ESG Asia Playbook: Understanding ESG investment approaches

As shared in our recent ESG 2023 Outlook, 2022 saw a global discourse on the role of ESG investing and defining what sustainability means in the investment context. Increasing complexity and sophistication to ESG investing calls to attention the fact that investors could have differing ESG objectives and approaches. This piece looks at a range of ESG investment objectives against the backdrop of sustainability trends in Asia.

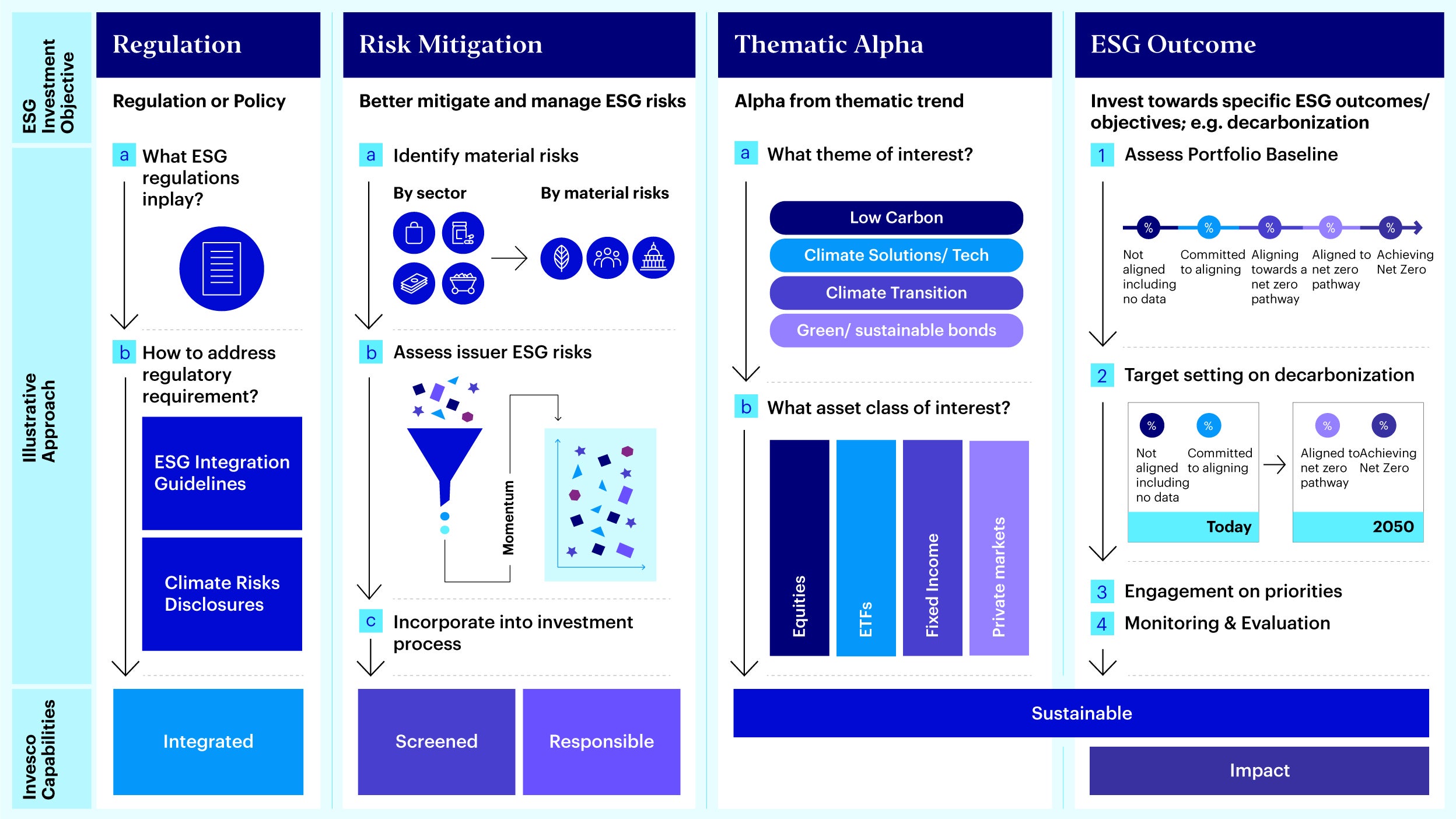

Understanding ESG investment objectives and capabilities

Allocating to sustainability investments typically starts with a discussion on underlying investor ESG objectives. We have seen four common drivers and motivations towards ESG investing – regulatory-driven, risk mitigation, thematic alpha and ESG outcomes.

