Previewing COP27 climate summit and the potential investment implications

Last year, the COP26 climate summit saw a historic commitment to phase down coal power.

This year, COP27 will be held in Sharm el Sheikh, Egypt on November 6-18.

Since COP26 last year, what have been the key global and Asian developments in climate transition?

- Global backdrop: Geopolitical events have caused energy and food security risks. Various regions have had policy developments both as a way to build longer-term energy independence and growth from green economy.

- EU: Announced REPowerEU plan to increase energy independence through energy savings, accelerating renewables targets to 45 by 2030.1

- US: Announced Inflation Reduction Act including increasing clean energy capacity in solar, wind, battery; consumer rebates and production tax credits for renewables, EVs and energy efficient appliances.2

- China: President Xi’s 20 th Party Congress opening speech reiterated importance of environmental protection, energy security and promoting green lifestyles.3 This is alongside the policy and implementation of 1 +N Framework announced in 2021 and recent launch of China Green Bond Principles unifying standards with global alignment.

What will be the key focus of COP27 this year?

Mitigation – the shift to implementation of net zero:

- In COP26, 138 countries committed to net zero covering >80% of global emissions and >90% of GDP.4

- A key focus of COP27 remains on implementation of net zero commitments, esp. how countries and stakeholders would work towards strengthening and delivering on 2030 targets.

