ESG Regulation in Asia

Growth of ESG Regulation in Asia: Opportunities and Implications for Sustainable Investing

Alongside growing ESG investing scene in Asia, there has been a rapid corresponding development in ESG regulations in the region. Globally it is estimated that there are now more than a thousand ESG regulations including more than 200 relevant regulations in Asia, a two-fold increase since 2016.1 Overall, regulatory developments increase standardization and promotes sustainable investing creating investment opportunities. At the same time, corporates and investors would need develop corresponding capabilities and processes to meet regulations while also being mindful of limitations of regulations.

Landscape of ESG regulations in Asia

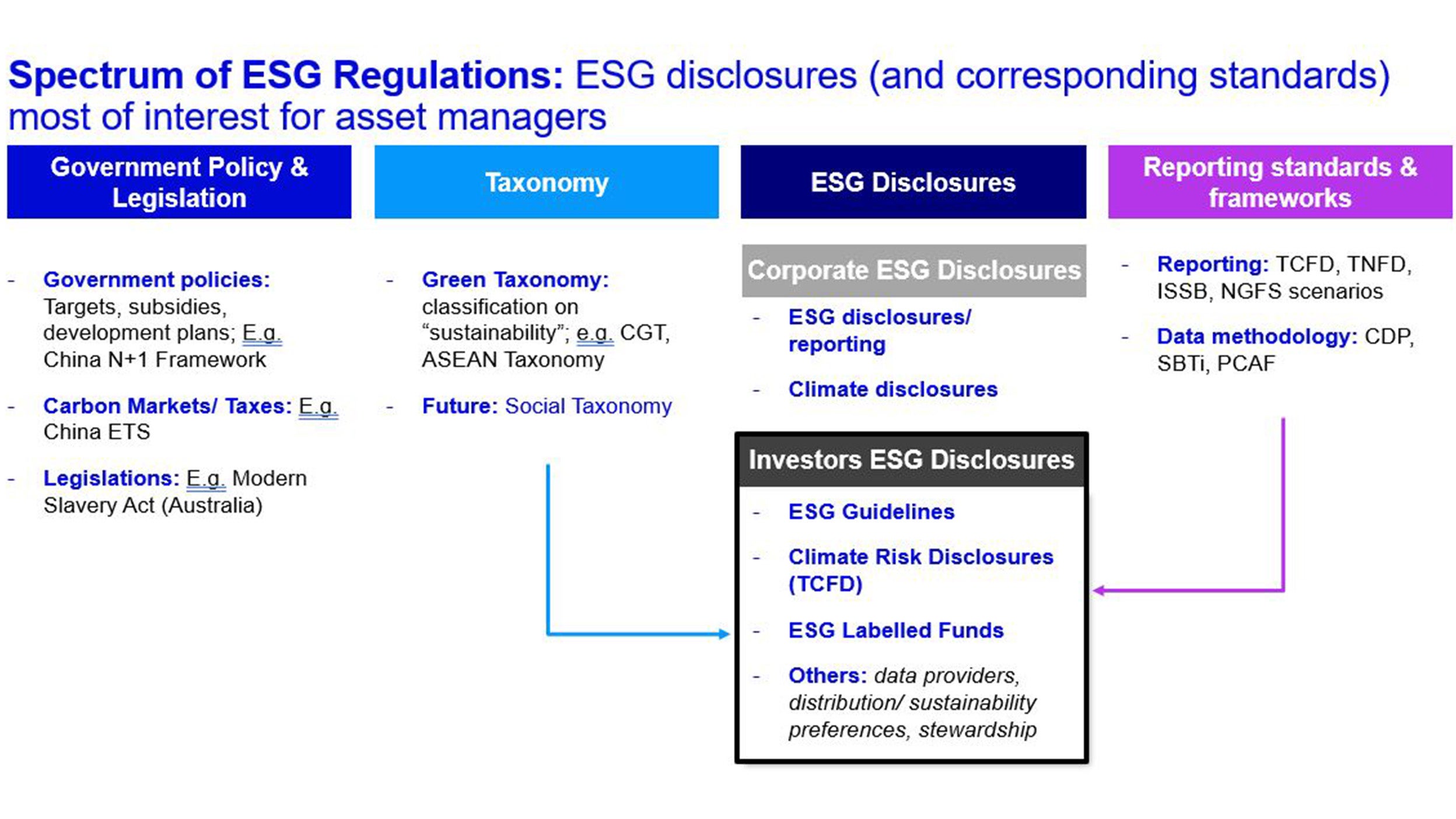

Just as most of global ESG AUM flows have been led by Europe, much of global ESG regulatory developments have seen European regulators and governments at the forefront. While there are various types of ESG regulations and different ways of categorizing, broadly speaking we believe there are four types of ESG regulations.

Source: Invesco Analysis

First, governments often enact different laws and policy initiatives to promote sustainability agenda or regulate against certain ESG risks. These includes:

Government policies most notably climate agenda driven initiatives including net zero commitments, decarbonization targets and plans, sector-level transition roadmaps (China’s 3060 goals and N+1 Guiding Framework, Hong Kong’s Climate Action Plan 2050, Singapore Green Plan 2030 would all be relevant examples).

Carbon markets and taxes can be said to be more specific form of government initiatives designed to reduce emissions whether it’s through cap and trade (China’s Emissions Trading Scheme) or imposing carbon taxes (Singapore’s Carbon Pricing Act)

Legislations are enacted predominantly to regulate against material business or commercial risks or sanctions against areas of national priorities or geopolitical events (EU’s proposed Corporate Sustainability Due Diligence Directive, Australia’s Modern Slavery Act would be relevant examples)

Second, taxonomies serve as a classification standard to define and assess whether an activity or investment is sustainable.

Green or Sustainable Taxonomies: Clearly defined standards are critical in ensuring consistency and confidence in sustainable finance and investments. Within sustainability and environment, green taxonomies are a classification tool that defines what can be considered as sustainable. Globally there is now more than 20 taxonomies being actively developed2. Selected ones in Asia includes:3