Source: Invesco. For illustrative purposes only.

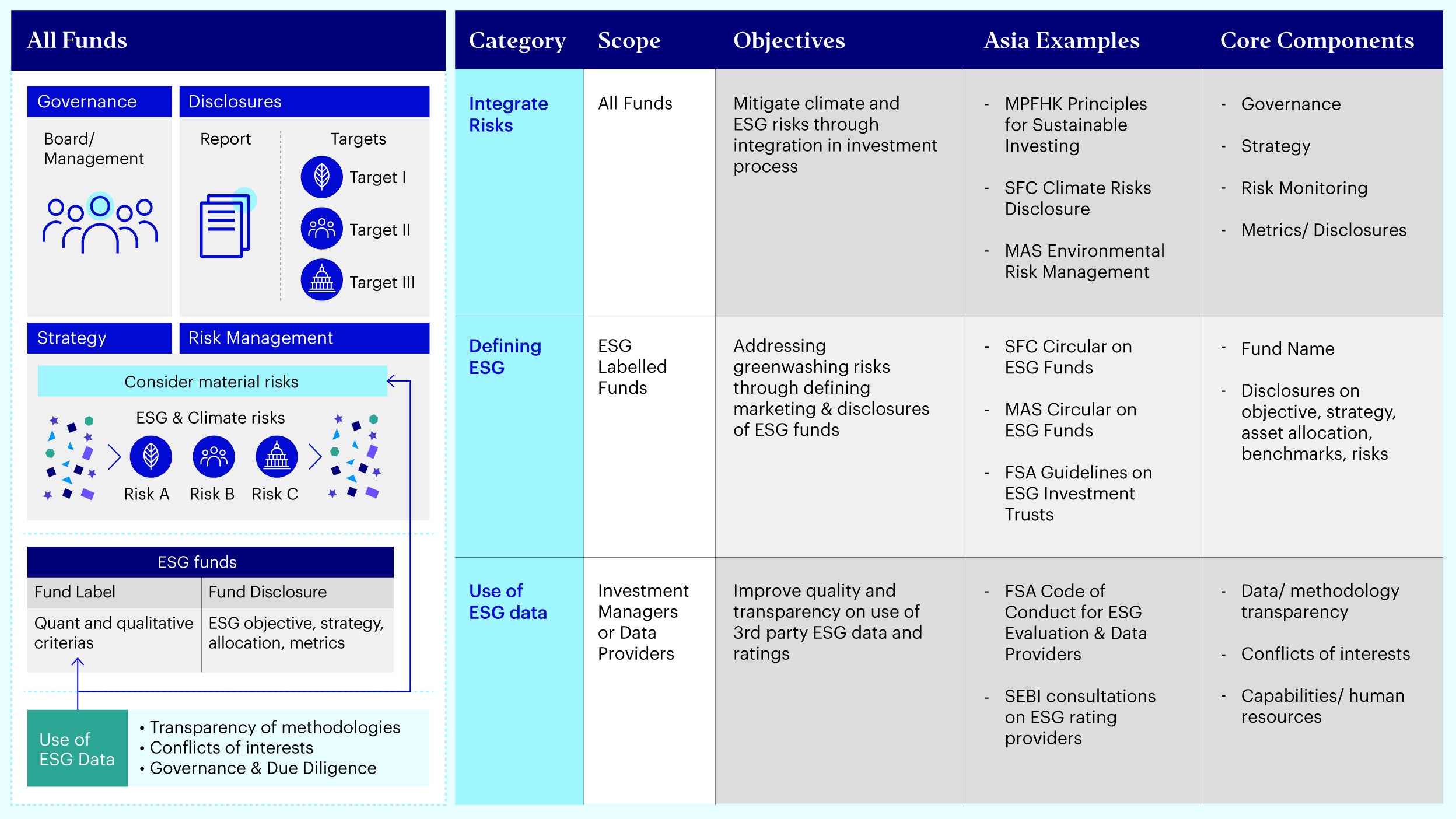

1) Regulation: Integration, defining ESG and the use of data in Asia

Within Asia, regulatory trends have focused on increasing integration, addressing greenwashing and improving use of ESG data.

Source: Invesco. For illustrative purposes only. Note: Mandatory Provident Fund Hong Kong (MPFHK), Securities and Futures Commission (SFC), Monetary Authority of Singapore (MAS), Financial Services Agency (FSA), Securities and Exchange Board of India (SEBI).

