Japan’s investment story: Opportunities from ESG and sustainable investing

The United Nations Principles for Responsible Investment conference was recently held in Japan in October.

Prime Minister Kishida made several announcements at the event including pledging $600B1 of pension assets to become signatories of PRI.

The following piece examines key ESG developments in the Japanese market.

1. ESG considerations for pension funds: Why are pension funds committing to responsible investments?

Japan has about $3.6T USD2 of household financial assets managed by asset managers and owners like insurances and pensions.

At the PRI conference, Prime Minister Kishida announced that seven representative public pension funds with $600B USD in AUM will start preparations to become signatories to PRI (Principle for Responsible Investments).

Becoming signatories require these pension funds to3:

- Have a responsible investment policy setting the investor’s overall approach to ESG investing;

- Senior-level oversight of responsible investment;

- Internal/ external staff implementing responsible investments for the investor.

Japan has always had one of the most PRI signatories in Asia with over 120 investor signatories4 as of June 2023.

As detailed by one of Japan’s largest pension funds, the key investment case for adopting responsible investments include5:

- Long-term value creation of investees and sustainable growth of entire capital market is critical for stable income overtime especially for pension funds that are universal owners and cross-generational investors.

- Many ESG risks tends to increase in materiality over the long-term and consideration of such risks in investment process is key for any investor managing assets for future generations.

- Many negative environmental and social externalities will likely also impact other companies and sectors affecting longer-term economic growth. These risks could be better managed through engagements and stewardship with underlying investee portfolio.

2. Broader ESG developments in Japan: What are the key policies and regulatory changes?

At the PRI conference, Prime Minister Kishida also made several other announcements including:

- Climate transition bonds: Target issuance of $130B USD6 transition bonds in both climate solutions (renewables, hydrogen) and high-emitting sectors (steel, chemicals, automobiles).

- Green transformation investments: Encouraging development of green transformation and transition related investment products including for retail investors who can benefit tax exemptions program for small investments.

- Impact investment: Promotion of impact investments including JFSA guidelines on impact investment and planned establishment of an “Impact Consortium” bringing together public and private stakeholders in impact investing.

These developments align to other notable policy and regulatory developments to-date include:

- ESG regulations: In addition to the impact investing guidelines, FSA has also released:

- ESG fund disclosures and guidelines: providing guidance on disclosure requirements for funds marketed as ESG funds including ESG factors used in process and any ESG targets or allocation.

- ESG data providers code of conduct: guidance for both ESG data and rating providers as well as on investors’ due diligence on third party providers.

- Green Transformation: Government proposed plan to achieve near $1T USD7 of private-public investments to bring about Japan’s green transformation including:

- Growth oriented carbon pricing: Proposed Emissions Trading Scheme (GX-ETS) beginning with voluntary participation leading to introduction of auctions alongside transition bonds providing upfront investment support for industry decarbonization with bonds backed by financial resources from carbon pricing and carbon levy on fossil fuel importers.

- Regulations and promotion: Stimulate investments to scale existing and commercialize new technologies to achieve stronger industrial competitiveness.

- New financing: developing blended finance and promoting transition financing including investor guidance and sector roadmaps.

- International development: supporting other Asian economies in decarbonization.

- Governance reforms: Tokyo Stock Exchange reform is targeting to improve the attractiveness of Tokyo stock market via several measures including:

- Governance code: Following the first governance code in 2015, revisions were made in 2018 and 2021 which now requires board monitoring on sustainability initiatives and disclosure requirements on sustainability.

- Market restructuring rules: New “comply or explain” requirement if direct listed companies are trading below P/B ratio of 1 including specific action plans to improve capital efficiency8.

