Nature, climate, adaptation: Investment opportunities and approaches

The COP16 (Convention on Biological Diversity) held in Colombia in late October continued to call into focus the importance of biodiversity and natural ecosystem services on which many sectors and economies depend . At the same time, corporates are continuing to examine the financially material risks and opportunities that climate transition might have on their sectors and businesses. How are nature and climate linked? In this piece we examine how these two themes intersect with a particular focus on adaptation as a connecting factor.

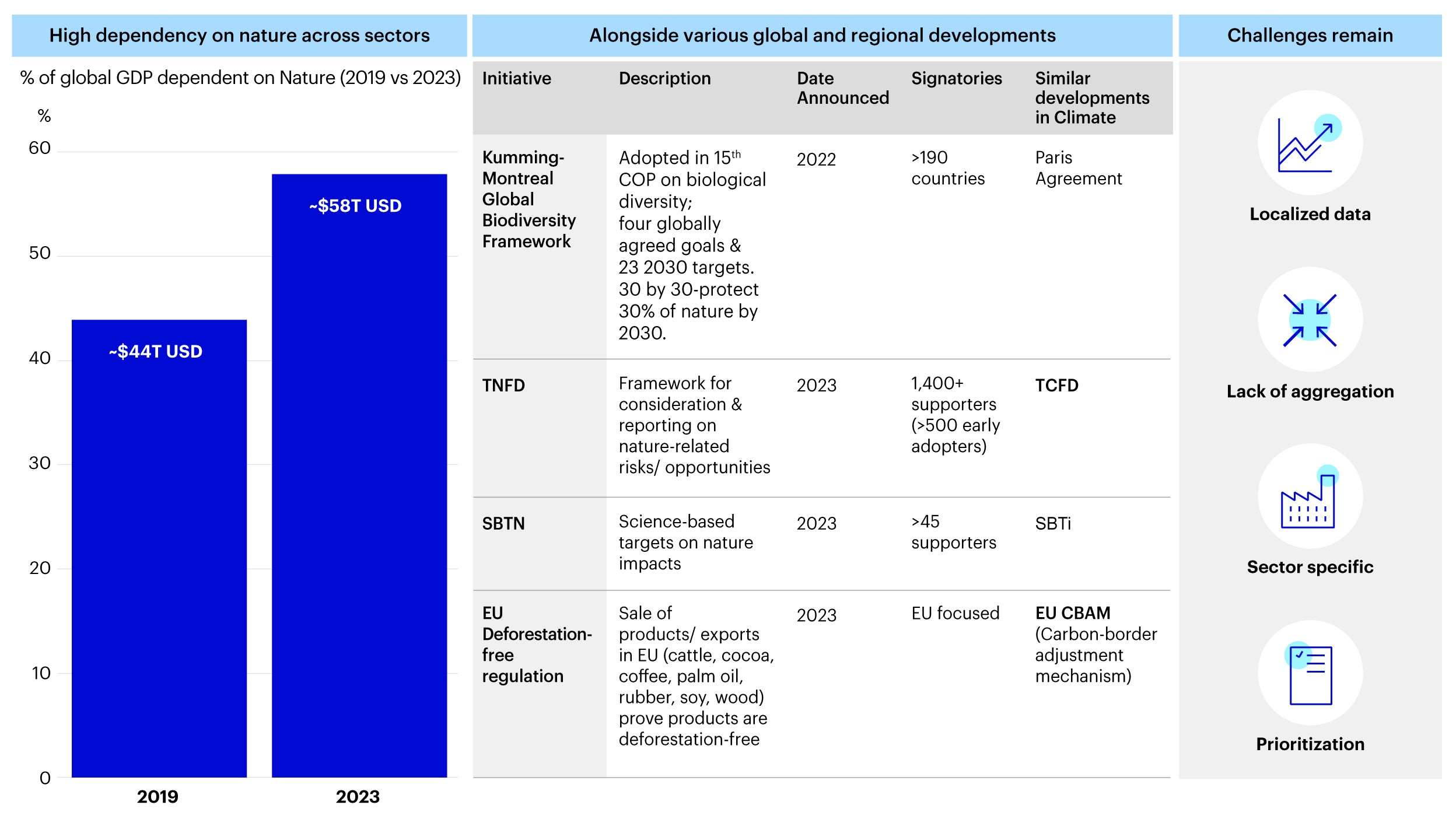

Nature 101: Global developments and challenges today

Source: PwC, Climate Action, September 2023, How the world’s largest companies depend on nature and biodiversity; UN Food and Agriculture Organization; Taskforce on Nature-related Financial Disclosures (TNFD); Science-Based Targets Network (SBTN).

Nature generally refers to natural world including land, ocean, freshwater and atmosphere that interacts with societies and economies, whether in providing ecosystem services to different sectors or being impacted by businesses. Globally, investors and companies are recognizing nature loss as a source of systemic risk for economies and financial markets. In September 2023, the Network for Greening the Financial System (NGFS), a network of over 125 central banks and financial supervisors, encouraged all central banks to assess and act on financial risks from nature loss.1 More than half of world’s GDP is moderately or highly dependent on nature. The agrifood sector, with a valuation of US $4 trillion, is one of the sectors that is most dependent.2 Additionally, global developments in frameworks like the Taskforce for Nature-related Financial Disclosures (TNFD) and in policies like the Kunming-Montreal Global Biodiversity Framework have also strengthened the focus on this theme.

However, implementing nature-related considerations in investments can be complex given challenges relating to:

- Localized data: Importance of location-specific analysis of nature impact which requires granularity of data on location and characteristics of location in question.

- Lack of aggregation: Nature-related metrics tend to be extremely context dependent and unlike climate there is a lack of singular aggregable metric that can be easily measured like emissions.

- Sector specific: Financially material dependencies on nature vary by sector which also makes the comparison across sectors challenging.

- Prioritization: State of disclosures on nature by companies are still in its infancy and with many companies focusing their attention on transition planning and understanding climate-related risks and opportunities, there might be a question on resourcing and prioritization across different sustainability themes.

Given the challenges laid out, investors need to identify a suitable starting point for implementing nature-related considerations into the investment process.

