Sustainable investing outlook

Outlook for 2025

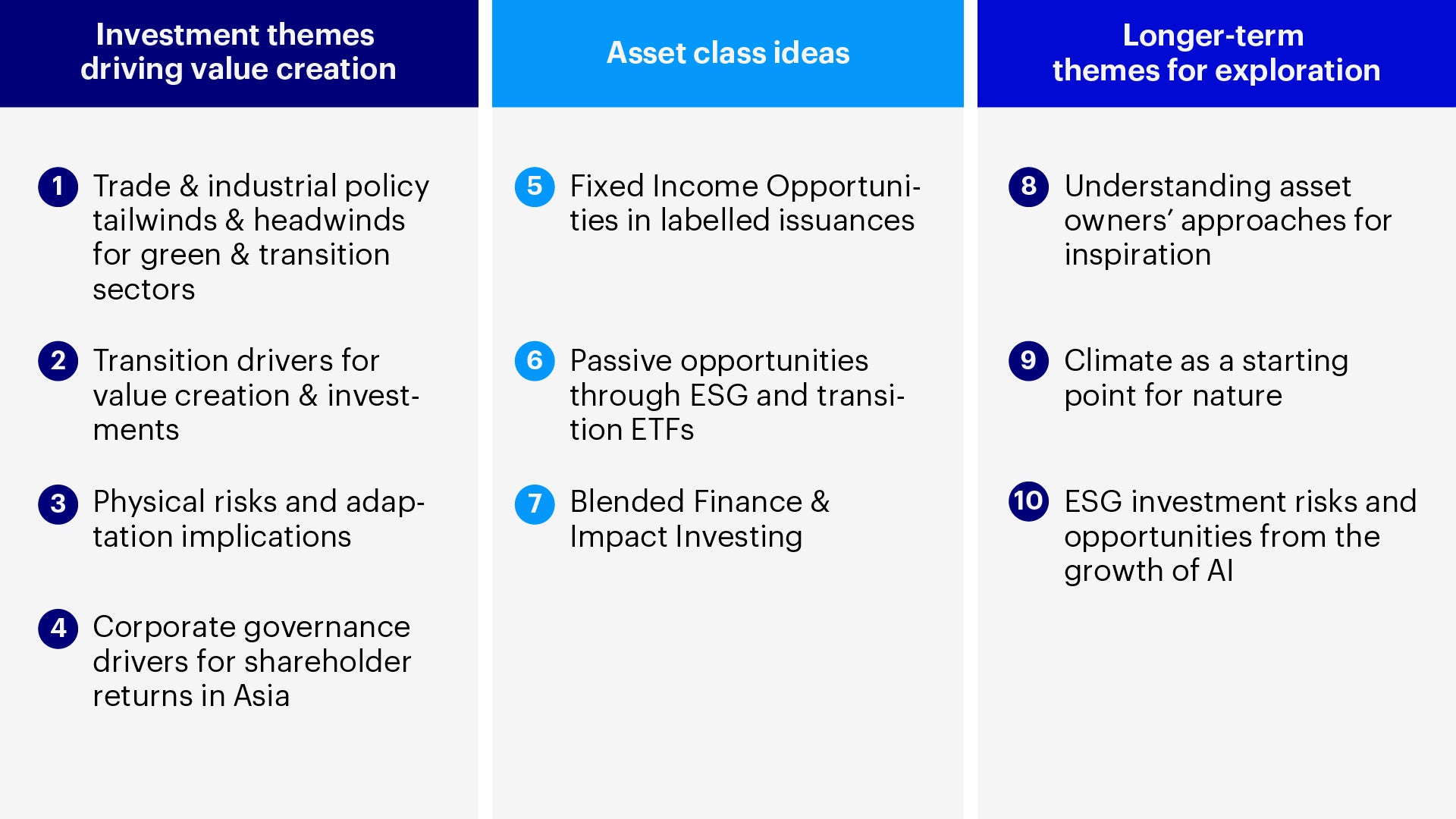

What sustainable investing opportunities do we expect to see in 2025? Recent regional and national developments emphasize the growing role of trade, industrial, and supply chain policies in supporting green sectors. Climate mitigation, transition, and adaptation will also continue to be investment themes of focus across asset classes. In this outlook, we present 10 ideas that address 3 questions:

- Which investment ideas can drive value in 2025?

- What are opportunities across asset classes?

- What are longer-term trends worth keeping a look-out for?

Source: Invesco analysis.

Investment ideas driving value in 2025

1. Trade and industrial policy tailwinds and headwinds for green and transition sectors

o We expect trade and industrial policy considerations to become increasingly important for investors. Policies like Europe’s Carbon Border Adjustment Mechanism1 or Japan’s Green Transformation Plan2 provide policy support and subsidies for green technologies while also having financially material implications for high emitters.

