Targeting Net Zero in Asia

Executive summary

Reducing global energy-related carbon dioxide emissions to net-zero by 2050 is a mammoth task. Yet it cannot be achieved unless Asian countries play their part. This article looks at the key considerations surrounding targeting net-zero in Asia, including the potential challenges on both the sovereign and corporate levels. We explain Invesco’s Net-Zero Investment Framework applied to the Asia fixed income landscape. We also outline the important role that material-emitting sectors have to play on the net-zero journey, as well as the potential investment opportunities arising from this transition.

Introduction

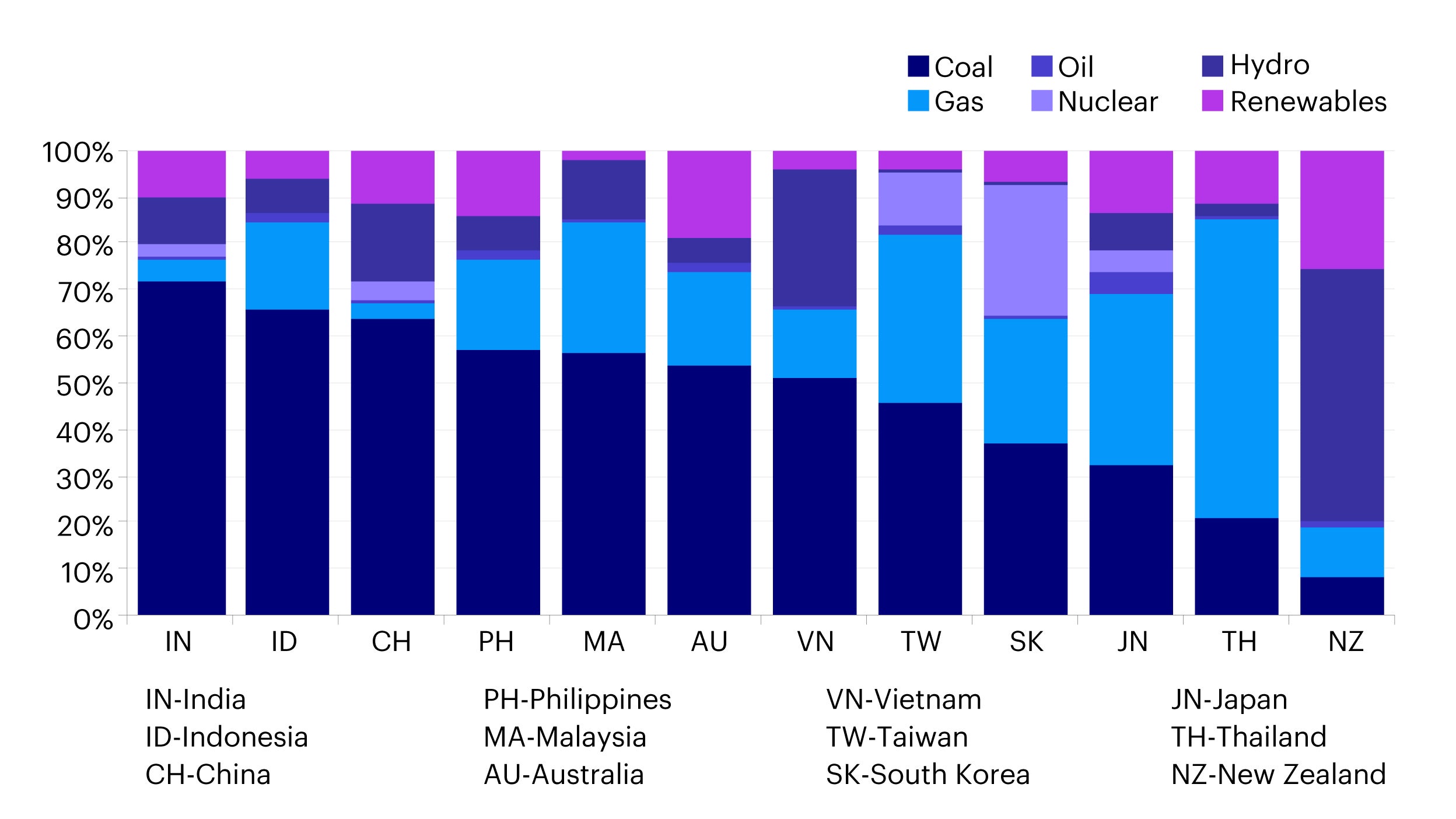

Asia is home to about 60% of the world’s population and is considered the main engine of global growth1. Its rapid economic development in the past two decades, however, has been largely predicated on fossil fuel consumption. In 2020, 52% of the region’s energy demand and over 70% of its carbon emission footprint was coal-based2. Although the use of renewables is growing across the region, fossil fuel capacity is rising at a still faster rate in order to meet energy demand. As of November 2021, more than 90% of the 195 coal plants being built around the world were located in Asia, according to data from the Global Energy Monitor.3 In 2020, Asia decarbonized by just 0.9%, which is significantly below the 12.9% decarbonization rate required for the 1.5-degree scenario outlined in the Paris Agreement.4