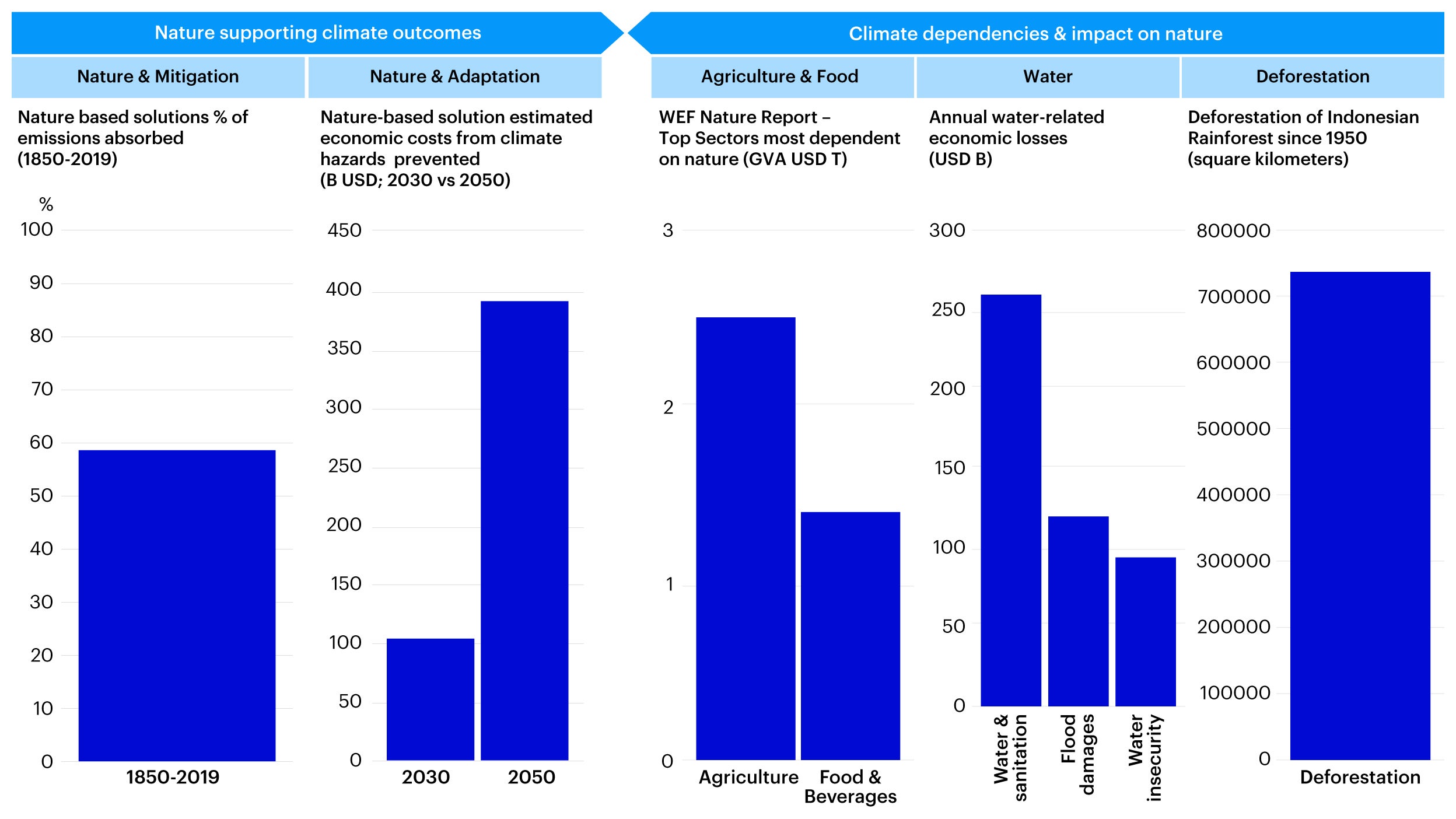

Linkages of climate and nature: highlights on adaptation

Source: WWF, Our climate’s secret ally: uncovering the story of nature in IPCC Sixth Assessment Report, November 2022; International Union for Conservation of Nature, Nature-based solutions and the Global Goal on Adaptation, 2023; World Economic Forum (WEF), Nature Risk Rising”, January 2020; Organisation for Economic Cooperation and Development (OECD), Water Topic; Associated Press, Indonesia’s massive metals build-out is felling the forest for batteries, July 2024.

We believe a good starting point for investors looking at nature-related considerations is to identify the links between climate and nature. We identify 3 key links: 1) impact of nature-based solutions on climate change mitigation and emissions reduction; 2) nature-based solutions for climate adaptation; and, 3) nature’s dependencies on climate.

1. Nature and mitigation: Nature-based solutions can provide up to 37% of the climate change mitigation required to meet the world’s 2030 climate targets.3 Historically, natural global sinks of land and ocean absorbed 59% of total emissions between 1850 and 2019.4 Forests capture emissions through photosynthesis and store carbon in biomass and soils while oceans provide carbon storage through mangroves and salt marshes while modulating the temperature and heat in our ecosystem. Oceans can absorb up to 90% of excess heat caused by climate change and 23% of human created carbon emissions.5

2. Nature and adaptation: Nature-based solutions can help minimize potential physical risks and climate hazards. Coral and oyster reef systems can reduce coastal erosion, forests can soak up excess rainwater minimizing runoff and damage from flooding, and coastal wetlands can stabilize coastlines by trapping sediment and reducing wave height with dense vegetation.6 Nature-based solutions like coastal wetlands are on average 2-5 times cheaper7 than artificially constructed barriers to deal with wave heights and sea level rise. Such solutions also have added benefits on public health where researchers have found that urban green spaces can have an impact on urban residents and public mental and physical health.8 Overall, nature-based solutions are estimated to reduce the intensity of climate hazards by 26% which amounts to economic costs of about US $104 billion by 2030 and $393 billion by 2050.9