- EU: Under the Carbon Border Adjustment Mechanism (CBAM), from 2026 onwards importers of goods in-scope under CBAM (including iron, steel, cement, aluminium) would have to pay a carbon price aligned with EU’s Emissions Trading Scheme, affecting cost competitiveness of imports versus EU producers3. Additionally, Mario Draghi’s report on the future of European competitiveness released in 20244 calls into focus how transition technologies can be a driver for economic productivity. Investors can keep a keen eye on sectors that will likely be beneficiaries of government policy tailwinds and support. National trade policies in some markets might also create headwinds in the form of tariffs for other economies. Sectors that could benefit:

o Grid and storage: Draghi’s report emphasizes the importance of upgrading cross-border grids and transmission infrastructure while also stressing the importance of building out more comprehensive energy storage supply chains.

o Nuclear: Nuclear could become an important source for energy diversification as markets like the EU, China, Korea, and Japan have all set capacity expansion targets as a share of their energy mix. The role of nuclear is also growing with electricity demand growth driven by the AI boom.

- US: With the focus on tax cuts and strategic competition with China we could see certain sectors and regions benefit from the reshoring and expansion of manufacturing in US and in markets where the US has free trade agreements. Elements of the Inflation Reduction Act5 aligned to reshoring activity (such as the 45X Advanced Manufacturing Production Credit6 and Domestic Content Bonus Tax Credit7) will benefit while areas like tax credits and subsidies for electric vehicles (EVs) may be at risk.

- APAC: Japan’s Green Transformation (GX) policies seek to catalyze US$1 trillion in private-public investments to bring about Japan’s transition.8 Priority areas identified for increasing public and private investments, include next generation solar panels, floating offshore wind, nuclear energy, hydrogen and carbon capture & storage technologies9. The ASEAN region is increasingly focused on understanding climate physical risks and the growth of National Adaptation Plans among Southeast Asian countries will help support growth in adaptation financing.

2. Transition drivers for value creation and investments

- As companies and investors consider transition plans and engagements, understanding the linkage between transition and business value creation and risks is key. We think climate transition will create market opportunities for new technologies (such as sustainable aviation fuel or green steel) and affect costs of operation through carbon taxes and financing via green capex spending requirements. Companies can also capture potential financing opportunities from transition-related bond issuances.

- UK and transition planning: The Carbon Disclosure Project’s latest research highlights that there has been a 44% increase in companies with a climate transition plan in the past year, but the number of credible plans remains low.10 We believe the quality and coverage of transition plans will likely continue to grow over time, offering additional information for investors. The UK has led the way, with the Transition Plan Taskforce releasing its final transition plan sectoral guidance this year and conducting a thorough transition finance market review11.

- China, Japan and transition financing: China, on the other hand, has focused heavily on increasing transition financing, which has been facilitated by the growth of transition taxonomies across different Chinese cities. In some cases, transition financing issuers will also need to have their own transition plans and transition considerations in place. Likewise, the Japanese government’s green transition policies, alongside its recent US$11 billion12 transition bond issuance, also highlights transition financing opportunities in Asia.

3. Physical risks and adaptation implications

- Physical risks and projected climate hazards could result in costs of more than US$500 billion on real assets (or up to 26% of the total real estate asset value of the S&P Global REIT Index)13. Floods, droughts, and heat waves all bring material impacts across sectors, whether it’s on agrifood supply chain shocks, damage to infrastructure and real estate, or rising insurance premiums. Understanding the impact of physical risks on real assets will be critical, and investing in adaptation solutions can help to avert potential longer-term costs and losses.

- National Adaptation Plans (NAPs) provide a helpful guide for investors to understand how different regions are seeing physical risk impact on their economies and sectors and where financing and investment is required. As of Nov 2024, in the leadup to COP29, 59 countries have submitted NAPs to the UN (up from just 4 in 2018)14 and we believe this provides a valuable map for investors to identify potential adaptation risks and opportunities.

4. Corporate governance drivers for shareholder returns in Asia

- Various regions have been implementing corporate governance reforms including Japan’s Tokyo Stock Exchange reforms15, Korean’s value-up programme16, and more recently, China’s market value management programme17.

- The reforms generally look to improve capital efficiency and board effectiveness, including a focus on cost of capital and improving shareholder returns.

Opportunities across asset classes

5. Fixed income opportunities in labelled issuances

- Sustainability labelled fixed income issuances have remained consistent through the first half of 2024 reaching US$554 billion (7% year-on-year relative to H1 2023).18

- Labelled fixed income issuances have become an effective credit quality screen for investors, with ESG regulatory requirements in EMEA affecting access to broader pools of investors and funds.

- Transition and resilience financing are also growing as new categories where in addition to the development of regional transition taxonomies mentioned above (such as in China), there has also been developments in adaptation taxonomies, such as the Climate Bonds Initiative’s resilience taxonomy19.