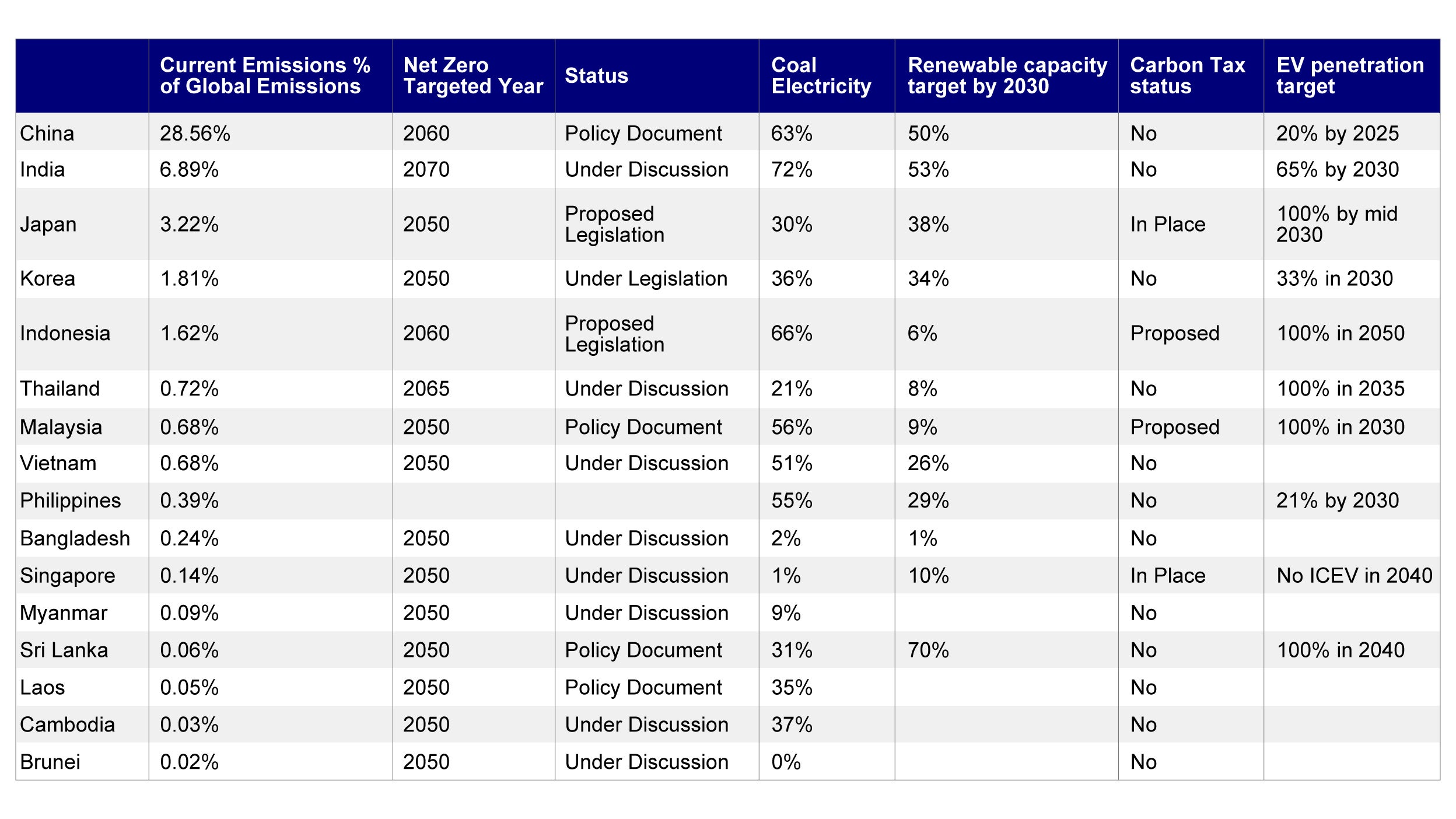

At the same time, the region’s high incidence of extreme weather events as a result of human activity highlights the need for countries to act on decarbonization. As of mid-October 2021, just seven Asian countries had set some form of net-zero commitment, either in terms of current or proposed legislation or national policy, while for another eight, these were under discussion (Table 1).5 Many of these targets were announced in the lead-up to the 26th United Nations Climate Change Conference of the Parties (COP26) held in early November 2021, or soon afterward.

This article looks at the key considerations surrounding targeting net-zero in Asia, including the potential challenges on both the sovereign and corporate levels. We leverage on an earlier piece by Robert Neilson and David Todd at Invesco, who covered the practical implications of targeting net-zero for global investment grade credit portfolios.

Source: BP, Philippine Department of Energy, HSBC; data as of October 2021.