3. Nature’s dependencies on climate: Many aspects of nature can be affected by the climate and in some instances even transition developments. Examples include:

o Agrifood security: Climate variability could be a driver of growing global hunger with droughts with the potential to cause more than 80% of total damage and losses to agriculture.10 Climate hazards can also accelerate loss of biodiversity in agrifood ecosystems which could affect vulnerability to pests and related commodity price fluctuations and supply chain cost inflation.

o Water access and oceans: Heatwaves, flood and storms could impact freshwater ecosystems and affect water quality and availability. Warming and acidification also affect sea life and food webs in oceans. Like the agrifood impact, physical risks could affect the costs of goods, services and infrastructure. Disruptions to water access and sanitation risks are also tied to potential health risks and costs for certain populations and regions.

o Deforestation and biodiversity: Global energy and climate transition has led to a growth in electric vehicles (EVs) as a climate solution. However, the growth of EV supply chains has also resulted in potential deforestation and biodiversity impacts. The growing demand for green transition materials such as nickel, cobalt and manganese can cause a corresponding mining impact on deforestation as well as on habitat loss, soil erosion, and diminishing biodiversity.11

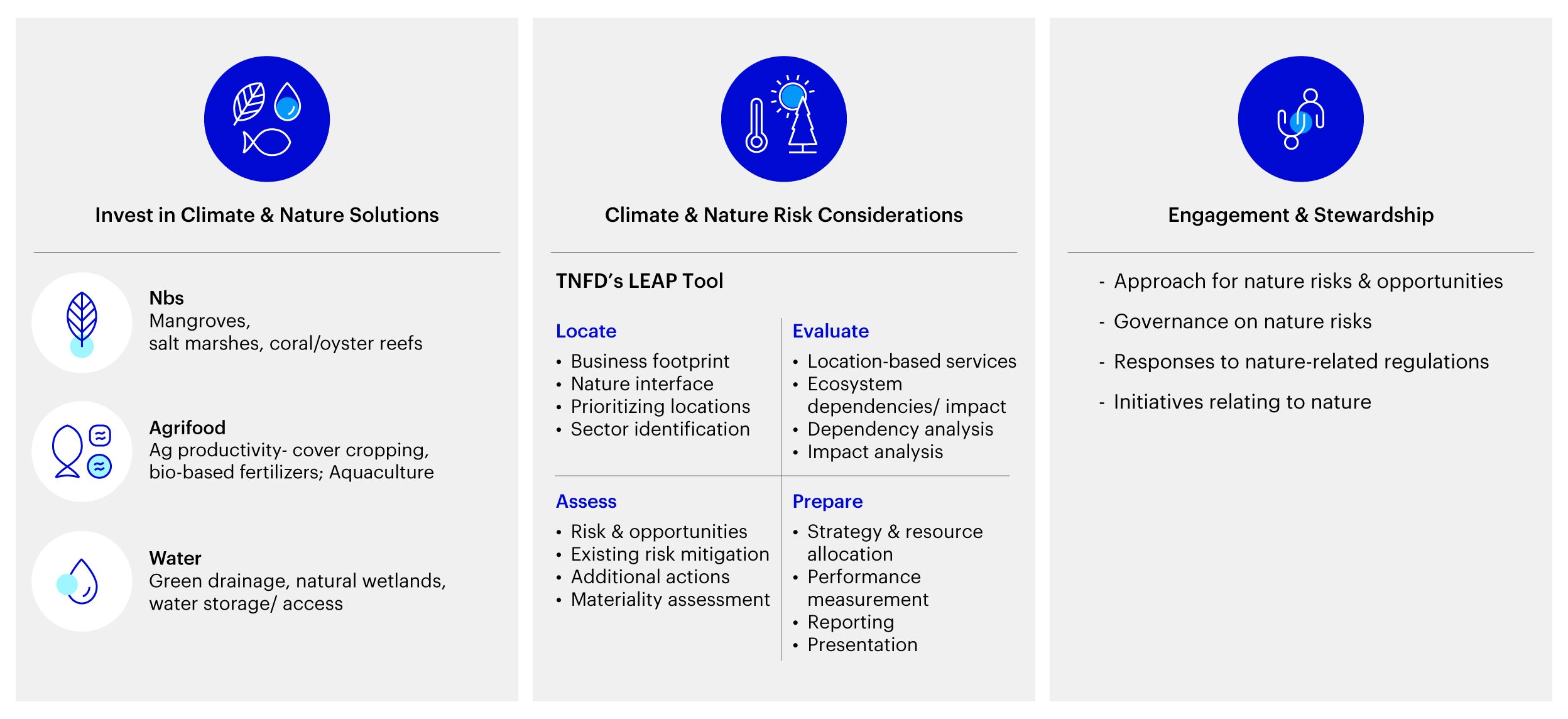

Investment opportunities and approaches for climate and nature

Source: Invesco Analysis; Taskforce on Nature-related Financial Disclosures. Note: Nbs is Nature-based solutions, LEAP is Locate, Evaluate, Assess, Prepare.

We are positive on the following investment opportunities which encompass the earlier themes:

1. Investing in climate and nature solutions: Identifying solutions at the intersection of climate and nature. Fixed income is one effective way of investing into mission-driven businesses that are nature positive through analyzing the underlying use of proceeds. For the same issuer’s debt offerings, the use of proceeds is clearly defined in each deal document as compared to equity offerings where it is much more difficult to track the use of proceeds. These can include nature-based solutions that help minimize physical risk impacts or it can also be broader solutions that helps both in climate and nature outcomes. Examples of such solutions include:

o Nature-based solutions: Restoration of coastal habitats through mangroves, salt marshes, coral and oyster reefs that helps with coastal protection and reduction in flood impacts while also increasing biodiversity12 as well as food security. These will also have an ancillary impact on local communities to generate sustainable income and jobs, particularly within eco-tourism related projects. The certification of high-quality carbon removal provides an additional cashflow stream to fund these projects.