3. State of ESG investments and disclosures in Japan: How do Japanese corporates measure up?

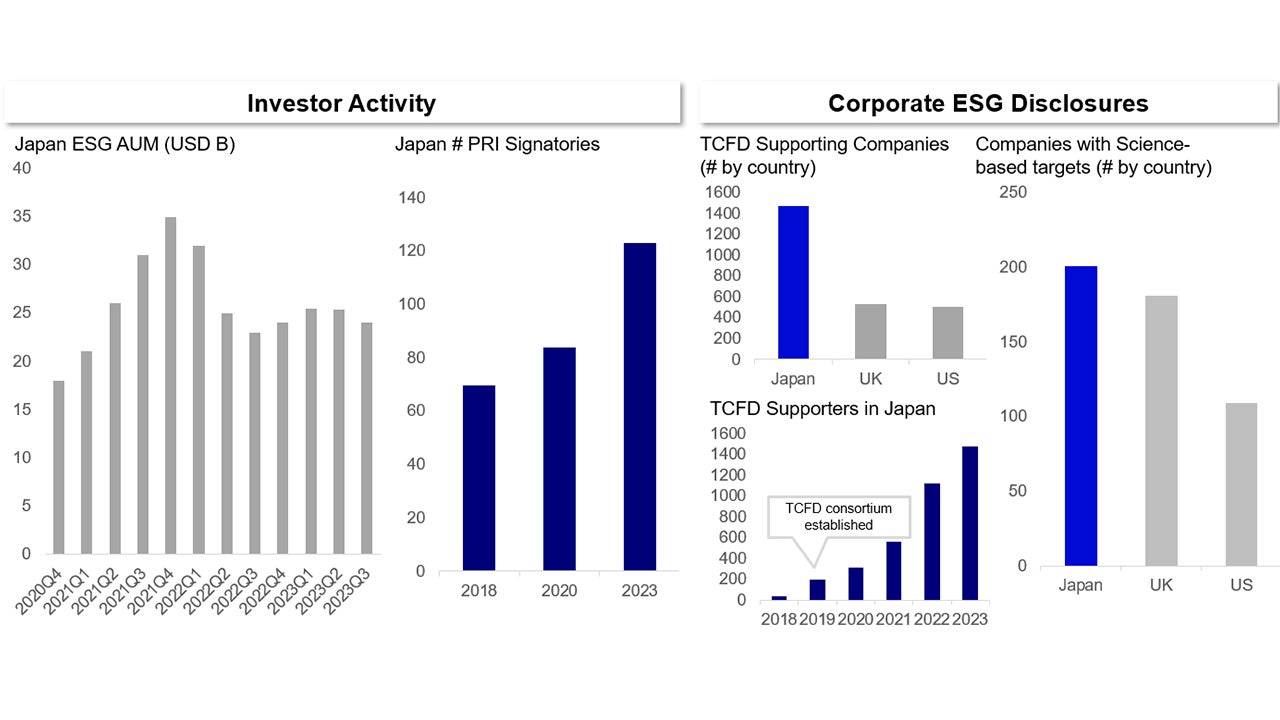

- Investments: ESG AUM in Japan has been steady at $20B USD9 with PRI signatories from Japan also growing from around 8010 in 2020 to more than 12011 in 2023.

- Corporate disclosures: Japan also has one of the highest corporate sustainability disclosures in Asia with many supporting TCFD (Taskforce for Climate-related Financial Disclosures)12 and setting science-based targets13.

Source: Morningstar (Global_ESG_Q3_2023_Flow_Report_final.pdf (contentstack.io) ), Morgan Stanley; PRI (2020- New and former signatories | PRI Web Page | PRI (unpri.org) ; 2023- PRI update (unpri.org) ) ; TCFD (About TCFD | TCFD Consortium (tcfd-consortium.jp) ); SBTI (SBTiMonitoringReport2022.pdf (sciencebasedtargets.org) )

4. Investment implications and opportunities

Given the regulatory and policy developments alongside investor and corporate uptake, two key interesting investment implications can be considered:

Governance plays for ROE:

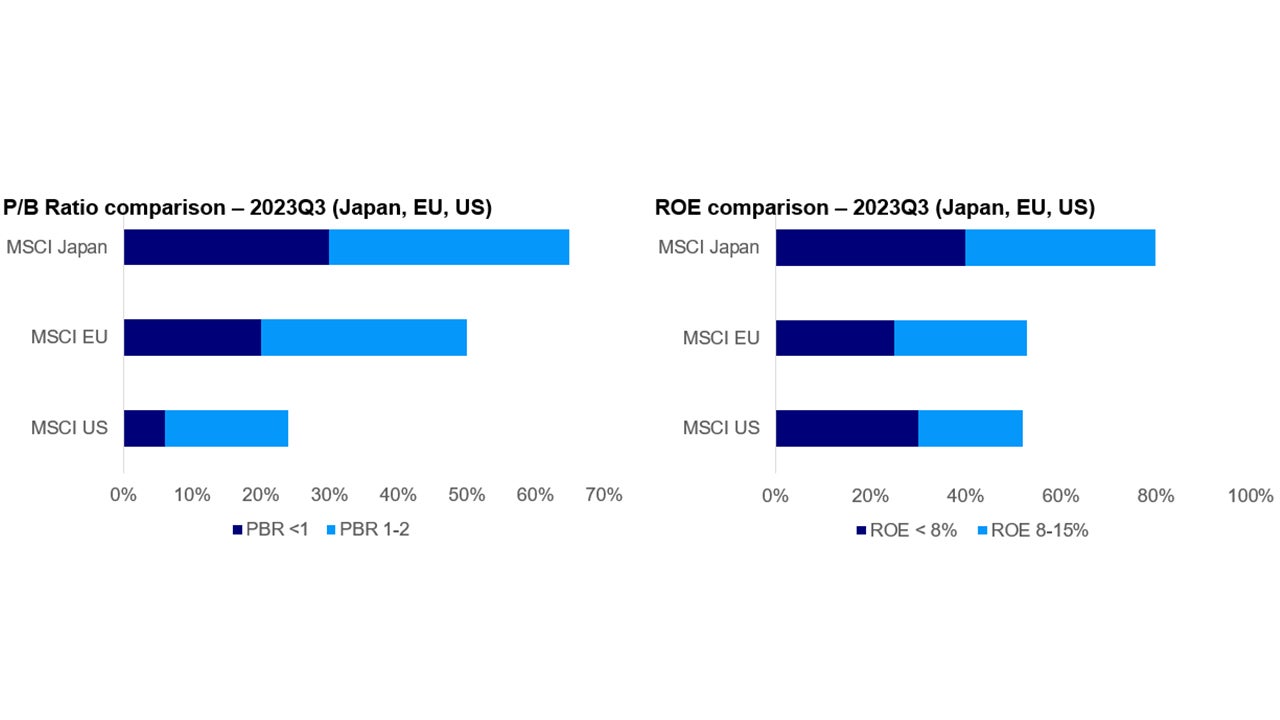

- Growing P/B ratios: The Tokyo Exchange previously mentioned in early 2023 that half of its prime listings and 60%14 of standard listings trade at a price-to-book ratio of less than one with a ROE (return on equity of less than 8%).15 This is far lower than corresponding constituents in that of Europe and the US.

Source: RIMES, Morgan Stanley Research (2023Q3); MSCI, FactSet, Bloomberg, Bernstein Analysis

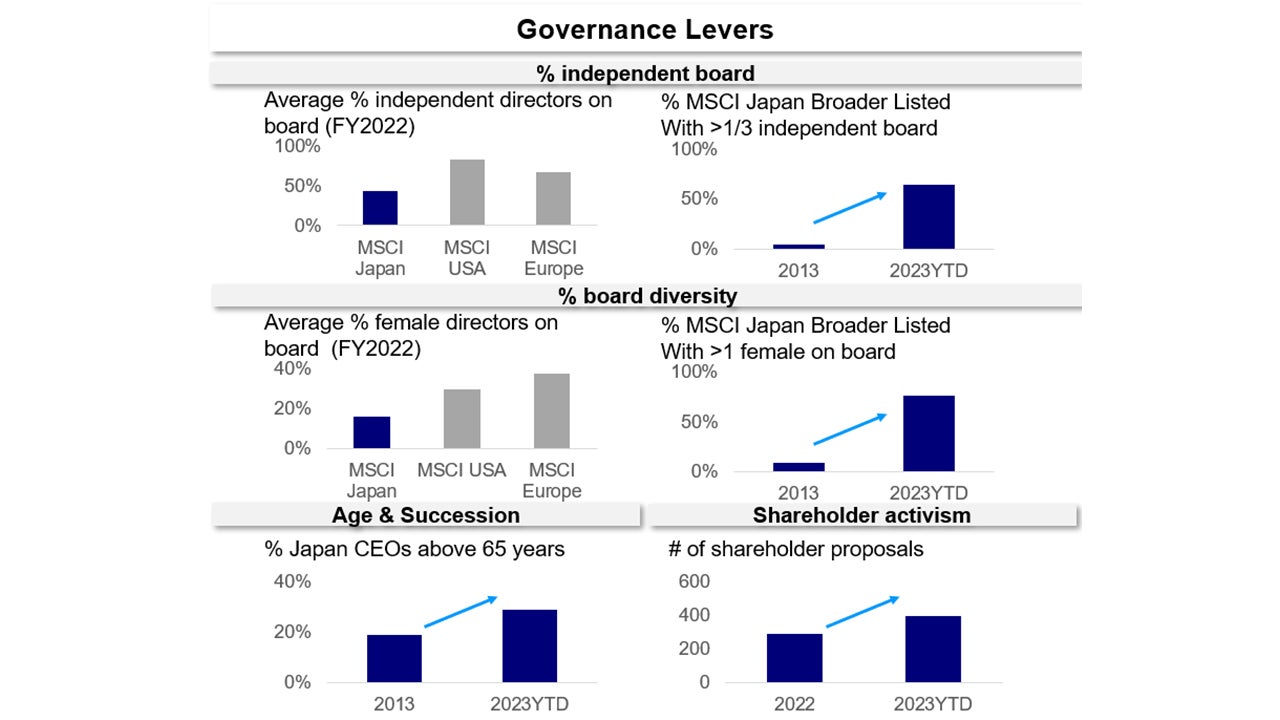

- Governance levers: Driving improvement of corporate governance through stewardship and engagement has the potential to improve ROE overtime; core levers of governance include:

- Board independence: Companies with higher percentage of independent board members historically tend to outperform benchmarks.16 While Japanese average board independence % are still behind the US or EU, the proportion has increased significantly over time. This independence should ideally also carry over to nomination and compensation committees.