| Geography | Status | Details |

|---|---|---|

| China | Live | Updated Green Projects Catalogue released in April 2021; primarily for green bond market usage |

| Japan | Live | Green Bond Guidelines (by Ministry of Environment) updated in 2020 |

| Malaysia | Live | Principles-based taxonomy published in April 2021 by Malaysian Central Bank |

| ASEAN | In development | ASEAN Taxonomy draft released in November 2021 |

| Singapore | In development | 2nd version of Green and Transition Taxonomy released in May 2022; currently undergoing consultation |

EU and China’s also partnered on Common Ground Taxonomy (CGT)- a comparison between taxonomies of both regions (Hong Kong will also adopt a taxonomy with reference to CGT). Common notable comparison items for taxonomies include the environmental priorities covered (mitigation vs adaptation), the scope of sectors and activities and assessment criteria.

Other taxonomies: Outside of climate, there are also developments in having taxonomies to define social objectives or impact relating to UN Sustainable Development Goals (SDGs); most notably EU’s ongoing work on Social Taxonomy.

Third, disclosures enable transparency and comparability in sustainability-related reporting. This includes:

- Corporate disclosures: Including both broad sustainability and ESG reporting requirements (e.g. HKEX ESG Reporting Guidelines) and climate related disclosures (e.g. China’s CSRC Environmental Guidelines).

Financial Institutions or Investors disclosures including:

General ESG Guidelines: Often relating to integrating ESG considerations as part of investment process.

Climate Risk Disclosures: Similar to corporate climate disclosures, often TCFD-aligned requirements on taking into account climate risks in strategy, governance and disclosures (SFC’s Climate Risk Requirements or MAS’s Environmental Risks Guidelines).

ESG Fund Disclosures: Additional requirements on ESG labelled Funds to disclosure sustainability metrics (SFC or MAS ESG Funds Disclosure requirements).

Others: Many other regulations are also being developed including regulations on ESG data providers and stewardship.

Finally, reporting standards and frameworks (such as International Sustainability Standards Board or Taskforce for Nature Related Disclosures) alongside data methodologies (like those for emissions calculation) provides additional guidance that feeds into disclosures and regulations.