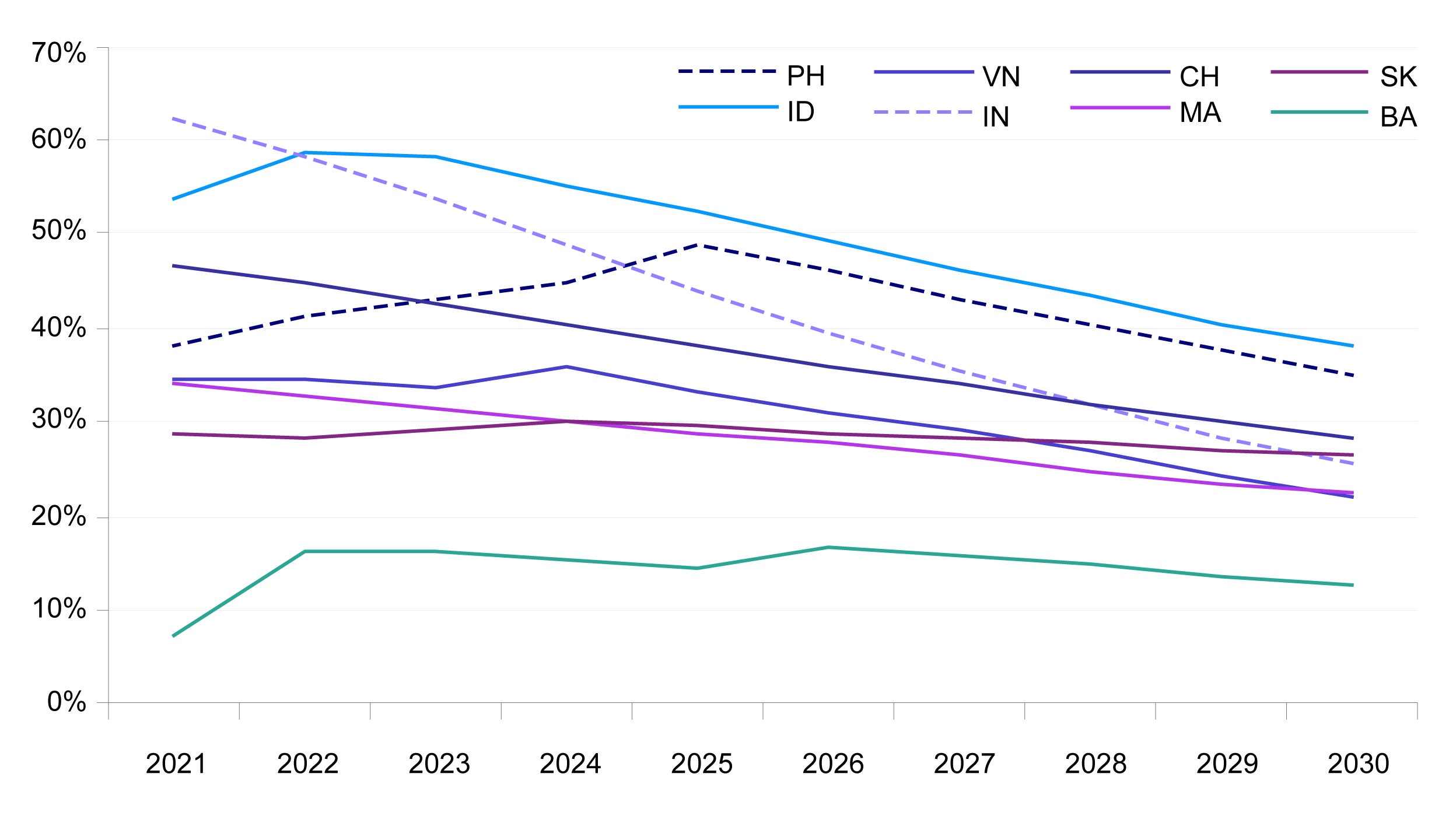

Source: Carbon Tracker, HSBC assumptions; data as of October 2021.

Source: Government energy ministries, BP, ADB, HSBC, Invesco; data as of December 2021.

Key considerations for Asian sovereigns on the path to net-zero

The path for Asia to reach net-zero is not going to be easy. However, as the famous proverb goes, a journey of a thousand miles starts with a single step. We outline some of the key steps that sovereigns in the region can consider.