o Agrifood: Solutions that help improve agrifood productivity and security such as cover cropping, bio-based fertilizers and low tillage.13 Nature-based agrifood solutions typically have lower costs and are more easily integrated into production systems. Aquaculture is a particularly important area in parts of Southeast Asia, and it can help assist overfished stocks to recover while also tackling illegal fishing.

o Water: Solutions like green drainage systems that reduce flooding impact while also increasing biodiversity.14 In the same vein, increasing affordable access to clean water is also a key impact focus area, which includes solutions such as constructed and natural wetlands, green roofs and soil filtration systems.

2. Climate and nature risk considerations: Considering nature-related financially material risks has to start with understanding what the risks are and the linkages to businesses. The TNFD’s LEAP (Locate, Evaluate, Assess, Prepare) tool provides a good starting framework for both corporates and investors, beginning with prioritizing locations where assets are based, evaluating ecosystem dependencies of these assets, and then assessing the potential risks and opportunities before formulating plans and initiatives in response. From a portfolio perspective, investors can begin by focusing on sectors where the potential financially material impacts are the highest. These tend to be sectors with highest nature dependencies such as agriculture and food, paper and packaging, or mining and materials.

3. Engagement and stewardship: Financially-material nature-related risks can then be fed as discussion items for engagement with investee holdings. Potential areas where investors can look to understand more include:

o Companies’ approach, policies and governance to identify and analyze nature-related risks and opportunities including underlying revenue exposure and supply chain dependencies

o Companies’ responses to comply with regulations like the EU Deforestation Regulation

o Companies’ initiatives and progress on addressing identified risks and opportunities

Investing at the nexus of nature and climate

As nature grows in importance as a financially material risk across sectors and financial markets, we believe a good starting point is to begin by analyzing opportunities at the intersection of climate and nature. Whether it is investing directly into climate and nature solutions such as through fixed income or factoring in such risks into broader investments considerations, the climate and nature nexus is an emerging trendy worthy of investor attention.