Source: Morgan Stanley; Goldman Sachs; ASFIMA . *Analysis of ESG Regulations in Asia4

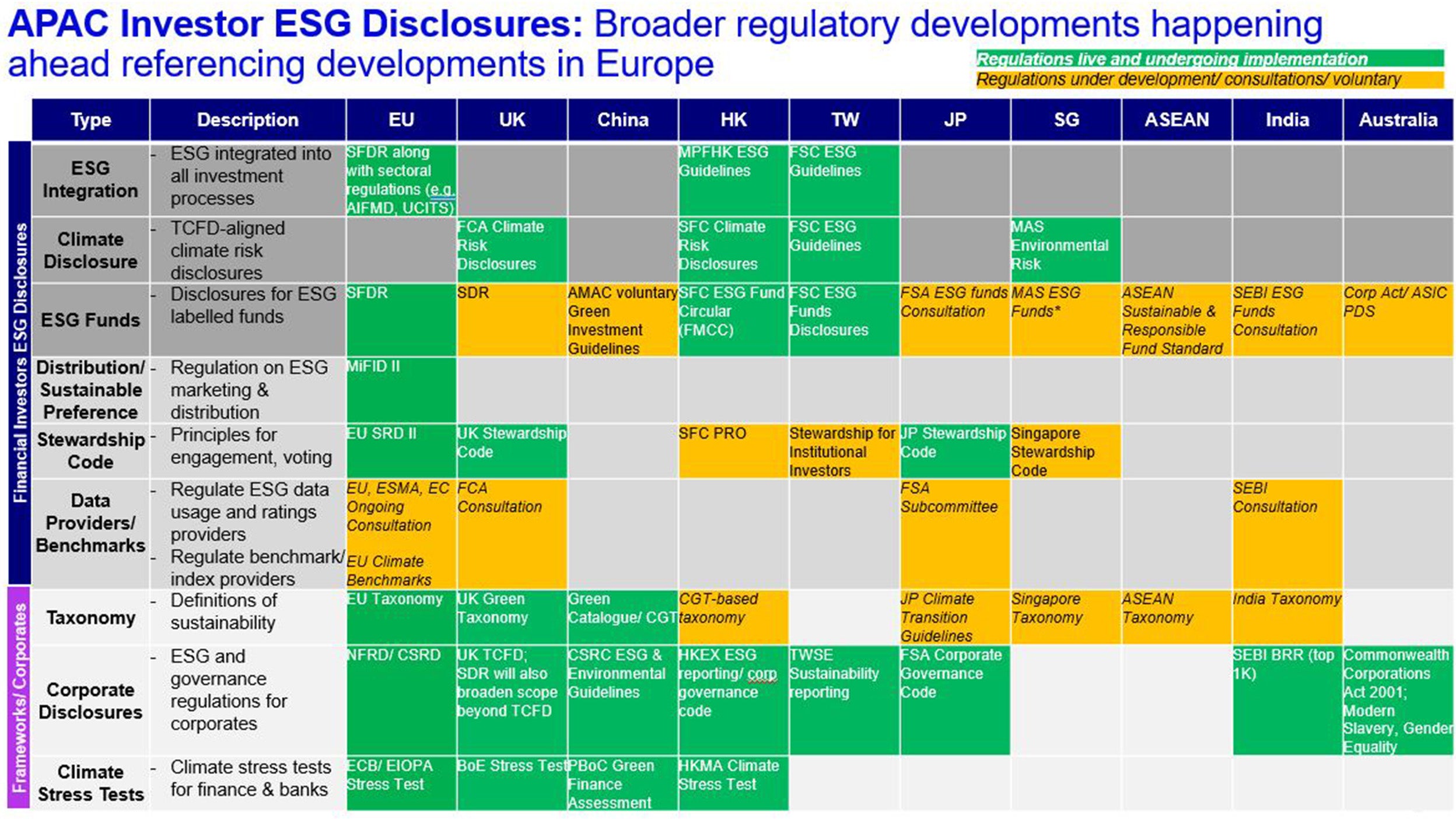

Looking at the broader ESG regulatory landscape in Asia, European regulatory development has served as a helpful frame of reference for the region. Broadly speaking, climate-related regulations including TCFD disclosures for both corporates and financial institutions have been a key priority. Relatedly, as mentioned there has also been a proliferation of creating taxonomies in the region. These are followed closely by more broad ESG regulations like those for ESG funds or stewardship codes that could come into play ahead as well. Overall, these developments are positive in bringing coherence to sustainable investing. In the longer term, continued focus would be on interoperability and standardization given differences across the region.

Investment Implications of ESG regulations

Acceleration in ESG regulations creates corresponding opportunities and implications for investors in the region. Regulations will lead to greater transparency-driven leadership premiums, continued shift towards green and sustainability, continued capital flows to ESG with continued need to be mindful of greenwashing risks.

First, increasing disclosures and reporting frameworks will lead to greater transparency on ESG leaders versus laggards. Corporate ESG reporting requirements has helped to raise regional ESG disclosure rates increasing ESG data availability. This is further supported by taxonomies development that enhances granularity in sustainable activities and revenues being reported. Industry research has shown a 10-15 percentage points EV/ EBITDA premium between ESG leaders compared to ESG laggards.5

Second, climate policies and regulations has also accelerated green investments. There has been a greater focus on carbon in investments with industry research showing at least 20-30% P/E premiums for low carbon emitters.6 Companies making early voluntary adoption of taxonomy-aligned reporting offers potential investment upside. As emissions trading schemes or carbon tax policies continue to mature in the region, we expect these premiums to further widen over time.