1. Becoming “renewable ready”

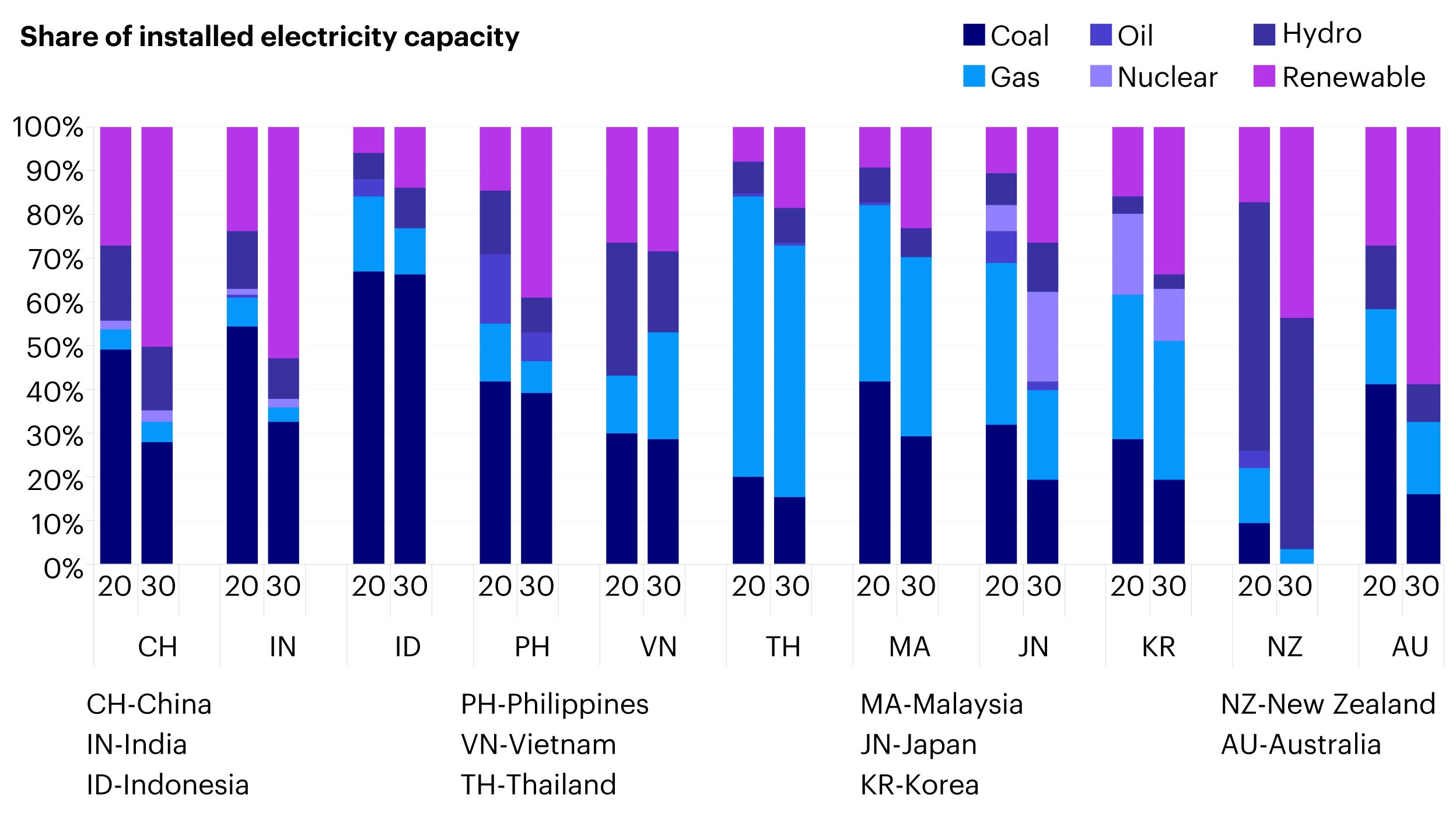

Moving to net-zero will no doubt require a shift in Asia’s energy mix away from coal, oil and natural gas, and toward renewable energy, which includes wind, solar, hydro, bio-mass and nuclear power. One major constraint facing Asian sovereigns is the maturity of their renewable energy sources and associated infrastructure. Currently, the contribution of renewables to overall energy production in Asia is not as high in percentage terms relative to other regions like Europe. Therefore, demand for renewable energy is very likely to outstrip supply. This is particularly the case for countries like Japan, whose renewable capacity target is expected to double from its 2019 commitment in the next ten years (Figure 3).6

Source: Australia Department of Energy, New Zealand Interim Climate Change Committee, Taiwan Bureau of Energy, Sri Lanka Ministry of Power, Bangladesh Ministry of Power, Philippine Department of Energy, Thailand Board of Investment, Malaysia Energy Commission, Global Energy Interconnection Development and Corporation Organisation, Indonesia Ministry of Energy and Natural Resources, Vietnam Ministry of Trade and Industry, Korea Ministry of Trade, Japan Agency for Energy; data as of October 2021. NB: As per convention, we do not include hydroelectric power as a modern renewable. Korea is approved plan from December 2020 that may be adjusted.

While Asian nations have planned substantial renewable energy capacity additions through 2030, the grid infrastructure in some of these countries is not designed to accommodate the variable nature of renewable power output. China and India appear to be on track to reach their 