While addressing these regulations may often signify having effective governance and oversight with relevant and timely disclosures, from an investment perspective some of the key differentiating capabilities required include:

- Robust ESG process that transcends solely relying on ESG ratings and overlaying with investors’ stewardship and engagement

- Proprietary ESG data that considers multiple sources and understand limitations of data, particularly in forward looking assessments

- Evolving scenario analysis through constant review of scenarios and improving physical risk assessment capabilities

- Coordinated approach to engagement and stewardship with clear topic prioritization and tracking of outcomes

The continued growth and adoption of ESG regulations will likely increase transparency premiums and facilitate capital flows into sustainability assets in the longer term.

2) Risk Mitigation: Asia implications on supply chain, controversies, carbon prices and physical risks

Another common motivation for considering ESG factors in investments revolves around effectively lowering material ESG risks in holdings that can have adverse valuation impact. In Asia, the trends we have seen:

- Supply chain dislocations: Geopolitical and macroeconomic developments have seen government policies promoting localized production (e.g., US Inflation Reduction Act [US IRA]) and also a growing focus on labor-related due diligence (e.g., Japan Human Rights Due Diligence [DD] Guidelines). These trends might impact Asia suppliers’ share of wallet of global exports. Raw material and component bottlenecks (such as in solar or electric vehicles [EVs]) previously could also affect supply dynamics.

- Carbon prices and markets: Asia’s carbon prices and markets still have room to grow when compared to Europe, but increasing developments in market building (e.g., Hong Kong Exchange [HKEX] Core Climate platform), cross-border impact (e.g., European Union Carbon Border Adjustment Mechanism [EU CBAM]) and in stepping up of prices (e.g., Singapore Carbon Tax roadmap) could create substantial EBITDA risks for high-emitting sectors ahead.

- Physical risks: Floods, droughts, heat, and water stress are common topics across Asia with significant risks on long-term value of assets, insurability risks and broader supply shocks.

- Controversies: Some of these are legislation related (e.g., Australia’s Modern Slavery Act) while some relates to recent tends on human capital/ labor conditions or governance-related issues. Either way these incidents and events may often trigger material downward pressure on valuation and calls into importance the earlier identification and assessment of such risks.

Potential mitigation has to begin with an understanding of material ESG risks that could be unique to a region, sector, or company. These risks can then be considered in the investment process with implications including but not limited to exclusions or becoming a focus for engagement.

