Heat waves and El Nino: implications & opportunities in sustainability and adaptation

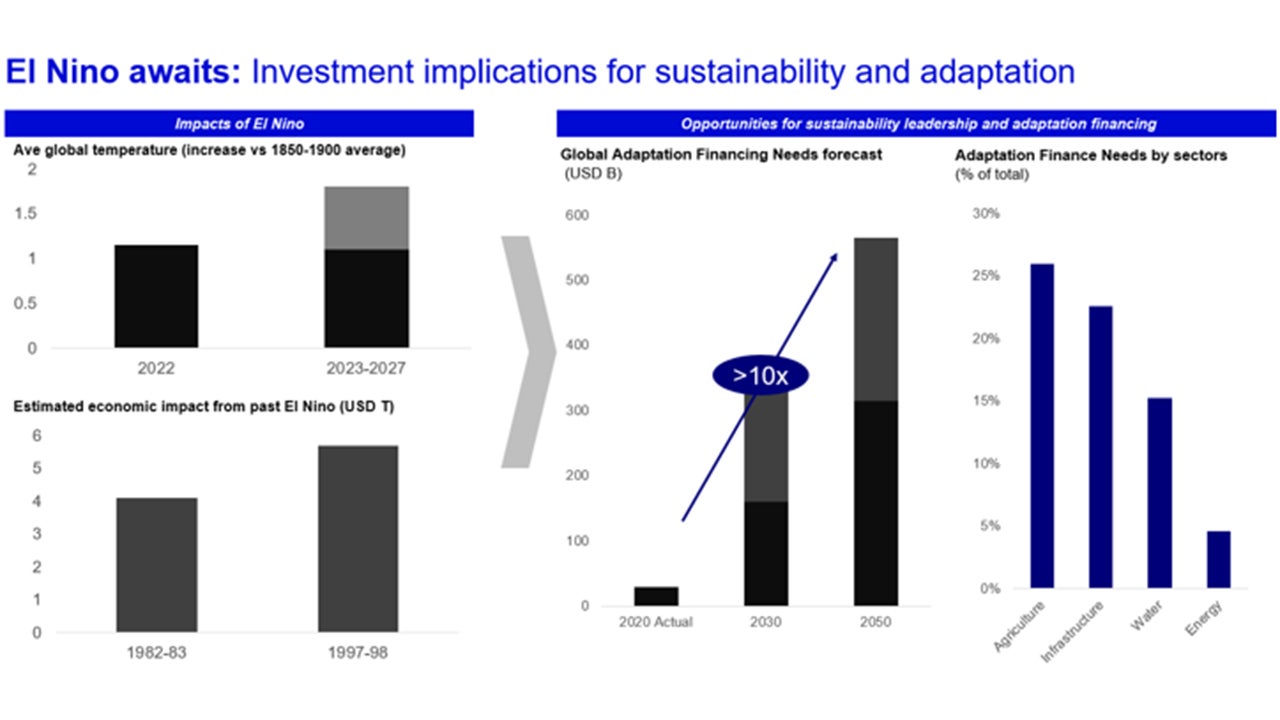

Entering into summer, various regions are starting to feel the heat and temperature surges. In particular, 2023 will likely see the development of El Nino weather phenomenon that will bring about specific investment implications and opportunities for sustainability and adaptation.

There have been forecasts that this year many countries will experience heat waves. Why is this the case?

- The UN World Meteorological Organization (WMO) announced last month that 2023 will likely see El Nino developing – a naturally occurring climate pattern seeing increased heat and warming globally.1

- This phenomenon results in abnormal warming of surface waters in eastern equatorial Pacific and a shift in large-scale rain clouds will disrupt local and regional weather patterns.2

How could heat waves impact on corporations and countries in both near and longer term?

- Over this period, certain regions in Asia will see significant temperature increases (e.g. Singapore for instance saw temperature increased by 0.6 degree Celsius above long-term average during 2015/16 El Nino event)3 and corresponding decrease in rainfall resulting in warmer and drier conditions in Asia and Africa while energizing rainfall in South America.

- Expect early season heat waves, new heat records alongside droughts in Pacific region versus floodings in other regions. Previous El Nino in 1997/8 have resulted in $5.7T USD in income losses globally and causing 23,000 deaths.4

- Potential industry impact includes

i)Changes in weather and climate affecting agriculture and food supply chains, with potential shortages and price hikes. Asia accounts for >60% of global agriculture production and supply shocks will see significant yield declines.5

ii)Increase in temperatures affecting energy demand and consumption (e.g. in air-conditioning), increasing related costs and expenses; Asia as a large energy importer will continue to see material energy security risk and self-sufficiency might decrease from 72% to 63% by 2050.6

iii)Intensity of weather events causing relevant infrastructural and physical assets damage; impacting short-term maintenance capex and longer-term insurance premiums.

Source: WMO (Global temperatures set to reach new records in next five years | World Meteorological Organization (wmo.int) ); Science/ CleanTechnica (Economic Damage From Next El Niño To Total $3 Trillion – CleanTechnica ); UNEP Adaptation Gap Report 2022 (Adaptation Gap Report 2022 | UNEP - UN Environment Programme ); UNEP Adaptation Gap Report 2021 (Adaptation Gap Report 2021 (unep.org) ); Invesco Analysis. For illustrative purposes only

In response, are there any actions that corporations and countries are working on / expected to cope with heat waves? (great to have some Asian perspective here)

- Different sectors and issuers have started to prepare relevant actions; examples include

i.Agriculture: More acute monitoring of weather changes and crop supply; corresponding stocking up on key commodities; preparing with relevant irrigation.

ii.Real estate and infrastructure: Relevant infrastructure upgrades and installing of energy efficiency and cooling technologies, particularly city cooling infrastructure.

iii.Energy sector: Having sufficient spare grid capacity to support the increased electricity needs from urban centres, as adverse weather may impact the level of renewable electricity production.

What are the investment implications / opportunities?

- Sustainability leadership: against the backdrop of climate changes, bond issuers who are better positioned in resilience readiness will benefit against issuers who will face financial & operation risks as weather-related impact materializes. Issuers with technologies and services that helps increase resilience or offers adaptation solutions will also benefit from adoption.

- An example is a Hong Kong property company that owns 4.5mn square feet of space in HK Island. It has reduced carbon intensity by 38% from 2005 levels and also 40% of debt financed by sustainable finance, which it has achieved ahead of its own target setting date. It incorporates decarbonization initiatives from design, construction to operation stage, buildings consume around 90% of electricity in HK.7

- Adaptation financing: El Nino will further increase demands for adaptation financing, key investment themes include:

i)Agriculture and Food security: Strengthening supply security including sustainable agriculture and food systems transformation.

ii)Water: Helping increase water availability and supply including water conservation and delivery assets.

iii)Infrastructure: Incorporating climate resilience in infrastructure including early warning climate systems and protective infrastructure.

iv)Biodiversity Bonds: Chinese banks have issued bonds in this format that specifically focuses on natural forest protection, river, lake and wetland conservation amongst others.