- Age and succession: Ageing population trends have also contributed to a higher composition of boards with ageing executives in Japan with implications and risks on business succession ahead, particularly impacting larger corporates.

- Gender diversity on board: While the overall percentage of female directors on board is still lower compared to other regions, the proportion of Japanese companies with females on their board has increased over time and there is further room for growth. The government targets to have 30% females on the board by 2030 and having minimum one female on the board by 2025.

- Shareholder engagement: Shareholder proposals have been on the rise in Japan particularly on director election and capital structure. Regulation platform for collaborative engagements will be constructed by Japan’s FSA to encourage more effective shareholder engagements for the listed companies.

Source: RIMES, Morgan Stanley Research (2023Q3); MSCI, FactSet, Bloomberg, Bernstein Analysis

- Investment opportunities:

Governance leaders with better existing performance on levers like board independence and diversity could see earlier upsides especially as they are closer to governance metrics in US and EU markets17.

Governance improvers would play more into identifying mispriced assets and value styles; assessing on management commitment and plans on governance improvements would be key.

Transition story: per above, the Japanese government’s Green Transformation plan can lead to near $1T USD in investments for whole economy transition. Corresponding opportunities:

- Transition leadership: Carbon pricing through ETS and carbon levy will create pricing and cost signals for companies to encourage earlier decarbonization to reduce EBITDA impact. Upside to be captured by corporates making earlier progress on transition particularly in high-emitting sectors

- Green markets: emphasis on technology investments and green markets development could create opportunities in green products (e.g. green steel, green buildings) that can become new engines for growth. Key sectors in GX plan include:

- Energy: broadening mix including targets for solar, wind and development of nuclear and hydrogen;

- Transport: targets for EVs and charging infrastructure alongside greening shipping and aviation;

- Built environment: policies for zero emissions buildings;

- Industry: focus on green steel and carbon neutral cement.

- Energy: broadening mix including targets for solar, wind and development of nuclear and hydrogen;

- New financing: Emphasis on blended financing and building of sustainable finance markets could also create opportunities in transition bonds and other sustainable funds & financial products.

Reference:

-

1

Source: Japan Govt Statement by Prime Minister Kishida at PRI in Person 2023

-

2

Source: Japan Govt Statement by Prime Minister Kishida at PRI in Person 2023

-

3

Source: PRI Minimum requirements for investor membership | Reporting guidance | PRI (unpri.org)

-

4

Source: UN PRI PRI update (unpri.org)

-

5

Source: GPIF GPIF_ESGREPORT_FY2021.pdf

-

6

Source: JP Gov Statement by Prime Minister Kishida at PRI in Person 2023 (Speeches and Statements <br>by the Prime Minister) | Prime Minister's Office of Japan (kantei.go.jp)

-

7

Source: GR Japan gr_japan_overview_of_gx_plans_january_2023.pdf (grjapan.com)

-

8

Source: CNBC https://www.cnbc.com/2023/06/13/investing-is-japan-inc-finally-serious-about-corporate-governance-.html

-

9

Source: Morningstar https://assets.contentstack.io/v3/assets/blt4eb669caa7dc65b2/blt7d329f330547f085/6537e909de6c442b29970d4d/Global_ESG_Q3_2023_Flow_Report_final.pdf

-

10

Source: PRI 2020 New and former signatories | PRI Web Page | PRI (unpri.org)

-

11

Source: PRI 2023 PRI update (unpri.org)

-

12

Source: TCFD Consortium https://tcfd-consortium.jp/en/about

-

13

Source: SBTI https://sciencebasedtargets.org/resources/files/SBTiMonitoringReport2022.pdf

-

14

Source: CNBC https://www.cnbc.com/2023/06/13/investing-is-japan-inc-finally-serious-about-corporate-governance-.html

-

15

Source: CNBC https://www.cnbc.com/2023/06/13/investing-is-japan-inc-finally-serious-about-corporate-governance-.html

-

16

Source: Bernstein Analysis Japan 2.0: ESG"MAQ": Measuring the unmeasured - Corporate Governance changes in Japan

-

17

Source: Morgan Stanley Research- Japan’s Governance Journey: Alpha Opportunities awaiting discovery