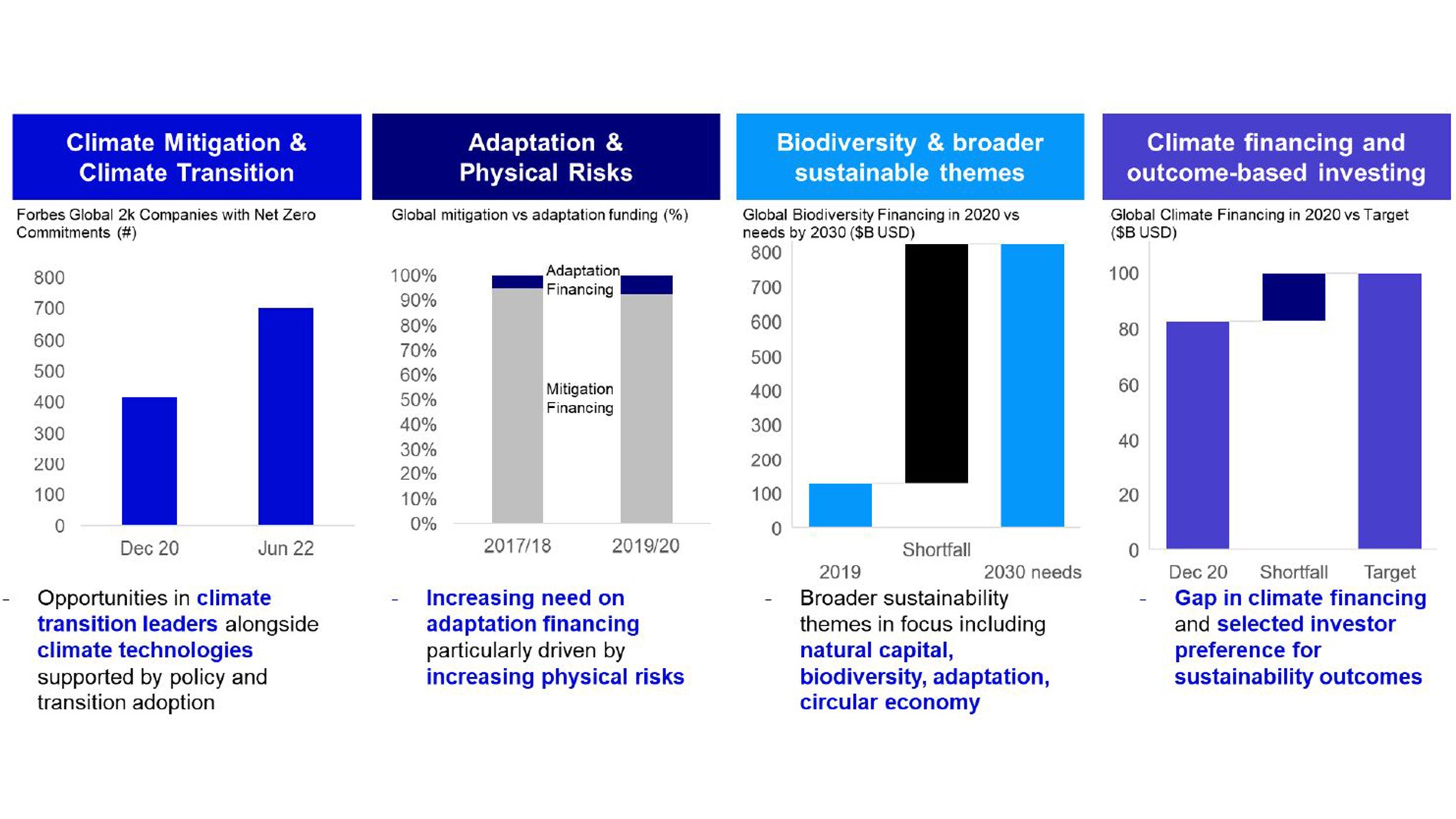

- Besides, there has been a significant increase in corporate net zero commitments5 - next step is to understand sectoral pathways and decarbonization plans.

Adaptation - coming into the spotlight:

- Currently more than 90% of climate finance goes into climate mitigation.6 Yet extreme flooding, droughts and heatwaves this year shed light on the importance of adaptation.

- Expect strong emphasis on the Glasgow-Sharm el-Sheikh (GLASS)7 work program - a two-year program established in COP26 to work towards the global goal on adaption.

- A balance between mitigation and adaptation is needed for both businesses and investors.

Biodiversity – linkage to climate:

- While focus on biodiversity will come at UN Biodiversity Conference (COP15) in December, climate affects biodiversity. Nature-based solutions play a key role in emissions reduction.

- Linkages to adaptation and financing would be interesting to watch in the leadup to COP15.

- Increasing importance to understand natural capital opportunities and risks for businesses.

Finance – addressing the shortfall:

Source: Net Zero Stocktake (https://zerotracker.net/insights/pr-net-zero-stocktake-2022); Global Landscape of Climate Finance 2021 (https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-2021/); OECD (https://www.climatechangenews.com/2022/07/29/rich-countries-fall-17bn-short-of-2020-climate-goal/); Paulson Institute (https://www.paulsoninstitute.org/conservation/financing-nature-report/)

What are the investment implications?

Climate Transition Story:

- Increase in corporate net zero commitments, green revenue, capex plans and disclosures alongside future implications of carbon prices create opportunities to invest in the transition of high-emitting sectoral leaders.

- Particularly for China, policy support through 2060 goals and 1+N framework for high-emitting sectors will create investment opportunities during the transition process.

- Clean and renewable technologies will benefit both from policy tailwinds and transition leaders’ adoption.

Broader sustainability thematic:

- Going beyond mitigation towards evaluating opportunities in adaptation, natural capital, biodiversity and circular economy.

- Fixed income as an asset class presents unique investment opportunities especially as issuances in green and sustainability bonds grow such as in China market.

Adaptation related opportunities:

- A wide range of adaptation solutions are in demand, including opportunities to grow coastal protection and flooding systems, agriculture and food security, wastewater treatment and urban infrastructure upgrades.

- Opportunities arise from various capabilities including accurate assessment of physical risks and financial impact, evaluation frameworks to assess quality and implementation of solutions.

Outcome-based or impact investing segment:

- National climate commitments funneling to investor portfolio objectives alongside increasing data and standards (such as green revenue or capex data from EU Taxonomy Regulation) will drive growth of outcome-based investing as a segment for some investors.