2030 targets, however, grid limitations are expected to impede the significant jump in renewable power generation that is needed to fully meet demand. Other countries, such as Indonesia and Malaysia, are lagging their initial targets. Grid upgrading, load distribution, and storage capacity breakthroughs are all issues that will likely need to be tackled in the region in order for renewables to account for a higher proportion of overall electricity generation.

2. A top-down approach from a sovereign perspective and bottom-up approach from corporates are complementary for the net-zero journey

Countries in the region are undoubtedly at various stages of economic development. Their economic growth model, whether it is more export-oriented or dependent on consumption versus services, will have a huge bearing on how they chart their path to net-zero. The journey to net-zero will also look very different depending on if Asian governments choose a more top-down (policy-led) or bottom-up (private sector-driven) approach.

Taking the example of China, following President Xi Jinping’s announcement of the nation’s ambitious carbon neutrality targets (to achieve peak carbon emissions by 2030 and target net-zero by 2060), the government has acted swiftly to curb carbon emissions in areas such as energy policy, industrial policy and construction and transportation. Also, as China’s material-emitting sectors are primarily within the purview of state-owned enterprises (SOEs), these firms have the motivation and stability to implement national strategies and policies. Private companies, on the other hand, are more likely to react to policy initiatives as they trickle-down to the sector and corporate level.