Third, growth of ESG AUM and flows continued to drive capital to ESG leaders as well as companies making good ESG momentum. This is further supported by government legislations such as on supply chain, modern slavery that further helps investors mitigate risky holdings with higher controversy risks. This is also further fueled by asset owners and institutional investors adopting ESG investing as part of their approach, with signatories to the UN Principles for Responsible Investment growing to more than 4000.7 Similar trends in adopting ESG and climate investing could also play out amongst retail investors.

That said, while regulatory development brings opportunities, certain greenwashing risks remain. In the past months, Morningstar removed sustainable investment labels from over a thousand European-domiciled funds, despite many of them being SFDR Article 8 funds.8 While regulations will continue to bring about data accessibility, consistency and standardization, it is vital for investors to always evaluate a fund’s strategy against its sustainability objective and approach to effectively address risks in greenwashing.

Invesco’s response to ESG regulations in Asia

In view of regulatory and broader sustainability trends, Invesco has continued to develop supporting processes and systems.

More information about our sustainable investing capabilities can be found in our annual stewardship reports. Climate Change continues to be a firm priority especially in the management of environmental and climate-risks. This involves having the right governance, strategy, risk management and disclosures. Having proprietary technology and data capabilities such as ESGIntel that provides issuer-level ESG ratings or ESGCentral that offers portfolio ESG and climate analysis also helps us better evaluate and conduct forward looking assessments on risks and opportunities. Please refer to our Environmental Risk Management Policy adopted in Hong Kong and Singapore.

Effective regulatory development is a crucial foundation for a well-functioning sustainable investing market and will continue to create opportunities and implications for investors in the longer term.

Footnotes

-

1

UN PRI.

- 2

-

3

FoSDA (Future of Sustainable Data Alliance) https://futureofsustainabledata.com/taxomania-an-international-overview/

-

4

Invesco Analysis; MS Primer Sustainability: Global ESG Regulation Primer (ms.com) ; GS Primer Sustainability: Global ESG Regulation Primer (ms.com) ; ASFIMA

-

5

GS SUSTAIN. APAC ESG Regulations in Asia. A new era for ESG in Asia Pacific (gs.com)

-

6

ibid

-

7

UN PRI PRI reaches 4000 signatories with emerging markets boosting RI uptake | Blog post | PRI (unpri.org)

-

8

ESG Clarity https://esgclarity.com/morningstar-drops-sustainable-tag-from-1200-funds/