6. Passive opportunities through ESG and transition ETFs

- Passive opportunities in sustainable investing have grown as a share of total ESG assets under management (AUM)20, and ESG ETFs are viewed as one of the fastest growing smart beta strategies in Europe.21

- Passive investing allows for cost-efficient customization of ESG and climate considerations, and transition-related ETFs could be an interesting space for future growth by identifying companies that are making quicker progress on transition.

7. Blended finance and impact investing

- Blended finance is defined as “the use of catalytic capital from public or philanthropic sources to increase private sector investment in sustainable development”22. Global blended finance reached a 5 year high in the past year to US$15 billion23 and in the past decade, blended finance has mobilized over US$200 billion24 in capital towards sustainable development in developing economies. Climate adaptation, as a growing theme of focus, is well positioned to benefit from blended finance, with more development financing willing to take on higher leverage ratios to help support this emerging market.

- Relatedly, impact investing (defined as investments whose objective is to generate an intentional, measurable, and beneficial social or environmental impact25) market has also grown to $1.5T USD as of 202426 and with blended finance as a segment within impact investing contributing to the overall growth. This growth would be of interest for institutional investors who might have additional investment objectives such as aligning investments to national strategic goals or supporting global sustainable development with their capital.

Longer-term trends

8. Understanding the approaches taken by asset owners

- Understanding how asset owners are approaching sustainable investing provides a lens to learn best practices, discover emerging trends and priorities, and identify potential investment opportunities.

- An increasing number of asset owners are looking at climate solutions, climate indexes, outcomes-based engagement, and impact investments.

9. Climate as a starting point for nature

- The COP16 (Convention on Biological Diversity) continued to call into focus the importance of biodiversity and natural ecosystem services on which many sectors and economies depend. At the same time, many corporates and investors face the challenge of knowing how best to consider financially material nature-related risks. We believe that linking climate and nature is a helpful place to start when analyzing nature related opportunities..

- Nature-based solutions can provide 37% of the mitigation required to meet 2030 climate targets27 while also offering a more economical way of minimizing physical risks and climate hazards. For example, nature-based solutions like coastal wetlands are on average 2-5 times cheaper than artificially constructed barriers to deal with wave heights and sea level rise28. Climate physical risks also impact different aspects of natural capital, including agrifood security, water access, and oceans and biodiversity. We recommend investors and corporates aim to understand more about the nexus between climate and nature.

10. ESG Investment risks and opportunities from the growth of AI

- With continued growth in AI, ESG can become an effective lens with which to analyze relevant investment risks. Whether it’s growing risks of power and water consumption as data centers grow, or social considerations relating to automation or talent upskilling, ESG can serve as a framework to help with the anticipation and pricing in of risks as the AI space continues to grow. In particular, the increase in electricity and power demand from the growth of data centers to meet the needs of AI, has led to investors’ increased interest in nuclear29. Nuclear offers a low-carbon alternative source of energy complementary to renewables, while also strengthening energy security. Companies across the utilities and energy sectors could continue to see valuation growth from nuclear exposure30.

Capturing returns from sustainable investing in 2025

It is important that investors look to identify drivers of return and value in 2025, from understanding policy tailwinds to drawing linkages between transition and governance reforms and a company’s value creation and shareholder returns. In addition to investing in equities, investors can look to explore the wider set of asset class opportunities available to them, including labelled fixed income, sustainability-related ETFs, or innovations in blended finance and impact investing. We believe the 10 themes we outlined here can serve as helpful ideas and tools for investors to consider in 2025, whether it’s for asset allocation, sector selection, or portfolio risk management.

Investment Risks:

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations), and investors may not get back the full amount invested.

Footnotes

-

1

Center for European Reform, Learning from CBAM’s Transitional Phase: early impacts on trade and climate efforts, Dec 2024, https://www.cer.eu/publications/archive/policy-brief/2024/learning-cbams-transitional-impacts-trade

-

2

Japan METI, Japan’s Green Transformation Policy and Transition Finance, April 2024, https://cdnw8.eu-japan.eu/sites/default/files/imce/2024.4.18%20METI.pdf

-

3

Center for European Reform, Learning from CBAM’s Transitional Phase: early impacts on trade and climate efforts, Dec 2024, https://www.cer.eu/publications/archive/policy-brief/2024/learning-cbams-transitional-impacts-trade

-

4

EU Commission, EU Competitiveness: Looking Ahead, Sep 2024, https://commission.europa.eu/topics/strengthening-european-competitiveness/eu-competitiveness-looking-ahead_en

-

5

US Department of Treasury, Inflation Reduction Act, Sep 2024, https://home.treasury.gov/policy-issues/inflation-reduction-act

-

6

Federal Register, Advanced Manufacturing Production Credit, Oct 2024, https://www.federalregister.gov/documents/2024/10/28/2024-24840/advanced-manufacturing-production-credit