In contrast, Japan’s private sector is leading the way. In mid-2019, 20 Japanese companies signed a petition to campaign for faster energy grid transition, in a bid to boost their own global competitiveness. They called on the government to set a higher target for sourcing electricity from renewable energy sources: they recommended that at least 50% of Japan’s electricity should come from renewable sources by 2030 versus its previous ambition of 22-24%.7 As of July 2021, over 60 Japanese companies have joined the RE100 initiative and are committed to 100% renewable electricity.8

Major Asian exchanges have also been leading the charge when it comes to improving sustainability-related disclosures for listed companies. This is already the fifth year in which Hong Kong-listed firms have been mandated to issue ESG reports by the Hong Kong Exchange (HKEX).9 They have since implemented a “comply-or-explain” regime for issuers on ESG data in areas such as carbon emissions data and carbon intensity.10 Similarly, the Singapore Exchange (SGX) now requires all issuers to provide climate reporting in their sustainability reports on a ‘comply or explain’ basis, starting from the 2022 financial year, in order to be more closely linked to Task Force on Climate-related Financial Disclosures (TCFD).11 Such regulations have spurred improved climate disclosures in the region, which we believe are required for net-zero progress and target setting.

3. Developing the regional taxonomy and alignment with international standards

There are two key areas where a taxonomy will be particularly helpful on the journey to net-zero in Asia. One is to define sector-specific guidance for business activities in three areas: green, transitional, or non-green. A second is to set up clear guidelines around corporate sustainability-related reporting. While the specifics may differ, broad principles such as “do no significant harm”, use of revenue thresholds, and clearly defined, consistent environmental goals across the region can help to build consensus.

The announcement of the Common Ground Taxonomy (CGT) between the People’s Bank of China (PBoC) and the European Commission in November last year was groundbreaking. The CGT is the first activity to map and compare the Chinese and EU taxonomies. The initial stage covers climate change mitigation and will map all activities in both taxonomies for commonalities. The ASEAN regional taxonomy was also released in November and will be integral in directing capital toward activities focused on transition and climate change mitigation.