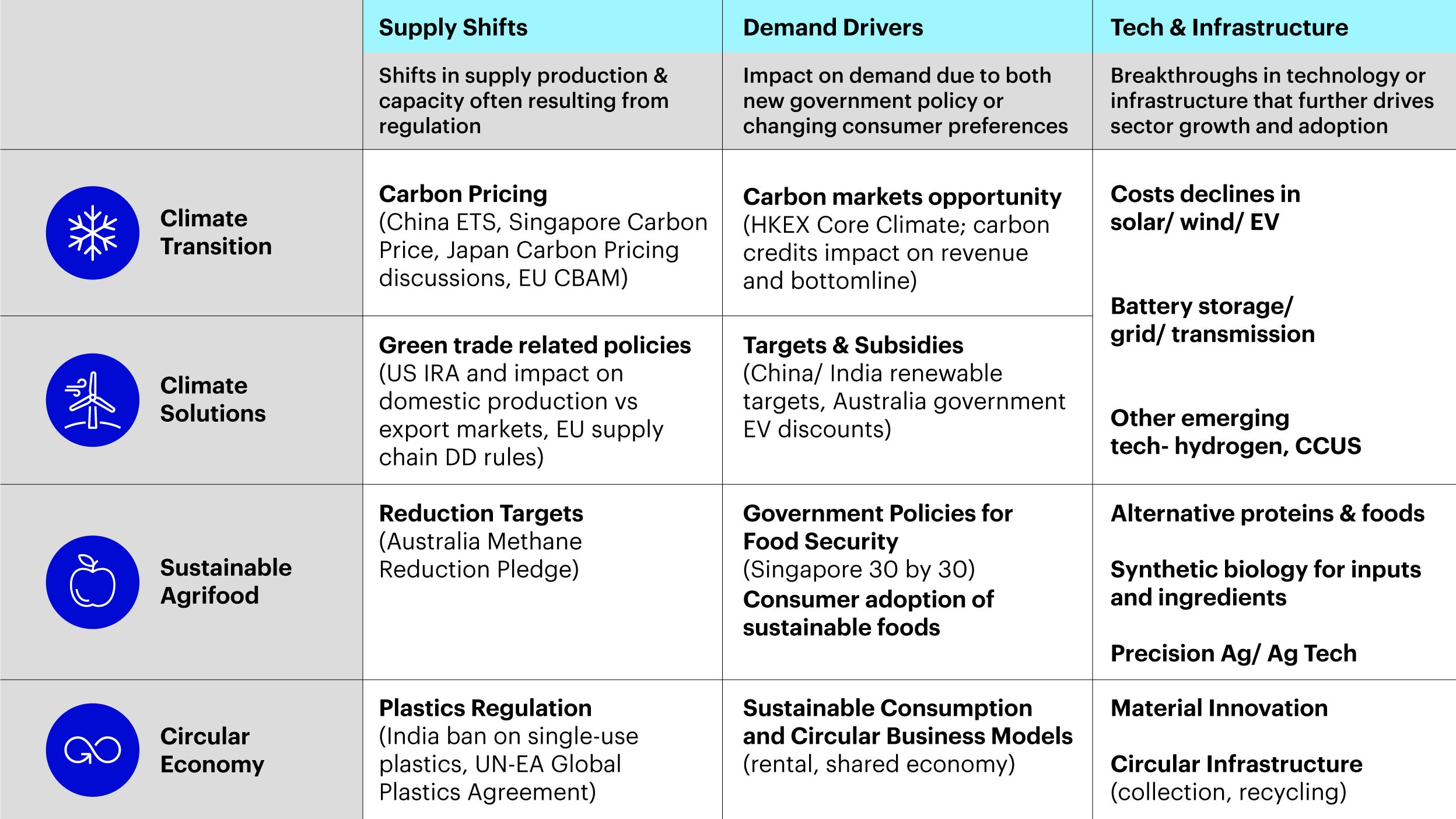

3) Thematic Alpha: Opportunities from Asia’s sustainability growth

Thematic ESG strategies have always seen healthy investor interest. The drivers for alpha may often come from shifts in supply such as new policies or policies, demand changes as consumer preferences adjust and breakthroughs in technology and supporting infrastructure.

Source: Invesco. For illustrative purposes only. Note: China Exchange Trading Scheme (China ETS), United Nations Environment Assembly (UN-EA), carbon capture, utilization, and storage (CCUS).

The intersection of these forces can be seen in:

- Climate Transition: Net zero implementation driving corporate’s commitments, target setting and increasing green capex and revenue; opportunities in transition leadership and climate technologies benefitting from adoption.

- Climate Solutions: As above, pure play technologies with more maturity (like solar, wind, EVs) could see increasing growth from policy drivers but beyond that, there would also be increasing focus on building out supporting infrastructure (grid and storage) and up-and-coming technologies (hydrogen, carbon capture and storage).

- Agriculture and Food: Opportunities in technologies and business models improving agrifood security amidst elevated food prices and physical risks impact. Further opportunities in agrifood solutions delivering on emissions and waste reduction.

- Circular Economy: Government legislations and targets on waste and plastics may have implications across packaging, food and beverages, electronics, and materials value chains with focus on circular business models and waste recycling.

4) ESG Outcomes: Towards net zero and impact investing

Certain investors might prioritize certain ESG characteristics or outcomes in their investment portfolios- some of these might be more driven by investor ethical preferences, while for others it might be a specific outcome like climate and net zero. In terms of drivers:

- Growth in climate commitments: Signatories to the Glasgow Financial Alliance for Net Zero (GFANZ) has grown from 160 in April 2021 to more than 550 institutions in COP27 last year1. Correspondingly, these investors are looking for strategies that can gradually reduce the emissions of their portfolios overtime.

- Interest in assessing outcomes: Invesco’s Global Sovereign Asset Management Study last year also showed increasing trends of investors adopting impact investing and focusing more on ESG outcomes. Against the backdrop of greenwashing risks and considerations, a greater focus on impact allows for better evaluation and monitoring of portfolio ESG outcomes.

Correspondingly, such strategies often require proprietary frameworks for investment selection and impact monitoring, data capabilities especially forward-looking assessments on ESG metrics and an outcomes-based engagement approach and roadmap.

From objectives to approaches and asset allocation

We previously shared about Invesco’s nomenclature of ESG investing approaches, in the same vein thinking about asset allocation to ESG investments can begin with an understanding of investors’ objectives. Integration and screened/ exclusionary approaches can align well to meeting regulatory developments or assessing ESG risks while investors interested in thematic alpha or outcomes can find suitable sustainable or impact strategies.

Going into 2023, the complexity of ESG investing requires increasing sophistication in approaches which can be helped by understanding underlying investors’ ESG objectives.