ESG trends in focus: El Nino, adaptation, transition and the investment implications

Recent heat waves, droughts and floodings as a result of El Nino have hit news headlines. The phenomenon have led investors and thought leaders to focus on climate adaptation and the related investment opportunities.

Indeed, June 2023 was the hottest June in the past 174 years1, creating an urgency for governments and corporations to take actions to adapt to a warmer world in the long run. What are the investment implications?

Q1) El Nino is back after 7 years. What is the expected impact on commodities/ agrifood?

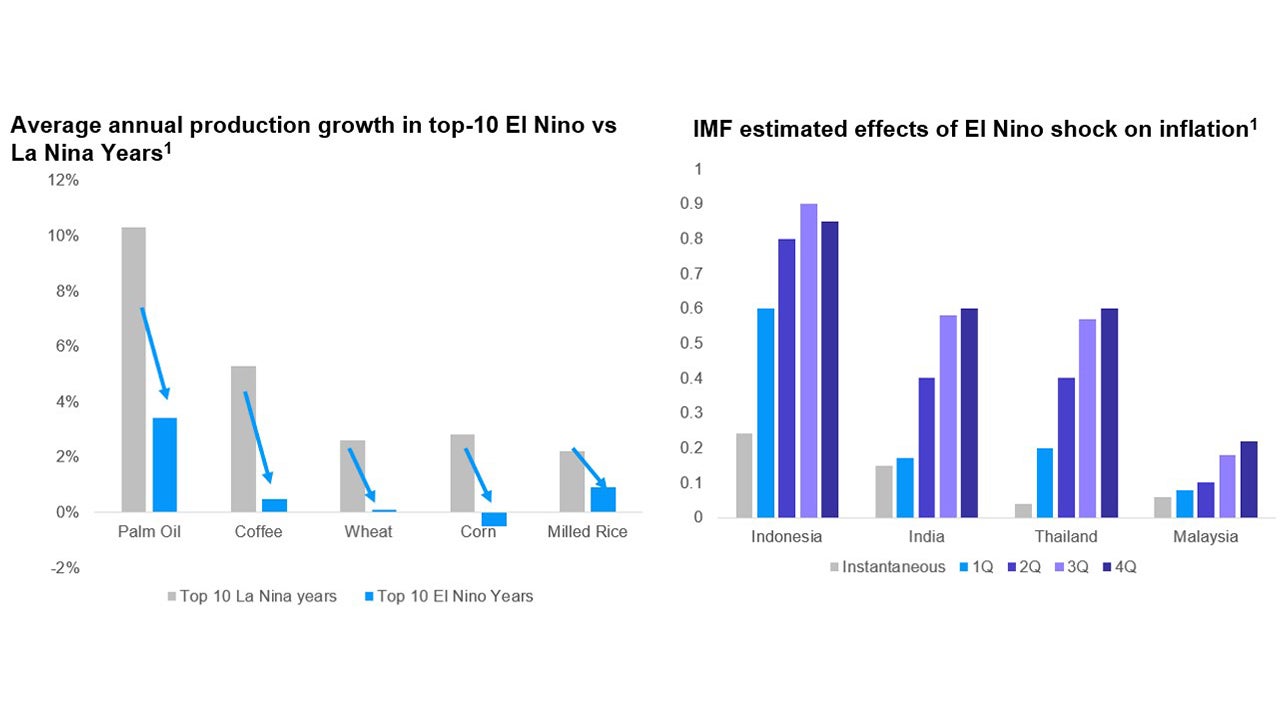

While some regions have seen floods, other regions are experiencing heat waves with rainfall forecasted to be up to 10% lower than average in some countries2 with droughts, impacting crop outputs and supply that might fuel inflation:

- Rising input costs: Higher food prices fueled by reduced output could drive input costs of companies.

- Pre-emptive stocking: Reactionary measures of companies rushing to lock-in supply could further drive prices and exacerbate inflationary pressures.

- Regulatory risks: Governments taking pre-emptive regulatory responses such as banning of certain exports would add to price impact.

- Export & import dependency: Economies with high primary sector economic shares (e.g. agriculture, forestry) or large weight of food in CPI will likely see bigger shocks from reduced yields. Export-driven economies could potentially benefit from price increases.

Note: (1) El Nino (2015, 1987, 1997, 1982, 1991, 1992, 2002, 1983, 1994, 2019); La Nina (1999, 2022, 2011, 2000, 1988, 2008, 2021, 2007, 1989, 1985)

Source: Bloomberg, Haver Analytics, Barclays Research; IMF, CLSA Analysis

Q2) What can countries / corporations do to alleviate these impacts? What are the investment implications and opportunities?

Governments may enact supply-side measures like food subsidies (rather than solely relying on monetary policy). Corporations may consider the right hedging strategies on raw material input and pricing strategies given cost inflation.

From an investment perspective, key implications are

- Factoring of El Nino risks: primary risks relating to supply shortages and agricommodity input costs:

- Agriculture yields: Potential declines in yields. Arbitrage opportunity may exist for commodities like wheat (where impact on Australian yields could be opportunities for wheat producers in US and Europe).

- Consumer product manufacturers: Risks of increased raw material costs (e.g. in sugar, palm oil, barley). Key is in whether rising prices can be passed downstream.

- Secondary socioeconomic impact: Yield reduction could impact farmers’ ability to repay debts which could affect certain financials and non-performing loan profiles.

- Adaptation & Supply Chain:

- Agrifood security: Droughts and flooding may result in crop production setbacks particularly in Asia where many countries like Indonesia, India and Thailand are most vulnerable to climate physical risks.

Adaptation opportunities may exist in helping agriculture to be more climate resilient and increase crop yields such as in weather warning systems, improving soil quality and irrigation and other agriculture digitization.

- Water security: Persistent droughts exacerbate challenges in ensuring clean water supply and sanitation.

Within Asia, India and China could be amongst most affected in water shortages especially given water usage in industrial processes like steel making or chips manufacturing3.

Opportunities may emerge in relevant urban infrastructure and water sanitation.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Reference:

-

1

Source: NASA, as of June 2023

-

2

Source: Bloomberg, as of July 2023

-

3

Source: CNBC, as of June 2023