Application of Invesco’s Net-Zero Investment Framework to Asia fixed income

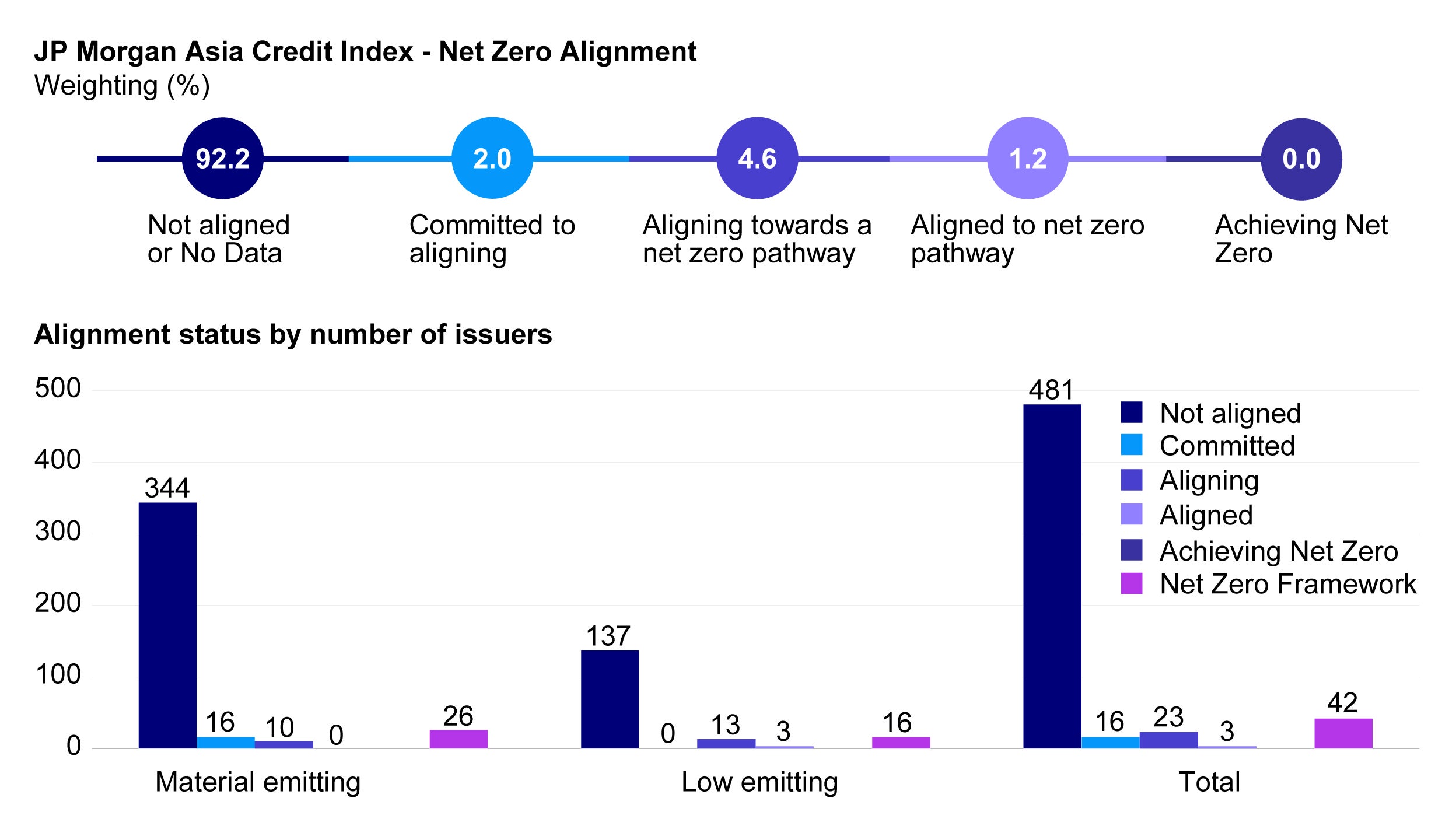

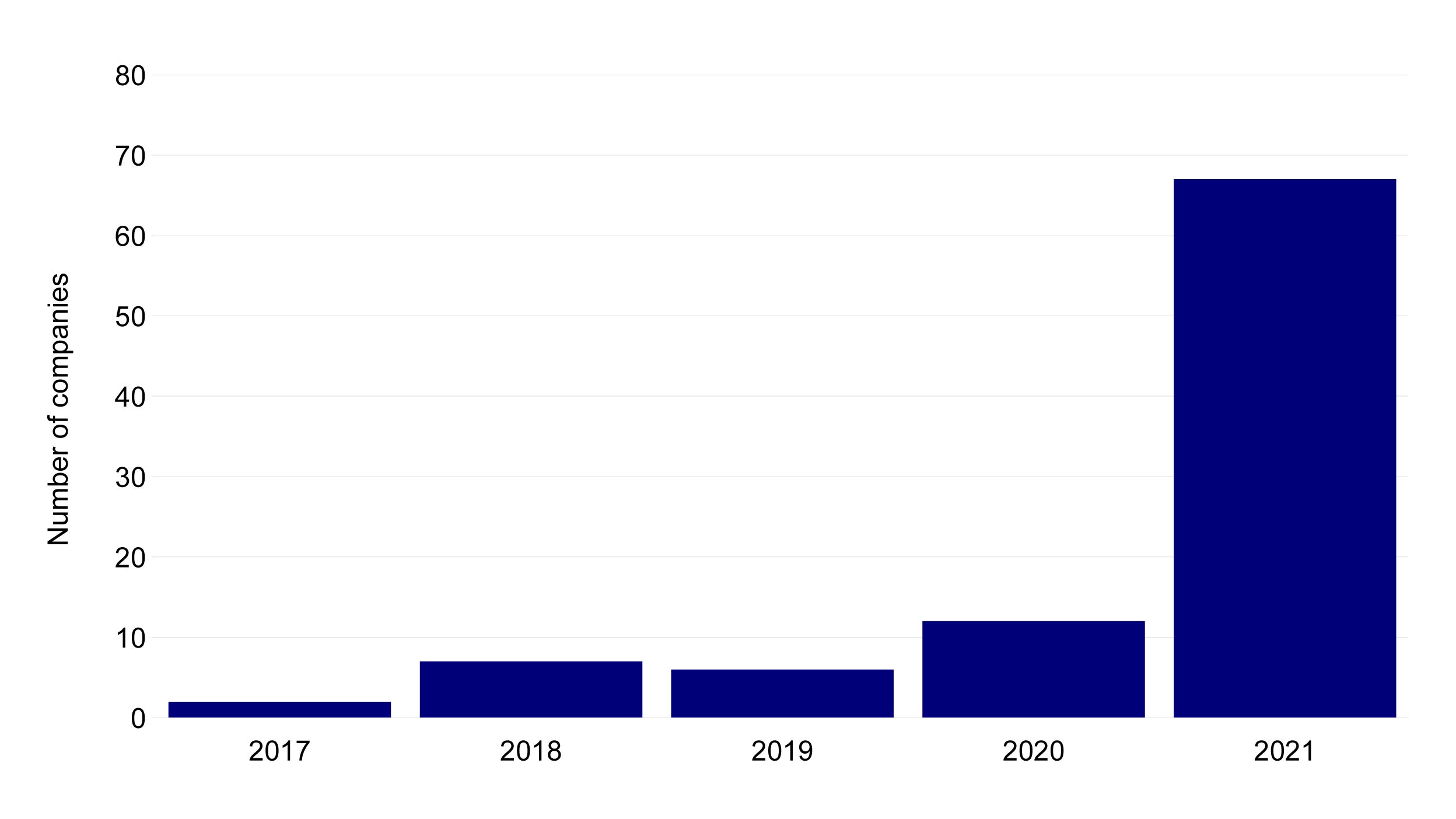

At Invesco, we have mapped our Net-Zero Investment Framework to the J.P. Morgan Asia Credit Index (JACI) of 565 issuer names (Figure 4). While it shows a fairly low level of alignment among listed Asian companies at present, the picture is a rapidly improving, with exponential growth in the number of Asian companies having committed net-zero targets in recent years (Figure 5).

Source: Invesco; data as of December 2021.

Source: Science Based Targets Initiative (SBTi); data as of December 2021.

Footnotes

-

1

For the climate, Asia-Pacific must phase out fossil-fuel subsidies, May 2021, https://www.bruegel.org/2021/05/for-the-climate-asia-pacific-must-phase-out-fossil-fuel- subsidies/

-

2

Asia Pacific’s energy transition conundrum – is net zero possible?, August 2021, https://www.woodmac.com/news/opinion/asia-pacifics-energy-transition-conundrum-is-net-zero- possible/

-

3

COP26 aims to banish coal. Asia is building hundreds of power plants to burn it, November 2021, https://www.reuters.com/business/energy/cop26-aims-banish-coal-asia-is-building-hundreds- power-plants-burn-it-2021-10-29/

-

4

