Globally, EV penetration of new car sales is forecasted to reach 80% or more by 2040 in key markets like Europe, US and China2. Driven by:

Policy tailwinds

- ICE phase out: national and regional net zero commitments being implemented in auto sector through phasing out of combustion vehicles (e.g. UK/EU mandates by 2035 all new car sales must be zero-emission).

- Subsidies: such as US Inflation Reduction Act (IRA) allowing for $7.5K USD3 consumer tax credit for EV purchases (if car final assembly in US).

Cost reductions and economies of scale

- Battery: lithium-ion batteries have seen up to 85% cost reduction between 2010 and 20194.

- Productivity gains: including new casting process reducing parts, production area and time5.

Other considerations

Consumer perspective: main barriers to EV adoption often relates to price, charging and range:

- Pricing: continued declines are expected given tech breakthroughs and increasing scale; greater traditional OEM entering EVs market also created range of more affordable EV options.

- Charging infrastructure: 2022 saw 55% increase in public charging points to 2.7M globally6 including fast chargers that enable much quicker charging.

- Range: historically a concern, range has increased with battery breakthroughs; further helped by the increase in charging infrastructure. Less of concern in “cities” given intra-driving with lower range requirements.

Environmental, social and governance (ESG) risks: while EVs would be critical in driving transport sector transition, other ESG considerations and risks in longer term would include environmental and water impact in EV supply chains, worker safety and child labor risks in certain regions where critical minerals are mined. These considerations may create material financial controversy risks for companies in the sector.

Source: Bloomberg NEF (EVO Report 2022 | BloombergNEF | Bloomberg Finance LP (bnef.com)); CTVC/ InsideEVs (IRA and the new capital cost of climate #114 (ctvc.co)); World in Data (The price of batteries has declined by 97% in the last three decades - Our World in Data).

Investment implications: nuances important in identifying winners in Asia

Investment opportunities

- China EV story: China is the largest auto market in the world with highest EV penetration (>50% share of global EV sales in 2022)7. Within the market, key battlegrounds remain centered on product range & innovation, brand and cost positioning; enhancingpenetration outside of Tier 1 or 2 cities and commercial vehicles segments like buses and trucks segment could also be interesting growth stories.

- Export opportunity: the other thesis is in assessing the size of export opportunity of Chinese EV makers, many offering greater value for money models. In 2022, 35% of exported EVs came from China (up from 25% in 2021)8 with Europe being China’s largest export market. Impact of new subsidies encouraging local production would need to be considered (see below).

- Broader EV supply chain & batteries: innovations in broader EV supply chain benefitting from growth in EV penetration includes cell manufacturing, cathode & anode technologies upgrades (such as shift to LFP, lithium-iron-phosphate, and LMFP, lithium-manganese-iron-phosphate battery), seperators and battery recycling. Margin recovery likely after recent correction of upstream lithium raw materials prices.

- Equities: potential longer-term demand recovery story as economy and income growth pick up.

- Fixed income: credit ratings upside to issuers with longer-term exposure to mega trend.

Risks and considerations

- Supply chain shifts: EV policies and subsidies like US IRA and EU Green Deal Industrial Plan are increasingly focused on encouraging local production and supply chains. Yet Asia and China still take significant share (anywhere from 50-80%)9 on EV related supply chains from raw materials to processing and supply chain components. Would be interesting to observe potential supply chain shifts in the sector.

- Commoditization: industry research highlighted that solar and polysilicon industries both experienced significant commoditization and cost deflations with scale10. Longer term commoditization risks could exist in particular for batteries.

- Branding vs technology: EVs are not just a technology play but much is also centered on consumers’ brand perceptions. Product innovation needs to be complemented by effective sales & marketing, distribution and after-sales support.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

Reference:

-

1

Yahoo News China EV Price War Reaches Fever Pitch: An Analysis (yahoo.com)

-

2

Bloomberg NEF EVO Report 2022 | BloombergNEF | Bloomberg Finance LP (bnef.com)

-

3

Reuters Factbox: How U.S. electric vehicle subsidy rules impact Europe | Reuters

-

4

Economist Data point: clean energy costs are falling (economist.com)

-

5

The Driven Tesla and BYD electric vehicle price war shows EV price cuts are a trend, not a fad (thedriven.io)

-

6

IEA Global EV Outlook 2023: Catching up with climate ambitions (windows.net)

-

7

IEA Global EV Outlook 2023: Catching up with climate ambitions (windows.net)

-

8

IEA Global EV Outlook 2023: Catching up with climate ambitions (windows.net)

-

9

Bloomberg NEF Supply Chain Latest: US Treasury Guidance on IRA Subsidies - Bloomberg

-

10

MS Tesla Inc: EV Battery Commoditization? Lessons from Solar and LED