We offer two final thoughts for investors to consider when investing in the climate and nature space. First, blended finance offers opportunities for investors to derisk. Partnership with the public sector and foundations or philanthropic foundations are also critical to improve project design both from an impact perspective as well as underlying execution. Second, the complexity of the climate and nature nexus requires investors to build out robust frameworks to evaluate each investment before and throughout their lifecycle to enhance the long-term credit quality and depth of impact these investments can achieve.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Footnotes

-

1

Network for Greening the Financial System, September 2023, Nature-related financial risks: A conceptual framework to guide action by central banks and supervisors, https://www.ngfs.net/sites/default/files/medias/documents/ngfs_conceptual-framework-on-nature-related-risks.pdf

-

2

FAIRR, “Tackling the Climate-Nature Nexus”, March 2024, https://go.fairr.org/2024-Tackling-the-Climate-Nature-Nexus-Report

-

3

FAIRR, “Tackling the Climate-Nature Nexus”, March 2024, https://go.fairr.org/2024-Tackling-the-Climate-Nature-Nexus-Report

-

4

WWF, “Our climate’s secret ally: uncovering the story of nature in IPCC Sixth Assessment Report”, Nov 2022, https://wwfint.awsassets.panda.org/downloads/wwf_our_climates_secret_ally_uncovering_the_story_of_nature_in_the_ipcc_ar6.pdf

-

5

World Bank Group, “What you need to know about blue carbon”, Nov 2023, https://www.worldbank.org/en/news/feature/2023/11/21/what-you-need-to-know-about-blue-carbon

-

6

Global Commission on Adaptation, “The Role of the Natural Environment in Adaptation”, 2019, https://gca.org/wp content/uploads/2020/12/RoleofNaturalEnvironmentinAdaptation_V2.pdf

-

7

Global Commission on Adaptation, “The Role of the Natural Environment in Adaptation”, 2019, https://gca.org/wp-content/uploads/2020/12/RoleofNaturalEnvironmentinAdaptation_V2.pdf

-

8

Springer, “Nature-Based Solutions to Climate Change Adaptation in Urban Areas”, 2017, https://link.springer.com/book/10.1007/978-3-319-56091-5

-

9

IUCN, “Nbs and Global goal on adaptation”, 2023, https://iucn.org/resources/information-brief/nature-based-solutions-and-global-goal-adaptation-launch-friends-eba

-

10

Global Commission on Adaptation, “The Role of the Natural Environment in Adaptation”, 2019, https://gca.org/wp-content/uploads/2020/12/RoleofNaturalEnvironmentinAdaptation_V2.pdf

-

11

AidEnvironment, Rainforest Foundation Norway, “Short Circuits: Exploring the broken links of mineral supply chain policies in electric vehicle industry”, May 2024, https://dv719tqmsuwvb.cloudfront.net/documents/RFN-Mineral-Supply-Chains_final.pdf

-

12

OECD, “Nature-based solutions for adapting to water-related climate risks”, Jul 2020, https://www.oecd.org/content/dam/oecd/en/publications/reports/2020/07/nature-based-solutions-for-adapting-to-water-related-climate-risks_c715ede8/2257873d-en.pdf

-

13

FAIRR, “Tackling the Climate-Nature Nexus”, March 2024, https://go.fairr.org/2024-Tackling-the-Climate-Nature-Nexus-Report

-

14

OECD, “Nature-based solutions for adapting to water-related climate risks”, Jul 2020, https://www.oecd.org/content/dam/oecd/en/publications/reports/2020/07/nature-based-solutions-for-adapting-to-water-related-climate-risks_c715ede8/2257873d-en.pdf