-

7

IRS, Domestic content bonus credit, May 2024, https://www.irs.gov/credits-deductions/domestic-content-bonus-credit

-

8

GR Japan, Overview of Japan’s Green Transformation (GX), Jan 2023, https://grjapan.com/sites/default/files/content/articles/files/gr_japan_overview_of_gx_plans_january_2023.pdf

-

9

Japan METI, Japan’s Green Transformation Policy and Transition Finance, April 2024, https://cdnw8.eu-japan.eu/sites/default/files/imce/2024.4.18%20METI.pdf

-

10

CDP, 1.5 still the goal, June 2024, https://www.cdp.net/en/articles/media/15c-still-the-goal-businesses-disclosing-climate-transition-plans-jumps-nearly-50

-

11

UK Transition Plan Taskforce, Progress Achieved and the Path Ahead: The Final Report of Transition Plan Taskforce, Oct 2024, https://transitiontaskforce.net/ ; Macfarlanes, Publication of the UK Transition Plan

-

12

CBI, Japan’s Climate Transition Bond, Feb 2024, https://www.climatebonds.net/resources/reports/japans-climate-transition-bond

-

13

GIC, Integrationg Climate Adaptation into Physical Risk Models, Sep 2024, https://www.gic.com.sg/thinkspace/sustainability/integrating-climate-adaptation-into-physical-risk-models/#:~:text=Importantly%2C%20physical%20risks%20are%20estimated,%2D7.0)%20scenarios%2C%20respectively.

-

14

UN Climate Change, Submitted NAPs platform, Nov 2024, https://napcentral.org/submitted-NAPs ; UNFCCC, Progress in process to formulate and implement national adaptation plans, Nov 2024, https://unfccc.int/sites/default/files/resource/NAP_Progress_Report_2024.pdf

-

15

Japan Exchange Group, Follow-up of Market Restructuring, Nov 2024, https://www.jpx.co.jp/english/equities/follow-up/02.html

-

16

Financial Services Commission, Active support to be provided to promote voluntary efforts of listed companies in enhancing their value, Feb 2024, https://www.fsc.go.kr/eng/pr010101/81778

-

17

Gov.cn, China unveils new policies on M&A, market value management, Sep 2024, https://english.www.gov.cn/news/202409/25/content_WS66f349e8c6d0868f4e8eb38f.html

-

18

CBI, Sustainable Debt Market Summary H1 2024, https://www.climatebonds.net/files/reports/cbi_mr_h1_2024_02e_1.pdf

-

19

Climate Bonds Initiative, Resilience Taxonomy, Sep 2024, https://www.climatebonds.net/files/page/files/resilience_brochure_v5.pdf

-

20

Morningstar, Is Passive the answer to ESG Investing, Oct 2023, https://www.morningstar.co.uk/uk/news/240247/is-passive-the-answer-to-esg-investing.aspx

-

21

BofA Sustainability Research and Bloomberg Analysis, as of 2024

-

22

Convergence, Blended Finance, as of Dec 2024, https://www.convergence.finance/blended-finance

-

23

Convergence, Global blended finance volumes reach 5 year high, April 2024, https://www.convergence.finance/news/5na5Qlr4gpXsYwQ2nRqzJ1/view

-

24

UBS, Four trends in blended finance that will drive impact in 2024 and beyond, https://www.ubs.com/global/en/sustainability-impact/social-impact-and-philanthropy/learning-center/blog/2024/four-trends-in-blended-finance-2024.html#:~:text=Blended%20finance%20is%20gaining%20momentum,to%20crowd%20in%20private%20capital.

-

25

Invesco, ESG and Impact Investing in Asia, Mar 2023, https://www.invesco.com/apac/en/institutional/insights/esg/esg-and-impact-investing-in-asia.html

-

26

Impact Investor, GIIN Survey: Global Impact market reaches $1.57trn AUM, Oct 2024, https://impact-investor.com/giin-survey-global-impact-market-reaches-1-57trn-aum/

-

27

FAIRR, “Tackling the Climate-Nature Nexus”, March 2024, https://go.fairr.org/2024-Tackling-the-Climate-Nature-Nexus-Report

-

28

Global Commission on Adaptation, “The Role of the Natural Environment in Adaptation”, 2019, https://gca.org/wp-content/uploads/2020/12/RoleofNaturalEnvironmentinAdaptation_V2.pdf

-

29

Quartz, AI is pushing data centers toward a nuclear-powered future, Nov 2024, https://qz.com/data-centers-ai-artificial-intelligence-nuclear-power-1851687533

-

30

Yahoo Finance, Nuclear power stocks are soaring amid an AI energy push, Oct 2024, https://finance.yahoo.com/news/nuclear-power-stocks-soaring-amid-231848159.html