Code Red - Asia Pacific’s Time To Go Green, November 2021, https://www.pwc.com/gx/en/asia-pacific/net-zero/asia-pacific-code-red-to-go-green.pdf

-

5

Asia’s energy transition, October 2021, HSBC

-

6

Japan aims for 36-38% of energy to come from renewables by 2030, October 2021, https://www.reuters.com/business/energy/japan-aims-36-38-energy-come-renewables-by-2030-2021-10-22/

-

7

Major companies call for ambitious 2030 renewable electricity targets in Japan – News, June 2019, https://www.there100.org/our-work/news/major-companies-call-ambitious-2030-renewable-electricity-targets-japan-news

-

8

Japanese Government renewable energy target falls short, July 2021, https://www.there100.org/our-work/news/japanese-government-renewable-energy-target-falls-short

-

9

Is Chinese business on the cusp of a ‘leapfrog moment’ in ESG reporting?, March 2021, https://www.weforum.org/agenda/2021/03/chinese-business-leapfrog-moment-esg-reporting/

-

10

PRIMER: HKEX’s new ESG disclosure rules, February 2020, https://www.iflr.com/article/b1lmx64723h43z/primer-hkexs-new-esg-disclosure-rules

-

11

SGX mandates climate and board diversity disclosures - Singapore Exchange (SGX), December 2021, https://www.sgx.com/media-centre/20211215-sgx-mandates-climate-and-board-diversity-disclosures